After an investigation exposed Claudio Reyna’s “bullying” and Gregg Berhalter’s past, what’s next for the USMNT and U.S. Soccer’s insular culture? The post Explained: What's next for USMNT as report finds Reyna 'bullying,' Berhalter told truth appeared first on Buy It At A Bargain – Deals And Reviews.

Tag: Truth

How to Build Credit for A Business: The Truth About Fast Business Credit

Business credit is a journey, not a destination. It’s not somewhere you get to, but rather a road you travel down, continually making progress. It’s time to change our mindset from business credit being a thing you get quickly, to being a thing you can start building quickly, and then continue building upon. This is the truth behind fast business credit

How to Build Credit for a Business: The Truth is Growth Takes Time

Growing your business credit portfolio doesn’t happen overnight. Your portfolio can grow over the life of your business. The key to speed is to get accounts that will build business credit while growing your portfolio at the same time.

The Keys to Building Business Credit

Start with a Fundable Foundation. Then, get initial accounts reporting. Knowing which accounts will approve you and report positive payment history is essential.

A Fundable Foundation Includes:

- Separate, consistent contact information

- EIN

- Incorporate

- Fundable foundation

- Separate business bank account

- D-U-N-S Number

- Profession, user friendly business website and email address on same domain

Initial Accounts

With a Fundable foundation, you can start applying for initial accounts. These are limited, but as you grow, more tools become available. There are not a ton of vendors that offer credit without an established business credit score, and of the ones that do, even fewer report positive payment history.

Even if they do, they do not always make it easy to find that out, or what they require for approval. Applying for and using smaller accounts that report sets you up to qualify for accounts that are harder to get in the future.

The major roadblock when it comes to building business credit is finding accounts that you both qualify for and that will report positive payment history.

Trial and Error is Slow

If you just start applying for credit in the name of your business, without knowing if you qualify or if they will report, your progress will be slow.

How to Build Credit for a Business: The Business Credit Builder

This is the beauty of the Credit Suite Business Credit Builder. We find the vendors for you and tell you which ones to apply for and when. This saves you an abundance of time.

In fact, we gather all of the business credit building blocks together in one place and tell you when it is time to use each one. We offer lists of vetted vendors as you become eligible for them. This cuts out considerable time over the trial and error method.

When you know specifically which accounts will approve you and report your positive payment history, you stop wasting time on accounts that will do neither.

The Secret Benefit of the Business Credit Builder

Once you complete the steps, the initial building process is done. However, you aren’t finished growing your portfolio. That process continues. The Business Credit Builder has a large list of advanced vendors. These vendors extend credit to businesses based on business credit scores, but they may not report.

Still, they are important to your business credit portfolio. They allow you to get supplies you need to serve your clients and pay for them after you are paid for the job. As you grow, you can ask for higher limits. The best part is, you have access to this list for 5 years!

The Beauty of a Strong Business Credit Portfolio

Think of a business credit portfolio as a pool of various types of business credit. You can leverage it to run your business successfully. This “pool” will allow you to further business growth and success.

How to Build Credit for a Business: It’s Okay to Use Personal Guarantees

A well-rounded business credit portfolio can include both PG and non-PG financing. In general, personal guarantees should be avoided, but sometimes you just can’t avoid them. If a personal guarantee will help you qualify for funding or credit cards, and you wouldn’t qualify without it, it can be smart to offer one. This is especially true if they report payments to the business credit CRAs. Then they can help you build your business credit score.

How to Build Credit for a Business: The Truth

You can get business credit quickly, in the form of vendor credit, soon after you set up a Fundable Foundation. But, you won’t get anywhere on vendor credit alone. You need a variety of types of business credit accounts. The only way to get those is to continue building on the accounts you have and manage them responsibly.

The post How to Build Credit for A Business: The Truth About Fast Business Credit appeared first on Credit Suite.

Tier 1 Business Credit – Dive Into the Truth

There are a lot of questions out there about the business credit tiers. A lot of business owners claim they have strong business credit and they never even considered the tiers. There is a school of thought that they are not necessary and a waste of time. Tier 1 business credit gets a particularly bad rap as being unnecessary. It’s time we dive into the truth about Tier 1 business credit.

The Truth About the Tiers and Tier 1 Business Credit

What are business credit tiers? Actually, the tier system is just how Credit Suite ranks vendor credit based on how easy it is to get approval. When you work through our business credit builder, you start by setting up a fundable foundation. Once your business is set up properly, you begin applying for Tier 1 business credit vendors. After you have enough of those reporting payments to the business credit reporting agencies, you can move on to Tier 2, Tier 3, and finally Tier 4 and advanced vendors.

First, let’s get one thing out of the way. The truth is, some business owners can build strong business credit without working through the tiers. That’s a fact. Here’s another truth. Most business owners can’t. Honestly, several factors need to fall into place perfectly to be approved for business credit accounts without working through the tiers in order.

These include but are not limited to:

- Substantial income

- Willingness to give a personal guarantee

- Excellent credit

- High value collateral and the willingness to use it to fund the business

However, the tiers are the key to gaining access to advanced vendors and more business funding without these things.

The Benefit of Working Through the Tiers in Order

The vendor tiers are set up by Credit Suite. It’s a sort of formula to allow business owners to build their business credit without any more personal guarantee than necessary. So, even if you are able to skip them, it’s not wise to do so. The tiers can still be useful as a way to limit your personal guarantees when it comes to business funding.

When you set your business up the right way, and work through the vendor tiers in order, your business can eventually fund itself with minimal impact on personal credit.

A Deep Dive Into Tier 1 Vendors

What makes Tier 1 vendors so special? These are starter vendors that will extend net terms on invoices. They do so with less focus on credit score than other vendors and creditors. Not only that, but they will also report those payments to the business credit reporting agencies.

However, it only works if your business has a fundable foundation. That includes having professional business contact information, an EIN, being incorporated, and having a D-U-N-S number, among other things.

How Do You Find Tier 1 Business Credit Vendors?

Since most vendors do not classify themselves into tiers, how do you find them? A simple search will give you a few options. However, the information changes without warning. We are always finding new vendors that fit into Tier 1, and often we discover vendors have changed their requirements or reporting standards in ways that make them no longer Tier 1 vendors.

Here are just a few Tier 1 business credit vendors we know of currently.

76

76 offers a fleet card that reports to Dun & Bradstreet and Experian.

To qualify, you need the following:

- Your corporate entity must be in good standing with the applicable Secretary of State

- An EIN

- Company address matching everywhere

- D-U-N-S number from Dun & Bradstreet

- Your business license (if applicable)

- A business bank account

- Business phone number listed on 411

They will ask for your SSN for identification purposes. You can use a $500 deposit instead of using a personal guarantee if you have less than one year in business. Their terms are net 15.

The CEO Creative

The CEO Creative reports to Equifax and Credit Safe. They offer low prices on electronics, wireless earbuds, cameras for cars and trucks, speakers and more. They also have quality custom design and branding services. You can create your own logo, business cards, and business accessories.

There is a membership fee, and the minimum order before they will report to the business credit bureaus is $40.

To qualify, you need the following:

- Your corporate entity must be in good standing with the applicable Secretary of State

- Business credit history

- EIN

- Company address matching everywhere

- Your business license (if applicable)

- A business bank account

- At least 120 days in business

Grainger Industrial Supply

Grainger sells hardware, power tools, pumps and more, in addition to performing fleet maintenance. They report to Dun and Bradstreet.

If a business doesn’t have established credit, they will want to see additional documents like accounts payable balance and business financials. Terms are Net 30, Net 45, Net 60, or Net 90.

To qualify, you need:

To be an entity in good standing with Secretary of State

- EIN

- Business address (matching everywhere)

- D-U-N-S number

- Business license (if applicable)

- Separate, dedication business bank account

- Business registered to Secretary of State (SOS) for at least 60 days

What’s After Tier 1 Vendors

When you choose to build business credit this way, you need 3 to 5 accounts reporting before you qualify for vendors in the next tier. Use vendors in Tier 1 to buy the things you need for your business anyway. As a result, you will be well on your way to building a strong business credit portfolio.

The goal is at least 10 business credit accounts reporting to your business credit report. For some, it is possible to get those 10 accounts from any tier by offering a personal guarantee. However, even if this is possible for you, it’s not always the most strategic move. It’s not wise to have all of your business credit tied to your personal credit.

Some business accounts require a personal guarantee regardless. But the more credit you can get in the name of your business without a personal guarantee, the better. Tier 1 vendors are the gateway to building a strong business credit profile with minimum personal guarantee.

The post Tier 1 Business Credit – Dive Into the Truth appeared first on Credit Suite.

The Truth About Business Funding With No Personal Guarantee Credit

Does business funding with no personal guarantee credit exist? The simple answer is yes. How do you get it, and do you even need it? Those are harder questions to answer.

What’s the Real Story Behind Business Business Funding With No Personal Guarantee Credit?

To some, it may seem like a mythical idea, a unicorn if you will. Even if you have strong business credit, many lenders will ask for a personal guarantee on a business loan. So, what are companies talking about when they say you can fund a business with no personal guarantee credit? Let’s find out.

What is Business Credit?

Before we can talk about no personal guarantee credit for business funding,we need to define a few terms.

First, we’ll define business credit. Business credit is credit, like a credit card or other type of credit account, in the name of your business rather than in your name personally. When you apply, you use your business name, your business contact information, and your EIN instead of your social security number.

What frustrates you the most about funding your business? Check out how our free guide can help.

Then, the business is responsible for repayment. Sometimes, the account does not report to your personal credit report. Meaning, your personal credit scores will not be affected by your business credit accounts.

Business Credit vs. Business Credit Report

Now, let’s talk about your business credit report. This is a report, like your personal credit report. Lenders use it to evaluate the creditworthiness of the business. It consists of the credit history of the business, the business credit score, and other data. The business credit score is made up of the payment history of those business credit accounts that actually report to the business credit reporting agencies.

Not all business accounts will do that. But those that do, are the ones that make up the score on the business credit report.

Personal Guarantee

To understand what no personal guarantee credit is, you have to know what a personal guarantee is. If you get a credit account with a personal guarantee, you are responsible for repayment. By definition, all personal credit accounts have a personal guarantee.

This could mean a hard pull on your personal credit, which can lower your personal credit score. However, in theory, if your business has an account in its own name and it is set up to be a separate entity from you, the owner, it is responsible for its own debt.

Still, many companies require a personal guarantee from the business owner before extending business credit, especially small businesses. This is due to many factors, including data from the Bureau of Labor statistics that states 20% of new businesses fail within the first year, 45% within the first 5 years, and 65% in the first 10 years. In fact, only 25% of new businesses make it 15 years or more.

It’s easy to see why lenders and credit card companies would ask for a personal guarantee from business owners when it comes to business credit.

What frustrates you the most about funding your business? Check out how our free guide can help.

Can You Get No Personal Guarantee Credit for Business Funding?

The short answer to this is yes, but it is not that simple. First, most business accounts that do not require a personal guarantee are designed for larger businesses or older businesses.

There is very little out there when it comes to no personal guarantee credit for small, newer businesses. There are some vendors that will extend net terms without a personal guarantee if your business meets certain requirements.

Requirements may include a certain minimum time in business, a minimum average balance in a business bank account, specific annual revenue, and more. Other than that, there are a couple of business charge cards you can get without a personal guarantee. For example, Brex and Divvy both offer this type of product.

The catch is, these are charge cards, not credit cards. So you have to pay the balance off each month. Basically, it’s like a card that you can use anywhere and you have net 3o terms on the balance. It’s similar to a vendor account, but more flexible.

There are also business credit cards available without a personal guarantee, but only if your business credit is strong enough. In general, your business needs to be earning millions in annual revenue to qualify for these cards.

What’s so Bad About a Personal Guarantee?

Why try to avoid a personal guarantee? No one likes risk. That’s why businesses require a personal guarantee and why business owners don’t love to give one. However, if you have true business credit that requires a personal guarantee, the business will have to pay first. You will be personally liable for anything that the business cannot cover. Still, you will not be first in line for all of it.

A Personal Guarantee can Accelerate Your Business Growth

A better option is to realize that if your business is small and young, you are likely going to need a personal guarantee for much of the funding. Yet, you can work to reduce your liability in a number of ways. The first way to do that is to incorporate your business as a corporation, S-corp, or LLC. Your business attorney or accounting professional can help you with that.

Next, you can look at funding options that do not require credit at all. Does this debt-free funding even exist? Sure it does.

Grants, Crowdfunding, Angel Investors, ROBS, and more can be used to get as much funding as possible without any repayment.

Work on Building Business Credit

Then, you can work on building a strong business credit profile for your business, including a strong business credit score. This will help you be able to get funding for your business without as much reliance on a personal guarantee. Basically, the stronger the business credit, the less the lender feels the need to rely on the owner’s creditworthiness.

The key to this is to look for creditors who will report positive payment history to your business credit profile. Even some lenders that require a personal guarantee may report payments to your business credit report and not your personal credit report.

Stop worrying about the personal guarantee and worry more about building business credit so you can reduce the amount of personal guarantee required to get the funding you need.

Get Funding While Building Business Credit

If you cannot get all of the funding you need for your business with non-debt options, and your business is young and small, you may very well have to use a personal guarantee to get the funding you need in the beginning. That is okay.

What frustrates you the most about funding your business? Check out how our free guide can help.

The key is to know exactly what you are getting. Definitely make sure you apply with your business name, EIN, and contact information. Then find out what credit agencies they report to. If they report to the business credit agencies like Dun & Bradstreet, Experian Business, or Equifax (Business), that is a good thing. It will help you reach your goal of building business credit faster.

If they report to personal credit, so be it. Just keep working through the process of building your business credit profile as quickly as possible. Then, you can tip the scales away from your personal liability as much and as quickly as possible.

Debt-Free Funding

If you really want to stay away from a personal guarantee, you can try one of these debt-free funding options. Just remember, debt-free doesn’t mean cost-free. There are always some costs associated with funding.

Rollover for Business Startups (ROBS)

This is a 401(k) Rollover for Working Capital program. It’s also known as a Rollover for Business Startups (ROBS). Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan owns the business through its company stock investments, rather than the individual.

This type of financing isn’t a loan against your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian. The plan has to be a plan from an employer you no longer work for, and you can no longer be contributing.

Crowdfunding

Crowdfunding is a way of getting multiple smaller donations from a lot of individuals. Hence the term “crowd” in crowdfunding. There are many options for crowdfunding platforms, but be sure you know what you are getting into. Many crowdfunding platforms make you give all of the funding back if you do not make your goal by the end of the campaign.

They will take a percentage of the donations. That’s how they make their money. In addition, they may push to have you deliver on your promises. Crowdfunding tends to work best when donors can personally connect with a product or service . Straightforward businesses may not do so well.

The kinds of businesses which do the best often associate with products not quite on the shelves yet or artistic endeavors.

Angel Investors

While there are “professional” angel investors out there, an angel investor can be pretty much anyone. It could be a friend or family member sitting on home equity, or local professionals who are looking to invest. Consider people you know well and people you may not know so well.

What frustrates you the most about funding your business? Check out how our free guide can help.

Grants

There are some grant options available, and of course those do not have to be repaid. However, they are highly competitive, and it is unlikely it will be enough to fully fund your business. Also, grants will require time on your part to prepare all necessary paperwork. Some even require an application fee.

Other Funding Options

No personal guarantee credit for business funding is great to have. Still, chances are you are going to need a personal guarantee to get funding at some point. There are a lot of good options out there. In fact, SBA loans are a great option. You can also look into alternative lenders like Fundbox and OnDeck or Accion.

Using a personal guarantee to get the ball rolling while you work on building your business credit profile is a valid option. It is what most business owners have to do. But, you need to build a strong business credit score so lenders can start to rely more on the credit worthiness of your business than you personally. Credit Suite has a whole program designed to help do just that. Find out more about the Business Credit Builder now.

The post The Truth About Business Funding With No Personal Guarantee Credit appeared first on Credit Suite.

The Truth About Website Hosting Costs

Every website needs a hosting plan.

But there’s such a wide range of web hosting costs out there. It’s overwhelming for beginners and experienced website owners alike. How much should you pay for web hosting? Are you overpaying for web hosting? How much does web hosting really cost?

Some plans start below $1 per month. Others start at over $2,000 per month!

To make matters even more complicated, there are 330,000+ web hosting providers on the market today. Trying to find the best web hosting plan for your site without overpaying can feel like an impossible task.

Fortunately, I’m going to let you in on a little secret—you don’t need to overpay for web hosting.

This guide will teach you the truth about web hosting costs. I’ve identified the top costs associated with web hosting and how to evaluate those costs as you’re shopping around. You’ll learn more about how much you should pay for certain web hosting benefits and whether or not you even need specific features in your hosting plan.

My Favorite Tool for Keeping Web Hosting Costs Low

Bluehost is my favorite tool for keeping web hosting costs low.

As an industry leader in the web hosting space, more than two million sites worldwide rely on Bluehost for hosting. They have packages for everyone. Whether you’re starting a small personal blog or looking for a new provider to host your business site with millions of monthly visits, Bluehost can accommodate your needs.

To be clear, Bluehost is not necessarily the cheapest web hosting provider on the market. Some providers offer free web hosting or web hosting for less than a dollar. But you should avoid free web hosting at all costs—there is always a catch.

But Bluehost really delivers in terms of value. They offer low entry-level pricing for new websites, and their web hosting services help keep other costs low over time.

Continue below to learn more about general web hosting costs. I’ll even explain how Bluehost can help save you some money in some of these categories.

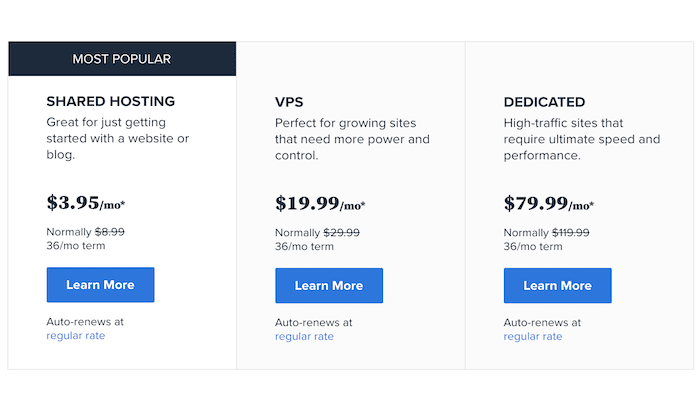

Cost #1: Web Hosting Type

The type of web hosting plan you select will have the most significant impact on the price. This isn’t a hard and fast rule, but generally speaking, here’s the order listed from cheapest to most expensive:

- Shared web hosting

- Cloud web hosting

- VPS (virtual private server) web hosting

- Dedicated server web hosting

Depending on the hosting provider, cloud hosting and VPS hosting might be switched. But the list above is a good rule of thumb.

Check out this pricing page from Bluehost as an example:

As you can see, there’s a significant price gap between each type of web hosting. The starting price of a dedicated server is roughly 20 times higher than the shared starting rate.

Unless you’re expecting huge traffic surges out of the gate, the vast majority of new websites should stick to a shared plan. That’s the best way to save some money, and you can always upgrade down the road as your site grows.

Most shared plans can accommodate anywhere from 10,000 to 25,000 monthly visits. Once you start getting into the 50,000 monthly visit range, you should consider upgrading to a VPS or cloud package. I wouldn’t consider a dedicated server until you eclipse 100,000 monthly visits, and even at that point, it’s not 100% necessary.

Cost #2: Contract Length

Generally speaking, you’ll need to commit to a longer-term contract to get the lowest possible rate. This is one of the best ways to save money on web hosting costs, especially as a new customer.

Depending on the provider, plans are typically offered in 12, 24, 36, and up to 48-month contract terms. Month-to-month web hosting isn’t very common. So expect to commit to a year, at a minimum.

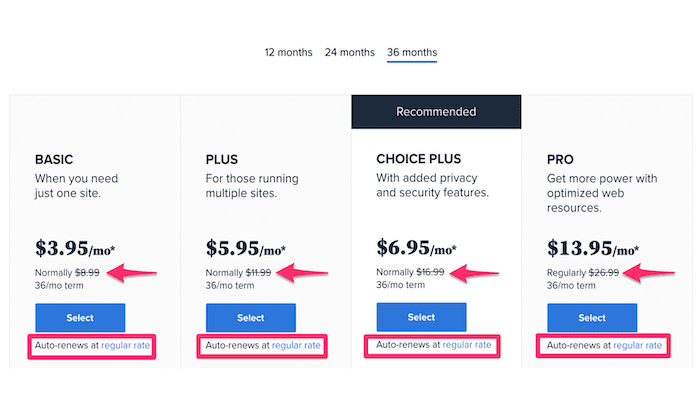

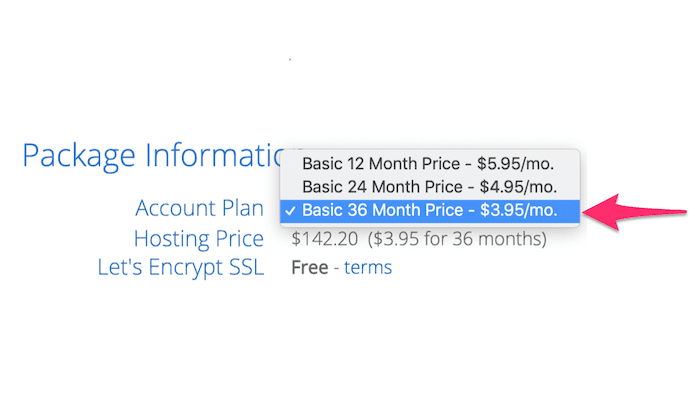

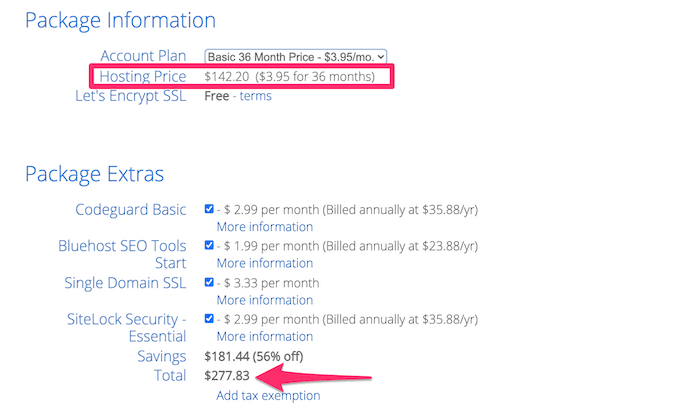

Here’s an example of the different prices offered by Bluehost based on contract length:

As you can see, there’s a $2 per month difference in price between the 36-month contract and the 12-month contract. This isn’t life-changing money or anything like that. But it will save you $72 over the course of three years.

Just understand that you’ll need to pay upfront for your contract in full when you sign up. In this case, $3.95 per month for 36 months actually means $142.20 today.

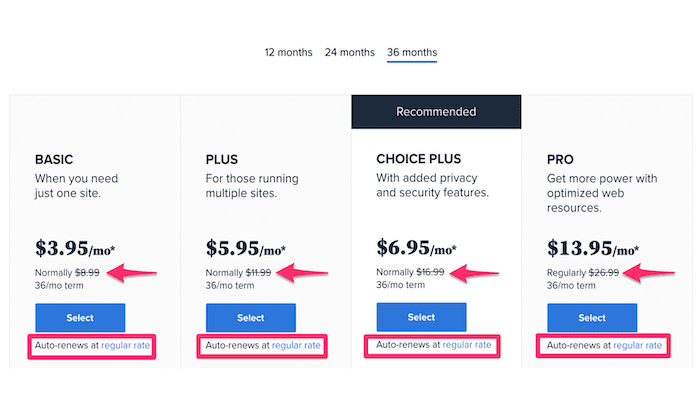

Cost #3: Renewal Rates

Locking in a long-term contract also helps you avoid renewal rates. It’s standard practice in the web hosting industry for providers to offer low promotional rates and then jack up the prices when your contract renews.

Don’t get me wrong. It’s not like they aren’t upfront about it. But most people don’t think about the costs they’re going to incur three or four years down the road. Some providers double, triple, or even quadruple your rate upon renewal.

Let’s take a closer look at the shared hosting packages from Bluehost. You can clearly see the renewal rates below each introductory price.

In this case, the renewal rate is more than double the introductory price. Believe it or not, this is actually fairly reasonable compared to some of the other web hosting providers on the market today.

There’s not a whole lot that you can do to avoid this increase. Your best bet is to just lock in a long-term introductory contact. That’s the best way to save the most money.

Once your website has been up and running for a few years, the extra costs upon renewal shouldn’t feel like too much of a burden.

Cost #4: Hosting Resources

Every web hosting plan allocates a certain number of resources to your website. While this might vary slightly from one provider to another, here’s a basic overview of what to expect:

- Bandwidth — How quickly your server can transfer data.

- CPUs — Central processing units to handle all the requests on your site.

- RAM — Short-term memory for processing multiple requests simultaneously.

- SSD Storage — The maximum allowed size of your website.

Generally speaking, the more resources you have, the higher your hosting costs will be.

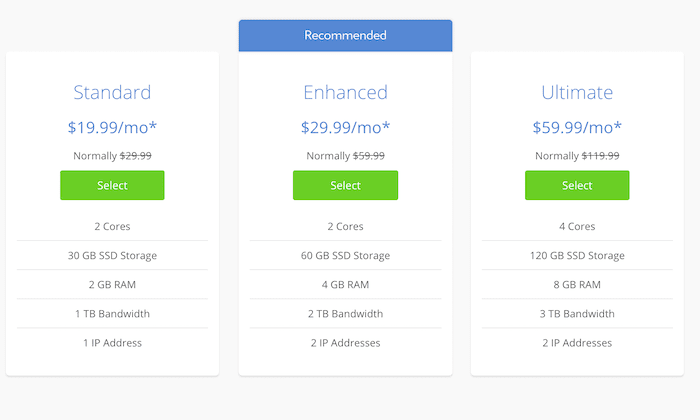

Here’s a screenshot from Bluehost’s VPS pricing table to illustrate my point:

As you can see, the SSD storage, RAM, and bandwidth increase at each tier. The number of CPU cores remains the same from the Standard to Enhanced plan but doubles at the Ultimate package level.

Some providers offer “unlimited” or “unmetered” bandwidth. Just be forewarned that you’re not actually getting unlimited bandwidth. Unlimited bandwidth doesn’t really exist. Even the best servers have limits. Unlimited bandwidth just means that you can use as much bandwidth within a particular range offered by the provider.

So, how much bandwidth do you need? This isn’t an exact science, but generally, 5 GB of bandwidth can accommodate up to 15,000 or 20,000 visitors per month browsing pages with an average size of 50 KB.

Consider a cloud hosting plan if your traffic varies significantly from month to month. These packages typically allow you to scale resources on-demand to accommodate traffic spikes.

Cost #5: Setup Fees and Site Migrations

Most web hosting providers offer free setups. This is especially true with entry-level packages, like shared hosting plans. However, if the provider actually needs to take in-depth steps to get you started, you might incur some setup fees.

Setup fees are more common at the dedicated server level, where providers need to physically add hardware components based on your plan requests.

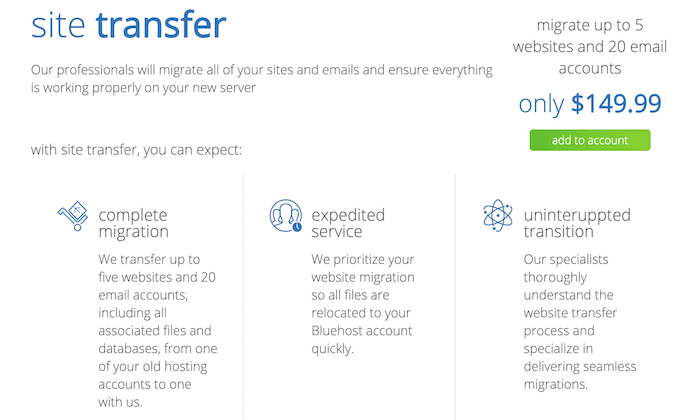

If you’re transferring your website from one hosting provider to another, you might incur a site migration fee as well.

Bluehost charges $149.99 for site transfers. Other providers offer this service for free, but it shouldn’t make or break your decision to use one web host over another.

You can justify the cost by having a professional handle this for you. I don’t recommend trying to migrate a website on your own. Too much can go wrong, so pay the fee and don’t think twice about it.

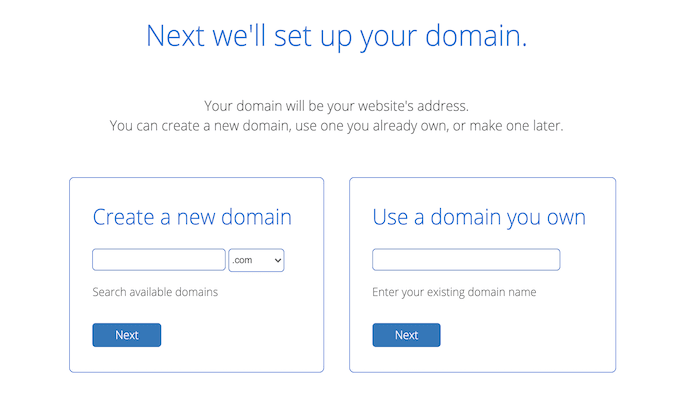

Cost #6: Domain Registration

Normally, I wouldn’t mix domain registration and web hosting. It’s usually in your best interest to get your domain name from a domain registrar and your hosting package from a web hosting provider.

That said, new websites can bundle the two, especially through Bluehost. All new Bluehost customers get a free domain for one year with a web hosting subscription.

It’s cheaper long-term to get your domain directly from a registrar. Bluehost’s domain renewal rates will be a bit higher. But overall, the added cost is pretty marginal.

Most new website owners will just find it easier to bundle everything under one roof, as opposed to using different platforms for a domain name and hosting plan.

Cost #7: Security

I don’t care what type of website you have; security needs to be a top priority for everyone.

There are a handful of different security measures that should be added to your site. I’m referring to things like network protocols, spam filtering, malware scans, firewalls, and more. But you can get additional security directly from your web hosting provider.

At a minimum, every web host should be offering you a free SSL certificate. That’s become an industry standard, and I wouldn’t recommend any host that charges an extra SSL fee.

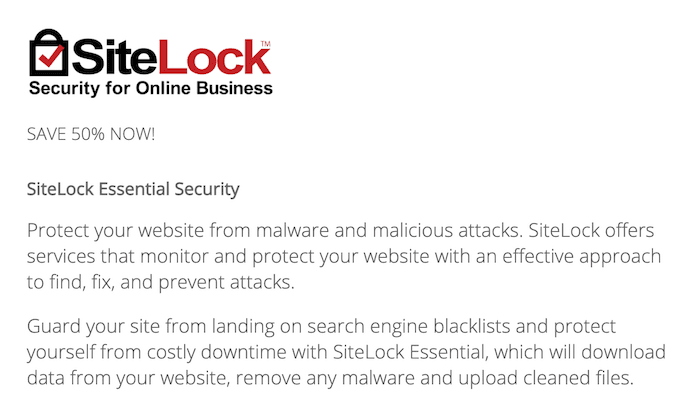

The exact security options vary from provider to provider, but here’s an example from Bluehost.

For $2.99 per month, SiteLock Security Essential gives you automated malware detection, unlimited page scans, blacklist monitoring, file-level scanning, automatic malware removal, plugin scanning, weekly reports, and more.

Alternatively, you could always skip this and beef up security on your own. If you’re using WordPress, there are plenty of great WordPress security plugins to consider.

Cost #8: Managed Support and Server Maintenance

Managed web hosting has become increasingly popular over the years. The term has different meanings depending on the plan and provider you’re using, but in short, a managed web host will take care of all the server operations behind the scenes. This typically includes setup, maintenance, server monitoring, support, updates, and more.

Alternatively, high-traffic websites could consider a managed WordPress plan.

The entry-level managed plan from Bluehost starts at $19.95 per month and can accommodate up to 50,000 visitors per month. These plans scale all the way up to sites with 500,000 monthly visitors.

If you’re using a dedicated server, you definitely need to think about the maintenance costs. Dedicated servers are typically offered with managed or unmanaged options.

The unmanaged plans will be cheaper if you’re just comparing rates side-by-side. But you’ll be responsible for the cost of maintaining and updating the server on your own. Unless you’re really technical or have a dedicated IT team, it’s generally better to just get a managed plan from your hosting provider. Long-term, it’s cheaper than managing a server on your own.

Cost #9: Package Extras

Every web hosting provider makes an effort to sign you up for as many different services as possible. Navigating through upsells is just part of shopping around for web hosting.

With that said, you can skip the vast majority of add-ons and upsells offered by web hosts, especially the ones that aren’t directly tied to web hosting.

Here’s an example to show you what I mean:

The web hosting costs highlighted above come to $142.20. But if you add-on all of the package extras to your plan, your total becomes $277.83. That’s a big jump from an advertised price of $3.95 per month.

Believe it or not, Bluehost actually doesn’t even offer that many extras compared to other hosting providers. Some will offer double or even triple this amount.

The key here is knowing what to select and what not to select.

A single domain SSL isn’t necessary, as you’re already getting a free Let’s Encrypt SSL with your plan. You don’t need the marketing or SEO tools. SiteLock Security Essential is something we discussed earlier.

If you’re not going to get security features elsewhere, adding it on now is a good choice.

Codeguard Basic is another 50/50 option. It includes daily backups, one-click restores, and other helpful tools. But you could always get this later on from other plugins or services.

Cost #10: Downtime

Downtime is an indirect cost of web hosting. It’s not something that you’ll see on your bill.

But every time your site goes down due to a server crash or network error, it costs you money. The type of website you have and your monetization strategy will dictate exactly how much money you’re losing.

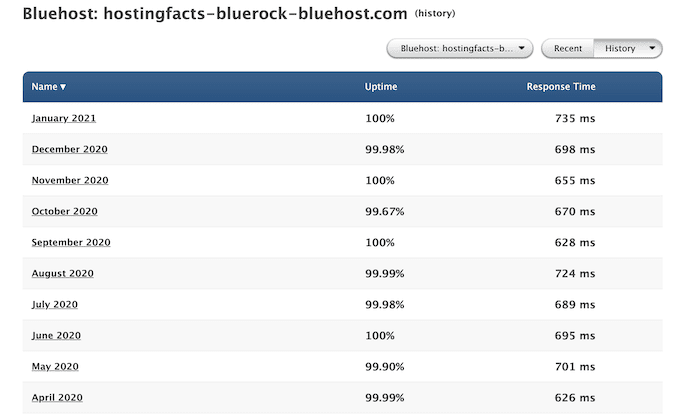

You can use uptime monitoring from Pingdom to see how different web hosts stack up with each other. Here’s an example showing Bluehost’s uptime stats over the last ten months.

Don’t just look at an uptime guarantee from a hosting provider and assume you’re in good shape. Those guarantees typically come with all types of contingencies. In the event that they fail to meet the uptime agreement, you’ll just get credit off of a future bill.

But that $0.50 or $1.25 credit two years from now isn’t worth the cost of losing customers today.

Always look at reviews to see what real people have to say about the uptime reliability of different web hosting providers. Frequent downtime can be costly long-term.

Conclusion

What’s the truth about web hosting costs? You don’t need to pay a fortune.

Your total cost to host a website will depend on several different factors. I’ve identified the top ten costs associated with web hosting above. As you can see from this list, it’s actually fairly easy to keep hosting costs low if you understand what to look for.

Bluehost is my favorite way to save money on web hosting. So if you sign up with them, you’re on the right track. You’ll even get a free SSL certificate and free domain name.

The post The Truth About Website Hosting Costs appeared first on Neil Patel.

The Truth about Unsecured Business Loans in a Recession

The novel coronavirus has upended our economy. We’re already a recession. If you’ve got less than stellar credit, then you may feel you must put up collateral. But that’s not necessarily so. Here’s the truth about unsecured business loans in a recession.

Get the Truth about Unsecured Business Loans in a Recession

Unsecured business loans in a recession can save you. Here’s the skinny on this little-known form of funding.

Bad credit does not have to be a dead weight around your company’s proverbial neck. However, it does make it more challenging to obtain a small business loan. For a brand-new small business in particular, your company credit will be poor as a matter of course.

This is because you just will not have the sort of history and seasoning which can make your commercial credit score rise. And, then, make lending institutions want to lend your business funds).

Hence, lenders are not going to be too thrilled about offering your business a business loan. This is because they genuinely have no clue if your small business will be able to repay the loan. But you are still, with good reason wondering how to fund a small business with poor credit.

Unsecured Business Loans in a Recession: UCC Blanket Liens

As a result of this, lenders will typically obtain a UCC blanket lien in case they do give your company a loan. A UCC blanket lien is a notification which goes on your credit report. It says that the lender has an interest in all of your company’s assets until you repay the loan completely. Thus, there could be unfortunate consequences if you need to default.

Plus, most of these loans will also entail personal guarantees.

But That’s Different! What are Unsecured Business Loans in a Recession? Our Credit Line Hybrid is a Superb Choice!

Check out our credit line hybrid. It’s available for all business owners. Get the benefit of 0% rates cards offer, and the cash out capability of a credit line. Get approvals to $150,000. Pay 0% rates for 6 – 18 months, with normal card rates afterwards. No documentation, no tax returns or bank statements are necessary. This program is ideal for startups, high-risk industries, and those who desire low payments. It also works if you don’t want to supply financials.

Our credit line hybrid is a superb choice during this time of economic uncertainty.

With this form of business financing, you work with a lender who concentrates on securing business credit cards. This is a very unusual, very few know about program which few lending sources offer. They can in most cases get you three to five times the approvals that you can get on your own.

This is because they are familiar with the sources to apply for, the order to apply, and can time their applications so the card issuers won’t decline you for the other card inquiries. Individual approvals frequently range from $2,000 – 50,000.

The end result of their services is that you frequently get up to five cards that simulate the credit limits of your highest limit accounts now. Multiple cards create competition, and this means they will raise your limits, generally within 6 months or less of first approval.

Approvals

Approvals can go up to $150,000 per entity such as a corporation. They actually get you three to five business credit cards that report solely to the business credit reporting agencies. This is huge, something most lenders don’t offer or advertise. Not only will you get cash, but you build your business credit as well so in three to four months, you can then use your new company credit to get even more money.

Details

You get credit with no security, assets, or collateral. Lender has no collateral to collect in case of default. Because there is no collateral, and they don’t look or care about your cash flow, the only thing that matters is your personal credit.

With a 650 you will get just personal cards. But with a 680 credit score, you will get both company and personal cards.

Rates

The lender can also get you low introductory rates, usually 0% for 6-18 months. You’ll then pay normal rates after that, typically 5-21% APR with 20-25% APR for cash advances. And they’ll also get you the best cards for points. So this means you get the best rewards.

Like with anything, there are substantial benefits in working with a source who specializes in this area. The results will be far better than if you try to go at it on your own.

Unsecured Business Loans in a Recession: The Alternative: Building Business Credit

Not enough time in business? Or do you not have enough revenue? Then it’s time to start business credit building.

Every Business Needs Small Business Credit Establishing

Small business credit is credit in a company’s name. It doesn’t connect to an owner’s individual credit, not even if the owner is a sole proprietor and the solitary employee of the business.

Accordingly, an entrepreneur’s business and consumer credit scores can be very different.

The Benefits

Given that business credit is distinct from individual, it helps to safeguard a business owner’s personal assets, in the event of legal action or business insolvency.

Also, with two distinct credit scores, a small business owner can get two separate cards from the same vendor. This effectively doubles buying power.

Another advantage is that even start-ups can do this. Going to a bank for a business loan can be a formula for frustration. But building small business credit, when done correctly, is a plan for success.

Consumer credit scores are dependent on payments but also various other components like credit use percentages.

But for business credit, the scores actually merely hinge on whether a small business pays its debts on a timely basis.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

The Process

Establishing small business credit is a process, and it does not occur without effort. A company will need to actively work to develop business credit.

Nevertheless, it can be done readily and quickly, and it is much more rapid than building consumer credit scores.

Merchants are a big part of this process.

Undertaking the steps out of order will lead to repetitive denials. No one can start at the top with business credit. For instance, you can’t start with retail or cash credit from your bank. If you do, you’ll get a denial 100% of the time.

Company Fundability

A company has to be fundable to credit issuers and merchants.

For this reason, a business will need a professional-looking website and email address. And it needs to have website hosting bought from a company like GoDaddy.

And also, business telephone and fax numbers must have a listing on ListYourself.net.

Likewise, the business telephone number should be toll-free (800 exchange or similar).

A company will also need a bank account dedicated strictly to it, and it must have all of the licenses necessary for running.

Licenses

These licenses all must be in the particular, accurate name of the small business. And they need to have the same business address and telephone numbers.

So keep in mind, that this means not just state licenses, but possibly also city licenses.

Dealing with the IRS

Visit the IRS web site and acquire an EIN for the company. They’re free of charge. Choose a business entity such as corporation, LLC, etc.

A company can get started as a sole proprietor. But they will more than likely want to switch to a variety of corporation or an LLC.

This is in order to decrease risk. And it will maximize tax benefits.

A business entity will matter when it comes to taxes and liability in the event of litigation. A sole proprietorship means the business owner is it when it comes to liability and taxes. No one else is responsible.

Sole Proprietors Take Note

If you operate a company as a sole proprietor, then at the very least be sure to file for a DBA. This is ‘doing business as’ status.

If you do not, then your personal name is the same as the small business name. Consequently, you can wind up being personally liable for all small business debts.

In addition, according to the IRS, by having this structure there is a 1 in 7 chance of an IRS audit. There is a 1 in 50 probability for corporations! Steer clear of confusion and significantly decrease the odds of an IRS audit at the same time.

Beginning the Business Credit Reporting Process

Start at the D&B website and get a cost-free D-U-N-S number. A D-U-N-S number is how D&B gets a small business into their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the small business. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

By doing so, Experian and Equifax will have something to report on.

Vendor Credit

First you need to establish trade lines that report. This is also called vendor credit. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get retail and cash credit.

These kinds of accounts tend to be for the things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But to start with, what is trade credit? These trade lines are credit issuers who will give you starter credit when you have none now. Terms are generally Net 30, rather than revolving.

Therefore, if you get an approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts have to be paid fully within 60 days. In contrast to with revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To start your business credit profile the proper way, you ought to get approval for vendor accounts that report to the business credit reporting agencies. When that’s done, you can then make use of the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit – It Makes Sense

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with a minimum of effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 3 of these to move onto the next step, which is retail credit.

Accounts That Do Not Report

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to at the very least one of the CRAs, a trade account which does not report can yet be of some worth.

You can always ask non-reporting accounts for trade references. Additionally credit accounts of any sort will help you to better even out business expenditures, consequently making financial planning less complicated. These are companies like PayPal Credit, T-Mobile, and Best Buy.

Retail Credit

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs, then move to retail credit. These are service providers which include Office Depot and Staples.

Only use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the company’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then move onto fleet credit. These are businesses like BP and Conoco. Use this credit to buy fuel, and to repair and maintain vehicles. Just use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the business’s EIN.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Cash Credit

Have you been sensibly handling the credit you’ve up to this point? Then move to more universal cash credit. These are businesses like Visa and MasterCard. Only use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

One example is the Fuelman MasterCard. They report to D&B and Equifax Business. They need to see a PAYDEX Score of 78 or better. And they also want you to have 10 trade lines reporting on your D&B report.

These are commonly MasterCard credit cards. If you have more trade accounts reporting, then these are doable.

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and address any inaccuracies ASAP. Get in the habit of checking credit reports. Dig into the particulars, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update Your Record

Update the info if there are errors or the info is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. And for Equifax, go here: www.equifax.com/business/small-business.

Fix Your Business Credit

So, what’s all this monitoring for? It’s to challenge any problems in your records. Mistakes in your credit report(s) can be corrected. But the CRAs usually want you to dispute in a particular way.

Get your company’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Disputes

Disputing credit report inaccuracies normally means you send a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always send copies and keep the originals.

Fixing credit report errors also means you precisely spell out any charges you contest. Make your dispute letter as clear as possible. Be specific about the problems with your report. Use certified mail so that you will have proof that you sent in your dispute.

Dispute your or your business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute inaccuracies on your or your business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service contact number is here: www.dandb.com/glossary/paydex.

A Word about Building Business Credit

Always use credit responsibly! Don’t borrow beyond what you can pay off. Track balances and deadlines for repayments. Paying off in a timely manner and in full will do more to elevate business credit scores than pretty much anything else.

Growing small business credit pays off. Great business credit scores help a business get loans. Your loan provider knows the company can pay its financial obligations. They know the business is for real.

The small business’s EIN links to high scores and credit issuers won’t feel the need to request a personal guarantee.

Business credit is an asset which can help your company for many years to come. Learn more here and get started toward growing business credit.

Unsecured Business Loans in a Recession: Takeaways

For each of these alternatives, you will definitely have a preferable rate of interest if your credit score is better than poor. And you will most likely have more options, so you can shop around and compare plans.

If your business can stand by until your credit– either company or personal or both– improves, then your alternatives will significantly improve, too. In the meantime, unsecured business loans in a recession can help. Use this pause in our lives to improve your credit. Because the COVID-19 situation will not last forever.

The post The Truth about Unsecured Business Loans in a Recession appeared first on Credit Suite.

Risky SIC Codes in a Recession: The Ugly Truth of Risk and Skittish Lenders

Risky SIC Codes –Will Your Business Be Denied Funding?

All businesses can potentially have problems getting loans during a recession. This is the nature of an economic downturn – funding tends to dry up. Higher-risk businesses have problems even in the best of economic times. But when you put them both together, you get risky SIC codes in a recession.

If funding possible at all? While SIC codes may or may not matter for SBA Paycheck Protection Program funding, they do matter elsewhere.

Do you know which SIC codes get you denied? But before we go any further, just what is a SIC code, anyway?

Risky SIC Codes in a Recession: SIC Codes

The SIC Code (Standard Industrial Classification) is a part of a business classification system.

A Standard Industry Classification code, or SIC is a four digit numerical code which is assigned by the U.S. government to businesses, to make it easier to identify the primary activity of the business. It is an indicator of the kind of business a company is in.

The Securities and Exchange Commission developed this system. For example, if your company makes tires and/or inner tubes, then your SIC code would be 3011. The numbers are somewhat intelligent in that there are ranges of industry groups which correspond to the first of the four digits, such as manufacturing corresponds to four-digit SIC codes which start with either a 2 or a 3.

The combination of the first and second digits then defines the major industry group. In our example, 30 will designate ‘Rubber and Miscellaneous Plastic Products’.

The SIC code’s digits are grouped to identify the industry and industry group. The first two digits in the SIC code identify the major industry group, the third digit identifies the industry group and the fourth digit identifies the industry.

The IRS

In fact, the Internal Revenue Service will use the SIC code that you select. This is in order to determine if your business tax returns are comparable to the other businesses in your industry. Hence, if your tax deductions do not reasonably resemble the other businesses in your industry, your business could be audited.

Furthermore, some companies may be labeled high-risk when they do not select the right SIC codes to classify their company. However, if you understand how the business classification system works, then you can choose the correct code on your first try.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business.

Risky SIC Codes in a Recession: NAICS Codes

The North American Industry Classification System (NAICS) is another business classification code.

This code classifies business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. economy. NAICS industry codes define establishments based on the activities in which they are primarily engaged.

The NAICS puts out its own list of high-risk and high-cash industries. Higher risk industries on the list include casinos, pawn shops, and liquor stores, but also automotive dealers and restaurants.

OSHA requires injury and illness reports from certain high-risk industries.

Restricted industries (automatic decline) include:

- Ammunition or Weapons Manufacturing; wholesale and retail.

- Bail Bonds

- Check Cashing Agencies

- Energy, oil trading, or petroleum extraction or production

- Finance: (Federal Reserve Banks, foreign banks, banks, bank holding companies,

loan brokers, commodity brokers, security brokers, mortgage brokers, mortgage bankers, mortgage companies, bail bond companies, or mutual fund managers). - Gaming or Gambling Activities

- Loans for the speculative purchases of securities or goods.

- Pawn shops

- Political campaigns, candidates, or committees

- Public administration (e.g., city, county, state, and federal governmental agencies).

- X-rated products or entertainment

High-Risk Industries (subject to stricter underwriting guidelines):

- Agriculture or forest products

- Auto, recreational vehicle or boat sales.

- Courier services

- Computer and software related services.

- Dry cleaners

- Entertainment (adult entertainment is to be considered restricted).

- General contractors

- Gasoline stations or convenience stores (also known as c-stores)

- Healthcare; specifically nursing homes, assisted living facilities, and continuing care retirement centers.

More High-Risk Industries

- Special trade contractors

- Hotels or motels

- Jewelry, precious stones and metals; wholesale and retail.

- Limousine services

- Long distance or “over-the-road” trucking.

- Mobile or manufactured home sales.

- Phone sales and direct selling establishments

- Real estate agents/brokers

- Real estate developers or land sub-dividers

- Restaurants or drinking establishments.

- Software or programming companies

- Taxi cabs (including the purchase of cab medallions) .

- Travel agencies

Risky SIC Codes in a Recession: Which Code is in Use?

They both are. However, the SIC code system is phasing out and NAICS will replace it. But for the moment, assume they are both in play, as the transition has not yet finished. These coding systems are similar but not identical.

Lenders, banks, insurance companies and business credit reporting agencies use the two business classification systems to determine if your business is a high-risk industry classification. This means that you could get a denial for a loan or a business credit card based on your business classification. Some SIC codes can trigger automatic turn-downs, higher premiums, and reducing credit limits for your business.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business.

Risky SIC Codes in a Recession: Risks

When considering any aspects of a business, risk has to be a major factor. There are inherent issues in every single industry. Crops fail, lease terms go up too high so a company has to move, or tariffs or even a war make importing less reliable.

But some businesses are considered to be risky by their very nature. And this is the case even if everything else goes off like a hitch and the business is prospering. Risk is inherent within these business types. Therefore, even if your business doesn’t feel risky, it just might be anyway.

Why Risk Matters

The biggest reason why risk matters has to do with funding. There are several industries where lending institutions are hesitant to do business. In those particular cases, there are stricter underwriting guidelines. But at least a company can get funding.

Not so with other industries. In some industries, no funding is available at all. As a result, those businesses will need to find other solutions for financing. These solutions can include, potentially, crowdfunding, angel investors, venture capital, business credit building and more.

Still, a lot of businesses would rather work with lenders. But where are lenders’ ideas of the magnitude of risk coming from?

Risky SIC Codes in a Recession: Real Injury Risks According to the CDC

In 1999, the Centers for Disease Control published an article on risks in small businesses. This article contains information on SIC codes. And it gives information on injuries associated with the codes. While this is not the true means by which lending institutions decide on risk, it is still of interest. And it can demonstrate what may be behind some of the reasoning.

Part of the calculation of risk comes from occupational injuries. These are such as those noted in the CDC report. But the other side of the risk coin is occupations which are high in cash transactions. After all, a pawn shop might not have much of a specific risk of injury at all. But the large amounts of cash normally associated with one mean that it can be a tempting target for thieves.

Risky SIC Codes in a Recession: Choosing Better SIC Codes

The choice of SIC code is yours. For automotive sales, for example, you would normally select 5511, ‘Motor Vehicle Dealers (New and Used)’. But most lenders will automatically turn your business down because of the high-risk factor within the business classification name. Of course you want to be honest with your SIC coding classification. But if more than one SIC code could apply, there is nothing wrong with choosing the SIC code which will not get you denied by lenders.

Therefore, if you want to have your automobile sales company, you need to develop a business code which has auto and home supply stores, motor vehicle parts and accessories, or car washes written in the actual business code. That way, you can still operate your real business of “automotive sales” without actually being considered a risk factor.

There is nothing deceptive or dishonest about doing this.

Check the SIC code database for more information on these codes.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business.

Risky SIC Codes in a Recession: Choosing Lower-Risk Business Names

Beyond coming up with the perfect memorable name which is easy to spell and say, and evokes your company’s mission statement, there’s also the matter of risk. Adding a risky business type into your business name will trigger financing denials.

For example, bail bonds are a restricted industry. So are many types of financing business types, and check cashing agencies. Hence naming your venture Chico’s Bail Bonds is a recipe for a delay if not an outright denial.

But it is the same as with choosing a lower-risk SIC code when two apply. There is nothing deceptive, illegal, or unethical in naming your company Chico’s.

Will this more generalized name guarantee funding for your business venture? Of course it won’t. But at least your business will not be automatically turned down before you can make your case for funding.

Risky SIC Codes in a Recession: Takeaways

Choosing the incorrect SIC codes could end up costing your business and get you labeled as high-risk. And this could directly impact your insurance premiums, your financing ability, and even your credit limit recommendations. This small error of choosing the wrong SIC codes could cost your business in the future. Therefore, be sure to do your research before you select any SIC codes for your business. Because you might just end up choosing risky SIC codes in a recession. And those could get you a denial. And it does not have to be that way.

The post Risky SIC Codes in a Recession: The Ugly Truth of Risk and Skittish Lenders appeared first on Credit Suite.