The 5 Best Email Marketing Companies of 2020

Almost everyone uses email.

But here’s the sweet part.

The people you’re trying to reach or retain already have active email addresses. Heck, most of them used or would use one to sign-up for your service or product.

If you can get into (and stay) in people’s inbox, you can make a ton of money. Data shows companies can generate $38 for every $1 email investment.

Unfortunately, getting into an inbox is not a stroll in the park.

Now that’s where the best email marketing companies come in.

These companies will help you to strategize, collect relevant email addresses, create, and manage email marketing campaigns that drive business growth.

How do I know this?

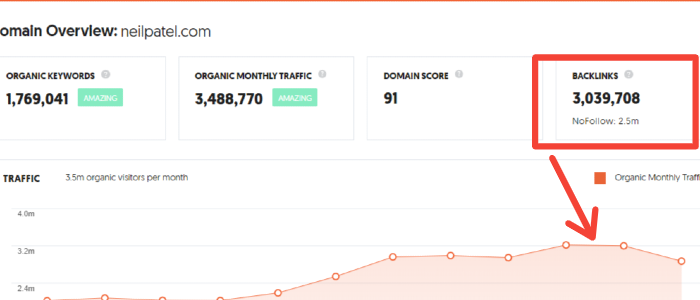

Our team at Neil Patel Digital vetted hundreds of email marketing companies based on their brand reputation, client portfolio, ratings, and their areas of expertise.

The result?

The very top email agencies you can trust. Not only would they get you into the inbox of your ideal customers, but these companies can keep you in there till you turn prospects into brand advocates.

The 5 Top Email Marketing Companies in The World

- Neil Patel Digital – Best for email content

- Inbox Army – Best for full-service email management

- Fix My Churn – Best for SaaS onboarding email and churn

- Action Rocket – Best for custom HTML & CSS enterprise email

- SmartMail – Best for ecommerce email marketing

I’m confident the best email marketing companies listed above and reviewed below are reliable because of their proven track records.

Hire any of them, according to your needs, and they’ll help you to turn email marketing into a growth channel for your business.

Without further ado, let’s explore each of these companies and see for yourself why we consider them the very best.

#1 Neil Patel Digital – Best For Email Content

Email marketing is effective, no doubt. But it has its downside too.

According to two different studies, between 0.19% and 0.52% of your email subscribers would unsubscribe per email you send.

Now, guess what was one of the top three reasons found Jilt, an email marketing software, responsible for why people unsubscribe from emails?

Bad content!

In other words, irrespective of how excellent your email marketing strategy is, writing killer emails that resonate with your prospects and keeps you in their inbox requires excellent content.

And that’s where we, Neil Patel Digital, come in. It is also why clients, from startups to enterprise brands, love working with us.

Email is also an excellent channel for content distribution.

However, he quality of content has to be amazing. If not, your unsubscribes will tank the ROI of your email campaigns.

Again, this is one area we stand out from the crowd.

At Neil Patel Digital, our email content service starts by producing engaging content your customers and prospects will love.

Then, we use email marketing as one of the channels to promote it:

You can check out Neil Patel Digital’s content services here.

#2 InboxArmy – best for full-service email management

For in-house teams looking for rapid email marketing turn around, InboxArmy comes highly recommended.

As a full-service email management company, InboxArmy offers a spectrum of services, including email templates’ design, custom coding, and 360-degree email marketing management:

This agency offers volume-based pricing for companies and white label services for fellow digital marketing agencies, which goes to prove their experience.

And they serve clients from government agencies like Texas Health Resources, to companies such as LandCentral, Airbnb, Jockey, and several others.

#3 Fix My Churn – best for SaaS onboarding email and churn

When it comes to email marketing, Software as a Service (SaaS) brands have special needs.

First, when new trial users sign-up, they need excellent email onboarding sequences to convert them into happy, paying customers.

And if an existing customer stops using your product or wants to churn, you can retain them with relevant churn email.

Fix My Churn specializes in these two areas:

Fix My Churn collaborates with tech companies with a monthly subscription business model.

The company applies top-notch SaaS copywriting skills to craft relationship-based email sequences to keep customers happy.

#4 Action Rocket – best for custom HTML & CSS enterprise email

Action Rocket needs no introduction in the enterprise email marketing sector.

This company even partners with the top email marketing software brands like MailChimp, Litmus, and Campaign Monitor to drive innovation in the email space.

Action Rocket has years of experience strategizing and executing custom HTML and CSS email and CRM development programs for enterprise companies:

Founded in 2011, the company works with a knit-team of experienced developers who are excellent at strategy, design, and coding of complex and customized email programs.

And their clientele speaks for themselves, including the BBC, Marks & Spencer, Global Radio, and many others.

#5 SmartMail – Best for eCommerce email marketing

SmartMail is the Done For You (DFY) email marketing company that comes highly recommended by ecommerce businesses.

This company handles everything ecommerce email marketing for online stores. And excel most at launching campaigns based on automated triggers.

Across the customer lifetime cycle, SmartMail is exceptional at strategizing and executing optimized email marketing campaigns for ecommerce businesses.

And they have a track record and excellent results to show.

SmartMail has generated over $187 million in revenues for ecommerce brands via email, sent billions of emails, and serve over 87 businesses, including Skechers, French Connection, Cotton:On, and others.

5 Characteristics That Make a Great Email Marketing Company

What characteristics make an email marketing company great?

They are as follows.

1. Well-versed in content creation

Most companies get buried in strategizing and outlining plans for email marketing.

What they wrongly relegate to the backseat?

The quality of your email’s content goes a long way in determining how effective your email marketing campaigns would be.

A fundamental characteristic of the top email marketing company is to focus on creating engaging content to power your email campaigns.

And a world-class email company will help you blent top-tier content with amazing promotions to also get the conversions that you need. Great companies blend the two seamlessly.

2. An Impressive Portfolio

An email marketing company that claims to be among the best must have something to back that claim up.

One of such things is their client portfolio.

Who have they implemented a series of email marketing campaigns for? Were those campaigns successful?

Anyway, you don’t even need to ask a top email marketing company those questions, as you’ll find the answers in their clients’ portfolio.

And looking out for this portfolio-displaying characteristic in top email marketing also does you good.

It helps you to see who they have helped and to decide if they’ll be a good fit for your company.

At Neil Patel Digital, we have a clients you may recognize.

3. Thought Leadership

In its 40 years of existence, email marketing has evolved tremendously.

What worked yesterday may not work today. And even if it does work, it may require a different approach.

Due to the always-evolving nature of trends and modern strategies applicable to email marketing, top companies must keep pace with these changes to deliver the best work.

Thought-leadership is how the top email marketing brands keep such needed pace with the industry.

And they do this by sharing new learnings, experiments, emerging strategies, and tactics publicly to retain brand reputation among other professionals.

So, you should do some research and look out for this characteristic, as it is an excellent way to spot a top email marketing company.

4. Real Life Testimonials

Anyone can claim to be the best, but it is what others say about them shows their competence most.

In the business setting, you’ll find how past and existing clients feel and say of a company’s work in the testimonials they leave behind.

The truth is executing a successful email campaign that drives growth for a company is hard.

A notable characteristic of the top email marketing company is the real-life testimonials they receive from clients for their work publicly.

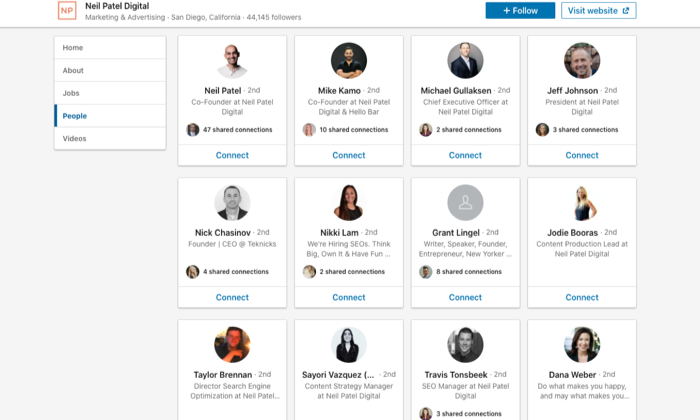

5. A Diversified Team of Experts

A lot of thought goes into a successful email marketing campaign.

From strategy to the acquisition of email addresses, selection of email marketing software, email copywriting, and campaign management, they all require some different kind of expertise.

Established email marketing brands are never a one-person show. It is usually a team of experts, collaborating to drive results.

And that’s one characteristic of top email marketing companies: Displaying the entire team that works to plan, execute, manage, and optimize email campaigns:

What to Expect from a Great Email Marketing Company

Ultimately, an exceptional email marketing company to help you turn email into a real business growth channel that:

- Nurture prospects into customers

- Facilitates customer relationship management

- Turns email marketing into a reliable content medium.

But to get to these benefits, there are steps to expect before you start working with one. Some of the most notable ones are what follows.

1. A discovery session

As you saw in the review and categorization of the best email marketing companies based on their areas of expertise above, not all can serve all clients across all industries.

To determine if they can solve your specific problems, excellent email marketing companies start by getting to fill an inquiry form.

Filling this inquiry form allows you to share your challenges and business goals related to email marketing.

After filling this form, expect a discovery session where an expert would talk one-on-one with you to understand your needs better.

2. Research & strategy recommendations

A discovery call allows the company to gain more clarity and context about your business needs relevant to email. But, don’t expect them to propose a solution right off the bat.

Top email marketing brands would typically use what you shared with them to delve into research.

From there, they can make sense of how to tackle your challenges and identify the best possible strategies they can deploy to work with you.

Expect to receive a summary of their research and recommendations via email or another call, which usually ends with deciding if you’re fit to work together.

3. A contract with project deliverables

If everything goes well up to this point, and you like their recommendations, expect a contract that outlines what a top email marketing company would do, and what it’ll cost to work with you.

This contract also outlines project timelines and deliverables, legal requirements to work together, and your expected investment.

4. Client onboarding

If the contract, project scope, deliverables, pricing, and others look good, exceptional email marketing companies would have a custom onboarding process to initiate the process of working with your company.

This onboarding process will help you and the company to establish an understanding of how to manage your product, and any other thing necessary for a smooth working relationship.

Start Email Marketing from Day One

Don’t make the mistake of starting email marketing later on.

Most businesses recognize the need for social media, SEO, content marketing, and others early on, but they leave emails to the backseat because it is not trending.

Well, you shouldn’t.

A few reasons to take start email marketing from day one are:

Marketers who used email marketing to segment their audience said they saw a 760% increase in revenue.

That’s unreal.

Whether you do email yourself and get help from one of the top email companies, get started today.

The post The 5 Best Email Marketing Companies of 2020 appeared first on Neil Patel.