How to Use First-Party Data for Ad Personalization

Have you ever felt like someone was watching you online? Those shoes you just searched for on Amazon suddenly show up in ads on Facebook. Maybe you start seeing ads on YouTube for a resort you were researching for an upcoming vacation.

The truth is, you are being watched. In fact, marketers have used cookies to track the actions of internet users for years—but that may soon change. Google announced they are ending the use of third-party cookies. As a result, most businesses will have to rely on first-party data for things like ad targeting.

What does that mean for your marketing strategy? It might not be as bad as you think.

Here’s what you need to know about first-party data and how to use it to create targeted paid ads. (Spoiler alert: It might actually be better for your PPC strategy in the long run!)

What Is First-Party Data?

Before we dig into what this change means for your paid ads, let’s talk about the different types of data companies use in marketing.

First-party data is information companies collect from their own sources about their customers. For example, the data from your website tracking tool, your email subscribers, or surveying your audience.

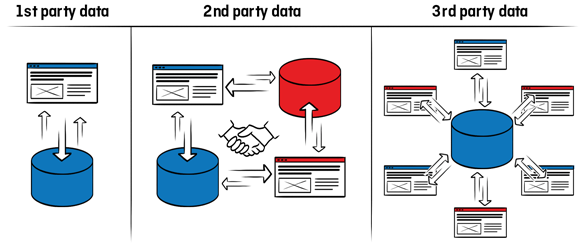

Second-party data is when two or more organizations come together to mutually share their data. Third-party data is collected by one source, often aggregated, and then sold to a third party who has no connection with the original source.

To summarize:

- first-party data: data you collect about your customers or site visitors

- second-party data: data you and someone else pool together

- third-party data: data collected by one party and sold or shared with an unrelated third-party

What Is the Difference Between First-Party Data and Third-Party Data?

Third-party data, the type Google is phasing out, refers to data collected from (as you might have guessed) a third-party, meaning a site or entity without a direct relationship with the original source.

Third-party data is collected, aggregated, and sold to other parties. The problem is the brands buying the data have little idea where it came from.

There are other issues, too. For example, you can buy third-party data, but so can your competitors. That makes it hard to be competitive.

This chart helps illustrate the difference between the different types of data.

Why Is Third-Party Data Being Phased Out?

The main reason third-party data is being phased out is due to major security and privacy issues.

David Temkin, Director of Product Management, Ads Privacy, and Trust at Google, shared,

People shouldn’t have to accept being tracked across the web in order to get the benefits of relevant advertising. And advertisers don’t need to track individual consumers across the web to get the performance benefits of digital advertising.

Advances in aggregation, anonymization, on-device processing and other privacy-preserving technologies offer a clear path to replacing individual identifiers.

Google isn’t the only one phasing out cookies. Firefox stopped using cookies in 2013, and Microsoft made “Do Not Track” their default setting the same year.

In addition to privacy issues, cookies aren’t as accurate as some might think. For example, they can’t always track users across devices.

If you shop on your phone for a pair of shoes but buy them on your laptop, you might still see ads for those shoes on your mobile device—which is terrible for ad spend, as brands waste money targeting users that have already converted.

How Will Using First-Party Data Impact Ad Personalization?

As Google phases out third-party cookies, many brands will begin using first-party data to better personalize ads. What does this mean for your paid marketing strategy?

Don’t worry; you won’t have to rebuild your marketing strategy from scratch. However, there are a few changes you’ll want to pay attention to:

- Brands will need to focus on collecting first-party data: If you haven’t been gathering data about your audience, now is the time. Consider hosting contests, using website tracking tools, or sending out surveys to collect more information about your audience.

- Competitive analysis will get harder: One of the downfalls of third-party data is that you and your competitors are using the exact same targeting data. With the move to away from third-party cookies, it might become harder to understand why your competitors are taking certain actions.

- Ads may get more personalized: First-party data is data from your actual site visitors and customers, making it easier to create a personalized experience.

Day-to-day, the switch away from third-party data is unlikely to impact the marketing world in a massive way. Most brands will begin to rely on first-party data more; however, Google is also creating what they call a “privacy sandbox” to allow brands to target users without invading their privacy.

Brands that want to succeed shouldn’t rely entirely on Google’s new data plan because there are a ton of advantages to using this type of data?

Advantages of Only Using First-Party Data for Ad Personalization

Why should you consider moving to first-party data rather than relying solely on Google’s privacy sandbox?

For starters, most brands are increasing their reliance on first-party data, which likely means they are seeing positive results. According to Google, 87 percent of APAC brands consider it critical to their marketing efforts.

Let’s look at a few other benefits to consider.

First-Party Data Is More Accurate

First-party data is information you collect about your customers. This makes it more accurate because you know who it is about and where it came from.

Third-party data is sold and sometimes resold, which means brands have no access to the source data and, sometimes, very little idea about where the data is actually from.

Boost Marketing Performance

Some people are really concerned about the end of third-party data, but I’m not. Why? Because first-party data isn’t just more accurate; it’s also much more efficient at driving consumers to take action.

According to a study by Boston Consulting Group, marketers that use first-party data see a lift in marketing efficiency, generating nearly double the revenue from a single ad or placement.

Your Competitors Don’t Have the Same Data

Standing out online sometimes feels impossible. With millions of companies, billions of internet users, and more content being churned out every day, brands that want to stand out face a ton of noise.

With third-party data, you and your competitors can buy the exact same data, which makes it pretty hard to be competitive. However, your competitors don’t have access to the data you collect, making it easier to test new initiatives or uncover opportunities about your own traffic and customers.

You Can Double Down on Personalization

According to Forrester, 89 percent of digital companies invest in marketing personalization. It’s easy to see why when 80 percent of customers report they are more likely to purchase from brands that offer a personalized experience.

Using third-party data for personalization was never a perfect match. You might not know when a customer converts from another device or if the data you’re using is skewed. With first-party data, you can dive into personalization, secure in the knowledge that your data is accurate.

It Is More Standardized

Imagine asking five people to create a puzzle piece. You give them all the same parameters for height, length, and shape. Even with the same directions, each of those pieces isn’t quite going to fit together.

The same thing happens with third-party data. Each platform might gather it just a little bit differently, which can make it almost impossible to pull all that data together. With first-party data, however, you gather the data. This means you can ensure it is standardized and works well with all your tools and systems.

First-Party Data Is Cheaper

Third-party data is purchased from another vendor, which means you are shelling out cash for data that is less efficient, less accurate, and harder to use. First-party data, on the other hand, is information from your own audience.

Which means you don’t have to buy it. You will have to pay a bit to collect and store the data, but it’s likely much cheaper than purchasing the data from another source.

How to Use First-Party Data for Ad Personalization

We’ve covered what first-party data is, why Google is ditching third-party data, and a few of the advantages of using it. How do you actually put first-party data to use? Here’s what you need to know to use this data for ad personalization.

Determine How to Leverage First-Party Data

Before you start collecting data, take the time to figure out how you will use the data to further your marketing goals. How you plan to use the data will impact what type of data you want to collect and how you gather it.

You might use it to:

- build brand awareness

- reduce churn

- send timely ads

- drive more qualified leads

For example, if the data will be used to send more personalized email marketing campaigns, you could gather the data through an email survey.

Make a Plan to Gather First-Party Data

Unlike third-party data, you can’t just buy first-party data; you’ll have to gather it yourself. Luckily, there’s no shortage of ways to gather it.

For example, you can collect first-party data from:

- website visitor tracking tools like Crazy Egg

- your mobile apps

- offline surveys

- social media channels

- user registration for your website

- contests

Before making a plan to gather data, think about how you plan the data to personalize your marketing. For example, retargeting ads, personalized product recommendations, or account-based marketing.

Ask Permission to Gather the Data

One of the major issues with third-party data is some web users don’t even realize they’re being tracked. As first-party data becomes more popular (and as privacy laws limit the data we collect about our audiences), it’s important to be transparent about the data you gather.

Ensure your audience clearly understands what data you collect, what you do with it, and how it’s stored. Being transparent about the data you collect and how you use it isn’t just the right thing to do, it’s required by law in some places, like the EU’s GDPR.

Test, Tweak, and Retest

With third-party data, you get what you get. There is no way to change the type of data you collect or adjust how you gather it.

With first-party data, you can test to figure out the best way to collect data by adjusting how you gather it or test and tweak how you use the data by A/B testing ads to see what your audience responds to.

Conclusion

Third-party cookies are coming to an end. What does that mean for marketers? It means it’s time to start leveraging first-party data for personalization. The good news is, it is more accurate and cheaper, and it can even improve marketing efficiency.

The first step to using first-party data is to find a way to collect it through polls, customer surveys, or website tracking tools. Then make a plan for how to use it. If you need help getting it set up, we can help.

Are you planning to use first-party data for ad personalization? What are your marketing goals?