Article URL: https://upchieve.welcomekit.co/jobs/mobile-engineer_brooklyn Comments URL: https://news.ycombinator.com/item?id=28097927 Points: 1 # Comments: 0

Month: August 2021

You Can Build EIN Credit Today

Did You Know You Can Build EIN Credit?

Yes, you really can build EIN credit for your business.

But let’s start with some definitions and background on business credit.

Business Credit

This is credit in a business’s name. It is not tied to the owner’s creditworthiness. Instead, business credit scores depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization won’t affect your consumer FICO score. Plus the business owner isn’t personally liable for the debt the business incurs. This can be true for you as you build EIN credit for your business.

Another advantage is that even startup businesses can do this. Visiting a bank for a business loan can be a recipe for frustration. But building business credit, when done correctly, is a plan for success.

Consumer credit scores depend on payments but also various other factors like credit utilization percentages.

But for company credit, the scores truly just hinge on if a small business pays its invoices timely.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Vendors are a big component of this process.

Doing the steps out of sequence results in repetitive rejections. No one can start at the top with business credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

Company Fundability to Build EIN Credit

A company must be fundable to lending institutions and vendors.

That is why, a small business needs a professional-looking website and email address. And it needs to have site hosting from a company such as GoDaddy.

Additionally, business phone numbers need to have a listing on 411. You can do that here: http://www.listyourself.net.

Also, the business telephone number should be toll-free (800 exchange or the equivalent).

A company also needs a bank account devoted strictly to it, and it must have every one of the licenses essential for running.

Licenses

These licenses all have to be in the identical, accurate name of the company. And they must have the same company address and telephone numbers.

So keep in mind, that this means not just state licenses, but possibly also city licenses.

Keep your business protected with our professional business credit monitoring.

Working with the Internal Revenue Service to Build EIN Credit

Visit the Internal Revenue Service website and get an EIN for the company. They’re free of charge. Select a business entity like corporation, LLC, etc.

A small business may get started as a sole proprietor. But they absolutely need to change to a form of corporation or an LLC.

This is to decrease risk. And it will make the most of tax benefits.

A business entity matters when it involves taxes and liability in the event of a lawsuit. A sole proprietorship means the business owner is it when it comes to liability and taxes. No one else is responsible.

The best thing to do is to incorporate. You should only look at a DBA as an interim step on the way to incorporation.

Starting to Build EIN Credit

Start at the D&B web site and get a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a small business into their system, to produce a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s web sites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

This way, Experian and Equifax have something to report on.

Starter Vendor Credit

First you should build tradelines that report. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get credit for numerous purposes, and from all sorts of places.

These kinds of accounts tend to be for things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first of all, what is trade credit? These trade lines are credit issuers who give you starter credit when you have none now. Terms are generally Net 30, versus revolving.

Therefore, if you get an approval for $1,000 in vendor credit and use all of it, you need to pay that money back in a set term, like within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts must be paid completely within 60 days. Unlike revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To launch your business credit profile the proper way, you should get approval for vendor accounts that report to the business credit reporting bureaus. When that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit – It Makes Sense

Not every vendor can help in the same way true starter credit can. These are vendors that grant approval with a minimum of effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

As you get starter credit, you can also start to get credit from retailers. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Uline

Uline is a true starter vendor. You can find them online at www.uline.com. They sell shipping, packing, and industrial supplies, and they report to Dun & Bradstreet and Experian. You MUST have a D-U-N-S number and an EIN before starting with them. They will ask for your corporate bank information. Your company address must be uniform everywhere. You need for an order to be $50 or more before they’ll report it. Your first few orders may need to be prepaid initially so your business can get approval for Net 30 terms.

- How to apply with them:

- Add an item to your shopping cart

- Go to checkout

- Select to Open an Account

- Select to be invoiced

Marathon

Check out starter vendor Marathon. Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products throughout the United States. Their comprehensive product line supports commercial, industrial, and retail operations. This card reports to Dun & Bradstreet, Experian, and Equifax. Before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying so they don’t red-flag your account for fraud.

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere.

- D-U-N-S number

- Business License (if applicable)

- And a business bank account

- Business phone number listed on 411

Your SSN is required for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can give a $500 deposit instead of using a personal guarantee, if in business less than a year. Apply online. Terms are Net 15. Get it here: https://www.marathonbrand.com/.

Grainger Industrial Supply

Grainger Industrial Supply is likewise a true starter vendor. You can find them online at www.grainger.com. They sell hardware, power tools, pumps and more. They also do fleet maintenance. And they report to D&B. You need a business license, EIN, and a D-U-N-S number.

- To qualify, you need the following:

- A business license (if applicable)

- An EIN number

- A company address matching everywhere

- A corporate bank account

- A D-U-N-S number from Dun & Bradstreet

Your business entity must be in good standing with the applicable Secretary of State. If your business doesn’t have established credit, they will require additional documents. So, these are items like accounts payable, income statement, balance sheets, and the like.

Apply online or over the phone.

Accounts That Do Not Report

Non-reporting trade accounts can also be helpful. While you do want trade accounts to report to a minimum of one of the CRAs, a trade account which does not report can still be of some value.

You can always ask non-reporting accounts for trade references. And also, credit accounts of any sort ought to help you to better even out business expenditures, thus making financial planning simpler.

Store Credit

Store credit comes from a variety of retail service providers.

You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the company’s EIN on these credit applications.

Fleet Credit

Fleet credit is from service providers where you can purchase fuel and fix and take care of vehicles. You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the company’s EIN.

Keep your business protected with our professional business credit monitoring.

Cash Credit

These are businesses such as Visa and MasterCard. You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are frequently MasterCard credit cards.

Monitor Your Business Credit

Know what is happening with your credit. Make certain it is being reported and address any errors as soon as possible. Get in the practice of checking credit reports. Dig into the particulars, not just the scores.

We can help you monitor business credit at Experian, Equifax, and D&B for a lot less than it would cost you at the CRAs. See: www.creditsuite.com/monitoring.

Update Your Information

Update the info if there are inaccuracies or the data is incomplete.

Fix Your Business Credit

So, what’s all this monitoring for? It’s to challenge any errors in your records. Mistakes in your credit report(s) can be taken care of. But the CRAs usually want you to dispute in a particular way.

Disputes

Disputing credit report mistakes typically means you send a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always mail copies and keep the original copies.

Fixing credit report errors also means you specifically detail any charges you challenge. Make your dispute letter as clear as possible. Be specific about the concerns with your report. Use certified mail to have proof that you sent in your dispute.

Keep your business protected with our professional business credit monitoring.

A Word about How to Build EIN Credit

Always use credit smartly! Never borrow more than what you can pay off. Monitor balances and deadlines for repayments. Paying on schedule and fully does more to increase business credit scores than nearly anything else.

Building small business credit pays off. Excellent business credit scores help a small business get loans. Your lender knows the small business can pay its financial obligations. They know the company is for real.

The small business’s EIN links to high scores and loan providers won’t feel the need to request a personal guarantee.

How to Build EIN Credit: Takeaways

Business credit is an asset which can help your small business for years to come. Learn more here and get started toward establishing small business credit.

The post You Can Build EIN Credit Today appeared first on Credit Suite.

Itron stock bounces after Raymond James analyst says it's a 'strong buy' after big selloff

Shares of Itron Inc. bounced 6.4% in afternoon trading Friday, after Raymond James analyst Pavel Molchanov suggested it was time to back up the truck on the provider of products to measure energy and water. Molchanov raised his rating to strong buy from outperform, after the stock plunged 26.4% on Thursday — the biggest one-day selloff since July 2002 — in the wake of a big profit miss and slashed full-year outlook, with the company citing supply chain challenges. With the selloff, Molchanov believes the market is “missing the forest for the trees.” He gave “three fundamental reasons” to buy the stock that the market is overlooking: 1) None of the smart meter revenue is disappearing — it will come when supply is available; after some sluggishness, software revenue is finally showing strength; and lowest leverage in 7 years opens the door to acquisitions in software, and perhaps beyond. Itron’s stock had dropped 20.3% year to date, while the S&P 500 has gained 18.1%.

Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they move. Visit MarketWatch.com for more information on this news.

The post Itron stock bounces after Raymond James analyst says it’s a ‘strong buy’ after big selloff appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Itron stock bounces after Raymond James analyst says it’s a ‘strong buy’ after big selloff appeared first on Buy It At A Bargain – Deals And Reviews.

U.S. crude oil ends 1.2% lower Friday and logs steepest weekly skid since October

Crude-oil futures finished sharply lower Friday, with the commodity staging a turnaround from earlier gains after a better-than-expected report on U.S. employment helped to deliver a fillip to the U.S. dollar, weighing on assets priced in the currency. West Texas Intermediate crude for September delivery closed down 81 cents, or 1.2%, to settle at $68.28 a barrel, with a weekly slide of 7.7%, based on the most-active contract at last week’s settlement. The weekly decline marked the sharpest for the contract since the week ended Oct. 30, FactSet data show. The dollar was climbing 0.6% on the day and 0.7% on the week, as gauged by the ICE U.S. Dollar Index .

Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they move. Visit MarketWatch.com for more information on this news.

The post U.S. crude oil ends 1.2% lower Friday and logs steepest weekly skid since October appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post U.S. crude oil ends 1.2% lower Friday and logs steepest weekly skid since October appeared first on Buy It At A Bargain – Deals And Reviews.

7 Tips to Highlight Product Features on Your Website

Whether your customers are shopping for tennis shoes or a marketing automation tool, they care about your product’s features. Features (along with price and design) are one of the main factors people consider when comparing products.

Would you buy a computer without knowing how much storage it has? Or a pair of yoga pants without knowing whether they stretch?

Despite their importance, many brands fail to make their product’s features clear on their websites—and that could cause revenue to drop.

Your product’s features are massive selling points, so they need to be clear and compelling. Here’s how to get your product features right.

What Is a Product Feature?

A product feature is a characteristic of your product that differentiates it from other products in the market. It could be how it looks (a design feature), how you can use it (a functional feature) or what it comes with (an added-value feature).

Let’s take running shoes as an example. The material of the shoe is a feature, so is the technology in the shoe. Both are highlighted in this example by Nike.

What about a software product?

Features typically center on the product’s functionality (what you can do with it), but they can also include integrations or data security. Slack’s feature page below highlights these types of features:

Features don’t have to be unique to your product, though. As design, technology, and manufacturing processes evolve, some features become standard. You’d be hard-pressed to buy a smartphone without a touchscreen, but that doesn’t mean it isn’t a feature brands can talk about.

Whether your product comes with ten features or two, you need to be talking about them across your website including your product descriptions, landing page, and even your homepage.

Make your product features clear so customers can easily compare you to your competitors. It’s even more important if your product boasts the best features in the industry. The more you shout about them, the more likely consumers are to take notice—and maybe make a purchase.

7 Strategies for Highlighting Product Features

You know what features are, and you know why they’re important to include on your site. Now let’s look at seven ways e-commerce stores and SaaS tools can effectively leverage them.

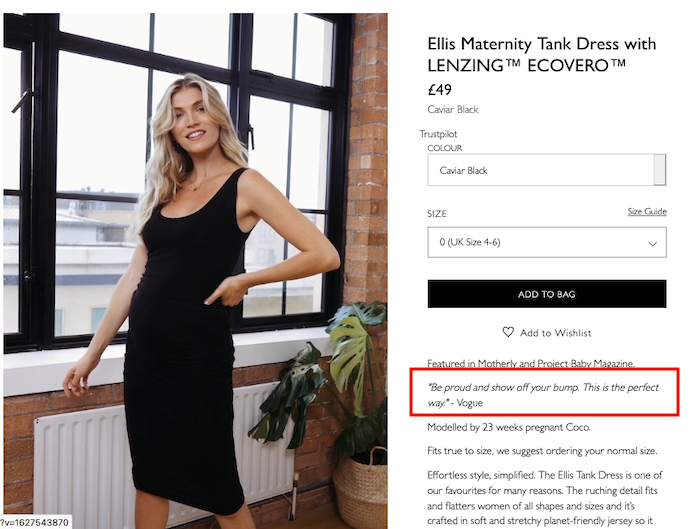

Include Social Proof

Talking about how great your features are is nice, but every other company does the same thing. Even if your product features are superior, customers may not believe you. After all, only one-third of customers trust the brands they buy from.

You need social proof to convince them your product delivers. Add quotes and testimonials from your customers or trusted third parties that mention your product features to relevant pages. Better yet, include images and videos of them using your product.

Featuring real people showing off your product’s features instantly makes them more credible and makes it much more likely consumers will trust your brand.

UK maternity brand Isabella Oliver does a great job of this, including a quote from Vogue in the product description of a maternity tank dress.

Speak to Your Target Audience

You need to understand your target audience to write about your product features effectively. If you have buyer personas, make sure to refer to them while writing. This will help you prioritize which features your customers care about most.

Start by looking at reviews for your product and those of your competitors—G2 is a great place to start for software companies and Amazon for e-commerce brands. Identify the top features customers talk about and prioritize them.

Be wary of trying to target everyone. This is particularly important for SaaS products that can have a dozen different use cases. Each target customer should have a dedicated landing page where you speak exclusively about relevant product features. If you try to speak to everyone on one landing page, you’ll end up not targeting any audience well.

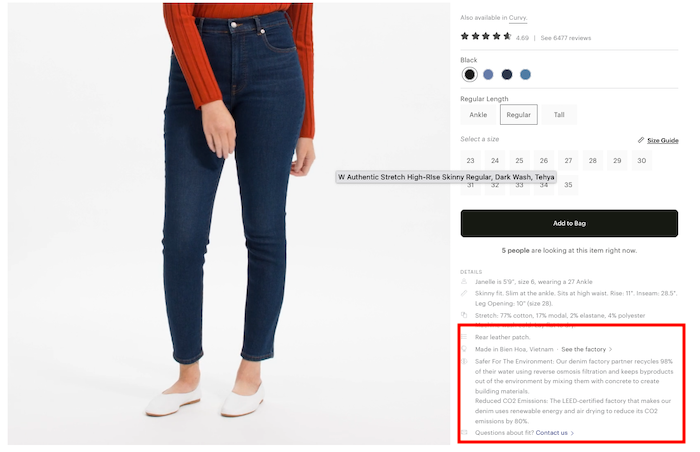

Everlane is an example of a brand who knows their target audience and what they care about. Each product description includes a link to the factory it’s made in and other information related to sustainability.

Focus on the Benefits

Consumers only care so much about what makes your product special. What they really care about is how it benefits them.

Talk about a benefit whenever you mention a feature.

Writing about benefits requires a bit more effort and creativity. Your product’s features are fairly obvious, especially to you. What isn’t so obvious is how the user benefits from them. Think about your customer personas and spend some time reading product reviews. These will help you get into your customers’ minds and focus on the benefits they care about.

If you really want to do a good job, interview your customers to find out exactly how they benefit from your product. It takes a little more effort, but this is hands-down the best way to tease out the benefits of your product.

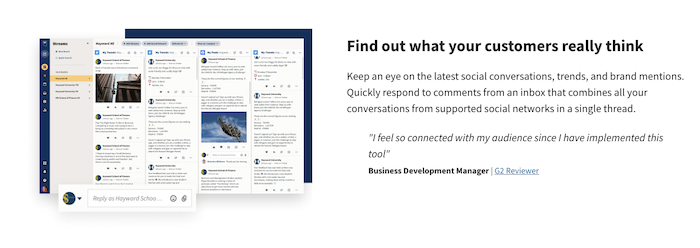

One of Hootsuite’s most popular features is the ability to track social media mentions on their dashboard–but that’s not how the brand sells the feature to its users. Instead, they focus on the benefit: finding out what customers really think. They even follow this up with another user-generated benefit of the feature.

Draw Attention to the Important Details

There are some features you’ll want customers to take note of more than others. That’s why it’s important to create a hierarchy of features and look for ways to draw attention to the features consumers care most about.

To do this, break your page into sections and devote each section to a specific feature. Use a bold heading to grab your reader’s attention and back this up with short, sharp copy and eye-catching imagery.

Google takes this to the extreme by letting each feature take up all of the screen’s real estate. There’s no way to miss them:

Another is to remove the navigation menu from your landing page. With no way to move away from the page, users are forced to focus on your sales copy and read about your product’s features. Don’t get carried away using this tactic, however. Most customers won’t be happy with you removing the navigation bar, especially if you’re an e-commerce site.

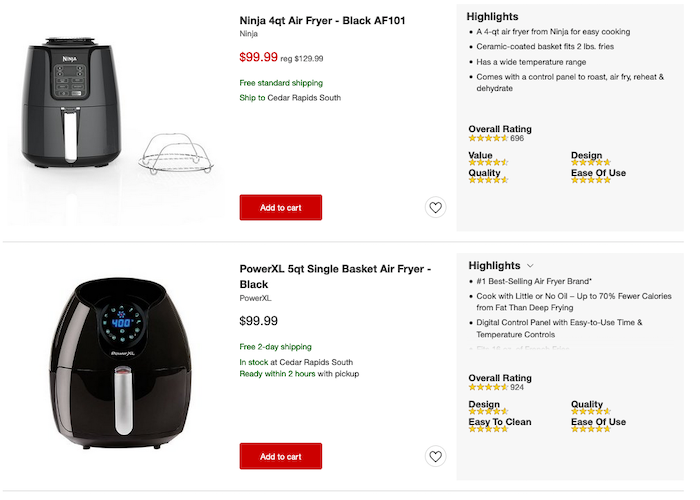

Make Information Scannable

Your customers are busy, and most aren’t going to read every word on your page. Instead, they’re going to scan it for key bits of information. It’s your job to make your product features as scannable as possible while still getting across the core message.

Bullet points are an excellent tool because huge chunks of text are a massive turn-off for readers—especially if you want to share a lot of information.

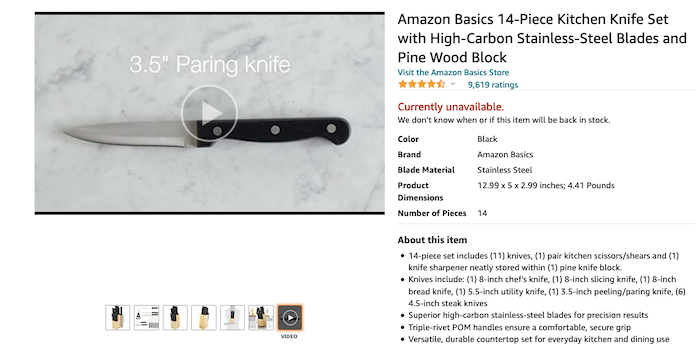

Target includes a bullet list of each product’s features on their listing page, so you don’t even have to click them individually to get the need-to-know information.

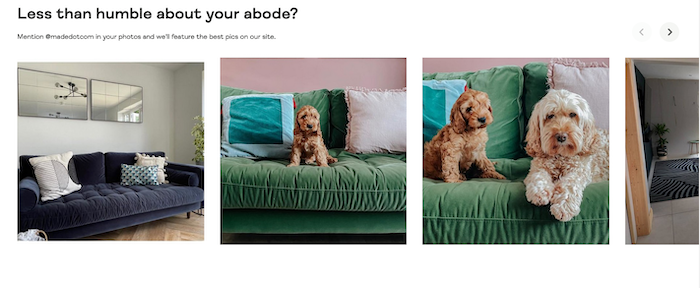

Use Video and Images

Words aren’t the only way to get across your product features. Images and videos are usually a much better way to get across exactly what your product can do.

Images are an easy way to show customers how key features look and work. They are particularly powerful for design-focused features and most e-commerce products in general. Bonus points if you include user-generated photos in your descriptions.

UK furniture brand Made did a great job of including user-generated images in their product listings. Potential customers can see exactly what each sofa will look like in a range of settings.

Videos take a little more work, but they can be even more effective. For example, you could create an explainer video that highlights your product’s core features, or a separate video for each feature.

Your feature-led videos can also be used as part of your onboarding process and by your sales team during client calls. They can even boost your search rankings, especially if you host them on YouTube.

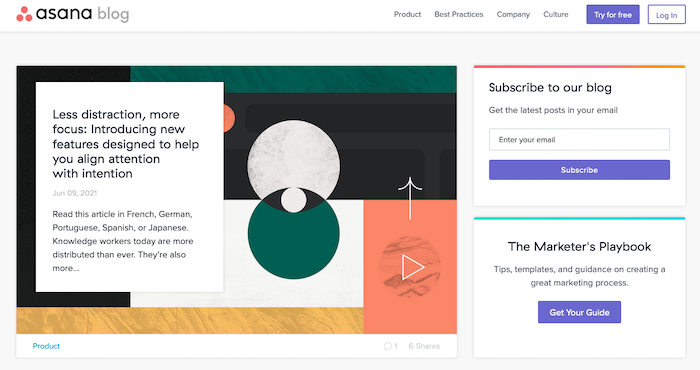

Write Blog Posts and Emails

If you have a SaaS product, blog posts, emails, and other forms of content marketing are one of the best ways to highlight your product features—particularly if those features come in the form of new software releases.

Make sure your blog posts talk about the benefits that users can gain from the new features and don’t just talk about the features alone. Plenty of screenshots are also a good idea, so is a video if you can create one.

Unlike other forms of content marketing, there’s no need to post these articles regularly. Writing them when you have a new feature to describe is enough.

Email updates should also be sent sparingly. Only email when you have a new feature to announce and keep your email succinct. Only include the key details in the email and link to a more in-depth blog post if necessary.

Existing users will learn about the new features when using the software, so it may be wise to only send an email about features that may re-engage lost customers.

Asana’s blog is filled with feature-focused blog posts. Note that many don’t focus on individual features. Rather they cluster feature releases around a particular topic and write about that instead.

3 Examples of Product Feature Highlights

If the examples above weren’t enough for you, I’ve got three more examples of brands that do a great job highlighting their product features.

Apple

Few companies are better than Apple at creating buzz about their products. There aren’t many better at highlighting their product’s benefits, either.

Apple makes a point of creating a new banner for every feature, pairs each with a user benefit, and includes high-quality images and graphics. Even if you already have an iPhone, reading their product pages makes you want to upgrade.

Amazon

Amazon is famous for its in-depth product listings, but those listings are also great at highlighting each product’s most important features.

The clear layout makes it easy for customers to skim the product description, and bullet points highlight the most important features. There’s even a video showcasing the product in detail.

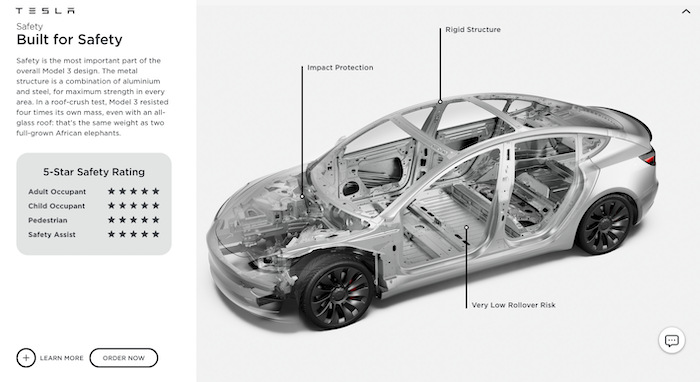

Tesla

Tesla combines several of the tactics mentioned above to highlight the key features of the Model 3. Each feature is given a hierarchy—security is first—and takes up the entire page. They also use graphics to illustrate points and annotations to draw attention to specific features.

Frequently Asked Questions About Product Features

What are product features?

Your product features are any characteristic of your product that makes it stand out and separates it from your competitors. It can include the look and design of the product, how it’s made, or what you can do with it.

What are examples of product features?

For an e-commerce product, the material the product is made with can be a feature—if it’s made from recycled plastic, for example. For SaaS products, features include the functionality of the product. The ability to instantly message colleagues is a feature of Slack, for instance.

What’s the difference between a product feature and a benefit?

A feature is a characteristic of your product. A benefit is how a customer can use that characteristic to overcome a pain point.

How can I highlight the features of my SaaS product?

A sales page is an excellent way to highlight all of the features of your SaaS products. Blog posts, videos, and demos are also great ways to highlight SaaS features.

How can I highlight the features of my e-commerce product?

Your product description is the best place to highlight the features of your e-commerce product. Make sure they are easy to read and stand out from the rest of your copy.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What are product features?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Your product features are any characteristic of your product that makes it stand out and separates it from your competitors. It can include the look and design of the product, how it’s made, or what you can do with it.”

}

}

, {

“@type”: “Question”,

“name”: “What are examples of product features?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “For an e-commerce product, the material the product is made with can be a feature—if it’s made from recycled plastic, for example. For SaaS products, features include the functionality of the product. The ability to instantly message colleagues is a feature of Slack, for instance.”

}

}

, {

“@type”: “Question”,

“name”: “What’s the difference between a product feature and a benefit?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A feature is a characteristic of your product. A benefit is how a customer can use that characteristic to overcome a pain point.”

}

}

, {

“@type”: “Question”,

“name”: “How can I highlight the features of my SaaS product?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A sales page is an excellent way to highlight all of the features of your SaaS products. Blog posts, videos, and demos are also great ways to highlight SaaS features.”

}

}

, {

“@type”: “Question”,

“name”: “How can I highlight the features of my e-commerce product?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Your product description is the best place to highlight the features of your e-commerce product. Make sure they are easy to read and stand out from the rest of your copy.”

}

}

]

}

The Conclusion of My Product Features Guide

Showcasing your product features is a hugely underrated tactic. Marketers and salespeople will tell you to focus on the benefits of your product rather than the features. While benefits are important, they rely on explaining your features clearly first. Features are also one of the most common ways potential customers compare your product with your competitors.

Take time to determine which features are most important and get opinions from current customers if you can. Then use the seven tactics I’ve listed above to make them as clear as possible on your site.

Which features of your product are you most proud of?

ReadMe (YC W15) is hiring a product marketer who loves developers

Article URL: https://readme.com/careers#product-marketing-manager

Comments URL: https://news.ycombinator.com/item?id=28089922

Points: 1

# Comments: 0

Head of Growth Marketing at Bonsai (YC W16) – Remote Only

Article URL: https://www.ycombinator.com/companies/bonsai/jobs/HY1P6AN-head-of-growth-marketing

Comments URL: https://news.ycombinator.com/item?id=28092680

Points: 1

# Comments: 0

Wrestler had 15 drinks a day, slept with 10,000 women, documentary reveals

Justice Department drops case against Code Pink protester who laughed at Jeff Sessions

Learn About Your Equifax Credit Report

Did You Want to Learn About Your Equifax Credit Report?

It is time to learn about your Equifax credit report.

But let us start with some definitions and background on business credit.

Business Credit

This is credit in the name of a business. It is not tied to the creditworthiness of its owner or owners. Instead, business credit scores are going to depend on how well a company can pay its bills. Hence consumer and business credit scores can vary dramatically.

Business Credit Benefits

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of business accounts. Business credit utilization is not going to affect your consumer FICO score. Plus the business owner is not going to be personally liable for the debt the business incurs.

Business Credit Details

Being accepted for business credit is not automatic. Building business credit requires some work. Some of the steps are intuitive, and some of them are not.

Fundability

Fundability is the current ability of our business to get funding. Some factors are within your control. Others (like your time in business) are not. Your online presence and data are one area which is at or close to 100% with your control.

Business Credit, Fundability, and Business Funding Applications

The better your business credit and fundability are, the more likely you will get approval for business financing. Today, let us concentrate on your Equifax report.

Build Fundability on Business Credit Applications to Avoid Denials

Keep your business looking fundable (legit) with:

- A professional website and email address

- A toll-free phone number

- List your phone number with 411

- A business address (not a PO box or a UPS box)

- Get all necessary licenses for running your business

Fundability: Industry Alignment

If your business is over the road trucking, then it needs to be listed that way. Pro tip: when your industry can be called several different names, like long distance trucking, mention those other phrases on your website.

There are Three Main Credit Bureaus – But What Differentiates an Equifax Credit Report?

What distinguishes Equifax reports from reports from the other two main credit bureaus? And can you use that information to your advantage?

Business Credit Reporting Agencies

There are three different credit bureaus for business: Dun & Bradstreet, Experian, and Equifax. FICO SBSS and CreditSafe are also players.

In the business world Equifax and Experian are up there, but it is Dun & Bradstreet which is the major player.

Dun and Bradstreet has more than 10 times the records of the next closest reporting agency. For more information, see dnb.com/about-us/company.html. It makes sense to start with Dun and Bradstreet, even when looking at your Equifax credit report. This is because you are going to have to start the business credit building process with them anyway.

Dun & Bradstreet

Dun and Bradstreet is the oldest and largest credit reporting agency. Go to Dun and Bradstreet’s website and look for your business, at dnb.com/duns-number. But what happens if you are unable to find it? Then get a free D-U-N-S number. You will always need a D-U-N-S number to start building business credit. Go here to get a D-U-N-S number: dnb.com/duns-number/get-a-duns.html.

A D-U-N-S number is how Dun and Bradstreet gets your company into their system. And a D-U-N-S number plus 3 payment experiences leads to a PAYDEX score. A payment experience is a record of a purchase from a business which reports to a credit reporting agency. In this case, Dun and Bradstreet. Once you are in Dun and Bradstreet’s system, search Equifax and Experian’s sites for your business. You can do so at creditsuite.com/reports.

Keep your business protected with our professional business credit monitoring.

Your Equifax Credit Report

But your Equifax credit report is going to be different. The company gets its data from:

- A data sharing agreement with the Small Business Exchange

- Net 30 type industry trade credit information from a wide variety of suppliers

- These suppliers provide products and services to businesses on an invoice basis

Equifax scores answer one basic question. How likely is a business to go severely delinquent in its payments? The score is an indication of whether a company is likely to make late payments.

You can check out a sample Equifax credit report for small business at https://assets.equifax.com/assets/usis/small_business_sample_credit_report.pdf.

Here’s what’s in that report.

Company Identifying Information

The first section is devoted to identifying information about your company, namely your business name and address and telephone number. This section will also include your Equifax ID. An Equifax ID is how Equifax can tell your business from similarly-named businesses.

Credit Risk Score

The next section is about the Credit Risk Score. This score runs from 101 to 992. Higher numbers are better. This section also shows key factors.

Key factors are positives and negatives about your business, such as how old your oldest account is, and whether you have any charge-offs, and the size of your business.

Credit Utilization

The next section shows credit utilization. This is shown as a pie chart. It graphically shows which percent of your available credit line you are using. It also has identifying labels to show how much each percentage truly is. But it is only for your financial accounts.

Payment Index

The next part is your Payment Index. The score runs from 0 to 100. Higher numbers are better. It also shows Industry Median.

There is also a table explaining the numbers:

- 90+: Paid as Agreed

- 80-89: 1-30 days overdue

- 60-79: 31-60 days overdue

- 40-59: 61-90 days overdue

- 20-39: 91-120 days overdue

- 1-19: 120+ days overdue

Days Beyond Terms

This is a line graph. It shows the average days beyond terms by date reported. It is for non-financial accounts only. Plus it shows any recent trends, so if you’ve improved your payment habits, it will show up here.

Business Failure Score

The next piece is on your Business Failure Score. This score runs from 1000 to 1880. It shows its own key factors, like recent balance information.

Inquiries

The next section is devoted to inquiries. It shows the date, and whether it was an inquiry on a financial or non-financial account. This is a rather short part of the report.

Bureau Messages

The bureau messages part, appears to be a free form field. It seems its purpose is to add notes to a profile. These can be notes on the number of locations, or business aliases.

Bureau Summary Data

The bureau summary data section contains a wealth of information. It shows:

- The number of financial and non-financial accounts

- Date the credit became active

- Number of charge offs

- Total dollars past due

- Most severe status in 24 months

- Single highest credit extended

- Total current card exposure

- Median balance

- Average open balance

It also shows Recent Activity, which includes:

- The number of accounts delinquent

- New accounts opened

- Inquiries and

- Accounts updated

Keep your business protected with our professional business credit monitoring.

Public Records

The public records section has information on:

- Type Status:

- Bankruptcy

- Judgments

- Whether judgments are satisfied or not

- Liens filed and opened, or released

- Number

- Dollar and

- Most recent date filed

If there are none reported, then the date field will indicate as much.

Additional Information

The final section appears to contain somewhat miscellaneous information, which probably doesn’t fit in well anywhere else. such as alternate company Names and DBAs.

It also contains:

- Owners and Guarantor Names (name, type, date reported)

- Business and Guarantor Comments (seems to be another freeform field) and

- Report Details (this shows the date the report was generated)

Improving Your Equifax Report

Now that you know what goes into it, you can see that some of the more important pieces of data Equifax looks into are:

- public records

- credit usage

- and how you handle your financial and nonfinancial accounts

Improve your Equifax score by:

- Clearing your debts as quickly as possible and not going delinquent

- Keeping credit utilization within reason, as that makes it easier to pay your bills

- And avoiding late payments

Whatever improves your Equifax report is bound to improve your reports at D&B and Experian. Paying off accounts pays dividends, as does avoiding bankruptcies.

Disputing Issues with Your Equifax Report

Equifax will not change your scores without proof. They are starting to accept more and more online disputes. But include proofs of payment with it. These are documents like receipts and cancelled checks.

Fixing credit report errors also means you specifically spell out any charges you challenge. Make your dispute as crystal clear as possible. If you need to snail mail anything in, then use certified mail so that you will have proof that you sent in your dispute. Correct Equifax issues at: equifax.com/small-business-faqs/#Dispute-FAQs. Be specific about the concerns with your report.

Monitoring Equifax Credit Report Scores

At Equifax, you would use Equifax Complete. It currently costs $19.95 per month, after an offer of 30 days for $4.95. See equifax.com/equifax-complete/Equifax.

Keep your business protected with our professional business credit monitoring.

Monitoring Your Equifax Credit Report and Other Business Credit Reports

But add together monitoring for the three biggest credit reporting agencies for a year and the cost is staggering. It costs $468 for Dun and Bradstreet, $189 for Experian, and $224.40 for Equifax (with a special). For a grand total of $881.40!

Monitoring Your Dun and Bradstreet, Experian, and Equifax Credit Report and Scores

You can monitor your business credit at Dun and Bradstreet, Equifax, and Experian through Credit Suite, for considerable savings over what it would cost you at those different credit bureaus. And all in one place! Credit Suite offers monitoring through the Business Finance Suite (through Nav). See what credit issuers and lenders see so you can directly improve your scores and get the business credit and funding you need. See suitelogin.com and creditsuite.com/monitoring.

Your Equifax Credit Report: Takeaways

Equifax gets much of its data from the Small Business Financial Exchange.

Monitoring all of your business credit reports is always going to be expensive. But you can save 90% by monitoring your Dun and Bradstreet, Experian, and Equifax scores through Credit Suite.

The post Learn About Your Equifax Credit Report appeared first on Credit Suite.