Article URL: https://jobs.ashbyhq.com/moderntreasury/a14a33e3-c262-425a-830c-d86965d2a864?utm_source=yYPEbOqnBd

Comments URL: https://news.ycombinator.com/item?id=28484316

Points: 1

# Comments: 0

Article URL: https://jobs.ashbyhq.com/moderntreasury/a14a33e3-c262-425a-830c-d86965d2a864?utm_source=yYPEbOqnBd

Comments URL: https://news.ycombinator.com/item?id=28484316

Points: 1

# Comments: 0

The Chevrolet Corvette Stingray’s fuel economy rating has been reduced because too many customers are choosing an optional high performance package that makes it less efficient.

Are you looking to setup a business? Your business can be much more likely to get funding from the jump – if you set it up the right way. Here’s how.

Setting up a business is a task that can take a while. There are a lot of moving parts. It’s a lot more than just hanging out a shingle. And the way your business is set up can directly affect the ability of your business to succeed.

What is it? Fundability is as a business’s ability to get funding. You can make it harder or easier for your business to get money. A lot of the power is in your hands. Yes, you have some control over this.

A business starts with no credit profile. Therefore, what’s on an application is all that’s reviewed for approvals. So your application must be very strong. Nearly half of all companies fail in their first 5 years, and about 2/3 in the first ten. As a result, new businesses don’t seem fundable to lenders. You can change that by building for fundability from the very start.

An early step to fundability is the industry your business is in. Some industries are considered to be riskier than others. When it comes to traditional funding sources, added risk can mean stricter underwriting guidelines or even no funding at all

Risky industries tend to be places where chances of personal injury or property damage are high, or a lot of cash is used, or the revenue stream is unstable. Weapons manufacturing, pawn shops, and the political campaigns all fill the bill.

Check with your Secretary of State – they might require that a business name be unique. While checking your name with your Secretary of State, also ensure they have all the necessary information for your company. Make sure that you are in good standing with them, and that your entity is active. You will have to file annual reports and pay a fee each year to stay active.

Keep the name of a high-risk or restricted industry out of your business name. There is nothing underhanded about this – it is above board and honest. And it can help prevent an automatic or nearly automatic denial from a lender. A common reason for loan and credit card application denials is the lender can’t easily locate a business online. The business name on your application should be the exact same as what’s listed online and with your Secretary of State.

A full business name should include any recorded DBA filing in use. But consider a DBA only a short stop on the way to incorporating. Make sure the business name is exactly the same on corporation papers, licenses, utility statements, and bank statements. Also make sure the business name and all other information is the same on as many online listings you can find.

A business address must be a real brick and mortar building. It must be deliverable physical address. This can never be a UPS box or a PO Box. Some lenders will not approve and fund unless you meet this criterion. Lenders check with USPS and places like Google Maps to see if you’re using a home address. If you are, you may get a decline.

In particular, retail establishments like clothing boutiques need their own address. If your business is a retail establishment like this, do not use a home address on your application! Not even if your company is just you . You can use a virtual address. We like Regus, Davinci, and Alliance Virtual Offices. But keep in mind that there are credit providers that will not accept virtual addresses.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

You can get a free EIN for your business at IRS.gov. Just like you have a Social Security Number, your business has an EIN. Your EIN is used to open a bank account and to build a business credit profile. To truly separate business credit from personal credit your business must be a separate legal entity, not a sole proprietor or partnership. Only incorporating creates a new, separate entity.

A corporation or LLC business entity gives you more credibility in many cases. These entities by default reduce your personal liability. Other entities don’t. File this with the Secretary of State for your state. Make sure your entity is set up in the same state as your business address. Verify all listings show the same name, address, phone numbers, etc. as in state and other records. Also make sure your address with the IRS matches everywhere else.

Contact State, County, and City Government offices to see if there are any required licenses and permits to operate your type of business. Licensing requirements differ. Differences depend on state, town, and industry. Always make sure you have the proper licensing for your corporation.

Do not apply for funding if you are unlicensed. Verify that all main agencies (State, IRS, Bank, and 411 national directory) have your business listed the same way and with your exact legal name. And make sure the address on your licenses is the same as all other documents. Being licensed also builds credibility in your business, and that can help you get more customers.

The IRS website is also where you choose SIC and NAICS codes. Industries are classified by 2 kinds of codes. They are SIC (Standard Industrial Classification) and NAICS (North American Industry Classification System). You chose these codes. Be honest when you choose your codes.

There’s no reason to choose the riskiest code if a less risky one might apply. The NAICS system is phasing out the SIC system. But that’s taking years.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Toll-free phone numbers are best. Lenders see them as a sign of business credibility. Even if you’re a single owner with a home-based business, a toll-free number provides the perception that you are an even bigger company. It’s very easy and inexpensive to set up a virtual local phone number or a toll free 800 number. A cell or home phone number as your main business line could get you flagged as un-established – but VOIP is okay.

If you don’t want customers and prospects calling you all day long, do not use a personal cell phone or residential phone as the business phone number. It also helps with fundability if you have a dedicated business phone number. Your phone number must be listed with 411 for most credit issuers and lenders to approve you. Check for your record to see if you’re listed. Make sure your information is accurate. No record? Then use ListYourself.net to get a listing.

Credit providers will research your corporation on the internet. It is best if they learned everything directly from your corporate website. Not having a company website can hurt your chances of getting corporate credit. You need it to be a professional website.

Use places like TemplateMonster.com and Upwork.com and get a site up cheap and fast. Get a professional logo from Fiverr. Buy web hosting from a company like GoDaddy. Do not use Weebly or Wix. This is because you want it to be your domain, not domain.wix.com. Your domain should be your business name, if possible

You need a company email address for your business. This email must be on the same domain as your website. Use a professional email address such as yourname@yoursite.com. It often comes with a website domain provider such as GoDaddy. This is not just professional; it also greatly helps your chances of getting approval from a credit provider. Do not use Yahoo, AOL, Gmail, Hotmail, or similar kinds of email.

You must have a bank account devoted strictly to your business. The IRS does not want you commingling funds. Make accounting easier and reduce the risk of audit at tax time. Keep personal and business funds separate. The simplest way to do this is with a separate account.

Your business banking history is vital to your future success of being able to secure larger business loans. The date you open your business bank account is the day that lenders consider your business to have started. So if you incorporated your business 10 years ago, but just opened the business bank account yesterday, then your business started yesterday. The longer your business banking history, the better your borrowing potential is.

Look to the future. It’s bank (and other) loans, and other kinds of funding. Set your business up for bank loan approval success. Keep a balance of $10,000 or more, for at least three months. This gives you a Low 5 Bank Rating.

With a Low 5 Bank Rating, most conventional banks see your corporation as fundable. Less than $10,000 in your account gives you lower than a Low 5 bank rating. If you don’t have a Low 5, you can still get corporate credit and alternative loans, but you would not be able to get a conventional loan. Bank ratings measure how responsible the account owner is with funds.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Getting a business merchant account is a smart way to help out your business. Now your business will be able to accept credit and debit cards. Studies show that customers will spend more if they can pay by card. This also increases your finance options. It’s generally more secure, too.

Go to D&B’s website and look for your business. Can’t find it? Then get a free D-U-N-S number. A D-U-N-S number plus payment experiences leads to a PAYDEX score. Once you are in D&B’s system, search Experian and Equifax’s sites for your business. Another ID number is the BIN (Business Identification Number) number from Experian. Experian’s BizSource assigns a BIN.

You can get the most favorable funding by paying all bills on time. This will get your business:

Keep all records consistent! CRAs and creditors are going to look at everything. So it had better match, or you’ll get a denial due to fraud. That’s how lenders interpret inconsistencies.

Your business name, address, and phone number – all your business information – must look the same in these places and more:

Let’s not forget about your personal credit. Personal credit quality is often helpful for getting funding. So if your personal credit is not in order, get it straightened out and improve it. This generally means paying your bills on time and curbing your usage. For a business loan at a conventional bank you need good personal, business, and bank credit. While you want to build good business credit, having good personal credit can get you started.

Good personal credit will open doors, and it will open them earlier. Do you eventually want to try for an SBA loan? Then you will need to have good personal credit.

The way your business is set up can directly affect whether your business survives. Details such as business name, address, phone number, and email address all play a part. When you setup a business smartly, you can also help assure prospects that your business is on the up and up. It also means getting set up with D&B and other business CRAs, so you can start building business credit.

The post How to Setup a Business the Right Way to Start Building Business Credit appeared first on Credit Suite.

The post How to Setup a Business the Right Way to Start Building Business Credit appeared first on Automation For Your Email Marketing Sales Funnel.

The post How to Setup a Business the Right Way to Start Building Business Credit appeared first on Buy It At A Bargain – Deals And Reviews.

And how can they affect if you can get funding? We tell you all about NAICS Codes. They could be the difference between getting business money or not getting any money.

Federal statistical agencies use the North American Industry Classification System (NAICS) . The idea is to classify business establishments. This is to collect, analyze, and publish statistical data, related to the U.S. business economy.

The NAICS was developed under the auspices of the Office of Management and Budget (OMB). Its adoption was in 1997. The intention is to replace the Standard Industrial Classification (SIC) system. The U.S. Economic Classification Policy Committee (ECPC) developed it with Statistics Canada and Mexico’s Instituto Nacional de Estadistica y Geografia. The intent was to make business stats easy to compare among North American countries.

NAICS is a 2- through 6-digit hierarchical classification system. It offers five levels of detail. Each digit in the code is part of a series of progressively narrower categories. The more digits in the code, the more classification detail.

The first two digits are the economic sector. The third digit designates the subsector. And the fourth digit designates the industry group. The fifth digit designates the NAICS industry. The sixth digit designates the national industry.

A 5-digit NAICS code is comparable in code and definitions for most of the NAICS sectors. This is across the three countries participating in NAICS. They are the United States, Canada, and Mexico. The 6-digit level lets the U.S., Canada, and Mexico all have country-specific detail. A complete and valid NAICS code has six digits.

NAICS industry codes define businesses based on the primary activities they engage in. Recently, the NAICS changed many of its codes as it updated its philosophy. It no longer sets aside online businesses. Now the NAICS no longer distinguishes businesses by how they deliver goods or services.

There is an older NAICS list of high-risk and high-cash industries. Higher risk industries on the list include casinos, pawn shops, and liquor stores. But it also included automotive dealers and restaurants. But this list is from 2014 and does not appear to have ever gotten any updating.

Per the NAICS, various professionals in the banking industry compiled the list. The idea was to use it as a working guide. But it is not an officially sanctioned list. They do not guarantee the accuracy of this list.

When considering any aspects of a business, risk must be a major factor. There are inherent issues in every single industry. But some businesses are considered to be risky by their very nature. This is the case even if everything else goes off like a hitch and the business is prospering. Risk is inherent within these business types. Even if your business doesn’t feel risky, it could be anyway.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

The biggest reason why risk matters has to do with funding. There are several industries where lending institutions are hesitant to do business. In those particular cases, there are stricter underwriting guidelines. But at least a company can get funding.

In some industries, no funding is available at all. As a result, those businesses will need to find other solutions for financing. These solutions can include:

Still, a lot of businesses would rather work with lenders. But where are lenders’ ideas of the degree of risk coming from? One clue comes from the CDC.

The Centers for Disease Control looks at risks in small businesses. Part of the calculation of risk comes from occupational injuries. But the other side of the risk coin is occupations which are high in cash transactions. After all, a pawn shop might not have much of a specific risk of injury at all. But the large amounts of cash normally associated with one mean it can be a tempting target for thieves.

These industries (among many others) can get an automatic decline:

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

These industries (among many others) can be subject to stricter underwriting guidelines:

According to the older list, the following codes are among those considered to be high risk:

How do you choose a better code?

Of course you want to be 100% honest when it comes to selecting your NAICS code. But if more than one can apply, you don’t have to choose the one that’s higher risk. So it pays to check and be careful when making your selection.

Also, if only high risk codes apply, there’s nothing wrong with changing your business. Then you may be able to match a related but lower risk code. There is nothing underhanded or dishonest about doing this.

Let’s say your business is automotive transmission repair (NAICS Code 811113). We know this is a high risk code. But 811191 is not on the NAICS list. It covers Automotive Oil Change and Lubrication Shops. So why not offer oil changes and use the lower risk code? It could be the difference between getting funding, or not.

The Internal Revenue Service will use the NAICS code you select. This is to see if your business tax returns are comparable to other businesses in your industry. If your deductions do not reasonably resemble other businesses in your industry, your business could be subject to an audit.

The IRS may label some companies as high-risk when they do not choose the right NAICS code. But if you know how the system works, then you can choose the correct code on your first try.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Lenders, banks, insurance companies, and business CRAs all use codes. They tend to use both NAICS and SIC Codes. SIC Codes are the older business classification system. D&B uses both SIC and NAICS Codes.

OSHA uses NAICS Codes for industry identification in its data. These agencies use them to determine if your business is in a high-risk industry. So you could get a loan or business credit card denial based on your business classification. Some SIC codes in particular can trigger automatic turn-downs. You could end up paying higher premiums, and get reduced credit limits for your business.

Will a better NAICS code guarantee funding for your business venture? Of course it won’t. But at least your business will not be automatically turned down before you can make a case for funding.

Industries are defined by codes from the North American Industry Classification System. Codes go up to six digits for the most granular information. Some codes are always associated with high risk. This makes it harder to get business funding. So if more than one NAICS code can apply to your business, pick the one that’s less risky.

The post In Just a Few Minutes of Your Time, Learn All About Avoiding Risky NAICS Codes appeared first on Credit Suite.

The post In Just a Few Minutes of Your Time, Learn All About Avoiding Risky NAICS Codes appeared first on Automation For Your Email Marketing Sales Funnel.

The post In Just a Few Minutes of Your Time, Learn All About Avoiding Risky NAICS Codes appeared first on Buy It At A Bargain – Deals And Reviews.

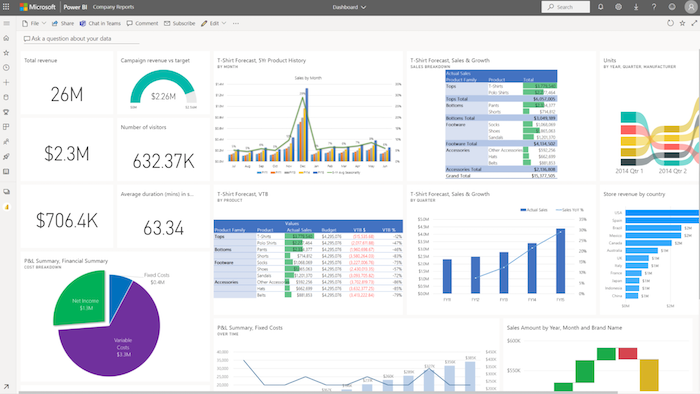

From sales targets to conversion rates, chances are you track a range of valuable analytics data. After all, this data allows you to create a winning marketing strategy and grow your business.

The problem? It’s not always easy to make sense of the data, especially if it’s held across a bunch of different files on your hard drive.

Wouldn’t it be great if you could bring these data sources together and view, at a glance, exactly how your marketing strategies are performing? If you could visualize your data and share your findings with key team members?

Well, I’ve got great news for you. Power BI (short for business intelligence), a Microsoft tool, makes all of this (and more!) possible.

Let me introduce you to what’s awesome about Power BI and give you some ideas for how to use it as part of a wider marketing strategy.

Think of Power BI as a connectivity tool. The interface allows you to bring unconnected sources together, like data from spreadsheets or online services, and turn them into rich, interactive reports.

With Microsoft’s Power BI, you can visualize your marketing data and gain insights you might not access otherwise. Visual reports may help give you a better sense of what’s working across your organization:

Whether you need a report for a presentation or a new marketing strategy, Power BI can help.

There are three parts to Power BI:

There are also free different subscription levels, depending on your needs:

You can use the Power BI Desktop app on the free tier, but you can’t use the cloud-based service without a paid subscription. This means you can generate reports in the free app, but you can’t share them on the cloud.

If you’re unsure whether a Pro or Premium subscription meets your needs, you can sign up for a free Power BI Pro trial.

Microsoft has made Power BI as straightforward as possible, but let’s walk through some of the key steps for getting started.

First, decide which plan you want. As mentioned, you can sign up for the free plan, which uses the Power BI Desktop app, a free Pro or Premium trial, or a paid monthly subscription.

To find out more about the tiers, check out the pricing page.

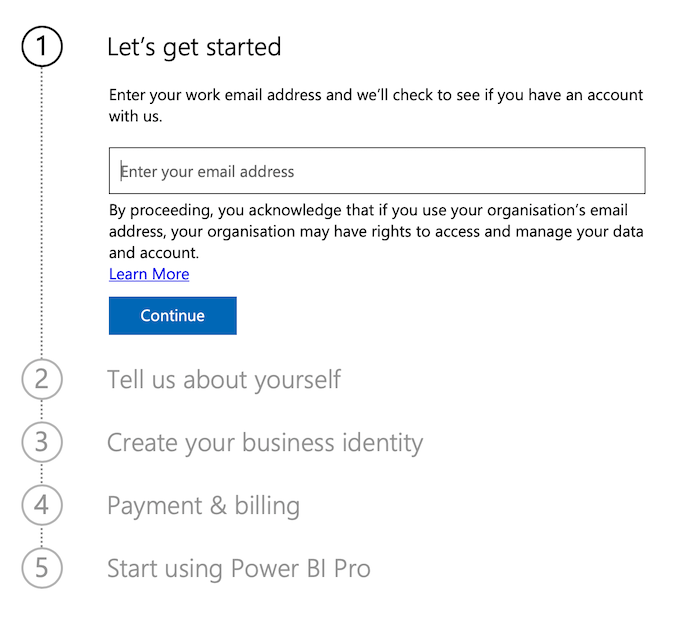

Next, you need a Power BI account.

Click “Try free” or “Buy now” on the pricing page, depending on which plan you choose. Then, follow the onscreen instructions to create your Power BI account:

Once you’re set up, you can start using the Power BI suite.

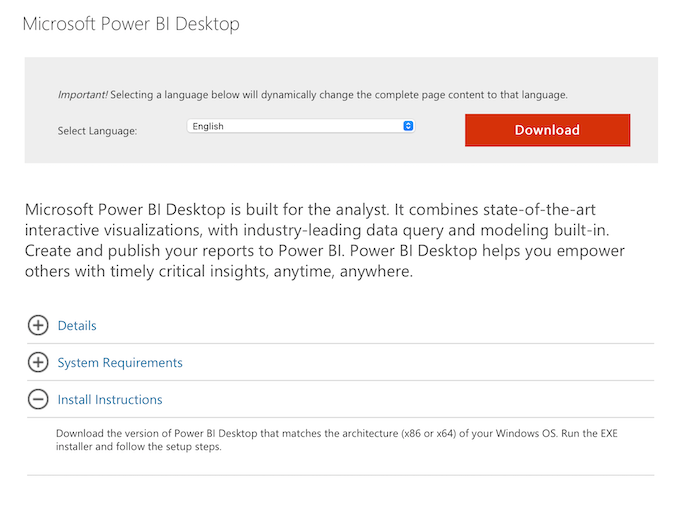

Then, download and install the Power BI Desktop app.

Many marketers use Power BI Desktop to import datasets, create reports, and then switch to the cloud-based Power BI service to share their findings and collaborate.

However, you might only need Power BI Desktop if you work alone or share data very occasionally.

With that in mind, here’s how to get Power BI Desktop.

If you’re going for a paid tier, you can then sign up for the cloud-based Power BI service.

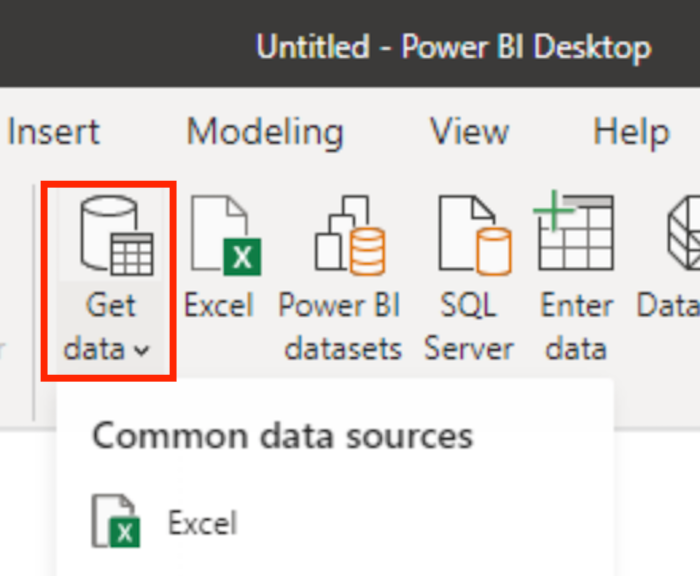

To get started with Power BI Desktop, you need to import data. You can import data from multiple sources, including the web, Excel spreadsheets, and existing Power BI datasets.

First, select “Get data” from Power BI’s home ribbon, and pick your data source:

To see all available data sources, click the “More” option at the bottom of the menu.

Next, open the relevant file.

Remember, you’re not restricted to importing just one dataset.

To create a visual report, you must first create relationships between your data sources. You do this by modeling your data.

Microsoft has a whole tutorial on this, but essentially, “modeling” is how you decide what type of report you want to create.

For example, maybe you want a report showing conversion rates for different paid ads for A/B testing purposes. As long as you have the data, you can make it visually usable with Power BI.

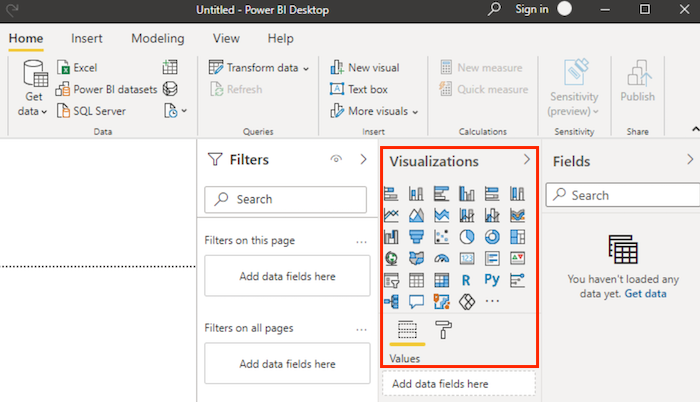

Next, choose your visualization. Your visualization is the format for reviewing your report, such as pie chart, bar chart, and so on:

You can also segment the data further by adding custom on-screen filters for your team members to interact with.

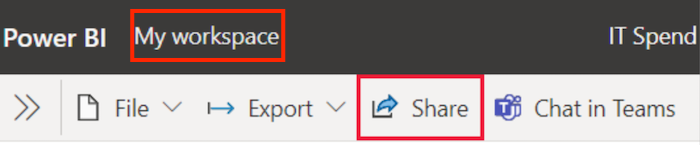

Ready to share your work? If you’re using the Power BI service, simply access your desired report from the workspace and click the “Share” option:

Once shared, your recipients can interact with the report based on whatever permissions you give them.

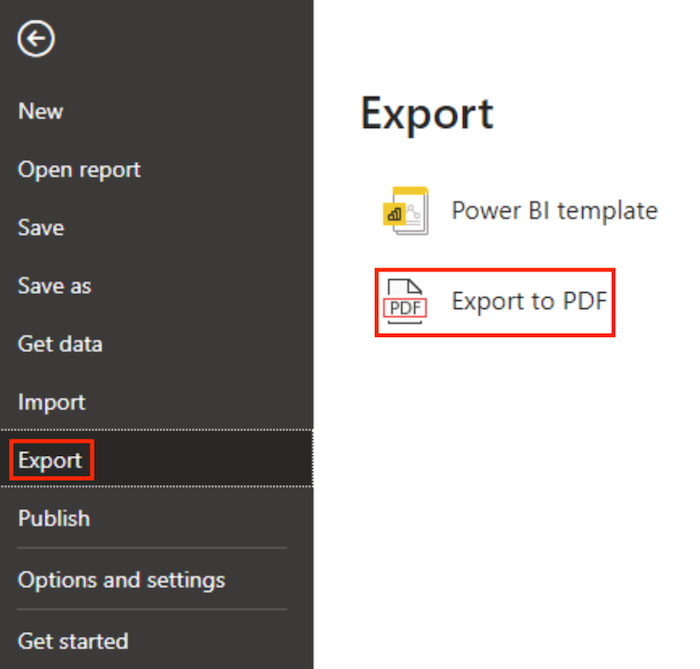

Want to export a report from the Power BI Desktop app?

One option is to convert it to a PDF. You can then share the report with others or move it over to the Power BI service.

To create a PDF from the Power BI Desktop side menu bar, click on options in the following order:

The document then loads onto your standard PDF viewer, and you can share it easily from there.

OK, so that’s how Power BI works.

How can you use the tool to improve your marketing strategy, though?

While there are many ways you can use the interface, here are four ways you can employ Power BI as a marketing professional.

Organic data is hugely important to any marketer because it shows how many people engage with your content and buy your services without clicking on paid ads.

Power BI makes it simple to track organic data. For example, say you want to track your most popular keywords. With Power BI, you can easily import keyword data from a spreadsheet or platform like Google Analytics and analyze the results.

What’s more, you can use the report you generate to impress prospective clients with your SEO knowledge and, in turn, potentially secure new business.

Want to measure your paid ad performance?

Simply import your relevant data, such as keyword research, cost-per-click (CPC) analysis, and conversion rates into Power BI. This may help you better understand the strengths and weaknesses of your paid ad campaigns.

You can also create reports combining your paid and organic data. In this sense, Power BI offers you a unique insight into your overall marketing performance by combining highly valuable datasets in a clear, visually appealing way.

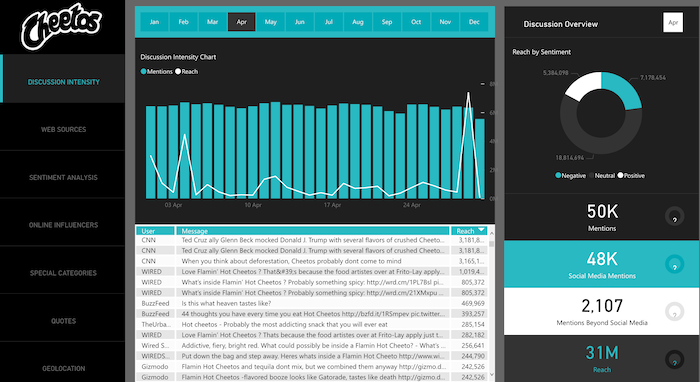

Is social media integral to your marketing strategy? With Power BI, you can create a dedicated dashboard to help you track key performance metrics, such as:

Power BI is a helpful tool for helping marketers visualize their campaigns and monitor social media performance. It’s compatible with platforms like Facebook, Twitter, and Instagram, so it’s flexible enough to handle cross-channel marketing campaigns.

Maybe you want to impress a key client with marketing insights. Or, perhaps you’re meeting with senior management, and they want a detailed performance overview. In any case, Power BI lets you generate clear, engaging, user-friendly reports to share with others.

You could also use Power BI reports to identify trends and growth opportunities in the marketplace or as part of a business startup modeling plan.

Microsoft’s Power BI lets you turn datasets into visual analytics reports. You can then visualize critical marketing data and share the results across your organization.

Power BI is an affordable, scalable tool for transforming raw data into visual reports. It’s customizable, flexible, and fosters collaboration within your team.

On the other hand, the dashboard may seem crowded. It also takes a fair amount of time to process high volumes of data, and it can take a while to master the interface.

All things considered, though, it’s worth giving it a shot.

There’s a free tool for developing reports and viewing them privately. However, if you plan to share reports in the cloud or need an enterprise-level solution, monthly subscription packages are available.

You can import Facebook data to Power BI. Request a copy of your Facebook page information, download the report, and import your chosen files or datasets into Power BI. The process is similar for Instagram and Twitter data.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is Power BI?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Microsoft’s Power BI lets you turn datasets into visual analytics reports. You can then visualize critical marketing data and share the results across your organization.

”

}

}

, {

“@type”: “Question”,

“name”: “What Are the pros and cons of Power BI for marketers?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Power BI is an affordable, scalable tool for transforming raw data into visual reports. It’s customizable, flexible, and fosters collaboration within your team.

On the other hand, the dashboard may seem crowded. It also takes a fair amount of time to process high volumes of data, and it can take a while to master the interface.

All things considered, though, it’s worth giving it a shot.

”

}

}

, {

“@type”: “Question”,

“name”: “How much does Power BI cost?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

There’s a free tool for developing reports and viewing them privately. However, if you plan to share reports in the cloud or need an enterprise-level solution, monthly subscription packages are available.

”

}

}

, {

“@type”: “Question”,

“name”: “Can I connect Power BI to Facebook?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You can import Facebook data to Power BI. Request a copy of your Facebook page information, download the report, and import your chosen files or datasets into Power BI. The process is similar for Instagram and Twitter data.

”

}

}

]

}

With Power BI, visualizing your core marketing data just got a whole lot easier. You can view everything from sales targets to paid ad performance from a single dashboard, which could help you pivot your marketing efforts to suit your goals and objectives.

What’s more, there’s a subscription to suit every budget, whether you need a free data visualization tool or a scalable enterprise-level solution.

All that said, Power BI is not the only data visualization tool out there, so before you commit to a paid plan, you might want to explore all your options. If you need more help reaching your marketing goals or identifying which metrics to track, you can check out my consulting services.

Have you tried Power BI yet? How’s it working for you?

TikTok is absolutely huge right now—and will be long into the future.

It has almost 100 million monthly active users in the U.S. alone, and is one of the most downloaded apps on the App Store, topping giants like YouTube, Instagram, and WhatsApp.

Why has it become so popular?

TikTok has boomed due to the potential for anyone to become an influencer on its platform. You don’t need to be a professional to create cool videos or even have a huge following to go viral. All you need is a phone and a personality—then your audience will come to you.

However, content creation does come with a warning: not every video you create is going to be perfect the first time around.

Editing is a great way to sharpen footage to improve the quality or create something that would be impossible with just one take. Perhaps you want a video where you are having a conversation with yourself. Through editing, this is possible.

If you don’t know where to start when it comes to editing videos on TikTok, this in-depth guide will have you creating viral-worthy TikTok videos in no time.

Luckily, it’s pretty straightforward to edit TikTok videos, and in-app features allow you to make changes and adjustments without complication.

You’ll need to record a video before you start editing one. Open up the app, choose the length of video you want to create, and get recording. Record several clips if you mean to stitch clips together, or upload footage if you have video content already.

Now let’s get editing.

Tap “Adjust Clips” if you want to cut your videos down to size. Simply move the red lines on either side of the video bar to change the start and stop points. Tap and hold video clips to rearrange them or delete them. You can also split a video in two by using the white line that runs down the video bar.

You can quickly add a filter to your video by clicking on the “Filters” tab. Blanket filters come in four categories:

Pick whichever seems most appropriate to your video, and you’ll be good to go.

Sound is a vital part of any viral TikTok video and it’s super easy to add a great song to your creation.

Tap on the “Sounds” section at the bottom of the screen to explore all of the pre-loaded music the app offers. You can browse trending songs or search for a specific track you have in mind. Once you’ve found the perfect sound, choose where you want it to start.

You can also play sound while you record to better sync your shots with the music—a great feature for when you are joining in on TikTok trends.

Effects are what make TikTok videos stand apart. Tap on the “Effects” tab to add a huge range of visual effects to your video. You can speed up your video, reverse it, add special filters, and create transitions between video clips.

Tap on the “Text” tab to add captions to your TikTok video. There’s a huge range of fonts to choose from and you can also change the color and alignment of your copy.

Type what you want to appear on your video, as well as the font and color. Then choose at which point you want it to appear on the video and for how long. Simple.

Finally, you can add stickers to any part of your video. These include polls, timestamps, and emojis.

TikTok’s internal editor is a fantastic tool, but it does have its limitations. For example, you can’t add the “Ken Burns” effect (which creates motion from static images) or record time-lapses. That’s why many TikTokers prefer to use an external editor to take their videos to the next level.

Some require editing skills, but there are others that can be used by anyone.

CapCut is a free all-in-one editing tool owned by TikTok’s parent company, ByteDance. It’s packed with all the editing functions you need (trimming, filters, stabilization, and splitting) plus all of the functions you’ve been dying to experiment with (such as zooming, filters, stickers, and loads more). The app also has a massive library of licensed music you can use for free in your videos.

InShot is an undisputed leader when it comes to editing video clips for social networks. Best of all, it’s easy to do from your iPhone or Android device. As well as the standard editing features you’ve come to expect, InShot has an abundance of visual and audio effects, and you can also import your own tunes. There is a slight downfall, however, that InShot doesn’t have its own built-in music library.

Zoomerang is a simple and easy-to-use video editing app that’s perfect for anyone looking to get started editing TikTok videos. Inside, you’ll find helpful tutorials, a library of more than 100 effects, filters, music, and loads more. You can buy a subscription to have an ad-free experience, but the free version works perfectly well.

The Videoshop app is available on the App Store and Google Play. You can add music, captions, and a wide range of effects and filters. You can also adjust the video speed. Videoshop is one of the best apps for merging and splicing clips from different videos.

It also allows you to upload videos directly to every major social media platform—making an influencer or digital marketer’s job just a little easier.

Funimate is another excellent app for editing TikTok videos. The app is available for free on the App Store and Google Play, but you’ll need to pay for advanced features like removing the Funimate watermark.

Free features include splicing clips, adding music, and inserting a range of effects and stickers. What makes Funimate stand apart from other video editing apps is its daily challenges. These are a great way to enhance your editing experience and get better every day through new and exciting ways. Funimate’s prompts are great for inspiring creativity.

Do you prefer to sit at your computer?

No problem. Just use VEED.

They offer an extensive editing suite complete with all of the functionality you need to create killer TikTok videos. It also has its own in-built library of music, making it easy to find the perfect song. If this sounds overwhelming, don’t worry. VEED has a great user platform, which is simple to learn, and you’ll soon be editing like a pro.

If you’re looking for a free video editor that works on both Windows and Mac, you can do worse than BeeCut. This popular editor is easy to use and comes packed with a suite of editing tools. You can add filters, transitions, and overlays, as well as a host of TikTok effects.

The beauty of TikTok’s platform is that anyone can make awesome edits to their videos. If you’re serious about editing your video, follow these tips:

Sound is one of the most important elements of a great TikTok video. (Here’s a lesser-known secret: it’s almost as important as the video quality). If you’re not going to layer sound over your content, then make sure you’re using a good quality microphone when speaking and minimize background noises.

You must also remember that not everyone will play videos out loud. In fact, 92 percent of viewers watch videos with the sound low or off—so it pays to add captions to your videos so that people can still enjoy them in silent mode.

The TikTok photo editing trick is a neat way to create stunning, vibrant images. Plus, it’s not hard to do. Just add these settings to your images:

Have you ever come across an awesome effect or filter on TikTok and wanted to use it in your own videos? You can now save filters and effects to your favorites section for easy access when editing your next video.

For tracks, tap on the “Sound” tab at the bottom of the screen and click “Add to Favorites.” For effects and filters, you can find the name above the TikToker’s account details.

The green screen effect lets you change your drab background into literally anything. You can find it in the “Effects” section in the bottom left-hand corner when creating videos. You can either use a photo as your background or a video. Choose whichever you like then hit record.

Don’t forget you can change your background between clips to mix things up!

Is there anything worse than the sound of your own voice? On TikTok, you don’t have to settle for it. Once you’ve recorded your video you can use the “Voice Effects” tab to change your voice into a robot, a chipmunk, or dozens of other fun alternatives.

TikTok also has a great editing dashboard for businesses or personal brands looking to utilize their audience for sales. Advertisers can access a suite of editing tools to make their video content suitable to upload on TikTok through these steps:

No, you won’t be able to edit any part of your video once published. Your best bet is to create a new video.

Yes, you can make exactly the same edits to a saved video as you can to a video you’ve just recorded.

TikTok’s in-app editor is very good and fit-for-purpose. Otherwise, CapCut, Zoomerang, and BeeCut are great alternatives with extra features.

You can edit virtually everything including the sound and speed. You can mesh clips together, add text, sound, filters, and other images.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Can You Edit a TikTok Video After Posting?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

No, you won’t be able to edit any part of your video once published. Your best bet is to create a new video.

”

}

}

, {

“@type”: “Question”,

“name”: “Can You Edit a Saved TikTok Video?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes, you can make exactly the same edits to a saved video as you can to a video you’ve just recorded.

”

}

}

, {

“@type”: “Question”,

“name”: “What Is the Best Editing App for TikTok?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

TikTok’s in-app editor is very good and fit-for-purpose. Otherwise, CapCut, Zoomerang, and BeeCut are great alternatives with extra features.

”

}

}

, {

“@type”: “Question”,

“name”: “What Can You Edit on a TikTok Video?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You can edit virtually everything including the sound and speed. You can mesh clips together, add text, sound, filters, and other images.

”

}

}

]

}

It doesn’t matter if you’re just using TikTok for fun or to promote your brand, knowing how to edit your videos effectively will help make creating high-quality, engaging videos with the potential to go viral ten times easier.

Growing a following on TikTok doesn’t have to be as complicated as you think.

Instead of messy content, do yourself justice through high-tech editing.

Which TikTok editing feature will you use the most?

And how can they affect if you can get funding? We tell you all about NAICS Codes. They could be the difference between getting business money or not getting any money.

Federal statistical agencies use the North American Industry Classification System (NAICS) . The idea is to classify business establishments. This is to collect, analyze, and publish statistical data, related to the U.S. business economy.

The NAICS was developed under the auspices of the Office of Management and Budget (OMB). Its adoption was in 1997. The intention is to replace the Standard Industrial Classification (SIC) system. The U.S. Economic Classification Policy Committee (ECPC) developed it with Statistics Canada and Mexico’s Instituto Nacional de Estadistica y Geografia. The intent was to make business stats easy to compare among North American countries.

NAICS is a 2- through 6-digit hierarchical classification system. It offers five levels of detail. Each digit in the code is part of a series of progressively narrower categories. The more digits in the code, the more classification detail.

The first two digits are the economic sector. The third digit designates the subsector. And the fourth digit designates the industry group. The fifth digit designates the NAICS industry. The sixth digit designates the national industry.

A 5-digit NAICS code is comparable in code and definitions for most of the NAICS sectors. This is across the three countries participating in NAICS. They are the United States, Canada, and Mexico. The 6-digit level lets the U.S., Canada, and Mexico all have country-specific detail. A complete and valid NAICS code has six digits.

NAICS industry codes define businesses based on the primary activities they engage in. Recently, the NAICS changed many of its codes as it updated its philosophy. It no longer sets aside online businesses. Now the NAICS no longer distinguishes businesses by how they deliver goods or services.

There is an older NAICS list of high-risk and high-cash industries. Higher risk industries on the list include casinos, pawn shops, and liquor stores. But it also included automotive dealers and restaurants. But this list is from 2014 and does not appear to have ever gotten any updating.

Per the NAICS, various professionals in the banking industry compiled the list. The idea was to use it as a working guide. But it is not an officially sanctioned list. They do not guarantee the accuracy of this list.

When considering any aspects of a business, risk must be a major factor. There are inherent issues in every single industry. But some businesses are considered to be risky by their very nature. This is the case even if everything else goes off like a hitch and the business is prospering. Risk is inherent within these business types. Even if your business doesn’t feel risky, it could be anyway.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

The biggest reason why risk matters has to do with funding. There are several industries where lending institutions are hesitant to do business. In those particular cases, there are stricter underwriting guidelines. But at least a company can get funding.

In some industries, no funding is available at all. As a result, those businesses will need to find other solutions for financing. These solutions can include:

Still, a lot of businesses would rather work with lenders. But where are lenders’ ideas of the degree of risk coming from? One clue comes from the CDC.

The Centers for Disease Control looks at risks in small businesses. Part of the calculation of risk comes from occupational injuries. But the other side of the risk coin is occupations which are high in cash transactions. After all, a pawn shop might not have much of a specific risk of injury at all. But the large amounts of cash normally associated with one mean it can be a tempting target for thieves.

These industries (among many others) can get an automatic decline:

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

These industries (among many others) can be subject to stricter underwriting guidelines:

According to the older list, the following codes are among those considered to be high risk:

How do you choose a better code?

Of course you want to be 100% honest when it comes to selecting your NAICS code. But if more than one can apply, you don’t have to choose the one that’s higher risk. So it pays to check and be careful when making your selection.

Also, if only high risk codes apply, there’s nothing wrong with changing your business. Then you may be able to match a related but lower risk code. There is nothing underhanded or dishonest about doing this.

Let’s say your business is automotive transmission repair (NAICS Code 811113). We know this is a high risk code. But 811191 is not on the NAICS list. It covers Automotive Oil Change and Lubrication Shops. So why not offer oil changes and use the lower risk code? It could be the difference between getting funding, or not.

The Internal Revenue Service will use the NAICS code you select. This is to see if your business tax returns are comparable to other businesses in your industry. If your deductions do not reasonably resemble other businesses in your industry, your business could be subject to an audit.

The IRS may label some companies as high-risk when they do not choose the right NAICS code. But if you know how the system works, then you can choose the correct code on your first try.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Lenders, banks, insurance companies, and business CRAs all use codes. They tend to use both NAICS and SIC Codes. SIC Codes are the older business classification system. D&B uses both SIC and NAICS Codes.

OSHA uses NAICS Codes for industry identification in its data. These agencies use them to determine if your business is in a high-risk industry. So you could get a loan or business credit card denial based on your business classification. Some SIC codes in particular can trigger automatic turn-downs. You could end up paying higher premiums, and get reduced credit limits for your business.

Will a better NAICS code guarantee funding for your business venture? Of course it won’t. But at least your business will not be automatically turned down before you can make a case for funding.

Industries are defined by codes from the North American Industry Classification System. Codes go up to six digits for the most granular information. Some codes are always associated with high risk. This makes it harder to get business funding. So if more than one NAICS code can apply to your business, pick the one that’s less risky.

The post In Just a Few Minutes of Your Time, Learn All About Avoiding Risky NAICS Codes appeared first on Credit Suite.