Article URL: https://questdb.io/careers

Comments URL: https://news.ycombinator.com/item?id=31541880

Points: 1

# Comments: 0

Article URL: https://questdb.io/careers

Comments URL: https://news.ycombinator.com/item?id=31541880

Points: 1

# Comments: 0

The full strawberry moon, the next full moon, will fall on June 13-14. The supermoon is also known as the honey moon, mead moon or rose moon, according to NASA.

If you are thinking about making the leap from side hustle to small business, you are probably wondering how to fund it. Even a side hustle has financing options. Can you get a fast business loan? Is a business loan even the best option for your business at this point?

A side hustle, by definition, is a business you run on the “side”. That means, you keep your day job. This kind of activity is typically bootstrapped. Often, the funding is with money from your day job. What if it isn’t enough though?

There are other options for funding a side hustle. The options may allow you to grow and expand your business without using personal funds. That is the dream of a lot of small business owners. As a result, many jump on the fast business loan bandwagon.

While there are ways to make that dream come true, fast business loans are not often the way to make it happen. First, they are more likely to be personal loans than fast business loans.

That means, the business owner is solely responsible for repayment and for default. Business loans can work much differently if the business is set up properly. So, what does it take to get the funding you need for your side hustle, and can you really leave the idea of quick business loans behind? Should you?

There are plenty of challenges when it comes to business funding for a side hustle. One huge challenge is a lack of business credit history. As a result, there is no business credit score or a poor business credit score. That pretty much knocks a business out of the running for traditional fast business loans.

Another challenge is usually a side hustle is not yet set up properly to get business funding. Most business loans look for a Fundable Foundation. This includes a number of things, like getting an EIN and incorporating, that most side hustles do not have.

Foundation. This includes a number of things, like getting an EIN and incorporating, that most side hustles do not have.

Not being set up properly to get funding leads to reliance on personal credit and financial resources. Sometimes this is necessary, but it’s best to avoid it when possible.

There are options for getting around each challenge. Credit Suite can offer resources to help you get the funds you need to grow your side hustle into something more.

We can help you get the funding you need now, and guide you step-by-step through the process of setting up in a way that will help you get funding far into the future. Eventually you’ll qualify not only for fast business loans, but for options such as SBA loans, a merchant cash advance, and even a traditional line of credit.

Traditional business loans are hard to get for a side hustle, but not impossible. Yet, approval will likely lean heavily on personal credit. Fast business loans usually have higher interest rates and less favorable terms anyway. This may be even more so when it comes to a side hustle.

The key is to look for business loan programs from non-traditional lenders. Many of these operate online and you can get pretty fast business loans if you qualify. But remember, quick business loans come with a price. Anything fast business related is going to cost you. In the case of business loans, the cost comes in the form of higher interest rates and more personal liability.

For most small business owners, particularly startup owners, personal credit scores will be a vital part of any lender determining if a business should qualify. If you have good credit, getting a business loan, even a fast business loan, will probably not be an issue.

Still, as a business owner, you do not want to rely on personal funds any more than absolutely necessary. What can you do? The key is to build separate credit for your business. As you do, lenders will be able to use it to help make the approval decision when you apply for a business loan.

Keep in mind, when it comes to most business loans, your business credit score will be used with, not instead of, your personal score, in most cases.

The truth is, your goal should not always be fast business loans. Fast business loans are great. However, a better goal is to create a situation in which your business qualifies for any funding it needs, when it needs it.

As a side hustle, you are not likely to qualify for merchant cash advances, typical small business loans, and other fast types of financing.

However, you are in the perfect situation to start building Fundability right now, from the beginning. You’ll save yourself a lot of time and money in the long term. Better yet, done correctly, you could never have to worry about fast business loans again.

right now, from the beginning. You’ll save yourself a lot of time and money in the long term. Better yet, done correctly, you could never have to worry about fast business loans again.

Foundation

FoundationThis is a must for business funding of any kind, not just fast business loans. Without this, credit providers and lenders will not recognize the business as a separate entity from you, the owner.

That means a lot of things, but a big one is there is likely to be no separate business credit report without a Fundable Foundation. It includes:

Foundation. It includes:

We guide you step by step through the process of building a Fundable Foundation. We can help you find vendor accounts that will report. And we can show you how to build business credit in the most efficient way possible.

Foundation. We can help you find vendor accounts that will report. And we can show you how to build business credit in the most efficient way possible.

Funding a side hustle is hard. But there are other options besides personal finances. You may qualify for a fast business loan, but it’s a long shot. If you take in enough credit card payments, a merchant cash advance may work. Most side hustles do not, however.

Credit Suite can help you build Fundability so you can access those options and more. We can help you build a strong business credit portfolio for your small business so you can effectively manage cash flow.

so you can access those options and more. We can help you build a strong business credit portfolio for your small business so you can effectively manage cash flow.

We can help you get funding right now, and help you get set up to qualify for other types of credit in the future, including:

In addition, we can help you find funding that does not require a personal guarantee, and help you determine if and when a personal guarantee may be worth it. In the end, Credit Suite is on a mission to ensure every small business is set to get the funding it needs in the form of small business loans, a line of credit, equipment loans, and whatever else they may need.

Small businesses looking for fast cash may find success getting funding with online lenders. Quick business loans just do not come from traditional banks. Their systems are much different and the application and underwriting process usually takes much longer.

Online lenders however, are often specifically designed for quick business loans. In some cases you can get fast business loan approval and even have funds in as little as a week.

There are a lot of lenders out there. Some are great to work with, while others are closer to a scam. Be careful and do your own research. Here are a couple of lenders to get you started if you decide to pursue the fast business loan option.

Fundbox is actually a line of credit rather than a small business loan. Still, it is a great funding option because the requirements for approval are much more manageable that those typical of a regular bank.

Their process is automated and super-fast. Repayments are automatic. They draft them electronically on a weekly basis. One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn currently, as the repayment period is comparatively short.

You will have to pay attention and be certain to manage cash flow accordingly so you have enough funds in the account to cover your payment each week.

They want to see at least 3 months in business, $50,000 or more in annual revenue, and a business checking account with a minimum balance of $500.

Upstart is an online lender that uses a completely innovative platform for small business loans. The company itself thinks that financial information and FICO on their own may not give the whole picture when it comes to the risk of making a small business loan to a specific borrower.

As a result, they opt instead to use a combination of artificial intelligence (AI) and machine learning to gather alternative data. Then, they use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities.

Note, this is a personal loan. But, if you need funding now and your personal credit is not great, it can be a good option. It’s a start at least.

This is an excellent way to get fast business funding for a side hustle. If you have a retirement plan, it may be the best option even. First, it is not a loan. There is no early withdrawal fee or tax penalty.

This Credit Suite program offers a flexible and powerful way to leverage assets that are in a 401(k) plan or IRA.

It really is fast too. In fact, it may take as little as 3 weeks. So while it isn’t a loan, it certainly qualifies as fast business funding. The IRS calls this a Rollover for Business Startups (ROBS).

The IRS considers a ROBS qualified plan to be a separate entity. It has its own set of requirements. Technically, the plan owns the business, not the individual. As a result, some filing exceptions for individuals might not apply to the plan. Still, always check with a tax expert when it comes to tax matters.

Honestly, it’s not hard to qualify. There is no need to submit financials or have good credit to get approval. In fact, all the lender wants is a copy of your two most recent 401(k) statements. The plan must have a value of more than $35,000 to get approval. You can get up to the amount of your 401(k) that is “rollable.”

It cannot be a plan from a business where you work currently. It has to be from previous employment, and you can’t still be contributing to it.

It may sound complicated, but Credit Suite business credit experts will help every step of the way. They will help you set up a 401(k) plan in your company. Next, you’ll invest your 401(k) funds in it. Your business then has the cash flow it needs, but no debt. Despite how hard it sounds, your part is fast and easy. We handle the hard stuff.

First of all,not all plans allow for loans. If your plan does, the IRS will only let you borrow up to 50%, capped at $50,000, before you have to start paying taxes.

Also, with a 401K loan you will pay interest. Of course, you are paying interest to yourself. However, you will be making monthly payments, whereas with the 401K Rollover for Working Capital, there is no payment.

This unique program allows you to tap into your existing retirement account without penalties or taxable distributions. You also avoid loans, banks, or credit checks. There is no debt and no monthly payment.

A credit line hybrid is a credit card stacking program that allows for unsecured business funding. It functions much like a line-of-credit. You can draw the cash you need, and repay only what you use.

It allows you to fund your business without putting up collateral, and you only have to use what you need to cover a cash flow gap, purchase supplies, or anything else.

You do need good personal credit. Your personal credit score should be at least 68o. In addition, there cannot be any liens, judgments, bankruptcies or late payments on your personal credit report.

If you do not meet all of the requirements, it’s not the end of the story. You can take on a credit partner that meets them. Some business owners work with a friend or relative to fund their business.

It’s really perfect for growing a side hustle, as you can get it without a ton of documents and it’s flexible.

There are many benefits to using a credit line hybrid. First, it is unsecured. There is no need for collateral. Also, the funding is “no-doc.” You do not have to provide any bank statements or financials.

Additionally, often you can get interest rates as low as 0% for the first few months. This allows you to put that savings back into your business.

It is flexible financing that functions much like a revolving credit line. The process is pretty fast. Part of that is due the fact you get qualified experts to walk you through it.

What is crowdfunding? It’s actually a pretty common way for small business owners to try to take a side hustle to the next level. You can access tons of investors at once. And, you can test the market at the same time.

You market your business on the platform. Anyone who wants can invest in the company. Some platforms accept donations as low as $5 or $10 dollars, though most require more.

With rewards-based crowdfunding, you get some token of thanks for your donation. With equity-based crowdfunding, which almost always requires $500 or more, investors get shares of the company.

It works well for some businesses, but not for every business. In fact, most find that they need to supplement their crowdfunding money with some other form of funding. Since it is debt free cash however, it may be worth considering.

While there are a lot of successful crowdfunding campaigns, the majority are not able to fully fund their business through crowdfunding. According to Startups.com, the average success rate of a campaign is 50%, and 78% of crowdfunding campaigns reach their goal.

That sounds somewhat promising. However, it appears success depends greatly on your market, among other things. Here are a few more statistics from the same study with success broken down by the type of business:

None of these hit the 50% success rate. If you choose to go this route, be sure you have a backup plan.

There are actually two types of crowdfunding. There is rewards based crowdfunding and equity crowdfunding. Many see all crowdfunding as a mix between the two. However, they are actually very different.

In fact, while some platforms allow campaigns to do both, many only allow one or the other. It’s important to determine which one will work best for your business before you decide on a platform.

The best one for your business will depend on a number of factors. It helps to understand the benefits, as well as the drawbacks, of each option.

It’s important to note since the topic here is getting a fast business loan, that this is neither a loan or fast funding. It is a way that you can possibly fund a side hustle and grow it into a full fledged business. But, you do not repay funds to investors and it may or may not be fast. With most platforms, though not all, you do not get the funds until you reach your funding goal. There is no way to tell how long that might take.

The truth is, you may not really want a fast business loan right now. There are costs and other factors to consider. One of the other options may work better.

In fact, a fast business loan that offers same business day cash in your account is one of the most expensive types available. Instead of a quick business loan, it’s more useful to have flexible financing options in place to use as needed.

When that is the case, you can have access to funds on the same business day without having to worry about a fast business loan. You can bridge a cash flow gap, take advantage of business day payment discounts, and more.

But it takes time. If you are ready to jump now, you want to be able to fund it fast. Is that possible? Is a fast business loan the best way to do it? If you can get on with an online lender, maybe. The Credit Line Hybrid usually works really well too. Of course, if you have a retirement plan, it’s hard to beat a ROBS.

Find out how we can help you qualify for financing, as well as the financing options we offer, now.

The post Get the Perfect Fast Business Loan for Your Side Hustle appeared first on Credit Suite.

Codeless | Hybrid | Frontend Developer | Dordrecht, the Netherlands

As a Developer you will innovate and improve our in-house Low Code Development platform.

At Codeless we help businesses to renew outdated software. With that, we help businesses with unique and distinctive processes realize their ambitions by solving complex software challenges, often caused by a constantly changing software landscape. We are a small and international family company with 80 employees in the Netherlands, Romania, and Emirates.

Tech Stack: Angular, TS, HTML, CSS, JS (almost done migrating). For the rest: .Net, Azure, K8, Docker.

Apply at: https://careers.codeless.com/o/senior-front-end-developer-an…

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission. Looking to create a professional website without buying a new service? There are a few good free website builders out there. Yes, I’m talking about zero-cost tools that don’t require any coding or design … Continue reading Best Free Website Builders

Article URL: https://www.ribbonhealth.com/open-roles/?gh_jid=4154303004 Comments URL: https://news.ycombinator.com/item?id=31531910 Points: 1 # Comments: 0 The post Ribbon (YC S17) is hiring data engineers who want to help simplify healthcare first appeared on Online Web Store Site.

With most of the NBA world believing the Heat were done, Butler rose up to force a Game 7 in Miami.

The post Jimmy Butler's picture-perfect performance gives Miami life appeared first on Buy It At A Bargain – Deals And Reviews.

Successful marketing requires a focused strategy and an outstanding team to bring it all together. However, introducing an effective marketing organization structure can take your business to the next level.

With a solid marketing structure in place, your staff knows exactly what is expected of them. With everyone clear on their jobs and their roles in the company’s success, everything operates more smoothly, and it enables your team to work in unison.

However, not all business models are suitable for all companies. If you want to choose the right marketing organization structure, you need to know which type is best for your business.

How do you choose? Let’s talk about the five most common structures, how they work, and the pros and cons of each one.

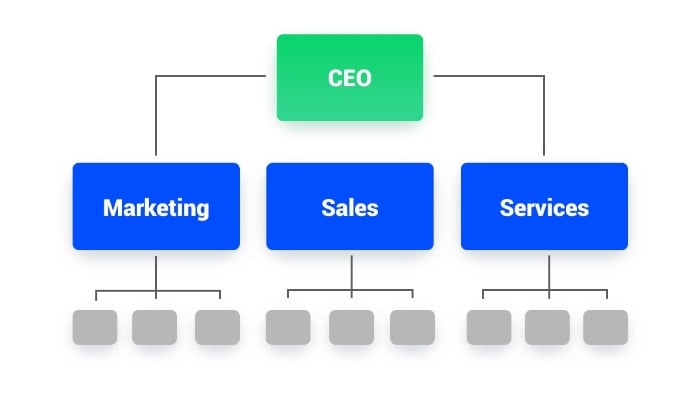

A marketing organizational structure is the setup of a company’s marketing department. It determines the leadership chain and sets out your business’s goals. It also defines employee roles, establishes employee structure, and organizes teams.

Organizational structures in marketing come in many shapes and sizes, but they all serve the same purpose: to create a system that enables the marketing department to function effectively and achieve its goals.

As Gartner’s Marketing Organization Survey 2020 notes, marketers are continuing to strive to create “more effective and responsive organizations” while minimizing disruption.

According to their research, 27 percent of marketers use functional marketing organization structures in their business.

Setting up a structure benefits your company in multiple ways, empowering employers, allowing better focus, and enabling agility. Let’s look at this in more detail.

Today’s businesses need to be agile. Agility is essential in fast-changing sectors, allowing your team to enhance efficiency, prioritize workloads, create relevant products, and allocate budgets more effectively. It also makes it easier to shift when technology, trends, or Google’s Algorithms change.

Agile marketing is increasing in areas like content creation and creative services, with 77 percent of businesses taking this approach.

If you want your business to succeed, you need the best people for the job. A functional marketing organization structure groups your team based on skills, ensuring you have the right person for each job and they have the support they need.

When employees are in positions that fit their skills and the support they need, they are empowered to succeed—which improves loyalty and your bottom line.

When employees have clear goals, it’s easier for them to concentrate on their tasks. When every employee on the marketing team is working with the same focus, it streamlines the process and enables collaboration.

Additionally, focus keeps team members engaged. This is crucial because, according to Gallup, engagement increases productivity by 18 percent. Further, it increases profitability by 23 percent, while decreasing absenteeism by 81 percent.

There are several types of marketing organizational structures. Each model has its own advantages and disadvantages, which we detail in this section. Keep in mind what works well for your business may not be suitable for someone else.

A company’s structure depends on its size, products, customers, and type. Below, we’ll cover the most common systems and who should consider using them.

A functional marketing organizational structure describes a company’s design and is built around the marketing functions it has to perform. As detailed in the intro, research by Gartner shows 27 percent of marketers use this model.

The functional structure allows for clear communication and cooperation between different departments. It also makes it easy to identify and assign specific tasks to individual employees.

This type of structure allows for greater specialization and expertise within the marketing function, leading to improved efficiency and effectiveness in marketing operations.

Amazon uses this structure for its e-commerce business because it’s well-suited to the sector. Additionally, the functional marketing organization structure is favored by larger organizations and is ideal for companies with a stable environment.

Despite the positives, this structure can lead to communication breakdowns, decreased creativity, and inflexibility. Additionally, it may be difficult to move people around within a functional frame, potentially impacting the company’s ability to respond quickly to market changes.

Finally, functional structures can be difficult to manage when a business grows too large.

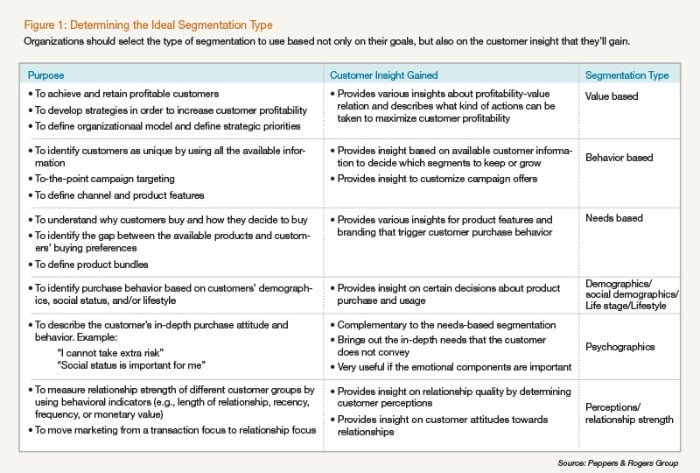

Segmented marketing organizational structures allow firms to tailor their marketing efforts to specific customer segments. For each segment of customers, a different team is responsible for understanding their needs and creating tailored marketing programs.

The structure usually works well for companies with a large customer base and a complex sales process. Businesses can ensure customers are constantly engaged, and it allows the streamlining of communication between different departments.

Additionally, organizations using this model can decide how best to segment depending on their aims and the resulting customer insights.

Advantages of this model include:

However, this structure can also be costly because it requires multiple teams with different skills and knowledge.

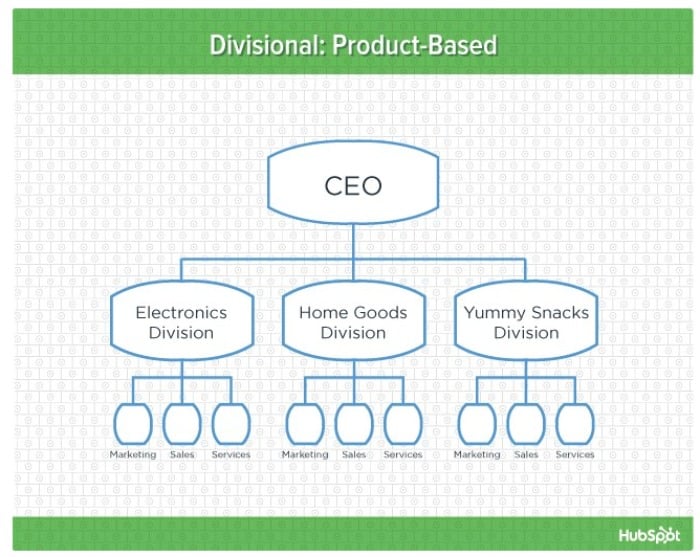

Product marketing teams have a multitude of tasks, including target audience research, content marketing, and analytics. Then there are co-branding partnerships to consider, with research showing 71 percent of consumers enjoy multiple brands working together to make a unique product.

With so much going on, what’s the best way to coordinate? By introducing a product marketing organization structure.

In this model, each group has its team of marketers responsible for developing and executing the marketing strategy for their specific product line. A product marketing organizational structure is the preferred model for businesses with different lines of products/services and looks like this:

This model allows organizations to respond to changing trends and meet customer needs while concentrating on targeted market sectors.

However, it can be difficult to track and measure the effectiveness of the marketing activities due to a lack of central control and duplicate roles in different divisions. To work around this challenge, businesses may consider grouping similar products together.

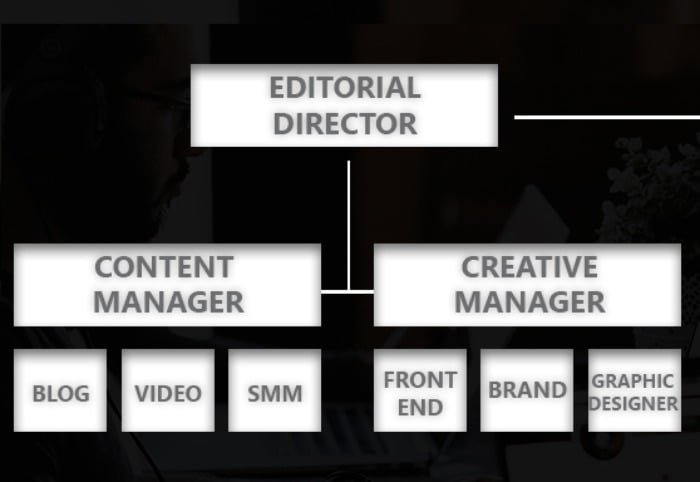

A digital marketing organizational structure is essential for any company looking to create an online presence. If your business has a dedicated team to handle all digital marketing tasks, you can make and implement a cohesive strategy to reach your target audience.

The structure of a digital marketing department varies by company size but often includes a mix of people with various backgrounds and skillsets.

With a digital marketing organization structure, the company can have specialized teams that focus on different aspects of digital marketing, such as search engine optimization (SEO), paid search engine advertising (PPC), graphic design, and content marketing.

This specialization allows each team to become an expert in their area of focus, which leads to better results for the company.

Depending on which model you use, your structure might look like this:

You might also choose to have different organizations for paid versus organic, social versus content, and so forth.

In today’s business world, companies need to adapt to the ever-changing market. One way to do this is through a hybrid or matrix marketing organizational structure. This structure allows companies to have the best of both worlds by combining the advantages of both functional and divisional systems.

Both of these structures have their advantages. For instance, a functional structure works on a centralized basis, with each department reporting to a single leader. This allows for better communication and coordination between departments.

By contrast, a divisional structure is centralized, with each department having its own head and reports to a different leader. This allows for more local decision-making but can lead to duplication of efforts and coordination problems between departments.

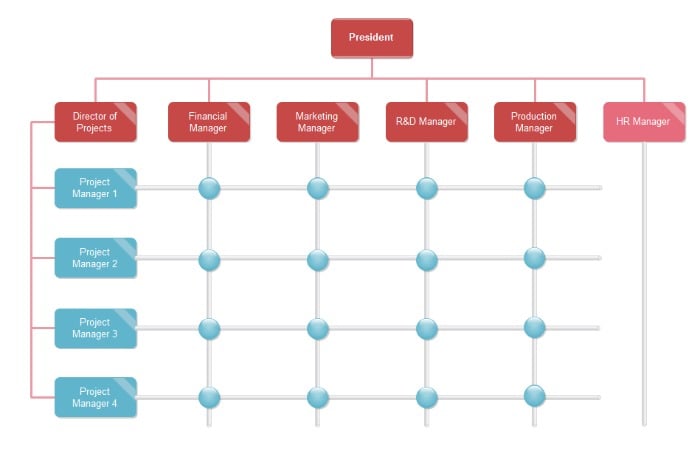

In practice, your hybrid/matrix marketing organizational structure might look something like this:

The flexibility of the hybrid model means it’s enormously popular among businesses, with 72 percent of employees working in matrixed teams.

A big advantage of a hybrid marketing organization is they tend to be more responsive to changes in the market. Because it is flexible, it can quickly adapt to new conditions.

However, a hybrid structure can lead to conflict between departments or divisions, and it’s sometimes hard for departments to coordinate. Gallup’s research also uncovered a lot of overwhelm with the hybrid model, with 45 percent of employees saying they spend most of their day responding to requests from coworkers.

Companies often use the hybrid model in dynamic environments which move from project to project.

The market organizational structures listed above are among the most popular, but there are more you could choose from.

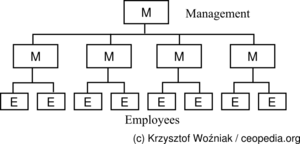

For instance, a linear organization structure is a management style where all employees and managers report to one boss.

This type of organization is common in small businesses and marketing organizations. The linear organization structure is easy to understand and can be effective when the company is small, and everyone reports to the same person.

In a marketing firm, you can use the linear form to control the flow of information from the top down. However, this can also be limiting because it does not allow for horizontal communication among employees.

Finally, projectized organization structures are organizational structures in which specific, temporary projects are given to their departments that report directly to top management. In businesses with high fluctuation in workloads, this type of structure makes it possible to quickly set up and disband project-specific teams as needed.

A typical projectized organizational structure would look something like this:

When choosing an organizational structure, think about both your current needs and your future needs. If you plan to launch several products in the next year, for example, it makes sense to create a product-based marketing structure from the start.

Each business works differently, meaning which system works well for one may not work for another. The linear structure, which has one leader, is the most common. You could choose from several types, including functional, matrix, or divisional.

To keep things simple, consulting firm the Pedowitz Group suggests a basic structure for a B2B marketing organization structure to focus on tasks like content and digital services, digital demand generation, and reporting to a CMO. There is no “one size fits all” structure for a business: you need to begin by looking at your business’s overall aims and current strategy. To guide you, the Edward Lowe Foundation has some great tips.

The linear structure is the most basic model and the functional structure is the most common and also easy to implement.

It varies depending on the size of your business, the type of structure you go with, your goals, and your current strategy. It can take weeks or months to get it right, and then you need to review your structure regularly to make sure it works for your goals.

Yes, consider all options when structuring your team. This includes both freelancers and contractors. Freelancers can be an excellent option for short-term projects or for filling gaps in your team’s skill set. Contractors can be a good option for long-term projects.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is the best marketing organizational structure for small businesses?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Each business works differently, meaning which system works well for one may not work for another. The linear structure, which has one leader, is the most common. You could choose from several types, including functional, matrix, or divisional.

”

}

}

, {

“@type”: “Question”,

“name”: “What is the best marketing organizational structure for B2B businesses?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

To keep things simple, consulting firm the Pedowitz Group suggests a basic structure for a B2B marketing organization structure to focus on tasks like content and digital services, digital demand generation, and reporting to a CMO. There is no “one size fits all” structure for a business: you need to begin by looking at your business’s overall aims and current strategy. To guide you, the Edward Lowe Foundation has some great tips.

”

}

}

, {

“@type”: “Question”,

“name”: “What is the simplest marketing organizational structure?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The linear structure is the most basic model and the functional structure is the most common and also easy to implement.

”

}

}

, {

“@type”: “Question”,

“name”: “How long does it take to set up a marketing organizational structure? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

It varies depending on the size of your business, the type of structure you go with, your goals, and your current strategy. It can take weeks or months to get it right, and then you need to review your structure regularly to make sure it works for your goals.

”

}

}

, {

“@type”: “Question”,

“name”: “Should I consider freelancers and contractors in my marketing organizational structure?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes, consider all options when structuring your team. This includes both freelancers and contractors. Freelancers can be an excellent option for short-term projects or for filling gaps in your team’s skill set. Contractors can be a good option for long-term projects.

”

}

}

]

}

The structure of an organization’s marketing department can significantly impact its overall performance.

The best structure for your business will depend on the products or services you offer, the size of your company, and your geographical location.

Companies should carefully evaluate their options and select the format most likely to lead to success.

Popular choices include the foundational structure, product-based, or a divisional model. Alternatively, you might want to adopt a hybrid model to cater to today’s hybrid consumers.

Do you use a marketing organization structure? Which model works best for you?

Contrasting Business Credit Cards Can Help Owners Save Money

You might not recognize it, yet selecting an organization credit scores card is simply as important of a choice as any kind of that you will certainly make as a service proprietor. It is essential for you to recognize exactly how to contrast organization debt cards in order to locate the one that is best for you.

Debt Limits

The initial product to look at when you contrast service credit score cards is the prospective credit rating restriction of the card. You need to have an excellent concept prior to looking into service credit history cards of exactly how much you require the credit history restriction to be.

A credit scores card that does not offer you a high adequate limitation will certainly require you to utilize even more than one service credit scores card, which makes maintaining track of expenditures much extra complicated as well as tough. Assume wise when obtaining a service credit rating card as well as locate one that provides a credit history restriction that is finest for your organization.

Rate of interest

When you contrast service credit rating cards, you definitely need to take into consideration rate of interest prices. This is typical with a service, especially one that is simply beginning out, since cash is linked up in the company and also not available for paying the equilibrium off each month. You require to locate the service credit score card with the most affordable passion price in order to conserve your company cash.

Incentives Programs

At the exact same time, organization credit score cards with incentive programs have a tendency to have greater rate of interest rats. When you contrast organization credit rating cards, be certain to contrast the passion price to the advantages provided by the incentives program in order to identify if the payment is worth the pay-in.

Fringe benefits

Service credit rating cards, like routine debt cards, can have a number of added advantages connected with them, such as traveling insurance policy, expanded service warranties, and also acquisition security. When you contrast service credit history cards, take into consideration these advantages meticulously as well as discover out as a lot as feasible regarding these advantages. Finding out that 2 organization cards each deal traveling insurance policy is not sufficient.

You might not recognize it, however selecting a service credit report card is simply as essential of a choice as any kind of that you will certainly make as a company proprietor. The initial thing to look at when you contrast organization credit scores cards is the possible credit history restriction of the card. A credit score card that does not provide you a high sufficient restriction will certainly require you to utilize even more than one company credit score card, which makes maintaining track of costs much extra complex as well as hard. Believe clever when obtaining a company credit rating card and also locate one that supplies a credit history restriction that is finest for your service.

You require to discover the service debt card with the least expensive passion price in order to conserve your company cash.

What is Fundability and what on earth does it have to do with business loan denial? First, by its very definition Fundability

and what on earth does it have to do with business loan denial? First, by its very definition Fundability is the ability to get funding.

is the ability to get funding.

If your business isn’t seen by a lender as Fundable , you will not get loan approval. It’s not all about your credit report or credit score either.

, you will not get loan approval. It’s not all about your credit report or credit score either.

There is so much more to approving a loan application than that. Good credit history is important, because of course they want to know you’ll make your monthly payments. However, your application has to make it to that point first. If the business isn’t set up to be Fundable , it might not.

, it might not.

It can be incredibly disheartening to fill out a loan application and get a denial. Whether you apply at your local credit union or a traditional bank, they are going to pull credit reports just like with a personal loan.

The difference is, in addition to personal credit and financial information, they will want to see the credit history of the business as well. If your personal credit score is great you may be able to get a loan based on it alone, but it will most likely be considered a personal loan.

Helps

HelpsStrong Fundability , which includes a strong credit score for your business, will increase approval chances and the chances of getting better terms and lower interest rates.

, which includes a strong credit score for your business, will increase approval chances and the chances of getting better terms and lower interest rates.

Understanding why a lender denies an application can be helpful. There are many seemingly small details that can cause issues, and they are not likely to tell you what your specific problem is. So, it’s important to know what factors they consider other than credit.

You have two types of credit scores when you’re a business owner. Rather, you should have two types. You should have a personal one and one for your business. The truth is, many business owners do not even realize the second score exists.

Sure, they may have some vague idea that their business has its own credit separate from their personal score. But, they think it just sort of happens. This is due to the fact that personal credit does just that. It just happens, passively, as you get and use credit.

Credit scores for business are completely different animals. You have to be intentional with both establishing and building it. You have to actively set up your business in a way that it will have its own score, and then seek out accounts that will report positive payment history so that your score grows. Not every account will do this.

Factors that Can Help You Avoid Loan Denial

Factors that Can Help You Avoid Loan DenialThere are at least 125 factors that affect the Fundability of a business, and they all make a difference when it comes to loan denial. However, here are the Top 5.

of a business, and they all make a difference when it comes to loan denial. However, here are the Top 5.

Your personal credit score is still a part of this, even though it is separate from your business. It is affected by several factors. These include credit utilization and payment history. Even how many different types of accounts you have on your report can negatively impact your score.

You are entitled to a free credit report each year. Make sure to get it from each of the main credit bureaus. Check your free credit score, as it may provide some insight if you have a loan denied. Some apps offer a free peek at your score once a month also, so you can keep up with it during the year.

In addition to the fact that most traditional lenders will check your personal credit, it can also affect your business credit. It is not unheard of for a business credit bureau to actually use your personal credit score in their calculation of your business credit score. Both Experian and FICO SBSS do this.

So, even if a credit provider only relies on business credit, your personal credit may still affect Fundability .

.

In contrast, payment history is the main thing that makes or breaks business credit. Get your credit report from each credit reporting agency, and check it carefully. You may find the score isn’t great or that it is non-existent because of many accounts not reporting positive payment history.

You will not find free access to your business credit reports. Yet, Credit Suite offers an ongoing monitoring package that is a fraction of the price that others charge.

It’s important in the beginning to choose credit accounts carefully. You need to both get approval and know they will report payments you make. Not all do, and some only report missed payments.

Credit Suite maintains a thorough and up-to-date database of vendors that report, along with what is required for approval. We can help you apply for the right ones at the right time to build business credit in the most effective and efficient way possible, saving you both time and money.

Foundation Helps Prevent Loan Denial

Foundation Helps Prevent Loan Denial Foundation includes:

Foundation includes:While none of these things guarantee loan approval, they are all necessary for Fundability and building business credit. So, a lack of these things can definitely result in loan denial.

and building business credit. So, a lack of these things can definitely result in loan denial.

Imagine a lender looks at your loan application and see’s the name “Jack Sparrow’s Weed Dispensary.” While marijuana is legal in some states, it is pretty much universally considered a risky industry by lenders. That said, this name could get your loan denied before they even look at a single credit report.

Instead, just leave the part that indicates risk out. Just call it “Jack Sparrow’s.” At least you’ll get further along and avoid loan denial simply because of your business name.

But, you likely know already that your credit score is important when it comes to both getting a personal loan and trying to get business funding. Let’s look at some of the lesser known Fundability Factors that can cause, or prevent, loan denial.

Factors that can cause, or prevent, loan denial.

In a lender’s mind, inconsistency is a red flag for fraud. It doesn’t take much. If your business information is not listed exactly the name everywhere they look, you may have a loan denial on your hands.

This includes something as small as using an ampersand in one place and the word “and” in another. Even a common misspelling can lead to big problems.

For example, if you list your business as “Joe and Bo’s” on the loan application, but the credit report says “Jo and Bo’s” or “Joe & Bo’s,” or anything at all different, you could be denied automatically.

Lenders spend a lot of time going through a potential borrower’s credit history. Most will not take the time to chase down and reconcile minor errors before they even get to the credit reports.

Of course, you always have to handle credit responsibly. Things like excessive credit card debt on your personal credit will always cause issues. Furthermore, if your business does not have the monthly gross income it needs to handle loan payments, approval isn’t likely.

The whole point of underwriting is to ensure your company can and will handle monthly debt payments, and monthly income is a big part of that. Some business owners use personal loans to fund their business until they get to that point. It’s best to avoid this if at all possible. You could end up with bad credit on the personal side and bad credit or no credit on the business side. It’s best to find a balance.

Underwriters will look at all sorts of things to determine loan eligibility. Of course, they will start with the application. Make sure it’s complete and accurate. Then, they’ll examine both your business and personal credit file.

It varies by lender, but one thing they may look at is the cash deposit history in your business bank account. Personal finance information may come into play if you do not have a lot of business finance history. That means potentially employment history, defaulted loans, late payments, and more can be fair game. A hard credit inquiry on your personal credit report related to this is possible as well, which will have a small negative impact.

If you get approval, this information will play a part in decisions related to interest rate and credit limit. Loan offers depend heavily on your financial situation, and each new loan will go through the whole process again. So, if you have been denied once, but have made all your loan payments on any other debt since then, you may not be denied the next time.

to Help Prevent Loan Denial

to Help Prevent Loan DenialThere are a number of ways Credit Suite can help. First, we have trained business credit specialists that can walk you through each step of setting up a Fundable Foundation. Then, we can help you find the accounts you need to report payments so that your business credit score can grow.

Foundation. Then, we can help you find the accounts you need to report payments so that your business credit score can grow.

As already noted, we offer business credit monitoring at a fraction of the cost, so you can see each step of the way how many accounts you have reporting and track your progress.

, But Financing Too

, But Financing TooIn addition, we can help you find the funding you need right now. Our finger is on the pulse of the industry. We know which lenders are approving most frequently at any given time. We know which loan products you qualify for, and we can guide you as to which types of funding may work best for your business now and in the future.

and Business Credit

and Business CreditOur team can give you long term strategies to help increase your chances of getting approved. We can show you how to apply for a loan in a way that will offer better odds by ensuring there is no missing information or inaccurate information.

As you qualify for more accounts, your business credit score will only grow. If you keep your finances in order, including keeping excellent credit, you will soon be eligible and get approved for credit cards and loans.

With the strong Fundability Credit Suite can help you build, you can get the funding you need, when you need it, now and in the future.

Credit Suite can help you build, you can get the funding you need, when you need it, now and in the future.

The post Top 5 Ways Fundability™Can Prevent a Loan Denial appeared first on Credit Suite.