Article URL: https://www.terravion.com/full-stack-developer/ Comments URL: https://news.ycombinator.com/item?id=21085692 Points: 1 # Comments: 0

Category: Business News

Business News

Regarding Consumer Credit

Concerning Consumer Credit If you do not comprehend non-mortgage consumer debt, you will certainly be even more most likely to abuse credit report, as well as destroy your monetary circumstance. That is why the topic of non-mortgage consumer debt is so crucial.When they obtain their trainee credit history card, a whole lot of individuals obtain …

Regarding Consumer Credit

Concerning Consumer Credit

If you do not comprehend non-mortgage consumer debt, you will certainly be even more most likely to abuse credit report, as well as destroy your monetary circumstance. That is why the topic of non-mortgage consumer debt is so crucial.

When they obtain their trainee credit history card, a whole lot of individuals obtain their initial experience with customer credit score. This is where their research of non-mortgage consumer debt starts. Bank card customers require to be well-informed in credit score terms such as APR, benefits, equilibrium transfer and also money back.

You can additionally obtain division shop cards details to one brand name shop. The APR on these customer credit report cards is typically substantially greater than a lot of routine credit report cards.

When you are a customer of credit scores you require to recognize your lawful civil liberties to ensure that you can safeguard on your own. If you are being worried by collection agencies, you ought to be mindful of the Fair Debt Collection Act, which lays out the policies that restricts the activities an enthusiast can make use of to fetch his cash.

You can obtain your credit history record from a credit report reporting bureau. You might be qualified for a totally free credit score record to watch your customer credit history standing.

Non-mortgage consumer debt therapy

Abuse of credit scores can frequently result in a high quantity of non-mortgage consumer debt financings which can consequently bring about personal bankruptcies. It might be beneficial to look for out customer credit rating therapy if you are dealing with a frustrating financial debt circumstance.

Customer credit report therapy might aid if your credit score scenario has actually weakened. Therapy can aid you identify your monetary circumstance as well as assist you locate methods to fix your credit report. Therapy can aid you far better handle your financial resources, to ensure that you can avoid of financial obligation and also end up being an extra enlightened customer of non-mortgage consumer debt.

A great deal of individuals obtain their very first experience with customer credit history when they obtain their trainee credit rating card. The APR on these customer credit rating cards is commonly substantially greater than a lot of normal credit scores cards.

You might be qualified for a cost-free debt record to see your customer credit scores condition. If your credit rating circumstance has actually worn away, customer credit scores therapy might aid.

The post Regarding Consumer Credit appeared first on ROI Credit Builders.

Online Business Loans Versus Factoring

Which one is Best for You, and Tips for Finding More Options

There are so many more options for funding a business than most business owners realize. Everyone knows about loans and investors. The thing is, not only are there dozens more options, but just within those two categories there are a ton of options. Figuring out which one will work best for you and your business can be a daunting task. Do you go with traditional or online business loans? Crowdfunding or invoice factoring?

Before you can truly know the best answer, you must have a deep, in-depth understanding of each option. You cannot understand which option is best for your without knowing everything about each one and how they compare to each other.

In addition, the choice is dependent upon a number of variables that will be unique to your situation. Why do you need the money? How soon do you need it? What does your credit look like? How long have you been in business? All of this culminates to an arrow pointing you in the right direction.

To keep things from being too overwhelming, it is sometimes best to consider and compare just a couple of options at a time. For example, which is the best for you between online business loans and factoring invoices?

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

What Are Online Business Loans?

Of course, this sounds like a dumb question. They are business loans that you get online, right? It’s self-explanatory. Maybe the better question is, what is the difference between online business loans and other business loans.

There are many differences actually. Online business loans:

- Have an application process that takes place exclusively online

- Have a much faster application and approval process

- Offer less strict qualifications guidelines

- Sometimes utilize alternative methods of determining qualification

- Get money into your account much faster, sometimes within as little as a day or two

- Often have higher interest rates than traditional loans

What does all of this mean? It means that if you have trouble qualifying for a traditional loan, an online loan can be a good alternative. This is also true if you need funds quickly, or do not want to have to wade through the lengthy application process that traditional lenders are known for.

However, all this good does have a negative thrown in the mix. Online business loans generally have higher interest rates and less favorable terms. If eligibility and time are not an issue, traditional loans are the most cost effective.

So Then, what is Factoring?

This is more specifically referring to invoice factoring. That of course, means that you must have open invoices to qualify. Consequently, you must be extending credit to customers in some form. Usually this involves invoices with net terms, such as net 30, 60, or 90.

Then, you turn those invoices over to a factoring company. They give you an agreed upon percentage of the total of the invoices, such as 80%. You get this amount of money immediately. When your customer pays, the factoring company keeps their agreed upon fee, and they send you the rest.

This is different from selling invoices, in which you sell your invoices at a premium and do not collect anything else. The buyer then tries to collect the full price from the customer and keeps it, profiting from the premium they were sold at. This is more typical with severely delinquent invoices.

You can factor invoices on an ongoing basis to help with cash flow, or you can do it to aid in a one-time cash crunch. It is quick, but it can be costly. If you are an established business that has little problem collecting on invoices however, this is a funding option that is easy to qualify for. Since the funds are secured with the invoices, there is little worry about credit rating.

Online Business Loans vs. Factoring: Which One Should You Choose?

Even knowing everything you can about each option, it can still be difficult to differentiate between which one would work best for you and your situation. The truth is, one could be best this time, and in the future, the other one will work better.

Take the following factors into consideration:

- Why do you need funds?

- How often do you need funds?

- What does your credit score look like?

- How long have you been in business?

- Do you have open invoices?

- Do you have trouble collecting on open invoices?

If your credit is not terrible, and you only need funds this one time for something specific, it might be best to go with online business loans. You do not have to have a credit score that is up to standards with what traditional lenders require, fund will come fairly quickly, and your interest rate will likely be lower than the factoring fee you would pay.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

Of course, if you do not qualify for invoice factoring, that is another reason to choose online business loans.

If you need fast cash or an ongoing cash flow to cover a collections gap, you may want to look into factoring. You can set it up to where your invoices are automatically factored and you get a portion of the funds right away. Be sure you are not covering up a bigger issue however. Factoring only works if your customers pay.

Building Business Credit Can Open Up Online Business Loans and Other Options

Of course, you shouldn’t feel that these two are your only options, even if your credit history disqualifies you for other types of financing. If you work on building business credit, you can increase your options for funding, and even open up new options for online business loans.

What is Business Credit?

Glad you asked! Business credit is a credit report and score that is based solely on the financial history of your business. In some cases, it does not take your personal credit score into account at all. Even if your personal score is considered, in most cases a strong business credit score will prevail when it comes to business financing.

Why Do You Need Business Credit?

Since business credit is distinct from individual credit, it can help secure an entrepreneur’s personal assets if there is litigation or business insolvency. Also, with two distinct credit scores, a business owner can get two different cards from the same merchant. This effectively doubles purchasing power.

How Do You Get Business Credit?

Establishing small business credit is a process, and it does not occur automatically. A company will need to proactively work to establish business credit. The goal is to make the business appear fundable to lending institutions and merchants. Here is how to make that happen.

Contact Information

Your business needs a professional-looking website and email address. Remember, the site needs to have site hosting bought from a company such as GoDaddy. A free web hosting service or free email service will not work for these purposes.

The business needs a separate phone number as well. It should be from a free exchange and be listed along with the fax number on 411. You can do that here: http://www.listyourself.net.

Business Bank Account

A dedicated business bank account is also necessary. This will not only aid in making your business appear fundable, but it will also help keep business expenses separate for tax purposes.

Incorporation and EIN

Visit the Internal Revenue Service web site and acquire an EIN for the small business. They’re free. You also need to select a business entity like a corporation, LLC, etc. Formally incorporating helps to separate your business from yourself, and as an added bonus, it offers more protection to your personal assets.

Get a D-U-N-S Number

Go to the Dun & Bradstreet website and get a D-U-N-S number. This is a number that D&B assigns to a business when it goes into their system. It is necessary to have this number before the system will generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for correctness and completeness. If there are no records with them, that will be handled with the next step.

What’s that Next Step?

The next step is to work your way through the credit tiers, adding more cards in higher tiers as you gain accounts in the one you are currently in. Start with the vendor credit tier.

Vendor Credit Tier

First, build tradelines that report. This is also called the vendor credit tier. Then you’ll have an established credit profile, and you’ll get a business credit score.

These types of accounts tend to be for the things bought all the time, like marketing materials, shipping boxes, outdoor workwear, ink and toner, and office furniture.

These trade lines are with vendors who will give you starter credit when there is none already. Terms are typically Net 30, rather than revolving. That means if you get an approval for $1,000 in vendor credit and use all of it, you must pay that money back in within the net terms.

Not all vendors work for starter credit. Find some great options here.

Retail Credit Tier

Once there are 5 to 8 or more vendor trade accounts reporting to at least one of the credit reporting agencies, then move onto the retail credit tier. These are companies such as Lowes and Staples.

In fact, Lowes works really well because they report to D&B, Equifax and Business Experian. They will need to see a D-U-N-S and a PAYDEX score of 78 or more though, so be sure to work that vendor credit tier the right way.

Fleet Credit Tier

Once enough accounts are reporting from retail credit, you can apply for cards in the fleet credit tier. This tier includes businesses such as BP and Conoco. Use this credit to buy fuel, as well as to repair and maintain vehicles.

Shell is an example in this tier. They report to D&B and Business Experian. A PAYDEX Score of 78 or higher and a 411 small business telephone listing are required for approval. They might say they want a specific amount of time in business or revenue. However, that will not be necessary if you already have enough vendor accounts.

Cash Credit Tier

If you are responsible with the credit you earn in these three tiers you will be able to move on to the cash credit tier. It includes service providers such as Visa and MasterCard not attached to a retail store.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

Qualify for Online Business Loans and Monitor Your Business Credit

Keep tabs on what is happening with your credit. Make sure it is being reported and take care of any errors ASAP. Get in the practice of checking credit reports and digging into the particulars, not just the scores. We can help you monitor business credit at Experian and D&B for only $24/month. See: www.creditsuite.com/monitoring.

At D&B you can monitor at: www.dandb.com/credit-builder. At Experian, you can monitor your account at: www.smartbusinessreports.com/Landing/1217/. And at Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business. Experian and Equifax cost about $19.99; D&B ranges from $49.99 to $99.99.

Monitoring your credit not only allows you to keep an eye on mistakes and work to get them corrected, but it also lets you see your progress. You can see how many accounts are reporting and what your score is. This will give you an idea of what you can do with it.

How Does Business Credit Affect the Online Business Loans vs. Factoring Question?

While both online business loans and factoring are legitimate funding options for a business, neither are ideal. There are better options out there, with lower interest rates and better terms. The problem is, those options are not available to many business owners for a number of reasons. Building business credit opens up a number of other possibilities for funding your business, and the more options you have, the better.

The post Online Business Loans Versus Factoring appeared first on Credit Suite.

Advertise Yourself To Affiliate Manager

Advertise Yourself To Affiliate Manager

As an associate supervisor, you can take advantage of your initiatives by aiding hire, assistance, as well as aid an entire military of associates to do those jobs for you. That indicates much less job as an associate supervisor, and also much more revenues leveraged from all the associates you handle.

If you have an item or solution of your very own, you can begin your very own associate program and also advertise on your own to associate supervisor. Well, also if you do not have your very own item or solution, you can still end up being an associate supervisor, since lots of on-line services are currently recognizing exactly how a lot extra they can make from their associate programs when they employ a certified associate supervisor to run it for them.

The various other choice you have is to discover a person with a services or product that does not have an associate program configuration, as well as do a joint endeavor with them, where you construct them an associate program, as well as become their associate supervisor. You can after that work out some regards to exactly how you earn money; whether you desire an established month-to-month income, a percent of all associate sales, or a little both.

If you currently have a services or product and also you do not have an associate program in position for it, after that what are you awaiting? Launch an associate program as quickly as you can, become your very own associate supervisor, or work with another person that is certified to handle your associate program. Caution: Your revenues might skyrocket, so be prepared to take care of a great deal of sales.

As an associate supervisor, there are a great deal of points you require to recognize in order to optimize your associate programs efficiency. It is necessary to recognize where to locate and also hire very associates (These are associates that will certainly make most of your sales). Exactly how to encourage as well as urge associates to market extra, and also exactly how to produce and also use marketing/sales devices to your associates to make their work simpler, as well as enable them to make even more sales.

Thankfully, there are several areas to discover training products (such as electronic books, records, & software application) online for complimentary, as well as the greater valued much more detailed programs produced to generate specialist associate supervisors. Some programs also have associate supervisor positioning programs, so that after you finish their qualification demands, they will certainly assist position you in a high paying associate supervisor placement right away. None of these gaining numbers are ensured, and also it all depends on the associate supervisor positionings you would certainly obtain as well as the initiatives you place forth as a devoted as well as effective associate supervisor.

If you have an item or solution of your very own, you can begin your very own associate program and also advertise on your own to associate supervisor. Well, also if you do not have your very own item or solution, you can still come to be an associate supervisor, since lots of on the internet organisations are currently understanding exactly how a lot extra they can gain from their associate programs when they work with a certified associate supervisor to run it for them. Beginning up an associate program as quickly as you can, become your very own associate supervisor, or employ somebody else that is certified to handle your associate program. Some programs also have associate supervisor positioning programs, so that after you finish their qualification needs, they will certainly aid position you in a high paying associate supervisor placement right away. None of these making numbers are ensured, and also it all depends on the associate supervisor positionings you would certainly get as well as the initiatives you place forth as a devoted and also effective associate supervisor.

The post Advertise Yourself To Affiliate Manager appeared first on Automation For Your Email Marketing Sales Funnel.

The post Advertise Yourself To Affiliate Manager appeared first on Buy It At A Bargain – Deals And Reviews.

Assume Before You Buy A Consumer Debt Consolidation Program

Believe Before You Buy A Consumer Debt Consolidation Program

Globe has actually come to be quick relocating today. With the increase in the economic situation as well as accessibility to sources worldwide, it is not unusual to see lots of people enter financial obligation and afterwards take into consideration registering in a customer financial obligation combination program. There can be numerous costs that can go back to haunt your joy.

Expenses such as education and learning expenses, own a home expenses, various other expenses and also clinical costs quickly accumulate and also end up being the factor behind your cash money water drainage. There is constantly a slim line of distinction in between maintaining your head over water as well as sinking in the red. Financial obligation debt consolidation procedure is quick acquiring footing in the economic market these days.

You can discover different customer financial obligation combination programs readily available that can aid you address your financial debt issues. You can warrant your demand to go in for a financial debt loan consolidation program depending on exactly how much deep in credit history you locate on your own in. You require to keep in mind that by the financial debt loan consolidation procedure, you do not remove any kind of exceptional financial debt.

Financial obligation loan consolidation can resolve numerous kinds of financial obligations such as credit history card financial debts, clinical financings and also individual lendings. As a customer, you should keep in mind that the period of a customer financial obligation loan consolidation program is generally longer than the various other car loans. While looking for a customer financial obligation combination program on the Internet, you need to be extremely clear in what you are looking for in the program.

Financial obligation combination may offer you an impression of points being in control. You ought to wind up your financial debt loan consolidation finance within the slated time duration to conserve on your own some rate of interest.

With the broaden in the economic climate as well as accessibility to sources around the world, it is not odd to see several individuals obtain right into financial debt and also after that think about enlisting in a customer financial debt combination program. You can discover different customer financial debt combination programs offered that can aid you fix your financial obligation issues. You require to keep in mind that by the financial obligation loan consolidation procedure, you do not get rid of any type of exceptional financial obligation.

Financial obligation debt consolidation can attend to different kinds of financial obligations such as credit scores card financial obligations, clinical lendings as well as individual car loans. While looking for a customer financial debt combination program on the Internet, you ought to be really clear in what you are looking for in the program.

The post Assume Before You Buy A Consumer Debt Consolidation Program appeared first on ROI Credit Builders.

Saudi Arabia Considers Doubling Stakes in Aramco Public Offering

How I Ranked For 636,363 Keywords Using This Simple Hack

When I started doing SEO on NeilPatel.com I used this advanced formula

to rank for 477,000 keywords.

Over time, my traffic started to flatline and I wasn’t ranking for many more keywords, even though I was continually creating more content.

But then I figured out a simple hack that took me from

477,000 keywords to 636,363 keywords as you can see in the image above.

So, what was this hack?

Well, it’s so effective that I just updated Ubersuggest so that includes the

hack.

So how did I do it?

When someone does a Google search, what are they typically

doing? They are trying to find a solution to their problem, right?

So how can you easily identify these problems people are

searching for?

Typically, you want to look for 3 types of keyword phrases:

- Questions – people type in questions because they are looking for answers. And if your product or service helps answer those questions, you’ll see a boost in conversions.

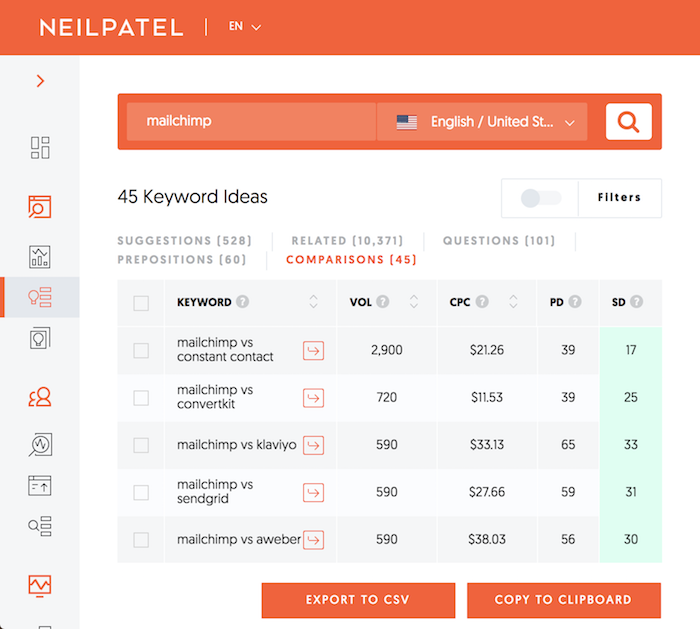

- Comparisons – when someone is searching for comparison keywords such as “MailChimp VS Converkit” there is high buyer intent, even if your company isn’t mentioned in the search phase. (I’ll go into how to leverage this in a bit.)

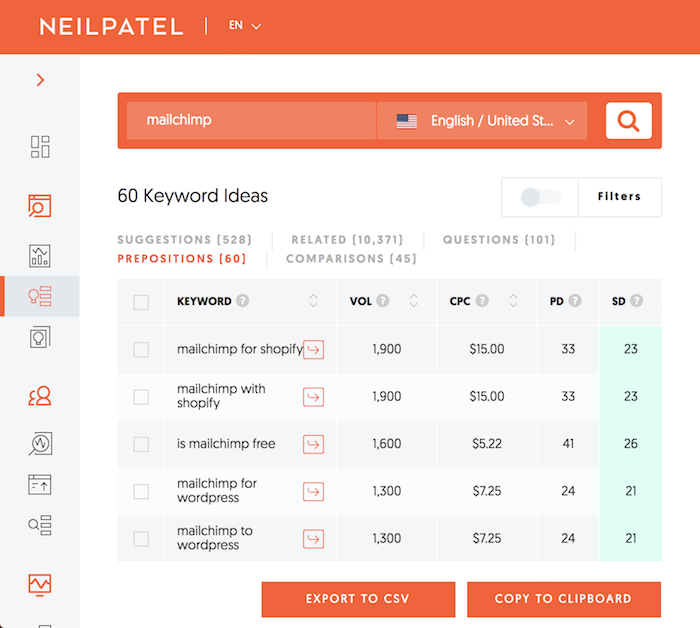

- Prepositions – when keywords contain a preposition, they tend to be more descriptive. If you aren’t sure what a preposition is, simple prepositions are words like at, for, in, off, on, over, and under. These common prepositions can be used to describe a location, time, or place.

But how do you find these keywords?

Well, I just updated Ubersuggest to now show you questions, comparisons, and prepositions.

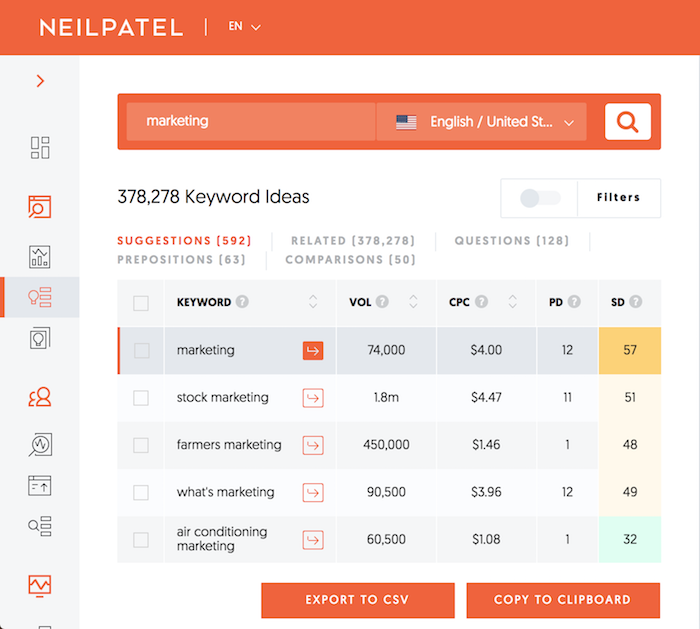

Just head over to Ubersuggest and type in a keyword that you want to go after. For this example, I typed in the word “marketing”.

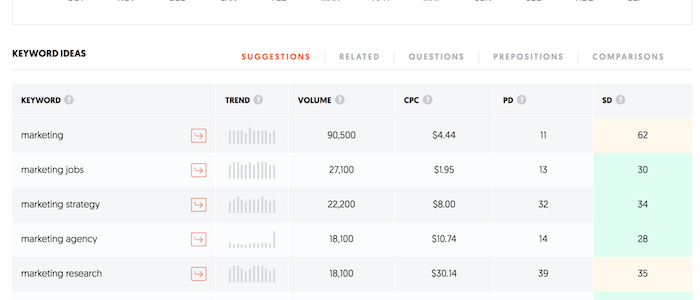

Then as you scroll down, in the keywords ideas table you’ll see tabs for questions, prepositions, and comparisons.

I want you to click on the “view all keyword ideas”.

You’ll now be taken to the keyword ideas report that looks

like this:

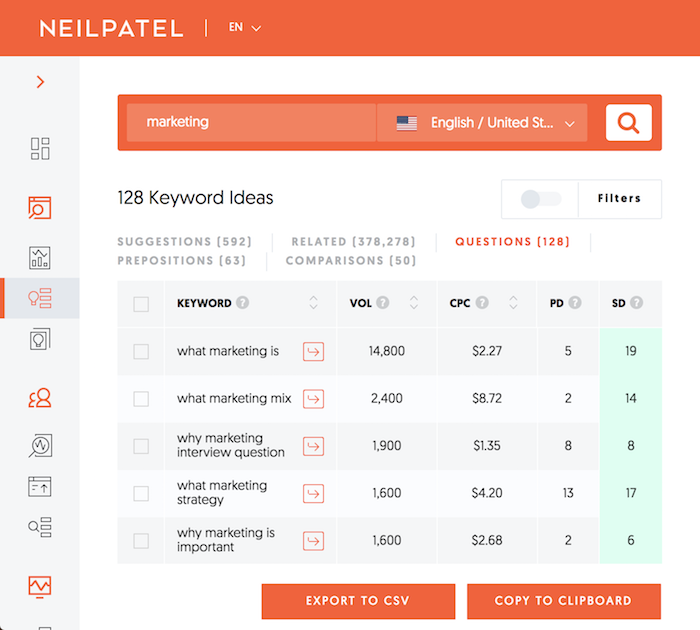

Now, click on the tab labeled “questions”. It will adjust the keyword recommendations to show you all of the popular questions related to the main keyword you just researched.

You’ll then see some suggestions that you could consider

going after. Such as:

- Why is marketing important?

- What marketing does?

- How marketing works?

But as you scroll down, you’ll find more specific questions such

as:

- Why a marketing plan is important?

- How marketing and sales work together?

- How many marketing emails should you send?

Now that you are able to see these questions people are typing, in theory, you can easily rank for them as most of them have an SEO difficulty score of 20 or so out of a 100 (the higher the number the more competitive it is).

More importantly, though, you can create content around all of those phrases and sell people to your product or service.

For example, if you created an article on “why a marketing plan is important,” you can go into how you also can create a marketing plan. From there you can transition into describing your services on creating a marketing plan and how people can contact you if they want your help or expertise in creating one.

You can do something similar with the “how marketing and sales work together” article in which you can break down how to make each department work together. From there, you can either be an affiliate for software solutions that help merge the two departments like HubSpot or sell your own software if you offer one. You can even pitch your consulting services that help tie sales and marketing together.

And as for the “how many marketing emails should you send,” you can create content around that and have an affiliate link to popular email tools that have high deliverability and offer automation. Or you can promote your own email product.

Now imagine all of the extra keywords you can rank for by going after question-related keywords. What’s amazing about this is most of these keywords are competitive and they have extremely high search intent.

Can it get any better?

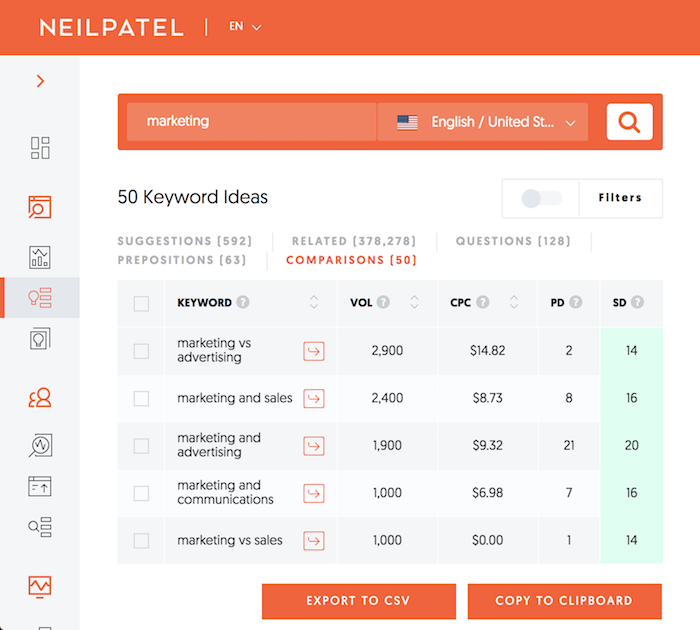

Speaking of search intent, I want you to click on the comparisons

tab.

You’ll see a list of ideas just like you did with the questions tab. But what I love doing here is typing in a competitor’s brand name here.

Let’s say I am offering an email marketing tool. I could type in “Mailchimp” and see what comparison ideas Ubersuggest comes up with.

Now for this example, I want you to imagine that you have an email company called Drip and Drip isn’t really mentioned in any of these keyword comparison ideas.

What’ll you want to do is create articles on all of the popular comparison terms like “Mailchimp vs Constant Contact” or “Mailchimp vs Convertkit” and within those articles break down the differences and also compare them with your own tool Drip.

Be honest when writing the comparisons. Show off which is the best solution using facts and data and break down how you are different and in what ways your own solution is better than the two solutions the reader is comparing.

This will bring awareness to your solution and you’ll find

that people will start purchasing it even though they were comparing two of

your competitors.

If you want a good example of how to create a neutral

comparison type of blog post, check out this article

comparing web hosts.

And if you want to take it one step further, you can click on the “prepositions” tab to find even more ideas.

Sticking with the Mailchimp example, you can see that people are curious about Shopify and WordPress integrations.

You can write articles related to integrations and also push your own product and break down how it differs from the others.

If you want to take it one level deeper, it will give you ideas on how to modify your business. For example, if I created an email marketing tool, I would create a Shopify, WordPress, Woocomerce, and Squarespace integration based on the ideas I got from the prepositions tab.

So how did I rank for 636,363 keywords?

I didn’t use all of the examples above on NeilPatel.com because I am not really trying to sell a product and I don’t have the time to write thousands of new blog posts.

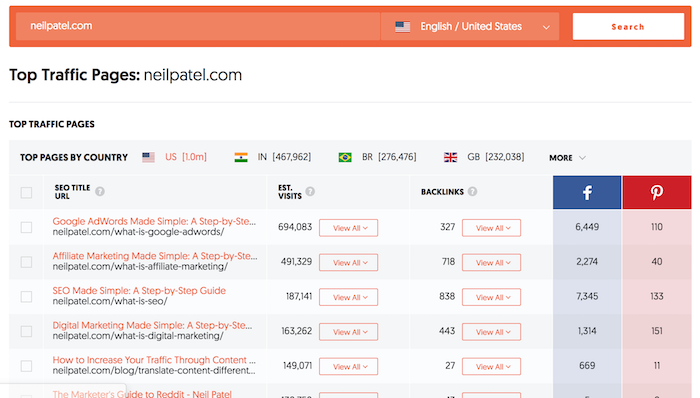

But I did type in my domain name into Ubersuggest and then headed over to the top pages report.

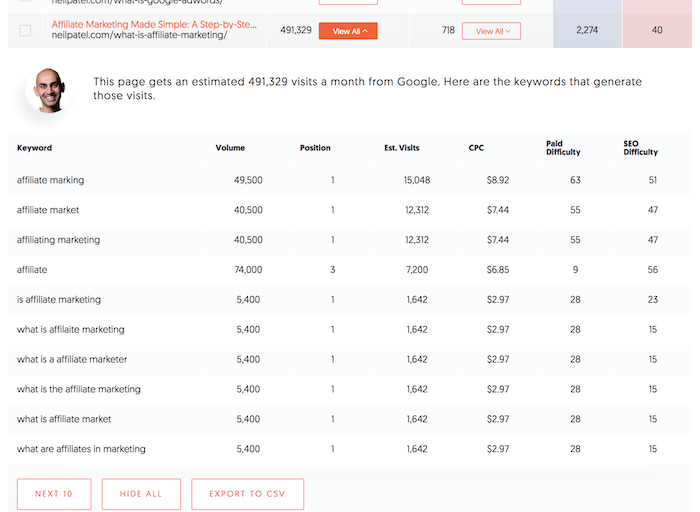

From there I looked at the pages that are already ranking well on Google and clicked on the “view all” button to see the exact keywords each page ranks for.

As you can see from that page I rank for questions like “what

is affiliate marketing” as well as popular prepositions and comparisons.

How did I do this?

Well, that top pages report shows you keywords each of your pages already ranks for. So all you have to do is research each of those terms through Ubersuggest and find popular questions, prepositions, and comparisons.

Conclusion

The natural instinct for any SEO or marketer is to rank for

popular terms that have a lot of search traffic.

But there is an issue with that strategy. It takes a lot of time, it’s extremely competitive, and many of those search phrases don’t cause a ton of conversions as they are super generic.

So, what should you do instead?

Focus on solving people’s problems. The way you do this is by creating content around the questions, prepositions, and comparisons people are searching for in Google.

What do you think about the new Ubersuggest feature?

The post How I Ranked For 636,363 Keywords Using This Simple Hack appeared first on Neil Patel.

The post How I Ranked For 636,363 Keywords Using This Simple Hack appeared first on #1 SEO FOR SMALL BUSINESSES.

The post How I Ranked For 636,363 Keywords Using This Simple Hack appeared first on Buy It At A Bargain – Deals And Reviews.

US-China cold war and rising protectionism could split world order

Experts say the world may face a "multi-dimensional cold war" as nations are "pressured to take sides" between the U.S. and China.

The post US-China cold war and rising protectionism could split world order appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post US-China cold war and rising protectionism could split world order appeared first on Buy It At A Bargain – Deals And Reviews.

Scale AI is hiring engineers to accelerate the development of AI

Article URL: https://scale.com/careers

Comments URL: https://news.ycombinator.com/item?id=21068224

Points: 1

# Comments: 0