When you think about SEO and what’s changed over the last 5 years, what comes to your mind?

Chances are, it’s something related to how it’s harder to get rankings on Google.

But why has it gotten harder to get more organic traffic?

Well, if you ask most SEOs, they’ll say it’s because Google has created a much more complex algorithm.

They look at factors like page speed, brand queries, and hundreds of other factors that it may have not been placing much emphasis on in the past.

But that’s only half the story.

The reason SEO has gotten harder is only partially related to Google’s algorithm changes.

Here’s what most SEOs aren’t talking about that you need to pay attention to because this will show you the future of SEO.

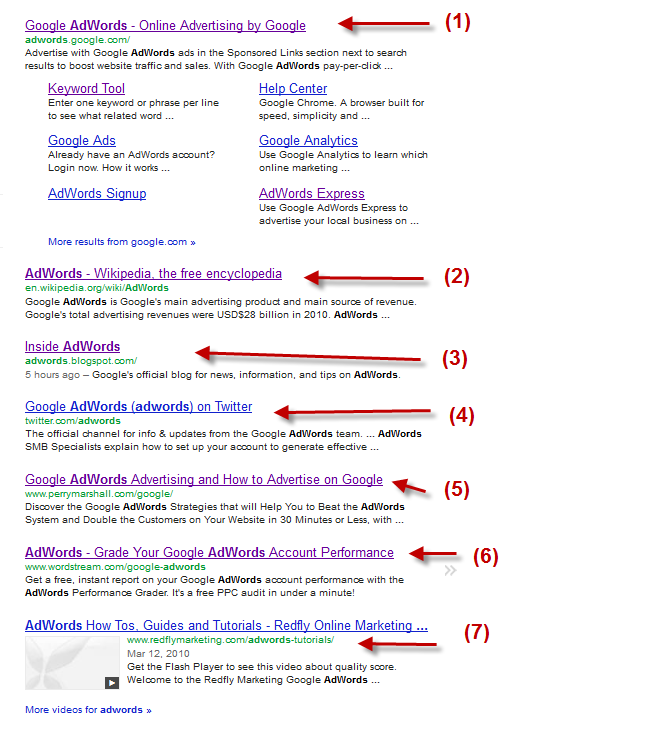

Google’s ever-changing layout

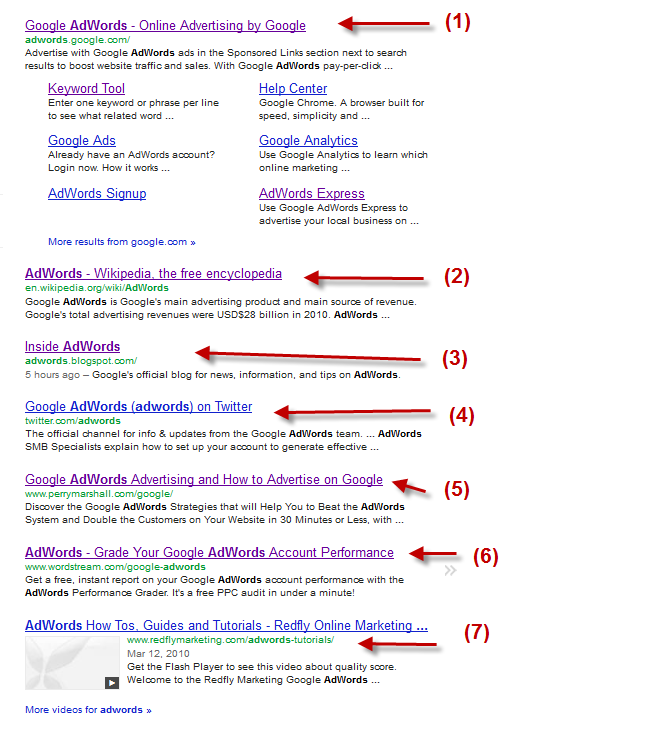

When you perform a Google search, what do you see?

Some organic listings and some paid results, right?

And that’s what Google has shown for years. Much hasn’t changed from its core concept.

But over the years, they have continually made small layout tweaks which have added up to big changes.

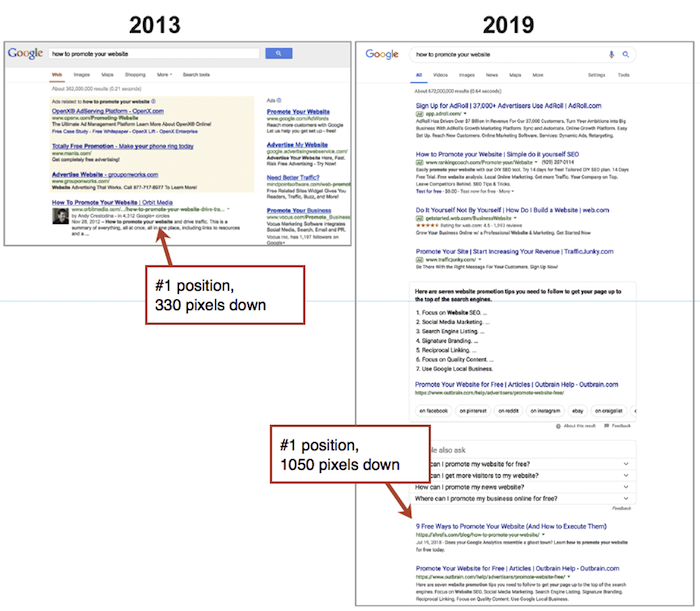

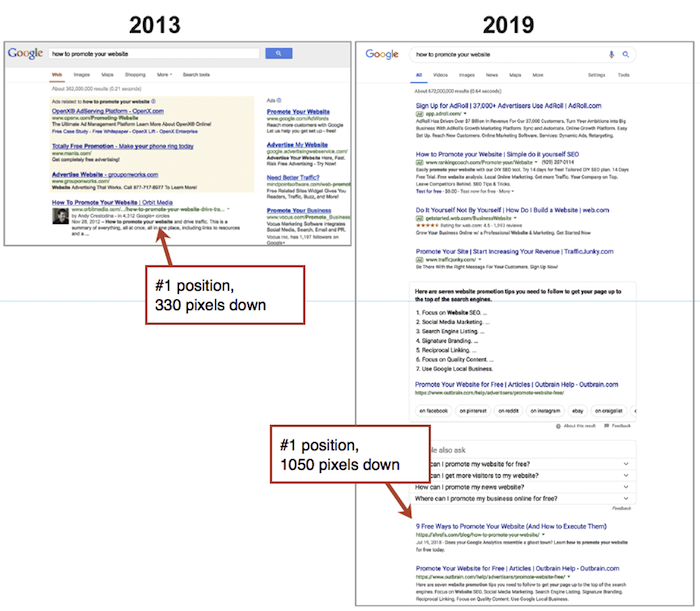

Let’s look at Google’s layout changes over the past few years… lucky for us, Orbit Media performed random Google searches in 2013, 2014, and 2015 and compared them to Google’s current layout for us.

The big differences from 2013 versus 2019 are:

- The first organic listing is drastically pushed down

- The ads used to be clearly identified through design elements, but now they blend in more.

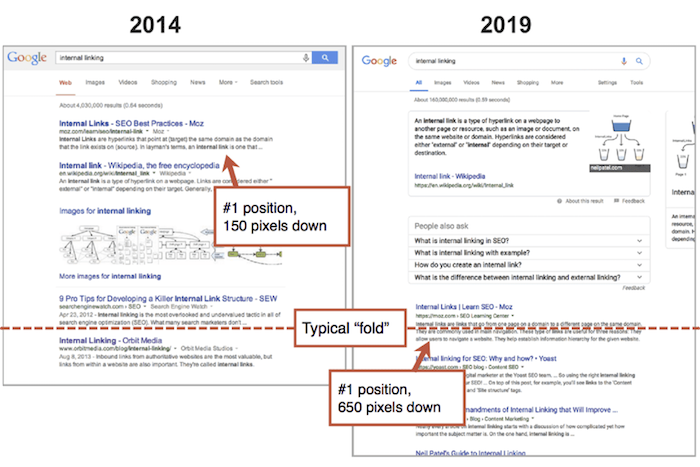

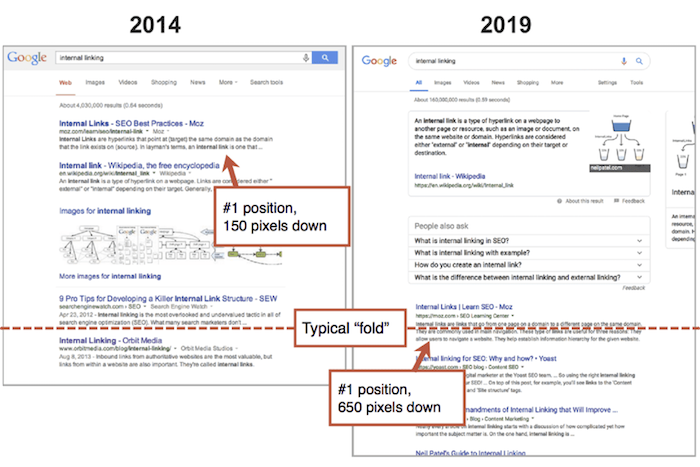

Now let’s look at 2014 versus 2019:

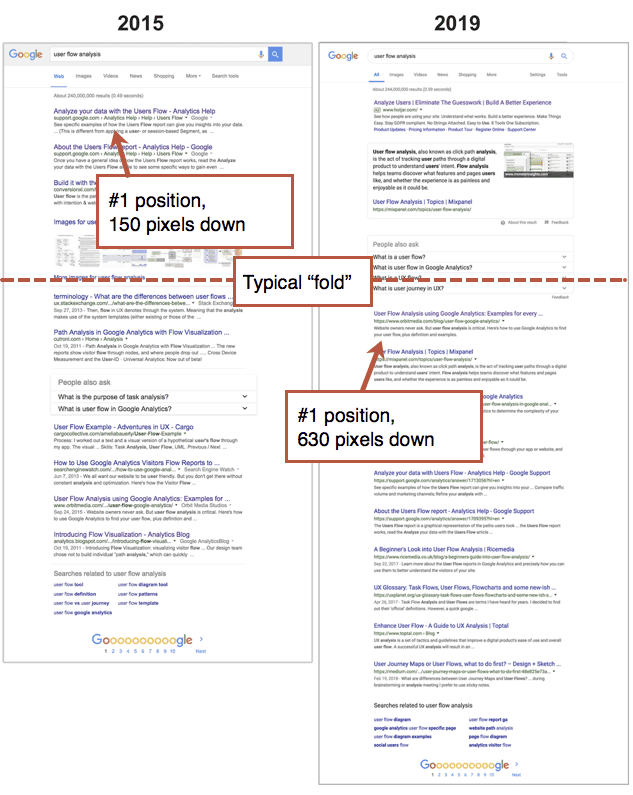

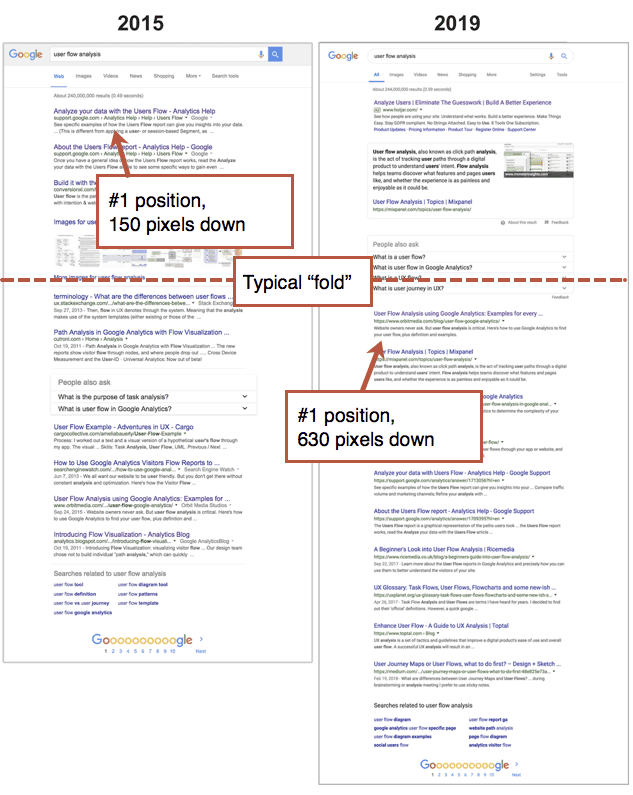

And 2015 versus 2019:

The big trend is that the organic search results have been drastically pushed down below the fold. Roughly by 3.3X.

That’s a huge difference!

A listing these days may have a map, elements from their knowledge graph, more videos and images, and whatever else Google feels their users may want.

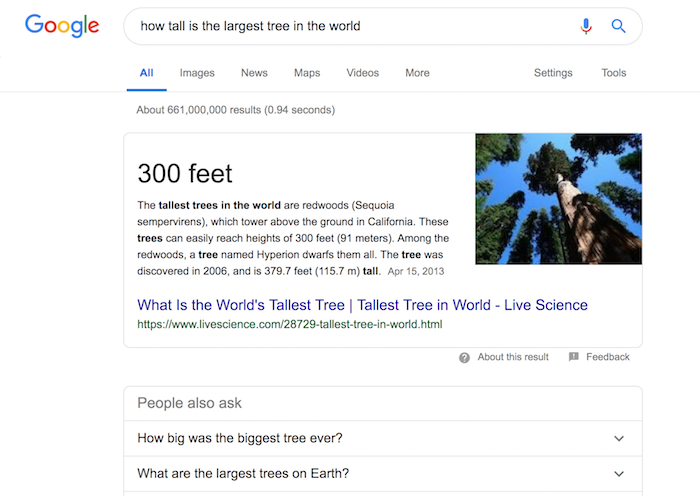

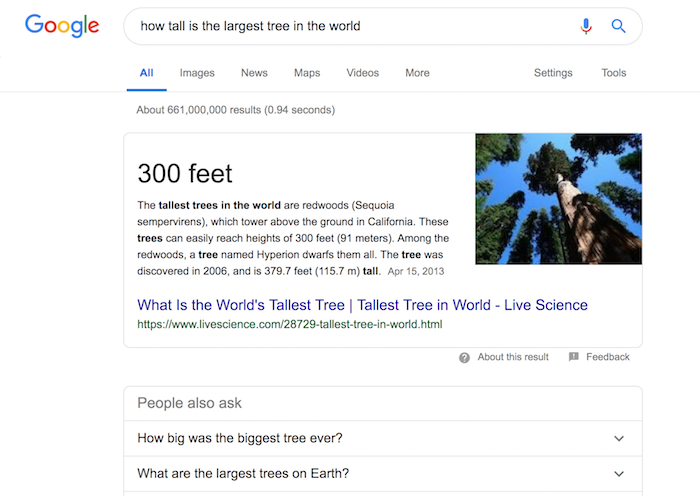

Another big trend is that there are now featured snippets. Although these featured snippets can drive traffic to your site, they also provide the searcher with the answer they are looking for without having to click through to your site.

Just perform a search for the largest tree in the world…

Sure, I could click through over to livescience.com to get the answer, but why? Google gives it to me right then and there.

With organic listings being pushed down, and Google answering a portion of people’s questions without them even needing to click through, this means organic listings will get fewer clicks over time.

And it’s not stopping there

Let me ask you a question…

How many organic listings are on the first page?

10, right?

Well, that’s what we are used to, but when’s the last time you actually counted?

Google’s dumped 5.5% of organic first page listings. Yes, the first page does have 10 listings a lot of the time, but not as often now.

Here’s a graph that’ll show you the change:

18%!! That’s the percentage of first page listings with less than 10 organic results.

What’s crazy is it used to be 2%. That’s a huge jump.

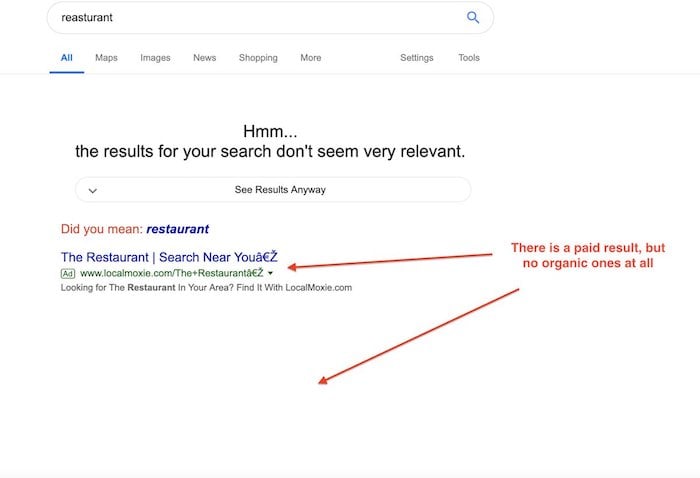

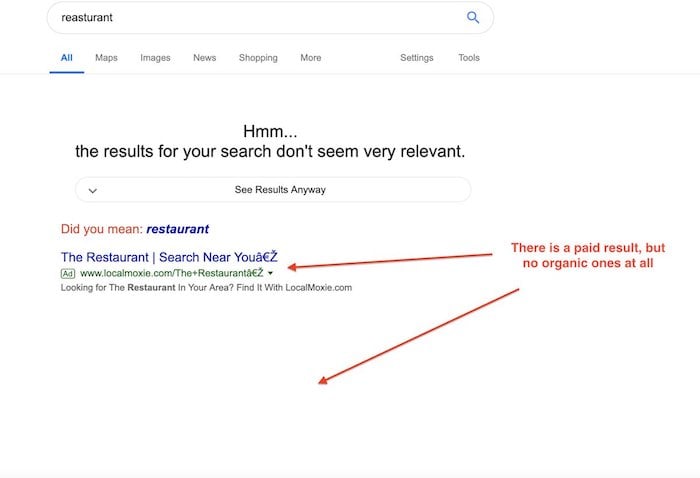

So, what else is Google testing with their layout?

This is a small test that they are doing with their layout, in which some results may not have any listings.

But Google did report that was a glitch. The page was not supposed to contain any organic listings, but at the same time, it was supposed to contain no paid listings either.

And over time you should continually expect Google to run more layout experiments and make more permanent changes.

Now before we get into the future of SEO, let’s get one thing straight.

Google is a publicly traded company. Sure, their goal is to create an amazing product, but they have to make money at the same time.

You can’t blame them for making changes that increase their ad revenues.

Yes, you may claim that this is creating a terrible experience for users, but is it really? If it was, people would switch to Bing or any of the other alternative search engines out there.

I still use Google every day. Yes, it may be harder to get clicks organically, but as a user, they’ve created an amazing experience.

The future of SEO

Google doesn’t just make changes to their layout blindly. They run experiments, they survey users, they try to figure out what searchers want and provide it.

Based on the layout changes they have made over the years, you can make a few assumptions:

- More rich snippets – people want the answers to their problems as quickly as possible. You’ll see more versions and variations of rich snippets integrated within future layouts as this provides searches with their answers faster.

- Less clicks to your site because of voice search – according to Comscore, 50% of searches will be voice searches by 2020. Don’t expect people to go to your site because of voice search.

- People are trained to ignore ads – no matter how much Google pushes the first organic listing below the fold, people are trained to ignore ads. No matter how much Google blends them in, most people tend to click on organic listings.

- 43.9% of the world still hasn’t come online – we all know Google is the dominant global search engine. But only 56.1% of the world’s population has Internet access. As more people come online, more people will use Google as their search engine, which means more people to click on your organic listings.

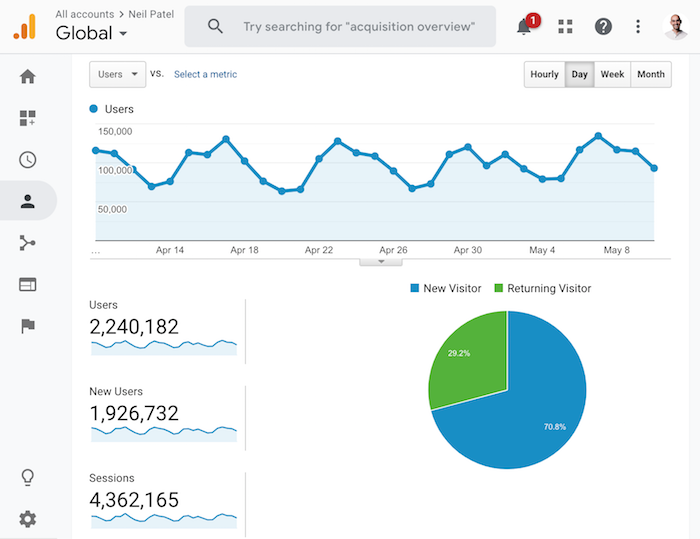

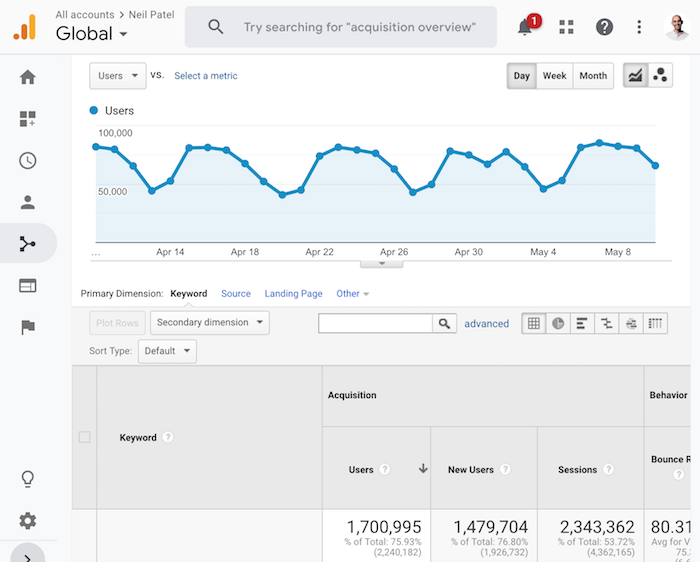

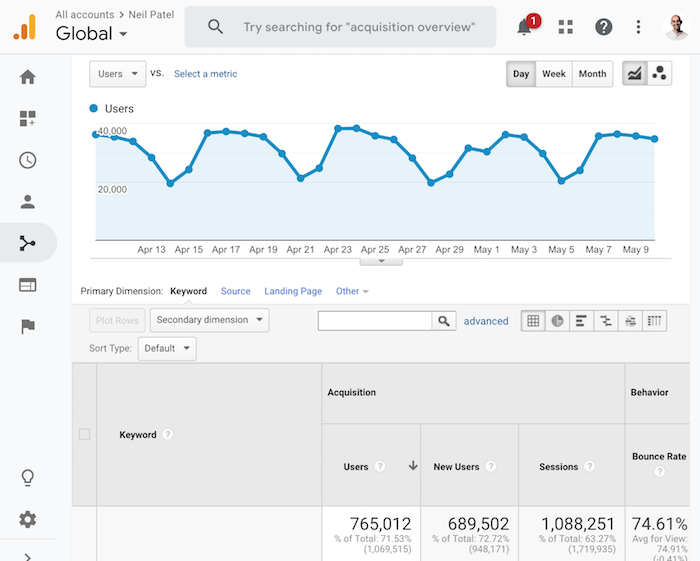

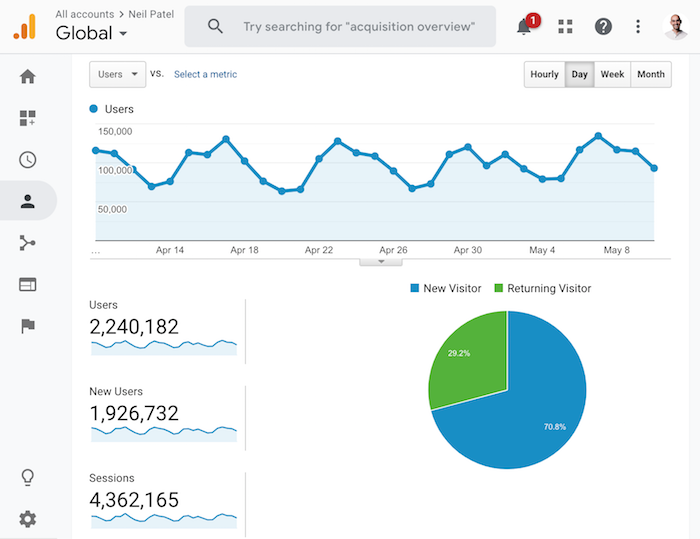

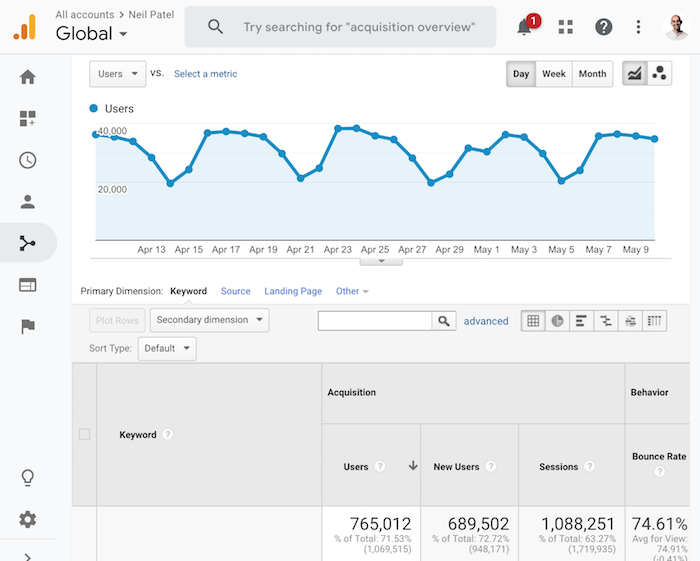

In other words, SEO isn’t dead and it is still an amazing channel. Just look at my traffic stats over the last 31 days:

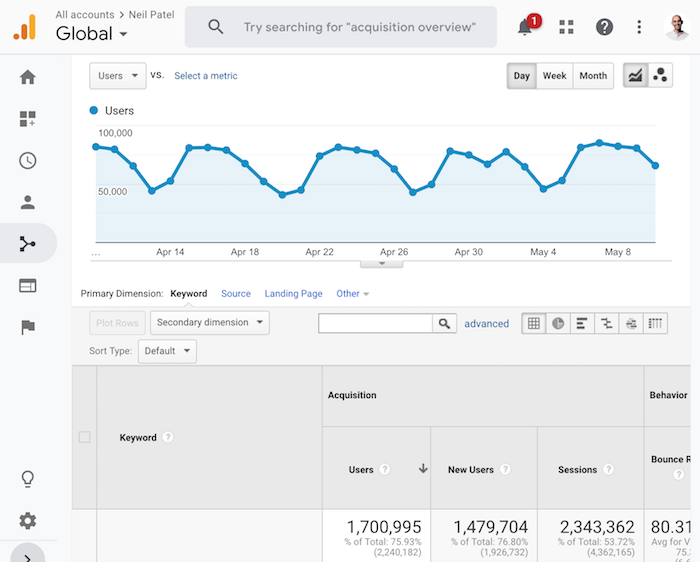

Now of those 4,362,165 monthly visits, guess how many come from search engines like Google?

A whopping 2,343,362 visits.

In other words, SEO makes up 53.71% of my traffic. That’s a ton of traffic.

And even with Google’s continual changes, you would expect my traffic to be lower, but it isn’t… it’s gone up.

A year ago, I was generating 1,088,251 visits a month from Google. It’s now gone up to 2,343,362 even though Google’s algorithm has continually gotten harder and organic results are continually being pushed further below the fold.

But still, you shouldn’t only rely on SEO

I love Google and even though there is a future for SEO, you shouldn’t rely on it. No matter how good you are at SEO, it doesn’t guarantee success.

Let’s look at a company that you are familiar with… Airbnb.

Did you know that Airbnb didn’t come up with the concept of renting out your house or rooms in your house?

Can you guess who it was?

It was VRBO and they came up with that model 13 years before Airbnb did.

But here’s what’s interesting… who do you think wins when it comes to SEO?

Shockingly, it’s VRBO.

VRBO crushes Airbnb when it comes to Google rankings and they have for a very long time. Here are just a few examples of keywords VRBO ranks for that Airbnb doesn’t:

- hilton head rentals

- ocean city maryland rentals

- cape cod rentals

- cabin rentals

- vacation homes

- vacation rentals

- vacation home rentals

Airbnb does rank for organic keywords as well, but most of them are brand related.

They crushed their competition without relying on SEO and they were 13 years late when it came to entering the market.

So how did Airbnb win? Well, the main way was they built a better product.

But in addition to that, you focused on an omnichannel approach. From SEO to PPC to advertising on TV screens in airplanes, they tried all of the major channels out there.

Yes, you need to do SEO, but you can’t rely on it as your only source of traffic or income. Diversify, not because of Google, but because you can’t control consumer behavior.

People may not prefer to use search engines in the future, they may want something else, which means you will have to adapt.

Plus you can no longer build a big business through one channel.

Yes, Facebook did grow through referrals. Quora did grow through SEO. Dropbox grew through social media… but those circumstances don’t exist anymore. What worked for these old companies won’t work for you.

You have to leverage all channels to do well in today’s market.

Conclusion

Google may be making changes that you don’t like as a marketer or business owner, but that doesn’t mean SEO is dead.

You can see it from my own traffic stats. You can still grow your traffic, even with Google’s ever-changing algorithm.

Don’t worry about the future because you won’t be able to always predict it or even prevent the inevitable.

The only real solution is to take an omnichannel approach so that you aren’t relying on any one channel.

What do you think about Google’s current layout?

The post How Google’s New Layout Predicts the Future of SEO appeared first on Neil Patel.