What percentage of your search traffic is driven by your top 10 pages?

Chances are, it’s a large portion.

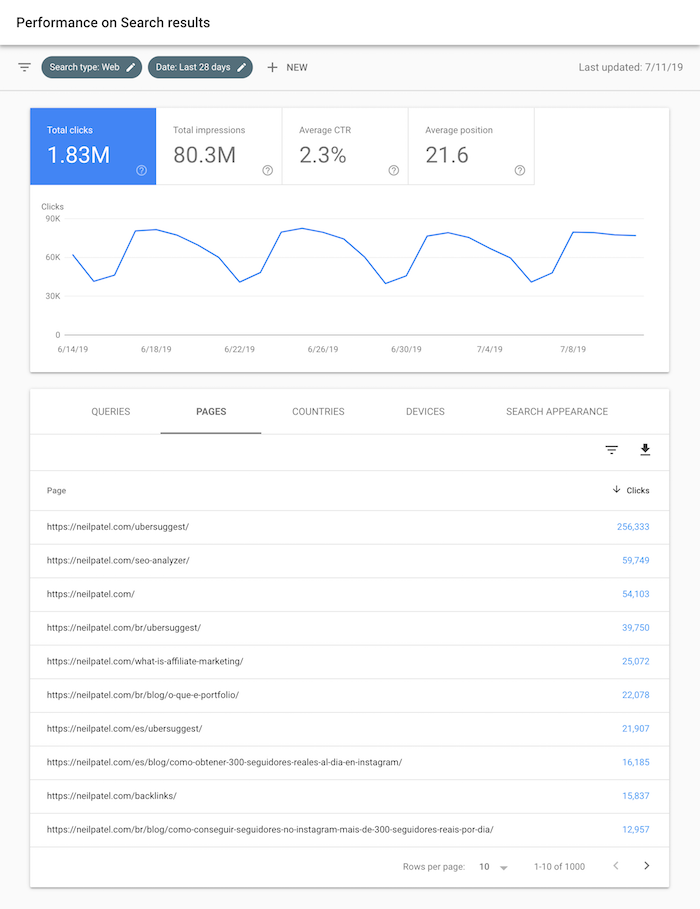

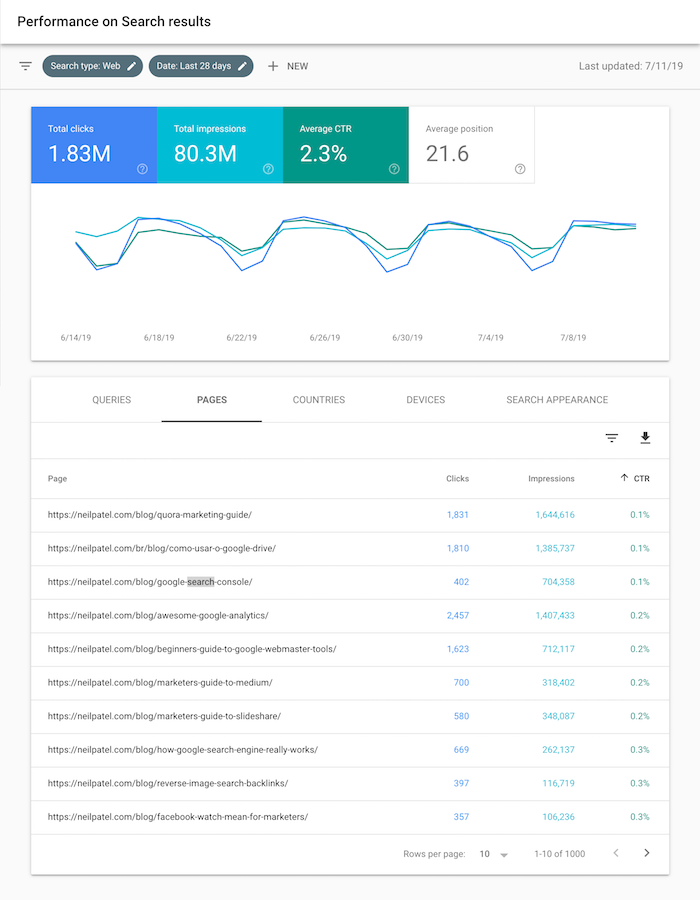

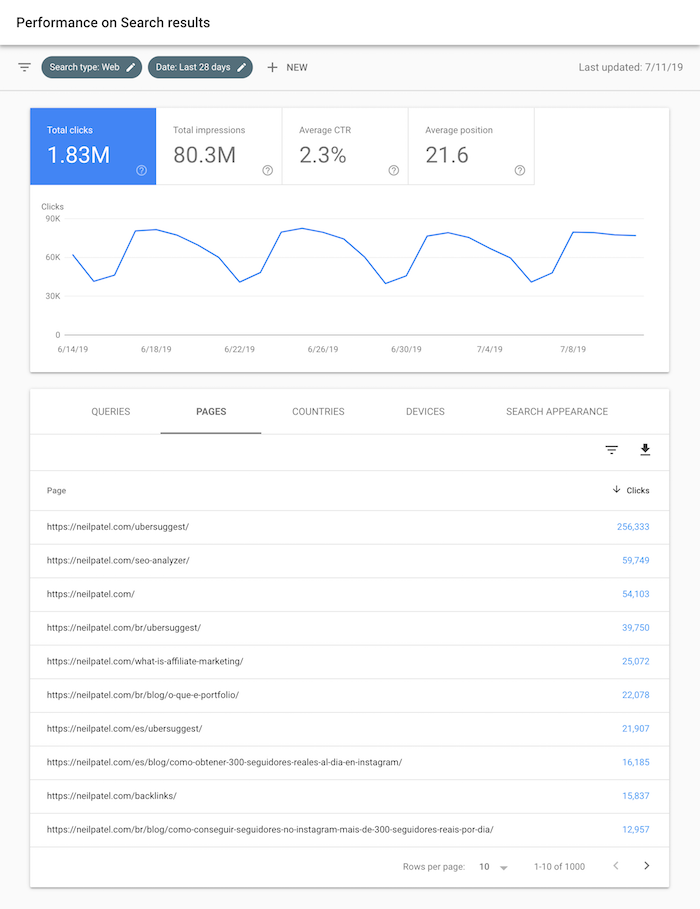

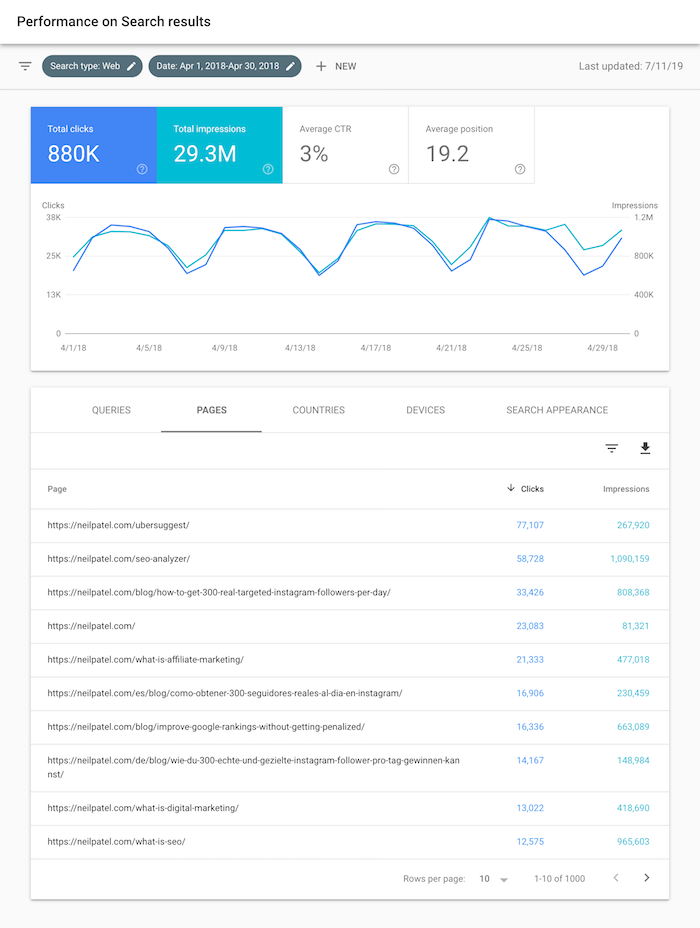

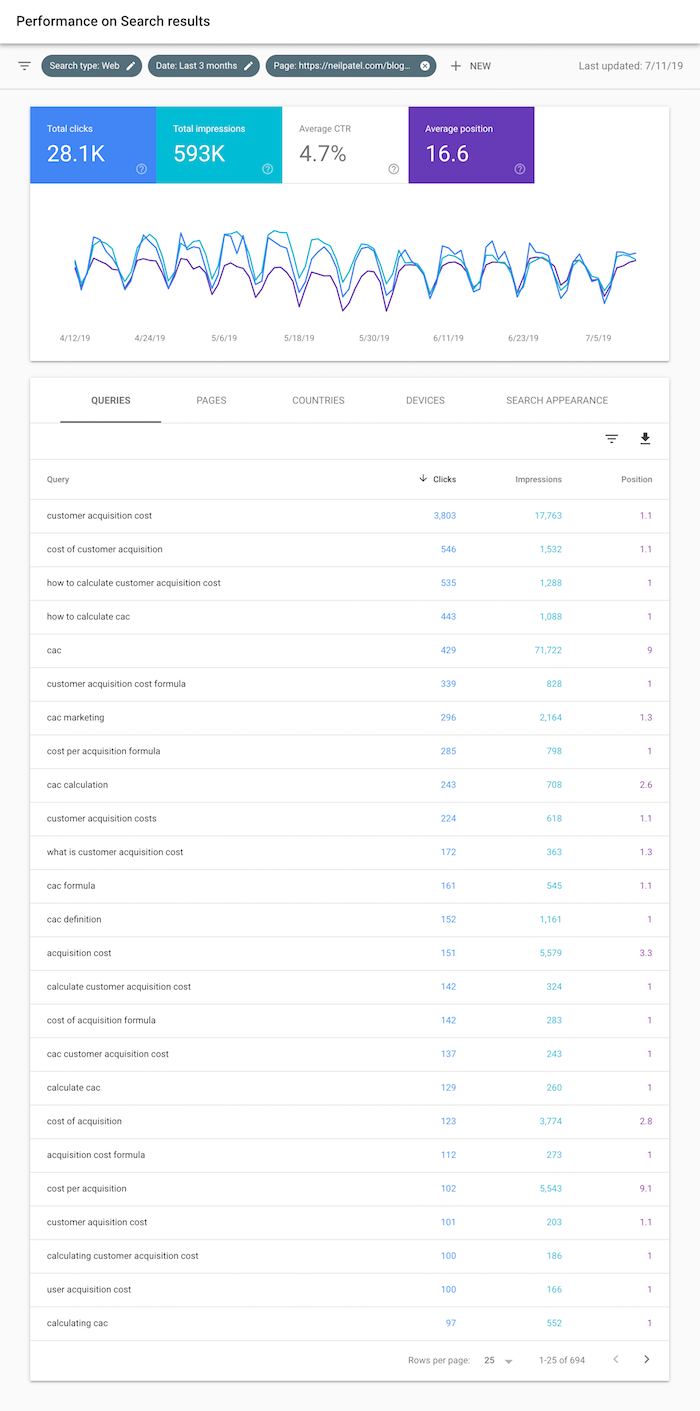

Just look at the screenshot below. You’ll see that my top 10 pages drive 28.7% of my search traffic.

That may not seem like a high number, but I have 5,441 blog posts. In other words, 0.1% of my pages make up 28.7% of my search traffic.

Typically, with smaller sites, the percentages are much higher in which the top 10 pages make up the majority of their search traffic.

So, what does that tell you?

You should just focus on your top 10 pages and ignore the rest? Or, even worse, just focus on cranking out more new content?

Quality over quantity

I used to have the philosophy of “more is better.” I was cranking out dozens of articles each week. At one point, I was publishing 2 articles a day on this blog.

And, over time, my traffic grew, but not by much.

I was spending all of this time writing and realized that the majority of the content I was publishing never ranked.

So, what did I do?

I started focusing on my old, outdated content to boost my traffic.

Just think of it this way: Every week I publish one new piece of content, but my team, on average, is updating 23 older articles.

When I used to write more frequently, my top 10 pages made up 33% of my search traffic.

Since then, I have increased my search traffic by 107% and reduced my reliance on my top 10 pages by 13%.

So how did I do this? Well, as I mentioned, I have my team focus on updating my old, outdated content while I focus on creating new content.

Here’s exactly what I have my team implement, step by step.

Look for pages that were once loved

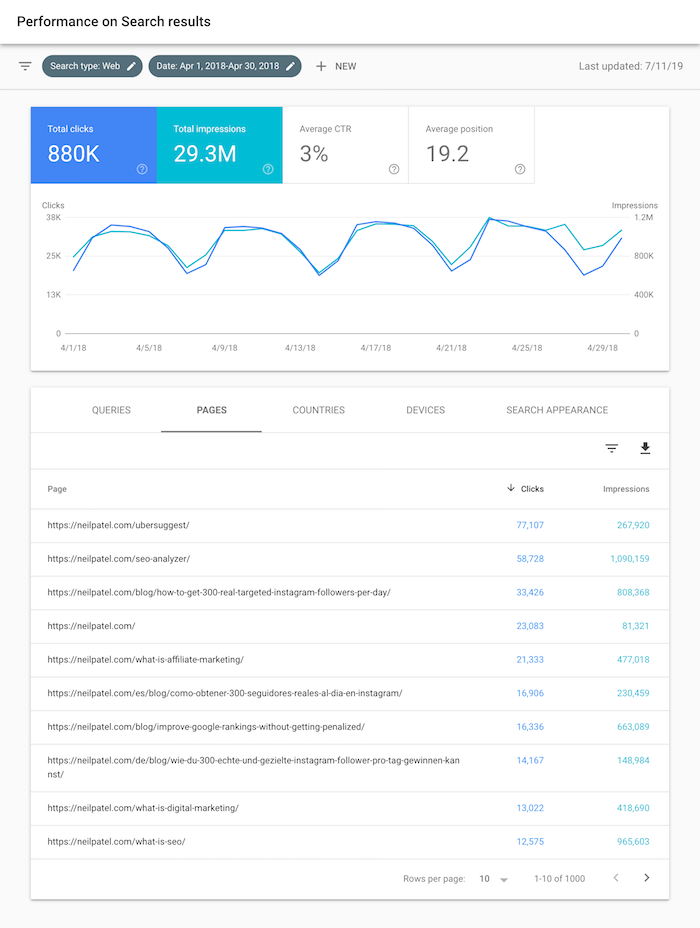

With Google Search Console, you have access to data for a much longer period of time. You can go back up to 16 months.

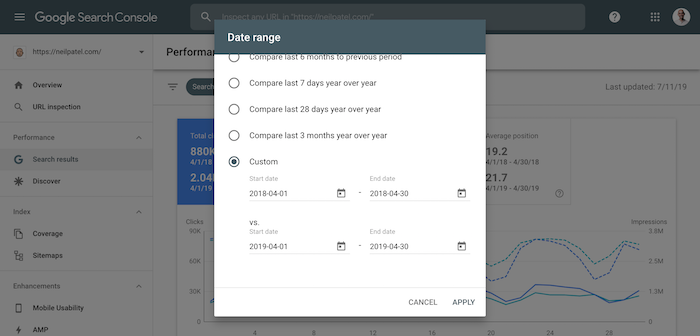

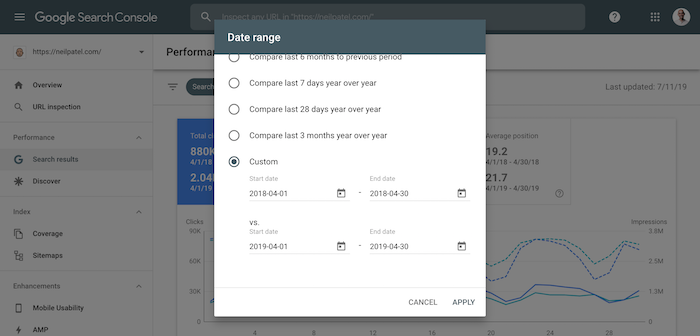

So, I want you to compare this month’s results during the same period as last year.

You can do this by clicking on “date” and then “compare.” Next, select your older date period first (should be roughly from a year ago) and then select today’s date period.

I’ve been doing this for a while, so I selected an older date range so you can see a better set of data before my team really focused on updating old content.

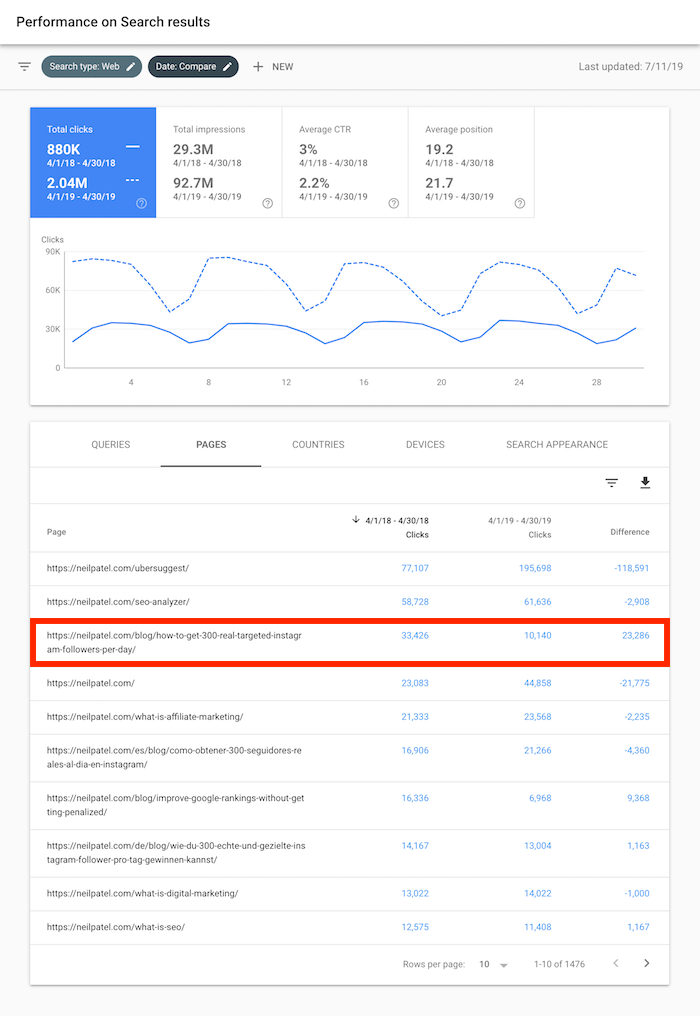

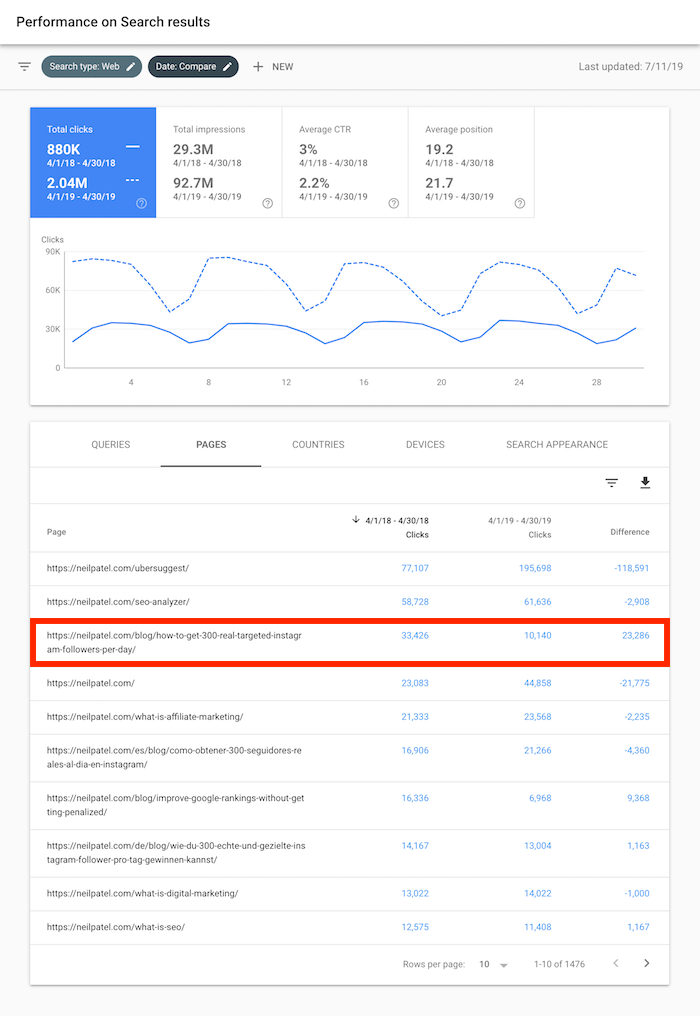

You should then see a report that looks something like this:

What you’ll want to do is look for articles that used to get a ton of traffic and have less now. From the screenshot above, you can see that my article on Instagram used to perform really well, but no so much anymore.

Keep in mind that I selected the older date range first. I did this to see which of my old pieces of content used to rank well so I can see if any of them have dropped over the last 12 months.

This will show you old content that Google used to love, but no longer does.

Now, let’s find content that Google never loved.

Look for pages Google never loved

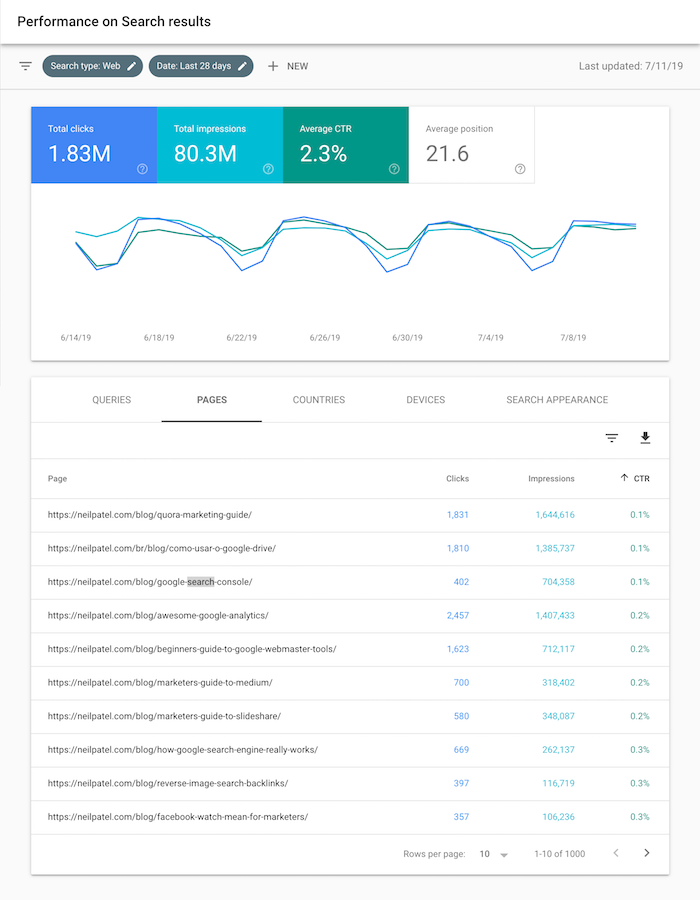

Log back into Search Console and look for pages that have a high impression count but never got any real clicks.

The easiest way to find these pages is to set your date range to the last 28 days and look at each page’s metrics from an impression, click, and CTR perspective.

Sort the CTR column in ascending order (lowest percentage at the top, the highest percentage at the bottom).

Typically, the pages at the top of that list have the most potential. It means that Google is ranking you but you just aren’t getting too many clicks.

It usually isn’t just related to your title tag and meta description. It typically has to do with the content on the page.

Now it’s time to create a list of pages that have the greatest potential.

It’s time to prioritize

Typically, the pages that have the most potential are the ones that used to rank but no longer rank. Google used to rank and like them, which means if you give those pages a little tender loving care, you can easily get them loved by Google again.

The second group of pages that have potential, but not as much as the first, are the ones with a high impression count but an extremely low CTR.

These pages are harder to fix because they never really performed that well.

How to update your old content

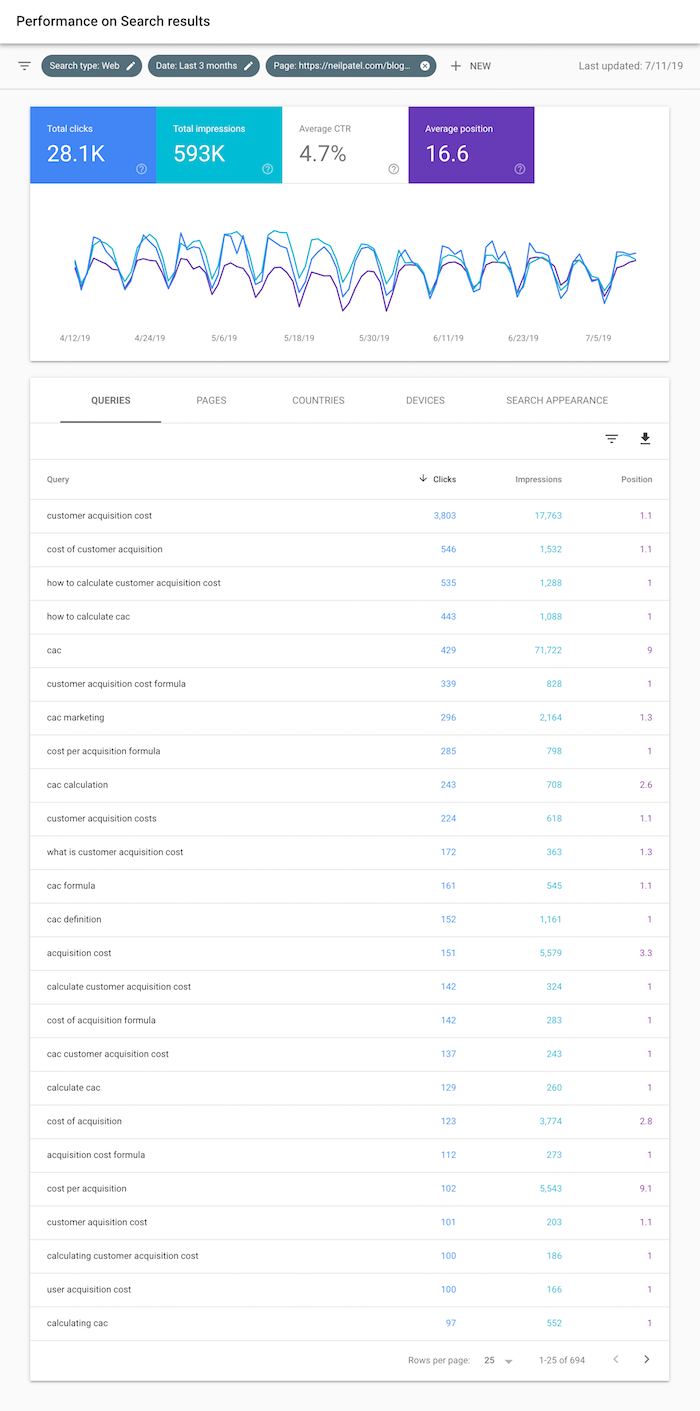

Now that you have a list of pages to fix so you can boost your search engine rankings, I want you to log in to Google Search Console, find that article, click on it, and then click on “queries.”

For the keywords that don’t rank in the top 5 or have a high impression volume, I want you to go to your ranking article and see if the article is relevant for that term.

If not, adjust the article to at least include that term and cover that topic.

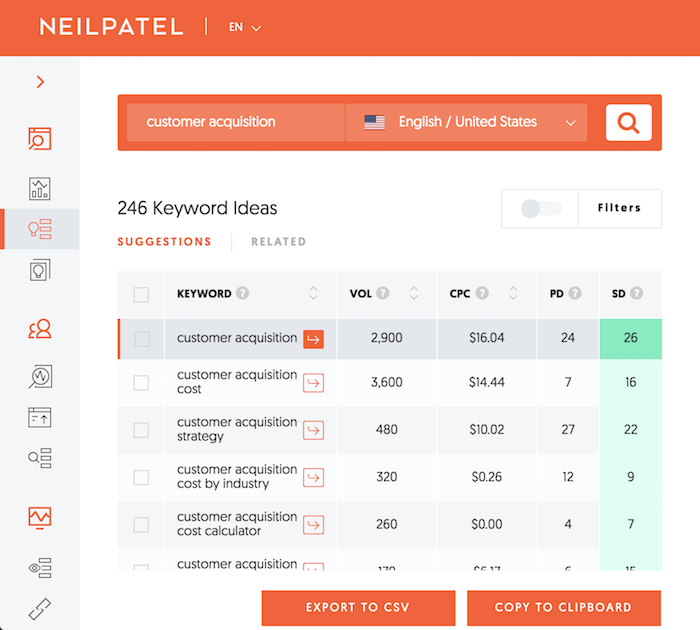

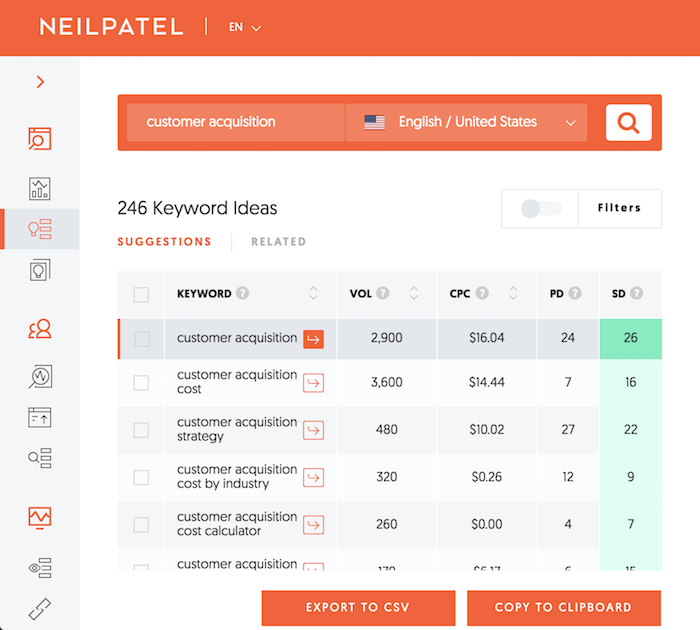

For the terms you already rank for in the top 5 spots, head over to Ubersuggest and type in those keywords and click on the keyword ideas report.

You’ll then see a report with all of the long-tail variations of that keyword.

If you adjust the article and include any of the long-tail phrases Ubersuggest gives you, you’ll see quick traffic gains.

In other words, if you already rank for the head term, it’s not hard to rank for the long-tail variation of it as well.

In addition to including the right keywords, you’ll want to update the post. Make sure all of the information is relevant, the pictures are up to date, and if you could include any multimedia (like embedding relevant YouTube videos) you’ll be able to increase the time on site of your visitors.

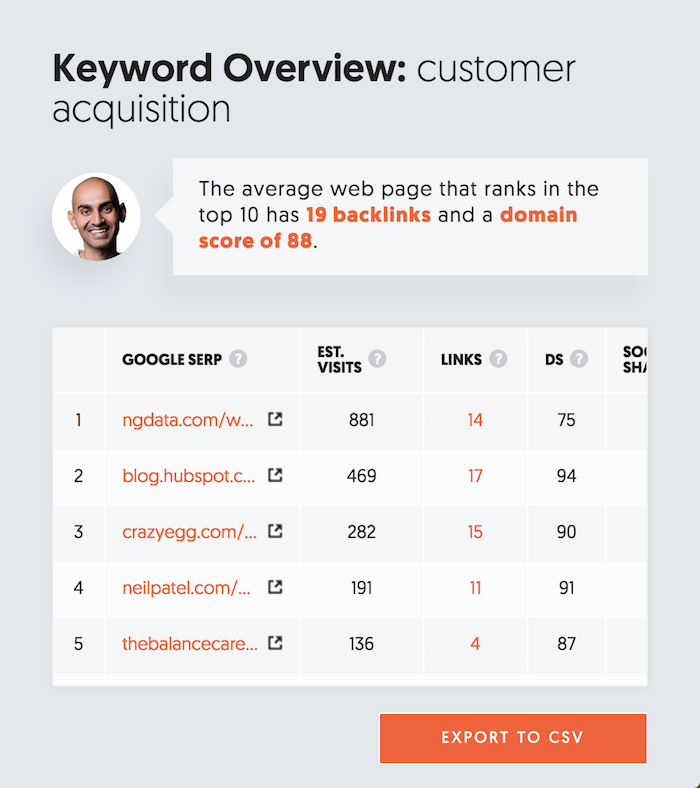

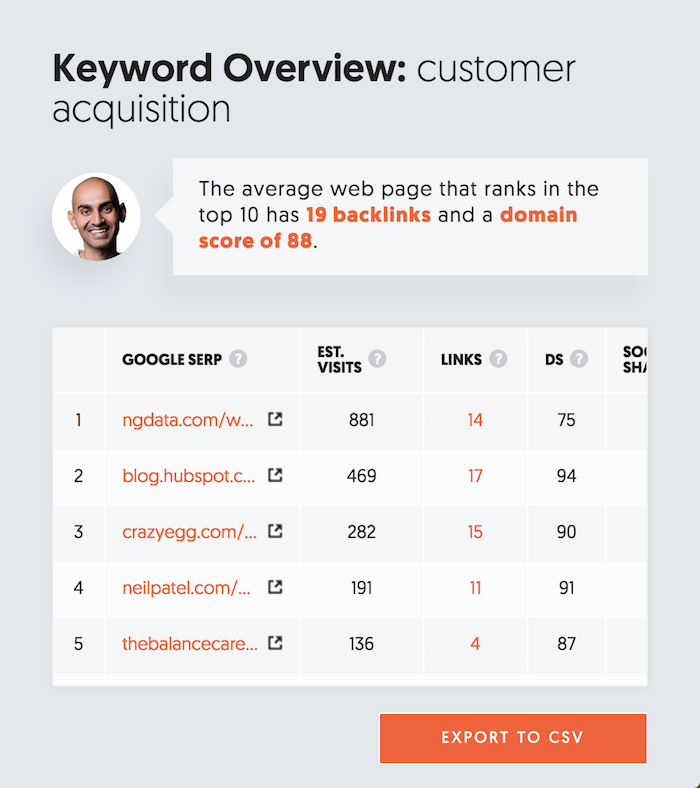

Finally, when updating your content, make sure your article is more thorough than all of the other sites that rank for the terms you are trying to rank for.

Remember that keyword ideas report I had you check out on Ubersuggest? On the right-hand side of that report, it shows you all of the sites that rank for that keyword.

You can quickly see who’s currently ranking in each country, visit their web page, and make sure you create something better.

User metrics

User behavior is one of the biggest factors with Google’s algorithm.

Once you update your old content, you’ll want to optimize for user signals as that’ll help boost rankings.

A great example of user metrics is optimizing your title tags and meta description.

For example, if everyone searched a keyword on Google and clicked on the second result instead of the first, it tells Google that the second result is more relevant and that it should be ranking in the first spot instead of the second.

And Google eventually would make that change.

If you can use persuasive copy and convince people to click on your search listing instead of the competition, eventually your rankings will climb. And you can do so by following these 2 articles:

- How to Craft Amazing Headlines

- How to Write Copy like Apple

Over the years, I’ve done a lot of title tag and meta description tests and I’ve also found that these keywords help increase clicks:

- What is

- Best

- Amazing

- [lists]

- How to

- Free

- You

- Tips

- Why

- Tricks

- Great

You can also use tools like Clickflow to A/B test your meta tags.

Don’t forget to promote (again)

Now that your content is up to date and you’ve optimized your meta tags for clicks, it’s time for you to promote your content.

I know what you are thinking… why would you promote old content, right?

Well, technically it isn’t old anymore.

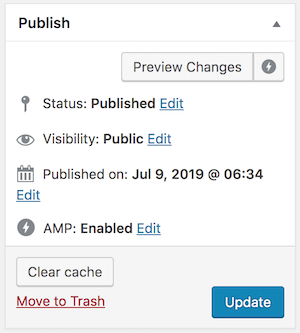

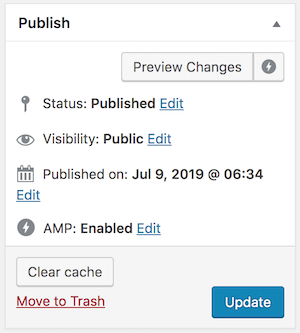

First of all, you should update the published date or last updated date within your WordPress.

That way search engines know your content is changed, more relevant, and up to date.

Secondly, you need to promote the article. It’s new now, so why wouldn’t you share it with the world?

The simplest thing you can do is share it on the social web. I typically share my content on Facebook, Twitter, and LinkedIn… but you can pick whatever social profiles you have.

Although Google doesn’t really look at social signals, Bing does. Plus, some people who visit your page from the social web may decide to link to your article, which does help rankings.

And if you want to go above and beyond, check out Meet Edgar. It’s what I use to continually schedule my old content to be promoted on the social web. That way I don’t have to manually do it or set reminders.

In addition to social shares, you should consider sending out a text-based email blast to your audience promoting your content.

It’s a great way to get a quick boost of traffic and breathe life into your old content.

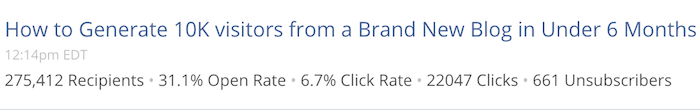

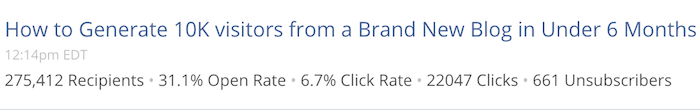

Here’s an example of a text-based email blast that I send so you can copy my format.

Subject: How to Generate 10K visitors from a Brand New Blog in Under 6 Months

If I tell you to do 100 things to grow your traffic, I know you won’t do it.

Heck, even I wouldn’t. It’s just too much work.

In the spirit of simplicity, just do this and you’ll get to 10,000 visitors.

I’ll even make a deal with you. If you follow it and don’t hit 10,000 visitors and you can show me you followed it, I will help you for free.

That’s how confident I am that it works.

Cheers,

Neil Patel

As you can see, simple text-based emails are generating 30% open rates and 6% click rates for me. Not too shabby.

You can also use tools like Subscribers to send out a push notification. Every time I update a post I send out a push. Look at my stats… I can easily generate an extra 7,000 visitors from a single push.

And don’t forget to build links

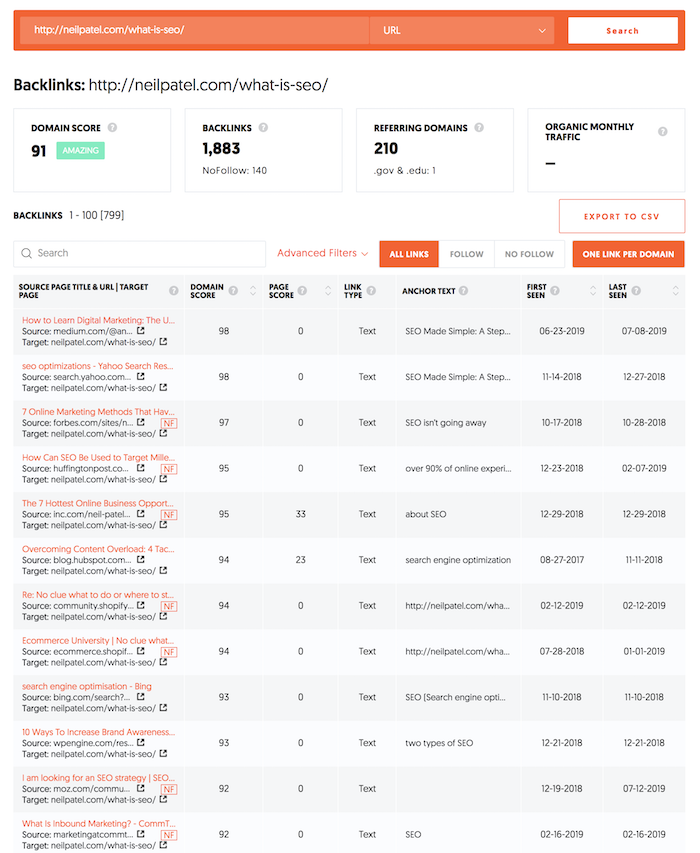

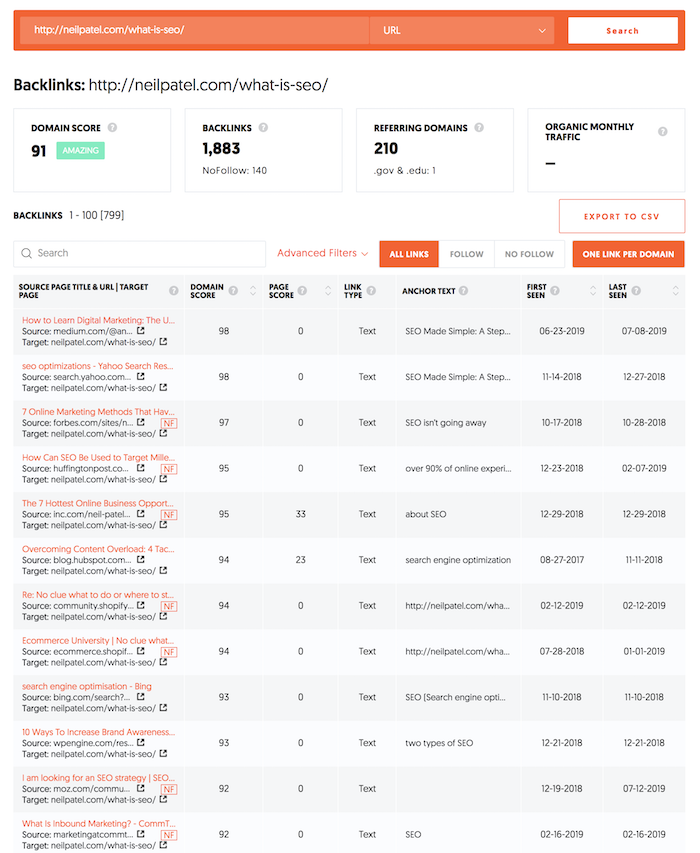

The last step you want to leverage is link building. You can use Backlinks to see who is linking to competing articles:

All you have to do is put in a competing URL and select “URL” from the drop-down menu and you’ll see every site that links to that page.

From there, you’ll want to reach out to each site and ask them to link to you.

The easiest way to do this is to leverage the skyscraper technique and the steps in this article.

Conclusion

Once you hit the 150 mark in the number of pages on your site, you should consider focusing the majority of your time to updating old content instead of creating new content.

If you have over 1,000 pages, you should definitely spend 80-plus percent of your time updating old content instead of writing new content.

The key to ranking your old, outdated content is to first focus on the content that used to rank but doesn’t anymore.

Once you fix those pages, you should see results within a month or two. From there, you can then focus on pages that have a high impression count but a low click count.

So, are you going to focus your time on ranking your old content or creating new content?

The post How to Rank Your Old, Outdated Content appeared first on Neil Patel.