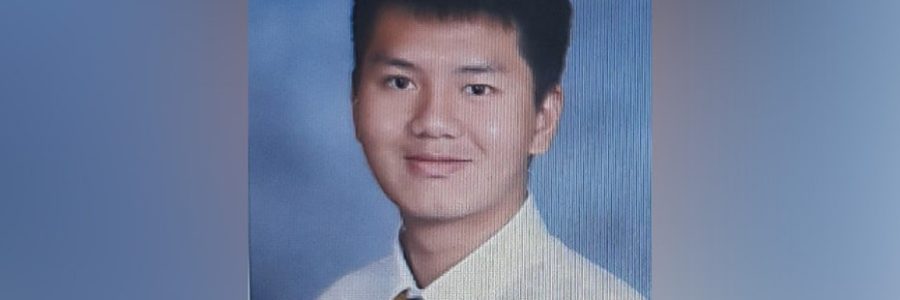

Teenage foreign exchange student from China 'forcefully' abducted in Utah: police

Police are looking for a 17-year-old foreign exchange student who they believe was “forcefully taken” from the home he was sharing with his host family in Utah.

In a press conference on Friday, Riverdale Police Chief Casey Warren said that authorities believe that Kai Zhuang, an exchange student from China, was “forcefully taken” and is “being held against his will.”

Authorities said that Zhuang was last seen at about 3:30 a.m. on Thursday and police were notified of his disappearance by 8:30 p.m. that night.

The student was described as 5-feet-9, 150 pounds with black hair and black eyes.

UTAH MOMMY BLOGGER RUBY FRANKE PLEADS GUILTY TO 4 COUNTS OF AGGRAVATED CHILD ABUSE

Police sent an endangered missing person advisory on Friday after the department received a call from Zhuang’s local high school saying that they had heard from his concerned parents in China.

MISSING NC GIRL FOUND INSIDE TRAP DOOR, KENTUCKY MAN CHARGED WITH KINAPPING: REPORTS

Zhuang’s frantic parents claimed that they received a photo of their son along with a ransom letter, Chief Warren said.

Riverdale police say they are working with the FBI, the US Embassy in China and Chinese officials to locate the missing juvenile.

No suspect has been identified at this time.

Anyone with information about Zhuang’s disappearance is asked to call the Riverdale Police Department at (801)394-6616.

The U.S. Embassy in China did not immediately respond to Fox News Digital’s request for comment.