The Best Web Hosting Services (In-Depth Review)

Looking for a hosting solution for your website?

You’re in luck because with today’s options, it has never been easier to keep your website online.

They take care of all the technical stuff and you get to enjoy casually updating your website for conversions.

And the best part is that most of them are very affordable which helps startups get a hold of their business quickly.

That’s why I put together a list of the best hosting services of 2020 for you.

So without further ado…

The Top 7 Options For Hosting Your Website in 2020:

How to Choose The Best Hosting Service For Your Website:

When it comes to the best web hosting services you have to look at various important factors.

If you jump in too quick you might get into something that’s not suitable for your business.

But don’t let any of that doubt creep into your mind.

Instead, sit back and relax while we present to you all the factors that you need to be aware of before making a decision.

You can weigh the different web hosting services and decide which is the best solution for your specific business.

Hosting factor #1 – Uptime reliability:

If your hosting is down, no one would be able to access your website.

And obviously you want your website running 24/7.

Luckily, in 2020 this is not a huge problem since most web hosting providers offer a ‘99.99% network uptime guarantee’.

That means that your website would go down very rarely.

And even when it does, you can contact your hosting service and you will get compensation.

Most of the time that would be in the form of hosting credits.

If you want to prepare for the worst, you can check out our Website Downtime Survival Guide.

One of the best practices to making sure everything runs smoothly even when you’re taking a break is to sign up for a tracking tool like uptime robot.

If your hosting service crosses the line, this tool will notify you that you need to find a new webserver to host.

Hosting factor #2 – Speed is key:

Website loading speed is extremely crucial when it comes to SEO optimization in 2020.

That’s simply because if your pages load slowly, people will bounce out of your website and your ranking will fall down the drain.

You need a trustworthy host provider that can guarantee optimal website loading speed.

The thing is that you can’t know the exact loading speed before you try the hosting service yourself.

But you can always optimize your website loading speed using free tools and effective loading speed practices.

And the best news is that even if your budget is tight, you can still get a good loading speed.

But don’t expect anything spectacular for say $4/month.

Generally, the higher the price, the faster your pages will load.

Anyways, we will include our personal experience regarding loading speed for each of the options down below.

Hosting factor #3 – Customer service:

Good Customer Service will come in handy when something goes wrong.

Especially if you’re new to websites, you’re bound to make mistakes that may lead to your website being down for a while.

And the more time it’s out, the more it will cost you.

So a good support team will help you get the issues solved in no time.

Even if you made a major mistake that’s impossible to come back from…

Most support teams will have a full backup of your website so you can get back to a working version.

You always want your support team to have a live chat or a telephone you can call.

Email just doesn’t make the cut if you want to resolve the issue fast, which you should want, given that your website is down.

We made sure to include only website hosting services with strong communication skills.

The Different Types of Web Hosting Services:

In 2020 there are a lot of different types of web hosting services.

The most commonly used being:

Shared Hosting

This means your website will be stored on the same server as a bunch of other websites.

It is a cheap option for startup websites.

With the right one, you can have customizable options and average loading speed.

Don’t look at Shared Hosting as a long-term solution because Shared Hosting can not withstand high levels of traffic.

It’s definitely a good solution for people that just want to get their website up and running fast.

VPS Hosting

The Virtual Private Server (VPS) is definitely a better option than Shared Hosting.

Each website is hosted in its own virtual space which speeds up your loading speed and also allows you to get more traffic on your website.

This option is best if you’re planning to scale your website fast.

Yet again, it’s not a long-term option if you want to be one of the top websites in your industry.

Simply because it still has limitations when it comes to website traffic.

Dedicated Hosting

This is considered the most reliable and overall the best option out there.

You get a dedicated server just for your website with full control over everything.

But prepare yourself for a pricey alternative.

That option is mainly for the best of the best.

If you have plans to scale your traffic to enormously high levels, this is the only option for you.

But if you’re just starting out, we recommend one of the other 2 options.

Anyways, the web hosting services below give you the option to choose between different types of hosting services.

So just choose the one that fits your business and your budget best.

#1 – Bluehost — Best for WordPress Hosting

If you’re looking to set up your website in less than a week, you’re probably considering WordPress.

After all, according to NetCraft, 35% of the Internet is powered by WordPress.

And it’s not a surprise. WordPress has been a leader in the industry for years now.

So if you’re looking for the best hosting option for your WordPress website, you can definitely trust Bluehost.

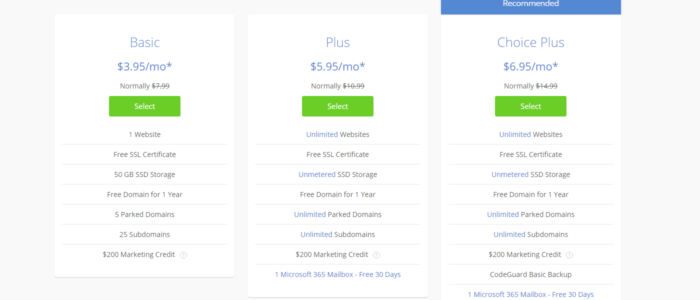

Their Pricing Options start from as low as $3.95/month and get up to $6.95/month.

Which is still not that expensive considering all the unlimited features they bring to the table.

Regarding website loading speed, as long as you don’t fill your WordPress site with plugins, you should be good.

And even if you make a crucial mistake or overload your website with different plugins, you’re in good hands.

Their Customer Support is extremely responsive. They have both an active telephone line and a live chat you can rely on at all times.

#2 – HostGator — The most affordable option for Startups

HostGator is one of the most preferred options when it comes to blogging.

They are perfect if you’re looking for the most affordable way to begin posting online.

Pricing options start from the jaw-dropping $2.75/month.

Once again, you can’t expect the best features for such a low price.

But it’s a great alternative for startups that want to get their website up and running.

And just like Bluehost, they have a responsive telephone line with a live chat you can access at any moment.

You can also find a giant database with common questions beginners have, together with professional opinions and solutions to those problems.

Everything is explained and demonstrated step-by-step and if you’re still not sure that you can do it on your own.

Just shoot them a message and start chatting with their professional customer support.

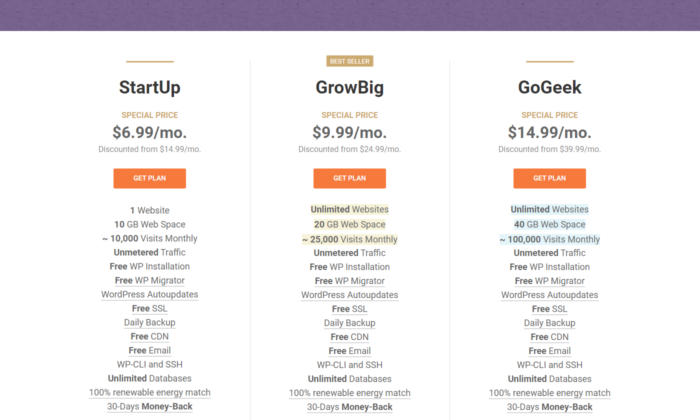

#3 – Siteground — Best for WooCommerce Hosting

Do you want to sell your products online?

Then you’re probably in need of a good, reliable WooCommerce Hosting Service.

If that’s that case, then you should take a look at Siteground.

They have separated their pricing options depending on your scalability.

Most Hosting Services cut you here and there when it comes to cheaper options.

This is not the case here!

Siteground really wants to overdeliver, even if you choose their cheapest options.

Their Customer Service has a whopping 90% resolution at first contact.

That means that 90% of the time you’ll chat or speak with an expert in their team and resolve your issue in no time.

So if you’re looking for the best WooCommerce solution, Siteground is the hosting service for you.

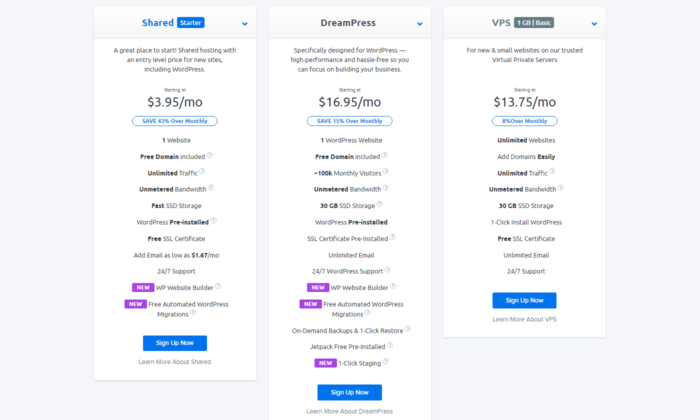

#4 – Dreamhost — Best option if you want quick and responsive website changes

Dreamhost has been a big player for the longest time now.

Founded in 1996 it is one of the oldest hosting services available online.

Some people might think it must be outdated by now.

But that can’t be further from the truth.

Exactly because of their ability to adapt quickly to new trends they’re still considered one of the best in the business.

They don’t look at your website as just another website.

They know that your website is your own vision for the future.

“We Make Sure Your Purpose, Is Our Purpose”

And that’s not just words. Over 1.5 million websites host with Dreamhost.

You can expect great loading speed and friendly, helpful customer support on your side.

With incredibly adaptable services you can literally change your business in a matter of hours.

They know that things change as time passes.

Maybe you want to try out something new.

Maybe you’re certain that your current business model is outdated.

With their fascinating adaptable features, they will be your best friend when making major changes in your website.

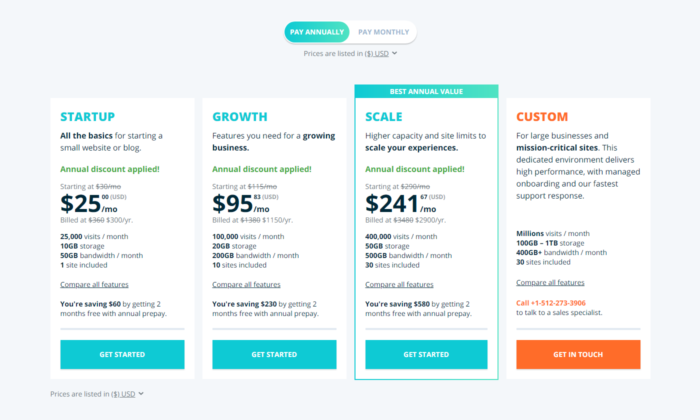

#5 – WP Engine — Best option if you know your limits

We’re getting to the more advanced options now.

With WP Engine you can customize and get the exact features you need.

Of course, their services are not as cheap as some of the others on the list.

But if you’re certain what are the exact characteristics you need in a website, then WP Engine got your back.

You just have to contact them and work out the best plan for your specific situation.

Of course, their experts are going to help you choose the correct option without pushing you to stuff you wouldn’t need.

It’s a great Hosting Service if you’re looking to scale big.

Don’t expect cheap services, but expect great quality and support on the way to your successful business.

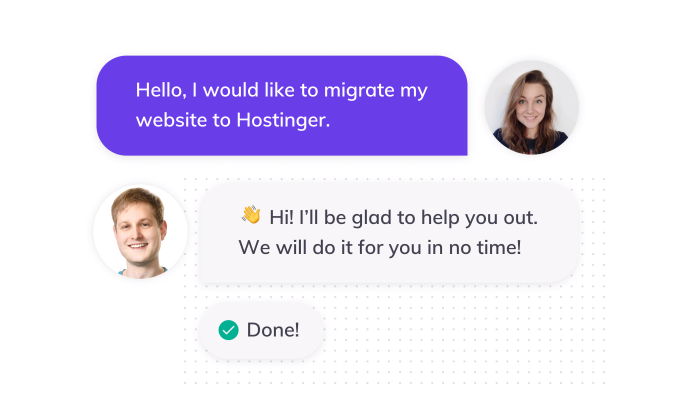

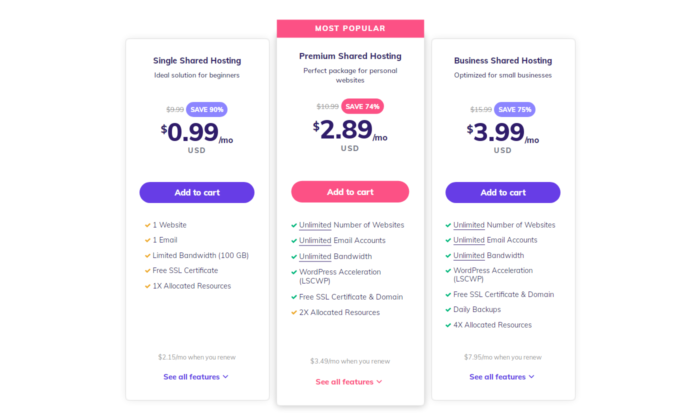

#6 – Hostinger — Low-Cost Shared Hosting options for Startups

Hostinger is unique with it’s Shared Hosting Services.

Their prices literally start from $0.99/month. WOW.

Of course, you’ll be very limited with this option but it shows how much they are ready to do in order to satisfy their customers.

We personally recommend one of the higher tier options:

The good thing with Hostinger is that for as low as $3.99/month you can get unlimited access to everything.

With 24/7/365 support, you can expect professional assistance at any point.

For $3.99/month you get great loading speed and daily website backups.

That means even if you mess up badly, you always have access to previous versions of your website.

It is the best option if you’re searching specifically for a Shared Hosting Service that’s affordable and reliable.

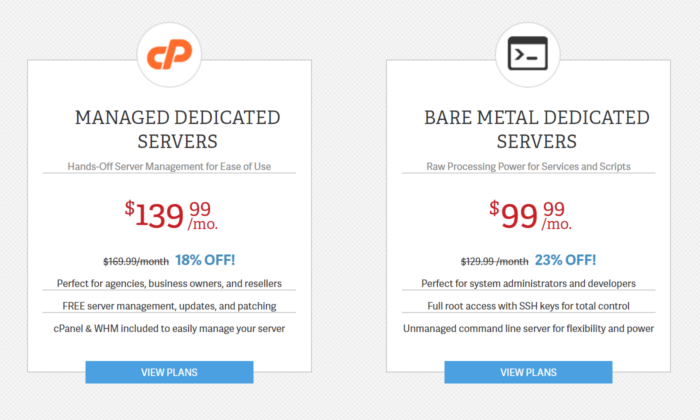

#7 – InMotion — Best option for Scaling BIG

Are you positive that your website is going to dominate the online space?

If you’re 100% sure, then you should definitely take a closer look at InMotion.

Their VPS and Dedicated hosting services are far from cheap.

But with Premium prices come Premium services. We are talking fast loading speed and devoted customer support.

Obviously there’s also affordable WordPress Hosting and Shared Hosting options.

But if you’ve tried these before and now you’re looking for the next step.

InMotion is going to overdeliver on every promise.

Check out their plans and choose the one that fits your needs best.

Your Hosting Service Is Your Best Friend

Make sure you make a well-thought-out decision.

You’re most likely going to have a long-term relationship with the hosting service you choose.

So carefully look into every option that caught your eye today and choose the one that fits your needs best.

So, whether you choose one of my top recommendations or scout out your own, use the tips and best practices we talked about to make an educated decision… like the future of your business depends on it.

Because it does!

Have you worked with any website hosting companies in the past? How did it go and did you get the results you hoped for?

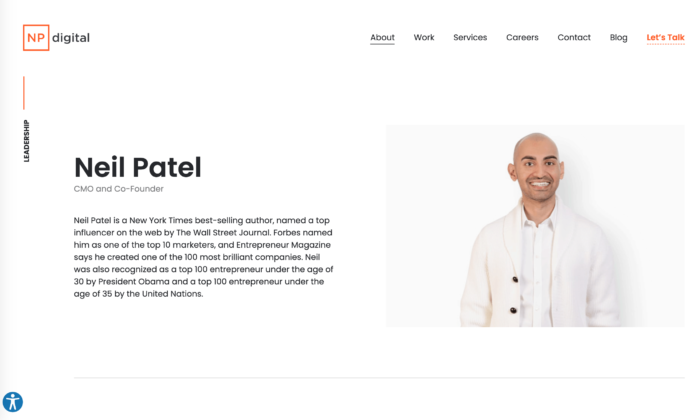

The post The Best Web Hosting Services (In-Depth Review) appeared first on Neil Patel.

at the end of the first year. There is no minimal spend requirement.

at the end of the first year. There is no minimal spend requirement.