Why You Should Build Interactive Tools to Increase Sales

The average American sees up to 10,000 ads and brand messages every single day. Sounds a little overwhelming, right? That’s because it is.

After seeing this many ads every day, viewers simply stop noticing them—meaning they aren’t engaging with them. As a result, you miss out on sales opportunities.

You need to go further to engage your target audience and convert them by personalizing the whole marketing experience through interactive marketing tools. Here’s what you need to know.

What Are Interactive Tools in Marketing?

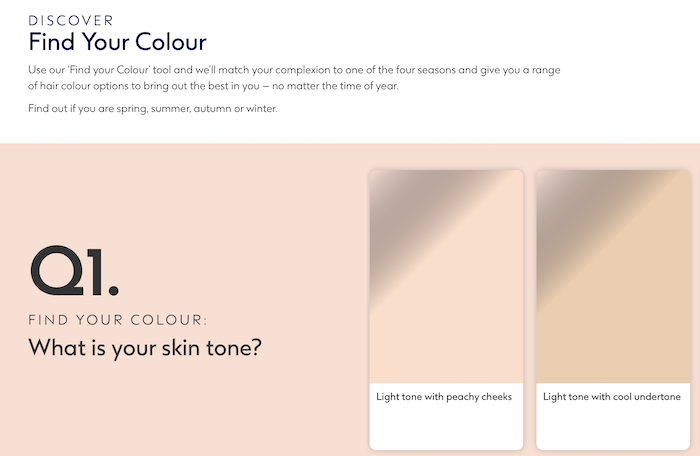

Pretend for a moment that you’re looking for new hair color. It’s tricky because you’re unsure which colors suit you, and you could use some personalized help.

Finally, a website catches your eye because there’s an interactive tool designed to help you pick a hair color. All you need to do is input some simple details, such as your skin tone and eye color, and you’ll see a list of compatible hair dyes.

The outcome? You purchase a hair dye. In other words, you just went from a potential lead to a paying customer, and it’s all thanks to that interactive website tool.

Essentially, this is precisely how interactive tools for marketing are meant to work. And this particular example isn’t imaginary—you can check out Boots to see what I mean:

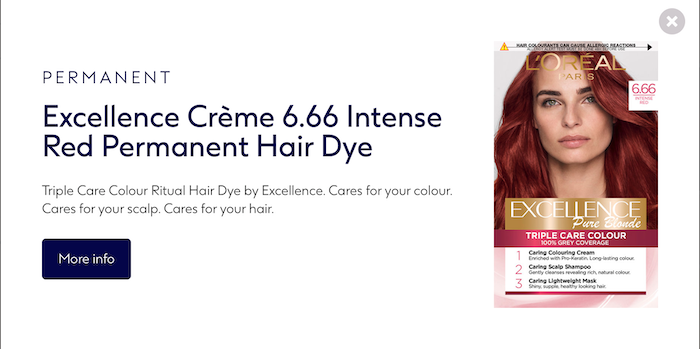

If you go through the sequence, you’ll find a list of compatible colors. Then, when you click on a color, a link pops up to take you straight to the right product:

How’s that for convenience?

With just a few minutes of interaction, users get helpful, meaningful results—and you may make a sale.

Examples of Interactive Tools

That’s just one example of interactive tools in a sales context. However, you can build many interactive tools and discover at least as many ways you can use them in your marketing strategy.

Here are five common types of interactive marketing tools we can use in different ways.

Virtual Try Ons for Interactive Marketing

This one’s similar to what we just worked through, but it’s not quite identical—we’re taking it one step further.

Embedded “quizzes” like the one we just looked at rely on customers clicking on certain answers. The algorithm then presents people with solutions matching their answers.

Conversely, virtual try-ons use augmented reality or simple image captures to let people use selfies to “try on” everything from makeup to glasses.

The benefit? Customers know whether the product suits them or not, so they’re more likely to buy. Briefly, here’s how they work:

- Someone visits your product page.

- They tap the “try on” link, which activates the user’s phone camera.

- With augmented reality, the user places the product on their face to see how it looks.

- If they’re happy with the appearance, the prospective customer moves the product to their basket and goes through checkout.

It’s not just limited to beauty products or accessories, either. For instance, platforms like Amazon allow their users to “place” furniture around the room to see if they look good in their home. The same technology applies.

Interactive Measurement Tools

Customers sometimes find buying products like shoes online challenging because it’s hard to determine what size to get.

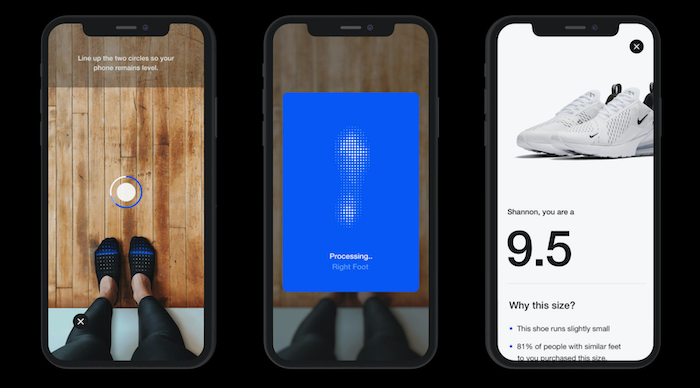

That’s where measurement tools come in. Let’s break down Nike’s Digital Foot Measurement Tool as an example.

- Customers shop through the Nike app.

- They decide on the shoes they want and opt to “try them on.”

- The camera scan’s the person’s foot to get measurements rather than using augmented reality.

- Once the scan is complete, the app tells the person which size they should choose.

It’s easy to see how this may lead to more sales and, happily, fewer returns.

Interactive Calculators

Calculators are useful interactive tools for your website and can be used in more ways than one might think, including as:

- Nutritional calculators

- Pricing calculators to help potential customers build customized product “bundles”

- Financial calculators to help people select the right financial product for their circumstances

Whichever sector you’re in, there’s a good chance you can use an interactive calculator to personalize the user experience.

For example, say you run a kitchen supplies website, and you want people to buy your recipe books. They’ve asked questions about how healthy the recipes are.

A nutritional calculator can help them out and, in turn, encourage people to spend more time on your website and potentially have more trust in your brand.

7 Reasons You Should Use Interactive Tools to Increase Sales

We’ve explored what interactive marketing tools are and how they work. There’s still a fundamental question remaining: Can these tools increase your sales?

The answer is: Yes! Here are my top seven reasons why interactive tools in your marketing strategy can increase sales:

1. Interactive Tools Boost Engagement Levels

Customer engagement is vital, but it’s hard to stand out from the crowd. Here are two reasons why:

- The average person spends almost two and a half hours a day scrolling through social media. In this time, they’re exposed to countless marketing messages, from banner ads to PPC.

- We’ve become “conditioned” to ignore banners (a phenomenon dubbed “banner blindness.”)

Don’t worry, though. This time is where interactive tools have their chance to shine. 66% of marketers report an increase in engagement levels after introducing interactive content to their marketing plans.

Ultimately, increased customer engagement is a pretty effective way to generate more sales in the long-term, so it’s worth using interactive tools in your content.

2. Improved UX Using Interactive Tools May Convert Customers

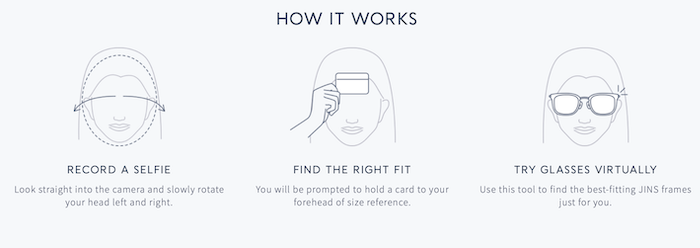

Conversion is what marketing is all about, and interactive tools could help you do just that. Let me show you how it’s working for JINS, a prescription eyewear provider.

As a forward-thinking company, JINS wanted a new, innovative way to increase conversion rates and improve customer experience. Their solution came via virtual try-ons for glasses.

All someone needs to do is turn on their camera and upload a selfie to the platform. Once that’s done, the user chooses which frames they’re interested in and puts them onto the selfie.

Here’s what it looks like in action. On the left, we have the selfie, and on the right, the actual frames after the customer made their purchase:

Potential customers now have a quick and accurate way to gauge which glasses to buy! According to JINS, conversion rates have drastically improved since they added this interactive tool.

3. Interactive Tools Allow Customers to Feel Confident in Large Purchases

Like I said earlier, this is not just about trying on hair colors or checking out fashion accessories. This technology is about making big purchases, too.

Take Target, for example. Users upload a picture of their room and place a true-to-life copy of a furniture piece in the space. They can also download the Target app and try out the augmented reality version instead, which is a little more engaging because you can move the product around the room. Amazon does this with many of their products in their app as well.

This feature allows users to check if the furniture or other large item fits their space before purchasing it, which means they’re more likely to click “buy” and less likely to make returns.

4. Personalized User Experience via Interactive Tools Can Increase Conversions

Do you see a pattern of personalization forming? Interactive tools allow us to personalize marketing like never before. Here’s why it matters from a sales perspective:

- 80% of customers are more likely to buy from a company offering a personalized experience.

- Up to 56% of online shoppers return to businesses offering product recommendations and other personalized services.

These stats tell us two things:

First, customers crave personalization. They want to feel valued by companies.

Second, they’re more likely to become loyal customers if there’s a personal touch to your marketing efforts.

This is a no-brainer way to build brand loyalty and increase your chance of future sales.

5. Interactive Tools Increase Lead Generation

I’ve touched on this already, but it’s worth emphasizing just how effective a lead generation strategy using interactive tools can be from a sales perspective.

Firstly, there’s an SEO angle. If you can attract more social media shares and inbound links, you should generate more traffic. Additionally, if people spend more time on your website and there’s a lower bounce rate, your search engine ranking can improve. Social shares may boost your SEO ranking by over 20%, too. (You can check who’s linking back to you with my free backlink checker.)

The upshot of interactive tools catching people’s eyes is that there could be more organic traffic and better quality leads because the people you’re attracting are already looking for your product or service.

Let’s think about this from another angle, too. The data you’re capturing from prospects as they use your tools may help you figure out what your customers want so you can improve your products and services.

Consequently, you can generate more quality leads in the long-term, all without much extra effort from a marketing perspective.

Sounds great, right?

6. Automate Your Marketing With Interactive Tools

Yes, interactive tools can help you automate your marketing efforts, and the tools do much of the work for you. The algorithms detect what the customer wants and make recommendations or offer solutions based on this information.

This can help you increase sales and make alterations as needed because you can:

- Check your metrics to ensure the tools are working how you want them to

- Make changes to the UX based on what you’re seeing

- Compare performance across different interactive tools and invest time, energy, and resources in the ones performing most effectively

7. Interactive Tools May Draw Traffic to Your Website

Without traffic coming to your website, there’s little chance you’ll make sales. Again, interactive tools can help you out here. Here’s why.

Firstly, 47% of people use ad blockers now, so there’s a chance some potential customers won’t even see your marketing if you’ve focused efforts on those. Interactive tools help you sidestep this problem.

Secondly, 79% of successful marketers say interactive tools and content encourage people to return to their websites. It’s not just about creating new content, either—you can use the same content time and time again when you have interactive tools.

Think about it. If a customer loves the eyeglasses they purchased from you the first time around, they’re more likely to return to your online shop. There, they’ll use the same virtual try on tool they used before to check out different pairs. You didn’t have to try to impress them with new interactive tools, promotional emails, or any other marketing strategy—they liked what they used the first time and engaged with it again.

How’s that for a cost-efficient way to solidify a lasting relationship with your customer base?

Conclusion

Why should you build interactive tools to increase your sales? Well, as we can see, they’re not just a reliable way to generate leads and improve conversion rates, but they’re cost-effective, too.

They’re not especially challenging to deploy, either. It’s easy enough to find interactive tools you can tweak to suit your needs and embed them on your website. If you want more help with introducing interactive tools into your marketing strategy, check out my consulting services.

Have you tried interactive marketing tools yet?

The post Why You Should Build Interactive Tools to Increase Sales appeared first on Neil Patel.