Business vendor credit accounts are not usually talked about as part of a business credit portfolio. The emphasis is generally put on credit cards, lines of credit, and loans. However, they are vitally important to the cause. A Strong Business Credit Portfolio Can Help Move Your Business Forward A business credit portfolio is made up … Continue reading How Business Vendor Credit Accounts Can Improve a Business Credit Portfolio

Tag: Business

Is Credit Union Direct Lending a Valid Option for Your Business?

Banks aren’t opening their vaults as easily for businesses these days as they have in the past. Many business owners are finding it necessary to get creative when it comes to business funding. In many cases, credit unions are seizing the opportunity to step in and fill the gap.

Credit Union Direct Lending Works Well for Some Businesses, Is Yours One of Them?

In fact, back in 2018, Member Business Lending (MBL), partnered with CU Direct to help this process along. MBL is the leading credit union service provider when it comes to business loan origination services. CU Direct, well known for the CUDL (Credit Union Direct Lending) system, works with thousands of auto dealerships to help facilitate auto-financing through credit unions.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Together, the two are able to streamline the credit union business loan processes. It’s a good thing too, because more and more businesses are looking to credit unions to get the funding they need since banks aren’t coughing it up.

So, is credit union direct lending right for your business? Let’s find out.

What Does it Take to Qualify for Business Loan From a Credit Union?

While all lenders have their own requirements, it’s a fair bet you are going to need to provide the following to any lender.

- Loan application form

- Personal financial statement

- Business plan

- At least three years of financial statements and tax returns for existing businesses

Most lenders will be looking for the following:

- Regular income sufficient to repay the loan along and stay solvent

- A good credit history

- Collateral

- Financials in line with or exceeding peers.

- Owner equity in the business.

If you cannot provide all of the information, it could go a couple of ways. They could automatically deny the loan. However, some credit unions are willing to review the information provided.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

A complete loan application will typically include:

- Current financial statements to within 3 months, and three years of past financial statements and tax returns

- Personal financial statements from all principals of the business

- A description of the collateral or purchase receipts or quotes if the loan is for new equipment

- Projections on a month by month basis for up to two years, or the length of the loan if less than 2 years

- A complete, professional business plan

- Authorization for loan request from Board of Directors or partners

- Personal guarantee

It’s important to note that personal credit score is handled differently by each institution when it comes to credit union business loans. It’s a fair bet that if they are asking for a personal guarantee, they are going to want to see a strong personal credit score.

However, we have heard from at least one credit union that this is not always the case. This particular credit union does not have a standard minimum credit score requirement. They say they take each loan application on a case by case basis.

So, even if you do not have a great personal credit score, if you are strong in the other areas you may still qualify for a business loan from a credit union. You just have to find the right lender.

Why Can Loans from a Credit Union be a Good Option?

So, why would you pursue a loan from a credit union over a loan at a bank? In short, lower interest rates and fees. Credit unions are cooperative, non-profit organizations. As such, they do not pay federal and state income taxes. So, they are able to pass the savings on in the form of lower rates and fees.

Due to a difference in structure and loan application review processes, credit unions are also often able to process loans much more quickly than banks.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

What if Loans from a Credit Union Are Not an Option?

At this point, you are likely either thinking, “I can do this!” or “What am I going to do now?” You’ve either realized you’ve got this in the bag, or you know you need to pursue other options until you get some issues taken care of.

There are a few things you can do. If you need money right now, you can look at getting a loan from an alternative lender. Credit Suite’s Credit Line Hybrid funding may also be an option. There are a lot of funding options out there.

Whatever you do, it’s likely you need to work on your fundability while you do it. Most business loan denials result from a fundability issue. You can get a free consultation with a business credit expert to help you analyze your fundability. They can show you what you can do to improve your chances of approval. With strong fundability, you’ll be able to get the best deals on the business funding you need, when you need it.

The post Is Credit Union Direct Lending a Valid Option for Your Business? appeared first on Credit Suite.

How Do Government Contracts for Small Business Work?

Get Government Contracts for Small Business

Are you looking for government contracts for small business? The federal government can be a terrific place to get clients. But there are many details to learn! The Small Business Administration has got you covered.

Government Contracting

The government is a huge consumer of goods and services. So any US business should be trying to get a supply contract with them. Unlike other customers, the government will be a consumer for as long as the United States exists. The SBA Contracting Guide helps small businesses navigate the details.

SBA Contracting Guide

The SBA has a role in government contracting. They work with federal agencies and offer what are essentially SBA contracting assistance programs. The idea is to award 23% of prime government contract dollars to eligible small businesses. It also offers counseling and help to small business contractors.

Government contracts are a tremendous financial opportunity for small businesses. Per the SBA Contracting Guide, the US government buys all types of products and services. And the law requires it to consider buying from small businesses.

The government wants to buy from small businesses for several reasons, including:

- They want to ensure that large businesses don’t muscle out small businesses

- To gain access to the new ideas that small businesses provide

- To support small businesses as engines of economic development and job creation

- And to offer opportunities to disadvantaged socio-economic groups

How Do Government Contracts Work?

- Requesting proposals, evaluating bids, and awarding contracts should be on a level playing field

- The government should consider a bid from any qualified business

- With set-aside and sole-source contracts, federal agencies must publicly list their contract opportunities

- Some of these contracts are set aside only for small businesses

At times, set-aside contracts might make up certain types of tasks on larger contracts. In others, entire contracts may be reserved for small businesses. When a contract is set aside for one specific small business, it’s called a sole-source contract.

Demolish your funding problems with 27 killer ways to get cash for your business.

Does Your Business Have What it Takes to Get Government Contracts for Small Business?

Start with market research. To bid on and win government contracts, you must sell products or services the government buys. And you must do so at a competitive price. Check to see if there’s a market for your product or service. The SBA can help you to determine how big the market is, and find potential buyers.

The Federal Procurement Data System

Move onto the Federal Procurement Data System. This system is the repository of all federal contracting data for contracts over $25,000. With this system, you can see which agencies have contracts and with whom. Find out what agencies buy, and learn which contractors have contracts.

USSpending.gov

Take a look at USASpending.gov. USASpending.gov tracks government spending through the contracts it awards. This searchable database contains information for each federal contract. Use this information to help identify government purchasing trends.

Agency Recurring Procurement Forecasts

Federal agency procurement forecasts can be very helpful. Each government agency releases a procurement forecast. It includes contracting opportunities for small businesses. Review Agency Recurring Procurement Forecasts. Find out if there are agencies that are buying what you sell.

Procurement forecasts can get granular. You can look up procurement for (for example) the Department of Veterans Affairs. And then break it down by location. And then see budgeted amounts for everything from asbestos abatement to buying stretchers.

What Makes a Successful Contractor?

The government prefers to work with established, reliable businesses. This means it’s likely that startups need not apply. Do you have a track record of delivering quality goods and services on time and within budget? Is your reputation within your industry strong?

Downsides of Trying to Get Government Contracts for Small Business

It take a long time to win your first government contract. And it can also take a significant amount of money. Some businesses spend between $80,000 and $130,000 to earn their first contract! Also, it could take up to two years to start making a return on your investment. So you must have enough cash flow to sustain your business.

Keep a diverse list of private-sector clients. This can help offset any potential initial losses. Being e-commerce savvy is also very important in government contracting. For example, to work with the Department of Defense, you must be able to invoice and receive payments electronically.

The SBA Offers Counseling to Small Businesses

One form of this help comes from a government contracts website called Procurement Center Representatives. Procurement Center Representatives (PCRs) help small businesses win federal contracts. PCRs view many federal acquisition and procurement strategies before they’re announced. This way, they can influence opportunities that should be set aside for small businesses. PCRs also conduct market research and help small businesses with payment issues. They also provide counseling on the contracting process.

Subcontracting Program Assistance (SPA)

SBA Learning Center

You can also check out the SBA Learning Center. The SBA offers free online courses. These are to help small businesses understand government contracting. These are in the form of video classes.

Demolish your funding problems with 27 killer ways to get cash for your business.

Procurement Technical Assistance Centers (PTACs)

Or work with Procurement Technical Assistance Centers. PTACs help small businesses interested in government contracting. PTACs can help you determine if your business is ready for government contracting. They can help you register in the proper databases. And they can help you to find and bid on contracts.

SCORE

Another option is working with SCORE. SCORE is a nonprofit association. It has thousands of volunteer business counselors around the country. These counselors educate small business owners. SCORE provides free in-person and online counseling. They also provide educational workshops.

Small Business Development Centers

Or try the SBA’s Small Business Development Centers. Small Business Development Centers (SBDCs) offer free, one-on-one counseling and low-cost training services. Business owners can go to SBDCs for help with procurement and contracting. SBDCs will also help with market research. And they will provide 8(a) program support for minority-owned businesses

SBA Small Business Offices

Or you can turn to the SBA’s small business offices. Many federal agencies have an Office of Small and Disadvantaged Business Utilization (OSDBU). Or they may have an Office of Small Business Programs (OSBP). These offices work to identify opportunities to contract with small businesses.

OSDBUs and OSBPs

An OSDBU promotes using certain kinds of small businesses. These include disadvantaged, 8(a), women-owned, veteran-owned, service-disabled veteran-owned, and HUBZone small businesses. This is within the US Department of Commerce’s (DOC) acquisition process.

OSBPs advocate to include small businesses in the cleared industrial base. They do so through education and collaboration. They also maximize opportunity for small businesses in DCSA acquisitions. DCSA stands for Defense Counterintelligence and Security Agency.

Demolish your funding problems with 27 killer ways to get cash for your business.

Basic Requirements for Getting Government Contracts for Small Business

Before a business can engage in federal contracting, they must meet certain basic minimum requirements. Your business must have a D-U-N-S number. It also needs an NAICS code.

You must also meet size standards. Most manufacturing companies must have 500 employees or fewer. Most non-manufacturing businesses with average annual receipts under $7.5 million will qualify. You’ll need to register with SAM (the System for Award Management). SAM is a database that government agencies search to find contractors. And you must maintain compliance. The federal government’s purchasing process comes under the Federal Acquisition Regulation.

Federal Acquisition Regulations

Note: Federal Acquisition Regulations allow for some deviance from the norm. Regulations covering government contracting programs for small businesses are in 13 CFR 125. This rule defines when a business can say one or more service-disabled veterans own it. It also includes the government definition of subcontracting.

How to Win Contracts

You want to find contracts – use databases like the Dynamic Small Business Search. And you must market to the government. Some great places to find out what agencies or prime contractors need are:

- Federal Procurement Data System

- Office of Small and Disadvantaged Business Utilization (OSDBU) (specific to some agencies)

- Office of Small Business Programs (OSBP) (specific to some agencies)

You also want to address any objections that may arise. A federal contracting officer may reject a business due to questions about ability to fulfill the contract. Then the SBA offers the small business a chance to apply for a Certificate of Competency. Here, you can prove your business is up to the challenge. But note: a COC is only good for one contract. So you may need to reapply in the future if you bid for another government contract in the future.

Types of Contracts

The government limits competition for certain contracts to small businesses. Those contracts are called small business set-asides. Set-asides can be competitive or sole-source. These can be some of the easiest government contracts to win.

Competitive Set-Asides

If 2+ small businesses could do the work or provide the products, the government sets aside the contract just for small businesses. Much of the time, this is automatic for government contracts under $150,000. Also, some set-asides are open only to small businesses in SBA contracting assistance programs.

Sole-Source Set-Asides

The government issues some contracts without a competitive bidding process. This often happens when only one business can fulfill the requirements of a contract. For consideration, register your business with the System for Award Management. And take part in any contracting program you may qualify for. Such as 8(a) Business Development or Women-Owned Small Business.

Government Contracts for Small Business: Takeaways

The US government is a huge consumer of goods and services. They are a client likely to be able to pay your business on time, and unlikely to go out of business in your lifetime. The SBA gives extensive guidance for getting government contracts for small business. Also, check if you or your business qualify for special programs to help you win government contracts.

The post How Do Government Contracts for Small Business Work? appeared first on Credit Suite.

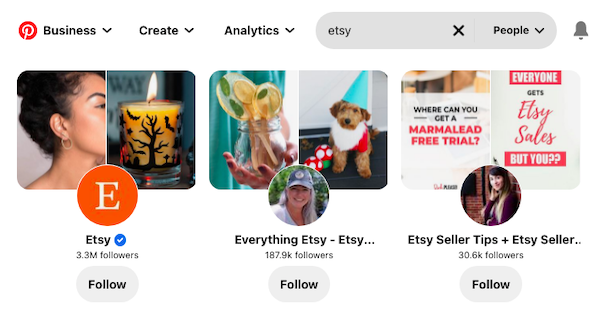

How to Use a Business Pinterest Account For Marketing and Brand Growth

If you still think Facebook and Twitter are the be-all and end-all of social media marketing tools, think again.

Say “Hi” to your business’s new best friend: business Pinterest accounts.

Eighty percent of Pinterest pins are repins, which means this is a platform that values sharable content. The average lifespan of a pin is three months which is much longer than Facebook which averages five to six hours, and Twitter which averages at 15-20 minutes..

Since Facebook purchased Instagram, Pinterest has become the hot ticket item for business marketing.

That’s for good reason. If an increase of 30% in Pinterest accounts over the last year isn’t an indication that your business should be joining over 250 million monthly active users, I don’t know what would be.

Aside from feeding obsessions with exotic destiny vacations and gourmet food, the real strength of Pinterest is the integrated features of its business accounts. Join the businesses with Pinterest for Business accounts, and you’ll get added marketing features to promote your brand on one of the fastest growing and insanely popular social media platforms.

Perks of Pinterest Business Accounts

If you don’t have an account already, or if your account is personal, you’re going to need to sign up for an official Pinterest for Business account to tap into the full potential of Pinterest’s marketing potency. With your business account, you get:

They Offer Different Terms of Service

The terms of service are a little bit different for a business, so be sure to read through them. The difference comes from the fact that you are using the account commercially.

You’ve still got the same Acceptable Use Policy and Pin Etiquette Policy, but there are a few guidelines for commercial use:

- Don’t promote spam, “such as asking participants to comment repeatedly.”

- Don’t “run a sweepstake where each pin, repin, or like represents an entry [or] ask pinners to vote with a repin or like.”

- Don’t run contests, sweepstakes or promotions “too often.”

- Don’t “suggest that Pinterest sponsors or endorses” your business.

They Provide Educational Marketing Materials

Pinterest doesn’t just give you the platform, they create educational marketing materials to teach you how to maximize its effectiveness for marketing your business.

They offer:

- Business resources: Tools, insights, guides on best practices to help creators make the most of Pinterest

- Pinterest business community: A place where creators and business can support each other

You can also check out the Pinterest Blog to stay updated on when these materials will be out and get some basic tips.

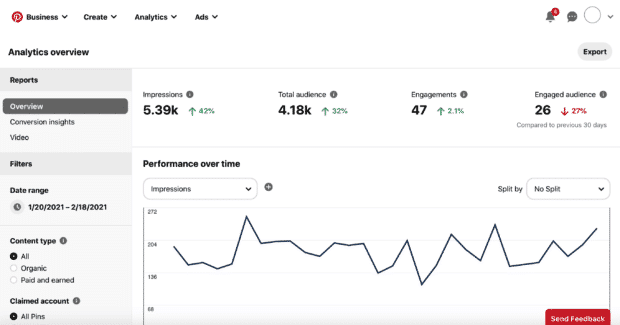

You Get Access to Pinterest Analytics

Pinterest Analytics is one of the newest and most awesome features of a Pinterest for Business account. When you verify your account, you get access to important tracking information. You’ll be able to see which strategies and content work so you can constantly improve your marketing.

Rich Pins Loaded With More Information than Average Pins

There are five different types of Rich Pins, all loaded with more information than your average pin for serious sales power. They include real-time price and stock updates, direct links to your site, and interactive map locations. There will be more details on Rich Pin strategy later.

Access to Upcoming Tools and Features

Pinterest has promised some new tools exclusively to business accounts in the future. As of right now, that includes buyable pins for e-commerce, Promoted Pins, the Pin It Button, and the Widget Builder. As new tools are being added, you can stay updated by joining the Pinterest newsletter.

Different Settings

You get to use your business name instead of the typical First + Last Name formula. This means your Pinterest account won’t have an automatic link to your Facebook account, so you should add a Facebook tab to your Pinterest home page.

How to Create Popular Pins from Your Pinterest Business Account

Your pins can get engagement for your business if you execute them right.

Pinterest has been described by the Social Media Examiner as a visual search engine. Just like when you are writing your blog articles or posting on your business Instagram account, you want your content to be searchable.

If it’s not searchable, then it won’t be found or seen.

Therefore, before you grab that mouse to start pinning, you have to understand the Pinterest culture, AKA what your followers search for, and learn how to create popular pins.

1. Create Pins in Most Popular Categories

If you know what the most popular Pinterest categories are, then you’ll have a better idea of which boards will work for your business.

Most of Pinterest users, 71.1 percent to be exact, are female. Males users only account for 14.9 percent of the audience. Pinterest posts are categorized, so if your business doesn’t have anything to do with DIY crafts, then don’t have a board dedicated to the art of glue-gunning. Pick the most relevant popular ones!

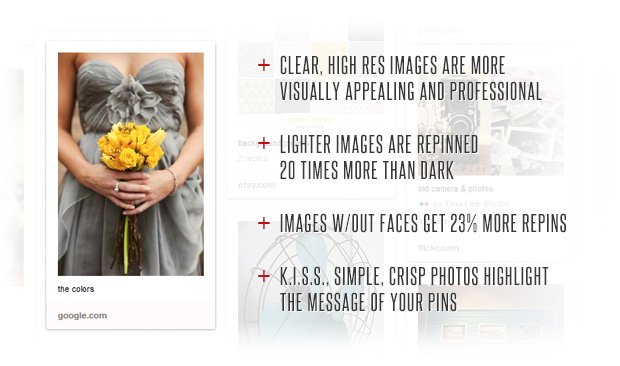

2. Use Images that Work

One quick perusal of Pinterest and it’s clear how visual a site it is. With such an emphasis on visual impact, your images are the cornerstone of any pin you share.

What makes the top Pinterest pins so popular?

3. Use Optimal Pin Size

All pins have the same width, with an unlimited length. A good size to shoot for is 736×1102 pixels for a typical pin. It’s not too big, and not too small. Canva’s Pinterest template is this size and makes sizing your images a lot easier.

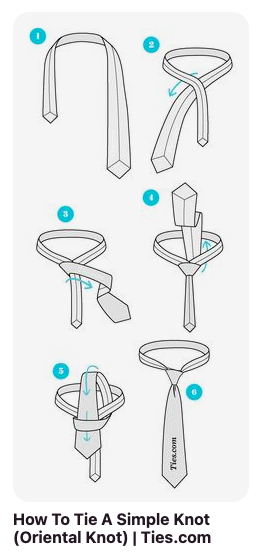

4. Use Instructographics

Sometimes it’s good to take advantage of the longer length allotment. The term “instructographic” was coined by Pinterest and it is another name for infographics. These are popular because of their DIY, how-to nature, which we know is popular on Pinterest.

How to Get Your Pins Seen and Shared: Optimizing Your Pins

It’s one thing to create a fantastic pin, but it’s a whole other game to get it seen and shared. No one is going to find your pin if you don’t optimize for engagement.

Know the Best Times to Pin

The best times to pin depend on your target audience’s habits, so you should always test for your specific optimal posting times. On average, the best times to post are 2 PM – 4 PM EST and 8 PM – 1 AM EST; and, research by HubSpot says Saturday morning is THE best time to post.

Make It Easy to Pin Content from Your Sites

Add a hovering Pin It button to any image on any of your sites or your phone app through Pinterest directly. If you use WordPress, there’s a Pinterest Pin It Hover button plugin.

These simple-to-integrate buttons direct your site visitors to either check out your Pinterest account or actually pin your site’s content on their own accounts. If you don’t have these buttons, there is little chance your site will bring ANY interaction with your Pinterest account.

Connect with Your Other Social Media Platforms

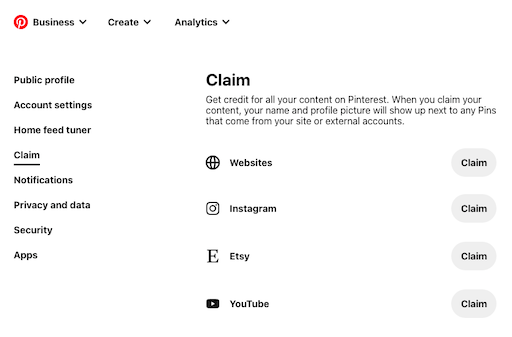

You don’t want to have to start over with followers when you create a new social media account. It’s super easy to connect your Instagram, Youtube and Etsy accounts to your Pinterest for Business account.

This will help you get more followers by tapping into the ones you already have on other platforms. It also will help spread your content across platforms so more eyeballs see it. It will add relevant buttons to your Pinterest account.

To connect your social media accounts:

- Go to your “Settings” in the dropdown menu

- Go to the “Claim” section

- Connect your accounts by hitting the “Claim” button

Share Pins in Your Newsletter

Take the difficulty out of getting people to find your pins by sending the pins straight to them! Your newsletter is the perfect place to throw in a couple of your latest pins and direct subscribers to your Pinterest account. Try this:

“Our most popular pins from this week. Head on over to our Pinterest for even more!”

SEO for Pinterest

You have to use some SEO strategy to get your pins discovered by the eyes of your target audience. Don’t worry, it doesn’t take much to optimize your pins in regard to Pinterest searches. Just follow these steps:

- Step 1: Research keywords. Try a tool like Google AdWords Keyword Planner to find popular keywords related to your business and your pins.

- Step 2: Add your keyword/keywords to your pin titles.

- Step 3: Add your keyword/keywords to your pin descriptions.

- Step 4: Add your keyword/keywords to your pin image file names.

As with any SEO you use, make sure not to sound too “keywordy.” Don’t go too crazy and add three keywords to your title and descriptions like a robot would. Optimize and still sound human by simply adding a strong keyword within the right context.

Use a Call-to-Pin

In the same way you use a call-to-action in your ad copy, a call-to-pin will significantly increase the engagement of your pins. In your pin’s description, add a little something like:

“Repin to your own inspiration board.”

Engage to Build Relationships and Gain New Followers

Now that you know what kinds of pins are popular and how to get your pins seen, the next step in Pinterest marketing is to use your pins to build relationships with followers and influencers that will grow your reach.

As we all know, more reach = more success.

Knowing what users look for when following other accounts will allow you to give them what they want and, in turn, grow your following. A little mind-reading never hurt anyone.

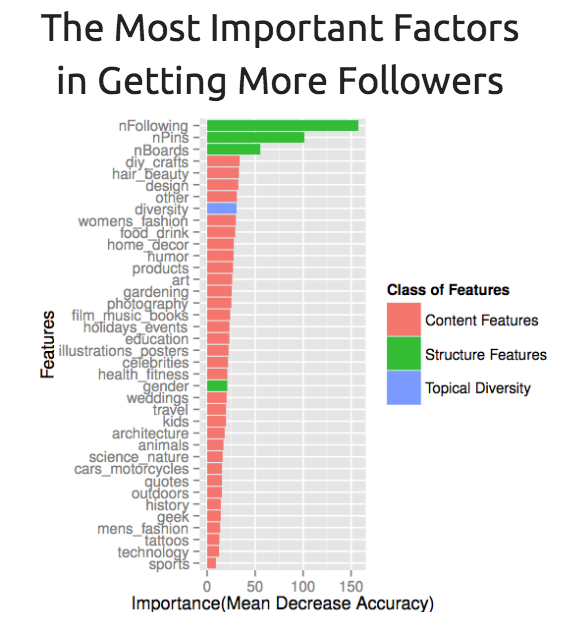

The University of Minnesota’s Pinterest study found that the three main factors that Pinterest users take into consideration in the should-I-follow-or-not decision-making process are:

- how many accounts you are following/are following you

- how many pins you have

- how many boards you have

To be on top of those factors and build relationships to grow your reach, you need to:

Post Frequently

To get more Pinterest followers, you should post between 5-30 new pins every day. Make sure you are not just repinning the content of others, but also pinning your own unique pins with your own content.

Warning! Avoid a major Pinterest faux pas: don’t pin all 30 new pins within 5 minutes. Spread your pinning throughout the day.

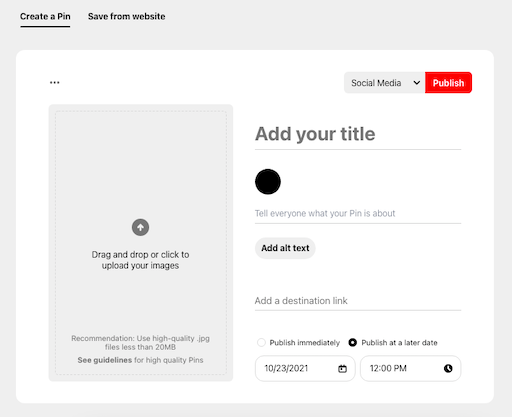

Tip! You can schedule pins with a business account.

Engage with Followers, Reply to Comments

Just like you respond to tweets, Facebook posts, and Instagram comments, engage with your followers directly by answering their questions and responding to their comments. Go the extra mile and address them directly, using their names to really take your customer service to the next level.

Comment on Your Followers’ Pins

Engagement is a two-way street. You need to reach out to your followers’ boards as well. Leave comments on their pins so they’ll feel some love. Their followers will see your brand, too!

Follow and Engage with Popular Boards

The best way to see a successful Pinterest strategy in action is to follow and engage with popular boards. You can learn a lot from the big dogs. See what kinds of pins they pin, what kinds of boards they have, and how much engaging they do. Your goal is to get on that level!

If you are commenting on these popular pins, your brand name will be seen by the huge number of people who follow those boards.

Tip! It’s a good idea to follow popular boards because they are relevant to your industry and business as opposed to “just because” they are the most popular. If your business has literally nothing to do with wedding fashion, you can do yourself a favor and follow the boards that have a following closer to yours. Those are the people you want to connect with anyway.

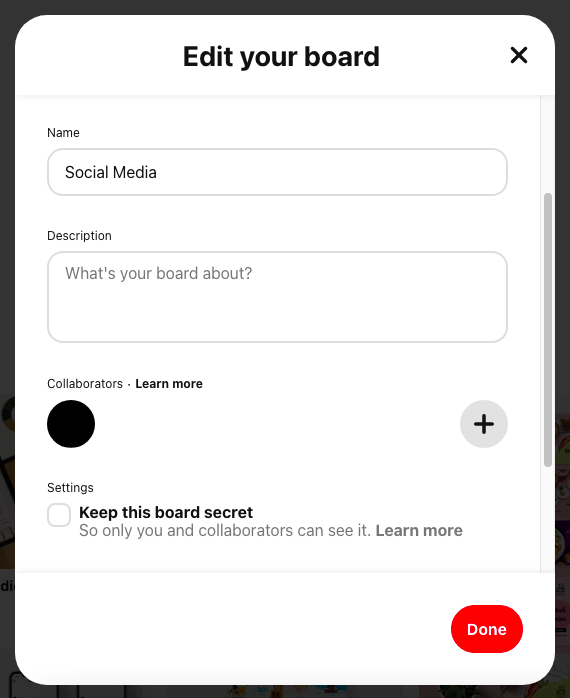

Invite Others to Pin on Your Boards with Open Boards

Another cool board feature for marketing is the Open Board, which allows users to contribute their own pins. All you have to do is give them pinning access by adding their name or email. You, as the creator, of course, have full veto power, and your contributors aren’t able to change the board name or description.

This feature is great for marketing because you get your community involved in a personal way.

Invite your followers and get big authority brownie points if you can get industry experts and leaders to contribute to your boards!

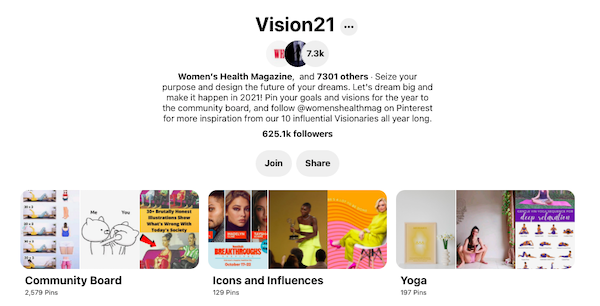

Case Study: Women’s Health Magazine

Women’s Health Magazine created an open board called “Vision 21” where their followers pin their goals and visions. It promotes fan interaction and the brand at the same time! Talk about win-win.

Build Influencer Relationships

Reach a wider audience and gain more followers by reaching out to influencers in your field.

Start by following their boards, repinning their pins, and leaving engaging comments on their pins. Once you’ve dropped your name that way, you can initiate a bigger collaboration.

Ask if they will post on a board of yours, or offer to contribute to one of their boards. Offer ideas for their boards and show that you are familiar with their content when initiating collaboration, and you’ll be closer to that “yes” you’re looking for.

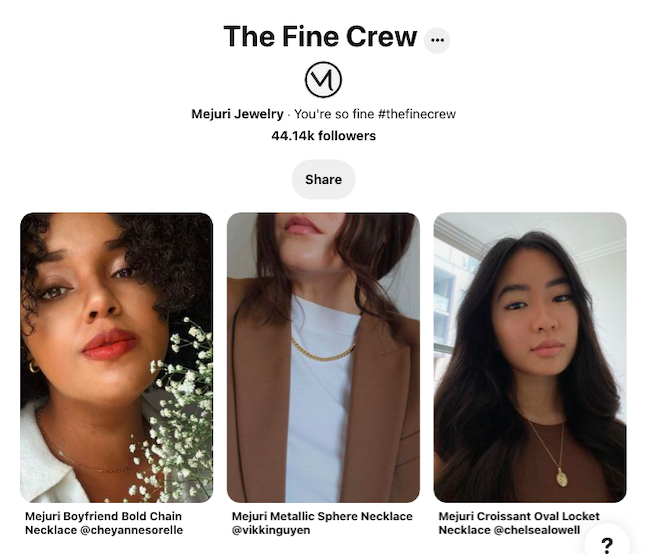

Case Study: Mejuri

Mejuri set themselves up for some great collaboration with their board dedicated to their community with the #thefinecrew. The Fine Crew board showcases their products worn by their community. Small influencers and brand partners are featured in Mejuri’s Instagram and Pinterest making it a great opportunity for cross-promotion.

Find Friends from Other Social Media Platforms

You know that when you create a new account with Instagram or another social media platform, they ask if you want to “Find Friends” using your phone’s contacts or Facebook friends.

Well, to save time and get a solid starting foundation of followers, Pinterest allows you to search for existing accounts.

How to Promote Your Brand Successfully: Business Pinterest Account Strategies

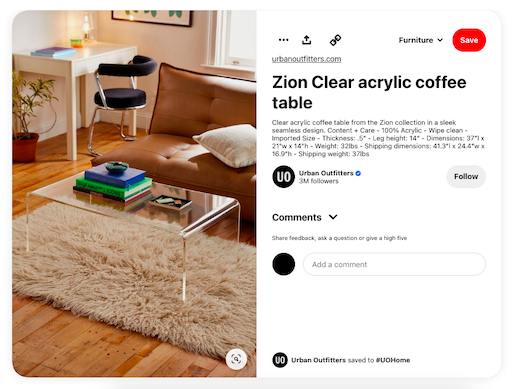

Integrate Rich Pins

My friends, I would like to introduce you to Rich Pins. Trust me, they have earned their name.You’ll see the big brands like Target and Wal-Mart taking advantage of Rich Pins,and, you should, too!

I’m not guaranteeing that you will be rolling in a pile of Benjamins with just a couple of Rich Pins, but there is a reason they are called “Rich Pins.” They are full of valuable, traffic-generating information; and, right now, they are the best direct strategy for growing your sales in the Pinterest sphere.

Rich Pins come in 3 different flavors: recipe, article, and product, all fully loaded with their own set of valuable features that will boost your engagement and direct traffic to your site.

Perks of Rich Pins

When you apply for Rich Pins, you’ll get real-time information automatically updated on your pins and more ways to direct people to your site because your site will be linked to your Rich Pins. No hassle, no fuss. Just leads.

This example, from Urban Outfitters, shows the features of a “product” pin at work. You’ve got an official link to the store’s site, as well as updated live price and stock availability information.

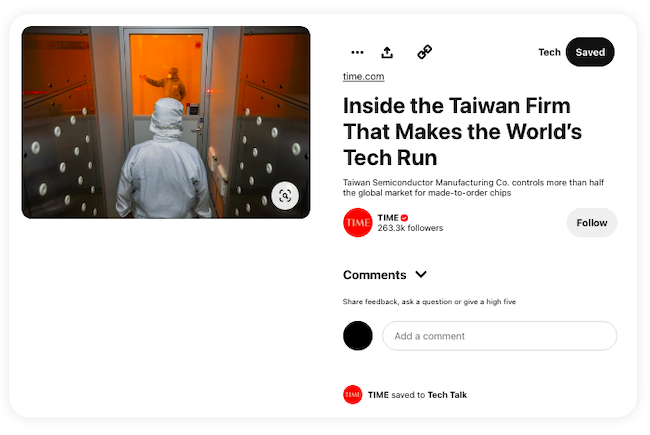

“Article” pins are also valuable in that they can promote your blog posts and direct Pinterest users to your blog. Article pins come with a larger title with your brand’s logo, a description, and a call-to-action at the bottom with a direct link to your original site.

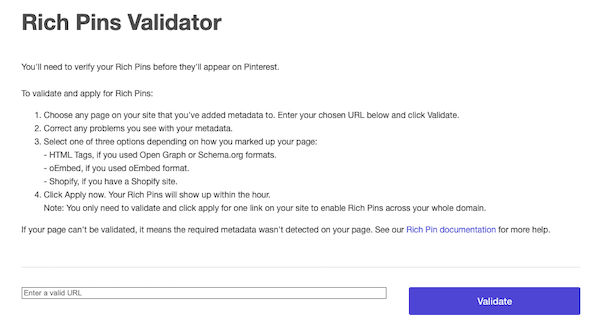

How to Integrate Rich Pins

For any of your Rich Pins to have even the potential to direct traffic to your site, you need to get them validated on the Pinterest site itself. (If you aren’t the most tech-savvy, you’ll probably want some help from your web developer…it involves meta tags.)Here’s how to do it:

- Go to this page

- Decide what kind of Rich Pin (product, recipe, or article) you want to apply for

- Read the documentation for your Rich Pin type

- Add the appropriate meta tags to your site

- Validate your Rich Pins and apply to get them approved

Once your Rich Pins are approved by Pinterest, they will be out there for the entire Pinterest world to see, to repin, and to be directed to your site.

I’m not telling you that you should think about using Rich Pins because it would help your business. I’m telling you that you NEED Rich Pins if you want to keep up in the crazy social media marketing world.

The Fortune 500 companies are all using Rich Pins. Follow the big boys, and you’ll have the potential for some serious growth.

Mix Up Your Content

The rule for all social media is to mix up your content. You will lose the interest of your followers and lose your chances of gaining any new ones if your content is static and not diverse enough.

Please, whatever you do, don’t just post product photos. Do you remember that study done by The University of Minnesota? Well, the diversity of pins was the 8th most important factor when users were deciding whether to follow an account. Throw in some other boards that give your followers added value to avoid coming off as overly salesy.

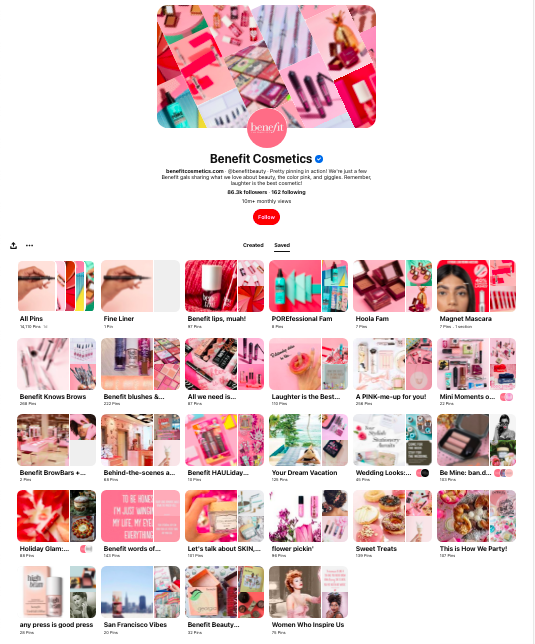

Case Study: Benefit Cosmetics

The official Benefit Cosmetics Pinterest does a great job of mixing up their content without stepping outside their niche. They have boards dedicated to their latest and hottest products, like “POREfessional Fam” and “Hoola Fam,” but also have a board just for “Behind-the-scenes at Benefit.”

All of these boards relate to their cosmetic products; but, by giving “A PINK me-up for you!,” they aren’t just saying “buy our makeup,” but “see how our makeup can help you.”

Include a Direct Link to Your Site

Not all of your pins are going to make sense as Rich Pins. (Product photos, events, and articles benefit from the added information provided with Rich Pins, but not all of your content will.)

It’s all about context.

When you are pinning images to your “brand inspiration” board, you don’t need Rich Pins. Relevant quotes to your business definitely wouldn’t call for a Rich Pin.

There is one piece of information that comes with Rich Pins that your other “simpler” pins need, too: a direct link to your site.

Even your inspirational pins need a link to your site because if one quote you posted last Tuesday changed one of your followers’ lives, they likely will want to check out your brand. If you have a link to take them to your site, they don’t have to go searching for information, and you increase the chances of them finding your site.

Simply include the link in your pin description, and you’re good to go.

Put Your Most Popular Boards on Top

Over time, you’ll be able to see which boards are more popular and get more engagement. Put your best foot forward and move these boards to the top of your page so when users come to your page, they will see your best material.

Keep It Seasonal and Relevant

Another way to keep your content fresh is to piggyback off of holidays, seasons, and events. Like the Benefit Cosmetics’ss “Holiday Glam: LEAF x Benefit,” the more specific boards add more relevancy and catch attention because they make those products even more specific and create a sense of urgency. Take advantage of that!

Create a Board Just for Blog Posts

Grab all those article Rich Pins you have, and organize them into their very own board! You’ll want to put this board at the top of your page so your followers will see it first thing. This will help draw traffic to your site and make it easier for users to find your content since it’s all in one easy-to-find-board. They will thank you.

Track Your Success and Learn the Strategies that Work with Pinterest Analytics

One of the newest features on Pinterest for Business is the super helpful Pinterest Analytics. This feature is only for business accounts and allows you to see:

- Which pins and boards from your profile people love most

- What people like to save from your website

- Who your Pinterest audience is, including their gender, location, and other interests

- Which devices people use when they’re pinning your stuff

- How adding the Pin It button to your website leads to referral traffic from Pinterest

Why are these statistics important to you?

Because they will help your account and your reach grow.

The information gained from your Pinterest Analytics shows you which strategies work and which ones don’t. Knowing this, you will be able to build your future Pinterest strategy based on hard facts. The strategies that work are proven because you proved them.

To get access to your Pinterest Analytics, you’re going to need to verify your website first.

There is another reason verifying your account is a good idea. It will help you gain authority and build trust. When Pinterest users see that little globe icon with a checkmark next to your website, they know you’re legit.

You can verify your website in the settings section by adding a meta tag. This will give you a verification badge, and you’ll be official. If you choose not to verify your site, you can still include a link to your site on your page, but you won’t be able to use Pinterest Analytics.

Don’t miss out on the crucial information Pinterest Analytics will give you. Verify your account!

How to Start Using Pinterest for Business to Improve Your Visibility and Promote Your Brand Right Now

I just threw a lot of information at you, I know. Don’t feel overwhelmed. The aspects of this guide are all totally necessary and can be broken down easily.

Just to quickly recap…

Your Pinterest for Business account comes with a ton of marketing power that’s completely different from a personal account. To tap into that power, you need to:

- Create popular images that are:

- bright

- crisp

- high quality

- 736×1102 pixels

- infographics

- in popular categories

- Get your pins seen by:

- pinning from 2 PM – 4 PM EST and 8 PM -1 AM EST

- using keywords in pin titles, descriptions, and image file names

- linking to your other social media platforms

- adding the Pin It hover button and Pinterest widget to your sites

- sending your pins in newsletters

- adding a call-to-pin in your pin descriptions

- Engage with followers and influencers to grow your reach by:

- pinning up to 30 times per day

- responding to follower comments

- commenting on follower pins

- following popular boards and commenting

- inviting followers and influencers to pin on your boards

- building influencer relationships

- using “find friends” from Twitter and Facebook

- Promote your brand successfully with:

- Rich Pins

- direct site links in descriptions

- a variety of content: seasonal and relevant

- your most popular boards at the top

- a board dedicated just to your blog posts

- Use the information from Pinterest Analytics to create a more successful future strategy

If you follow the strategies here and learn from the engagement you get, your Pinterest for Business account will continue to develop for the better, attract more of your target audience, and direct people to your site.

Happy Pinning!

Frequently Asked Questions About Business Pinterest Accounts

What is a business account on Pinterest?

A business account on Pinterest is an account that gives users special access to features like analytics, pin scheduling, and business resources.

What is the difference between a personal account and a business account on Pinterest?

Are business accounts on Pinterest free?

How do I make popular Pinterest pins?

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is a business account on Pinterest?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

A business account on Pinterest is an account that gives users special access to features like analytics, pin scheduling, and business resources.

”

}

}

, {

“@type”: “Question”,

“name”: “What is the difference between a personal account and a business account on Pinterest?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

”

}

}

, {

“@type”: “Question”,

“name”: “Are business accounts on Pinterest free?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

”

}

}

, {

“@type”: “Question”,

“name”: “How do I make popular Pinterest pins?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

”

}

}

]

}

Business Pinterest Account For Marketing and Brand Growth Conclusion

Social media marketing is crucial to building brand awareness and steady relationships with customers. Pinterest is one channel that can help you do the same thing for your business. As a visual platform, it stands out because it acts like a visual search engine tailored to user interests. With the right strategy, Pinterest can improve your SEO, your customer outreach and help your business gain new fans.

How will you use a Pinterest business account to amplify your marketing?

How to Use a Business Pinterest Account For Marketing and Brand Growth

If you still think Facebook and Twitter are the be-all and end-all of social media marketing tools, think again. Say “Hi” to your business’s new best friend: business Pinterest accounts. Eighty percent of Pinterest pins are repins, which means this is a platform that values sharable content. The average lifespan of a pin is three … Continue reading How to Use a Business Pinterest Account For Marketing and Brand Growth

11 Tax Write Offs for Small Business That May Surprise You

You have to pay your taxes. Not only is it illegal not to, but paying your personal and business taxes is a major factor in fundability. If you apply for business funding and a lender sees you have not been paying your taxes, it will likely result in denial. After all, if you can’t pay … Continue reading 11 Tax Write Offs for Small Business That May Surprise You

11 Tax Write Offs for Small Business That May Surprise You

You have to pay your taxes. Not only is it illegal not to, but paying your personal and business taxes is a major factor in fundability. If you apply for business funding and a lender sees you have not been paying your taxes, it will likely result in denial. After all, if you can’t pay your taxes, how can they believe you will repay them? That said, there is no reason to pay more than necessary. There are several tax write offs for small business that can help. Many of them may surprise you.

Tax Write Offs for Small Business Can Save You Money

In truth, a tax professional is the best way to make sure you take advantage of all of the tax write-offs available. There are more than most realize. Below is a list of tax deductions for small business that can help. Remember, this is not a complete list, and not every business will be eligible for every deduction. Always work with a tax professional to ensure your business taxes and personal taxes are filed properly.

11 Tax Write Offs for Small Business

Check out this list of tax write offs for small business, and ask your tax professional if any of them are an option for you.

#1: Simplified Home Office Deduction

When it comes to business tax write offs, this one is pretty popular. Most everyone knows there is a way to deduct home office expenses on your taxes. If you work from your home, you can deduct the portion of that home that you use specifically for business purposes. However, you must have a dedicated office space that you only use for work. Then, you have to determine the percentage of home expenses that are associated with the business.

For example, if your home office space is ¼ of the total square footage of your home, you can deduct ¼ of the utilities, etc. as a business expense. As you can imagine, this calculation can get complicated and tedious quickly. As a result, a lot of home business owners do not take this deduction. They do not feel they can properly keep up with it. Some do not feel the deduction is worth the time it would take to keep up with all that is necessary for the calculation.

What you may not know is that there is a simplified calculation for this deduction. The simplified option is a quick and easy way to determine your home office deduction. You just multiply the total square footage of the space you dedicate to work only by $5. Remember, the maximum amount you can claim using this method is $1,500

#2: Qualified Business Income Deduction (QBI)

If you own a sole proprietorship, partnership, or an S corporation, you may be eligible for a qualified business income deduction. If so, you could deduct up to 20% of your qualified business income from your tax return.

That means if you have qualified business income of $100,000, you can deduct $20,000 and only pay taxes on $80,000.

#3: Bonus Depreciation

Depreciation tax write offs for small business are nothing new. Business assets like equipment are depreciated on the books over time at a set rate. That means you do not count the full cost of the item in the first year it is purchased. However, under bonus depreciation, you can deduct more than standard depreciation in the first year.

Before 2017 the bonus depreciation amount was 50% of the cost. Then, you would depreciate the remaining 50% of the cost over the life of the asset. However, the new law says that for anything purchased between September 27, 2017 and January 1, 2023, you can deduct 100% of the cost in the first year the item is put into service.

You don’t have to, but it could be advantageous to do so. Your tax professional can help you make that decision.

What types of items qualify for bonus depreciation? Tangible assets with a useful life of 20-years or less as dictated by the IRS.

Some items that fall into this category include:

- Machinery

- Equipment

- Computers

- Appliances

- And furniture

#4: Business Related Legal and Professional Fees

If you use an attorney or an accountant for business services, their fees are deductible. Did you have an accountant prepare your taxes? That’s deductible. Using an attorney to help draft employment contracts or a writer to write a business plan? That is all deductible.

#5: Dues and Memberships

Fees paid to professional organizations for membership are deductible.So, a pediatrician could deduct any fees paid for membership to the American Academy of Pediatrics, or an architect could join the American Design Drafting Association (ADDA). If the business pays the fees, it is tax deductible on that business’s tax return.

#6: Interest on a Business Loan

Did you know you can deduct the interest you pay on a business loan? If you meet a few qualifications that is.

Qualifications include:

- Funds come from an actual lender, not family or friends

- You are liable for the debt, legally

- Both you and the lender intend for the debt to be repaid

It’s also important to note that you have to actually spend the loan funds. You can’t just put them in an account and make payments. That’s considered an investment by the IRS, and therefore does not qualify as one of the tax write offs for small business.

#7: Bank Charges

Pay attention to your bank and credit card statements. All those little charges and fees are tax deductible. It may not seem like much, but they can add up. Especially when you consider all of the charges this can ecompass.

Costs such as:

- Cash deposit fees

- Merchant service fees

- Late fees

- Online banking fees

- And even credit card convenience fees

These all count, so keep up with them.

#8: Continuing Education Expenses

As a business owner, you can pay for continuing education for your employee and yourself, and it could be tax deductible. The IRS says if the cost is related to training that maintains or improves skills required for the job, it is deductible. The deduction includes a number of education related expenses.

For example:

- Course fees and tuition

- Books

- Supplies

- Lab fees

- And other similar items

#9: Business Animals

Animals that are used in the course of business are tax deductible. That means both the cost of the animal itself and the care and feeding of it. Of course, you can’t just buy a dog or cat and call it a business animal. However, if you have a dog and you use it as a guard dog in your business, some of those expenses could be tax deductible.

One fun example is a junkyard owner who bought cats to help with rats. The IRS ruled it was a legitimate business expense and therefore, deductible.

If you are an animal breeder, you can also deduct costs related to animals for breeding.

#10: Website and Other Internet Related Expenses

The costs associated with maintaining a website can be tax deductible. This may include hosting fees, design costs, and a number of other related expenses.

#11: Magazine Subscriptions

You can deduct the costs of some subscriptions, including those for professional journals, trade publications, and even technical journals. It’s important to note that you cannot deduct the cost of magazines for a waiting room.

Don’t Do It On Your Own

Want to know the number one sure fire way to pay more than you need to in business taxes? Try to do them yourself. Don’t do that. Hire a professional. After all, the fees are tax deductible. Then, you can know you are getting all the tax deductions for small business you are eligible for. Don’t let not paying taxes negatively affect business fundability. Want to know more about fundability and what may be affecting yours? Try a free consultation with one of our business credit specialists now.

The post 11 Tax Write Offs for Small Business That May Surprise You appeared first on Credit Suite.

Get Cash Flow Financing for Your Business – It Can Be a Great Way to Get Credit and Funding…

Can Cash Flow Financing Help YOUR Business?

For going concerns with some time in business, cash flow financing can be a good way to fund expansion, growth, or everyday needs. But what IS cash flow financing? And where do you get it?

Fundability, Cash Flow, and Your Business

Fundability is the ability of a business to get funding. It covers all the points a lender or credit provider will check when trying to figure out if you’ll pay back a loan or credit extended to you. These include details you may not have thought about or might think aren’t so important. But they are!

The 3 Cs Capital Acquisition Formula

When you think like a lender, you come to understand that all they want is to be sure that you’ll pay them back. Lenders look at one of three things for loan approval: cash flow, collateral, and/or credit. The more of these “Cs” you have, the more funding options are available. Let’s look at how cash flow financing can help your business.

Cash Flow Financing

Cash flow financing is a loan made to a company is backed by a company’s expected cash flows. A company’s cash flow is the amount of cash that flows in and out of a business. This is within a specific period. Cash flow financing or a cash flow loan uses generated cash flow as the way to pay back the loan. It’s one of the smarter financing activities you can do if you’ve got a going concern with predictable income.

Cash Flow Financing: Terms and Qualifying

Much of the time, you must have a few years in business. You may need a certain minimum credit score. You must prove historical cash flow, and present your accounts receivables and accounts payables, so the lender can determine how much to loan to your business.

Account Receivable Financing

You can use outstanding account receivables as your collateral for business financing. Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

Account Receivable Financing: Terms and Qualifying

Use your outstanding account receivables for financing. Get as much as 90% of receivables advanced ongoing or more, in less than 24 hours. The rest of the accounts receivable are released once the invoice is paid in full. Factor rates as low as 1.33%.

Terms are for Credit Suite account receivable financing. The only collateral necessary is your account receivables. Loan amounts run from $10,000 to $10 million. Up to 95% of receivables can be advanced within a week. Rates start at prime rate 2%. You must have a FICO score of 500 or better.

Receivables must come from another business or government agency, not an individual. Business must be open for at least one year to qualify. Medical receivables must have $1 million in annual sales or more. For the deal submission, you must provide the application, a breakdown of existing receivables, and a sample invoice.

Purchase Order Financing

Purchase order financing is advanced to a business with a large purchase order or contract, but the business is unable to fulfill it. A lender then loans the funds necessary to complete the order and charges a percentage for the service. Then the company can fulfill its order or contract.

The difference between purchase order and accounts receivable financing is purchase order financing involves a company lending you money to fulfill purchase orders. But accounts receivable financing involves a company buying your outstanding invoices. Still, they are both, at bottom, based on cash flow.

Purchase Order Financing: Terms and Qualifying

Terms are for Credit Suite purchase order financing. For approval, lenders will often review your outstanding purchase orders that need filling. They want to be sure the purchase orders are valid, and the suppliers you are dealing with are credible.

If so, then you can get approval, regardless of personal credit history. Rates tend to range from to 4%. In some instances, you can get 95% of your purchase order financed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Business Revenue Lending

This is a way to raise capital from investors who get a percentage of the enterprise’s ongoing gross revenues, in exchange for money invested. In a revenue-based financing investment, investors get a regular share of business income until a predetermined amount is paid. Often, this predetermined amount is a multiple of the principal investment. It is often between 3 to 5 times the original amount invested.

Business Revenue Lending: Terms and Qualifying

Since repayment of the loan is comes from revenues, the time it takes to repay the loan will fluctuate. The faster revenue grows, the quicker you’ll repay the loan, and vice versa. The percentage of monthly revenues committed to repayment can be as high as 10%. Monthly payments will fluctuate with revenue highs and lows and will continue until you’ve paid back the loan in full.

All terms are for the Credit Suite business revenue lending program. Necessary collateral is consistent revenue verifiable through bank statements. Loan amounts run from $5,000 to $500,000. Terms are for 3 to 36 months. Pay a factor rate of 1.10 to 1.45%. Credit you must have a 500 credit score or higher, with no recent bankruptcies.

Business must earn annual revenue of $120,000 or more per year. You must be in business for a year or more. The business must do over 5 small transactions each month. Financial services industries are prohibited, damaged credit is acceptable. Or business must bring in at least $15,000 monthly revenue with 6 months’ time in business. To get this deal, you must provide the application and 6 months of business bank statements.

Fundbox

Get a line of credit from Fundbox. Fundbox just wants to know about your cash flow when deciding whether to fund your business. Fundbox will connect straight to your online accounting software. That’s all you need to do. You can get a revolving line of credit for up to $100,000. Fundbox will auto debit your weekly payment from your bank account. You don’t need to show a particular personal credit score. And you don’t need to show a certain time in business.

Fundbox: Terms and Qualifying

Pay in equal installments over the course of a 12 or 24 week plan. Available credit replenishes as you pay. There are no penalty to repay early. Your business must be American. You must have a 600 or better personal FICO score, and $100,000 or more in annual revenue. Also, you must have a business checking account. Ideally you must have 6 months in business or more.

Demolish your funding problems with 27 killer ways to get cash for your business.

PayPal Working Capital Loan

You can get a loan from PayPal. But you must already have a PayPal business account. There is no personal guarantee. Loan amounts and eligibility depend on your sales via PayPal. So applying won’t result in a credit check.

PayPal Working Capital Loan: Terms and Qualifying

The maximum loan amount depends on your PayPal account history. To be eligible, you must have a PayPal Premier or Business account for 90 days or more. Also, you must process at least $20,000 in annual PayPal sales if you have a Premier account, or at least $15,000 in annual PayPal sales if you have a Business PayPal account. Pay off any existing PayPal Working Capital loan.

Since automatic repayments get deducted as a percentage of each PayPal sale, the amount you repay each day changes with your sales volume. The more you sell, the more repayment progress you’ll make that day. On days without sales, you’ll make no payments, but you must repay something at least every 90 days.

Depending on the loan terms you choose, you must pay at least 5% or 10% of your total loan amount (loan + the fixed fee) every 90 days. The 5% minimum applies to loans estimated to take 12 months or more for repayment. This has a basis in your business’ past PayPal sales and other factors. The 10% option applies to loans estimated to be repaid within 12 months.

Square

You can get loans through Square. Applying will not affect your personal credit score. Loan eligibility comes from several factors related to your business, including its payment processing volume, account history, and payment frequency.

You can get $300 to $250,000. Borrowers get a customized offer with a basis in their card sales through Square. Then they choose their loan size. You will pay no interest, just an ongoing flat fee

Square: Terms and Qualifying

There are no ongoing interest charges. Instead, you will pay one fixed loan fee to borrow the loan. The fixed fee is the difference between the total owed amount and the initial loan amount. The fixed fee will never change, regardless of how fast or slow the loan is repaid. It is automatically deducted until you pay back your loan in full. If sales are up one day, you pay more; if you have a slow day, you pay less. At least 1/18 of the initial balance must be repaid every 60 days.

They don’t want collateral for business loans of $75,000 or less. For loans amounts over $75,000, they take a security interest in your business assets. Then they will file a UCC statement with the Secretary of State where your business is organized. There is no personal guarantee.

Demolish your funding problems with 27 killer ways to get cash for your business.

Cash Flow Financing: Takeaways

There are several options for business funding that depend on your cash flow. Some are available through Credit Suite. There are also online options, such as through PayPal and Square. Contact us today for help with your options.

The post Get Cash Flow Financing for Your Business – It Can Be a Great Way to Get Credit and Funding… appeared first on Credit Suite.

Get Sprinter Vans with Business Credit: We Show You How

Building Your Commercial Fleet of Sprinter Vans While You Build Your Business and Its Credit

Want or need sprinter vans for your business? Then you should be building business credit!

Your business doesn’t start off with good business credit already built. In much the same way, you probably didn’t start with any vehicles. Or, at least, not with business vehicles you wanted to keep. And even if you bought your business fully created, you can still build it to greater heights. For all three goals, it pays to work in an orderly fashion. Step by step, it all works together.

Building business credit will mean getting vendor accounts. Starting with vendor credit accounts is a proven way to start building business credit. But we don’t include vendors just because they report to the business credit reporting agencies. We include them and we talk about them because they have quality products that you can use and great customer service. They are not just a means to an end!

But let’s start off with some basics.

How Do Sprinter Vans and Business Credit Work Together?

In general, the term ‘sprinter van’ is used more or less synonymously with ‘cargo van’. But it’s actually the name of a line of vans made by Mercedes-Benz. However, much like the words ‘Kleenex’ and ‘tissue’, the brand name has entered the lexicon as a synonym for a more general term.

Sprinter Vans and Business Credit Together

Sprinter vans tend to be a bit taller than full-sized SUVs. Per Zip Recruiter, you generally don’t need a special commercial license to drive a sprinter van. But in some states you may need a chauffeur’s license if you’re driving passengers.

According to Car and Driver, “over 50 percent of Sprinter vans that are sold in the U.S. are used for commercial purposes. The other half of these vans are sold as passenger shuttles and recreational vehicles, such as limousines, office vans, family vans, wheelchair accessible vans, and golf vans.”

Sprinter vans can currently cost between $35,000 and $45,000 and that’s before you add options.

Building Business Credit the Right Way

Start with building business credit. But you can’t start with high limits. First build starter trade lines that report (vendor credit). Then you’ll have an established credit profile. Then you’ll get a business credit score. With an established business credit profile and score you can start getting high credit limits.

The Process

Use your credit and pay on time, just like you should with personal credit. These vendors we’ll show you will report to the business credit reporting agencies. And you’ll build a good business credit score.

But Just What is Starter Vendor Credit?

These trade lines are creditors who will give you initial credit when you have none now. These vendors typically offer terms such as Net 30, instead of revolving. So if you are approved for $1,000 in vendor credit and use all of it, you must pay that money back in a set term such as within 30 days on a Net 30 account. However, there are some revolving accounts which are still considered to be starter vendors.

Vendor Credit Accounts

You must pay net 30 accounts in full within 30 days. And you have to pay net 60 accounts in full within 60 days. Unlike with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you used.

To start your business credit profile the RIGHT way, you need to get approved for vendor accounts that report to the business CRAs. Once that’s done, you can then use the credit, pay back what you used, and the account is reported to Dun & Bradstreet, Experian, or Equifax, or some combination.

Details

Once reported, then you have trade lines, an established credit profile, and an established credit score. Using a newly established business credit profile and score, you can then get approval for more credit under your EIN. For vendor credit, you can often leave your SSN off the application since this credit isn’t on offer through a bank.

With and EIN and not your SSN on the application. the credit issuer pulls your EIN credit. They see a solid profile and score, and as a result can approve you for more credit. Keep in mind, credit through a bank will require your SSN. It’s an anti-money laundering requirement under federal law.

Vendor Credit Cards

Vendor credit cards will get business credit building for your business going. Once you’ve added payment experiences from three vendors, and they have reported to business CRAs like Dun & Bradstreet, you can start qualifying for fleet credit. Make sure business credit cards don’t report on your personal credit

Every step and every credit provider is designed to help your business. The idea is to help you qualify for business credit cards that you will actually use. This isn’t building for the sake of building, and it isn’t just to increase a number. These credit providers are going to have what your business needs to succeed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Business Credit Benefits

Keep in mind, business credit is independent of personal. Applying for it often won’t harm your personal credit scores, although it can if you offer a PG and then fail to pay. An inquiry will also impact personal credit. Too many inquires can hurt your ability to get an approval. Building this asset can only help your business. You can help your future business right now.

Vendor Credit Benefits

You MUST have 3 or more vendor accounts reporting to move onto more credit with higher limits and better terms, more reporting accounts are even better. It will take 30-90 days for those accounts to report, 60 days on average. Do NOT apply for tier 2 credit without having 3 or more accounts first.

Getting a Vendor to Pull Credit Under your EIN

Remember, there is no Social Security requirement for starter vendor credit. This is unlike bank loans and more universal business credit cards. So leave the field blank. Don’t fill in any other number, as that’s a violation of two Federal laws. A blank field will force them to pull your business credit under your EIN.

But note: some creditors will still require an SSN for verification purposes. You should present your SSN in this situation but make sure you aren’t agreeing a PG or personal credit check.

Building Business Credit – What You Really Need to Know

You won’t get a Visa or a MasterCard (more universal business credit cards) right away. You need to have credit to get more credit. Start building trade lines to get the big payoff. Getting initial credit is the hardest part. The vast majority of trade vendors who issue credit don’t report it to the business reporting agencies. So, you MUST find sources which actually report.

Using Business Credit Vendors

Check out three of our favorite starter vendors:

- 76

- Wex Fleet

- Marathon

All three come from Wex

76

Phillips 66 Company owns 76. It has more than 1,800 retail fuel sites in the United States. This card reports to D&B and Experian. But keep in mind: before applying for multiple accounts with WEX Fleet cards, make sure to leave enough time in between applying so that they don’t red flag your account for fraud.

Qualifying for 76

To qualify, you need the following:

- Your corporate entity must be in good standing with the applicable Secretary of State

- An EIN

- Company address matching everywhere

- D-U-N-S number from Dun & Bradstreet

- Your business license (if applicable)

- A business bank account

- Business phone number with a 411 listing

Your SSN is necessary for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can give a $500 deposit instead of using a personal guarantee if you’ve been in business less than a year. Apply online or over the phone. Terms are Net 15. You can use this card at any P66, 76, or Conoco fueling location.

Wex Fleet

They report to Experian and D&B. Wex offers universal fleet cards, heavy truck cards, and universally accepted business fleet cards. Their cards have features supporting a small business. This includes a rewards program. But before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying, so that they don’t red flag your account for fraud.

If you’re not approved based on business credit history, or been in business for at least a year, then a $500 deposit is needed or a Personal Guarantee. Apply online or over the phone. Terms: Net 15 (Wex Fleet Card), Net 22, or revolving (Wex FlexCard).

Qualifying for Wex Fleet

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- Business phone number with a 411 listing

Demolish your funding problems with 27 killer ways to get cash for your business.

Marathon

Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products throughout the United States. Their product line supports commercial, industrial, and retail operations. This card reports to Dun & Bradstreet and Experian. Remember: before applying for multiple accounts with WEX Fleet cards, make sure to have enough time in between applying so they don’t red-flag your account for fraud.

Qualifying for Marathon

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere.

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Business phone number with a 411 listing

Your SSN is necessary for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can provide a $500 deposit instead of using a personal guarantee if you’ve been in business less than a year. Apply online or over the phone. Terms are Net 15.

Let’s move onto what’s called fleet credit.

Fleet Credit

Fleet credit comes after starter vendors. It comes from places like Gulf and Exxon. You can use it to:

- Buy fuel

- Maintain vehicles of all sorts, including sprinter vans

- Repair vehicles

Even businesses which don’t have big fleets can still benefit. Yes, fleet credit works for sprinter vans. These are usually gas credit cards.

There may be a minimal time in business requirement. If your business can’t make a time in business requirement, you may be able to instead offer a personal guarantee or give a deposit to secure the credit.

Now that you’ve got a bunch of cards to support your fleet, it’s time to look at vehicle financing to buy the fleet!

Vehicle Financing

Much like you probably didn’t buy your personal vehicles outright, financing is a great way to get a vehicle now, without having to wait until you can just pay cash and drive it off the lot. With a fleet car, your choices are usually buying or leasing. Providers include banks like Bank of America or the financing arm of the manufacturer, such as Chrysler Capital.

Using Business Credit for Vehicle Financing

You can even finance a vehicle purchase or lease through our Business Credit Builder. These offers are in Tier 4, so they’re going to have certain requirements that business credit neophytes just won’t be able to meet. Lenders will want to see that you have the income to support the purchase.

Consider Ally Car Financing.

Ally Car Financing Through Credit Suite

Ally provides personal financing. But they will also report to business credit bureaus. If your business qualifies for financing without the owner’s guarantee, you can get financing in the business name only. Ally will report to D&B, Experian, and Equifax.

Qualifying for an Ally Commercial Line of Credit

You will need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Bank reference

- Fleet financing references

If you use a personal guarantee, Ally will not report to the personal credit bureaus unless the account defaults.

Qualifying for Ally Commercial Vehicle Financing

You can get a lease or a loan. To qualify, you need most of the same things as you need for an Ally Commercial Line of Credit, except for a bank reference and fleet financing references. There is no minimum time in business requirement. Apply in person only, as the dealer will advise if you have an approval or will need to provide a Personal Guarantee (PG).

Ford Commercial Vehicle Financing Through Credit Suite

Ford offers several commercial vehicle financing options. These include loans, lines, and leases to actual business entities. This is not for sole proprietorships. You can get a loan or a lease.

Ford may ask for a Personal Guarantee (PG) if you are not approved on the merit of your application. Apply at the dealership. Ford will report to D&B, Experian, and Equifax.

Qualifying for Ford Commercial Vehicle Financing

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Strong business credit history, with a good Experian business credit score.

Now that you’ve got the cars and the cards, it’s time to look at using your business credit for vehicle financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing

With commercial vehicle financing, business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report. Starting off by giving a personal guarantee means you can get money, and start building your commercial fleet, now instead of later.

PG (Personal Guarantee) Financing

According to Investopedia, a personal guarantee is “an individual’s legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.”

When you provide a personal guarantee, you are adding your Social Security number to the application. You should expect a hard inquiry. You’re also adding the details of your personal income to the application.

No PG (Personal Guarantee) Financing

With no PG financing, you can get higher limits and better terms. Continue to build exceptional business credit and pay your bills on time. In general, the following will eliminate the need to provide a personal guarantee for this type of financing:

- good business credit

- a decent amount of time in business or

- good personal credit

Much like with any other kind of business borrowing, the more assurances you can give the lender, the better.

Get Sprinter Vans with Business Credit: Takeaways

Use business credit to buy everything you need to run a fleet, from fuel to service. And use auto financing to buy your sprinter vans. Help make your business’s future bright – today! Let’s get together and have a conversation about getting started.

The post Get Sprinter Vans with Business Credit: We Show You How appeared first on Credit Suite.

You Can Get a Fantastic Business Credit Card Bonus – Check Out Our Top Choices

Looking for a Business Credit Card Bonus?

There are a lot of business credit cards out there. Choices can come from well-known providers, and not so well-known ones. If you’re looking for a business credit card bonus, then you’ve come to the right place.

What Sort of a Business Credit Card Bonus is Available?

In general, bonuses will come in the form of either cash or points, sometimes travel points. Although we did find one where you can get a bonus in bitcoin! Virtually always, you will have to spend a minimum amount within a particular time frame before you can get the bonus. To find the best deal for you, check out the details closely.

Business Credit Card Bonus in Generous Points, Not Requiring a High Minimum Spend

We start with cards which give generous point bonuses but don’t require that you spend an arm and a leg in order to get them.

Bremer Bank Visa Smart Business Rewards