Enforcement of the vaccine mandate began Sept. 13, after a weeks-long public service announcement campaign.

Tag: Businesses

Why Small Businesses Should Invest in Cybersecurity

Small businesses are often at the greatest risk of cyberattacks because of their lack of resources and inability to invest in cybersecurity. However, with limited ability to protect the network from malware, ransomware, trojans and viruses, these attacks could lead to financial ruin.

Learn about the risks you can face if you do not prioritize cybersecurity.

What are the Risks?

The risks of not having adequate cybersecurity include the cybercriminal being able to access the following sensitive information:

- Client lists

- Customers’ credit card details

- Company financial data

- Internal pricing, product, and structure

- Designs, manufacturing details, and company secrets

- Usernames, passwords, and employee records

- Company processes leading to revenue

These risks have a serious impact on the company and can cause the entire business to fold if attacks are successful.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

The Impact of Cyber Attacks

The primary effect of a cyberattack involves financial damage. But these incidents can also cause irreparable harm to the company’s reputation. Some cybercriminals are looking to steal data rather than usernames or passwords. This may lead to identity theft or a ransomware attack that locks down all computers until the demand for monetary compensation is met. If you have to tell customers there was a breach, this can damage the company’s reputation. You may need identity monitoring for customers or employees to protect possible loss of credit details and personal identifiable information.

Why Small Businesses are Easy Targets

The susceptibility of a small business lies in the lack of properly secured computers, networks, and systems. However, there are many other reasons why they are targeted, including:

- Data is valuable to anyone looking for it. Small businesses have plenty of it.

- Hackers can mine cryptocurrency with access to computer data or use it for DDoS attacks on other businesses.

- As an initial entry point, the small business can provide the cybercriminal with access to other financial institutions or businesses connected through its network.

- Hackers have easier entry into the system to wreak havoc or steal data because there is no dedicated IT team.

- Insufficient security measures lead to leaks in security with single computers and entire networks whether for work-at-home employees or daily processes.

- Inadequate cybersecurity and a lack of employee education = about it can lead to a breach and theft of information for future use by hackers.

- Financial data may provide hackers with sensitive customer details and connections to banks through leaks in security or breaches into the company.

How to Boost Your Cybersecurity

Adequate cybersecurity requires an understanding of what is lacking in securing your network. Having a dedicated IT team to support the company is vital. But it is not cheap. Boosting the business in this way requires covering the basics in software and hardware to defend against threats. And the company needs a business-wide policy on cybersecurity and employee education about possible cyber threats. This education should include how to handle mobile devices while on company grounds and away from them.

Keep security infrastructure up to date by automatically installing updates to your software. Continue improving and learn how to ensure software can spot possible problems. contingency plan in place. Business identity monitoring services can scan the dark web. They can look for stolen usernames, passwords, and personal identifiable information. Every business should have a response plan in place in case of a cyber attack.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Cybersecurity Myths

If your employees and stakeholders are not aware of the potential risks, they are more likely to fall prey to cyberattacks. Here are some common myths that prevent businesses from taking cybersecurity concerns seriously:

- The business is too small. But cybercriminals are willing to attack if there is any possibility of financial gain. 70% of small businesses report being victims of cyberattacks.

- If no products are sold, there is no worry. Every company has information, financial transactions, and user data. Yet with malware, ransomware and data breaches, a hacker can make money.

- The company has nothing of worth. But cybercriminals can hold business data hostage through ransomware and demand money to return access. Also, about 70% of attacks of ransomware involved small businesses in 2018.

- Our company information cannot be breached. Password protection ensures a solid defense. But all it takes is one employee to click on the wrong link in email or text to lead to a data breach.

- Employees are aware of phishing emails. But not all phishing uses email. So some attacks appear completely genuine. Instead, they may appear as vendors or customers.

- Cybersecurity requires a one-time setup. Rather, proper cybersecurity is a never-ending, ongoing process.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Conclusion

Cybersecurity is a vital part of any business. But with proper protocols in place, a plan, and a team dedicated to protecting the company, you can safeguard company information from many breaches. Also, always stay updated and remain informed of the newest changes in data security.

BIO

David Lukić is an information privacy, security and compliance consultant at IDstrong.com. The passion to make cyber security accessible and interesting has led David to share all the knowledge he has.

The post Why Small Businesses Should Invest in Cybersecurity appeared first on Credit Suite.

Establish and Maintain Rock-Solid Business Credit When You Have No Business Credit. Check Out 3 Well-Known Starter Vendors for Business Credit That Will Happily Extend Credit to New and Established Businesses

Building The Perfect Business Credit Portfolio with Starter Vendors for Business Credit

A perfect business credit portfolio means working with starter vendors for business credit. Starting with vendor credit accounts is a proven way to start building business credit. But we don’t include vendors just because they report to the business credit reporting agencies. We include them and we talk about them because they have quality products that you can use, and great customer service. They are not just a means to an end!

Vendor Credit Cards

Vendor credit cards will kick off business credit building for your business. First, add payment experiences from three vendors. Then they must report to business CRAs like Dun & Bradstreet. And then you can start qualifying for store credit, and fleet credit as well. Make sure business credit cards don’t report on your personal credit.

Every step and every credit provider works to help your business. The idea is to help you qualify for business credit cards that you will actually use. This isn’t building for the sake of building, and it isn’t just to increase a number. These credit providers are going to have what your business needs to succeed.

Business Credit with Starter Vendors for Business Credit

Keep in mind, business credit is independent of personal. Applying for it won’t harm your personal credit scores. Building this asset can only help your business. You can help your future business right now.

Business credit doesn’t just happen. You have to actively build it. It all starts with starter vendors. They will approve your business for credit with little fuss.

Use your credit. Pay on time, just like you should with personal credit. These vendors will report to the business credit reporting agencies. And you’ll build a good business credit score.

How to Build Business Credit

Having an EIN doesn’t mean you have established credit. If you go to a bank to try and get bank credit cards using your EIN with no credit established, you’ll get denials. That is unless you have good personal credit and use it to get approvals while supplying your personal guarantee. But it doesn’t have to be that way.

You can’t start with high limits. First you must build starter trade lines that report (vendor credit). Then you’ll have an established credit profile. Then you’ll get a business credit score. With an established business credit profile and score you can start getting high credit limits.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines

What is Starter Vendor Credit?

These trade lines are creditors who will give you initial credit when you have none now. These vendors typically offer terms such as Net 30, instead of revolving. So if you get approval for $1,000 in vendor credit and use it all, you must pay that money back in a set term. That is, within 30 days on a Net 30 account. But there are some revolving accounts which we still consider to be starter vendors.

You must pay net 30 accounts in full within 30 days. And you must pay net 60 accounts in full within 60 days. Unlike with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you used.

Getting Started

To start your business credit profile the RIGHT way, get approval for vendor accounts that report to business CRAs. Once accomplished, you can then use the credit. Pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Once reported, then you have trade lines, an established credit profile, and an established credit score. Using a newly established business credit profile and score, you can then get approval for more credit under your EIN. For vendor credit, you can leave your SSN off the application. Then the credit issuer then pulls your EIN credit, sees a solid profile and score. They can then approve you for more credit.

Building Business Credit – What You Really Need to Know

Not ALL retailers will approve you just because of your credit profile and score. Some sources can also have a time in business requirement. You may need to be in business 1-3 years to get credit not requiring a personal guarantee. Some sources might require you meet certain revenue requirements for as well. But many starter vendors will approve you without these requirements.

But Keep in Mind

You won’t get a Visa or a MasterCard (bank credit cards) right away. And you need to have credit to get more credit. You need to start building trade lines to get the big payoff. Getting initial credit is the hardest part. Over 97% of trade vendors who issue credit don’t report it to the business reporting agencies. So, you MUST find sources which actually report.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

There are Benefits to Starter Vendors for Business Credit

Vendor credit is an important step in building business credit. Vendor credit is easier to get than retail or fleet credit. It can lead to more retail and fleet credit. Establishing credit will lead to lenders approving you. And best of all, this process is PROVEN to work! Just like for all credit, be responsible and pay on time.

More Benefits of Starter Vendors for Business Credit

You MUST have 3 or more vendor accounts reporting to move onto retail credit, and more are even better. It will take 30-90 days for those accounts to report. It’s 60 days on average. Do NOT apply for retail credit without having 3 or more accounts first.

Getting Starter Vendors for Business Credit to Pull Credit Under your EIN

There is no Social Security requirement for starter vendor credit. This is unlike bank loans and bank cards. So leave the field blank. Don’t fill in any other number, as that’s a violation of two Federal laws. A blank field will force them to pull your business credit under your EIN. Also, if there is a credit check, then it is perfectly permissible to provide the company’s EIN. You can use an EIN, rather than your Social Security Number and date of birth.

Using Business Credit

Check out FOUR of our favorite starter vendors for business credit:

- Grainger

- Uline

- Marathon

- Supply Works

Grainger Industrial Supply

They sell hardware, power tools, pumps and more. They also do fleet maintenance

Grainger will report to Dun and Bradstreet. If a business doesn’t have established credit, they will want to see more documents. These include accounts payable, income statement, balance sheets, etc. Terms are Net 30, Net 45, Net 60, or Net 90.

Qualifying for Grainger Industrial Supply

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- And your business must be registered to Secretary of State (SOS) for at least 60 days

Apply online or over the phone.

Uline

They sell shipping, packing and industrial supplies. They report to Dun & Bradstreet and Experian. You MUST create an account with Uline before starting to build business credit with them. Terms are Net 30.

Qualifying for Uline

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- And a business phone number listed in 411

- You must have a D&B PAYDEX score of 80 or better

Application may get approval for net 30 at time of order. Upon final review, Credit Department may change to a few prepaid orders, before granting Net 30.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Marathon

Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products throughout the United States. Their product line supports commercial, industrial, and retail operations. This card reports to Dun & Bradstreet and Experian. Before applying for more than one account with WEX Fleet cards, make sure to have enough time between applying. This is so they don’t red-flag your account for fraud.

Qualifying for Marathon

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere.

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Business phone number listed on 411

Your SSN is necessary for informational purposes. If concerned they will pull your personal credit talk to their credit department before applying. You can give a $500 deposit instead of using a personal guarantee, if in business less than a year. Apply online or over the phone. Terms are Net 15.

Supply Works

Supply Works is a part of Home Depot. They offer integrated facility maintenance supplies. But they will not accept virtual addresses. They will report to Experian. Terms are Net 30. Apply online or over the phone.

Qualifying for Supply Works

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- Trade/Bank references

- There is no minimal time in business requirement

Extra BONUS Vendor: Wex Fleet

They report to Experian and D&B. They offer universal fleet cards, heavy truck cards, and universally accepted business fleet cards. Their cards have features supporting a small business. This includes a rewards program. Before applying for more than one account with WEX Fleet cards, make sure to have enough time between applying. This is so they don’t red flag your account for fraud.

If you don’t get an approval on the basis of business credit history, or been in business 1 year, then a $500 deposit is necessary or a Personal Guarantee. You can apply online or over the phone. Terms are Net 15 (Wex Fleet Card), Net 22, or revolving (Wex FlexCard).

Qualifying for Wex Fleet

You need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address (matching everywhere)

- D-U-N-S number

- Business License (if applicable)

- Business Bank account

- And a Business Phone Number Listed in 411

Starter Vendors for Business Credit: Takeaways

Starter vendors are a PROVEN way to get the business credit ball rolling. They will approve you with minimal fuss. Certain requirements repeat. These include needing to have EIN and D-U-N-S numbers. And having proper licensing (if your industry requires that). Hence getting those details squared away is a smart step to take first. Want more help with building business credit? Ask us how we can help you – including our access to literally HUNDREDS of vendors. Let’s take the next steps together

The post Establish and Maintain Rock-Solid Business Credit When You Have No Business Credit. Check Out 3 Well-Known Starter Vendors for Business Credit That Will Happily Extend Credit to New and Established Businesses appeared first on Credit Suite.

Use This Secret Weapon to Slay Your Funding Foes and Find the Best Sources of Alternative Loans for Businesses

Are you struggling to get funding for your business? Never fear, alternative loans for businesses are here. They tend to get a bad rap. This is mostly due to the fact that predatory lending runs rampant in today’s world, and it’s hard to know who to trust and who is scamming you. However, not all sources of alternative business financing are created equal.

10 Alternative Loans for Businesses to Help Your Business Soar

Nothing is guaranteed and things change every day. Still, at the moment, these 10 alternative lenders for small business tend to work well for many. They also offer a wide range of alternative business financing options to fit a variety of needs.

Learn business loan secrets and get money for your business.

Fundation

When it comes to alternative loans for businesses, Fundation provides both term business loans and lines of credit. It is most known for its working capital financing options. These are funds meant to help cover the day-to-day costs of running a business rather than larger projects.

StreetShares

StreetShares has its roots in lending to veterans. They still hold true to that mission, but now offer term loans, lines of credit, and contract financing to all types of business owners. The maximum loan amount is $250,000, and preapproval only takes a few minutes. They use a soft pull on your credit so it doesn’t affect your score.

BlueVine

There are two options for small business financing with BlueVine. They include lines of credit and invoice factoring. Minimum loan amount is $5,000 and maximum loan amount is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business at least 6 months. Personal credit score has to be 600 or above.

Fundbox

With Fundbox, you get an online lender that offers a super-fast automated process. Originally, they only had invoice financing. Yet, now they offer a line of credit service as well. Repayments are automatic on a weekly basis. So,be sure you have enough funds in whatever account you let them draft from to cover your payment each week.

Kiva

Kiva is an online lender that is a little different. For example, the interest rate is 0%. That means even though you have to pay it back, it is absolutely free money. They don’t even check your credit. There is one catch though. You have to get at least 5 family members or friends to throw some money in the pot as well. In addition, you have to pitch in a $25 loan to another business on the platform.

Learn business loan secrets and get money for your business.

Fora Financial

Fora Financial was founded in 2008 by college roommates. It now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

OnDeck

Obtaining financing from OnDeck is quick and easy. First, you apply online. If you receive approval, your loan funds will go directly to your bank account.

Lendio

The secret to Lendio’s success is excellent customer service and a short, easy application process. The loan-connections service it offers slashes the time it takes to find the right alternative loans for businesses. This is due to its heavily vetted network of lenders.

Credibly

Credibly is a specialized lender offering unsecured business loans online. The application process and funding can be complete in as little as two days, sometimes less. They offer daily and weekly repayment options.

Upstart

Upstart uses a completely innovative platform for loans. They choose to use a combination of artificial intelligence (AI) and machine learning to gather alternative data for use in making credit decisions.

This may include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities.

Learn business loan secrets and get money for your business.

Warning: Alternative Loans for Businesses Aren’t for Everyone

Despite the fact that these alternative lending companies tend to offer alternative loans for businesses with less stringent requirements, they won’t work for everyone. Alternative financing methods are just not always a good fit. Here is another other option. Keep reading to the end for a sure-fire way to ensure you can always qualify for the business funding you need when you need it.

The Credit Line Hybrid

What if there were alternative financing options that allowed you to have an even better interest rate than a secured loan, and yet get the money faster and easier than any type of traditional funding. What if you could get business funding without having to supply bank statements or check stubs? This is exactly what the Credit Line Hybrid offers.

This is alternative funding for small business that allows you to fund your business without putting up collateral. You only pay back what you use. You do need good personal credit however. That is, your personal credit score should be at least 680. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months, you should have less than 6 credit inquiries. Also, you should have less than a 45% balance on all business and personal credit cards. In addition, you need at least 2 credit cards with at least 2 years credit history.

If you don’t meet all those requirements, you can still qualify. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

Use This Secret Weapon and Always Get the Business Funding You Need

To be eligible for the highest limits and best rates when it comes to business credit, your business has to be fundable. There are over 100 factors that impact the fundability of a business. It is a complicated web to weave through. Things from decades ago, long before you ever imagined owning a business, can affect fundability.

The key to having a strong, fundable business that can qualify for any funding is to work with a business credit expert. What can a business credit expert do for you?

- Help you assess the current fundability of your business

- Guide you to the most effective and efficient ways to improve fundability if necessary

- Help you find the best funding options for your business right now

- Guide you in what specific, actionable steps you need to take to qualify for more funding with better rates

- Leverage lender relationships to cut through a lot of the red tape and bureaucracy that can keep borrowers from getting the information they need, when they need it

It’s common for a borrower to call a lender or vendor credit department directly and not be able to find out if they report to the business credit reporting agencies, or exactly what they are looking for when it comes to credit approval.

A business credit expert already knows a lot of this information, and what they don’t know, they know how to get. They also know their way around alternative sources of financing for business, so they can offer guidance in this area as well.

This is your number one top-secret weapon to getting your business to a point where you know you can get funding when you need it. Try a free consultation with a Credit Suite business credit expert to get started now.

The post Use This Secret Weapon to Slay Your Funding Foes and Find the Best Sources of Alternative Loans for Businesses appeared first on Credit Suite.

Use This Secret Weapon to Slay Your Funding Foes and Find the Best Sources of Alternative Loans for Businesses

Are you struggling to get funding for your business? Never fear, alternative loans for businesses are here. They tend to get a bad rap. This is mostly due to the fact that predatory lending runs rampant in today’s world, and it’s hard to know who to trust and who is scamming you. However, not all … Continue reading Use This Secret Weapon to Slay Your Funding Foes and Find the Best Sources of Alternative Loans for Businesses

Get Grants for Small Black Owned Businesses

Check out Business Grants for Small Black Owned Businesses and So Much More

Are you one of the millions of black business owners in the US? Or are you starting a business? Money is always going to be an issue. What if you could get what is essentially free money? That’s what grants are (for the most part). Yes, you can get grants for small black owned businesses.

Looking for Grants for Small Black Owned Businesses – and Other Options

How do you find the best options for you? How do you know if you need to be looking for grants or business loans? We recommend that you explore every option. This is because it will probably take a combination of funding options to fully fund your business.

Funding and Grants for Small Black Owned Businesses

There are grants for black business owners, but not necessarily for them exclusively. Still, there are other funding choices out there. Loans, crowdfunding, and even angel investors are all viable options. More on those later.

Business Grants for Small Black Owned Businesses

The government and private organizations want to GIVE you money! Though highly competitive and rarely enough to fund a business on their own, grants are a great way to supplement other business funding. And they are still worth the effort to apply. There really isn’t anything to lose except time – it’s free money. Here are a few you can start with.

The Minority Business Development Agency

The Minority Business Development Agency (MBDA) is operated by the US Department of Commerce. It is dedicated to helping minority-owned businesses access the resources they need to grow and succeed. The MBDA is for both men and women. Grant competitions are regularly changing.

Visit the MBDA’s website for information on all current opportunities. Currently, the MBDA helps its members apply for grants via Grants.gov. This involves help with how to apply for government grants. See mbda.gov/grants.

Enterprising Women of Color Initiative

The MBDA oversees the Enterprising Women of Color (EWOC) Initiative. The initiative works to focus on the fast-expanding minority women entrepreneur population as a revenue generators for families, communities, and the nation. Minority women are the fastest growing population of entrepreneurs. While many women are making tremendous strides in the business world, they still face obstacles as entrepreneurs.

MBDA serves as an advocate for women’s economic empowerment, by supporting efforts to advance women’s equality and promote women economic advancement programming. The vision of EWOC is to ensure women worldwide to reach their economic potential. See mbda.gov.

The Verizon Small Business Recovery Fund

The Verizon Small Business Recovery Fund is new. It was established in response to the COVID-19 pandemic. The fund offers $10,000 to successful applicants. The fund is specifically focused on providing grants to business owners of color, women-owned businesses, and other underrepresented entrepreneurs. See lisc.org/covid-19/small-business-assistance/small-business-relief-grants/verizon-small-business-recovery-fund

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge has cash prizes ranging from $1,000 to $50,000. The association states its purpose is to help newer businesses that have an African American ownership. This is a pitch competition for startup businesses. See nbmbaa.org/scale-up-pitch-challenge.

Demolish your funding problems with 27 killer ways to get cash for your business.

Amber Grant

Black businesswomen have even more options open to them. The Amber Grant awards one prize of $10,000 per month to a woman-owned business. One of the recipients also receives an additional $25,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee. See ambergrantsforwomen.com/get-an-amber-grant/apply-now

Cartier Women’s Initiative Award

Black businesswomen can also try for a Cartier award. This award is for women and there’s no specification that a woman be a member of a minority group. The Cartier Women’s Initiative Award has a regional category award and a science and technology award. The regional award is $100,000 for first place, with $30,000 for second and third place.

The award goes to three women from each of seven international regions. This award is a grant to 21 female business owners from around the world each year. Women business owners who are just getting started may qualify. Look over the complete application for more information. See cartierwomensinitiative.com/about-us

Cartier Science and Technology Pioneer Award and Fellowship

The Cartier Science and Technology Pioneer award is new as of 2021. With this award, three more women impact entrepreneurs at the forefront of scientific and technological innovation will be recognized for a new thematic award. Open to women entrepreneurs from any country and sector, this award will highlight disruptive solutions built around unique, protected, or hard-to-reproduce technological or scientific advances.

The laureate will be awarded a $100,000 grant. Each of the two remaining finalists will receive a $30,000 grant.

Cartier also offers a fellowship program. The fellowship is an educational program geared towards the 24 fellows selected each year. This program aims to equip the fellows with the necessary skills to grow their business. Also, it helps them to build their leadership capacity by drawing upon the experience and expertise of an array of academics, practitioners, industry experts, and entrepreneurs.

The fellowship isn’t exactly a grant. But while it’s not a monetary award, the mentoring and networking opportunities could be worthwhile to apply for. See cartierwomensinitiative.com/fellowship-programme.

Demolish your funding problems with 27 killer ways to get cash for your business.

The Native American Business Development Institute (NABDI) Grant

Are you also part Native American? Then check out this grant.

The NABDI Grant is funded by the US Department of the Interior’s Bureau of Indian Affairs. It provides funding to business owners of Native American or Alaskan Native descent. In 2019, the program provided more than $727,000 to 21 indigenous tribes, to support economic feasibility studies for specific economic development projects or business startups.

For 2020, NABDI planned to award 20-25 grants. There is no minimum or maximum amount of funding that can be requested, but most awards range in value from $25,000 to $75,000. They only fund projects for one year at a time, which is when they expect projects to be completed. To apply for a NABDI grant for your proposed economic development feasibility study, go to bia.gov/service/grants/tedc/apply-nabdi-grant.

Indian Affairs

For black business owners who also have Native American heritage, it doesn’t stop there. There is more available via the Bureau of Indian Affairs. Businesses owned by Native Americans can get financing from the federal government through the Indian Affairs branch. An individual can fill out an application for up to $500,000, but business entities and tribal enterprises may apply for more.

Potential borrowers can apply with any lending institution, they just have to use the application for Indian Affairs. There are additional requirements if you use the funds for construction, renovation, or refinancing. In general, you must supply a list of collateral, a credit report, and an analysis of business operations. See bia.gov/as-ia/ieed/loan-guaranty-insurance-and-interest-subsidy-program.

The South Asian Arts Resiliency Fund

If your business is in the arts, and you’re also of South Asian descent, then check out this fund. The fund is run by the India Center Foundation. It supports US-based South Asian arts workers impacted by the COVID-19 pandemic.

The fund will disburse grants up to $2,000, depending on financial need to US-based arts workers of South Asian descent. This includes those in the performing arts, film, visual arts, and literature with heritage from Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. Initial funding for the program is $20,000, but the India Center Foundation is soliciting donations to expand the grant program.

Eligibility for The South Asian Arts Resiliency Fund

To be eligible, applicants must be of South Asian descent. Also, they must work in the arts and demonstrate loss of income due to COVID-19. Also, applicants must be:

- at least 21 years old

- not enrolled in a degree program, and

- able to receive taxable income in the US

You can put grant funding toward any artistic project you can develop, create, and present within four to six weeks of getting funding. See theindiacenter.us/artsfund.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grants.gov

Grants.gov is a running list of more than 1,000 available federal government grants. The website compiles grants from over two dozen government agencies. These include the SBA, USDA, and the US Department of Commerce. To find a grant right for your business, use the Search Grants tool on the website. You can sort through the list of grants by keyword or opportunity number.

Once you have located the grant you wish to apply for, click the opportunity number for more detail. There, you will find more information about the specific grant as well as any associated documentation you may need. To apply for a grant through Grants.gov, you must first register. Then, you can download an application package for the grant you want to get. Be ready for a lengthy process. See grants.gov.

An Alternative to Grants for Small Black Owned Businesses: Angel Investors

Angel investors are informal investors. Essentially, you are selling a part of your business to them. They tend to not want a huge percentage of your business. Also, they won’t pass by more conventional businesses, like with crowdfunding and venture capital. Hence they can be another supplement or replacement for grants.

An Alternative to Grants for Small Black Owned Businesses: Crowdfunding

If you would rather not rely on grants so much to fund your business, crowdfunding is a viable option. Keep in mind, not everyone with a campaign on a crowdfunding site is successful. More unique products and services tend to do better. Kickstarter and Indiegogo are two of the most popular crowdfunding platforms to use. Some platforms may have higher success rates than others.

An Alternative to Grants for Small Black Owned Businesses: Loans

If grants aren’t an option, loans might work for you.

Business Center for New Americans

If you’re an immigrant, then try the Business Center for New Americans. They offer a pilot program for microloans up to $75,000. They work with immigrants, refugees, women, and other minority entrepreneurs. The goal is to help minority business owners who have not been able to get traditional financing. Terms are 3% interest. Loan repayment term goes up to a year. See accompanycapital.org.

Grants for Small Black Owned Businesses: Takeaways

There are several options for grants for black owned businesses. Black entrepreneurs should apply for whichever grants they feel they are most likely to get. Other options for funding include crowdfunding, angel investors, and loans. Credit Suite can help you get the funding you need.

The post Get Grants for Small Black Owned Businesses appeared first on Credit Suite.

Get Grants for Small Black Owned Businesses

Check out Business Grants for Small Black Owned Businesses and So Much More Are you one of the millions of black business owners in the US? Or are you starting a business? Money is always going to be an issue. What if you could get what is essentially free money? That’s what grants are (for … Continue reading Get Grants for Small Black Owned Businesses

Grants for Small Black Owned Businesses

Check out Business Grants for Small Black Owned Businesses and So Much More

Are you one of the millions of black business owners in the US? Or are you starting a business? Money is always going to be an issue. What if you could get what is essentially free money? That’s what grants are (for the most part). Yes, you can get grants for small black owned businesses.

Looking for Grants for Small Black Owned Businesses – and Other Options

How do you find the best options for you? How do you know if you need to be looking for grants or business loans? We recommend that you explore every option. This is because it will probably take a combination of funding options to fully fund your business.

Funding and Grants for Small Black Owned Businesses

There are grants for black business owners, but not necessarily for them exclusively. Still, there are other funding choices out there. Loans, crowdfunding, also angel investors are all viable options. More on those later.

Business Grants for Small Black Owned Businesses

The government and private organizations want to GIVE you money! Though highly competitive and rarely enough to fund a business on their own, grants are a great way to supplement other business funding. And they are still worth the effort to apply. There really isn’t anything to lose except time – it’s free money. Here are a few you can start with.

The Minority Business Development Agency

The Minority Business Development Agency (MBDA) is operated by the US Department of Commerce. It is dedicated to helping minority-owned businesses access the resources they need to grow and succeed. The MBDA is for both men and women. Grant competitions are regularly changing.

Visit the MBDA’s website for information on all current opportunities. Currently, the MBDA helps its members apply for grants via Grants.gov. This also involves help with how to apply for government grants. See mbda.gov/grants.

Enterprising Women of Color Initiative

The MBDA also oversees the Enterprising Women of Color (EWOC) Initiative. The initiative works to focus on the fast-expanding minority women entrepreneur population as a revenue generators for families, communities, and the nation. Minority women are the fastest growing population of entrepreneurs. While many women are making tremendous strides in the business world, they still face obstacles as entrepreneurs.

MBDA serves as an advocate for women’s economic empowerment, by supporting efforts to advance women’s equality and promote women economic advancement programming. The vision of EWOC is to ensure women worldwide to reach their economic potential. See mbda.gov.

The Verizon Small Business Recovery Fund

The Verizon Small Business Recovery Fund is new. It was established in response to the COVID-19 pandemic. The fund offers $10,000 to successful applicants. The fund is specifically focused on providing grants to business owners of color, women-owned businesses, and other underrepresented entrepreneurs. See lisc.org/covid-19/small-business-assistance/small-business-relief-grants/verizon-small-business-recovery-fund

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge has cash prizes ranging from $1,000 to $50,000. The association states its purpose is to help newer businesses that have an African American ownership. This is a pitch competition for startup businesses. See nbmbaa.org/scale-up-pitch-challenge.

Demolish your funding problems with 27 killer ways to get cash for your business.

Amber Grant

Black businesswomen have even more options open to them. The Amber Grant awards one prize of $10,000 per month to a woman-owned business. One of the recipients also receives an additional $25,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee. See ambergrantsforwomen.com/get-an-amber-grant/apply-now

Cartier Women’s Initiative Award

Black businesswomen can also try for a Cartier award. This award is for women and there’s no specification that a woman be a member of a minority group. The Cartier Women’s Initiative Award has a regional category award and a science and technology award. The regional award is $100,000 for first place, with $30,000 for second and third place.

The award goes to three women from each of seven international regions. This award is a grant to 21 female business owners from around the world each year. Women business owners who are just getting started may qualify. Look over the complete application for more information. See cartierwomensinitiative.com/about-us

Cartier Science and Technology Pioneer Award and Fellowship

The Cartier Science and Technology Pioneer award is new as of 2021. With this award, three more women impact entrepreneurs at the forefront of scientific and technological innovation will be recognized for a new thematic award. Open to women entrepreneurs from any country and sector, this award will highlight disruptive solutions built around unique, protected, or hard-to-reproduce technological or scientific advances.

The laureate will be awarded a $100,000 grant. Each of the two remaining finalists will receive a $30,000 grant.

Cartier also offers a fellowship program. The fellowship is an educational program geared towards the 24 fellows selected each year. This program aims to equip the fellows with the necessary skills to grow their business. Also, it helps them to build their leadership capacity by drawing upon the experience and expertise of an array of academics, practitioners, industry experts, and entrepreneurs.

The fellowship isn’t exactly a grant. But while it’s not a monetary award, the mentoring and networking opportunities could be worthwhile to apply for. See cartierwomensinitiative.com/fellowship-programme.

Demolish your funding problems with 27 killer ways to get cash for your business.

The Native American Business Development Institute (NABDI) Grant

Are you also part Native American? Then check out this grant.

The NABDI Grant is funded by the US Department of the Interior’s Bureau of Indian Affairs. It provides funding to business owners of Native American or Alaskan Native descent. In 2019, the program provided more than $727,000 to 21 indigenous tribes, to support economic feasibility studies for specific economic development projects or business startups.

For 2020, NABDI planned to award 20-25 grants. There is no minimum or maximum amount of funding that can be requested, but most awards range in value from $25,000 to $75,000. They only fund projects for one year at a time, which is when they expect projects to be completed. To apply for a NABDI grant for your proposed economic development feasibility study, go to bia.gov/service/grants/tedc/apply-nabdi-grant.

Indian Affairs

For black business owners who also have Native American heritage, it doesn’t stop there. There is more available via the Bureau of Indian Affairs. Businesses owned by Native Americans can get financing from the federal government through the Indian Affairs branch. An individual can fill out an application for up to $500,000, but business entities and tribal enterprises may apply for more.

Potential borrowers can apply with any lending institution, they just have to use the application for Indian Affairs. There are additional requirements if you use the funds for construction, renovation, or refinancing. In general, you must supply a list of collateral, a credit report, and an analysis of business operations. See bia.gov/as-ia/ieed/loan-guaranty-insurance-and-interest-subsidy-program.

The South Asian Arts Resiliency Fund

If your business is in the arts, and you’re also of South Asian descent, then check out this fund. The fund is run by the India Center Foundation. It supports US-based South Asian arts workers impacted by the COVID-19 pandemic.

The fund will disburse grants up to $2,000, depending on financial need to US-based arts workers of South Asian descent. This includes those in the performing arts, film, visual arts, and literature with heritage from Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. Initial funding for the program is $20,000, but the India Center Foundation is soliciting donations to expand the grant program.

Eligibility for The South Asian Arts Resiliency Fund

To be eligible, applicants must be of South Asian descent. Also, they must work in the arts and demonstrate loss of income due to COVID-19. Also, applicants must be at least 21 years old. And they cannot be enrolled in a degree program. Also, they have to be able to receive taxable income in the US.

You can put grant funding toward any artistic project you can develop, create, and present within four to six weeks of getting funding. See theindiacenter.us/artsfund.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grants.gov

Grants.gov is a running list of more than 1,000 available federal government grants. The website compiles grants from over two dozen government agencies. These include the SBA, USDA, and the US Department of Commerce. To find a grant right for your business, use the Search Grants tool on the website. You can sort through the list of grants by keyword or opportunity number.

Once you have located the grant you wish to apply for, click the opportunity number for more detail. There, you will find more information about the specific grant as well as any associated documentation you may need. To apply for a grant through Grants.gov, you must first register. Then, you can download an application package for the grant you want to get. But also be ready for a lengthy process. See grants.gov.

An Alternative to Grants for Small Black Owned Businesses: Angel Investors

Angel investors are informal investors. Essentially, you are selling a part of your business to them. Also, they tend to not want a huge percentage of your business. Also, they won’t pass by more conventional businesses, like with crowdfunding and venture capital. Hence they can be another supplement or replacement for grants.

An Alternative to Grants for Small Black Owned Businesses: Crowdfunding

If you would rather not rely on grants so much to fund your business, crowdfunding is a viable option. Also keep in mind, not everyone with a campaign on a crowdfunding site is successful. More unique products and services tend to do better. Kickstarter and Indiegogo are two of the most popular crowdfunding platforms to use. Some platforms may have higher success rates than others.

An Alternative to Grants for Small Black Owned Businesses: Loans

If grants aren’t an option, loans might work for you.

Business Center for New Americans

If you’re also an immigrant, try the Business Center for New Americans. They offer a pilot program for microloans up to $75,000. They work with immigrants, refugees, women, and also other minority entrepreneurs. The goal is to help minority business owners who have not been able to get traditional financing. Also, terms are 3% interest. Loan repayment term goes up to a year. See accompanycapital.org.

Grants for Small Black Owned Businesses: Takeaways

There are several options for grants for black owned businesses. Black entrepreneurs should apply for whichever grants they feel they are most likely to get. Other options for funding include crowdfunding, angel investors, and loans. Credit Suite can help you get the funding you need.

The post Grants for Small Black Owned Businesses appeared first on Credit Suite.

There are Terrific Grant Funding Opportunities Out There for Small Businesses

Check Out Exceptional Grant Funding Opportunities

Are you looking for grant funding opportunities? Grants are exceptionally competitive, and they often require filling out a lot of paperwork. Still, if you can get them, they are essentially free money. So, if you feel you have a better than 50% chance, then it makes sense to go after appropriate grants.

It tends to help if you are a member of a minority or a protected class. Also, it can help if you are bringing in something new to an area that needs it. For example, rural electrification grants seem to always be available.

Let’s start with entrepreneurs who are members of minorities and protected classes.

Business Grant Funding Opportunities for Women

As female entrepreneurs continue to come into their own, the government and private ventures offer more grant funding opportunities. Here are a few to get you going.

Amber Grant

Women have some great grants open to them. The Amber Grant awards one prize of $10,000 per month to a woman-owned business. One of the recipients also receives an additional $25,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee. See ambergrantsforwomen.com/get-an-amber-grant/apply-now

Cartier Women’s Initiative Award

Businesswomen can also try for a Cartier award. This award is for women of all classes and groups. The Cartier Women’s Initiative Award has a regional category award and a science and technology award. The regional award is $100,000 for first place, with $30,000 for second and third place.

The award goes to three women from each of seven international regions. This award is a grant to 21 female business owners from around the world each year. Women business owners who are just getting started may qualify. Look over the complete application for more information. See cartierwomensinitiative.com/about-us

Cartier Science and Technology Pioneer Award and Fellowship

The Cartier Science and Technology Pioneer award is new as of 2021. With this award, three more women impact entrepreneurs at the forefront of scientific and technological innovation will be recognized for a new thematic award. Open to women entrepreneurs from any country and sector, this award will highlight disruptive solutions built around unique, protected, or hard-to-reproduce technological or scientific advances.

The laureate will be awarded a $100,000 grant. Each of the two remaining finalists will receive a $30,000 grant.

Cartier also offers a fellowship program. The fellowship is an educational program geared towards the 24 fellows selected each year. This program aims to equip the fellows with the necessary skills to grow their business. Also, it helps them to build their leadership capacity by drawing upon the experience and expertise of an array of academics, practitioners, industry experts, and entrepreneurs.

The fellowship isn’t exactly a grant. But while it’s not a monetary award, the mentoring and networking opportunities could be worthwhile to apply for. See cartierwomensinitiative.com/fellowship-programme.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grant Funding Opportunities for Black Business Owners

Entrepreneurs who are African American have other choices when it comes to grants. And for persons who are members of more than one minority – such as black women or people who are both Asian and Native American – there are more choices.

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge has cash prizes ranging from $1,000 to $50,000. The association states its purpose is to help newer businesses that have an African American ownership. This is a pitch competition for startup businesses. See nbmbaa.org/scale-up-pitch-challenge.

The Minority Business Development Agency

The Minority Business Development Agency (MBDA) is operated by the US Department of Commerce. It is dedicated to helping minority-owned businesses access the resources they need to grow and succeed. The MBDA is for both men and women. Grant competitions are regularly changing.

Visit the MBDA’s website for information on all current opportunities. Currently, the MBDA helps its members apply for grants via Grants.gov. This involves help with how to apply for government grants. See mbda.gov/grants.

Enterprising Women of Color Initiative

The MBDA oversees the Enterprising Women of Color (EWOC) Initiative. The initiative works to focus on the fast-expanding minority women entrepreneur population as a revenue generators for families, communities, and the nation. Minority women are the fastest growing population of entrepreneurs. While many women are making tremendous strides in the business world, they still face obstacles as entrepreneurs.

MBDA serves as an advocate for women’s economic empowerment, by supporting efforts to advance women’s equality and promote women economic advancement programming. The vision of EWOC is to ensure women worldwide to reach their economic potential. See mbda.gov.

Grant Funding Opportunities for Native American Entrepreneurs

The Native American Business Development Institute (NABDI) Grant

Are you all or part Native American? Then check out this grant.

The NABDI Grant is funded by the US Department of the Interior’s Bureau of Indian Affairs. It provides funding to business owners of Native American or Alaskan Native descent. In 2019, the program provided more than $727,000 to 21 indigenous tribes, to support economic feasibility studies for specific economic development projects or business startups.

For 2020, NABDI planned to award 20-25 grants. There is no minimum or maximum amount of funding that can be requested, but most awards range in value from $25,000 to $75,000. They only fund projects for one year at a time, which is when they expect projects to be completed. To apply for a NABDI grant for your proposed economic development feasibility study, go to bia.gov/service/grants/tedc/apply-nabdi-grant.

Indian Affairs

For business owners with Native American heritage, there is more available via the Bureau of Indian Affairs. Businesses owned by Native Americans can get financing from the federal government through the Indian Affairs branch. An individual can fill out an application for up to $500,000, but business entities and tribal enterprises may apply for more.

Potential borrowers can apply with any lending institution, they just have to use the application for Indian Affairs. There are additional requirements if you use the funds for construction, renovation, or refinancing. In general, you must supply a list of collateral, a credit report, and an analysis of business operations. See bia.gov/as-ia/ieed/loan-guaranty-insurance-and-interest-subsidy-program.

First Nations Development Institute Grants

The mission of this group is to offer grants that help Alaska Natives, Native Hawaiians, and Native Americans. They help in the application process in addition to funds. First Nations also helps point individuals to appropriate grants offered by other organizations, including the US government. This includes help with writing grant proposals. See firstnations.org/grantmaking.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grant Funding Opportunities for South Asian Entrepreneurs

The South Asian Arts Resiliency Fund

If your business is in the arts, and you’re also of South Asian descent, then check out this fund. The fund is run by the India Center Foundation. It supports US-based South Asian arts workers impacted by the COVID-19 pandemic.

The fund will disburse grants up to $2,000, depending on financial need to US-based arts workers of South Asian descent. This includes those in the performing arts, film, visual arts, and literature with heritage from Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. Initial funding for the program is $20,000, but the India Center Foundation is soliciting donations to expand the grant program.

Eligibility for The South Asian Arts Resiliency Fund

To be eligible, applicants must be of South Asian descent. Also, they must work in the arts and demonstrate loss of income due to COVID-19. Also, applicants must be:

- at least 21 years old

- not enrolled in a degree program, and

- able to receive taxable income in the US

You can put grant funding toward any artistic project you can develop, create, and present. It must be within four to six weeks of getting funding. See theindiacenter.us/artsfund.

Demolish your funding problems with 27 killer ways to get cash for your business.

Grant Funding Opportunities for Science-Based Businesses

The National Science Foundation supports small businesses with contracts and grants. They award nearly $190 million annually to startups and small businesses. This is through the Small Business Innovation Research (SBIR)/Small Business Technology Transfer (STTR) program.

The idea is to support transforming scientific discovery into products and services with commercial and societal impact. These grants support R&D across almost all areas of science and technology. To learn more about SBIR/STTR, visit https://seedfund.nsf.gov. See also nsf.gov/funding/smallbusiness.jsp.

Grant Funding Opportunities in Response to the Pandemic

The Verizon Small Business Recovery Fund

The Verizon Small Business Recovery Fund is new. It was established in response to the COVID-19 pandemic. The fund offers $10,000 to successful applicants. The fund is specifically focused on providing grants to business owners of color, women-owned businesses, and other underrepresented entrepreneurs. See lisc.org/covid-19/small-business-assistance/small-business-relief-grants/verizon-small-business-recovery-fund

Grant Funding Opportunities from the US Government

Grants.gov

Grants.gov is a running list of more than 1,000 available federal government grants. The website compiles grants from over two dozen government agencies. Such as the SBA, USDA, and the US Department of Commerce. To find a grant right for your business, use the Search Grants tool on the website. You can sort through the list of grants by keyword or opportunity number.

The USDA is where those rural electrification grants are.

Once you have located the grant you wish to apply for, click the opportunity number for more detail. There, you will find more information about the specific grant as well as any associated documentation you may need. To apply for a grant through Grants.gov, you must first register. Then, you can download an application package for the grant you want to get. Be ready for a lengthy process. See grants.gov.

Alternatives to Grants: Crowdfunding

If you would rather not rely on grants so much to fund your business, crowdfunding is a viable option. Keep in mind, not everyone with a campaign on a crowdfunding site is successful. More unique products and services tend to do better. Kickstarter and Indiegogo are two of the most popular crowdfunding platforms to use. Some platforms may have higher success rates than others.

Alternatives to Grants: Angel Investors

Angel investors are informal investors. Essentially, you are selling a part of your business to them. They tend to not want a huge percentage of your business. Also, they won’t pass by more conventional businesses, like with crowdfunding and venture capital. Hence they can be another supplement or replacement for grants.

Alternatives to Grants: Loans

If grants aren’t an option, loans might work for you.

Business Center for New Americans

If you’re an immigrant, try the Business Center for New Americans. They offer a pilot program for microloans up to $75,000. They work with immigrants, refugees, women, and other minority entrepreneurs. The goal is to help minority business owners who have not been able to get traditional financing. Terms are 3% interest. Loan repayment term goes up to a year. See accompanycapital.org.

Grant Funding Opportunities: Takeaways

The government and private organizations want to GIVE you money! Grants are a great way to supplement other business funding. And they are still worth the effort to apply. So there really isn’t anything to lose except time – it’s free money.

There are several grant funding opportunities out there for entrepreneurs. Members of minorities and protected classes tend to get some preference. But all entrepreneurs should apply for whichever grants they feel they are most likely to get. Also, other options for funding include crowdfunding, angel investors, and loans. Credit Suite can help you get the funding you need.

The post There are Terrific Grant Funding Opportunities Out There for Small Businesses appeared first on Credit Suite.

An Introduction to Yelp Ads for Local and e-Commerce Businesses

If you own a business, you know word of mouth is vital to your success.

A glowing review from a handful of customers, or even just one influential somebody, can put your business on the map. And a bad review? Well, that can ruin your reputation. Or at least put a good dent in it.

Before you worry about good or bad, you first need a place to get those reviews.

Here are a few questions to ponder:

- How can you, as a local business, stand out among your competitors?

- How can you attract the customer base you want, while also collecting reviews and ratings in one place?

- Most importantly, how can you interact with consumer reviews to put your business in the best possible light?

Let’s take a closer look at Yelp Ads, Yelp’s various other services, and how they may help.

What is Yelp?

A crowd-sourced business review platform for consumers, Yelp is also an excellent place for businesses to be found online.

Yelp prides itself on being the leading social network for consumer ratings and reviews.

In its earlier days, the platform was solely consumer-focused. It was a place for customers to leave their reviews without any expectation of a business’s response.

Yelp has expanded its platform in recent years with Yelp for Business, which gives business owners like you greater control over your listings and consumer interactions. These features go beyond the free page listing that any business can claim.

Yelp for Business Options

Yelp for Business offers two options: self-service and a contract plan.

Self-service is an à la carte offering that allows you to choose from Yelp’s premium business tools. These include:

- Yelp Ads

- Yelp Deals

- Yelp Reservations

- Business Highlights

- Profile upgrades

If you choose the contract plan, you’ll work with a Yelp sales representative to create an advertising program that fits your business’s needs. You pay a monthly fee for all the services included in your plan.

Why Yelp for Business May Be Right for Your Business

There’s no doubt that Yelp’s higher-than-average cost per click (CPC) and cost per mille (CPM) have garnered some negative press.

So why might you consider Yelp as part of your overall marketing strategy?

Yelp users are at a later stage in the buying cycle than those on Google or Bing. Consumers on Yelp are no longer looking for information about a service or product; they’re narrowing their focus to local businesses to make a purchase.

According to a Nielsen study, a whopping 82 percent of Yelp users intend to buy a service or product. So even if only a few hundred consumers per month see your ad, the likelihood of your ad being displayed to a potential customer is high.

Let’s look more closely at one of Yelp for Business’s key offerings: Yelp Ads.

What is Yelp Ads?

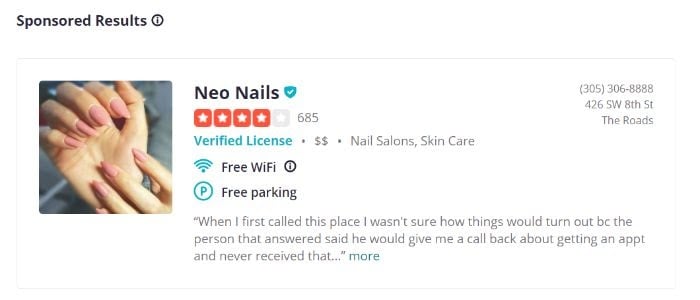

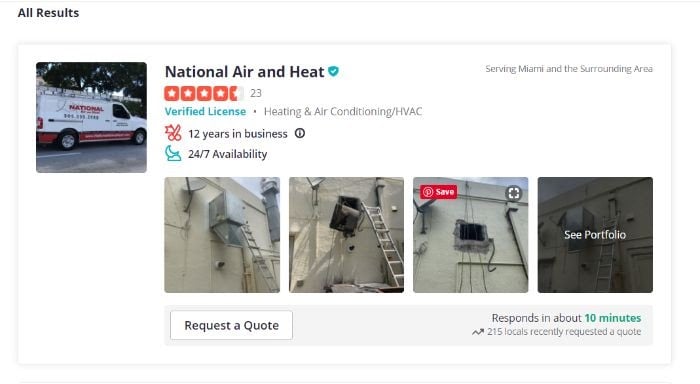

An advertising service exclusively targeting Yelp users, this feature displays advertisements to consumers on the platform’s search results pages and business pages, via desktop and mobile.

How Does Yelp Ads Work?

You can create standard or custom ads linked to your business listing.

The standard ad looks like any search result on Yelp. The difference is it will appear at the top of search page results and on competitors’ profiles:

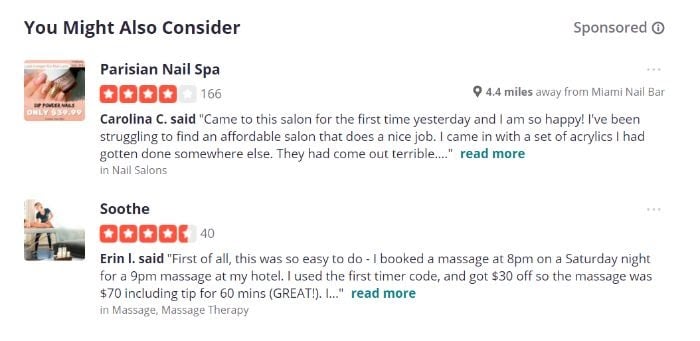

With custom ads, you can add text snippets, choose a photo, and select the customer review you’d like to feature:

You can also add value propositions to the bottom of your advertisements, such as sale and deal details or average response time. These are called Business Highlights, and they may be included in your Yelp for Business package or purchased separately.

Don’t forget your call to action (CTA). With this add-on feature, you can customize the CTA buttons on your listing page and at the bottom of your search result listings. This allows you to link directly to a relevant page or form on your website.

Like Google or Bing, your ads will display based on search terms, location, and other parameters determined by Yelp’s ranking algorithm.

Your ads can appear on relevant search result pages or competitor business pages across all Yelp platforms. These include the desktop site, the mobile site, and the mobile application (available on iOS and Android).

How to Get Started with Yelp Ads

Do you think Yelp Ads might be right for your business? Here’s how to get started.

Step 1: Claim Your Free Business Listing

If your business is well established, the odds are good that a listing already exists. To claim an existing listing, follow Yelp’s step-by-step instructions.

If your business doesn’t have a listing, it’s easy to register.

Step 2: Improve Your Profile

Your profile, also known as a Business Page, is your way to provide accurate information about your business to local consumers. Available fields include business hours, address, phone number, and a list of services and products.

The more accurate your profile is, the greater your chances of converting consumers who find your listing.

Step 3: Moderate Ratings and Reviews

As a verified business owner, you can respond to ratings and reviews publicly or privately. While you may be tempted to ignore a negative review, this can have a detrimental effect on how consumers view your business.

If you want to keep your business’s online reputation positive, promptly respond to reviews—both positive and negative.

With 71 percent of consumers saying they’re more likely to do business with a company that has responded to reviews, you can’t afford to miss out on this opportunity.

Step 4: Reach Out to a Yelp Sales Representative

When you choose the self-service option, you can immediately begin using Yelp Ads and other premium features. If you’d prefer a customized plan, you’ll need to work with a sales representative.

How to Optimize Yelp Ads for Your Local e-Commerce Business

In its early years, Yelp gained popularity in the restaurant industry. But as of June 2020, restaurants make up just 18 percent of businesses on the platform. Shopping isn’t too far behind, with 16 percent of companies categorized as such.

As a local e-commerce business, you, too, can benefit from Yelp’s various features.

Run Location-Targeted Advertisements

If you’re not reaching the right audience, what’s the point?

With Yelp Ads, you can run targeted ads based on consumer location.

As a local business, why might you want to target non-local as well as local consumers? I’m glad you asked!

Let’s say you own a hybrid business, online and in-store. Your physical storefront is in Connecticut, but your dropship warehouse is in Texas.

Instead of mentioning delivery times, a local Connecticut ad might focus on customers’ ability to purchase online and pick up in-store:

Order online. Pick up in-store today.

But a local Texas ad aimed at customers within a few hundred miles of your warehouse location may read:

Delivery within two business days. Guaranteed.

The same can apply to local businesses like florists and bookstores. Even if you don’t ship to locations outside your local area, you can still appeal to non-local consumers with services you do offer.

Let’s say you’re a florist who offers local delivery services in Albany, NY. Your ads to non-local consumers may look something like this:

Call now for free, next-day delivery within Albany, NY.

But how can you advertise to the right audience?

Target larger metropolitan areas around your locale, or use existing customer data to determine the most likely locations for your non-local consumers.

Keep Your Business Page Updated

With full control over your business page, include as much relevant information as possible.

What does this look like?

Did your business hours change? Or maybe you’re running a sale over the next week. This insight is the kind of information potential customers want to know.

Don’t have a physical storefront? You still have plenty of opportunities to flesh out your profile. For example, you can update your business’s:

- customer service hours

- refund and replacement policy

- quality guarantee; or

- shipping and handling timeframes.

Your customers will appreciate the transparency.

Tweak Your Strategy As Needed

Whether your business is brick-and-mortar or online, adaptability is crucial to success. How are you adapting to the results from your latest Yelp Ads campaign?

You may already use analytics software such as Google Analytics on your website. As a Yelp Ads user, you also have insight into campaign metrics, including:

- user views

- customer leads

- mobile calls

- CTA clicks

- directions and map views

- clicks to your website.

Keep track of campaign metrics, and use that data to adjust your ads and overall strategy. The key is to take a solutions-based approach to your advertising campaign. Here are a few examples.

Low Conversion Rate

You’ve started a new targeted campaign for a nearby metropolitan area. The CTA clicks are the highest you’ve ever seen on a campaign, but the conversion rate is abysmal.

The good news? Your campaign is sending people to your website. The bad news? The likely culprit is the landing page itself. You have three options:

- tweak the CTA text to reflect the information on your landing page more accurately

- link to a more relevant landing page on your website

- rewrite the copy on your landing page to encourage more conversions

Remember that Yelp Ads is just one step on your journey toward conversions.

Targeted ads can help drive relevant traffic to your website, but if your website is lacking, you’re more likely to lose the conversion.

Low Customer Lead Rate

Now let’s say user views are high, but customer leads are low. What’s the deal?

First, rule out the usual suspects such as out-of-date profile information and poor ratings or reviews.

Next, consider that your potential customers may be drawn away by sponsored ads on your business profile.

One way to combat this is to purchase a package that enables you to remove sponsored ads from your business page. You may also want to place additional value propositions and CTAs higher on your page, so users are more likely to interact with your website before they even see the sponsored ads below.

Conclusion

For many consumers, Yelp is more than just a ratings and reviews platform. It’s the search engine of choice when it comes to finding a local business for their needs.

You may be thinking, “It’s too late in the game to rank anywhere near the first page in Yelp local results. What’s the point?”

But that’s the beauty of Yelp Ads!

You can ensure your listing is at the top of the search page results every time. And you can experiment with the content in custom ads to see how leads respond. And if you need help setting up paid ad campaigns, set up an initial consulting call.

Even if you don’t intend to use Yelp’s premium services, you can get control of your business page and interact with consumers just by claiming your free business listing.

That leaves me with just one question:

Have you taken advantage of your free Yelp business listing yet?

The post An Introduction to Yelp Ads for Local and e-Commerce Businesses appeared first on Neil Patel.