Here is what we all know. COVID-19 is having a huge impact on the economy. It’s no secret. The market is scary right now. In fact, you are probably thinking now is not the time to make any big financial decisions about your business. But the truth might surprise you. In contrast, it could actually be a really good time to borrow. This is because of federal and state initiatives to help businesses during this time. There are some unique recession business funding opportunities available.

Beyond that, more are becoming available each day. In addition, some oldies but goodies are better options now than they were even a few days ago. There are federal government loans for small business.

You probably know how to prepare for a recession. But you probably weren’t expecting to see the effects of recession on business in less than a month. The impact of recession on businesses is already being felt. But there are recession resistant businesses out there. Let’s make sure yours is a recession proof small business.

The Ultimate Directory for Everything you Need to Know about Recession Business Funding Opportunities During the Coronavirus Pandemic

The federal government does not want to see a collapse of the economy any more than we do. They want to do what they can to help small businesses. As a result, they are taking steps to do just that.

States are doing the same. What steps are being taken? What do they mean for your fundability? It means you need to protect it like never before. To do this, you will need to know what help is available to you and your business.

The key is going to be figuring out how to strategically use the funding available right now to not only save your business, but to help it thrive.

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

Recession Business Funding Opportunities: The Bad News

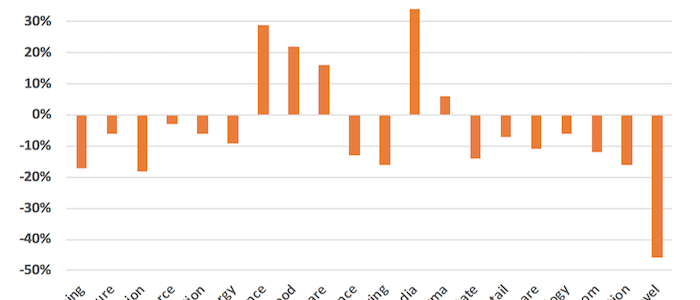

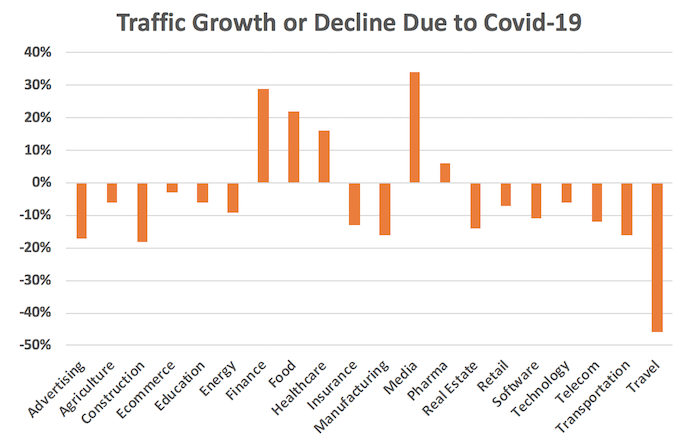

Then there’s the bad news. Businesses are closing. People aren’t going out. Spending is vastly curtailed. Unfortunately, without a steady flow of income, eventually businesses will not be able to make payments on existing expenses & debt.

While some businesses may be able to make current payments for a few months, access to new credit will likely not be around for long, at least when it comes to traditional banks.

But There’s Good News, Too

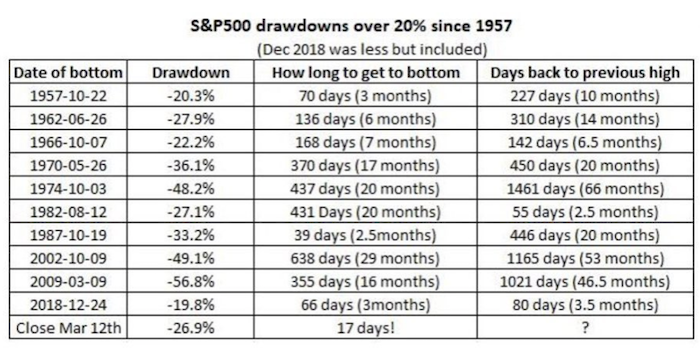

The good news in light of all of this darkness is that no one wants this to happen. Measures are being taken to try and stop the spiral. The most notable is the rate cut by the Federal Reserve. In fact, the most recent cut brought the rate down to 0%. Interest rates during recessions should be cut, and we are already there.

As a result, some states are even initiating their own programs to offer relief to businesses during this time. Not only that, but corporations and charities are jumping in with relief for workers. Truly, the key to surviving is to take advantage of the recession business funding opportunities available right now. Then, use them to protect your fundability, and your business. Turn yours into a recession resistant business.

Recession Business Funding Opportunities: Federal Initiatives

As you might imagine, the federal government is working on several options to help businesses during this time. One idea is a cut in the payroll tax. Another is to provide cash to each American to increase spending. Currently, SBA loans are getting an increase from the relief fund for COVID-19. So far $50 billion is going into the SBA as relief in March of 2020. Also, the SBA is waiving upfront costs on business loans for veterans, up to $1 million, in the SBA Express program.

Recession business funding opportunities via the feds will be in the trillions. There may be federal grant money. This situation is fluid, so there could be rural development grants. And they don’t have to be for businesses that make money during a recession.

SBA Disaster Relief

Currently, the SBA is permitted to exercise readily available authority. They will supply funding to businesses affected by the coronavirus to help overcome disruptions. The President is asking Congress to raise financing for this program. For now, the goal is to make 30 million small businesses better able to survive the coronavirus impact. The idea is to turn many into businesses that do well in a recession.

The Details

Here is what you need to know about the process for accessing these funds according to SBA.gov.

- This will make loans available to small businesses to help relieve the financial troubles caused by Coronavirus.

- The Office of Disaster Assistance will work with the Governor to submit the request for assistance.

Allowable uses of these funds include:

-

- Pay current debts

- Payroll

- Accounts payable

- Pay other bills that the business will not be able to pay due to the coronavirus impact

- The credit rate is 3.75%, or 2.75% for non-profits

- Businesses with credit available elsewhere are not eligible.

- In order to keep payments affordable, terms go up to 30 years. Determination on individual loan terms will be made on a case-by-case basis. The borrower’s ability to repay will play a role in this decision

- The Economic Injury Disaster Loans are just a part of the big picture of the federal government’s plan for relief.

More Information on These Federal Small Business Loans

Small Business Administration loans and grants may expand. We could end up with all kinds of government small business grants. But we don’t yet clearly know the details on grants and loans for small businesses. That is, for any from a federal grant department.

Federal Housing Relief

Likewise, the federal government is offering relief to families in the form of relief to homeowners. Last week, the President directed HUD to suspend evictions and foreclosures. This applied to single-family home mortgages that are backed by Fanny Mae and Freddie Mac for at least 60 days. It’s a creative form of financial aid for small business.

This week, it was announced that both mortgage insurers will give multifamily landlords a break on their loans. That is, if they do not evict anyone that has suffered coronavirus impact. FHFA Director Mark Calabria said in a press release

“Renters should not have to worry about being evicted from their home, and property owners should not have to worry about losing their building, due to the coronavirus. The multifamily forbearance and eviction suspension offered by the Enterprises should bring peace of mind to millions of families during this uncertain and difficult time.”

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

Recession Business Funding Opportunities by State

How to Find Recession Business Funding Opportunities in Your State

These posts also contain information on how to start a business in each state. Now is the time to try your recession proof business idea.

So make sure to check if your state has recession business funding opportunities for your recession proof business ideas!

State by State Responses to the Novel Coronavirus: Recession Business Funding Opportunities

First, let’s look at what each state is offering as coronavirus relief. They are stepping up their game. In fact, most are offering either funds or tax relief. Yet, some are even offering extensions on debts. Still, the details are continually changing. As a result, states’ plans are in flux. Check with state government websites for details and updates on government business loans. State by state, here’s what’s happening as of today. There are a lot of recession business funding opportunities out there. Many states are stepping up with government funding for business.

Alabama’s Response to COVID-19

Alabama has taken the following steps. On March 13, Governor Kay Ivey declared a state of emergency. The Governor has submitted a request to the SBA for Economic Injury Disaster Loans.

Alaska’s Response to COVID-19

Here’s how Alaska is handling the COVID-19 situation. On March 17, Governor Mike Dunleavy announced the creation of an Alaska Economic Stabilization Team. A bipartisan group of leaders will work with the Dunleavy administration. The goal is a plan to protect the state’s economy from the impact of COVID-19.

Leading the group will be former Governor Sean Parnell. Former US Senator Mark Begich will join. The remaining seats will be filled by a cross section of Alaska’s economic leaders and former elected officials.

Arizona’s Response to COVID-19

Arizona has the following response to the novel coronavirus. On March 11, Governor Doug Ducey declared a state of emergency. The Arizona Department of Health Services can now waive licensing requirements to provide healthcare officials with assistance in delivering services. The Governor has communicated with the SBA, seeking an Economic Injury Disaster Loan declaration. This will make it possible to get government backed small business loans.

Arkansas’s Response to COVID-19

Here is Arkansas’s response. On March 11, Governor Asa Hutchinson declared a state of emergency. The Governor put in a request to the SBA for Emergency Disaster Loans. They are also using state funds and grants to provide relief.

California’s Response to COVID-19 (with Recession Business Funding Opportunities)

This is how California is handling the COVID-19 situation. The city of San Francisco has started the COVID-19 Small Business Resiliency Fund.

To be eligible for the COVID-19 Small Businesses Resiliency Fund, small businesses must have at least 1 employee. Also,they can have no more than 5 employees. Plus, they must demonstrate a loss of revenue of 25% or more. They must have less than $2,500,000 in gross receipts as well. In addition, they must be engaged in activities regulated by the City and County of San Francisco. Of course, they need to have a license or permit associated to that regulation.

In California, employers experiencing a hardship as a result of COVID-19 may request up to a 60-day extension from the EDD to file their state payroll reports and deposit state payroll taxes. This is without penalty or interest. A written request for extension must be received within 60 days from the original delinquent date of the payment or return.

Colorado’s Response

Colorado is working toward COVID-19 as well. For example, the Pikes Peak SBDC is the lead for statewide disaster preparedness efforts in response to COVID-19. Also, the Colorado government offers work sharing as an alternative to laying off employees.

Requirements and qualifications for employers include reduced normal weekly work hours by at least 10%. But the reduction can be by no more than 40%. The reduction must affect at least two out of all employees in the business. Or a minimum of two employees in a certain unit. You must have paid as much in premiums as Colorado paid your former employees in unemployment insurance benefits.

Connecticut’s Response

Connecticut has this plan for handling COVID-19. On March 16, the SBA approved Governor Ned Lamont’s request to begin offering disaster-relief loans to Connecticut small businesses and nonprofits. Companies in the state can now apply for small business financial help of up to $2 million. There is a special page for this on the SBA website.

Delaware’s Response to COVID-19

Delaware is not falling short on doing something about COVID-19. On March 17, Governor John Carney submitted an application for the SBA to provide Delaware an Economic Injury Declaration. This makes loans available to small businesses and nonprofit organizations in New Castle, Kent and Sussex counties.

Florida’s Response to COVID-19 (with Recession Business Funding Opportunities)

Florida is taking the following steps to offer relief from the impact of the novel coronavirus. The Florida Small Business Emergency Bridge Loan Program is available to small business owners in all Florida counties. This is statewide to all those that experienced economic damage as a result of COVID-19.

Short-term, interest-free working capital loans are intended to bridge the gap between the time a crisis hits and when a business has longer term recovery resources available[AF1] . Loans under this small business financing program are short-term debt loans made by the state of Florida using public funds. They are not government grants.

Georgia’s Response to COVID-19

This is what Georgia is doing about COVID-19. On March 16, Governor Brian Kemp declared a public health state of emergency. Georgia has qualified for SBA Economic Injury Disaster Loans.

Hawaii’s Response to COVID-19 (with Recession Business Funding Opportunities)

Hawaii is taking these steps in response to the novel coronavirus. Hawaii’s House Resolution No. 54 established the House Select Committee on COVID-19 Economic and Financial Preparedness. The committee will work with representatives from local and state government. They will include private industry and nonprofits to inform the House of Representatives on the State’s economic and financial preparedness.

The Select Committee is tasked with examining economic and financial issues. That includes identifying the potential economic and financial impact to the state. So it also includes developing short-term and long-term mitigation plans. In addition, they will be monitoring COVID-19 conditions and outcomes.

Due to Hawaii’s unique position in reliance on tourism, you should expect for this committee’s mandate to broaden.

Idaho’s Response to COVID-19 (with Recession Business Funding Opportunities)

How is Idaho is handling COVID-19? On March 13, Governor Brad Little declared a state of emergency. The Governor also created a Coronavirus Working Group. So this group meets at least weekly to support the work of Idaho’s public health agencies. And they will increase coordination and communication around the many aspects of the issue.

The Joint Finance-Appropriations Committee approved Governor Brad Little’s request to transfer $2 million to the Governor’s Emergency Fund to help in Idaho’s response. But it does not appear that they have earmarked these funds at all for small businesses. This may change in time.

Illinois’s Response to COVID-19

What is Illinois doing about the COVID-19 situation? On March 9, Governor JB Pritzker issued a disaster proclamation giving the state access to federal and state resources to combat the spread of the virus. The state of Illinois is also releasing recommendations for an infectious disease outbreak response plan.

Indiana’s Response to COVID-19

This is what Indiana is doing to address COVID-19. On March 16, Governor Eric Holcomb announced restaurants, bars, and nightclubs would have to close. Unemployment claimants can do everything online and are not required to be there in person.

The SBA issued a disaster declaration for Indiana, offering financial assistance for Hoosier small businesses impacted by COVID-19. Small businesses, small agricultural cooperatives, and nonprofits across the state are eligible. So they can apply for low-interest loans up to $2 million. This is to help overcome the temporary loss of revenue due to COVID-19.

Business owners can use these loans to pay fixed debts, payroll, accounts payable and other bills. Loan interest rates for small businesses and nonprofits are 3.75% and 2.75%, respectively, with terms up to 30 years.

Iowa’s Response to COVID-19

Here’s how Iowa is handling COVID-19. Iowa is encouraging employers to participate in a voluntary work-sharing arrangement. This is as an alternative to layoffs. Employer accounts will not be charged for benefits paid under the VSW program directly or indirectly related to COVID-19.

In addition, eligible small business grants in amounts ranging from $5,000 to $25,000 are now available. The new program also includes a deferral of sale and use or withholding taxes due. And it has a penalty and interest waiver.

Eligibility requires:

- Business disruption due to the coronavirus pandemic

- Employment of 2-25 people before March 17, 2020

These Small Business Relief Grants will help businesses that are eligible maintain operations or reopen for business when this is all over. The funds cannot be used to pay debts acquired before March 17,2020.

Grant applications will go through a review process by the Iowa Economic Development Authority. They will determine the grant amount by the level of impact. This will include loss of sales revenue and workers.

Tax assistance applications will go through review by the Iowa Department of Revenue. They will determine if deferral and waiver is appropriate.

Kansas’s Response to COVID-19

This is what Kansas is doing about the coronavirus. On March 12, Governor Laura Kelly declared a state of emergency. The Governor has also temporarily prohibited utility and internet disconnects.

Kentucky’s Response to COVID-19

This is what Kentucky is doing about COVID-19. On March 6, Governor Andy Beshear declared a state of emergency. Public-facing facilities can only stay open if six-foot minimum social distancing is possible. The Commonwealth also provided guidelines for correctional facilities.

On March 16, Kentucky filed an application for an economic injury disaster loan declaration to get access to small business disaster assistance loans from the SBA. These loans will be for up to $2 million to small businesses affected by COVID-19.

Louisiana’s Response to COVID-19

Here is how Louisiana is dealing with COVID-19. From March 13 – 16 there was a declaration. And then there were two additions to it. Governor Mark Bel Edwards declared a state of emergency. Legal deadlines were postponed until at least April 13. Driver’s license expiration dates are postponed until May 20.

Maine’s Response to COVID-19 (with some Recession Business Funding Opportunities)

Maine is taking action as well. On March 17, Governor Janet Mills and the Maine Department of Health and Human Services (DHHS) took immediate steps to ensure access to critical services and benefits for Maine people, while protecting the health of employees and the public in response to COVID-19.

First, MaineCare will waive all copays for prescriptions, office visits, emergency department visits, radiology and lab services. Also, all Bureau of Motor Vehicles offices are closed until further notice.

In addition, the SBA has approved Maine’s March 16 application for SBA Economic Injury Disaster Loans to help Maine businesses overcome any temporary loss of revenue due to COVID-19.

Maryland’s Response to COVID-19

On March 5, Governor Larry Hogan declared a state of emergency and a catastrophic health emergency. On March 17, the Governor announced significant reductions in local and commuter bus, and light rail services to slow the spread of the virus.

If an employee receives unemployment benefits as a result of a coronavirus-related business shutdown, the employer’s unemployment taxes could increase. Unemployment benefits are proportionately charged to each employer based on weeks worked and wages earned in each individual’s base period.

Contributory employers could see an increase in their tax rate, which would result in higher taxes.But reimbursing employers will not be charged dollar for dollar for benefits paid. This should help avoid higher than expected unemployment costs.

There has been a March 23, 2020 update.

Massachusetts’s Response to COVID-19 (with Recession Business Funding Opportunities)

On March 16, Governor Charlie Baker announced a $10 million small business recovery loan fund to help companies struggling because of efforts to slow the coronavirus.

The fund will provide emergency capital up to $75,000 to Massachusetts-based businesses with under 50 full- and part-time employees. This includes nonprofit groups. Loans are immediately available to eligible businesses. No payments are due for the first six months.

Michigan’s Response to COVID-19

On March 16, Governor Gretchen Whitmer temporarily expanded eligibility for unemployment benefits.

Benefits are extended to workers with an unanticipated family care responsibility. This includes those who have childcare responsibilities due to school closures. Or who are forced to care for loved ones who become ill. It also covers workers who are sick, quarantined, or immunocompromised. This is if they are with no access to paid family and medical leave or are laid off. It also covers first responders in the public health community who become ill or are quarantined due to exposure to COVID-19.

Load restrictions are suspended for deliveries that meet immediate needs for medical supplies and equipment. This is for supplies related to the testing, diagnosis, and treatment of COVID-19.

They are also suspended for supplies and equipment necessary for community safety, sanitation, and the prevention of community transmission of COVID-19. These are items such as masks, gloves, hand sanitizer, soap, and disinfectants.

Other suspensions include those related to food for the emergency restocking of stores. Also, those related to equipment, supplies, and persons necessary to establish and manage temporary housing, quarantine, and isolation facilities related to the COVID-19 emergency.

These changes also cover persons designated by federal, state, or local authorities for medical, isolation, or quarantine purposes and persons necessary to provide other medical or emergency services, the supply of which may be affected by the COVID-19 emergency.

Michigan and the SBA

On March 17, the Governor applied for disaster relief for small businesses from the SBA. The Small Business Association of Michigan is encouraging the state to use the Business Interruption Insurance system to help those affected.

Under the proposal, businesses could apply for reimbursement from the state or the Michigan Strategic Fund. It would be processed through the existing Business Interruption Insurance system or the Michigan Department of Insurance and Financial Services.

Minnesota’s Response to COVID-19

Similarly, here is how Minnesota is handling the coronavirus situation. On March 13, Governor Tim Walz declared a peacetime emergency. Several places of public accommodation are closed. Beyond taverns and restaurants this also includes: hookah bars and vaping lounges, amusement parks, and country clubs.

For businesses which must lay off workers, the Governor ordered that the Minnesota Unemployment Insurance Program not use unemployment benefits paid as a result of the COVID-19 pandemic in computing the future unemployment tax rate of a taxpaying employer. This should keep tax rates down for employers.

Mississippi’s Response to COVID-19

On March 14, Governor Tate Reeves declared a state of emergency. As of March 17, Mississippi courts are restricting the size of gatherings in the state’s courtrooms for eight weeks to help slow the spread of the virus. Utility shutoffs are prohibited for the next 60 days.

Missouri’s Response to COVID-19

Along the same lines, here’s how Missouri is handling COVID-19. On March 13, Governor Michael Parson declared a state of emergency. The Governor also directed the Missouri State Emergency Management Agency and the Missouri Department of Economic Development to seek assistance for Missouri businesses through the SBA’s Economic Injury Disaster Loan program.

Montana’s Response to COVID-19

This is what Montana is doing about COVID-19. On March 10, Governor Steve Bullock declared a state of emergency. Uninsured Montana residents will be covered for COVID-19 testing and treatment. Employees laid off as a result of shutdowns due to COVID-19 are eligible for unemployment benefits. On March 17, the state became eligible for disaster relief loans from the SBA for small businesses.

Nebraska’s Response to COVID-19

On March 13, Governor Pete Ricketts issued a state of emergency. On March 17, the Governor issued an executive order to loosen unemployment eligibility restrictions. Nebraska has a COVID-19 hotline for information on the virus and government response.

In addition, Nebraska small businesses are eligible for disaster loans from the SBA.

Nevada’s Response to COVID-19

On March 17, Governor Steve Sisolak ordered a shutdown of nonessential businesses, including casinos and retail stores, for 30 days. The Gaming Control Board offered procedures for closing casinos. Also, low-interest loans will be available from the SBA for businesses to address debt, payroll or other bills.

New Hampshire’s Response to COVID-19

New Hampshire has taken measures as well. On March 17, Governor Chris Sununu banned all landlords from starting eviction proceedings and prohibited all foreclosures during the state of emergency initiated in response to COVID-19.

He also barred utility providers, such as electric, gas, water, telephone, cable, fuel and internet, from disconnecting service for nonpayment.

New Hampshire small businesses are eligible for disaster loans from the SBA. The state is switching to single-use bags for now. That means businesses may not be allowing reusable bags in stores.

New Jersey’s Response to COVID-19

The New Jersey Economic Development Authority , or NJEDA, has a portfolio of loan, financing, and technical assistance programs available to support small and medium-sized businesses.

Currently, several State agencies are engaging with local business leaders, local financial institutions, and business advocacy groups as well. Basically, this is to better understand what supports would have the most impact to ensure business and employment continuity.

New Mexico’s Response to COVID-19

On March 11, Governor Michelle Lujon Grisham declared a state of emergency. Then, on March 23rd the governor ordered a Shelter In Place for the entire state. New Mexico has qualified for the SBA Disaster Loan Assistance program to assist businesses negatively impacted by the COVID-19 public health emergency.

This includes low-interest federal disaster loans up to $2 million. The funds are to provide working capital to small businesses and non-profit organizations suffering substantial economic injury as a result of COVID-19.

New York’s Response to COVID-19

On March 8, New York City Mayor Bill DeBlasio announced the City will provide relief for small businesses across the City seeing a reduction in revenue because of COVID-19. Businesses with fewer than 100 employees who have seen sales decreases of 25% or more will be eligible for zero interest loans of up to $75,000 to help mitigate losses in profit.

The city is currently on a lockdown. Since New York is now a major site for the novel coronavirus, expect more changes soon.

New York State (Outside New York City)

On March 17, Senator Pam Helming and Assemblyman Colin J. Schmitt called for the establishment of a $890 million Small Business Emergency Assistance Fund for the State of New York. The $890 million would come from state settlement funds that are currently earmarked for use during economic uncertainty.

North Carolina’s Response to COVID-19

On March 17, Governor Roy Cooper ordered bars and restaurants closed to sit-down service. The Governor’s order also lifted some restrictions on unemployment benefits to help workers unemployed due to Covid-19 and those who are employed but will not receive a paycheck. Additionally, it adds benefit eligibility for those out of work because they have the virus or must care for someone who is sick.

North Carolina businesses are eligible for disaster loans from the SBA.

North Dakota’s Response to COVID-19

This is what North Dakota is doing about COVID-19. On March 13, Governor Doug Burgum declared a state of emergency.

North Dakota is seeking eligibility for emergency disaster loans for small businesses from the SBA. Small businesses will need to fill out an economic injury worksheet which will help the state qualify.

Ohio’s Response to COVID-19

On March 9, Governor Mike DeWine declared a state of emergency. As a result, the Ohio Department of Health prohibits mass gatherings of 100 or more persons.

Ohio is eligible for emergency disaster loans from the SBA. It is estimated that about 1,400 small businesses in Ohio will qualify for funding.

Oklahoma’s Response to COVID-19

On March 17, Governor Kevin Stitt urged Oklahomans to avoid eating in restaurants. He also discouraged discretionary travel and shopping trips. And he discouraged gatherings of more than ten people. But he initially did not declare any closings.

The Governor received a great deal of backlash for a tweet of him eating in a crowded restaurant with his family. After that, the Governor walked that back and declared a state of emergency.

As a result, Oklahoma small businesses are eligible to apply for emergency disaster loans from the SBA.

Oregon’s Response to COVID-19

Oregon encourages participation in its work share program. The goal is to minimize layoffs. The City of Portland provides support via Portland Community SOS.

Pennsylvania’s Response to COVID-19

What is Pennsylvania doing about COVID-19? On March 16, 2020, Governor Tom Wolf strongly urged non-essential businesses across the state to close for at least 14 days to help mitigate the spread of COVID-19.

The Keystone State’s main economic response is to direct businesses to the Pennsylvania Industrial Development Authority to get low-interest loans. Another suggestion was the Department of Community and Economic Development and their working capital loans could be of assistance to businesses impacted by COVID-19.

Rhode Island’s Response to COVID-19

The SBA announced it is offering low-interest federal disaster loans for working capital to Rhode Island small businesses suffering substantial economic injury as a result of COVID-19.

For businesses, municipalities, K-12 and other entities, Microsoft is providing six months of Office 365 tools for free to enable remote collaboration, file sharing and video conferencing. They’re also offering free assistance to set up these tools.

South Carolina’s Response to COVID-19

On March 13, Governor Henry McMaster declared a state of emergency. For restaurants, the Department of Health and Environmental Control will not be conducting routine inspections. But they will come and provide a non-graded evaluation and consultation upon request.

South Carolina small businesses are eligible for emergency disaster loans from the SBA.

South Dakota’s Response to COVID-19

Here’s what South Dakota is doing about COVID-19. On March 13, Governor Kristi Noem declared a state of emergency. The Governor is working with the SBA to obtain Economic Injury Disaster Loans for South Dakota businesses.

Tennessee’s Response to COVID-19

Here is what Tennessee is doing about COVID-19. On March 12, Governor Bill Lee declared a state of emergency. One part of the declaration is that it allows the construction of temporary health care structures in response to COVID-19. It also permits the waiver of certain regulations on childcare centers.

The Governor has applied for Tennessee to be eligible for emergency disaster loans from the SBA for small businesses.

Texas’s Response to COVID-19

On March 13, Governor Greg Abbott declared a state of emergency. Certain trucking regulations are being suspended to allow for the easier delivery of supplies.

The Governor has requested eligibility for emergency disaster loans for small businesses from the SBA.

Utah’s Response to COVID-19

This is how Utah is handling COVID-19. On March 6, Governor Gary Herbert declared a state of emergency. The Governor included the Salt Lake Chamber on the Utah Coronavirus Task Force to ensure the business community is considered throughout the current situation. Utah ski slopes closed due to COVID-19.

Utah small businesses are eligible for SBA emergency disaster loans. The city of Ogden has 0% loans of up to $10,000 available for small businesses. Furthermore, terms are 10 years with up to a 12 month deferral on payment.

Vermont’s Response to COVID-19

On or about March 11, Governor Phil Scott declared a state of emergency. The SBA will be able to provide Economic Injury Disaster Loans under a Governor’s Certification Disaster Declaration.

Also, the Agency of Commerce and Community Development is looking for data on impacts in the following areas:

- Economic Injury

- Supply Chain

- Workforce (Including that caused by lack of childcare)

- Business Travel

- Visitor Travel and Tourism Activities; and

- Remote Work Capabilities.

Contact a Vermont State Business Development Center for a disaster recovery guide.

Virginia’s Response to COVID-19

On March 12, Governor Ralph Northam declared a state of emergency. Regional workforce teams will be activated to support employers that slow or cease operations. Employers who do slow or cease operations will not be financially penalized for an increase in workers requesting unemployment benefits.

The Governor is authorizing rapid response funding, through the Workforce Innovation and Opportunity Act. This is for employers eligible to remain open during this emergency. Funds may be used to clean facilities and support emergency needs.

Washington DC’s Response to COVID-19

On March 17, Mayor Muriel Bowser announced that the SBA has accepted the District of Columbia’s declaration for assistance in the form of economic injury disaster loans following the advent of COVID-19. Furthermore, DC businesses can start applying now.

While the SBA directly administers this loan program, the Department of Small and Local Business Development, led by Director Kristi Whitfield, will work with the SBA on behalf of the District of Columbia.

Washington State’s Response to COVID-19 (with Recession Business Funding Opportunities)

By March 18, Governor Jay Inslee’s office had compiled a partial list of resources to support economic retention and recovery related to COVID-19 coronavirus.

The Washington State Department of Commerce’s Export Assistance Team division can help companies identify alternative markets. They can also provide firms with STEP Vouchers. These vouchers defray certain costs. These costs include those of trade show or trade mission fees, airfare, interpreter and translation services, business matchmaking, export training programs and more.

West Virginia’s Response to COVID-19

In West Virginia, Secretary of State offices throughout the state will not serve walk-in business and licensing customers. All these services can be completed online or by paper. For paper submission, packets and paperwork may be submitted in-person at a drop-off location or via the U.S. mail.

Per an application by Governor Jim Justice, West Virginia small businesses can apply for emergency disaster loans from the SBA.

Wisconsin’s Response to COVID-19

On March 12, Governor Tony Evers declared a state of emergency. The Governor worked with U.S. Sen. Tammy Baldwin to help secure federal funding to support efforts in responding to COVID-19 in Wisconsin.

On March 11, the Centers for Disease Control and Prevention announced that Wisconsin will be receiving more than $10.2 million to support response and prevention efforts.

Wyoming’s Response to COVID-19

What’s happening with Wyoming? On March 13, Governor Mark Gordon declared a state of emergency. Wyoming suggests small business owners apply with the SBA for low interest loans. They also suggest talking to bankers and other lenders for small business to see if short-term financial arrangements can be made. Entrepreneurs can talk to a Wyoming Small Business Development Center Network staff members. They can provide nontechnical advice and answer questions.

Other Relief and Recession Business Funding Opportunities

Some corporations and national charities are jumping in to offer relief to displaced workers, businesses, and other individuals. While some do not directly help businesses themselves, the argument can be made that helping employees definitely helps businesses. This type of help can also help employers keep their employees during these times.

Plus, more government financial aid to industries could be forthcoming. There will likely be even more help for small business owners in financial trouble.

USBG National Charity Foundation

For workers, some charities are jumping in. The USBG National Charity Foundation now offers a bartender emergency assistance program to help those who experiencing financial hardship in the industry. Those eligible can get help to pay bills and other expenses due to loss or decrease in income related to the coronavirus pandemic in the form of a grant.

To qualify for the grant, you must be a bartender, a child of a bartender, or be married to a bartender. You also have to show tangible proof of emergency.

Facebook Small Business Grants

Facebook recently announced their coronavirus relief effort for small businesses. $100,000,000 in cash grants and ad credits will be awarded to up to 30,000 small businesses that are eligible in over 30 countries Facebook operates. They promise share more details as they become available.

GrantWatch.com

GrantWatch has a page dedicated to government grant money available for coronavirus relief.

Recession Business Funding Opportunities: Other SBA Loans and Programs

While the emergency measures being taken by the Federal government to ensure access to SBA disaster loans are helpful, the other SBA programs and resources are still open and available. Don’t discount or discredit their helpfulness.

7(a) Loans

This is the Small Business Administration’s flagship loan program. It offers federally funded term loans up to $5 million. The funds can be used for expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the funds. It’s a great form of lending for small businesses.

The minimum credit score to qualify is 680. There is also a required down payment of at least 10% for the purchase of a business, commercial real estate, or equipment. The minimum time in business is 2 years. In the case of startups, business experience equivalent to two years will suffice.

This is by far the most popular loan program the SBA offers. Funds are available for a broad range of projects, from working capital to refinancing debt. And it even includes buying a new business or real estate.

504 Loans

These SBA business loans are also available up to $5 million. Funds can pay for machinery, facilities, or land. Generally, they are for expansion. Private sector lenders or nonprofits process and disburse the funds. They work especially well for commercial real estate purchases.

Terms for 504 Loans range from 10 to 20 years. Funding can take from 30 to 90 days. They require a minimum credit score of 680. The asset that is being financed must be used as collateral. Furthermore, there is a down payment requirement of 10%. This can increase to 15% for a new business.

Also, to qualify, you be in business at least 2 years, or management must have equivalent experience if the business is a startup. Still, it’s a good form of lending for small business.

Microloans

Microloans of up to $50,000 are available through this program. Basically, they work for starting a business, purchasing equipment, buying inventory, or for working capital. Community based non-profits administer microloan programs as intermediaries. Unlike other SBA programs, financing for these loans is directly from the Small Business Administration.

Interest rates on these loans are 7.75% to 8% above the lender’s cost to fund. In addition, terms go up to 6 years.[AF2] Microloans can take upwards of 90 days to fund. The minimum credit score is 640. In addition, collateral and down payment requirements vary by the small business lending source.

SBA CAPLine

There are 4 distinct CAPLine programs that differ mostly in the expenses they can fund. Each of them carries a maximum amount of $5 million and an interest rate that ranges from 7% to 10%. Funding can take 45 to 90 days.

CAPLine American Business Lending Programs

The four different programs are:

- Seasonal CAPLines -Financing for businesses preparing for a seasonal increase in sales.

- Contract CAPLines -Financing for businesses that need funding to fill a contract.

- Builder’s CAPLines -Financing for businesses taking on a real estate or construction project.

- Working capital CAPLines -Financing for businesses that are struggling with a short-term slump in sales.

Credit score must be at least 680 to qualify. There is no minimum time in business requirement. That is, unless you are getting a seasonal CAPLine. That one carries a one-year business requirement.

SBA Community Advantage Loans

This program is a pilot set to either expire or extend in 2020. Its purpose is to promote economic growth in underserved areas and markets. Credit decision makers overlook factors such as poor credit or low revenue if the business has the potential to stimulate the economy or create jobs in underserved areas.

Loan amounts range from $50,000 to $250,000 with a maximum interest rate of 11%. Terms range up to 25 years. It’s a great form of USA business lending for underserved areas.

Other Programs

In addition to these loan programs, the SBA offers additional programs and resources for certain groups. Examples include:

- Veterans Advantage- General-use business loans with no guarantee fee for majority veteran-owned small businesses.

- International Trade- General-use financing for businesses actively involved in international trade or hurt by competition from imports.

- Export Working Capital Program- Short-term working capital for exporters backed by invoices or other business assets.

Recession Business Funding Opportunities: Non-Traditional Lenders

If you are a traditional type person, now may be the time to start thinking outside of the box. Private, non-traditional lenders are going to keep lending for a bit after the traditional lenders tighten up the spigot. The nature of their business allows them to keep the funds flowing a little longer and a little more freely.

Usually, the interest rates with these lenders are higher than those of banks and credit unions. But their approval requirements are easier to meet. And due to the rate cut by the Fed, interest rates should still be lower than they were before the crisis. Here are a few of our favorites.

OnDeck

Apply online with OnDeck and get a decision as soon as processing is over. Loan funds will go to the bank account you select. Financing can be fast. Entrepreneurs can use such a loan to establish their company’s credit history by making prompt payments. Thankfully, they offer fixed rates. Amounts from $5,000- $500,000 are available.

With OnDeck, you will need to have a 600 or better personal credit score for a minimum of one owner. There is also a 3 or more years in business requirement. In addition, $250,000 or better gross yearly earnings is necessary. You cannot have a bankruptcy in the last 2 years. Unresolved liens and judgements are also deal breakers.

StreetShares

StreetShares is a loan provider offering term loans, credit lines, and specialized veteran company bonds. Also, small business loans and investing alternatives are available. Most recently, they offer contract financing. This is similar to invoice factoring. Pre-Approval takes just a few minutes. It does not hurt individual credit. Loans are available ranging from $2,000- 100,000.

You need to have one year or more in business and $25,000 or better in yearly income. Often, StreetShares will make exceptions for high-earning businesses at least 6 months old. Still, you need to have a 620 or better individual credit rating, be a United States citizen, and have reasonable credit. If you do not have reasonable credit, you will need a guarantor that does.

LoanBuilder

LoanBuilder is a service of PayPal. It concentrates on short-term lending to midsize businesses. They provide term loans. You might have the ability to get a loan by the next business day. They have customizable loans without an origination fee.

Loans range from $ 5,000- $500,000. Requirements include a 550 or better personal credit score, $42,000 or more in annual profits, and 9 months or more in business.

BlueVine

Get quick money with BlueVine. They offer invoice factoring as well as lines of credit. BlueVine can process financing in just a day. Loan amounts from $5,000 to 100,000 are available. Lines of credit are not available in all states. Like others, requirements are 6 or more months in business as well as $100,000 or more in yearly income. Plus, you need to have a 600 or better personal credit rating.

Credibly

Credibly is a direct loan provider that specializes in unsecured business funding. It can take just a day or two from application approval to financing. Funding can be used for overhead or day-to-day operations. Loans are available from $5,000- $250,000. Your personal credit does not need to be super-high.

Credibly requires a 500 or better individual credit score. In addition, 6 or more months in service and $15,000 or higher in average monthly deposits are required. Furthermore, you must have at least $10,000 in monthly deposits.

Fundbox

If you start with a search for an online lender, Fundbox is going to be one of the first to pop up. It is a line of credit rather than a loan, but it is a great funding option because there is no minimum credit score requirement.

They offer an automated process that is super-fast. Repayments are automatic, meaning they draft them electronically. They occur on a weekly basis. Remember, you could have a repayment as high as 5 to 7% of the amount you have drawn currently. That is because the repayment period is comparatively short. This means you need to be sure you have enough funds in whatever account you connect them to so that it can cover your payment each week.

Loan amounts come as low as $100 and as high as up to $100,000. The max initial draw is $50,000. Though there is no minimum credit score requirement, they do require at least 3 months in business, $50,000 or more in annual revenue, and a business checking account with a minimum balance of $500.

Upstart

Upstart is an online lender that uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO on their own to truly determine the risk of lending to a specific borrower. They choose to use a combination of artificial intelligence (AI) and machine learning to gather alternative data instead. They then use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities. Typically, business loans are available ranging from $1,000 to $50,000. Interest rates vary greatly, ranging from 7.5% to 35.99%. Repayment terms can be either 3 -year or 5-year.

To be eligible for a loan with Upstart, you must meet the following qualifications:

- Credit score of 620+

- No bankruptcies or negative public records

- No delinquent accounts

- Meet debt to income standards (they only note they will check this ratio, not what their standards are.)

- Have fewer than 6 inquiries in the past 6 months on your credit report, not including those related to student loans, vehicle loans, or mortgages

These are the requirements they list on their website. One independent review said that the requirement for the debt to income ratio is a maximum of 45%. It also says that the minimum annual income has to be at least $12,000. For more information visit our Upstart review.

Fora Financial

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

Bond Street

Offering term loans of $10,000 to $1 million, Bond Street terms are for up to 1 to 3 years. Bond Street will ask for both EIN and SSN.

The offer arrives within 3 days. Bond Street will only do a soft credit pull, and 640 or better credit score is likely to get you a loan. But Bond Street will look at other factors too. For example, they require 2 years in business and annual revenue of at least $200,000.

Like others, rates start at 6% and go up to 22%. APR works out to be 8 to 25%. Also, there is a 3 to 5 % origination fee.

Advantages are the soft credit pull and the fact that they will look at factors other than your personal credit if your FICO score is low. Another benefit is that Bond Street can offer very large loans if you qualify. Disadvantages are the longer time in business requirement and high APR.

Lending Club

Popular online lender Lending Club offers term loans. Similarly, business loans from $5,000 to $300,000 with from 1 to 5 years are available.

Quotes are ready in 5 minutes are less. Thankfully, funds are available in as little as 48 hours if approved. Furthermore, there are no prepayment penalties.

For these loans, annual Revenue must be $75,000 or more. In addition, you must be in business for 2 years or more. Personal FICO score of 620 or better is required. Interest Rates are regularly 5.99% to 29.99%. Total annualized rates starting at 8%.

Fortunately, annual revenue requirements are not too high. Another good thing is funds are available quickly. Unfortunately, rates can get high, but the Fed rate cut helps with that some.

Quarter Spot

Quarter Spot is an online lender that offers short term loans. Amounts ranging from $5,000 to $150,000 are available. The terms are 9 to 18 months. Like others, Quarter Spot will only do a soft credit check when you apply. To qualify, your company must have annual revenue of $200,000 or more. Also, you have to have a personal FICO Score of 550 or better. There is no fee to apply.

The minimum time in business is 12 months. Surprising to some, you must have a minimum average bank balance of $20,000. In addition, they require a minimum of $16,000 in monthly sales.

The borrower must own at least 50% of the business. Their rates are 25% to 40%.

Advantages are that the personal FICO score requirement is relatively low. Minimum average bank balance requirement is also fairly low. Disadvantages are that maximum rates are rather high.

Rapid Advance

Rapid Advance offers standard, select, and preferred loans. For standard loans, $5,000 to $1 million is available. Their terms are 4 to 12 months. Your company must have annual revenue of $120,000 or more. Also, you must have a personal FICO Score of 580 or better. The minimum time in business is 2 years.

For select loans, $15,000 to $1 million is available. Their terms are 6 to 15 months. You must have annual revenue of $240,000 or more and a personal FICO Score of 620 or better. The minimum time in business is 3 years. 1.12 to 1.31 factor rate.

For preferred loans with Rapid Advance, $15,000 to $200,000 is available. Their terms are 9 to 18 months. You must have annual revenue of $240,000 or more. For these, you must have a personal FICO Score of 660 or better.

The minimum time in business is 6 years. A minimum bank balance of $10,000 or more is also required. Consequently, borrowers must have at least 10 deposits from 5 different sources every month. There is a 1.11 to 1.25 factor rate.

The advantages with these loans are many. First, there are a few choices for loan types. Also, the maximum available amounts are high. In contrast, disadvantages include high minimum bank balance requirements and high annual revenue requirements.

Kiva

Kiva is an online lender that is a little different. For example, the interest rate is 0%. This means, even though you must pay it back it is absolutely free money. They don’t even check your credit. But there is one catch. You must get at least 5 family members or friends to throw some money in the pot as well. In addition, you have to pitch in a $25 loan to another business on the platform.

Accion

If your personal credit is okay, Accion may be a good fit. This is a microlender. They are a nonprofit, that offers installment loans to both startups and already existing businesses. The minimum credit score is 575. Sometimes, they will go as low as 500. You don’t have to already be in business. But if you are not, you must have less than $500 in past due debt. In addition, your business needs to be home or incubator based. This makes it perfect for those looking to start a new business from home while social distancing. It is also a great option for adapting an existing business to a home format.

Loans are from 6 to 60 months and interest rates range from 7% to 34%. A personal guarantee, and sometimes specific collateral, is necessary in most circumstances.

Why Choose a Private Lender During this time?

It is very possible you are reading this thinking to yourself, why would I choose over one of the already mentioned recession business funding opportunities? The truth is, in our current situation, you wouldn’t. Exhaust every available option for coronavirus relief first. SBA loans, rural small business grants, and anything else you can find, apply for it now. But what if that isn’t enough? Honestly, it is often easier to get funding from an online lender. This is especially true if your personal credit score is not up to par.

Most term loans and many lines of credit require a personal credit check. That is even if you have great business credit. With the U.S. and even the world economy spiraling into a crash for the ages, credit scores are bound to follow. Some lenders may take your business credit into account. Still, if your personal credit stinks, it won’t help you much. Private lenders tend to have lower minimum personal credit score requirements than traditional lenders.

Next, an online lender will typically send you the funds faster. That is a huge asset right now. Sometimes you can have the money in as little as a few days, with approval coming in as little as 24 hours. For sure, time is of the essence right now.

An Online Lender Could be the Answer for Recession Business Funding Opportunities

If you can go with a traditional lender, great. They often have better rates and terms. But like many business owners, you may not have that option. In that case, an online or private lender may be the perfect solution. They will have recession business funding opportunities. Approval requirements allow many more borrowers to get their funds quickly and easily. This is especially important in times of crisis like this. Even beyond COVID-19, the recession is sure to continue for a while. You need a plan, and private, online lenders could be a big part of that plan. Business to business lending could even be a good choice.

Understandably, the process of finding the best online lender for your business can be overwhelming. There is no need to stress more than you probably already are. We can help you find the right lender, and even walk you through the entire application process. We want to make it as easy as possible for you to get recession funding.

Consider Online Business Lending

You need to find the right one for you though. Consider the following factors:

- How much do you need?

- What do you need the funds for?

- What is your credit score?

- How much of a payment can your budget handle?

It’s also important to note, there are a lot of predatory lenders online. You must be careful. The list above is a great starting point, but don’t stop there. There are a lot of options, so take the time necessary to do your research. If a type of small business lending seems too good to be true, then it probably is.

Recession Business Funding Opportunities: Be Fundable Despite What Changes May Come

Of course, nothing is the same today as it was even a couple of days ago. Requirements necessary to gain access to funds will likely change and continue changing. Not only will federal requirements to access SBA loans change, but states are adding relief programs daily. Be sure to check back as our list of state programs will be updated.

For now, the basic elements of fundability will not change. Ensuring your business is as fundable as possible, and protecting your fundability even now, will only increase the ability of your business to get the USA loans funding it needs to survive during hard economic times.

Make Sure Your Business Is Set Up to Access Recession Business Funding Opportunities

Now is a good time to review how your business is set up. It needs a foundation of fundability. Basically, that is setting your business up in a way that it appears to be a fundable entity separate from you as the owner. It may seem that now is the worst time to be doing this. But if your business is currently shut down due to the coronavirus, you not only need to focus not only on how to stay in business. You also need to know how to get the most funding you possibly can when things start to go back to normal. Building fundability helps even for a guaranteed business loan.

While keeping credit in order is vital, the truth is it may be hard to do right now. Access what small business funding you can. But research options for funding for small business that will work even if your credit isn’t great. In addition, beyond credit, you can control other things that affect your ability to get funding, to a point. This will offset some of the potential reduction in credit score.

You Need Dedicated Contact Information

For example, you cannot share a phone number and address with your business. A business must have a dedicated business phone number and address.

How do you do that? First, you can get a separate phone line and have a separate business location. This is pretty standard. But it can cause issues if you run your business online out of your home.

Virtual Offices for Recession Businesses

In this case, you can get a virtual office address and a VoIP (Voice over Internet Protocol) business phone number. Basically, it allows you to speak on the phone via the internet instead of phone lines. A virtual address service will often offer other services as well. These may include live receptionists and meeting space. VoIP phone numbers can typically be forwarded to any number you want. As a result, you do not have to get a dedicated line to have a dedicated number.

Why does your business contact information need to be separate from your own? There are a number of reasons. But for fundability, there are only two. First, it makes your business seem more professional. In a lender’s eyes, this lends itself to appearing more fundable.

Next, it creates the separation needed between business and owner. This can ensure the business can build credit separate from the owner’s personal credit. While this isn’t the only step necessary for separation, it is a necessary step.

You Need an EIN for Many Recession Business Funding Opportunities

Another thing to consider is whether your business has an EIN. A lot of business owners, especially those running their business as a sole proprietorship have an issue. They tend to use their social security number on business documents. But an EIN is a much better option.

It not only further separates the business from the owner and appears more professional. In addition, it helps ensure that business credit accounts stay off your personal credit report.

You can get an EIN for free from the IRS. The process is fast and easy. It will make it easier to get government small business loans.

You have to Incorporate

There are several reasons for this. First, incorporating creates separation from the owner. This is necessary for building business credit and appearing fundable to lenders. It also helps protect your personal assets should the business struggle. There are tax benefits as well. Your options for incorporation include an S-corp, an LLC, or a corporation.

The one that you choose doesn’t matter much for fundability. Make that choice based on the level of liability protection you need and you budget. It’s best to talk to a tax professional or attorney when making the decision.

A Separate Business Bank Account is Essential for Traditional and Recession Business Funding Opportunities

You need a separate, dedicated business bank account. It helps create the separation necessary to build business credit, which is a huge piece of being fundable. But some of the recession business funding opportunities available during this time may also require a separate business bank account.

Be Consistent

This part of fundability can get complicated because it has so many interconnecting pieces. In fact, the consistency part can be especially daunting. This is because it goes all the way back to the start of your business. If it has been in operation for a while, you can see how that could be an issue.

The thing is, most business financing applications are denied due to fraud concerns. In truth, this can be an issue for you if you have different information across various records. All names, contact information, etc. needs to be consistent. This is when it comes to public records, accounts, websites, social media, and licenses.

Website

This is a great time to leverage your company website. First, you must have one. Yet, it can’t just be something you throw together. It needs to be professionally designed. In addition, you need to pay for hosting. With consumers trying to stay in due to social distancing, online trading is exploding. If your website isn’t up to par, you are going to miss out big time.

Also, your business email address needs to have the same URL as your website also. Truly, you shouldn’t use a free email service such as Yahoo or Gmail.

Do You Have Business Credit? If So, What’s It’s Like?

If you don’t have business credit, consider beginning to work on it if possible. You do have business credit? Now is not the time to let it slip. Now, take advantage of the recession business funding opportunities available to help you.

Do You Have a D-U-N-S Number?

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Likewise, each business in their database has a D-U-N-S number. If you do not have one, they will not recognize you. As a result, any accounts reporting will be discarded. You must have this number.

Other Agencies

Other agencies can affect your fundability as well. For example, there are two other main business credit reporting agencies. They are Experian and Equifax. Honestly, your record with these and other agencies can affect your ability to get funding also.

Other credit agencies exist, and some lenders do use them. CreditSafe and FICO SBSS are just a couple of examples. In addition, your file with LexisNexis and The Small Business Finance Exchange can affect your business credit score. Of course, that affects fundability too.

Monitor Your Business Credit

Monitoring is especially important during hard economic times. First, you need to stay on top of which accounts are being reported and what they are reporting. You don’t want anything to slip. Next, if it does start to slip, you need to know so you can take action.

If you find mistakes, you can contact the reporting agency in writing and have them corrected. Remember, send copies of backup documentation, not originals.

Keep Up with Financials

Honestly, this is more important now than ever before. Currently, some banks are even reviewing weekly financial information instead of monthly or quarterly. This way, they can see if income is starting to slide due to the COVID- 19 pandemic. It makes sense for small business lenders to work this way.

If you are a very small business, you may not give much thought to your financial statements. But it’s essential to do so, even now. You want to give yourself every opportunity to get US business lending.

Pay Your Bills, Both Business and Personal

Try hard to stay on top of bills during this time. Take advantage of all of the programs and resources, both state and federal, to help you do so. This is essential to maintaining healthy business and personal credit. Also, both of these are vital to fundability.

The Application Process

For this period of time, the main thing to remember here is to only apply for the loan for small business from government programs you qualify to take advantage of. Also, be prepared. You have to act fast. Yet, if you enter the federal small business loan process without everything you need, it will only slow things down. Take the time to read the requirements and gather what you need to first.

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

Starting a Business?

Now could be the perfect time to start recession proof small businesses. There are businesses that do well in recession, so do your homework. But remember, the best recession proof businesses are the ones which help people. If you want us to show you the best way to start and run a business even during a recession then check out our Startup Accelerator Course.

Check Out Recession Business Funding Opportunities During the COVID-19 Pandemic and Help You Protect Your Fundability

Of course, you’re thinking now is not the time to be building anything. You need to stay afloat. If you are not already fundable you can’t worry about that right now. Here’s the thing though…you can. First, get what United States government small business loans are available quickly. Then, take a second, breath, and consider the fundability of your business.

Honestly, there is no time like the present to get an EIN, separate your contact information, and even incorporate. While you do these things, you will be setting yourself up to building fundability and business credit. And you will be ready even during these hard times. That in turn, can only increase your access to funds over the long-term.

Basically, it is a matter of protecting what you have and growing what you can right now. Truly, it is a great time to borrow. The Fed’s rate cut should lead to lower interest rates than we have seen in years. In addition, many state and federal governments are working to make borrowing more accessible to businesses. This is to both help them stay afloat and to shore up the impending economic decline.

Start here to find what’s available to you both federally and in your state. And we’ll update often. So, if your state isn’t doing anything right now, come back every day to see if things have changed. The key to surviving is to take advantage of the recession business funding opportunities available to your business today. Time is short. Funds are limited. You must act now. Don’t wait.

The post Ride the Rapids: Your Essential Guide to Accessing Unique Recession Business Funding Opportunities Related to Coronavirus appeared first on Credit Suite.