41 Factors That Influence Your Website’s Credibility

There’s one thing you’ll need to convert more website visitors: credibility.

Credibility shows customers you’re safe and trustworthy. It’s impossible to generate more leads, sell more products, or attract more visitors without it.

Almost every company struggles with website credibility. Website visitors are immediately skeptical.

If you’re an unknown, you’re unsafe.

This means website visitors will need to be persuaded before they feel comfortable enough to take a chance on your business.

Your website visitors are looking for a reason to leave.

In fact, most visitors leave web pages in 15 seconds or less. Web pages with an effective value proposition will hold visitors’ attention longer.

Scientists from Microsoft Research analyzed page-visit duration for 205,873 web pages (with more than 10,000 visits to each page).

They found visitor time-on-site follows a Weibull distribution.

Weibull is a reliability metric used to analyze and predict the time-to-failure in components.

Let’s say you replace a spare part in a random piece of equipment. A Weibull analysis predicts when you’ll have to replace that specific part again. Doesn’t sound all that helpful, does it?

Replace “component failure” with “visitors leaving web pages,” and it becomes very helpful.

Here’s what scientists learned after analyzing hundreds of thousands of web pages.

There are two kinds of Weibull distributions.

- Positive Aging: The longer a component is used, the more likely it is to fail.

- Negative Aging: The longer a component is used, the less likely it is to fail.

Scientists found that 99 percent of web pages have a negative aging effect. When website visitors hit your landing page, they’re skeptical. They’re quickly scanning the page, looking for a reason to abandon your site.

Get your website visitors past the 30-second mark, and they’ll spend a lot more time on your site.

Why? Because they feel your website is more valuable to them. What makes your website more valuable to your visitors?

Credibility.

Credibility is an essential part of an effective value proposition. Your visitors are looking for signals that show your organization is reliable, trustworthy, and knowledgeable.

How To Improve Your Website’s Credibility

The success of your website depends on your credibility.

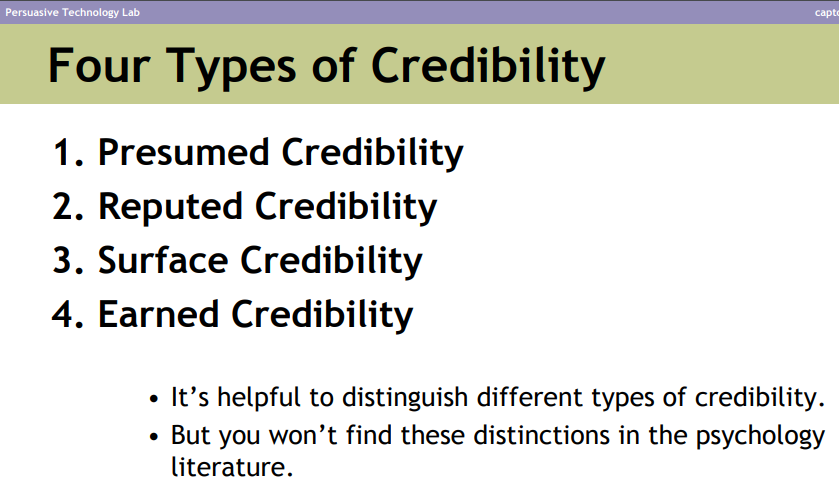

What type of factors influence website credibility? According to BJ Fogg, a researcher at Stanford’s Persuasive Tech Lab, there are four kinds of credibility.

- Earned Credibility: Your visitors have had a positive experience with your website (e.g. helpful information, little-to-no errors, expert advice, great customer service, etc.) and found your website to be both credible and valuable.

- Reputed Credibility: A referral from a third party — like family, friends, a co-worker, or someone you know — or unbiased reviewers who have had a positive experience with your website.

- Presumed Credibility: Familiarity and assumptions — a brand they’ve heard of is more credible than an unknown (e.g., I saw your YouTube ads, I read your guest post on Forbes, I listened to your interview on the Tim Ferriss show, etc.)

- Surface Credibility: A visitor’s subjective opinion of your website (e.g., I like the design, this looks trustworthy, great content, this page is confusing, etc.) is all that matters when you’re asking them to convert.

The goal with each of these credibility factors is to stack the deck in your favor.

Building your website’s credibility is a great way to attract more of the results you want. If you want to attract more visitors, you’ll need to choose the right credibility tools at the right time.

But which website credibility factors are most important?

Here’s a list of the factors that influence your website’s credibility and how you can use them.

1. Consistency (Over Time)

As long as you’re consistent, a visitor’s trust in you will grow. By consistently doing all the things I’ve shared in this article, it creates a really good reputation with your customers.

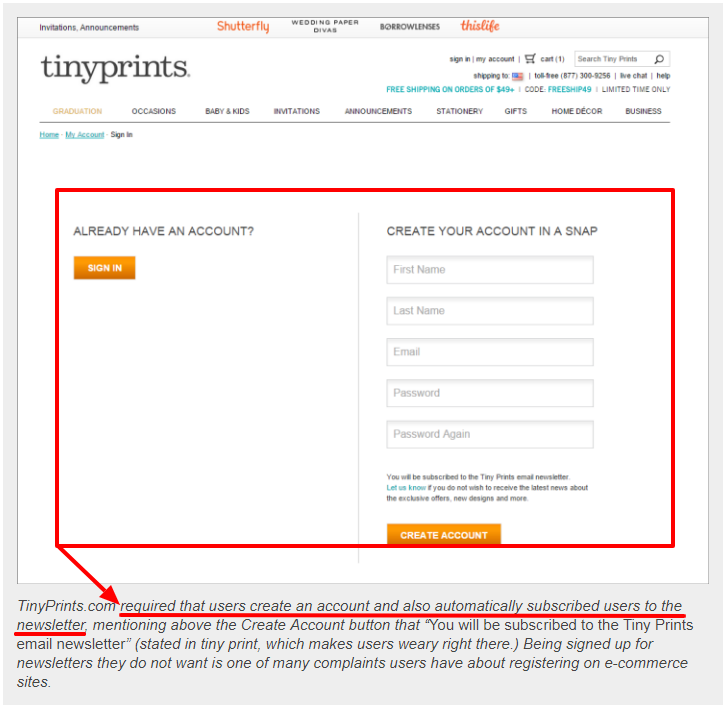

2. No Unnecessary Requirements

When you force customers to register before they can post a comment, initiate a live chat, or purchase your product, it decreases trust.

Asking for your customer’s phone number when you only need their name and email address increases resistance and decreases trust.

3. Add Helpful FAQs

Customers have questions and objections. An FAQ is a helpful way to give customers straight answers to some of their questions.

It’s common for organizations to treat their FAQs as a low-key sales page. It’s much better to be helpful, upfront, and honest with each and every one of your customers.

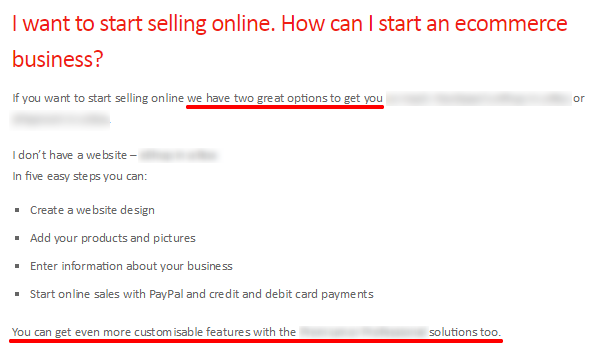

4. Minimize Jargon

If you’re selling to a mainstream audience, jargon isn’t a good idea. Research shows people are more likely to believe a concrete statement over an abstract one. Use specialized jargon for specialized audiences.

Sometimes jargon is a helpful way to establish credibility in a niche community, but it’s still a good idea to only use it sparingly. The more you use jargon, the more your credibility suffers.

5. An Up-to-Date Blog

Consistently creating content shows visitors your website is active and maintained. It also conditions them to check back frequently, always looking for fresh content that can help them.

6. Useful Expertise

Your website visitors are always on the lookout for expert-level content that solves their problems, moves them closer to their goals, or simply entertains them. They want expert content that’s fresh, surprising, and detailed.

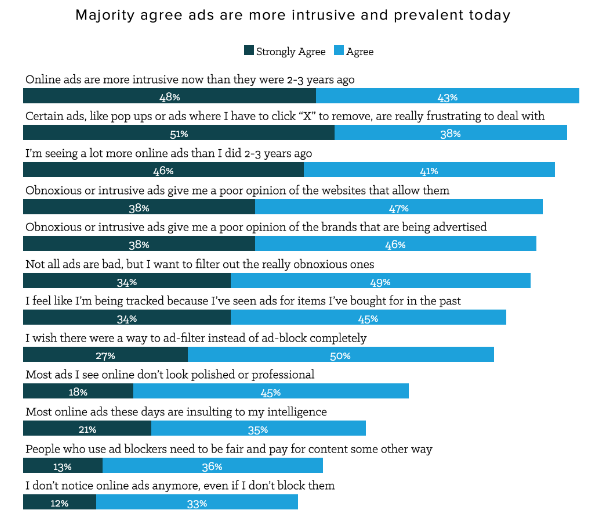

7. Minimal Advertising

People hate ads. They don’t like them because they’re annoying and pushy interruptions and they’re everywhere.

It’s a good idea to minimize the advertising on your site, so it doesn’t hurt or interrupt your visitor’s experience.

8. Helpful Customer Service

Great service gives website visitors a positive experience with your site, improving earned credibility. Friendly, knowledgeable support reps show website visitors that your company is experienced and efficient. Consider adding a live chat option to make it simple for your audience.

9. Cite Your Sources

Giving sources increases your trustworthiness. As customers trust you more and more, they’ll validate your sources less and less, but only if you have a track record of citing your sources and providing them with the evidence to support any claims you make.

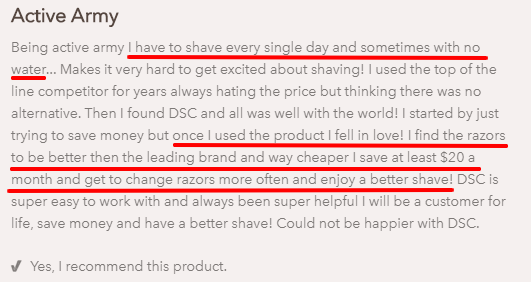

10. Customer Testimonials

Social proof in the form of testimonials gives visitors access to your customer’s mind. These testimonials show visitors what it’s like to be your customer, how you operate, and more.

The biggest downside to testimonials is that they’re one-sided, but they’re still a great way to build website credibility.

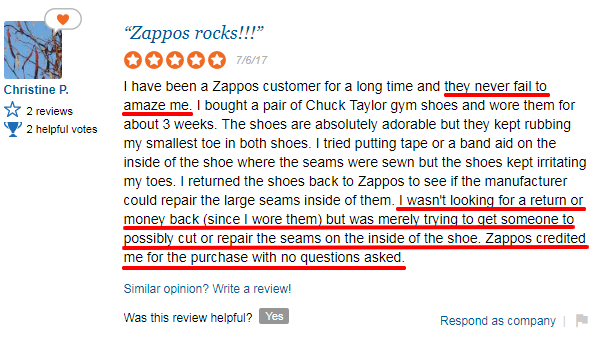

11. Include Customer Reviews

Customer reviews are similar to testimonials in the sense that customers can share their feedback. Reviews take that a step further, allowing customers, companies, and the community to have a conversation.

Reviews, when they’re positive, can boost credibility (and sales) dramatically. However, there is some value to negative reviews, so don’t let one bad review get you down.

12. Professional Product Reviews

These can come from influencers as large as Consumer Reports, TechCrunch, and BuzzFeed. They can also come from up-and-coming bloggers, individual reviewers with a YouTube channel, and your customers themselves.

Professional reviews are often seen as more credible due to the reputation and influence of the reviewer itself. A glowing review from a powerful influencer can lead to a large increase in sales.

13. Trust Seals

Logos or seals from independent and trustworthy authorities enable you to borrow their credibility as your own. Use trust seals like Web of Trust, GoDaddy Site Seal, Norton Secured, PayPal Verified, BBB Accredited Business, and HTTPS.

14. Reviews From Influencers and Notable Customers

Big-name reviews carry a lot of power, prestige, and reach. A testimonial from a powerful influencer can boost your trust and credibility. I used this exact strategy on Quicksprout to boost my credibility dramatically.

Reviews from these influencers are easier to get when your other credibility factors are straightened out.

15. Case Studies

These are typically created in collaboration between the business and the customer. Customers share their problems and expectations going into the relationship, then their experience and the results that followed.

Case studies, like testimonials, tend to be one-sided. However, they boost credibility because customers are willing to share their stories.

16. Connections to Influencers

This could be as complex as a large professional network and connections to large organizations, or as simple as associating with other well-known local or minor influencers.

17. Customer Validation

Displaying your client lists, the number of clients you have, or the industries your clients are in. When customers see their competitors or other brands they trust use you, they are more likely to trust your brand.

18. Third-Party Validation

As featured in, as seen on, used by these clients — this kind of validation borrows trust from bigger, more influential sites to build trust and credibility.

19. Press Mentions

Media exposure is a powerful credibility booster. The more prestigious the news organization, the greater the increase in credibility.

20. Awards

These can raise your company’s profile and give you a nice prestige boost. The more impressive the award, the bigger the boost.

However, there’s a downside to using awards. The less credible the award, the more likely customers are to question your business, products, or services.

21. Influencer Feedback

Being visible on an influencer’s site — whether that’s in the form of a testimonial, interview, guest post, or review — introduces website visitors to you, improving your credibility before they arrive on your site.

22. Guest Posts

Writing for other well-known publications means you’re familiar. Visitors have heard of your site before hitting your landing page.

23. Advertising

When it’s used well, advertising (via platforms like Google Ads, Facebook Ads, or YouTube Ads) creates presumed credibility in the form of branding and familiarity. If visitors have heard of you before, you’re more credible.

24. Branding

A solid brand gives you a specific place in a customer’s mind via psychological anchoring, which establishes credibility. Branding is what lasts in the long run.

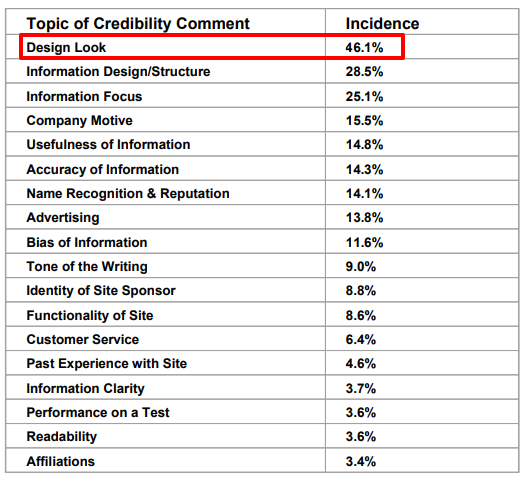

25. Professional Design

Customers form a first impression of your website in 50 milliseconds. There’s no thinking with this first impression. It’s visual, focused on aesthetics, and almost entirely emotional.

Stanford’s Persuasion Technology Lab found that almost half (46 percent) of people say a website’s design is the number one criteria for determining website credibility.

How does this happen?

Leading companies in every industry train customers, showing them what to expect. Customers take those lessons to other sites, using these leaders as a measuring stick.

26. Typography

Research shows larger fonts improve reading speeds. Website visitors comprehend more when typography is legible and clear. This seems like a no-brainer, but it can be easy to forget.

Remember, clarity trumps persuasion.

According to Flint McGlaughlin, your website visitors land on your site with a few questions:

- Where am I?

- What can I do here?

- Why should I do it?

The easier it is for website visitors to understand what you’re saying to them, the easier it is to persuade them to do what you want.

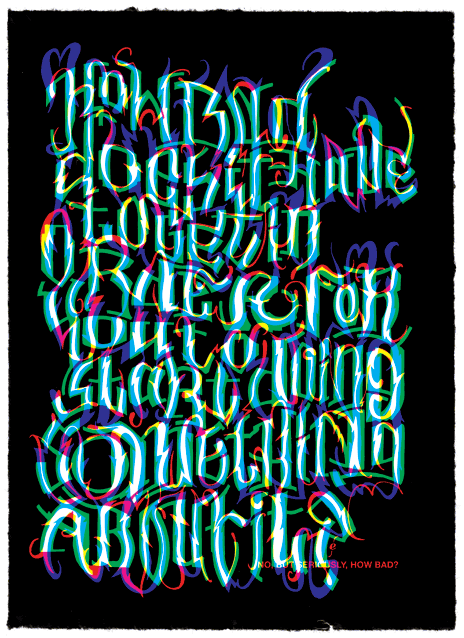

Which one is easier to understand?

Or this?

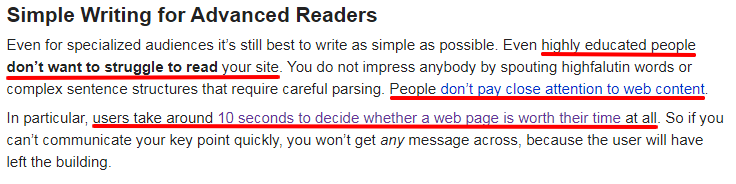

27. Simple Content

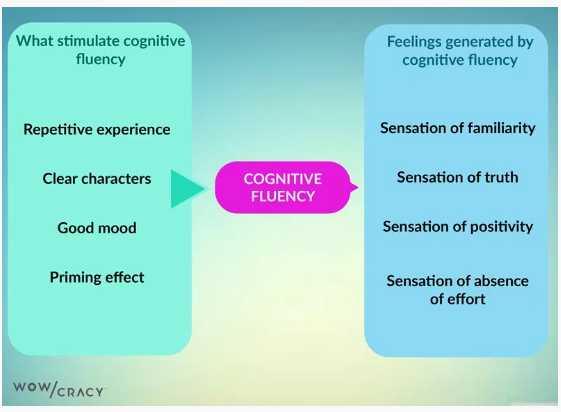

Smart marketers work to improve cognitive fluency. That’s the feeling of ease a visitor has when your content and visuals are easy to read.

The easier your content is to understand, the more familiar it feels, thus the easier it is for visitors to decide to buy.

28. Use Good Grammar

Yeap, spelling and grammar matters because it’s part of the first impression customers form about your brand. A typo here or there won’t ruin your credibility, but a consistent pattern of bad grammar hurts your credibility. Sites like Grammarly can help keep your grammar in check.

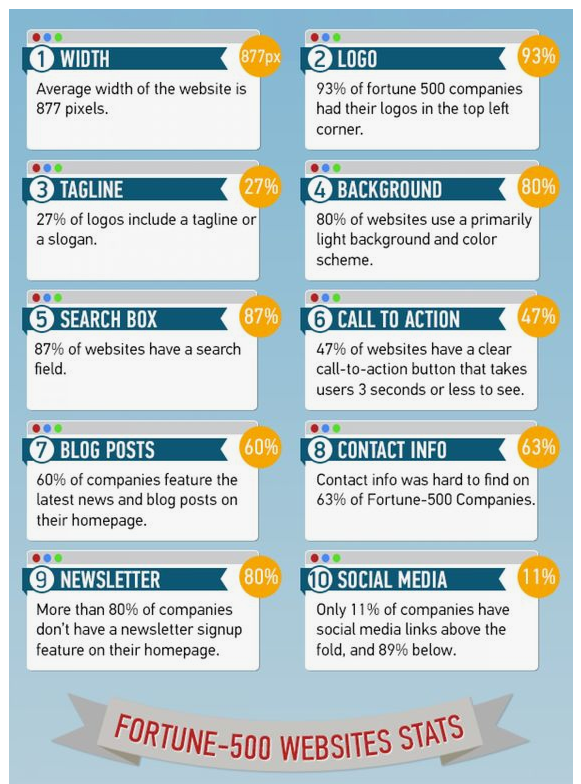

29. Good On-Site Search

Most e-commerce visitors start the buyer’s journey in the search box. In fact, a visitor that uses site search is 1.8X more likely to convert.

Website visitors often have a hard time with search. The keywords they use don’t always lead them to what they’re looking for. So, it’s often a good idea to redirect searches to navigation whenever possible.

30. Website Navigation

Your website navigation communicates trustworthiness to visitors. They expect your navigation to be organized and to use appropriate imagery and colors.

The easier it is for customers to find what they’re looking for, to solve their problems, the more trustworthy your website/business appears to be.

31. Ease of Use

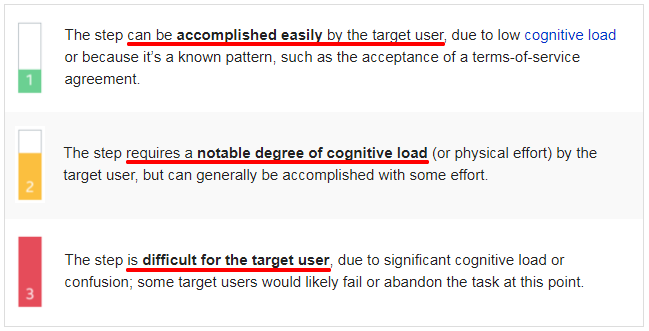

Usability experts trust PURE Scores to rate website ease-of-use, focusing specifically on tasks.

- Can website tasks be accomplished easily?

- Do website tasks require a large degree of cognitive load or physical effort?

- Are website tasks difficult for target visitors?

Website visitors are drawn to websites that are attractive and easy to use. Ease of use can also impact Google ranking.

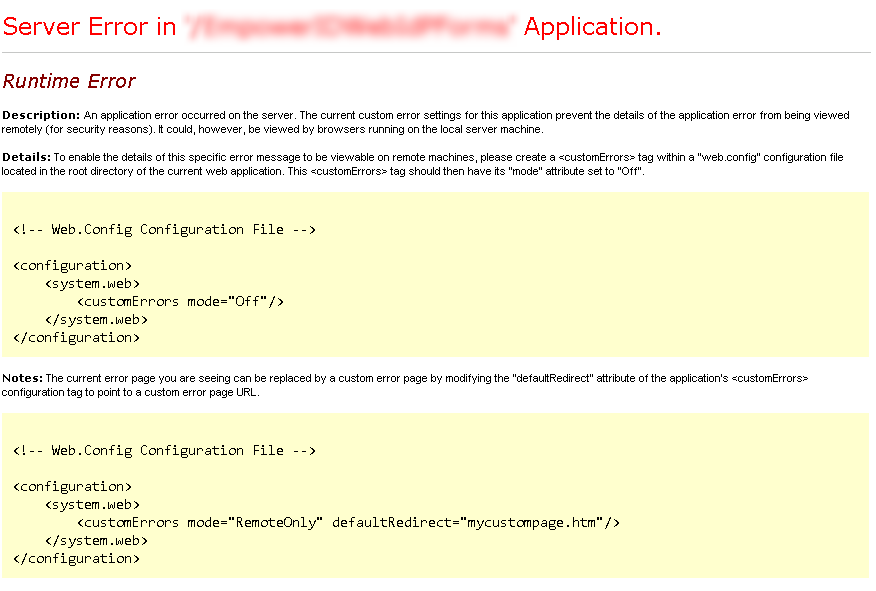

32. No technical problems

Broken links, missing pages, slow web pages, development bugs — these technical glitches decrease visitor confidence in your business and their willingness to convert.

33. Contact Information

Posting your phone number, address, email, live chat links, social media profiles, and hours of operation show you’re a real business and not a fly-by-night operator. Visitors feel confident knowing they can contact you whenever they run into trouble.

More importantly, your visitors know how to contact you.

34. Staff Photos and Bios

Customers want to see real people run your business. They want to hear your story, verify your background, and see who they’re giving their money to.

Sharing staff photos increase conversions. Hiding staff photos sends the message that you’re untrustworthy or hiding something.

35. High-Quality Images and Visuals

Website visitors expect your images and visuals to add context and meaning. Most websites use images (e.g., stock photos) as decoration, which according to Jakob Nielsen, are completely ignored.

Poor quality images will actually hurt your credibility and conversion rate.

Whenever possible, use real people in your photos, photos that display product details, and give visitors large, hi-res photos when they ask for it.

36. Clear Policies

Website visitors want to know what happens to their information. What’s your return, warranty, and privacy policy? Will you share their data with 3rd parties?

Customers look for this info when they’re close to conversion.

37. Clear Link Text

The anchor text in your links should describe the destination or outcome. It’s always a good idea to tell your visitors where you’re taking them.

38. Order/Product Information

How long will it take for customers to receive their order? How much does shipping cost? What comes with their order? Is the warranty included? How long does it last?

Website visitors want to see order, product, and fulfillment information upfront.

39. Convenience

The more convenient and compelling it is for your website visitors to buy, the more likely they are to spend. Look for ways to reduce user friction.

40. Displaying Prices

As far as a credibility factor goes, this one is tricky. If you’re selling to enterprise customers and you display your prices, it could be a turn-off. B2C and B2B (small to medium) businesses want to see the price.

As a general rule, people want to know how much your product or service costs.

For most customers, the value of what they’re getting and their perception of your price is just as, if not more, important than the price itself.

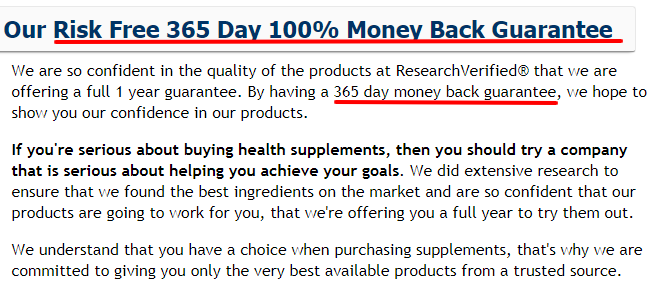

41. Share Guarantees and Warranties

These create clear standards you’ll have to follow. Customers get peace of mind knowing you’re willing to stand behind your products and services.

You get more business because customers feel more confident about doing business with you.

Website Credibility Factors Conclusion

If these credibility factors are important to your target visitors (and they are), they should be important to you. f

Credibility factors don’t apply equally in every industry. Some industries may prefer specific ones over others.

What’s important is that you use the credibility factors that matter to your customers.

There’s a simple solution if you’re not sure: just test it. Then keep testing until you find the solution that works best for you.

If you’re still unsure, ask your visitors. Many of them are willing to tell you what they think if you’ll take the time to ask them.

What types of strategies do you use to improve your website credibility?