Article URL: https://jobs.lever.co/newstory/b2757a8e-9690-497b-bbde-e533984c6761

Comments URL: https://news.ycombinator.com/item?id=30453732

Points: 1

# Comments: 0

Article URL: https://jobs.lever.co/newstory/b2757a8e-9690-497b-bbde-e533984c6761

Comments URL: https://news.ycombinator.com/item?id=30453732

Points: 1

# Comments: 0

Banks aren’t opening their vaults as easily for businesses these days as they have in the past. Many business owners are finding it necessary to get creative when it comes to business funding. In many cases, credit unions are seizing the opportunity to step in and fill the gap.

In fact, back in 2018, Member Business Lending (MBL), partnered with CU Direct to help this process along. MBL is the leading credit union service provider when it comes to business loan origination services. CU Direct, well known for the CUDL (Credit Union Direct Lending) system, works with thousands of auto dealerships to help facilitate auto-financing through credit unions.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Together, the two are able to streamline the credit union business loan processes. It’s a good thing too, because more and more businesses are looking to credit unions to get the funding they need since banks aren’t coughing it up.

So, is credit union direct lending right for your business? Let’s find out.

While all lenders have their own requirements, it’s a fair bet you are going to need to provide the following to any lender.

Most lenders will be looking for the following:

If you cannot provide all of the information, it could go a couple of ways. They could automatically deny the loan. However, some credit unions are willing to review the information provided.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

It’s important to note that personal credit score is handled differently by each institution when it comes to credit union business loans. It’s a fair bet that if they are asking for a personal guarantee, they are going to want to see a strong personal credit score.

However, we have heard from at least one credit union that this is not always the case. This particular credit union does not have a standard minimum credit score requirement. They say they take each loan application on a case by case basis.

So, even if you do not have a great personal credit score, if you are strong in the other areas you may still qualify for a business loan from a credit union. You just have to find the right lender.

So, why would you pursue a loan from a credit union over a loan at a bank? In short, lower interest rates and fees. Credit unions are cooperative, non-profit organizations. As such, they do not pay federal and state income taxes. So, they are able to pass the savings on in the form of lower rates and fees.

Due to a difference in structure and loan application review processes, credit unions are also often able to process loans much more quickly than banks.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

At this point, you are likely either thinking, “I can do this!” or “What am I going to do now?” You’ve either realized you’ve got this in the bag, or you know you need to pursue other options until you get some issues taken care of.

There are a few things you can do. If you need money right now, you can look at getting a loan from an alternative lender. Credit Suite’s Credit Line Hybrid funding may also be an option. There are a lot of funding options out there.

Whatever you do, it’s likely you need to work on your fundability while you do it. Most business loan denials result from a fundability issue. You can get a free consultation with a business credit expert to help you analyze your fundability. They can show you what you can do to improve your chances of approval. With strong fundability, you’ll be able to get the best deals on the business funding you need, when you need it.

The post Is Credit Union Direct Lending a Valid Option for Your Business? appeared first on Credit Suite.

In an increasingly digital world, direct mail seems old and boring.

You wouldn’t drive a horse-drawn carriage to work or use a pager to contact your friends, would you?

Of course not.

Direct mail feels outdated.

But direct mail is still a great way to reach your audience, grab their attention, and connect with them on a personal level.

In 2016, The Data & Marketing Association reported that the direct mail customer response rate increased by 43%. Even better, the prospect response rate increased by 190% compared to 2015.

Many marketers are in shock.

But the data is undeniable.

Direct mail is still effective, and using it is a game-changer for any serious marketer.

Here are 13 reasons why direct mail still isn’t dead.

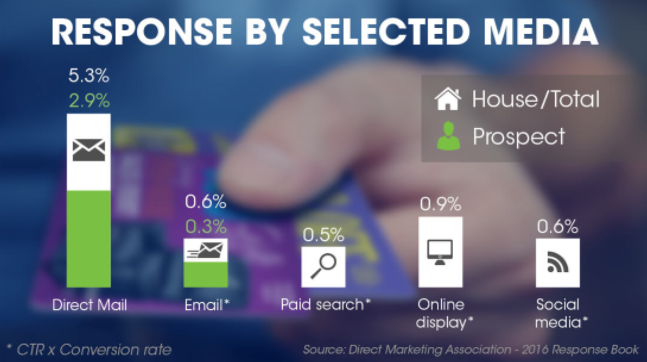

Would it surprise you if I said that direct mail gives you more bang for your buck than paid search and online display ads?

Well, it does.

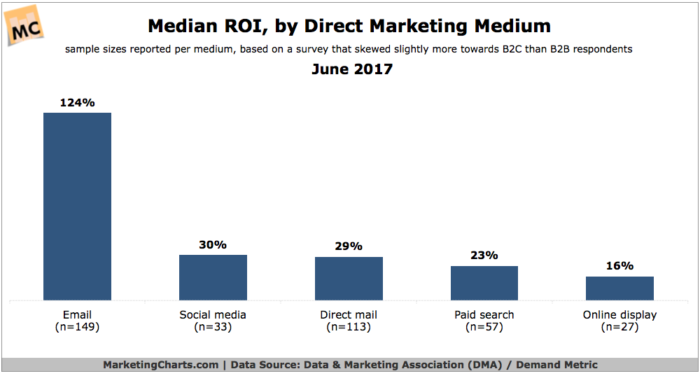

Direct mail has a median ROI of 29%, putting the ROI in third behind email and social media marketing in terms of ROI. Social media is ahead by only 1 percentage point.

That might not seem very high, but when you consider that paid search has an ROI of 23% and online display at 16%, that number looks a lot more attractive.

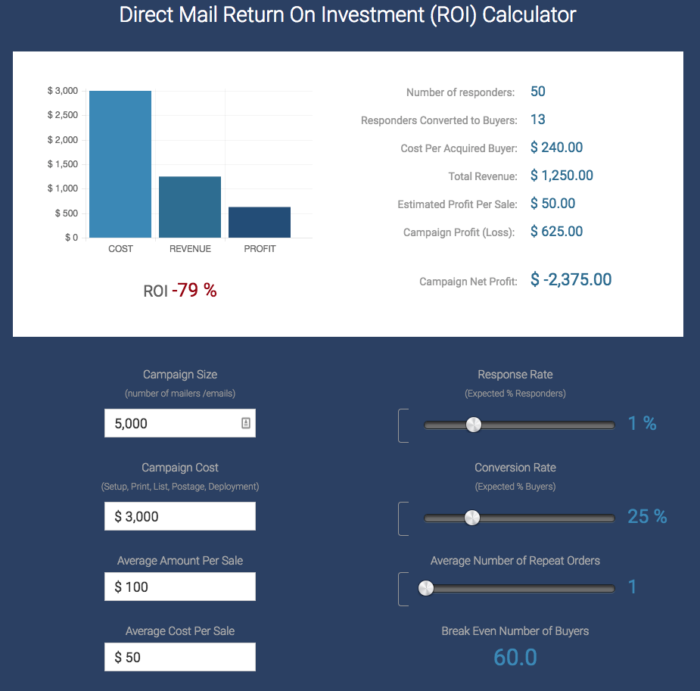

Are you curious about what your direct-mail ROI could become? You can go here to calculate it.

That baffling ROI says nothing of direct mail’s response rate, which is 5.3% for mail sent to houses and 2.9% for prospect lists.

Now compare that number to email, which has an average click-through rate of about 2% or 3%. And that’s the click-through rate, not the response rate, which is 0.6%.

Despite what the haters say, direct mail is still holding its own against other marketing channels.

Every great marketing strategy uses multiple channels.

Smart marketers wouldn’t run only Facebook Ads and call it a day.

They’d consider running Instagram ads, do paid search campaigns, and even use search engine optimization to increase traffic.

While you shouldn’t invest only in direct mail, you should consider it part of your marketing bag of tricks.

97th floor in Utah combined direct mail and digital marketing to increase loyalty with their clients.

First, they sent out a direct mailer to all of their clients with a holiday poem and a $20 bill with a scannable code next to it.

Endearing, right? But the beauty is when you flip over the card and look at the left-hand side. There’s a scannable code and a hashtag to use below it.

So what’s up with the $20 bill?

When someone scanned the code with their phone, it sent them to a video that encouraged them to spend $20 on someone less fortunate during the holiday season.

The agency then asked for everyone to share what they did on Twitter using the hashtag #20helps.

Combining direct mail with savvy digital-marketing techniques increases the personability of the message you’re sending.

When you give people something to do with your direct mail, such as watching a video, taking a selfie, or spending $20, few people resist the urge to participate.

On social media, targeting your audience is dead simple. Facebook, Instagram, and Twitter all offer tons of targeting tools based on interests, demographics, even behavior.

But what about sending the right message to your customers using direct mail?

Can you target your ideal client well enough to make it worth your time and money?

Yes, you can.

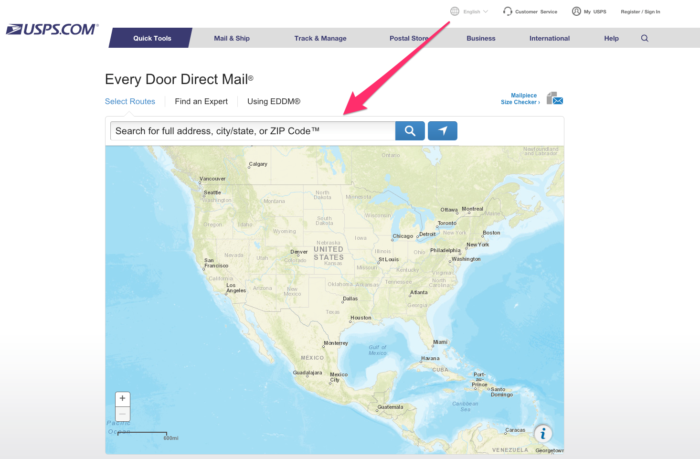

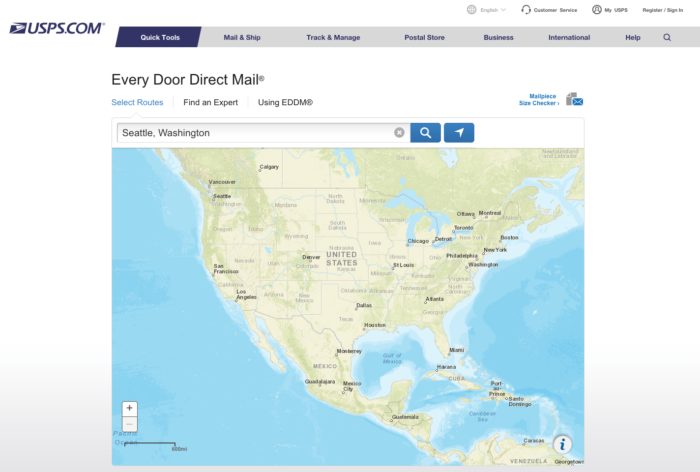

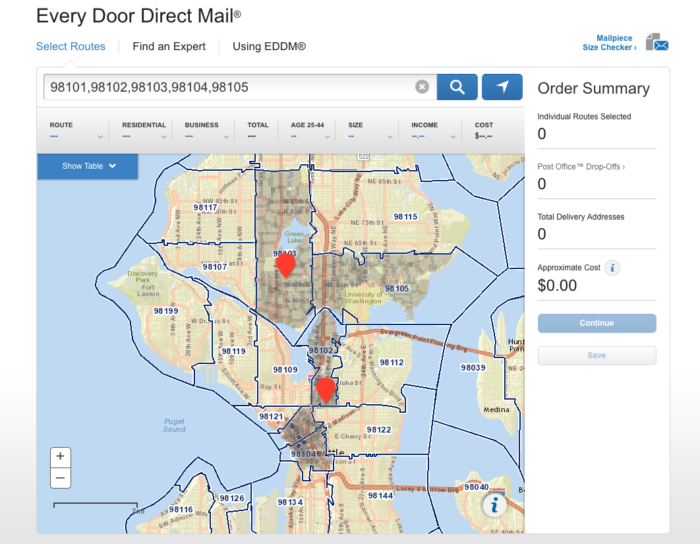

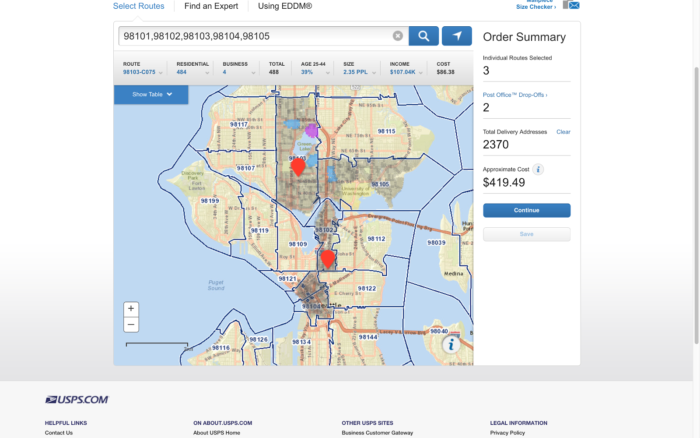

At USPS.com, you can use their Every Door Direct Mail tool to send mail to different customers in different areas.

Start by entering your city and state or zip code.

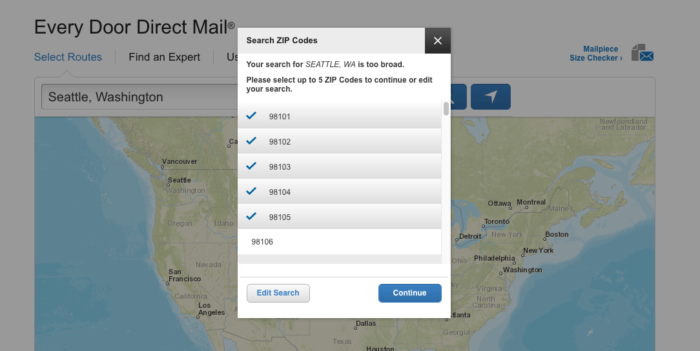

Hit enter. Select up to five zip codes near your location.

Then click continue. You’ll see a map that looks something like this.

When you hover your mouse over a route, the tool will show you the number of residents, number of businesses, age range, average household size, and average household income of that zone.

It even calculates the approximate cost of postage to send a mailer to that route.

As long as you already know who your target audience is, direct mail can be highly specific.

Technically, there is no automatic way to track direct mail response rates, ROI, and general engagement. Unlike a Facebook ad, you can’t track that the user went from your ad to your product page.

Maybe a customer visits your website after seeing your direct-mail piece. While this person would count as a lead from your website, they should be a lead from your direct-mail campaign.

But wait, I just said direct mail is trackable.

It’s a little more complex, but tracking direct mail is totally doable.

Here are a few tricks you can use to find out how well your direct-mail campaign is working.

First, if your goal is to get someone to call you, choose a unique phone number for that direct-mail campaign.

Similar to this, if your goal is to get people to visit your website, you can create a unique landing page to track your results.

When people visit or click on the landing page, you’ll know that they came from that direct-mail campaign.

Whatever CTA you choose for your direct mail campaign, use a unique tracking device, whether that is a phone number or website URL.

Then, you can count it as a lead from your direct-mail campaign.

At first glance, that might not seem like a good thing.

Maybe fewer marketers are using direct mail because it doesn’t work.

As I’ve already shown you with the above statistics, that isn’t the case.

The answer is simple. Since everyone is familiar with digital marketing, it’s easier to start getting results than a direct-mail campaign. So fewer people do it.

In 2016, there was a 2% decrease in direct mail delivered from the previous year.

Why is that a good thing for your direct-mail campaign?

When fewer marketers are sending mail, your piece has a higher chance of standing out.

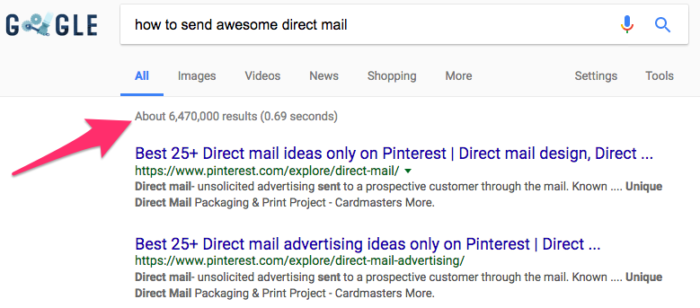

Think about how much harder it is today to rank in Google. If I type in “how to send awesome direct mail,” Google only shows me 10 results out of 6,470,000 possible answers.

In other words, the internet is full of marketing messages.

But mailboxes aren’t.

And that’s why direct mail still works so well in this digital age. Since it takes a bit more work than other digital marketing strategies, it’s less common and more effective.

Like hot baths and candlelit dinners, direct mail has become romanticized in our culture.

Think about it. When you receive a handwritten letter from someone, what do you do?

You get excited. Someone cares enough to write you a letter. It’s not very often that you receive something like this.

What do you do next?

I’ll bet you sit down and read every word of that letter. But it’s not just you who loves getting letters.

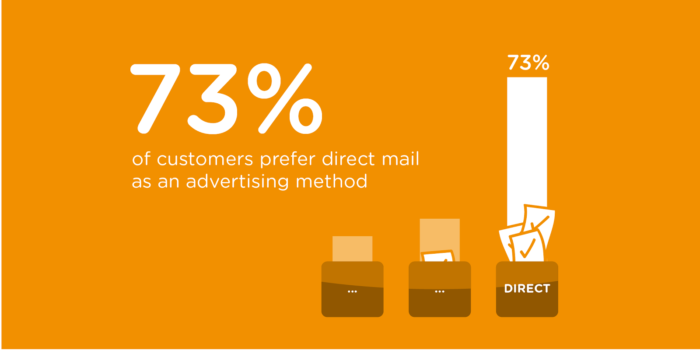

73% of people said that they prefer direct mail as an advertising method.

And, 59% of US consumers say they actually enjoy getting mail from brands.

Since people are receiving less direct mail, each piece of mail is more exciting.

Especially if your direct mail is handwritten. Even if you add your signature.

In a world where everything gets written by a machine, handwriting on a direct-mail piece is a touch that receivers won’t be able to ignore.

Just check out this example from BiggerPockets.

It’s more like getting a personal letter from a friend than a marketing message from a business.

Imagine this. You receive a coupon in the mail for $10 off your next meal at your favorite local pub.

If you’re like me, you set the coupon on your refrigerator for future use.

Then, you pretty much forget about it. For the next few weeks, the coupon sits in your kitchen with other unused direct-mail offers.

But one night, your buddy calls and wants to watch the big game at a restaurant. As you’re trying to decide where to go, you remember, “Oh! I have a coupon for our favorite pub.”

And at that moment, the coupon decides for you.

Even though the coupon is for just $10.

You could do the same thing with a haircut business.

Or an ecommerce store. No brick-and-mortar location needed.

Since direct mail is tangible, it sticks around. It clutters physical space.

Email is easy to forget about because it’s just a number on a screen.

As a general rule of thumb, about two percent of online advertisements garner our attention each day. In other words, only about 100 out of every 5,000 ad exposures have any meaningful impact on consumers.

But direct mail is unavoidable.

About 66% of people have purchased a product because of direct mail.

If your direct mail piece has a special offer, most people will save it for future use, and then they won’t be able to forget about it.

A certain fear accompanies direct mail.

What do I mean?

When you open the mailbox and pull out a small stack of letters, you won’t throw away any of the mail without glancing at it first.

You don’t immediately know which piece of mail requires your attention and which one you’re uninterested in. There is a fear that you might miss out on something important.

Because of that, you don’t want to throw mail away without taking a peek at it first.

Right?

When you receive an email, you probably have at least four (or forty) other tabs open on your computer. There are a bunch of notifications dinging on your phone and laptop.

The average American consumer is exposed to thousands of advertisements per day. In fact, it’s not unusual for the average consumer to see more than three hundred advertisements, of various sorts, within the first hour of waking up.

But when you receive a piece of direct mail, you’re at home, after work, with some extra time to view each letter.

Direct mail naturally gets more attention because there are fewer distractions when people see it.

As I’ve shown you, direct mail is tangible, meaning it has the potential to stick around for a long time in someone’s house.

For this reason, consistent mailing increases awareness of your brand.

How?

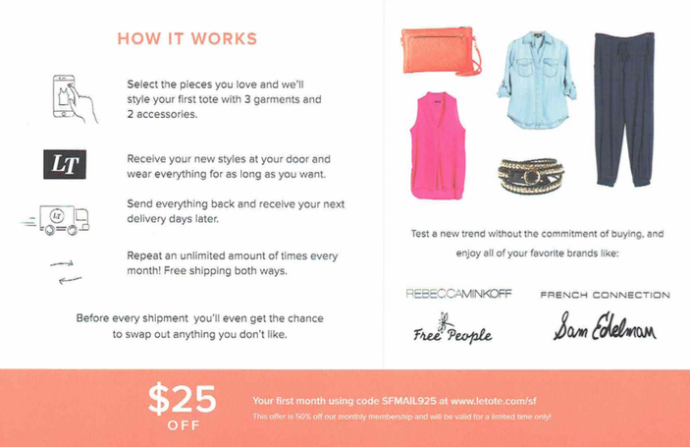

Consider this piece of direct mail from Le Tote.

The front has the value proposition and offer, while the back demonstrates how easy it makes your life.

Since this postcard offers a coupon, there’s a good chance that the recipients will save it for a later date.

But what if they don’t use it later?

What if they see it, read it, and then throw it away?

Did you just lose money on a poor direct-mail campaign?

Not necessarily.

Sure, your recipients might not have interest in your offer right now. But they saw your logo, your brand name, and what you do.

If there comes a day when they want your product, they might just visit your website and buy something from you.

Before the direct mail piece, there was no chance of that because they didn’t know who you were — that’s the power of branding.

And that’s a win for any marketer.

I consider this one of the most compelling reasons that direct mail still isn’t dead.

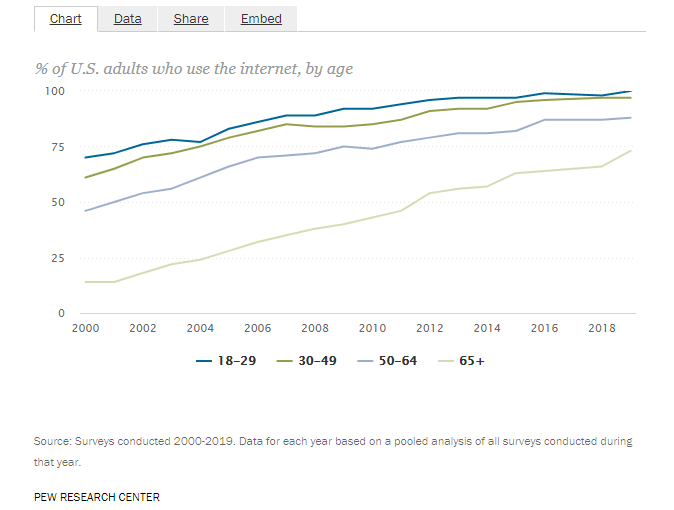

If you send an email, use Facebook Ads, or do any online marketing, your chance of reaching an older demographic isn’t very high.

Around 62% of people over the age of 70 use a smartphone. That percentage decreases all the way to 17% as the age increases.

Only 46% of American adults over the age of 65 use Facebook. And while that number is on the rise, that still means over half of older adults can’t be targeted on the larges social media platform in the world.

In fact, 33% of senior adults don’t even access the internet.

Conversely, direct mail reaches everyone, the young, and the old alike. Everyone checks the mail, and because of that, your postcards and coupons can turn just about anyone into a customer.

When it comes to direct mail and creativity, the sky’s the limit.

Because direct mail is a physical product, sending stuff that stands out is just a matter of having fun with it.

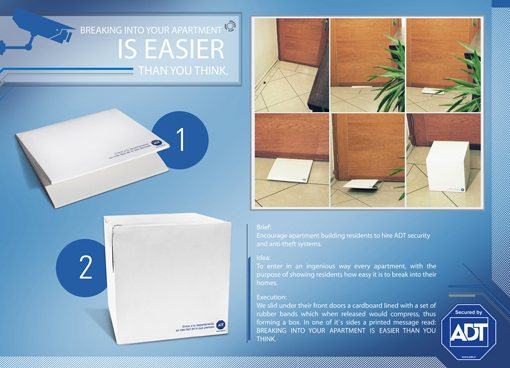

This example from ADT is a bit controversial in its execution. But it’s a great example of creative direct-mail marketing in action.

Here’s how it works.

A letter-sized card slides under the door to the house of the receiver. But the letter is carefully engineered to pop-up into a box once it’s under the door.

On the box, it reads, “Breaking into your apartment is easier than you think.”

When someone sees it, they might immediately think, “What the… Did someone break into my house?!”

ADT highlighted a problem in action. What’s a good solution? Get an ADT security system.

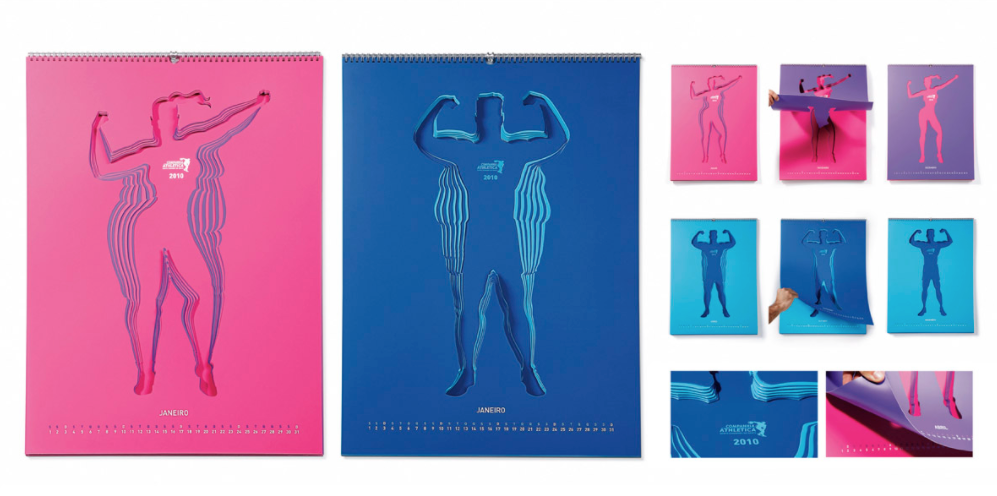

On the less controversial side of things, a gym in Brazil struggled with members quitting because they didn’t see immediate results from their workouts.

As a reminder that getting results takes consistent time in the gym, they sent out calendars to their members that illustrated the gradual progress they’d see if they stuck with the program.

Coming up with flashy ideas is not easy. If you’re not naturally creative, then talk with someone who is.

If a security-system brand and a gym can come up with interesting direct-mail pieces, the chances are that you can too.

It might just take a little extra thought.

With digital marketing, it’s impossible to hit all of the senses and difficult to hit more than two.

The five senses are touch, hearing, sight, taste, and smell.

At most, a digital campaign can only focus on sight and hearing. By making a digital ad interactive, some smart marketers can appeal to someone’s sense of touch. But even that experience is not the same.

By making a digital ad interactive, some smart marketers can appeal to someone’s sense of touch. But even that experience is not the same.

Everyone experiences the world through their senses. Direct mail can take advantage of all 5 of them.

George Patterson Y&R Melbourne sent out a cardboard box with two knobs on it and a baggy of electronic components. It included everything necessary to build an FM radio.

Everything, except for one thing: instructions.

The mail piece went out to college engineering students.

When they put together the radio, an ad played, offering the student a fast track to an exciting military career.

Talk about multi-sensory. This cardboard radio took advantage of three senses, and some might argue 4 with the smell of cardboard.

Consider this KitKat mailer.

This direct mail piece acts as if you ordered a KitKat to your mailbox, implying that it was too “chunky” to arrive at your home.

Although there are technically only two senses involved, sight and touch, this piece does a good job of including taste by emphasizing the “chunky”-ness of a KitKat.

Not to mention, it’s fully interactive as you walk to the store.

Because humans experience the world through five senses, the more of these that your direct mail activates, the more likely recipients will engage with your message.

Advertisements now flash before our eyes at blazing speeds. Each time we search, stream, watch, read, scroll, click, or swipe, we are bombarded by advertisements.

But direct mail stands out.

Imagine putting together a radio delivered to your mailbox.

Maybe you receive a box near your door that reads, “Breaking into your house is easy.”

Or you get a funny mailer from KitKat that says your candy bar was too “chunky” to arrive at your home.

Or you get a tiny record player in the mail.

If you’re like most people, you’ll tell your friends about these memorable pieces of marketing genius.

Because direct mail is tangible and endlessly creative, it sticks with your audience.

As long as you take the time to put together an amazing piece of direct mail, your audience won’t quickly forget the message you sent.

The expansion of digital marketing has only enhanced the return on investment for direct mail campaigns.

If you’re wondering why direct mail should take a place in your marketing tool belt, the above 13 reasons are answer enough.

Direct mail campaigns give a high ROI and even a higher ROI than paid ads. They can work effectively in a campaign by themselves or alongside a digital-marketing campaign.

You can use direct mail to target the right customers at the right time. And it’s easy to track the results of each campaign you run.

With direct mail becoming less common, there is less noise. You can capture the undivided attention of your customers with its romantic appeal.

Because direct mail is more likely to get read, it increases your brand awareness, even if the first letter is unsuccessful.

Unlike digital campaigns, direct mail has a larger appeal to every age group.

Since direct mail is a physical product, it allows room for creativity. Thus it can appeal to more senses, leaving a lasting and memorable impact on your customer.

In the end, direct mail is powerful because it’s different from the digital way of doing things.

I get hundreds of emails every week. But I get a fraction of that number in the form of letters in my mailbox.

To stand out in a world where everything has gone electronic, consider complementing your digital marketing strategy with a direct-mail campaign.

It’s a missing personal touch in a hectic world.

And as every great marketer knows, being personal pays off.

What is the biggest reason you think that direct mail is still going strong?

The post 13 Reasons Why Direct Mail Isn’t Dead appeared first on Neil Patel.

The William D Ford Direct Student Loan Program

The William D Ford Direct Student Loan Program

The Direct trainee financing program began around 15 years back and also was planned to remove the center male to make sure that, as opposed to entailing financial institutions, cooperative credit union as well as various other exclusive lending institutions, the Federal federal government car loans the cash straight to moms and dads and also trainees.

Straight lending programs overlap the option which is called the FFELP, or Federal Family Education Loan Program, which is a program developed to resolve a network of exclusive loan providers. Because straight lending programs replicate in lots of means the FFEL programs, it is necessary to determine which program you desire. Both programs use both Stafford as well as PLUS financings.

The standards for qualification on both programs coincides as well as they adhere to the same requirement based standards, or have the same credit history check demands as those for non demand based programs. Because both programs basically offer the exact same finance financing this elevates the all-natural concern of exactly how to pick in between them.

To some extent the choice includes selecting which of 2 suppliers you will certainly need to handle. Although both will certainly supply client solution employees to respond to any kind of concerns, in some instances you might locate that personal lending institutions will certainly be much more adaptable and also handy while the federal government will certainly be uncaring or extra administrative. This will certainly not constantly hold true naturally and also in some cases you will certainly discover that simply the reverse holds true.

Among the very best methods to obtain a feeling for the solution you are most likely to obtain from various lending institutions is to review a few of the Internet online forums managing the topic of pupil finances. With the significant development of social networks in current years it has actually ended up being a lot less complicated to discover a varied collection of point of views. Obviously you do need to take care as most of the sights shared are based a lot more on individual preference than unbiased standards, yet reviewing the messages will swiftly reveal you which side the poster prefers.

There are nevertheless some a lot more concrete distinctions in between both kinds of funding. Due to the fact that FFELP car loans are both financed as well as serviced by exclusive economic establishments the company with which you authorize a promissory note could not be the company to which you make payments. It is a typical technique nowadays for loan providers to ‘market’ lendings on various other business in similar as a lot of home loan firms do.

This is a crucial factor to consider due to the fact that you may have mosted likely to the problem of locating a lending institution you such as, selecting past just the rates of interest on the car loan and also settlement terms as well as liking their customer support, just to locate that your lending is offered on as well as you are handling a business which you had actually formerly denied. When it comes to straight fundings nevertheless, due to the fact that finances are not offered on by the Federal federal government, this trouble does not occur.

Probably one of the most crucial distinction for most of loan providers nevertheless will certainly be the distinction in prices, payment terms and also charges in between both. Below you require to bear in mind that while the rates of interest on Stafford and also PLUS fundings are formally repaired personal loan providers do take pleasure in some adaptability in various other locations.

They could or may except instance fee both source and also insurance coverage costs, which are presently examined at 3% and also 1%, according to Federal policies. These costs will certainly still be used to your funding, a personal loan provider may concur to soak up these in order to obtain your service. They may as an instance pick to change the days on which rate of interest costs are determined or to either expand a moratorium or raise your payment duration.

At the end of the day the only means to uncover simply what is offered is to search in similar means as you would certainly if you were trying to find any type of various other sort of lending.

Straight car loan programs overlap the choice which is called the FFELP, or Federal Family Education Loan Program, which is a program made to function via a network of exclusive loan providers. Because straight car loan programs replicate in lots of methods the FFEL programs, it is essential to choose which program you desire. Both programs provide both Stafford and also PLUS financings.

One of the ideal means to obtain a feeling for the solution you are most likely to obtain from various lending institutions is to check out some of the Internet discussion forums dealing with the topic of trainee financings. These fees will certainly still be used to your finance, an exclusive lending institution may concur to soak up these in order to obtain your company.

The post The William D Ford Direct Student Loan Program appeared first on ROI Credit Builders.

The William D Ford Direct Student Loan Program The William D Ford Direct Student Loan ProgramThe Direct trainee financing program began around 15 years back and also was planned to remove the center male to make sure that, as opposed to entailing financial institutions, cooperative credit union as well as various other exclusive lending institutions, … Continue reading The William D Ford Direct Student Loan Program

The William D Ford Direct Student Loan Program

The William D Ford Direct Student Loan Program

The Direct trainee financing program began around 15 years back and also was planned to remove the center male to make sure that, as opposed to entailing financial institutions, cooperative credit union as well as various other exclusive lending institutions, the Federal federal government car loans the cash straight to moms and dads and also trainees.

Straight lending programs overlap the option which is called the FFELP, or Federal Family Education Loan Program, which is a program developed to resolve a network of exclusive loan providers. Because straight lending programs replicate in lots of means the FFEL programs, it is necessary to determine which program you desire. Both programs use both Stafford as well as PLUS financings.

The standards for qualification on both programs coincides as well as they adhere to the same requirement based standards, or have the same credit history check demands as those for non demand based programs. Because both programs basically offer the exact same finance financing this elevates the all-natural concern of exactly how to pick in between them.

To some extent the choice includes selecting which of 2 suppliers you will certainly need to handle. Although both will certainly supply client solution employees to respond to any kind of concerns, in some instances you might locate that personal lending institutions will certainly be much more adaptable and also handy while the federal government will certainly be uncaring or extra administrative. This will certainly not constantly hold true naturally and also in some cases you will certainly discover that simply the reverse holds true.

Among the very best methods to obtain a feeling for the solution you are most likely to obtain from various lending institutions is to review a few of the Internet online forums managing the topic of pupil finances. With the significant development of social networks in current years it has actually ended up being a lot less complicated to discover a varied collection of point of views. Obviously you do need to take care as most of the sights shared are based a lot more on individual preference than unbiased standards, yet reviewing the messages will swiftly reveal you which side the poster prefers.

There are nevertheless some a lot more concrete distinctions in between both kinds of funding. Due to the fact that FFELP car loans are both financed as well as serviced by exclusive economic establishments the company with which you authorize a promissory note could not be the company to which you make payments. It is a typical technique nowadays for loan providers to ‘market’ lendings on various other business in similar as a lot of home loan firms do.

This is a crucial factor to consider due to the fact that you may have mosted likely to the problem of locating a lending institution you such as, selecting past just the rates of interest on the car loan and also settlement terms as well as liking their customer support, just to locate that your lending is offered on as well as you are handling a business which you had actually formerly denied. When it comes to straight fundings nevertheless, due to the fact that finances are not offered on by the Federal federal government, this trouble does not occur.

Probably one of the most crucial distinction for most of loan providers nevertheless will certainly be the distinction in prices, payment terms and also charges in between both. Below you require to bear in mind that while the rates of interest on Stafford and also PLUS fundings are formally repaired personal loan providers do take pleasure in some adaptability in various other locations.

They could or may except instance fee both source and also insurance coverage costs, which are presently examined at 3% and also 1%, according to Federal policies. These costs will certainly still be used to your funding, a personal loan provider may concur to soak up these in order to obtain your service. They may as an instance pick to change the days on which rate of interest costs are determined or to either expand a moratorium or raise your payment duration.

At the end of the day the only means to uncover simply what is offered is to search in similar means as you would certainly if you were trying to find any type of various other sort of lending.

Straight car loan programs overlap the choice which is called the FFELP, or Federal Family Education Loan Program, which is a program made to function via a network of exclusive loan providers. Because straight car loan programs replicate in lots of methods the FFEL programs, it is essential to choose which program you desire. Both programs provide both Stafford and also PLUS financings.

One of the ideal means to obtain a feeling for the solution you are most likely to obtain from various lending institutions is to check out some of the Internet discussion forums dealing with the topic of trainee financings. These fees will certainly still be used to your finance, an exclusive lending institution may concur to soak up these in order to obtain your company.

The post The William D Ford Direct Student Loan Program appeared first on ROI Credit Builders.

An Overview Of The Direct Deposit System

Straight down payment is an outstanding function supplied by lots of financial institutions all around your location. Financial is intended to be simple as well as practical, it has actually been made that a lot less complicated as well as much more practical with the offering of straight down payments. When believing regarding straight down payment, think about several of the points that might use to you.

Straight down payments are the activity of your company transferring your income straight right into your savings account by digital methods. This is simple and also incredibly risk-free for you to do, all you just need to do is initially, make sure that your company provides straight down payments (numerous companies currently days ONLY use straight down payments to their workers). The following point you will certainly need to do is complete a type that provides your company with your financial institution directing number, account number, as well as financial institution info.

It is reputable and also your income is transferred right into your financial institution account on time, you no much longer have to maintain track of the financial hrs or rush to satisfy the down payment due date. There are various other advantages to route down payments consisting of, when your funds are transferred straight the funds are offered to you promptly upon conclusion of the transfer.

One more outstanding advantage, is if you are far from your residence on organisation or on a holiday, you will certainly not need to stress over your income being available in the mail or being taken, your cash will certainly remain in your account securely. They are additionally incredibly safe, taken, lost, or shed checks will certainly come to be a distant memory. Straight down payments leave such a path behind it that tracking these are a lot easier than tracking a paper check.

As you can see straight down payments can make your life a lot easier and also decrease the variety of journeys you will certainly require to make to your financial organization.

Straight down payments are the activity of your company transferring your income straight right into your financial institution account by digital methods. By selecting straight down payments, you are making certain secure and also very easy transfer of your funds to your financial institution account. It is trusted and also your income is transferred right into your financial institution account on time, you no much longer have to maintain track of the financial hrs or rush to fulfill the down payment target date. There are various other advantages to route down payments consisting of, when your funds are transferred straight the funds are readily available to you quickly upon conclusion of the transfer.

The post An Overview Of The Direct Deposit System appeared first on ROI Credit Builders.

An Overview Of The Direct Deposit System

Straight down payment is an outstanding function supplied by lots of financial institutions all around your location. Financial is intended to be simple as well as practical, it has actually been made that a lot less complicated as well as much more practical with the offering of straight down payments. When believing regarding straight down payment, think about several of the points that might use to you.

Straight down payments are the activity of your company transferring your income straight right into your savings account by digital methods. This is simple and also incredibly risk-free for you to do, all you just need to do is initially, make sure that your company provides straight down payments (numerous companies currently days ONLY use straight down payments to their workers). The following point you will certainly need to do is complete a type that provides your company with your financial institution directing number, account number, as well as financial institution info.

It is reputable and also your income is transferred right into your financial institution account on time, you no much longer have to maintain track of the financial hrs or rush to satisfy the down payment due date. There are various other advantages to route down payments consisting of, when your funds are transferred straight the funds are offered to you promptly upon conclusion of the transfer.

One more outstanding advantage, is if you are far from your residence on organisation or on a holiday, you will certainly not need to stress over your income being available in the mail or being taken, your cash will certainly remain in your account securely. They are additionally incredibly safe, taken, lost, or shed checks will certainly come to be a distant memory. Straight down payments leave such a path behind it that tracking these are a lot easier than tracking a paper check.

As you can see straight down payments can make your life a lot easier and also decrease the variety of journeys you will certainly require to make to your financial organization.

Straight down payments are the activity of your company transferring your income straight right into your financial institution account by digital methods. By selecting straight down payments, you are making certain secure and also very easy transfer of your funds to your financial institution account. It is trusted and also your income is transferred right into your financial institution account on time, you no much longer have to maintain track of the financial hrs or rush to fulfill the down payment target date. There are various other advantages to route down payments consisting of, when your funds are transferred straight the funds are readily available to you quickly upon conclusion of the transfer.

The post An Overview Of The Direct Deposit System appeared first on ROI Credit Builders.