Digital Experience Platforms: Overview, Resources, Examples

Experience is kind of the holy grail when it comes to customer interaction, from marketing and sales to customer service and brand loyalty.

It’s something we all talk about, work toward, and set as a goal, but to some degree, it remains a concept we’re always trying to work for.

When do we actually achieve a great customer experience in our brands? Is it something we just have to continually improve and build on as new opportunities roll out?

When a customer has a great experience with you, they are more likely to come back and buy again.

Social media, mobile apps, in-app ads, artificial intelligence, augmented reality, and more have promised to help us put experience at the forefront.

As new options roll out, keeping customer experiences seamless and continuous across all digital platforms grows is highly important. This is where a digital experience platform (or DXP) comes in.

What Is a Digital Experience Platform?

Although the specifics vary by the product or vendor, a digital experience platform is a single digital hub that allows a brand to use data and AI to create and deploy custom content experiences for consumers and integrate them for consumption across an array of digital and other ecosystems.

In simpler terms, it’s a platform that lets you create custom experiences informed by your data and lets users experience them everywhere they look.

Just as important as a definition of what a digital experience platform is what it’s not. A digital experience platform is not just a single experience provider, no matter how revolutionary or innovative. It’s also not just a series of omnichannel brand messages linked together by a series of integrations or pointing to or from a webpage.

A digital experience platform is integrated and inclusive. It’s often an open-source platform that allows API integrations from various departments, such as sales, to deliver super personal experiences to users. Those features define this type of platform and differentiate it from others, which we will discuss later.

What Is the Difference Between DXP, CMS, and WEM?

When it comes to content creation and management, the acronyms can start to feel like alphabet soup. DXM, CMS, and WEM have similar purposes but approach it from slightly different angles.

Let’s look at the other two types of platforms first.

CMS stands for a content management system. By definition, it’s software that allows you to create, manage, and share your brand’s content. In more everyday terms, it’s a platform that allows you to build your website (and its content, such as pages and blog posts) with a backend interface that doesn’t require writing the code from scratch.

The interface is user-friendly and welcomes you to plug in your content and go. It also makes it easy for you to search through your content for reuse and resharing, create SEO-friendly content, and more.

How is it different from WEM, or web engagement management? We can think of WEM as the next generation of content management. It’s about how we interact on the internet and how customers expect brands to interact with them. Differentiating features of web engagement management include customer engagement through conversations, community building, multichannel reach, and automation.

Where does that leave us with a digital experience platform? It’s essentially a further evolution.

With the rise of AI and big data, we have more and more information for brands to use to deliver content that is more likely to convert. A DXP pulls information in but also delivers across multiple platforms.

How to Know If You Need a Digital Experience Platform

If your brand has been around for a while, or if you’re used the internet for e-commerce for any amount of time, you have a website, which means you have experience with a content management system. Whether you’ve dipped your toes into WEM environments or are wondering if a DXP is right for you, let’s talk more about who needs one.

A digital experience platform is about helping you reach people at many touchpoints and controlling the message they receive at those touchpoints.

It’s also about receiving data from your company and letting it drive the message.

How do you know if a digital experience platform is right for you? Here are a few questions to consider:

- Do I need more touchpoints with customers?

- Do I need to bring data from sales, inventory, and other departments into my marketing platform?

- Do I need to reach customers with custom and consistent messaging at every touchpoint?

- Do I need a platform to do all these things simultaneously and from one location?

- Are sales at a point where we can justify investing in and learning a new platform?

- Do we have the technical support, in-house or contracted, to take on the learning curve of an emerging platform?

A digital experience platform may not be a necessary next step for every brand, but if you’re struggling to keep up with a wide range of integrations and just need a place to take everything to the next level, this may be the right way to go.

Examples of Digital Experience Platform Tools

There are many to consider, but here are a few of the best tools for digital experience.

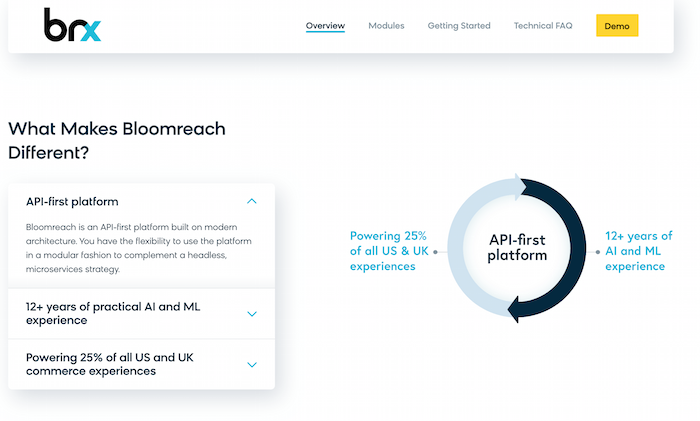

Bloomreach

Bloomreach is a popular digital experience platform for online commerce, which serves 25 percent of the e-commerce experiences in the United States and the United Kingdom. Its Bloomreach Experience Platform or BrX, as it’s called, features a number of modules, including SEO and merchandising.

Liferay

Liferay provides a digital experience platform that promises to be custom to your business needs, integrating with where you are today and growing with new features as your business grows. In other words, they boast you can get going with this platform quickly.

Core dna

Core dna emphasizes that, with their platform, all your digital marketing components are finally under one roof. You can keep track of the data in one place and make global adjustments from one location as well, rather than keeping up with various integrations and platforms.

FirstSpirit DXP

FirstSpirit DXP, from e-Spirit, highlights its ability to integrate with other platforms or tools you may already be using, along with its many features. It also makes sure to note the platform itself does not require deep development or coding knowledge on the user’s end but is approachable and easy to learn.

Digital Experience Platform Resources

A digital experience platform is a new concept in a lot of ways, so you may want to do a deeper dive and learn more before you decide whether it’s right for you. There are many resources available to help you get a handle on everything involved and learn how it can help your e-commerce shop. Here are a few to get you started.

An Intro to Digital Experience for Marketing Webinar

If you prefer an audio and visual overview of a digital experience platform, check out the Intro to Digital Experience webinar on YouTube from Progress. This 30-minute video covers all the basics, including what those custom touchpoints for customers look like and why they’re so important.

The webinar also speaks to the customer journey and how to remain consistent throughout. You’ll learn about how a digital experience platform relates to your CMS and how to take it to the next level.

Building Digital Experience Platforms Book

Written by Shailesh Kumar Shivakumar and Sourabhh Sethii and bearing the subtitle of “A Guide to Developing Next-Generation Enterprise Applications,” Building Digital Experience Platforms is for the person who is ready to get serious about a digital experience platform and geek out over the features and options available.

While the book goes into various open-source platforms available for creating a DXP, it also dives into the specifics about best practices and what you will want to consider as you design a digital experience platform. It also explores security issues and case studies.

Operationalizing a Digital Experience (DXP) Platform to Put Customers First Webinar

If you’re ready to really get into the weeds with what a digital experience platform is all about, this Operationalizing a Digital Experience (DXP) Platform webinar from Lytics has all the research and data you’re looking for. This webinar aims to discuss how companies are using customer data to drive custom experiences to convert.

It’s presented by Connie Moore, Senior Vice President of Research for Digital Clarity Group, and it covers topics such as why customer data technology is so important, how to put data at the center of your digital experience strategy, and the reasons why all of these topics are exploding in popularity.

The Rise of the Digital Experience Platform E-Book From Elastic Path

Are you wondering how a digital experience platform would fit in your business, or how it would impact your department and help you interact with other departments across the company? The Rise of the Digital Experience Platform e-book from Elastic Path seeks to help you answer those questions.

Of course, this is one of those email opt-in methods Elastic Path is using to get you on their email list. Nonetheless, it could be a helpful resource as you seek to wrap your head around what a DXP is all about. It promises tips and strategies for Chief Information Officers and Chief Digital Officers looking to incorporate a digital experience platform.

How Digital Experience Platforms Nurture and Facilitate Lasting Customer Relationships On-Demand Webinar

If you’re still skeptical about how exactly digital experience platforms can help you connect meaningfully with your customers, Bloomreach created a webinar entitled “How Digital Experience Platforms Nurture and Facilitate Lasting Customer Relationships” with Mehmet Olmez, managing director for Accenture Interactive, and Arjé Cahn, CTO of Bloomreach Experience.

They talk about how a DXP offers more than just multitouch or omnichannel and is the way of the future by seamlessly integrating those touchpoints and making them hyper-personalized. They also talk about how this supports e-commerce marketing and the benefits of having everything together under one digital hub.

Again, this is an email opt-in, so you can expect to get emails following up, but if you’re curious to learn about DXPs from the makers and marketers of digital experience platforms, this one may be worth your time.

Digital Experience Platform FAQs

A digital experience platform ties in data and AI learning technology to deliver seamless and multilayered touchpoints that are highly customized and relevant to each individual customer.

A digital experience platform or DXP serves as a single hub for e-commerce marketing, pulling in and learning from data from across the company’s ecosystem, including sales, inventory, and more, and then delivering highly customized experiences to shoppers.

DXP stands for digital experience platform. It’s the next evolution of content management, e-commerce experience solutions, and marketing technology and helps companies stand out as relevant in an increasingly noisy digital world.

As companies utilize digital experience platforms, good digital experiences for customers are pertinent and timely, meeting their needs and delivering content that ultimately leads to conversions.

Conclusion to Digital Experience Platforms

Customers want experiences with your brand. More importantly, they want really great experiences to keep them coming back for more. This includes everything from searching and coming across your website, to the sales, customer service, and follow-up process.

As you scale, ensuring a great customer experience can become harder and harder, but building a solid e-commerce website can help. A digital experience platform, or DXP, can provide space to create and automate experiences that will keep them returning.

Have you interacted with an engaging digital experience platform recently?