How to Find Your Target Audience

When I first started out in marketing, I thought traffic was everything.

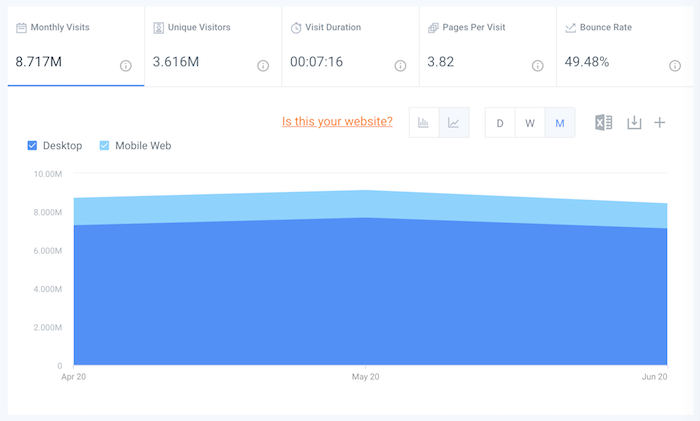

I wanted to be as big as companies like HubSpot. Just look at the image above and you’ll see how many visitors they are getting.

They generate 29.61 million visitors a month from 11.74 million people. And those visitors produce roughly 10 billion dollars of market cap.

Now, let’s look at NeilPatel.com. Can you guess how many visitors I’m getting each month?

I’m generating roughly 8.717 million visitors a month from 3.616 million people.

When you look at it from a unique visitor perspective, HubSpot is getting 3.24 times more unique visitors than me.

So, in theory, I should be worth roughly 3 times less than them, right? Well, technically I’m not even worth 1/10th of them. Not even close.

Why is that? It’s because I didn’t go after the right target audience, while HubSpot did.

And today, I want you to avoid making this massive mistake that I made. Because marketing is tough, so why would you start off by going after the wrong people?

It will just cause you to waste years and tons of money like it did with me.

Defining your target audience is the first and most essential step towards success for any company or business, especially if you are just getting started.

So before we dive into things, let me first break down what you are about to learn in this article:

- What is a Target Audience?

- The Difference Between Target Audience and Persona

- The Importance of Selecting Your Target Audience Correctly

- How to Define your Target Audience: 6 Questions to Help You

- Creating Customized Content for Your Audience

Let’s get started!

What is a target audience?

A target audience is a share of consumers that companies or businesses direct their marketing actions to drive awareness of their products or services.

I know that is a tongue twister, so let me simplify it a bit more…

The intention here is to target a market with whom you will communicate with. A group of people with the same level of education, goals, interests, problems, etc. that will need the product or service you are selling.

Basically, you want to target people who will buy your stuff.

If you target people who don’t want to buy your stuff, you might get more traffic to your site… but it won’t do much for you. And you’ll be pulling out your hair trying to figure out why none of your visitors are buying from you.

Now before we dive into the details on finding your target audience, let’s first go over “personas” because many people confuse them with a target audience and if you do, you’ll just end up wasting time.

The difference between a target audience and a persona

You already know the definition, so I won’t bore you with that again.

The most commonly used data to define the target audience of a company are:

- Age

- Gender

- Education background

- Purchasing power

- Social class

- Location

- Consumption habits

Examples of a target audience: Women, 20-30 years old, living in Los Angeles, with a bachelor’s degree, monthly income of $4,000 – $6,000, and passionate about fashion and decor.

If you start a company without knowing your exact target audience, you could end up like me instead of HubSpot… we wouldn’t want that now. 😉

And here is another example. Let’s say you have a business that sells educational toys. So your target audience might be children, mothers, education specialists, or teachers.

Or you have a motorcycle business. Your audience will definitely not be people younger than 18, right?

There is no point in trying to reach everyone in order to increase your chances of sales and profit. It will actually cost you more and decrease your profit margins in the long run.

Now let’s go over “personas”…

Persona

In marketing, personas are profiles of buyers that would be your ideal customers.

Personas are fictional characters with characteristics of your real customers. They’re developed based on target audience research and may help you direct your marketing actions better.

A persona is a person that may be interested in what you have to offer since they’re very connected to your brand and you must make an effort to make them a client and retain them.

A persona involves much deeper and more detailed research than the target audience since it includes:

- Personal characteristics

- Purchasing power

- Lifestyle

- Interests

- Engagement in social networks

- Professional information

Persona example: Mariana, 22, blogger. Lives in Miami, Florida. Has a journalism degree. Has a blog and posts makeup tutorials and tips about fashion and decor. She always follows fashion events in the area and participates in meetings with other people in the fashion niche. As a digital influencer, she cares a lot about what people see on her social network profiles. Likes to practice indoor activities and go to the gym in her free time.

If I had to define the main difference between persona and target audience, I’d say that the target audience considers the whole, in a more general way, while the persona has a more specific form.

And if you want help creating personas for business, check out this article about creating the perfect persona. But for now, let’s focus on finding your right target audience.

The importance of choosing your target audience correctly

The big mistake I made was that I didn’t figure out my target audience when I first started. I just created content and started marketing to anyone who wanted traffic.

But that is a bit too vague because not everyone who wants more traffic is a good fit for my ad agency.

They could just want to be famous on Instagram or YouTube, which is a lot of people, but that doesn’t help me generate more income.

Funny enough, there are more people who are interested in getting Instagram followers than people who want to learn about SEO.

But once you know your target audience, it’s easier to find and perform keyword research. For example, I know that I shouldn’t waste too much time writing articles about Instagram or Twitch even though the search volume is high.

It will just cause me to get irrelevant traffic and waste my time/money.

And that’s the key… especially when it comes to things like SEO or paid ads. The moment you know your target audience, you can perform keyword research correctly and find opportunities that don’t just drive traffic, but more importantly, drive revenue.

Now let’s figure out your target audience.

How to define your target audience: 6 questions to help you

Figuring out your target audience isn’t rocket science. It just comes down to a few simple questions.

6 actually, to be exact.

Go through each of the questions below and you’ll know the exact audience you are targeting.

1. Who are they?

When thinking about who might be your target audience, you must consider who are the people who identify with your brand.

One way to find out is to monitor who follows, likes, shares, and comments on your posts on social sites like Facebook, LinkedIn, YouTube, and Instagram.

If someone is willing to engage with you, then chances are they are your target.

But in many cases, your ideal audience may not always be on the social web. They might be inactive on social media but buy from your company frequently or sign up for your services.

Even those who bought from you only once must be considered a part of your target audience, as someone who bought once might buy again.

There is no point in making a great effort to sell if you don’t make a similar effort to keep the customers you have already gained.

Customers like to feel special, and that is why the post-sales process is so important. Your relationship with the customer must remain even after the purchase is completed.

2. What are their greatest difficulties, problems, or desires?

What is cool, interesting, and good for you might not be for the customer.

You can’t think only of yourself when it’s time to define the difficulties, problems, and desires of your target audience. You must put yourself in their shoes.

Don’t make offers based on what you think. Make them according to research grounded in data, previous experiences, and analysis of your potential customers’ behavior.

Understand the greatest difficulties your audience faces to try to help solve them.

3. Where do they find the information they need daily?

Everyone needs information.

Every day you are surrounded by tons of information on the channels that you follow, but when you need it the most, where do you go to find that information?

Identify the communication channels most appropriate to your target audience and try to talk to them using a specific language from their universe.

For example, I know my target audience will either read marketing blogs or spend a lot of time on social sites like YouTube and LinkedIn consuming information.

4. What is the benefit of your product?

Everyone wants solutions for their problems and to make their lives easier. This is a collective desire and it’s no different for your target audience.

Think a little about your product and the problem of your target audience. What benefits does your product or service offer? What can it do to solve those problems? What is the main value offer?

With so much competition, you must try to find your competitive advantage in your niche and always try to improve your product, offering something extra that others do not.

5. What draws their attention negatively?

Being optimistic helps a lot, but thinking about the negatives can also help, especially when we talk about target audiences.

Better than considering what your audience wants, you can consider what it definitely doesn’t want, what it considers negative, and what it avoids.

With this powerful information in hand, you may have more chances to captivate your potential customers.

Avoiding what they consider negative is the first step to gain their approval. After that, you only need to apply other strategies to do efficient marketing.

6. Who do they trust?

Trust is everything to your target audience. No one purchases a product or service from a company they don’t know or trust.

This is why reviews on Amazon are read and so important for sellers. They know it builds trust… it’s also helped Amazon become a trillion-dollar company.

Even though this is the last question to define target audiences, it is one of the most important ones.

This is why the reputation of your company is so important. Taking care of the relationship with your customers is essential as they will spread information about your brand on the internet and to their friends and family.

If you get good reviews, have positive comments, and garner a great reputation, this will be the base for potential customers to feel motivated to buy from you.

Creating customized content for your audience

Now that you know your audience, let’s get to the fun stuff. Let’s create content for them.

Everyone creates content, right? Just look at Google if you don’t believe me.

You just have to put a keyword on Google and you will see thousands if not millions of results for each keyword.

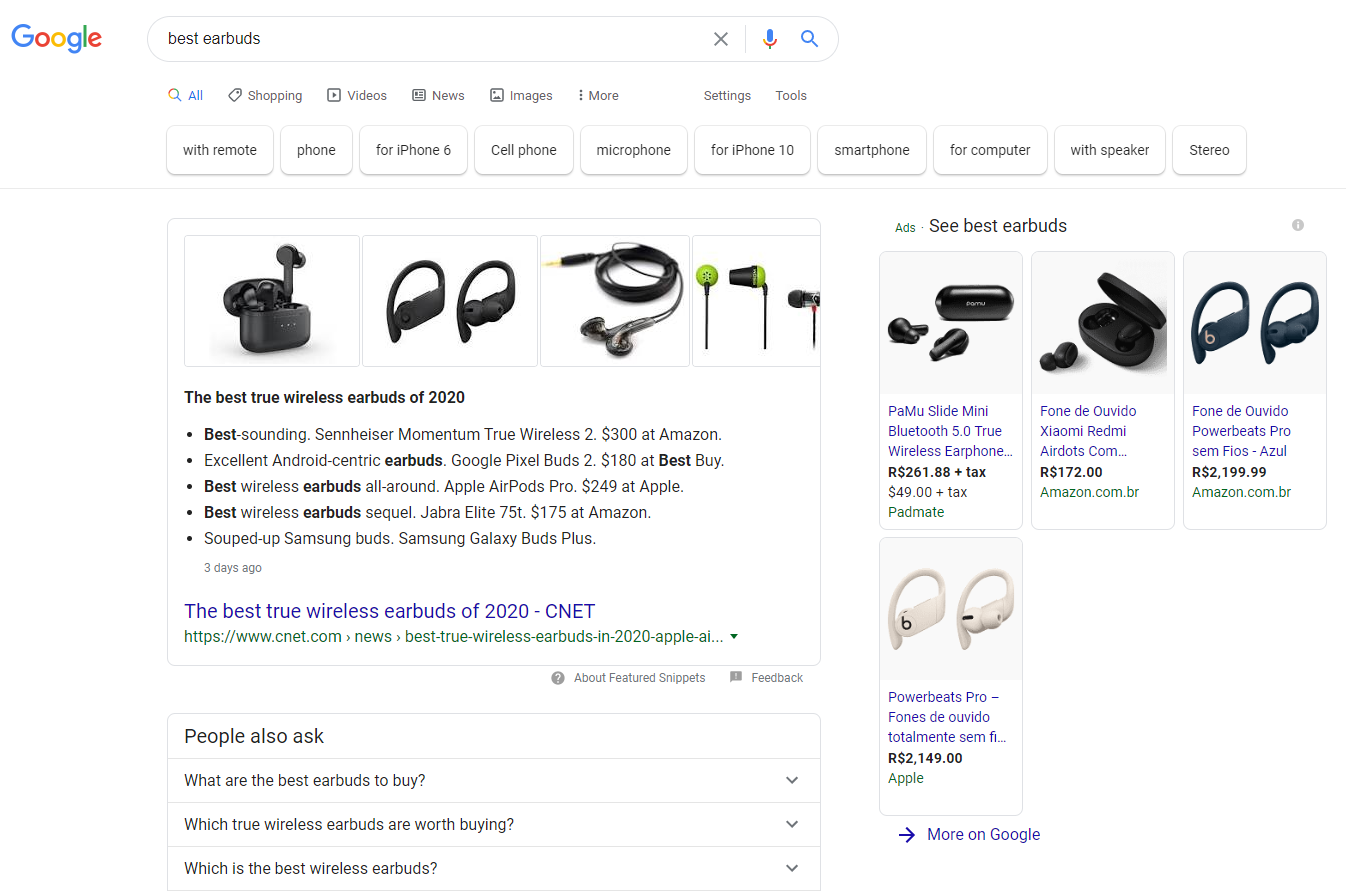

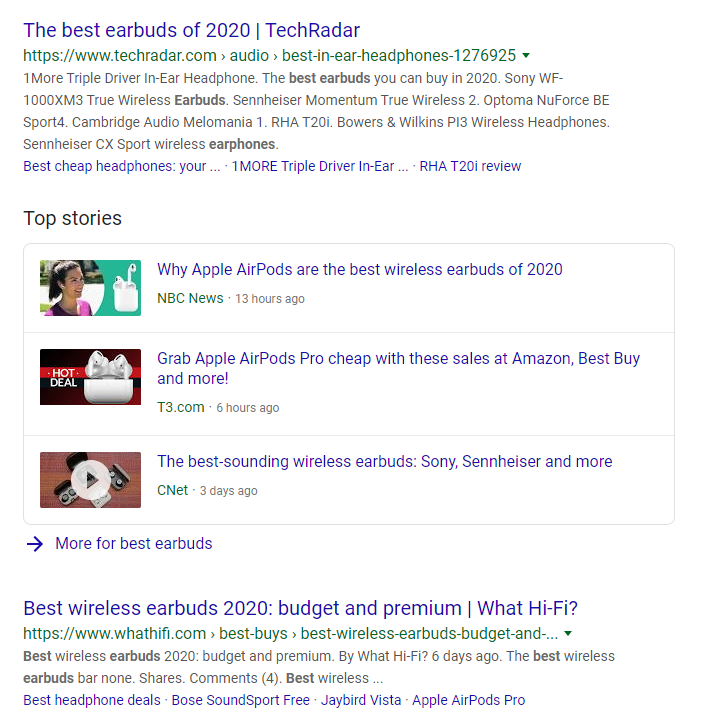

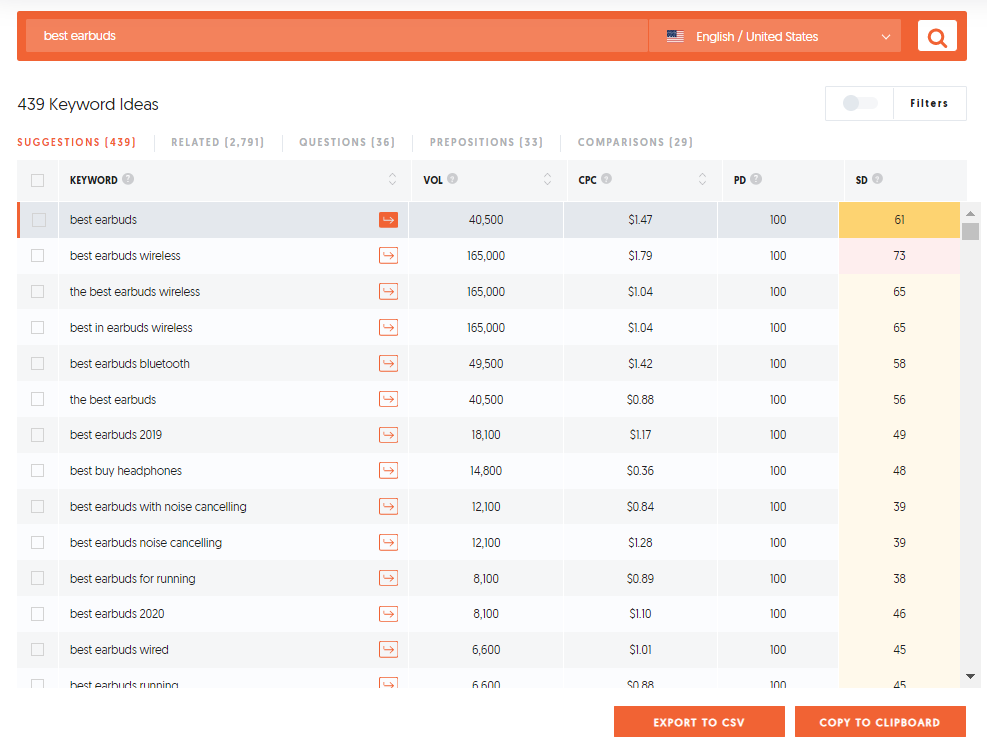

When you research “best earbuds” on Google, this is what you see:

First, there are options of products from Google Shopping, with ads and prices for different earphones for various audiences, needs, and tastes.

Next, there is a list of sites and blogs with information about different types of earphones and comparisons:

There is no shortage of content about this subject or any other that you can search for. Anyone can create and publish text with no barriers.

The question is how you can make this content more personalized and attractive for your consumer.

Everyone produces content. Millions of publications are posted every day.

The secret though is to create content that targets your ideal customer and no one else. Generic content may produce more traffic, but it will also produce fewer sales.

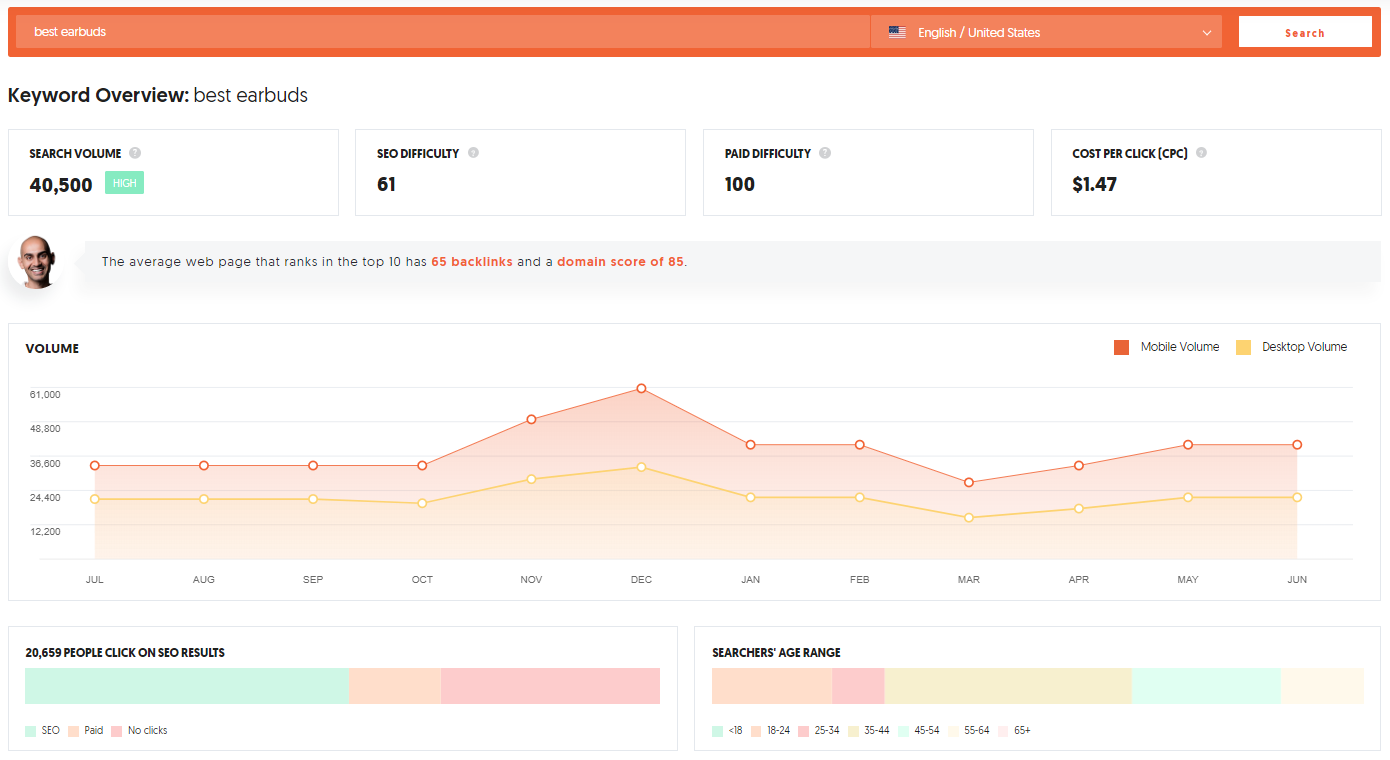

To find what your target audience is searching for, you can use Ubersuggest. Just type in a keyword related to your audience.

From there, on the left-hand navigation, click on “keyword ideas.” You’ll then be taken to a report that looks like the one below.

You now have topics to choose from. Not all of them will be a good fit but some will.

I recommend that you go after the long-tail terms, such as “best earbuds for running” (assuming your target audience is active). The more generic terms like “best earbuds” will drive traffic and a few sales, but it won’t convert as well as more specific terms.

The same goes if you are doing keyword research for the service industry or even the B2B space.

Types of content to create

Once you have a list of keywords you want to target, you might be confused as to what type of content you should be creating.

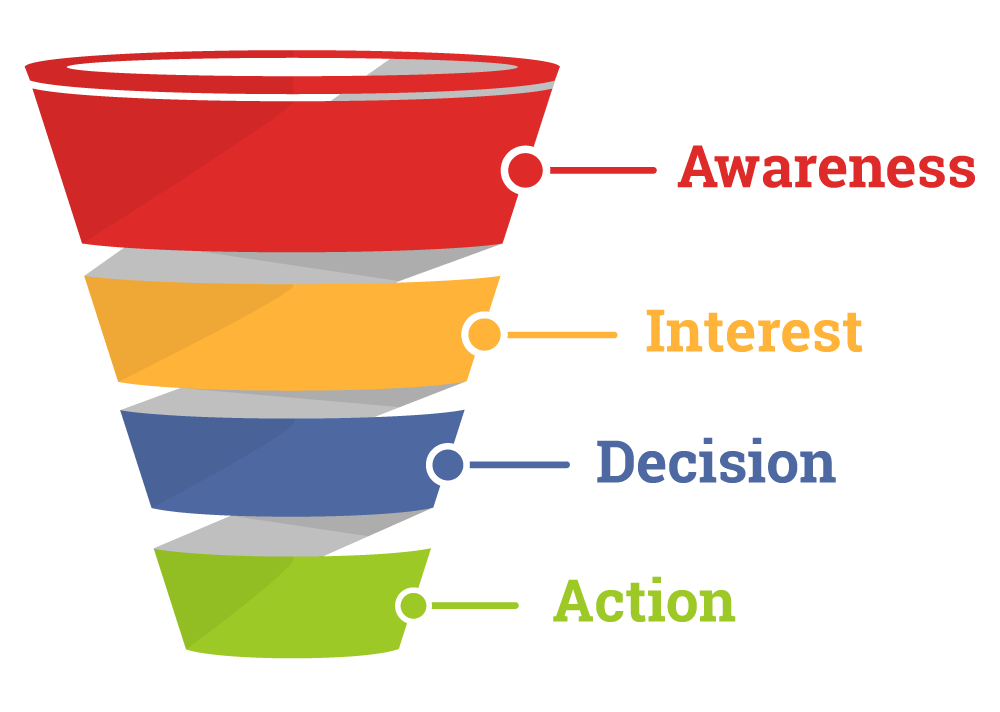

You’ll want to create content based on your funnel. In essence, you want to cover each step of the funnel.

The top of the funnel involves content created for visitors and leads, that is, people that might access your site, blog, or social networks by chance.

When thinking about the top of the funnel, the idea is to create materials with more general subjects, with clear and easily accessible language.

It could be educational content, including clarifications or curiosities about your product or service or something somehow related to your industry.

The middle of the funnel is when the conversions happen. In other words, in this stage, the person who has a problem and the intention to solve it considers the purchase of your product or service.

It’s the middle of the road, but it is not the sale itself, because it’s still only about ideas. It’s in the middle of the funnel that you get closer to your target audience and generate more identification.

Next: bottom of the funnel content. This content focuses more on your product or service.

Here you can introduce details about functions, benefits, and other direct information about your product or service.

It is far more likely to convert here as this particular audience has practically decided to buy already and you are only going to give them a final push.

Conclusion

I’m hoping this article saves you from making the big mistake I made.

But knowing your target audience isn’t enough, though. It doesn’t guarantee success. You still need to create and market your content. That’s why I covered keyword research in this article as well.

Once you create content, you may also want to check out these guides as they will help you attract the right people to your site:

- 17 content marketing strategies to improve engagement

- Social media: how to make the most of your investment

- Customer prospecting: learn to prospect customers and sell more

- Optimize your site so you can rank #1 on Google

So have you figured out your target audience yet?

The post How to Find Your Target Audience appeared first on Neil Patel.