Indianapolis Colts linebacker Darius Leonard spoke to reporters on Thursday about being unvaccinated. The three-time All-Pro said not getting the COVID-19 vaccine is a “personal decision” and he believes in getting “comfortable with something” before putting it into your body.

Tag: Getting

Improve Your Chances of Getting a Loan with Small Business Lenders

Small Business Lenders Have the Money You Want

Can you improve your chances of getting a loan from small business lenders?

Small Business Lenders, Business Loans, and Funding

Of course you know your business needs money. But business lending doesn’t just come from banks. Still, working to make your business more attractive to lending institutions isn’t just an end unto itself. It will also help your company also become more attractive to nontraditional lenders. It may even help make your business more attractive to prospects. There are factors which are within your control and you can help your business right now.

Start Making it Easier to Get Money from Small Business Lenders

Once you understand what banks and lenders are looking for, you can address their concerns directly. Many of these are actions you only need to take one time, and many of them will also help you to convince prospects to buy from you, thereby helping you recoup any incurred costs.

Working to More Easily Get Money from Small Business Lenders: It All Starts with Fundability

Fundability is the ability of your business to get funding. When lenders consider funding your business, does it appear to them to be a good idea to make the loan? What do they look at to make that determination? Fundability means recognizing what’s important to lenders, and then giving them what they want.

How Does a Business Become Fundable?

You probably already know that a great business credit score is important. But many of the aspects necessary for a strong business credit score work for fundability as well. A potential creditor or lender needs to see your business is legitimate and profitable. Many loan applications get denials due to fraud concerns. Others, simply because something didn’t match up and threw up a red flag.

Your Business Setup

A business must be set up to appear to be a fundable entity separate from you, the owner. The first step is to ensure your business has its own phone number and address. That doesn’t mean you must get a separate phone line, or even a separate location. You can still run your business from your house or on your computer.

Business Phone Numbers

You can get a business phone number that will work over the internet instead of phone lines. This is called a VoIP (voice over internet protocol). The phone number will forward to any phone you want it too so you can use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Virtual Offices

Use a virtual office for a business address. A virtual office is a business that offers a physical address for a fee. They sometimes they even offer mail service and live receptionist services. There are some that offer meeting spaces for those times you may need to meet a client or customer in person.

But not every vendor will accept a virtual address.

Business Website and Email

A business website can affect your ability to get funding. But a poorly put together website that appears unprofessional will not help you with customers or potential lenders. Spend the time and money necessary to ensure your website is professionally designed and works well.

Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your website. Don’t use a free service like Yahoo or Gmail.

Demolish your funding problems with 27 killer ways to get cash for your business.

Improve Your Chances of Getting Money from Small Business Lenders with Business Information and Consistency

All your business information should be the same everywhere you use it. But when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks. This is a problem because many loan applications fail each year due to fraud concerns simply because things do not match up.

Consider all the places where this information could be.

Credit providers won’t stop to consider all the ways you could list your business. If you write Incorporated in one place, and Inc. in another, it can be enough to trigger a denial. Consistent and congruent information makes it fast and easy for credit providers and lenders to find your business and its payment history.

Fix Inconsistent Information by Getting Organized

Consider all the places where your business has a listing. It’s your website, credit applications, even places like Yelp and Google Reviews. Take the time to keep records of all of these places, so Google your business often. Claim your profile on review sites to better control how your business name, address, and other particulars are presented. Copy and paste your information. Don’t chance an error with typing it out. This also means updating info whenever it changes.

Get an EIN

An EIN is an identifying number for your business that works like how your SSN works for you personally. Many sole proprietorships and partnership use their SSN for their business. But it can cause your personal and business credit to get mixed up. When you are looking to increase fundability, you need to apply for and use an EIN. Get one for free from the IRS.

Demolish your funding problems with 27 killer ways to get cash for your business.

Incorporate Your Business

A lot of businesses start off as sole proprietorships. But there’s no separation between the owner and the business with this setup. Partnerships are another entity where the ownership and the business are more intimately connected. With either entity, any other efforts at separating business and personal credit could be all for naught.

Why Incorporate?

A corporate structure truly separates business and personal credit and finances. This is because a corporation is considered to be its own entity. Should you choose a C-corporation, an S-corporation, or a limited liability corporation? That’s up to you to decide. We highly recommend working with a corporate lawyer or an accountant to determine what’s best for your particular situation.

Why Should You Incorporate Quickly?

When you incorporate, you become a new entity. Hence if you haven’t incorporated ASAP, you lose the time in business that you have and must start over. You also lose any positive payment history you may have accumulated.

Hence you must incorporate as soon as possible. It’s not just necessary for fundability and for building business credit. Time in business is also vital. The longer you have been in business the more fundable you appear. That starts on the date of incorporation. This is regardless of when you actually started doing business.

Improve Your Chances of Getting Funding from Small Business Lenders with a Separate Business Bank Account

There are business owners who pay for business expenses with personal credit cards and checks. But a business’s credit file is only supposed to reflect the financial performance of the company itself. Using personal payment methods can muddy the waters. Resist the temptation to pay for any business expenses with personal credit or checks.

Separate Your Business and Personal Finances

Your business must stand or fall on its own financially. Once you get credit from starter vendors or any other business or lender, use it on your business, and stop floating what are essentially interest-free loans to your business.

Get a Merchant Account

Another way to assure your finances get and stay separate is separate bank accounts. Often, a starter vendor will want for your business to have its own bank account anyway. While you’re at it, open a merchant account so you can take credit cards from your customers. Customers will spend more if they can pay with plastic.

Improve Your Chances with Small Business Lenders and Get all Required Licenses

Fundability means being a legitimate business. For a business to be legitimate it must have all of the necessary licenses it needs to run. If it doesn’t, red flags will fly up all over the place. Do research to ensure you have all the licenses necessary to legitimately run your business at the federal, state, and local levels. Being properly licensed can help assure skittish prospects that you and your business are legit.

Get a D-U-N-S Number

In addition to the EIN, there are identifying numbers that go along with your business credit reports. Some are assigned by the agency, like the Experian BIN. Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you must apply for one through the D&B website.

Demolish your funding problems with 27 killer ways to get cash for your business.

Business Credit Monitoring

The key to keeping records consistent is to monitor your reports frequently. Monitoring your credit means you know what’s going on with it. You can pounce on errors quickly. Yes, the business CRAs make them, but they are all committed to accuracy and want to correct those mistakes ASAP.

When it comes to business credit reports, you can monitor through the reporting agencies directly. But that’s expensive! Or you can save 90% and monitor through Credit Suite.

Improve Your Chances with Small Business Lenders with a Good Business Credit History

Your credit history has a lot to do with your credit score. It is a huge factor in the fundability of your business. The more accounts you have reporting on-time payments, the stronger your credit score will be.

Your credit history consists of a number of things including:

- How many accounts are reporting payments?

- How long have you had each account?

- What type of accounts are they?

- How much credit are you using on each account versus how much is available?

- Are you making your payments on these accounts consistently on time?

Personal credit scores come from several metrics. But business credit mainly depends on one thing, how early or late you pay your credit bills. Paying late will damage your business credit scores at all three of the major CRAs.

Improving Your Business’s Payment History

Here are a few suggestions on how to improve your company’s payment history:

- Set up reminders to pay – your phone or your business calendar are both fine

- Set aside money for your credit bills as a part of your budget so you’re not caught short

- Shop around for better deals and spend less if you can

- Repurpose older equipment or the like to avoid spending in the first place

Improve Your Chances with Small Business Lenders by Building Business Credit

Business credit is credit in the name of the business, not its owner(s). It’s a measure of how well your business (not you) pays its bills. Properly created business credit separates personal and business credit completely. So if your business defaults on payments or goes bankrupt, it protects your personal assets.

Good business credit is the way to qualify for funding without good personal credit, collateral, cash, or a guarantor. Here are some tips on building business credit to improve your chances for financing from small business lenders.

Buy from Vendors and Other Credit Providers Which Report

While many vendors and credit providers don’t report all payment experiences, they have no problem reporting late and missing payments. So, seek out and mainly (if not 100%) work with vendors which report. These are called starter vendors. Their requirements change all the time. Fortunately, we know which vendors report, and we keep up with their ever-changing requirements.

Spread Out Your Credit Applications Over Time

Asking for too many lines of credit at once signals that you’re desperate and could be overextending yourself. Building a successful business takes time. In the same way, so does building a good business credit profile. As a result, spread your applications for additional lines of credit over time.

Applying for a lot of credit at once also means you’ll have a number of brand-new accounts, which will bring the average age down. Not using your credit can result in credit providers closing inactive accounts. This, too, brings the average age down.

Use Your Credit

Business credit isn’t going to be built if you get cards and then forget about them and never use them. The business credit reporting agencies are calculating your scores based on the credit you use. Using your credit, and paying on time, is positive fodder from business credit scores and reports. You can’t control the passage of time, but you can control card usage and not apply for every credit card you see all at once.

Finally, Apply for the Right Loan

Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs? Choosing the right product to apply for can make all the difference. Don’t waste yours and the lender’s time by not considering the best loan product to apply for.

Improve Your Chances for Approvals from Small Business Lenders: Some Takeaways

There are steps you can take to make it more likely your business will get a loan. These steps may also help your business become more appealing to prospects. They also help with building business credit. And applying for the right loan product will also help improve your chances of getting a business loan from small business lenders.

The post Improve Your Chances of Getting a Loan with Small Business Lenders appeared first on Credit Suite.

How Google Lens is Getting Your Products Found Online

Google is constantly innovating and testing new features, and augmented reality (AR) is a hot topic right now.

You might think of AR as a way to make digital images appear in your living room. But Google’s visual search technology for Android, Google Lens, does a lot more than that.

It enables you to bring your physical environment into the digital world.

What Is Google Lens?

Google Lens is an image recognition technology that allows users to interact with real-world objects using their phone’s camera.

Using AI, Google’s technology interprets the objects on your phone camera and provides additional information. It can scan and translate text, see furniture in your house, and help you explore local landmarks.

Google Lens is integrated directly into the camera on some phone models. If it doesn’t come pre-loaded on your device, there’s also an app you can download from the Google Play store to try it out.

Uses of Google Lens

Have you ever been traveling and wished you could read that train ticket in a foreign language? With Google Lens, just hover your phone camera over it, and it will translate the text for you.

You can also use Google Lens to learn about your environment in other ways. If you point your camera at a nearby landmark, you’ll see historical facts and information about opening hours. If you use it on an animal or plant, it can identify the type of flower or the breed of dog.

When eating out at a restaurant, you see which items on the menu are most popular (this information is pulled from Google Maps). Students can even use it to help them with their homework: if they hover over an equation, they’ll get a step-by-step guide to solve the problem.

But one of Google Lens’ most exciting applications for marketers, and the one I’m going to talk about today, has to do with online shopping.

Say a user is browsing on their phone and sees a sweater they like.

Rather than typing a long query into Google (“brown sweater, zig-zag pattern…”), the user can tap and hold the image, and Google Lens will find the same item (or a similar one), so they can buy it.

The app also provides style tips and ideas about what items to pair with the sweater. The recommendations are based on AI’s understanding of how people in fashion photos typically wear similar clothing.

Before the shopping feature came out, users could already search for clothing by taking a screenshot and opening it in Google Photos, or by pointing their camera at a physical item in a store. Long clicking on an online image for an instant search just makes the whole process easier.

In the future, Google plans to make AR showrooms available, so shoppers may soon be able to try on clothes at home virtually.

How Can E-commerce Businesses Optimize for Google Lens?

Once SEOs experiments with the long click search, we’ll gain some more insights into what works and what doesn’t with that specific feature.

But we know a fair bit since Google Lens and image search have been around for a few years.

Here’s what you do if you want to optimize for Google Lens:

Get Your Products to Appear on Google Lens

Before we get into specifics about image optimization, you’ll want to make sure your product listings show up on Google. So how do you do that? With product listings.

Product listings on Google are free. You can also run a paid campaign on Google Shopping if you want, although Shopping now offers free listings as well.

If you take advantage of Google’s free product listings, your products will show up in Google Search, Google Images, Google Shopping, and Google Lens searches. However, they need to follow Google’s policies, and you’ll need to do one of the following two things:

- Open a Google Merchant Center account and create a feed to upload your product data

- Integrate structured data markup onto your website

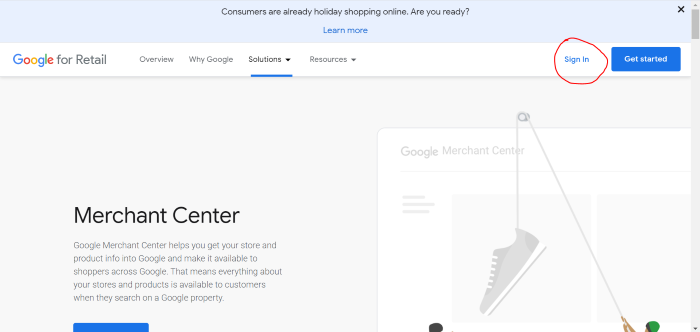

Google Merchant Center

Google Merchant Center lets Google know more about your products, so they can list them in search.

Here’s how to sign up for Google Merchant Center:

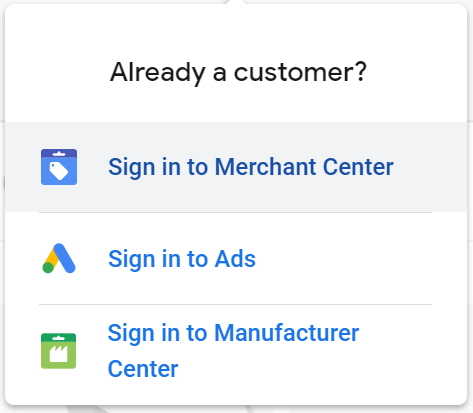

Go to Google’s Merchant Center homepage and sign in to your Google account.

Click “Sign in to Merchant Center” in the dropdown menu.

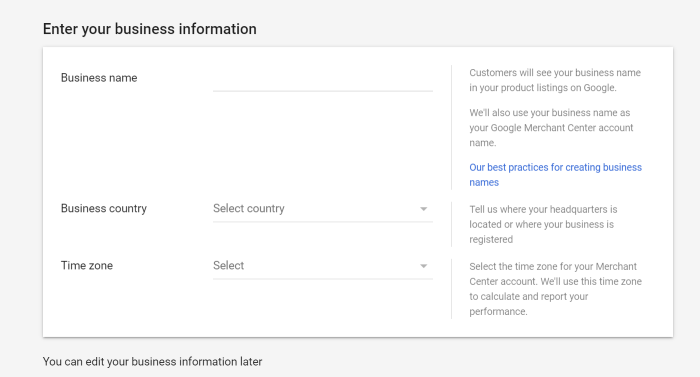

Then, enter your business’ name and information.

Scroll down, and fill in more information about your checkout process, tools you use, and whether you’d like to receive emails.

When you’re finished, agree to the Terms of Service and click “Create Account.”

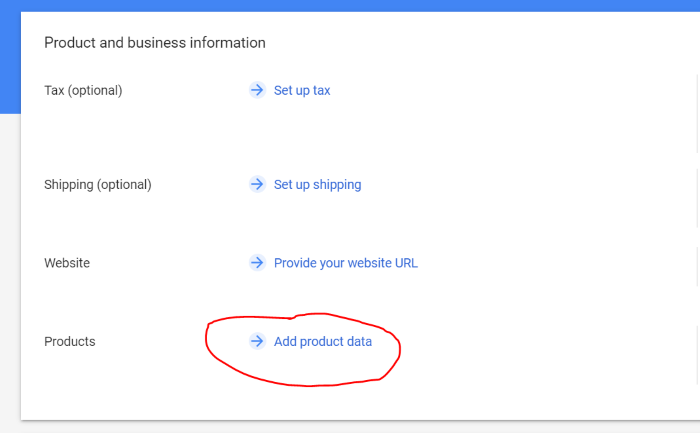

Once you’ve created your account, don’t forget to add your products.

You can do this by creating a product feed. On the home screen of your new account, click “Add product data”:

You can then choose to add individual or multiple products.

Structured Data Markup

If you don’t want to use Google Merchant Center, you can still get your products to show up on Google Lens and elsewhere. However, you’ll need to add some structured data markup to your website. (In fact, I recommend doing this even if you do use Google Merchant Center.)

Structured data markup is code snippets added to your HTML that help Google better understand information on your website. Schema.org annotations are the most commonly used markups for SEO.

For example, Schema can tell Google that a specific page is a recipe, an article, about a local business, or an event.

To implement Schema.org markup, you’ll need access to edit the HTML on your site.

Google provides a helpful support guide on setting up structured data so that your site is compatible with their Merchant Center.

If you use WordPress, there are also several Schema markup plugins.

Once you’ve added the code, use Google’s Structured Data Testing Tool to make sure Google understands your markups.

Follow Google Image Optimization Best Practices With Google Lens

Google Lens technology is similar to Google’s reverse image search, but with a more sophisticated use of AI. A lot of the same principles that apply to regular image optimization for SEO also apply when you’re optimizing for Google Lens.

Image Size

Large images that load slowly (or not at all) can hurt your SEO (as well as making your website less user-friendly).

Since e-commerce websites tend to have many images (as they should!), loading times are particularly important.

Use a compression tool like Compress JPEG or Compress PNG to shrink your images.

Label Images and Add Keywords

Make sure to use keywords and descriptive language wherever you can, for example in image titles, ALT text, filenames, and EXIF data.

Add image titles and ALT text via the HTML of your website, or using your content management system (like WordPress or Squarespace).

EXIF data can be edited locally on your computer. This data adds more in-depth information to your photo, such as the time and date it was taken and what camera was used.

Although machine learning tools like Google Lens rely more on image recognition than text when executing a search, adding clear and relevant information to your image can improve SEO and user experience.

Use High Photo Quality and Visuals For Google Lens

Another way to optimize for Google Lens is by providing crystal clear product images.

If someone long clicks on a brown sweater in a photo, and that sweater is a product you sell in your e-commerce store, you want your product to come up as part of their search. To do that, Google needs to understand the brown sweater you’re selling is the item the searcher is looking for.

Look through your website and replace any images that are blurry, cropped oddly, or don’t fully show items.

Ideally, you’ll want to use high-resolution images taken on a professional camera while balancing quality with file load time. Opt for a high-quality file format like .PNG or .JPG.

Google Lens vs. Pinterest Lens

Google Lens isn’t the only game in town. Pinterest offers a similar feature, called Pinterest Lens.

Just like Google Lens, Pinterest Lens allows users to shop for products from third-party retailers. Users can take a photo, upload one, or hover over a physical item with their camera to use the feature.

So what’s the difference between Google Lens and Pinterest Lens?

On Pinterest, there’s a lot of action going on inside the Pinterest app. Unlike the all-pervasive Google, Pinterest is a specific ecosystem with its own Verified Merchant Program and internal search engine.

If you want to optimize your brand for Pinterest Lens, make sure you have a Pinterest business account, get your products onto Pinterest using Catalogs, and join the Verified Merchant Program.

Otherwise, many of the same rules apply as with Google Lens. To get found in Pinterest Lens, optimize your images by adding keywords in the filename, title, and ALT text, and ensure photos load fast and are high quality.

What Does Google Lens Mean for Marketers?

Advances in Google Lens search aren’t just changing the nature of SEO. They also represent a significant shift in the way people look for products.

Nowadays, if you want to shop online, you might go to an online store and type in a specific search term. When you’ve found what you’re looking for, you’ll check out and go back to whatever you were doing before.

But with Google Lens, every minute you spend online becomes a potential shopping experience. While you’re busy looking through social media posts, reading blog articles, or messaging friends, you might spot an item you like and start casually browsing through products.

Tech journalists have viewed Google’s focus on improving the Shopping and Lens experiences as part of a broader strategy to compete with Amazon… and they’re probably right.

Google wants people to spend more time in Google search and less time browsing e-commerce websites.

If you’re a marketer working in e-commerce, this is big news. It means in the future, fewer people might be visiting your website directly by typing it into the address bar. Instead, they may arrive directly via channels like Google Lens or Pinterest Lens.

In the future, we may see brands investing more heavily in strategies like product placement as part of their marketing. If tons of pictures of a famous person using your product are floating around the web, people could then easily seek that product out directly with a Lens search.

Conclusion

Google is always innovating and creating new and different ways to search. Google Lens is the most recent example of the search giants’ constant growth.

For e-commerce retailers, this new technology should not be ignored as it could very well be the future of image search.

As marketers, we’re expected to pivot rapidly as technology changes, and Google Lens is no exception.

Have you heard about Google Lens or Pinterest Lens? What are your thoughts about this way of searching?

The post How Google Lens is Getting Your Products Found Online appeared first on Neil Patel.

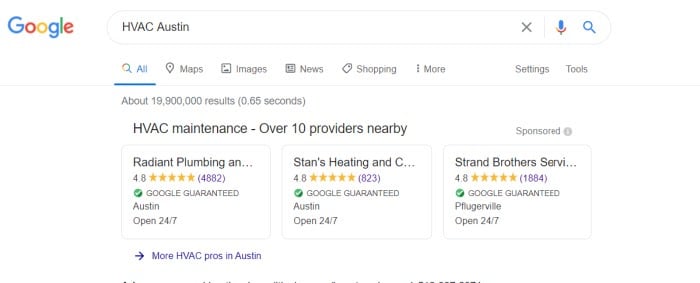

Is Getting “Google Guaranteed” Worth It?

Google has rolled out a new consumer protection feature called Google Guaranteed. Businesses advertising through Local Services Ads can apply for a Google Guaranteed qualification, offering extra reassurance to customers.

Google Guaranteed could be a powerful lead generation tool to help you stand out from your competitors.

The program helps showcase home service providers who have been pre-screened. With an easily visible green Google Guaranteed Badge showing a checkmark, these ads may draw customers’ notice more than others will. And it’s not just because of the eye-catching badge—it’s the knowledge they’re able to choose a business already certified by Google.

What should you know before applying? Let’s have a look at what Google Guaranteed is, who it benefits, and why you might want to consider it for your business.

What Is Google Guaranteed?

Google Guaranteed is a certification program created to increase customer confidence in local businesses. Customers who are vetting companies online can look for the Google Guaranteed Badge, which offers protection if something goes wrong.

Many businesses are already using Google’s Local Services Ads to generate leads for their companies through paid search efforts. The Google Guarantee offers help for businesses who want to draw more organic traffic instead.

Services booked through Local Services Ads are automatically insured up to a lifetime cap, which varies by location. Any customer booking this way has the comfort of knowing they can claim the amount of the invoice should they be dissatisfied with the service.

How to Tell If a Business Has Been Google Guaranteed

Google Guaranteed adds a green checkmark “badge” underneath the names of qualifying companies. If a customer uses an audio search on Google Assistant or Google Home instead of searching on a screen, there will be an audible confirmation of this guarantee.

How Does Google Guaranteed Work?

If your business uses Local Services Ads, you can apply to the program by signing up for Local Services Ads and applying to be Google Guaranteed. If the service is available in your area and you receive certification, a badge or logo will be displayed next to your ad.

When you apply, Google will check your business license, insurance, and online reviews. They’ll also conduct background checks on employees—at no cost to you. Owners’ backgrounds are always checked, and other backgrounds are checked based on the nature of your business.

If your company passes this screening, you’ll receive a badge to show customers Google has prequalified you.

If a customer is unhappy with your service, they can submit a claim to Google to be reimbursed for the amount of their invoice. Google will then reach out to you to learn more and may request additional information from the customer. You’ll have the opportunity to resolve things with your customer. If that doesn’t work, Google will decide on a fair resolution based on its discretion and findings.

What Does the Google Guaranteed Program Cover?

Google Guaranteed will cover customers the amount of the invoice in question up to $2000 in the US and Canada, with varying limits in other countries as the program expands.

Lifetime limits in different regions are as follows:

- United States: $2,000 USD

- Canada: CAD $2,000

- United Kingdom: £1,500

- Germany: €1,500

- France: €1,500

- Ireland: €1,500

- Italy: €1,500

- Spain: €1,500

- Belgium: €1,500

- Netherlands: €1,500

- Austria: €1,500

- Switzerland: ₣2,000

What Isn’t Covered by Google Guaranteed?

There are limitations to the coverage that should be noted by both companies and customers. For instance, customers must have booked the work through Local Services Ads itself and claim reimbursement within 30 days of service completion.

The claim must be for the amount on the invoice for the original service performed, up to a lifetime maximum. It cannot include any additions, future projects, damages, or cancellations, and a customer’s dissatisfaction with the price is not considered a valid reason for a refund.

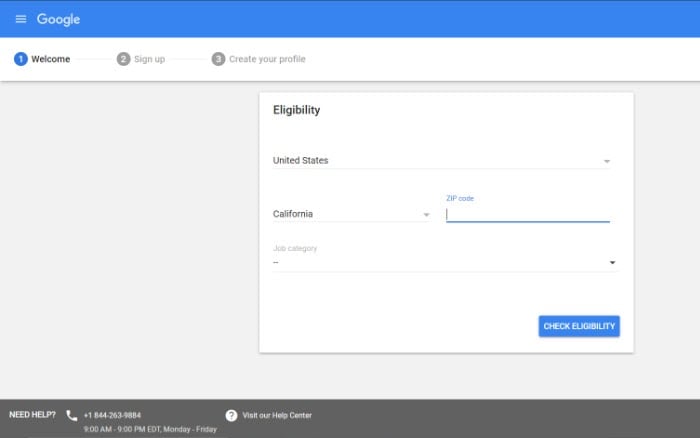

Is My Business Eligible for the Google Guaranteed Program?

If you’re eager to enroll, you may be in luck! Google Guaranteed has rolled out in many areas over the last couple of years, focusing on home services. The eligible industries for Google Guaranteed vary from region to region and may continue to change as the program expands. One of the first steps is to check eligibility to see if the program is available to you.

What Industries Are Eligible in the US?

In the USA, the following industries are eligible for Google Guaranteed: Appliance repair, auto glass, auto repair, carpet and upholstery cleaning, electrical, event planning, financial planning, garage door installation, home cleaning, HVAC (heating, ventilation, and air conditioning), junk removal, lawn care, locksmith services, pest control, pet grooming, photography, plumbing, roofing, tree services, water damage restoration, window cleaning, and window repair.

What Industries Are Eligible in Canada?

In Canada, Google Guaranteed covers HVAC companies, locksmith services, and plumbing businesses.

Does Google Guaranteed Cover All Professional Services?

The Google Guaranteed Program only covers home services for now. However, Google has a program called Google Screened, which covers professional services like financial planning, law, and real estate.

How Are Local Service Ads Related to Google Guaranteed?

The Local Services Ads program already offers you the ability to advertise to potential customers in your area through paid search.

Google Guaranteed is a feature of Local Service Ads intended to instill confidence in local businesses. It offers companies a way to potentially attract more organic traffic without investing the time and money needed for paid search engine marketing.

As a business owner, you may appreciate that it’s simpler to use, targets organic traffic, and costs you an easy-to-understand flat rate.

Is Google Guaranteed Worth It?

It depends on your business needs. You’ll need to decide if Google Guaranteed is worth the cost for your business, weighing the program’s cost and the time it will take to get and maintain the certification against the potential rewards.

You should also consider how much competition you typically have for your services. If you usually have to compete with a large number of other businesses, you’ll probably benefit more from having your ads highlighted.

How Does Google Guaranteed Benefit Businesses?

The Google Guaranteed Ads program offers a distinct way for businesses to rise to the top of search results, as they are displayed above the normal pay-per-click (PPC) Google Ads. Just keep in mind the ad format only allows you to show your company name, city, phone number, hours of operation, and customer rating.

What Does Google Guaranteed Offer Customers?

Google Guaranteed works to cut down on the confusion some experience when comparing local competitors by building customers’ trust in certified companies. The program acts as a consumer protection service, opening up a valuable avenue for customers to spend money with confidence. Vetting potential providers may become quicker and easier as customers know they have Google backing the quality.

Are There Any Drawbacks to the Google Guaranteed Program?

Applying to Google Guaranteed doesn’t result in an overnight acceptance, and you need to maintain your standing with the program. There are also costs associated with using the program, so any business should expect a bit of a learning curve to figure out how to measure results.

There is an in-depth certification process that includes background checks of some or all employees. Depending on the company’s size, this can take significant time to complete, so interested businesses should apply early and be patient while Google reviews their application.

It’s also worth noting this is a revenue source for Google, and they’re likely to expand it. While it may offer valuable benefits now, it will be interesting to see what happens in the future as more businesses sign up.

How will you stand out from the competition if they all get certified?

Is the Google Guaranteed Program Right for Your Business?

For many small businesses struggling to navigate the complicated world of pay-per-click search marketing, the Google Guaranteed Program could make a significant impact. It may allow you to spend less time worrying about keyword research and bidding strategies, so you could devote more of your time running your business.

While paid search can be a powerful tool, many businesses haven’t been able to devote the time or budget necessary to see a return on investment. While there is always expert digital marketing consulting available, those just getting started may want to try it out first.

How Much Does Getting Google Guaranteed Cost?

The program costs a base fee of $50 per month, for an annual cost of $600. However, there are also costs for every lead.

Google Guaranteed differs from pay-per-click. You’ll only pay when a customer calls or connects to engage your services, rather than paying each time a potential customer clicks on an ad.

Costs vary depending on your market and industry, but the average cost per Google Guaranteed lead seems to be about $25. Businesses are able to dispute leads that aren’t legitimate— for instance, if the customer is outside of the local area in your ad or if incomplete customer contact information is provided, preventing you from following up.

Similar programs have rolled out by other companies, such as Yelp’s Verified License, which you might compare with Google Guaranteed. Google’s new certification may resemble Yelp’s on the surface, but the Google Guaranteed program offers a powerful quality guarantee that Yelp doesn’t.

How to Set up Google Guaranteed for Your Business

To set up Google Guaranteed for your business, you’ll send in your application for consideration with Google.

You’ll indicate what country you’re in, what industry your business is in, and your zip code or postal code. This step will confirm if Google Guaranteed is available in your area, as mentioned above. Once that’s been confirmed, you can finish your application.

How to Get Ready for Google Business

If Google Guaranteed is not available in your area yet, there are still steps you can take to get ready for when it is. Ensure your business license and insurance are up to date. You should also check your Google reviews, encouraging your satisfied customers to review your business online, and address any negative reviews.

Maintain Your Google Guaranteed Standing

If you’ve been accepted into the Google Guaranteed Program, congratulations! However, your effort shouldn’t stop there. You’ll need to maintain the standards you established in order to receive the certification in the first place. These standards mean keeping your business license and insurance up to date. Monitor your Google reviews to address any issues, and continue to encourage your customers to provide reviews to begin with.

Conclusion

Google Guaranteed could be a powerful source of lead generation for businesses looking to grow. It may help small and medium-sized companies pull more organic traffic and compete without wading into paid search platforms.

Will you be signing your business up for Google Guaranteed?

The post Is Getting “Google Guaranteed” Worth It? appeared first on Neil Patel.

Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into

The COVID-19 pandemic caught the world by surprise. The economy is upside down. If you are a business trying to make it during this time, we can help. The Federal government has approved funding through The CARES Act, including the Paycheck Protection Plan. In addition, many states and local organizations are offering their own COVID-19 relief options. Beyond that, check out what we found out about Lima One Recession Funding. Note: The changing economic environment means nothing stays the same long. This information is accurate as of the time of this writing, but lenders are making changes frequently. Check Lima One Capital for updates.

Our Honest Review of Lima One Recession Funding

When it comes to real estate investments in a recession, there are a few options. You can flip houses, manage rental property, or some combination of both. One thing is for sure however, and that is that you almost always need financing. Lima One recession funding could help.

In recent years a ton of online real estate investment lending institutions have popped up. These differ from the tons of alternative lenders that have broken digital ground. Instead of business loans, they deal only in real estate lending. In addition, though most of the hard stuff is available to deal with online, there are brick and mortar offices.

They are similar to online lenders in many ways. As already mentioned, most of the forms are available online. Both application and approval can often happen with an online form. Also, Lima One recession financing may also allow for a lower credit score than a traditional bank would require for approval.

The main difference is that these companies, including Lima One, deal only in real estate investments. As such, there are certain things that cannot happen online, such as inspections and appraisals. If you are considering real estate investment, or if you are already in the business but looking for a new lender, Lima One recession financing could be the answer to all you seek.

In an effort to help you make an informed decision about Lima One recession financing, we took an in-depth look at their mission, policies, and products. Our research for this should help you decide if it will work for you. Before you can figure that out, especially if you are new to real estate investment, it may be helpful to have a quick reminder of how the process works.

What are Real Estate Investments?

When you get down to the nitty gritty, real estate investment is simply purchasing real estate for the purpose of generating profit. It can happen in a couple of different ways though.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Flipping Houses

This is the main topic of many television shows. You buy a house for almost nothing, fix it up, and resell it for a profit. It sounds simple enough, and even fun. There is much more to it however. The first roadblock is almost always funding. You have to have the money to buy the house in the first place.

Usually, house flipping financing is short-term, like 13 to 24 months. That isn’t a ton of time to fix it up and get it sold, and you are at the mercy of the contractor’s time table. It is very profitable for a lot of people, but there is a healthy dose of luck involved as well.

The greatest hurdle seen in many house flips is location. You can buy a great house at a great price and fix it up to an even better house that should sell for much more, but if it isn’t located in a place where people want to live, you are going to end up with a house that won’t turn a profit. Worse yet, it may not sell at all.

When looking at a home purchase for a flip, you have to consider location. Not doing so could be extremely detrimental.

Rental Properties

There are a couple of different options here as well, but when most folks think of rentals, they are thinking about buying houses to rent out to others. It can be pretty lucrative if you play your cards right.

Every town needs rental property, but the type of rental property needed may differ vastly. For example, a college town is going to need property that is clean, livable, and able to sleep several roommates to maximize cost effectiveness.

A large city will need a good mix of rental properties for professional young people and young families coming to the area for work. The singles will want something trendy and close to the action, while the families will be looking for size, stability, and something a little lower key. This would be the difference between a downtown loft and a three-bedroom two bath in the suburbs.

In the college town, smaller sized homes and duplexes are going to be vital. If you own a ton of family homes, you may run into issues. If you are in a town that a lot of families are moving to however, those rentals that will hold them could be a gold mine.

Location, Location, Location

Location really is huge.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Apartments are also a good bet if you want to get into rentals, but you still have to exercise caution. You want a complex that already generates a profit on the front end. Do not ignore the need for upkeep or maintenance either. Both are vital regardless of what type of rental you own, but apartments can be a little more difficult to manage due simply to the number of tenants you have to juggle.

Financing Options for Lima One Recession Funding

Different financing options are available for the various types of real estate investments. Your specific business situation can make a difference as well. Here is what is available as far as Lime One recession funding.

Fix N Flip

This is the house flipping loan available through Lima One Capital. It is a 13-month term loan up to 75% of ARV for 90% of purchase or rehab. There is no prepay penalty, and the minimum credit score necessary for approval is 600. This is pretty low, meaning your credit doesn’t have to be perfect to get started.

While this type of Lima One recession funding can open up a lot of opportunities, remember that there are some major risks involved with flipping houses. It is important to take this and the short loan term into consideration on the front end.

This is why it is important to remember that location is just as important as other factors when house flipping. If you have a great house and your budget is on point, but the house is in a part of town that no one is buying in, you are going to have issues.

Bridge Plus

The Bridge Plus loan is available to those who have 5 or more successful home flips in the past 2 years. It is a lower interest option for Lima One recession funding if you need a quick purchase or refinance for resale. The term is still 13 months, but the funds are more readily available and again, lower interest, due to the previous experience requirements.

Lima One Recession Funding: Construction Loans

If you are planning to do major work or build a structure for residential rental, this is the Lima One recession funding you need. You must already own the investment property or lot, and it is a 70% ARV with a 13-month term.

Cash Out Loan: Lima One Recession Funding at Its Finest

This loan is for those that already own property and want to leverage it. It is 0% down, with a 50% loan to “as-is” value. The term is 13 months.

Rental Financing: Another Form of Lima One Recession Funding

If you are looking at investment property to run as a rental rather than resale, Lima One recession funding has several options.

Rental 30

This option is open to all experience levels for purchase, refinance, or cash out. It is a 30-year term with interest ranging from 5.75% to 8.025%. The minimum amount available is $50,000 and the maximum is $1,000,000. There is no debt to income requirement for the borrower, and the minimum credit score required is 660.

Rental Premium

The Rental Premium product is a loan available with a 30-year term or with a 5/1 or 10/1 loan option. And the property has to have a value of at least $60,000. The minimum credit score for eligibility is 660.

Rental 2-1

This is a loan for rental property with a 2-year term and the option for a 1-year extension. The minimum loan amount is $50,000, and the maximum is $2.5M. The 660 minimum credit score still applies here.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit, even in a recession.

Multi Family Loan Overview

If you are going to buy multifamily rental property, this loan could be Lima One recession funding you need. A 2-year term with no prepayment penalty highlights the offering. Interest ranges from 8.99% to 10%. The fund amounts are variable between $250,000 to 5,000,000.

With most of these loans you also have the potential to cross-collateralize any property you already own or have under an existing loan with Lima One Capital.

Lima One Capital Recession Funding: What Are People Saying?

We can’t research Lima One recession funding without checking out the company on the Better Business Bureau website. According to the BBB, Lima One has been in business since 2010. They do have 5 complaints on file, but over 8 years that’s not too bad. Most of the complaints relate to issues dealing with individual staff members. They are not related to company policy or habitual ways of doing business. They have an A+ rating.

In addition, they made the top real estate lenders as issued by Fit Small Business in June of 2018.

They offer loans in 40 states.

What Else do You Need to Know about Lima One Recession Funding?

Most real estate loans, regardless of the lender, require 20% down. That can be a stretch during a recession. It can come from multiple sources, including loans from other lenders, leveraging properties you already own, gifts, or personal funds.

Location matters. I have mentioned this already, but you just can’t expect to buy cheap property to flip without thinking about why it is cheap. The same goes for rentals. What kind of renters will you get in the area? Will they pay? Location is an important element that you should pay attention to.

When you have a construction loan, it may cost you to make draws. Sometimes it can cost as much as $200 per construction draw. This is standard, but you need to be sure to add it to your budget, and be careful to manage your construction draws accordingly.

Budgets are important. That will go without saying to many, but just in case you weren’t sure, you need to have a budget and stick to it. It will pay off in the end.

Don’t over improve. You want to increase the value of the property, but stay aware of what your market can handle. Custom cabinets and marble counters are fabulous, but if those buying in that area cannot afford them, you are only going to lose money. Pay attention to the market in a particular location and what it can handle.

Along those lines, consider whether you are selling versus renting. If you are improving a property for rent, you need to pay closer attention to the durability of the materials you use.

Lima One Recession Funding: Conclusion

Finding funding of any kind during a recession is hard. There is no doubt about it. It is important to stay on top of your finances and do your research so that you can find the right sources to fit your needs. It is much easier to slide down a slippery slope. A good funding source could be the traction you need.

Overall, Lima One recession funding is solid. They know their business and generally offer great customer service. The only issue is that there may be, on occasion, a glitch in company-wide communication. However, the company addresses each complaint on the BBB website in a timely manner, and there are not a lot of those complaints. If you are looking at real estate investments, Lima One Capital isn’t a bad place to start.

Armed with this information, you should be able to make a more informed decision about a lender. If you are serious about breaking into real estate investment, or if you are an established investor looking for more funding options during the recession, we would love to help. Find out more here.

The post Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into appeared first on Credit Suite.

Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into

The COVID-19 pandemic caught the world by surprise. The economy is upside down. If you are a business trying to make it during this time, we can help. The Federal government has approved funding through The CARES Act, including the Paycheck Protection Plan. In addition, many states and local organizations are offering their own COVID-19 … Continue reading Lima One Recession Funding – Reliable Research So You Know What You’re Getting Into

Franchise tag: Who's getting paid, what's next

Monday is the deadline for teams to franchise players, and several teams already have locked down their stars.

The post Franchise tag: Who's getting paid, what's next appeared first on Buy It At A Bargain – Deals And Reviews.

Getting Investment Properties

Acquiring Investment Properties

Internet economic investment is gross economic investment minus decline. Monetary financial investment could be ready or ex-ante or ready for or prepared economic investment; or it could be ex-post, i.e., actually comprehended economic investment, or when economic investment is not just planned or suggested, yet which has actually truly been invested or used.

An added classification of economic investment may be individual monetary investment or public monetary investment. Individual economic investment gets on unique account, i.e., by special individuals, along with public monetary investment is by the federal government. Public economic investment is by the state or area authorities, such as framework of roads, public parks and so forth.

Economic financial investment which is independent of the level of income, is called independent economic investment. Independent monetary investment depends a whole lot a lot more on people advancement along with technical growth than on anything else. The influence of alteration in incomes is not completely dismissed, because higher profits would potentially lead to a lot more economic investment.

Circumstances of independent economic investment are long-range monetary investments in houses, roads, public frameworks as well as additionally different other type of public monetary investment. Public economic investment recommends monetary investment which occurs in straight comments to development, as well as additionally a great deal of the long-range monetary investment, which is simply prepared for to spend for itself over a prolonged period, can be concerned as independent economic investments.

Monetary financial investment may be ready or ex-ante or ready for or indicated monetary investment; or it could be ex-post, i.e., truly comprehended economic investment, or when economic investment is not simply planned or prepared, nonetheless which has actually been invested or carried out. Public economic investment recommends economic investment which takes place in straight response to production, as well as a whole lot of the long-range monetary investment, which is simply prepared for to pay for itself over an extensive period, can be connected to as independent economic investments.

Monetary financial investment could be ready or ex-ante or ready for or suggested monetary investment; or it may be ex-post, i.e., actually comprehended monetary investment, or when monetary investment is not simply planned or intended, nonetheless which has actually been invested or carried out. Circumstances of independent monetary investment are long-range economic investments in residences, streets, public frameworks as well as different other kinds of public economic investment. Public economic investment recommends economic investment which occurs in straight response to production, as well as a whole lot of the long-range monetary investment, which is simply expected to pay for itself over an extensive period, can be associated to as independent monetary investments.

The post Getting Investment Properties appeared first on ROI Credit Builders.

Getting started with Paper.li Starter

Welcome to Paper.li Starter! Below you’ll find tips and best practices for getting the most out of your Starter Plan. Make sure you’re getting the best and most accurate content using smart topics, URLs, RSS …

The post Getting started with Paper.li Starter appeared first on Paper.li blog.

Getting started with Paper.li Starter

Welcome to Paper.li Starter! Below you’ll find tips and best practices for getting the most out of your Starter Plan. Make sure you’re getting the best and most accurate content using smart topics, URLs, RSS … The post Getting started with Paper.li Starter appeared first on Paper.li blog.