Follow live: Michigan vs. Colorado State gets this March Madness party started

null

The post Follow live: Michigan vs. Colorado State gets this March Madness party started appeared first on Buy It At A Bargain – Deals And Reviews.

null

The post Follow live: Michigan vs. Colorado State gets this March Madness party started appeared first on Buy It At A Bargain – Deals And Reviews.

There’s no doubt about it: a successful video marketing campaign will absolutely transform how your business operates.

If you’ve been dreaming about an increase in brand awareness, organic lead generation, and personal connections with your customers – creating video content could be the solution you are looking for.

How?

Let’s take a look at the statistics.

On average, video content is shared 1200 percent more than text and image posts combined – making it the perfect pursuit for businesses looking to increase their organic reach.

Similarly, positive ROI statistics for video content have been booming for years – from 33 percent in 2015 to 87 percent in 2021. Businesses and marketers alike have taken note, diverting budgets towards hiring videographers to create new marketing materials for their website, email outreaches, social media, and even “OTT” video adverts on streaming platforms.

Why?

It seems the positive results have been due to audience preference, with video content being considered “easy to consume” as well as creating a welcome break from “overabundance of textual information online.”

For any smaller company with a low budget, creating video content can seem a little intimidating.

It’s hardly something you can leap into blindly, and understanding the process behind successful video marketing campaigns will help you avoid costly mistakes in the future.

As with any successful marketing campaign, you’ll need to start with a plan.

Holding your mobile phone, pointing it in the right direction, and clicking “record” might feel instinctual – but there’s a lot more work that goes on behind the scenes of video content.

Plans will help you slow down, breathe, and give you direction.

If you want your video marketing campaign to be successful, you’ll need as much attention as possible.

Having a plan in place will help you maximize your outreach by posting your video in the right places. Assuming you don’t have completely overlapping audiences, if you want to be sure that you’re reaching every one of your followers, you’ll want to post your video content on all of your social media accounts.

If you play your cards right, you might even see some of your videos go viral.

Additionally, instead of losing progress on a day where you are feeling flat and uninspired, a plan can help you structure content ideas, ensure you have the right tools for the video, and allow you to schedule time to actually edit your footage before posting.

This will considerably improve the quality of your video content.

Next, you need to make goals based on your plan – and keep track of measurable results.

Consider this: how would you define success?

More sales? A higher CTR? Better engagement on your social media posts?

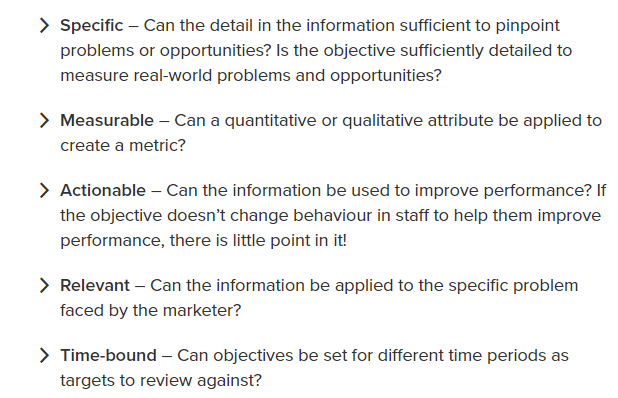

Take a look at these SMART goals:

SMART is a universally recognized system for creating measurable, trackable, and attainable goals.

If that’s too intense, here’s a condensed cheat-sheet version for your business:

Remember: don’t just make goals but actually hold yourself accountable for them.

If you started creating video content today, and six months from now, you had no definitive idea on the future direction of your content, I’d suggest that your campaign was in serious trouble.

Achieving consistent growth with video marketing comes down to two things:

1). Finding what works and recreating it in future videos.

2). Finding what doesn’t work and making sure that it’s not in your future videos.

These are the absolute basics of consistently increasing the effectiveness of your video content.

When you draft your plan of action, you’ll likely bounce around ideas for upcoming content or even choose to create a full content strategy.

Before proceeding, you need to remember the importance of staying true to your brand voice and giving your audience what they’ll actually want.

If you’ve been creating educational content on your blog, your best bet would be to start with educational video content and see if that resonates with your audience in the same way.

Stick with what you know.

So many companies are trying so hard to be innovative that they don’t pay attention to the tried-and-tested content types that already work.

Trying to come up with brilliant ideas and then executing them poorly could be harmful to your future video marketing efforts.

When choosing what type of content to make, study the three types of widely-recognized video in the marketing community:

Educational videos are all about adding value to your audience.

Give them a reason to watch your content, to share, or “follow for more”.

Hint: Nobody wants to get to the end of a video and feel like they’ve wasted their time.

Informative guides, product demonstrations and interesting thought pieces are likely to do really well online as they are great at engaging your audience and making them think.

For so-called “inspirational videos”, your job is to capture breathtaking views, change lives, play with emotions, reveal awe-inspiring moments, and produce motivational content designed to fire people up.

In this category, you’re trying to get people to laugh or smile.

Your content should intrigue them to investigate your brand further and create a positive experience that they’ll then associate with your brand or product in the future.

If you have no idea where to start: don’t worry, it’s not the end of the world.

Trialing content from each category will help you find your feet, as well as gain audience insight.

As time goes on, you’ll develop a stronger understanding of what type of video content works and what doesn’t.

Trust me, if your audience wants a different type of video, they’ll ask for it.

Pay attention to your comments section! I certainly do.

Okay, now that we’ve gotten all the planning out of the way, it’s time to dive into the fun part.

Video creation might seem overwhelming at first, but I’ll let you in on a little secret.

Your first video is supposed to be your worst.

Think about it! If every video is an improvement on the last one, it only makes sense that your first video is your worst, right?

Instead of stressing out over every minor detail, just dive into the creative process.

You’ve already made a plan. You have an idea for your first video.

Instead of trying to figure out the perfect way to start your video content creation journey, just get that first video out of the way.

Trust me, it’s only going to get easier.

Don’t get me wrong. You should still try to provide as much value as you can and be as professional as possible.

But expecting this video to be perfect is just unrealistic.

In the world of written content, you provide value by doing everything from offering tangible advice to being a great storyteller.

As far as I’m concerned, the sooner you start actually making relevant content… the better.

Creation means you’ll get feedback. Getting feedback means you can make changes where required, rather than nit-picking when there are no nits. Your audience will be vocal about what they do and don’t like, so you won’t be stranded for long.

It really is that simple.

Don’t have any of those fancy filming tools yet? No problem. I’ve got just the thing!

Go ahead and reach into your pockets for me.

Feel that rectangular piece of metal in there?

If you’ve got a smartphone, you’ve got what it takes to make a video.

It might not be perfect (although their rapidly improving cameras are certainly making a huge difference for low-budget marketers) and that’s absolutely okay.

As your video marketing strategy develops over time, you can upgrade and invest more time and money into video creation.

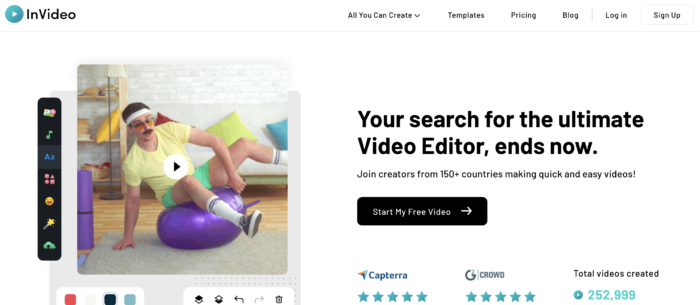

You can use InVideo as your one-stop solution for video editing and customization.

The best part?

You don’t need to have a ton of experience with design or editing to make awesome videos.

Why stop when you’re ahead?

If you’re seeing positive results but don’t have the time to handle video creation in the long run, look into hiring professionals to put together your videos, invest in a professional camera and lighting equipment to make your editing job easier, and increase your resources with licensed music, images, and fun little animated intros.

There might never be “the perfect moment” to post your first video, so don’t waste time and just get started.

I love discussing the creative process and useful tricks to use in the world of video marketing.

However, there’s more to executing a successful video marketing strategy than what you can see on the surface.

Behind the scenes, SEO is still massively important, whether you’re a fan of it or not.

It’s so important that I made a video for local businesses on how to pull it off without a huge marketing budget.

Let me be clear. If your video content is not being optimized for search, you are almost certainly missing out on free exposure.

Scary, right? Don’t worry. I’ve got a quick fix to get you back on track.

If you’re familiar with SEO for your blog, this is all going to seem oddly familiar.

The same way your article title should have keywords that you’re looking to rank highly for, your video title is going to determine your ranking on sites like YouTube.

Even if you’re familiar with SEO through your blog, this next part might be news for you.

Those description sections under videos on YouTube? Google’s Algorithm trawls through them for its users. For high-performing video marketing through SEO, the general idea here is the same:

Typically, the best descriptions are those that accurately explain your video in conjunction with keywords.

Overall, balance storytelling and metrics. Maybe even consider getting a copywriter involved if you are unsure what to write.

SEO is the cornerstone of any truly effective content strategy, and it’s especially important when it comes to video marketing.

It wasn’t too long ago that “celebrity endorsement”’ was something that only the world’s biggest brands could actually afford.

Smaller brands and local businesses could only sit back and watch athletes and actors use their mass appeal to help these businesses sell more of their products.

Don’t worry, though, things have changed.

Micro-influencers are on the rise.

They have their own loyal following and a unique understanding of how to appeal to the people in their industry.

Frankly? They can be pretty darn effective.

With the explosion of the internet and social media, our marketplaces look completely different, consumer habits have us browsing for the best price online, and marketing landscapes are almost unrecognizable.

The best influencers are able to run with your vision for content and provide you with unique and valuable insight on what would work best for their audience.

Plus, there’s no denying that having your brand presented to a group of anywhere from 100,000 to several million dedicated followers can be massively impactful.

Just take a look at how Dude Perfect partnered with Hasbro to promote the company’s new Nerf product, the Mega Magnus.

Effectively teaming up with influencers comes down to two things.

Just because you’re trying something new in the form of video content, there’s no reason to forget the principles of marketing that you’ve used with previous content.

If you’ve been implementing a well-rounded marketing strategy, you should be drawing from both organic and paid traffic.

If you’re completely new to this, or you just want a refresher on how to maximize your ads, this part is for you.

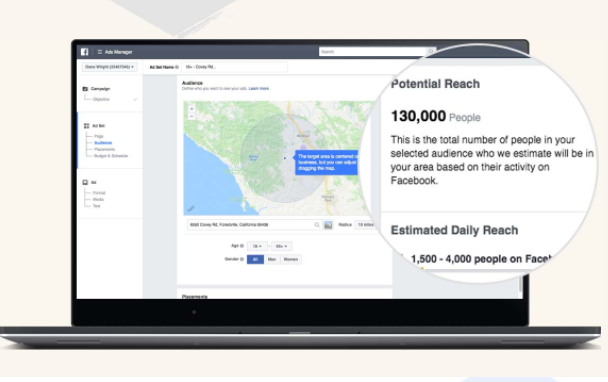

Let’s take a look at the Facebook ads targeting mechanics.

Using Facebook, brands can easily tailor their ads to suit a variety of different users.

Your ads can target users based on key demographics such as their age, gender, location, interest, and much more.

Because of social media analysis, you’ll even know what your typical daily reach is.

The best part?

You can customize each individual ad to maximize its relevance.

For example, let’s say that you created two videos.

The first video is for people getting ready to retire, and the second video is for people who just graduated college.

Instead of presenting your entire audience with an ad that likely won’t be very useful for them, you can ensure that each video gets its own category and is presented to relevant parties.

When you increase the quality of your video marketing by ensuring your ads are targeted, you’ll inevitably convert more users into customers.

Of course, Facebook isn’t the only place where you could choose to invest in ads.

Which brings up an important question: where should you be spending your money on ads?

Well, remember all the way back in the first section, when I mentioned that posting in a variety of different places would help you in the long term?

This is where that seemingly minor detail comes in handy.

Now that you’ve collected enough information on which platforms work best for your video marketing content, it’s time to put that data to use.

Armed with those metrics, you’ll be able to identify where your content is getting the most attention.

From there, it’s as simple as having a higher ad budget on those platforms.

If your audience likes to consume your videos on Instagram, Instagram ads it is.

If they love Facebook, promote your content on Facebook.

If you’re getting the most exposure out of YouTube, invest in YouTube ads.

Ride the wave of momentum, capitalize on your minor victories, and sooner or later, your video marketing will take off.

Starting on your video marketing journey is easy. Just follow our 6 steps to maximize your chance at success:

1). Create a Plan, Set Goals, and Measure Them

2). Stick With What You Know

3). Start Creating and Stop Holding Yourself Back

4). Search Matters

5). Partner With Influencers

6). Use Ads to Their Full Potential

Starting an online video marketing campaign has become easier due to social media. Instead of paying hundreds and thousands of dollars to get your video advert on TV, you can upload video content to your Facebook, Instagram, LinkedIn, or YouTube accounts anytime you want, at any budget you want.

Creating video content requires five main steps:

1. Create a goal

2. Film

3. Edit

4. Publish

5. Promote

There’s no limit on who can post video content online, so just start recording and strike for gold.

Video marketing works by providing users with content in a popular format. On top of paid reach, video marketing is great for generating organic leads and boosting brand awareness. It gives businesses the chance to create authentic, personable relationships with their customers.

Video marketing doesn’t technically require any budget at all. While higher quality videos tend to perform better, using your mobile phone and free editing services can, and does, work for many businesses. Marketing budgets should be approximately 11 percent of your overall annual budget, but how much – or how little – you spend on paid adverts, videographers, professional cameras, and editing services is entirely up to you.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How can I start video marketing?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Starting on your video marketing journey is easy. Just follow our 6 steps to maximize your chance at success:

1). Create a Plan, Set Goals, and Measure Them

2). Stick With What You Know

3). Start Creating and Stop Holding Yourself Back

4). Search Matters

5). Partner With Influencers

6). Use Ads to Their Full Potential”

}

}

, {

“@type”: “Question”,

“name”: “How do I start an online video marketing campaign?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Starting an online video marketing campaign has become easier due to social media. Instead of paying hundreds and thousands of dollars to get your video advert on TV, you can upload video content to your Facebook, Instagram, LinkedIn, or YouTube accounts anytime you want, at any budget you want. ”

}

}

, {

“@type”: “Question”,

“name”: “How do I get started with creating a video?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Creating video content requires five main steps:

1. Create a goal

2. Film

3. Edit

4. Publish

5. Promote

There’s no limit on who can post video content online, so just start recording and strike for gold.”

}

}

, {

“@type”: “Question”,

“name”: “How does video marketing work?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Video marketing works by providing users with content in a popular format. On top of paid reach, video marketing is great for generating organic leads and boosting brand awareness. It gives businesses the chance to create authentic, personable relationships with their customers.”

}

}

, {

“@type”: “Question”,

“name”: “What budget should I allocate to video marketing?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Video marketing doesn’t technically require any budget at all. While higher quality videos tend to perform better, using your mobile phone and free editing services can, and does, work for many businesses. Marketing budgets should be approximately 11 percent of your overall annual budget, but how much – or how little – you spend on paid adverts, videographers, professional cameras, and editing services is entirely up to you. ”

}

}

]

}

I’m not going to give you the impression that video marketing is easy. It’s tough, and it will challenge you.

Creating compelling content can be an uphill battle sometimes, particularly when you’re first getting started. Your first video isn’t going to be amazing.

Which is totally okay!

Leave perfection to the artists. Out here in the marketing world, I’ll settle for meaningful progress.

Come up with a strategy, and then execute that strategy by creating content as soon as you can. Measure your results, and take advantage of the (free) platforms and resources at your disposal.

Video marketing may not be an easy way to build your brand, but once you get the hang of it, you’ll wonder why you waited this long to get started.

It’s time to add video marketing to your content strategy.

If you’ve already experimented with video marketing, what’s working for you? How have your paid ads on sites like Facebook and Instagram worked out?

First, with COVID-19 in the picture, you are likely in survival mode. If your business has been affected by the pandemic, you need to sign up for the SBA Paycheck Protection Plan, a Disaster loan, or both. Do it now, because funds are limited and the application process takes time. This will help your business keep going while you figure out the next steps for whatever the future holds for our economy, including recession business finance.

During a recession, everything changes. There is less spending, less lending, and less cash moving period. Lenders are tighter with what they are willing to dole out, and that leaves many business owners wondering what to do about business funding. It makes recession business finance exceptionally tricky.

Some sources of funding that may work well during the good times are not reasonable to count on for recession business finance purposes. It is important to know what options are available and which ones will work best during harder economic times. Recession business finance can be a bit more difficult to navigate.

There are not as many options for recession business finance as there are for business funding during good economic times. Of the available options, the ones that will work best for you depends on a number of factors. You have to know more about each before you can make an educated decision. It is necessary to know the differences between them, what the qualifications are, and if you even have access to them before you can begin to think about making a decision.

We break it down for you here in our ultimate guide to recession business finance so you can make the best decision possible during the hard times of a recession.

These are the loans that you go to the bank to get. As a business, your business credit score can help you get some types of funding even if your personal score isn’t awesome. That isn’t necessarily the case with this type of funding.

With a traditional lender term loan, you are almost always going to have to give a personal guarantee. That means they will check your personal credit. If it isn’t in order, you will likely not get approval.

What does it mean to have your credit score in order? If you have a personal credit score of at least 750 you are in pretty good shape. Sometimes you can get approval with a score of 700+, but the terms will not be as favorable.

If you have really great business credit, your lender might be more inclined to offer a little more flexibility. However, your personal credit score will still weigh heavily on the terms and interest rate.

Of all of the available business funding types, this is the hardest to get. It is usually worth the trouble though if possible, because it often has the best rates and terms.

Term loans are not easy to get, and during a recession, it is even harder. Unless you have stellar personal and business credit with an already established, successful business, this is a long shot when it comes to recession business finance.

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

These are government secured term loans offered through traditional banks. The Small Business Administration, or SBA, works with lenders to offer small businesses funding solutions that they may not be able to get based on their own credit history. Because of the government guarantee, lenders are able to relax a little on the personal credit score requirements.

In fact, it is possible to get an SBA micro-loan with a personal credit score between 620 and 640. These are very small loans, up to $50,000. They may require personal collateral as well.

The trade-off with SBA loans is that the application progress is lengthy. There is a ton of red tape connected with these types of loans.

During a recession however, the government works hard to build the economy. In light of this, SBA loans may still be a viable option.

This is basically the traditional lender’s version of a business credit card. The credit is revolving, meaning you only pay back what you use, just like a credit card. Rates are typically much better that a credit card. The application and approval process, however, is more similar to that of a traditional term loan.

If you need revolving credit and can qualify for a term loan, this is the best option. It is great for bridging cash gaps and covering short term expenses without the high credit card interest rates. If you already have this in place before a recession hits, even better!

There are no cash back rewards or loyalty points though. That makes some business owners prefer business credit cards in some cases, despite higher interest rates.

Since this is basically a revolving traditional loan, it could be as difficult to come by during a recession as a term loan from a traditional lender may be.

When you apply for financing from traditional lenders, they will always ask for certain information. This is regardless of whether you are applying for a line of credit, an SBA loan, or a traditional term loan. You will need to provide, at a minimum:

While this list is not exhaustive, it is a good start for what you need to have together before you begin the application process if you plan to pursue this type of recession business finance.

A credit line hybrid is basically revolving, unsecured financing. It allows you to fund your business without putting up collateral, and you only pay back what you use.

How hard is it to qualify? Not as hard as you may think. You do need good personal credit. That is, your personal credit score should be at least 685. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Also, in the past 6 months, you should have less than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

If you do not meet all of the requirements, all is not lost. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, the funding is “no-doc.” This means you do not have to provide any bank statements or financials.

Not only that, but typically approval is up to 5x that of the highest credit limit on the personal credit report. Additionally, often you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

The process is pretty fast, especially with a qualified expert to walk you through it. One other benefit is this. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

An established business with accounts receivable can look to invoice factoring as a source of recession business finance. This is where the lender buys your outstanding invoices at a premium, and then collects the full amount themselves. You get cash right away, without waiting for your customers to pay the invoices.

For those businesses already up and running enough to have accounts receivable, this can be a viable option during a recession. If your customers cannot pay or are paying slowly due to the economic downturn, you can still get the funds you need to run your business, although not at full value of what you would get if your customer paid you.

The cash comes fast, which is also a bonus. Since the lender collects the funds directly from the customer, this can be a really good recession business finance option.

Because this type of funding is based on receivables, it is still a viable option if your business has them. The only problem is, during a recession, sales could go down. This would reduce the amount of funds you have available to you.

If you accept credit cards, you may be able to get a merchant cash advance. It is similar to invoice factoring, but instead of buying your open invoices, the lender advances cash based on expected credit card sales.

These are lenders other than traditional banks and credit unions that offer terms loans. Usually they operate online. Occasionally they will have a brick and mortar location as well. The difference between these and traditional lenders is that the loans have looser approval requirements and a much faster application process. Most often you can simply apply online, get approval in as little as 24 hours, and the funds are in your account within 24 to 48 hours after approval.

They are an option if your personal credit isn’t terrible and you need funding fast. In times of recession, these guys are a go-to source as they specialize in lending to those that may have trouble with traditional lenders.

There has been an explosion of non-traditional lenders onto the scene in recent years. Some are better than others. Be sure to research each one thoroughly. Check them out on the Better Business Bureau website and read online reviews to get a good start.

While there are not a lot of these out there, grants are a super source of recession business finance if you can get one. They are usually offered by professional organizations. There are some government grants available also. Competition can be fierce, but they are definitely worth a shot if you think you may qualify.

Requirements vary from grant to grant and most are only awarded to a certain number of recipients. More opportunities are available if you fall into one of the following categories.

There are also some corporations that offer grants in a contest format that do not require much other than that you meet the corporation’s definition of a small business and win the contest.

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

Federal government small business grants run through the Small Business Administration, but they are rarely awarded directly to a business. Instead, they award the grant to local non-profits or governments to disburse to small businesses in their communities. To find these, check with local economic development agencies and governmental entities to find out what available business funding types they have.

Another place to look is the local Small Business Development Center, or SBDC. These offer support to local small businesses and are generally related to a local college, university, or economic development center.

As a general rule, they do not offer grants themselves. They can, however, point you in the right direction. They know where the money is, who qualifies, and how to start the application process. These agencies also offer many other services to small businesses, making them a great resource regardless.

Corporate grants are another great option if you live in an area where they are available. Companies like FedEx and LendingTree have grant contests each year.

Grants are a great possibility at any stage of business. They shouldn’t be counted on too heavily however. Funds are limited and competition is fierce. A backup plan is definitely necessary if you are planning to use the funds for a specific purpose.

Credit cards as a whole get a bad reputation, but in lieu of another option, they can actually do the trick quite nicely. They are more readily even with a credit score that isn’t awesome, but the lower the credit score the higher the interest rate. Also, there are limits on how low they will go with a credit score.

Credit cards as a whole get a bad reputation, but in lieu of another option, they can actually do the trick quite nicely. They are more readily even with a credit score that isn’t awesome, but the lower the credit score the higher the interest rate. Also, there are limits on how low they will go with a credit score.

However, this is one of the available business funding types that most of the general public are eligible for at any given time. They do a credit check, but your credit doesn’t have to be as high as it would be to gain approval for a traditional loan.

The downside of business credit cards is that they typically have a high interest rate. The upside is that many of them offer rewards in the form of cash or points that can be helpful.

Credit cards are plentiful even during hard economic times. It may be harder to get approval if the recession has hit your credit score hard, but there are ways to fix that.

Apply for business credit cards with your business name and EIN to get them without a personal credit check. If you do not yet have a business credit score, you need to get one. Find more about how to establish and build business credit here.

Which type of recession business finance you should use in any given situation depends on many variables. The biggest piece of the puzzles is which types of funding you are eligible to receive. However, there really is more to it than that. Assuming you are eligible for all types of financing, here are some other factors to consider.

In the startup phase, there are a couple of things to think about when determining which funding types might work best.

If you fall into one of those categories that make grants an option, that is the best first stop. Grants are free and clear. That money is yours, without repayment, to use in your business. They typically do not rely on success of the business or the credit worthiness of the owner. The business or proposed business only has to meet the requirements set forth to apply, and then win the grant.

Traditional term loans are a good idea for the startup phase also, if you qualify. The interest rates and terms are generally more favorable than other types of financing for those that meet the credit requirements. They are less of an option during a recession however.

If you do not meet the credit requirements for traditional term loans, then non-traditional lenders are the next best option. They may have higher interest rates, but they do the trick. Plus, they can help build your business credit score if you make your payments on time. That, in turn, makes you more eligible for other types of recession business finance.

While not impossible, it is not usually a good idea to start a business using credit cards if it can be avoided. Of course, invoice factoring is not an option here as you have to already be in business to have the invoices necessary.

Check out how our reliable process will help your business get the best business credit cards, even during a recession.

There are several different aspects of growth that can benefit from various types of business funding.

If you see the potential for higher demand and need to increase inventory to accommodate, a revolving credit line is going to work best.

If already in place, these are instantly available to meet the cash needs that a large inventory purchase creates. They also allow for taking advantage of special pricing when available, which can be huge during a recession.

A business line-of-credit works well due to the lower interest rate, but business credit cards will work in this situation also. In fact, if they have really great rewards attached to them, they could even be the better option. It can’t hurt to have both available if you have that luxury so that you have choices.

If available, grants work well for growth projects during a recession also.

For large equipment, it is best to use traditional term loans of some sort if possible. This is simply because they are typically longer-term loans for larger amounts. Lower interest rates and favorable repayment terms are key. However, we all know that isn’t always possible. Other types of recession business finance can be used if necessary.

Grants may be an option if there is not a time crunch. If time is of the essence, it is possible to purchase equipment on credit cards, but you could run in to problems with cost versus credit limit.

Expanding during a recession can be tricky, if not downright risky. However, if you want to add on to your current building or add an additional location, term loan financing is the best option. Whether it needs to come from a traditional or non-traditional lender will depend on your specific situation.

Working capital is the cash you have available to run your business. Everything from payroll to repairs, maintenance, seasonal cash gaps, and emergencies are all things working capital covers.

Working capital can come from various sources. There are working capital loans available, but lines- of-credit and business credit cards can work in these situations as well. Unless you already have a working capital loan before the need arises, it is likely you are going to need to access business credit cards or some form of non-traditional financing for this.

In a pinch to cover a cash gap, a merchant cash advance or invoice factoring can work well.

It doesn’t matter what type of business you own or whether or not you need funding at this moment. If you own a business you need to know what the available business funding types are, which ones you currently qualify for, and how to qualify for those that are not currently available to you.

You also need to know which types of funding work best in various situations. Once you know these things, you can make an informed decision about how to best fund your business during the recession.

The post Your Ultimate Get Started Guide to Recession Business Finance appeared first on Credit Suite.

If you own a new business, one that is less than two years old, you likely need funding. Who are we kidding? Everyone needs funding of some sort right now. COVID-19 has made sure of that. It is also just as likely that you will have trouble finding funding that you qualify for. Maybe your personal credit isn’t great. Maybe you are still working on building business credit. While there are a ton of new initiatives to help businesses survive in these unprecedented times, they are mostly for existing businesses. Still, there are many options for new business funding as well. Here, we’ve broken them down in a list to help get you started. They are divided into the categories of SBA loans, private lenders, grants, and crowdfunding.

While it isn’t always wise to stack new business funding of the same type, it isn’t a bad idea to stack different types of funding. For example, you could apply for a grant and take out a loan at the same time. You could even run a crowdfunding campaign simultaneously. However, it is important to be careful of having too many loans out at once.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

These are traditional bank loans, but they have a government guarantee. The Small Business Administration, or SBA, works with financial institutions, like banks, to offer small businesses funding solutions that businesses may not be able to get based on their own credit history.  Because of the guarantee from the government, lenders are able to relax a little on the personal credit score requirements.

Because of the guarantee from the government, lenders are able to relax a little on the personal credit score requirements.

In fact, you can get an SBA microloan with a credit score between 620 and 640. They are small loans, only going up to $50,000. Also, they may require personal collateral.

The trade-off with SBA loans is that the application progress is lengthy. There is a ton of red tape connected with these types of loans.

This is the Small Business Administration’s main program. It offers term loans up to $5 million. Funds can be used for expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the funds.

The minimum credit score to qualify is 680, and there is also a required down payment of at least 10% for the purchase of a business, commercial real estate, or equipment. The minimum time in business is 2 years. In the case of startups, business experience of at least two years will work.

These loans are also available up to $5 million and can buy machinery, facilities, or land. They are generally used for expansion, and private sector lenders or nonprofits process and disburse them. They work especially well for commercial real estate purchases.

Terms for 504 Loans range from 10 to 20 years, and funding can take from 30 to 90 days. They require a minimum credit score of 680. In addition, they use the asset being financed as collateral. There is also a down payment requirement of 10%, which can increase to 15% for a new business.

The 2 years in business, or 2 years management experience in the case of startups, remains.

As mentioned, microloans go up to $50,000. They are good for starting a business, purchasing equipment, buying inventory, or for working capital. Community non-profits handle the administration of microloan programs. In contrast to their other programs, financing comes directly from the Small Business Administration.

Interest rates on these loans are 7.75% to 8% above the lender’s cost to fund. The terms go up to 6 years. They can take up to 90 days to fund. For these, the minimum credit score is 640. Furthermore, collateral and down payment requirements vary by lender.

Private business loans are loans from companies other than banks. They are sometimes also called alternative lenders. There are a few benefits to using private business loans over traditional loans.

First, they often have more flexible credit score minimums. Even though they still use your personal credit, they will usually accept a score much lower than traditional lenders. Also, they will often report to the business credit reporting agencies. This helps build or improve business credit.

Unfortunately, private business loans tend to have higher interest rates and less favorable terms. Still, the ability to get funding and the potential increase in business credit score can make it well worth it. Here are a few alternative, or private, lenders to consider.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Fundation offers loans for as little as $100 and as high as up to $100,000. The maximum first draw is $50,000. They do have some products that go up to $500,000. Though there is no minimum credit score requirement, they do require at least 3 months in business, $50,000 or more in annual revenue, and a business checking account with a minimum balance of $500.

One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn, as the repayment period is comparatively short.

Also, Fundation reports to Dun & Bradstreet, Equifax, SBFE, PayNet, and Experian, making them a great option if you are looking to build or improve business credit.

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more. In addition, the borrower must be in business for at least 6 months. They require a personal credit score of at least 600. In addition, BlueVine does not offer a line of credit in all states.

They report to Experian. They are one of the few invoice factoring companies that will report any business credit bureau.

With OnDeck, applying for financing is quick and easy. Apply online, and you will receive your decision once application processing is complete. Loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

The personal credit score requirement is 600 or more. In addition, you must be in business at least 3 years and have gross yearly earnings of at least $250,000. Also, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

OnDeck reports to the standard business credit bureaus.

The Business Backer offers a product they call FlexFund Line of Credit. Funds range in amount from $5,000 to $240,000, and draws can be repaid on either a daily or weekly basis.

They report to Dun & Bradstreet and Equifax.

StreetShares started as a service to veterans, but now offers term loans, lines of credit, and contract financing. They also offer small business loan investment options. The maximum loan amount is $250,000, and preapproval only takes a few minutes.

To be eligible for a StreetShares loan, you must be in business at least 12 months with annual revenue of $25,000. There have been cases where they made exceptions and made loans to companies in business at least 6 months with higher earnings. The borrower’s credit score must be at least 620.

When Fundbox offers an automated process that is super-fast. Originally, they only had invoice financing. However, now they offer a line of credit service as well. Repayments are automatic on a weekly basis, so be sure you have enough funds in whatever account you connect them to cover your payment each week.

Fundbox loans come as low as $100 and as high as up to $100,000. There are no revenue or time in business requirements, but your accounting or invoice software must be compatible and must be in use for at least 3 months. Furthermore, there is also no specific credit score requirement. You simply have to be an established business with regular monthly revenue.

Founded in 2008 by college roommates, they now fund more than $1.3 million in working capital around the country. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

The secret to Lendio’s success is customer service and a short, easy application process. This is due to its heavily vetted network of lenders. Sometimes, funding happens in as little as 24 hours.

One easy application can result in offers from as many as 75 lenders to choose from. The minimum loan amount is $500 and the maximum is $5,000,000. You must operate your business in the US or Canada. In addition, you must have a business bank account, and your personal credit score must be at least 560.

Credibly’s specialty is unsecured business loans. The application process and funding can be completed in as little as two days. Sometimes even less than that. They offer daily and weekly repayment options.

The minimum loan amount is $5,000 and the maximum is $250,000. First, they require a personal credit score of at least 500. Next, there is a 6 months or more in business requirement. At least $15,000 plus in average monthly deposits is also required.

Kabbage offers a small business line of credit that can help accomplish your business goals quickly. The minimum loan amount is $500 and the maximum is $250,000. They require you to be in business at least one year and have $50,000 or more in annual revenue or $4,200 or more in monthly revenue over the last 3 months.

They are great if you need cash quickly. Also, their non-traditional approach puts less weight on your credit score.

New business funding in the form of grants are available from a number of sources. A lot of these are designed specifically to help those business owners that are minorities, females, or veterans. Be sure to check out local organization options as well.

Here are a couple of options that are open to everyone.

FedEx uses this grant as a way to strengthen small business innovation. The company awards 10 grants. They range from $15,000 to $50,000 every year.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

You have to submit an entry via the FedEx website. There are a few questions about your business. An elevator pitch about what makes your business stand out is also required. In addition, you have to explain how you would use the grant funds. A 90-second video submission is optional.

The National Association for the Self-Employed (NASE) has small business Growth Grants that go up to $4,000. Grant recipients must be micro-businesses. Funds can be used for marketing, expansion, and to hire employees. These grants are open to everyone. However, you have to be a NASE member to apply. Cost of membership depends on the member level you choose.

This is not all that is out there. Do your research, and remember additional grant options are available to women and minority business owners.

Crowdfunding sites allow you to tell thousands of micro investors about your business. Anyone who wants to donate, or invest, can do so.

Investors offer amounts depending on the campaign and the platform you use. They may give $50, they may give $150, or they may give over $500. It might just be $5. Truly, any amount helps, right?

Though not always necessary, most entrepreneurs offer rewards to investors for their generosity. Usually, this comes in the form of the product the business will be selling. Different levels of giving result in different rewards. For example, a $50 gift may get you product A, and a $150 gift will get you an upgraded version of product A.

There are a lot of crowdfunding platforms out there. Here are a few to consider.

They are the largest crowdfunding platform. They have over 14 million backers and over 130,000 funded projects. Campaigns are for products and services such as:

A prototype is necessary. Projects cannot be for charity, although nonprofits can use Kickstarter. Equity cannot be offered as an incentive.

Taboo projects and perks include anything to do with:

There is a 5% fee on all funds which creators collect. The payment processor also applies payment processing fees, which are roughly 3-5%. If your campaign is not successful you do not pay a fee. There are also fees of 3% + $0.20 per pledge. Pledges under $10 have to pay a discounted micro pledge fee of 5% + $0.05 per pledge.

Indiegogo has over 9 million backers. Their minimum goal amount is $500. They charge 5% platform fees and 3% + 30¢ third-party credit card fees. Fees are deducted from the amount raised, not the goal you set. As a result, if you raise more than your goal, you will pay more in fees. They also offer a flexible funding option. This allows campaigns to keep any money they receive even if they do not reach their goal.

RocketHub is more for entrepreneurs who want venture capital. They give you an ELEQUITY Funding Room. This is where you can pitch your idea and see if it stirs up any interest from potential investors.

The platform is specifically for business owners working on projects in these categories:

If you reach your fundraising goal, there will be a 4% fee. In addition, you’ll pay a 4% credit card handling fee. But if you do not reach your goal, that fee jumps up to 8% plus the credit card handling fee.

CircleUp aims to help emerging brands and companies raise capital to grow. However, companies must apply and show revenue of at least $1 million to get a listing on the site. Still, they will sometimes make exceptions.

Due to its more thorough process, CircleUp can be good for entrepreneurs who already have a somewhat established business. These are business owners who want both funding and guidance in order to take their businesses to the next level.

This really comes from yourself. It’s not an outside source. Of course, there are many things that affect fundability, but one you can work on while you are using personal credit or investors for new business funding is business credit.

Whichever type or types of new business funding you choose to use, be sure to work on building business credit at the same time. This is a major part over overall fundability. Without strong fundability, it is hard to get any type of funding really. Personal credit will only get you so far when it comes to building and running a business.

The post 20 Sources of New Business Funding to Help You Get Started appeared first on Credit Suite.

Online lenders can be the perfect option for a business loan. This is especially true if your credit isn’t the best. An online lender is likely to have more relaxed terms and lower interest rates. Good ones can be hard to find however. We’ve done the research so you can get a head start on the game.

When looking for an online lender, it’s important that you find one that will work for your specific needs. They all have different requirements, terms and rates. Which one will work best for you will depend on a number of factors. For example, what do you need to funds for? How much do you need? What does your credit score look like? Consider the following options.

Find out why so many companies use our proven methods to get business loans.

If you start with a search for an online lender, Fundbox is going to be one of the first to pop up. It is a line of credit rather than a loan, but it is a great funding option because there is no minimum credit score requirement.

They offer an automated process that is super-fast. Repayments are automatic, meaning they draft them electronically, and they occur on a weekly basis. One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn currently, as the repayment period is comparatively short. This means you need to be sure you have enough funds in whatever account you connect them to so that it can cover your payment each week.

Loan amounts come as low as $100 and as high as up to $100,000, but the max initial draw is $50,000. Though there is no minimum credit score requirement, they do require at least 3 months in business, $50,000 or more in annual revenue, and a business checking account with a minimum balance of $500.

You will find with most any online lender, they often offer options more similar to invoice factoring and lines of credit. This is because these present fewer risks than straight term loans.

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Your personal credit score has to be 600 or above. It is important to note also, that BlueVine does not offer a line of credit in all states. You can find out more in our Bluevine review.

Upstart is an online lender that uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO on their own to truly determine the risk of lending to a specific borrower. They choose to use a combination of artificial intelligence (AI) and machine learning to gather alternative data instead. They then use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities. Typically, business loans are available ranging from $1,000 to $50,000. Interest rates vary greatly, ranging from 7.5% to 35.99%. Repayment terms can be either 3 -year or 5-year.

To be eligible for a loan with Upstart, you must meet the following qualifications:

These are the requirements they list on their website. One independent review said that the requirement for the debt to income ratio is a maximum of 45%. It also says that the minimum annual income has to be at least $12,000. For more information visit our Upstart review.

Find out why so many companies use our proven methods to get business loans.

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

Just like any other online lender, they do have certain requirements to qualify for a loan. For example, a personal credit score of 600 or more. Also, you must be in business for at least one year. Annual revenue must be at or exceed $100,000. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Offering term loans of $10,000 to $1 million, Bond Street terms are for up to 1 to 3 years. Bond Street will ask for both EIN and SSN.

The offer arrives within 3 days. Bond Street will only do a soft credit pull, and 640 or better credit score is likely to get you a loan. However, Bond Street will look at other factors too. For example, they require 2 years in business and annual revenue of at least $200,000.

Rates start at 6% and go up to 22%. APR works out to 8 to 25%, and there is a 3 to 5 % origination fee.

Advantages are the soft credit pull and the fact that they will look at factors other than your personal credit if your FICO score is low. Another benefit is that Bond Street can offer very large loans if you qualify. Disadvantages are the longer time in business requirement and high APR.

Popular online lender Lending Club offers term loans. Business loans from $5,000 to $300,000. Loan terms are 1 to 5 years.

Get a quote in less than 5 minutes. Funds are available in as little as 48 hours if approved. There are no prepayment penalties.

Annual Revenue must be $75,000 or more. You must be in business for 2 years or more. Personal FICO score of 620 or better is required.

Rates of 5.99% to 29.99%. Total annualized rates starting at 8%.

Advantages are that the annual revenue requirement isn’t too high. Funds are available quickly. Disadvantages include high maximum rates.

Quarter Spot is an online lender that offers short term loans. $5,000 to $150,000 is available. The terms are 9 to 18 months. Quarter Spot will only do a soft credit check when you apply. They confirmed this information when we asked.

Your company must have annual revenue of $200,000 or more. You have to have a personal FICO Score of 550 or better. There is no fee to apply.

The minimum time in business is 12 months. You must have a minimum average bank balance of $20,000. You must also show a minimum of $16,000 in monthly sales.

The borrower must own at least 50% of the business. Their rates are 25% to 40%.

Advantages are that the personal FICO score requirement is relatively low. Minimum average bank balance requirement is also fairly low. Disadvantages are that maximum rates are rather high.

Rapid Advance offers standard, select, and preferred loans. For standard loans, $5,000 to $1 million is available. Their terms are 4 to 12 months.

Your company must have annual revenue of $120,000 or more. You must have a personal FICO Score of 580 or better. The minimum time in business is 2 years. There is a 1.16 to 1.30 factor rate.

For select loans, $15,000 to $1 million is available. Their terms are 6 to 15 months. You must have annual revenue of $240,000 or more and a personal FICO Score of 620 or better. The minimum time in business is 3 years. 1.12 to 1.31 factor rate.

For preferred loans with Rapid Advance, $15,000 to $200,000 is available. Their terms are 9 to 18 months. You must have annual revenue of $240,000 or more. You must have a personal FICO Score of 660 or better.

The minimum time in business is 6 years. You must have a minimum bank balance of $10,000 or more. Borrowers must have at least 10 deposits from 5 different sources every month. There is a 1.11 to 1.25 factor rate.

The advantages are a few choices for loan types. And the maximum available amounts are high. Disadvantages are minimum bank balance requirements are fairly high. Their annual revenue requirements are also high.

Kiva is an online lender that is a little different. For example, the interest rate is 0%, so even though you have to pay it back it is absolutely free money. They don’t even check your credit. However, there is one catch. You have to get at least 5 family members or friends to throw some money in the pot as well. In addition, you have to pitch in a $25 loan to another business on the platform.

Find out why so many companies use our proven methods to get business loans.

If your personal credit is okay, Accion may be a good fit for small business startup loans bad credit. It is a microlender, a nonprofit, that offers installment loans to both startups and already existing businesses. The minimum credit score is 575. In some places they will go as low as 500. You don’t have to already be in business, but if you are not, you must have less than $500 in past due debt. In addition, your business needs to be home or incubator based.

Loans are from 6 to 60 months and interest rates range from 7% to 34%. A personal guarantee, and sometimes specific collateral, is necessary in most circumstances.

Credibly is also a good option for business loans for startups if you are already generating some revenue. They offer short term loans for both business expansion and working capital. You must be in business for at least 6 months to qualify, and they will approve loans to those with credit scores as low as 500.

It is very possible you are reading this thinking to yourself, why would I choose an online lender over a traditional lender. There are actually a few reasons. First, it is often easier to get funding from an online lender. This is especially true if your personal credit score is not up to par.

Even if you have great business credit, most term loans and many lines of credit require a personal credit check. They may take your business credit into account, but if your personal credit stinks, it won’t help you much. Online lenders tend to have lower minimum personal credit score requirements than traditional lenders.

Next, an online lender will typically send you the funds faster. Sometimes you can have the money in as little as a few days, with approval coming in as little as 24 hours. The traditional lending process can take months.

If you can go with a traditional lender, great. They often have better rates and terms. However, if you, like many business owners, do not have that option, an online lender may be the perfect solution. Approval requirements allow many more borrowers to get their funds quickly and easily. Take into account the following factors:

It’s also important to note, there are a lot of predatory lenders online. You have to be careful. The list above is a great starting point, but don’t stop there. There are a lot of options, so take the time necessary to do your research.

The post Looking for an Online Lender? We Have a List of 12 to Get You Started appeared first on Credit Suite.

Welcome to Paper.li Starter! Below you’ll find tips and best practices for getting the most out of your Starter Plan. Make sure you’re getting the best and most accurate content using smart topics, URLs, RSS …

The post Getting started with Paper.li Starter appeared first on Paper.li blog.

Welcome to Paper.li Starter! Below you’ll find tips and best practices for getting the most out of your Starter Plan. Make sure you’re getting the best and most accurate content using smart topics, URLs, RSS … The post Getting started with Paper.li Starter appeared first on Paper.li blog.

Welcome to Paper.li Pro! Below you’ll find tips and best practices for getting the most out of your Pro Plan. Personalize your paper with commentary, visuals, links, pinned articles, and more personal brand building features. … The post Getting started with Paper.li Pro appeared first on Paper.li blog.

Welcome to Paper.li Pro! Below you’ll find tips and best practices for getting the most out of your Pro Plan. Personalize your paper with commentary, visuals, links, pinned articles, and more personal brand building features. …

The post Getting started with Paper.li Pro appeared first on Paper.li blog.

Email List Building: How To Get Started Building Your Own Email Mailing List

Email listing structure is a typical advertising and marketing technique these days. There are really couple of companies that you can go right into these days that do not ask for your e-mail address or ask if you desire to authorize up for unique deals or updates with your e-mail.

These days, with every person asking for e-mail addresses with the quantity of spam on the net, it is obtaining harder and also harder for you to be able to obtain an individual’s e-mail address from them for your e-mail listing structure data source. If you are an in-store private asking for an e-mail address for developing your e-mail checklist, attempt aiming out the advantages, like e-newsletters, promos or various other advantages they could obtain by having their e-mail address on your e-mail checklist. For those of us with web sites, including an easy kind for e-mail collection is normally the ideal method to go regarding e-mail listing structure.

If you currently have an e-mail checklist, attempt this e-mail checklist structure choice. A 3rd choice in the e-mail checklist structure procedure is outbound telemarketing. In this procedure, you construct your e-mail checklist by speaking to clients over the phone and also allowing them understand they might possibly stay clear of the phone call if they authorized up for the e-mail solution.

When trying to do email listing structure, attempt to utilize as several of these as you can. This will certainly aid you to develop a huge e-mail address base.

These days, with everybody asking for e-mail addresses with the quantity of spam on the net, it is obtaining harder as well as harder for you to be able to obtain an individual’s e-mail address from them for your e-mail checklist structure data source. If you are an in-store private asking for an e-mail address for constructing your e-mail checklist, attempt aiming out the advantages, like e-newsletters, promos or various other advantages they could obtain by having their e-mail address on your e-mail listing. For those of us with internet sites, including a basic kind for e-mail collection is generally the finest method to go regarding e-mail checklist structure. If you currently have an e-mail checklist, attempt this e-mail listing structure choice.

The post Email List Building: How To Get Started Building Your Own Email Mailing List appeared first on ROI Credit Builders.