How to Use an LLC for Setting Up a Business One piece off setting up a business, beyond deciding on a name or buying web hosting, is deciding on the business entity. The business entity you choose will affect your business in numerous ways. If you want to know how to use an LLC, then … Continue reading Why and How to Use an LLC – is it a Good Choice for YOUR Business?

Tag: GOOD

Why and How to Use an LLC – is it a Good Choice for YOUR Business?

How to Use an LLC for Setting Up a Business

One piece off setting up a business, beyond deciding on a name or buying web hosting, is deciding on the business entity. The business entity you choose will affect your business in numerous ways. If you want to know how to use an LLC, then you’ve got to know about business entities.

Why Business Entities Matter

Your business entity will determine the following with reference to your business:

- Taxes

- Legal liability

- Costs and shares

LLCs

LLC stands for “limited liability company”. According to Nolo.com:

“An LLC is one type of legal entity that can be formed to own and operate a business. LLCs are very popular because they provide the same limited liability as a corporation, but are easier and cheaper to form and run.”

It “is a popular business structure combining both the liability protection of a corporation and pass-through taxation of a partnership. One advantage of an LLC is the flexibility it offers in terms of management and ownership structure.”

LLCs vs. Corporations vs. Partnerships

In order to best review what an LLC is, and how it can be helpful to your business, it pays to explain what partnerships and corporations are, including where they converge and where they differ from LLCs. We’ll also look at sole proprietorships.

Business Entities and the IRS

The IRS recognizes these business entities:

- Sole proprietorship

- Partnership

- C-Corporation

- S-Corporation

But an LLC is not considered a separate entity by the IRS. As a result, the IRS will follow certain rules depending on the size of an LLC, when it comes to deciding whether to treat it more like a partnership, or a corporation, or a sole proprietorship.

Business Entity Definitions

Let’s look at what the various business entities are.

Sole Proprietors and Partnerships

Sole proprietors – per the SBA, this type of structure “can be a good choice for low-risk businesses and owners who want to test their business idea before forming a more formal business.”

There are Limited Partnerships and Limited Liability Partnerships. Limited partnerships have only one general partner with unlimited liability. All other partners have limited liability.

Limited Partnerships and Limited Liability Partnerships

With limited partnerships, partners with limited liability also tend to have limited control over the company. The general partner (the partner without limited liability) must pay self-employment taxes. Limited liability partnerships work a lot like limited partnerships. But they give limited liability to every owner. An LLP protects each partner from debts against the partnership. Plus, partners will not be responsible for the actions of other partners.

C Corporations

C Corporations have a completely independent life separate from their shareholders. If a shareholder leaves the company or sells his or her shares, the C corporation can continue doing business relatively undisturbed. C corporations have an advantage when it comes to raising capital, because they can raise funds through the sale of stock. This can also be a benefit in attracting employees.

C corporations can be a good choice, for medium- or higher-risk businesses.

They can be good for businesses that need to raise money. And they can be good for businesses that plan to go public or eventually be sold. Incorporating (whether a C corporation or an S corporation) is also how to truly build business credit that’s separate from personal.

S Corporations

S Corporations are also called Subchapter S Corporations. An S Corporation is a special type of corporation. It is designed to avoid the double taxation drawback of regular C corps. S corps allow profits, and some losses, to be passed through directly to owners’ personal income, without ever being subject to corporate tax rates. S corporations are subject to certain rules, such as they can only have 100 or fewer shareholders.

Get our business credit building checklist and build business credit the fast and easy way.

How to Use an LLC and Other Business Entities When it Comes to Legal Liability

Let’s take a look at how legal liability differs among various business entities.

Sole Proprietors

With a sole proprietorship, there are no limits to personal liability. As a result, if the sole proprietorship did it, then so did its one owner. This includes all debts and obligations, and any risks from the actions of employees.

Partnerships

In partnership situations, partners retain full, shared liability. Therefore, partners are not only liable for their own actions, but they are also liable for any business debts and decisions made by the other partners. In addition, all of the partners’ personal assets can be seized to satisfy a partnership’s debt. Limited liability partnerships are an effort to address some of these downsides, like limiting a partner’s liability to just the money he or so put into the business.

C Corporations

Within a C corporation, shareholders’ personal assets get protection. Shareholders can usually just be held accountable for their investment in the stock of the company. But if an employee commits fraud or a felony under the corporation’s direction, then the corporate ‘veil’ can be ‘pierced’. If this happens, then personal assets can be on the line.

S Corporations and LLCs

An S corporation shareholder’s personal assets, like personal bank accounts, cannot be seized for the purpose of satisfying any business liabilities. Owners of an LLC are called ‘members’, as opposed to the owners of corporations, which are called ‘shareholders’. In an LLC, the LLC members get protection from personal liability for the business decisions or actions of the LLC. If the LLC incurs debt or is sued, the members’ personal assets are often exempt. But not always, hence the term ‘limited liability’.

Get our business credit building checklist and build business credit the fast and easy way.

How to Use an LLC for Distributing Costs and Shares

How do the distributions of costs and shares differ?

Sole Proprietorships, Partnerships, and LLCs

In a sole proprietorship, the owner is the company. If it makes money, so does the owner (and their share is 100%). In partnership situations, partner shares vary, and they should be clearly spelled out in the partnership agreement. An LLC works as another type of corporation. The only real difference is liability rather than shares and costs, so it works like other corporations.

Corporations (Both Types)

A corporation is run by its board of directors. These are usually the owners. Ownership stakes are defined by what percentage of stock everyone owns. If one person has a controlling interest (over 50% of the stock), then their decisions will generally overrule everyone else’s.

If the shareholders have smaller stakes in the corporation, sometimes shareholders will band together to influence decisions or even kick out board members. Profits are generally distributed per share percentages. But board members can take a salary. In an S Corporation, a shareholder working for the company must pay him or herself reasonable compensation. The shareholder has to get fair market value. Otherwise, the IRS may reclassify any additional corporate earnings as wages.

Taxes

How does taxation differ?

Sole Proprietors and Partnerships

Sole proprietors are the same as their owners, the owner pays taxes on the sole proprietorship’s profits. A partnership does not have to pay income tax. Instead, the business will pass through its profits or losses straight to the partners. Then the partners will include their respective share of the partnership’s income or loss on their personal tax returns.

Sole proprietors are the same as their owners, the owner pays taxes on the sole proprietorship’s profits. A partnership does not have to pay income tax. Instead, the business will pass through its profits or losses straight to the partners. Then the partners will include their respective share of the partnership’s income or loss on their personal tax returns.

C Corporations

C Corporations pay state and federal taxes, they sometimes also pay local taxes. This will include paying income taxes on profits. It is the opposite of partnerships and sole proprietorships.

A corporation can end up paying taxes twice, first when it makes a profit, and the second time when dividends go to the shareholders. This is the case even if there is just one shareholder

S Corporations

Only the wages of any S corporation shareholder who is also an employee are subject to employment tax. Any remaining income is payment to the owner as a distribution. Distributions are taxed at a lower rate, if at all.

Per the IRS, “Generally, an S corporation is exempt from federal income tax other than tax on certain capital gains and passive income. It is treated in the same way as a partnership, in that generally taxes are not paid at the corporate level.”

How to Use an LLC When it Comes to Taxes

An LLC is not a separate entity as per the Internal Revenue Service. As a result, it is not taxed directly. Instead, the members pay individual taxes. Members of an LLC have to pay an employment tax on the entire net income of the business.

Get our business credit building checklist and build business credit the fast and easy way.

How to Use an LLC: Upsides

LLC members get protection from personal liability for the LLC’s business decisions or actions. If the LLC incurs debt or someone sues it, member personal assets are often exempt. LLCs don’t pay the double taxation of standard corporations, and if they ‘pass through’ profits to member tax returns, LLC owners may be able to deduct 20% of their business income with the 20% pass-through deduction established under the Tax Cuts and Jobs Act of 2017.

How to Use an LLC: Downsides

The IRS (and others) doe not see an LLC as a separate entity, hence it’s not good for fully separating business from personal credit. LLC members end up paying employment taxes on the entire net income of the business. LLCs can’t issue shares so they can’t use the issuance of shares as a form of fundraising.

Annual/biennial renewal fees are often higher than for corporations. Setup fees (as of 2021) run from $40 (Kentucky) to $500 (Massachusetts). And annual/biennial renewal fees run from $0 (Arizona, Idaho, Minnesota, Missouri, New Mexico, Ohio, South Carolina, and Texas), to $800 (California, annually + $20 every other year).

Why and How to Use an LLC – is it Right for Your Business? Takeaways

If you want to build credit for your business, an LLC will not offer you the protection that a C corporation or an S corporation does. But an LLC is better than a partnership or a sole proprietorship, when it comes to personal liability.

If you want to (potentially) save on taxes, then an LLC might be a good idea. But if your business truly takes off, your personal taxes will be higher, even with a 20% deduction.

The post Why and How to Use an LLC – is it a Good Choice for YOUR Business? appeared first on Credit Suite.

Bill Maher amazed by Greg Gutfeld, 'new king of late night': 'Fox News found a good thing'

“Real Time” host Bill Maher appeared surprised by the success of Fox News’ late-night show “Gutfeld!”

Durant: 'How good can I be' after movie ending?

Kevin Durant has had his “movie” ending, winning two NBA titles. What he realized afterward is that it was his development as a player that drives him. “I want to experience that stuff [winning titles], but it’s not the end-all, be-all of why I play.”

The post Durant: 'How good can I be' after movie ending? appeared first on Buy It At A Bargain – Deals And Reviews.

The Good and Bad of Deadstock Products for E-commerce

E-commerce retailers face many obstacles in the realm of online business.

A common yet persistent issue is deadstock products.

The accumulation of deadstock inventory can drive up operational and warehouse costs. As more products enter the warehouse, the cost of storing unsold items can drain the valuable financial resources of your business.

What’s more, seasonal trends and products make it difficult to eliminate deadstock products completely.

How to solve this problem? This article explains how to avoid deadstock and how to get rid of it when it piles up in your warehouse.

Let’s start with the definition for deadstock first.

What Does Deadstock Mean?

Deadstock is synonymous with dead inventory.

These are items that haven’t been sold and are very unlikely to sell. If you don’t use an inventory management system, these goods likely pile up and remain forgotten in your warehouse.

An alternative definition of “deadstock” refers to goods that are no longer sold in stores. In this case, these deadstock goods, like unused or unworn shoes or vintage apparel, are sold at much higher rates.

For the purposes of this article, we won’t explore the latter definition in this post.

Is Deadstock Bad for Business?

Deadstock comes with a price.

Retailers won’t be able to recoup the cost of manufacturing products if they never sell.

As a result, unwanted items take up space in your warehouse. A longer stay means more storage costs for your business.

How to calculate deadstock? To understand its consequences for your business, calculate the costs involved in holding onto these useless products.

List rental costs, utilities, equipment, insurance, and security used to guard your items.

Ideally, businesses make up for these costs through sales, but deadstock products remain stagnant in your warehouse. Instead of making a profit, retailers pay to keep these useless goods.

Deadstock also has an attached opportunity cost.

The space occupied by these items could have been used for “headstock” or highly profitable and bestselling items, which instantly make a profit for your business.

How to Avoid Deadstock

In my experience, you need to avoid deadstock as much as possible.

Business of Fashion reports that dead inventory costs around $50 billion per year for the US retail industry.

If a retail brand’s standard margin is around 60%, then a deadstock worth $40,000 represents around $100,000 worth of retail sales and $60,000 of gross margin dollars.

I’ve advised a lot of e-commerce stores, and I can tell you it’s best to avoid deadstock than to wait for it to snowball at a later time.

So today, I’ll share tips for avoiding deadstock.

1. Improve Inventory Management For Less Deadstock

Inventory management is a major cause of deadstock.

Fortunately, an inventory management system can guarantee your inventory is monitored and managed appropriately.

Here are some popular inventory management systems:

- inFlow Inventory: an inventory management system that can manage up to 100 products.

- Sortly Pro: a cloud-based inventory management system that can handle up to 100 transaction entries per month.

- Odoo: a free open source enterprise resource planning (ERP) solution.

- ZhenHub: a cloud-based inventory management system for small and medium-sized businesses (SMBs).

There is no right or wrong inventory management system. Instead, find a solution that meets your needs.

Once you have a system in place, keep track of the products on your shelves, as well as those that end up as dead inventory. In addition, you must identify the products with no sales or low sales for the past year.

An intelligent inventory management system can identify bestselling items, allowable return dates, expiration dates, as well as flopped goods you’re better off without.

2. Discount Potential Deadstock Items

Pay attention to what’s selling and what’s not.

Take into account the latest market trends. What are the popular products people love? How long will this trend last?

Seasonal products might be selling like hot cakes for the first few weeks, but the excitement fades eventually.

A good tip is to discount potential deadstock items by hosting end-of-season sales.

For example, Patagonia, The North Face, and H&M frequently have end-of-season sales to sell their jackets and coats once the winter season ends. This way, they can get rid of deadstock items and make way for next season’s collections.

Perishable goods won’t be sellable after their expiration date has passed. That’s precisely why you must monitor items that will almost reach their expiration date and then offer them at discounted prices.

Tools like Wasteless utilize AI to prevent food waste through a dynamic pricing model. By using machine learning, they can use variables like brand popularity, seasonal popularity, and expiration dates to determine the real-time price of perishable goods.

Of course, your profit margins will be lower than expected for discounted products. However, a discount helps you get rid of unpopular products, and it’s a lot better than stocking these goods in a warehouse and paying more for storage.

At the very least, you have an opportunity to make up for the manufacturing costs and break even.

3. Know Your Target Audience

This happens all the time: You promote the product, but it just won’t sell.

If an item remains unsold despite numerous promotions, your target audience probably doesn’t want them.

Every time you source potential products to sell, you must understand the conditions you are dealing with.

This is why market research and surveys are crucial to your success. The socioeconomic profile, gender, location, and interests of your audience can predict the outcome of the sales of your store.

So, before you pay for manufacturing costs, ensure your consumers want the product.

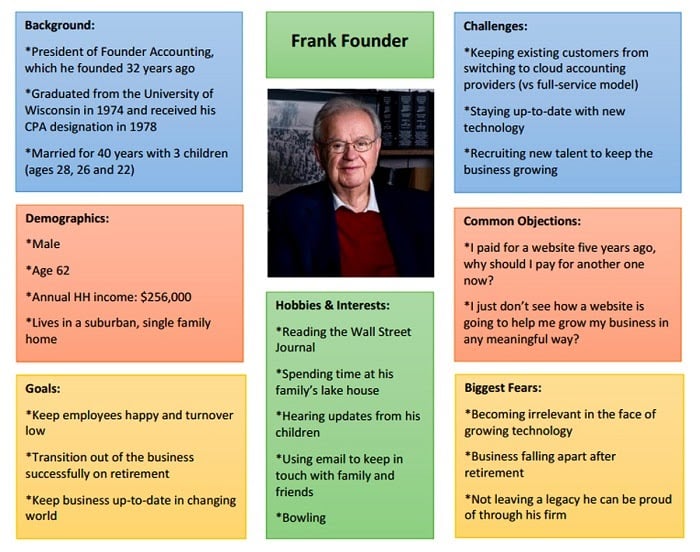

To get started, create a marketing persona for your online store. This doesn’t have to be complicated.

Here’s an example of a marketing persona that considers the demographics and characteristics of your consumers:

Another idea is to perform market research by sending regular surveys to pinpoint your customers’ needs. I highly recommend getting current customers as respondents because they’ve experienced your product and likely fit with the profile of your target market.

Survey Monkey recommends asking these questions to evaluate the product/market fit.

- How did you find this product?

- How would you feel if this product was no longer available?

- What are the benefits of using this product?

- What alternatives would you use if this product was no longer available?

- Have you recommended using this product to anyone?

It’s best to conduct surveys regularly to identify opportunities within your target market.

Also, understand the items and trends that customers love and take them into consideration for future product releases. You can use inventory management software to identify products that sold out quickly to make sure you’re selling the products that shoppers need.

Having more bestselling items is key to the elimination of deadstock, and while you won’t always be able to sell 100% of items in your inventory, knowing your customers and assessing product/market fit will help reduce the accumulation of deadstock.

4. Diversify Your Products to Avoid Deadstock

You may opt to sell bestselling items only to avoid deadstock completely.

However, you must guarantee that most of the bestselling items in your store don’t have the same features or characteristics. Otherwise, you can get more deadstock too.

Having too many similar items may mean cannibalization. Some customers may prefer one brand or item over another, which leads to low sales numbers for other goods.

This is common for retailers offering similar items from multiple brands.

Diversify your product inventory to avoid this consequence.

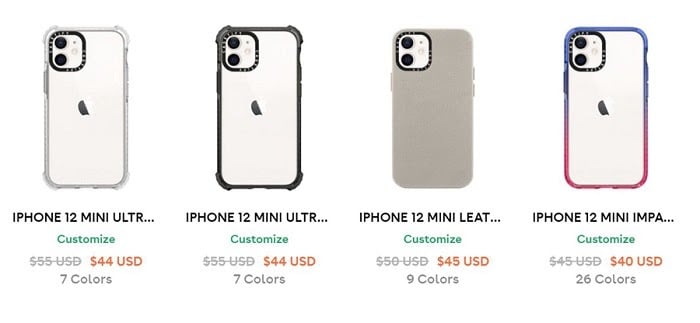

A good tip is to add complementary products of existing items in your e-commerce store. For starters, complementary goods are products that are used together. They may be completely different from an item you’re selling, but their combination of complementary goods will sweeten the deal.

For example, if you’re an iPhone retailer, then add iPhone cases and accessories to your arsenal. As the value of the latest iPhone decreases, it may become more mainstream. Thus, more people will be buying your cases and accessories in the future.

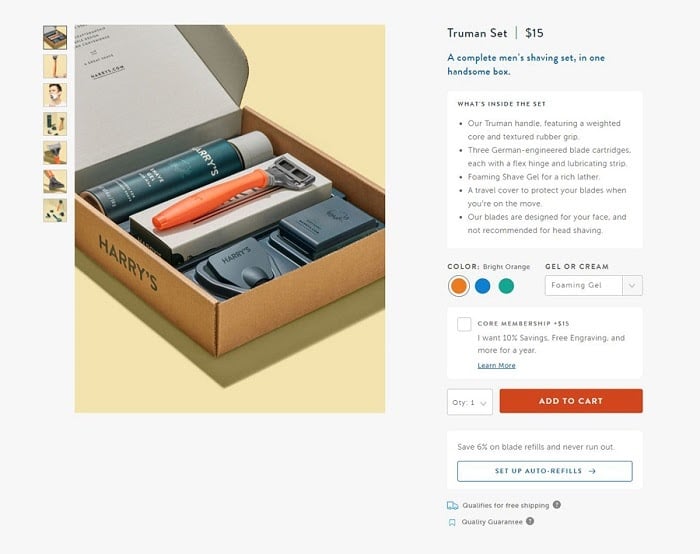

Alternatively, you can offer an assortment of related products, instead of selling them separately.

For instance, Harry’s – a men’s grooming brand – offers a “Truman Set,” which includes a foam shave gel, blades, and razors packed in one convenient package.

How Do I Get Rid Of Deadstock?

Now, if you already have deadstock, it’s time to get rid of it.

Here’s what you need to do.

1. Return Deadstock Items To Suppliers

If you’re in the window to return, this may be the best option.

In the short-run, you’ll pay a small fee, but at least you can avoid a major loss and more deadstock.

As long as the items are in good condition, you may be able to return them to the supplier. However, review the return policy of suppliers first to guarantee they allow this method.

Most suppliers have a restocking fee worth 10% of the merchandise. You’ll likely get an option to pay in credit rather than cash.

2. Put Deadstock in Clearance Sections and Bundles

What if you sold some items at a discount, but it just won’t sell? You can take it even further.

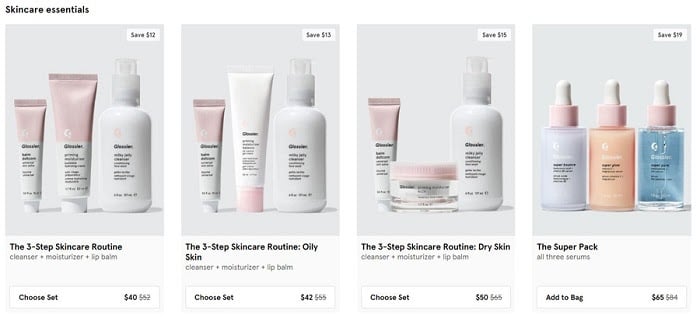

Find out the lowest price that you can sell these products. Then bundle related and complementary products together and sell them as a set.

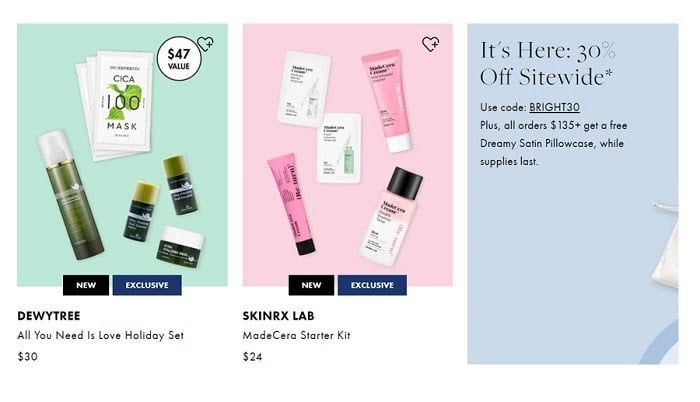

For example, Glossier bundles related items together and offers them at a discounted price. Many beauty enthusiasts prefer a complete set sold at a discounted rate, rather than purchasing a single item with no discount.

If you have a lot of stocks with the same item, get rid of them through freebies and giveaways. Consumers love to get free stuff, so it may compel them to return to your online store and make a purchase.

During the holidays, you can bundle items to create holiday gift sets with an assortment of products.

For example, Soko Glam bundles miniature-sized skincare products and sells them as a gift set for the season of giving. Plus, customers who make orders above $135 will receive a Dreamy Satin Pillowcase while supplies last.

3. Sell to Deadstock Buyers

You’ll likely lose some cash, but getting some money back is better than a total loss.

Here are some deadstock buyers to consider:

- Wholesale: If you have a lot of deadstock in good condition, you can sell them to wholesalers. For clothing retailers, popular boutique wholesale clothing suppliers include Sugarlips Wholesale, Bloom Wholesale, Wholesale Fashion Square, Tasha Apparel, Magnolia Fashion Wholesale, and LAShowRoom.

- Amazon Seller Central: Amazon has a Seller Central where you can adjust the pricing or match your competitor’s lowest price.

- eBay: Deadstock consisting of repaired or returned products could be sold to eBay at drastically reduced costs.

- Consignment shops and warehouses: These buyers usually purchase clothing, home goods, and old items that could be sold at low prices.

- Closeout liquidators: These businesses can buy a bulk of your deadstock and resell it in their own stores at cheaper prices.

4. Donate Deadstock to Charities

Finally, if a product just won’t sell, consider donating it to charity.

Donating to charity is a popular option for clothing retailers. You can sell deadstock items to discount stores like T.J.Maxx or the Outnet as a last-ditch attempt to make sales.

Some foundations like The Salvation Army and Oxfam accept donated clothes.

We bet there are many charities in your local communities and cities. You can donate to any organization, just make sure it’s legal. Find a reputable charity where you can sell your items.

While you may not be able to sell these goods, you can claim a tax write off for donating them. If handled well, this initiative will make your business look good.

Conclusion

If you want to eliminate deadstock products, make an active effort to find products that will sell.

Use an inventory management system to track unwanted items in your inventory. Bundle deadstock products and sell them as gift bundles or give them away as freebies. As a last resort, you can even sell deadstock products to wholesalers, consignment shops, Amazon, or eBay.

There are many options to avoid the accumulation of deadstock and get rid of unsold items stuck in your inventory,

How will you avoid deadstock products?

The post The Good and Bad of Deadstock Products for E-commerce appeared first on Neil Patel.

How a Good D&B Business Credit File Can Help In Hard Economic Times

No one realized when the year started that a crushing recession would follow a global pandemic. And yet, here we are living in this post COVID-19 world. Here’s how a good D&B business credit file can help you survive.

Everything you Need to Know about Your D&B Business Credit File and the Other Business Credit Reporting Agencies

When it comes to your business, business credit is one of the most important things you can focus on. Of course, you should keep your main focus on actually running the business. In hard times however, like during a recession, you will be glad you paid some attention to your business credit. Dun and Bradstreet is the largest and most widely used business credit reporting agency, or CRA. If you do not have a D&B business credit file, many lenders consider you to not have credit. There are other CRAs that are worth mentioning however.

It can help to understand a little more about business credit and how it can help in a recession. What makes it so special? Who needs it? How do you get it?

Why Business Credit?

There are a number of reasons why it is important to actively build business credit.

It Shields Your Personal Credit Report

It is important to organization success that you develop business credit. Without a business credit score, your capability to fund your business rests entirely on your individual credit score. That’s not a big deal if you have great personal credit.

However, business financing can impact your personal credit scores as well. If you finance your business on the merits of your personal credit, you will likely find your balances stay near your limits. On personal cards the limits are not as high as most business cards allow.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

This has a negative effect on your credit report. It is true even if you are making your payments on time. If your business has its very own credit report, it’s not a problem. Limits are higher, so you have a lot more credit to deal with. Regardless, it doesn’t impact your personal credit score.

When you have solid business credit, you have access to the funds you need to run your business. Not only that, but you can do what you need to do without worrying about exhausting cash reserves.

In short, business credit opens the door to higher limits, lower interest rates, and it protects your business transactions from affecting your personal credit. This is especially important during a recession. Imagine how much harder hard times would be if your personal credit was declining due to business issues.

Business Credit vs. Personal Credit

It is also difficult to see how a D&B Business credit file, or any business credit file, is necessary if you do not understand the differences between business credit and personal credit. We break it down here.

Key Differences Between Personal Credit Reports and Business Credit Reports:

- Personal FICO scores range from 300 to 850

- Business credit scores usually range from 0 to 100.

- FICO algorithms are commonly used by consumer credit bureaus to generate a credit score.

- Business credit scores do not follow industry standard algorithms, meaning they can vary greatly between credit reporting agencies.

- Business credit usually include only accounts that are in your company’s name. Your personal accounts are on your personal credit report.

- You can get a free copy of your personal credit report from the three major consumer credit reporting agencies each year. This includes Experian, Equifax, and TransUnion. There are also several free options for getting a glimpse at your credit scores at any given time.

- Business credit is quite different when it comes to accessibility. You have to pay to see your company’s credit report and to find out the score at all three major business credit reporting agencies, including Dun and Bradstreet, Experian, and Equifax.

- Not just anyone can see your personal credit report, but business credit reports are public. Anyone that wants to pay can see your business credit, including your D&B business credit file.

What Makes the D&B Business Credit File So Special?

Besides being the largest and most commonly uses, they offer way more than just a single business credit score. There are many reporting options that lenders can choose from to assess the credit worthiness of a specific business. Here is a breakdown of what they offer, with an explanation of what it all means.

Credit Reporting at Dun and Bradstreet: What Does Dun and Bradstreet Do?

The quick answer is they provide lenders with business credit reports to help them make lending decisions.

There are six different Dun and Bradstreet reporting options. All of them measure different areas of credit worthiness. The most popular option is also the easiest to understand. It is the PAYDEX. Generally speaking, this is the Dun and Bradstreet credit score most like the consumer FICO score. It measures the speed of payment. The score ranges from 1 to 100. A 70 or higher is “good.” For example, a score of 100 means that the company makes payments in advance, and a score of 1 indicates that they pay 120 days late, or more.

What Else Does a D&B Business Credit File Include?

In addition to the PAYDEX, there are many other options for a business credit report on you D&B business credit file.

● Dun and Bradstreet Delinquency Predictor Score

The delinquency predictor score measures the likelihood the company will not pay, will be late paying, or will fall into bankruptcy. The scale is 1 to 5, and a 2 is good.

● Financial Stress Score

The financial stress score is a measurement of the pressure on a company’s balance sheet. It indicates the likelihood of a shutdown within a year. It measures with a minimum of 5 and a maximum of 1, with a score of 2 being a good thing.

- Supplier Evaluation Risk Rating

This is a rating that ranks the odds of a company surviving 12 months. The minimum score is 9 and the maximum is 1. A score of 5 is good.

- Credit Limit Recommendation

The credit limit recommendation shows a business’s borrowing capacity. It is a dollar amount recommendation for how much debt a company can handle. Typically creditors use it to determine how much credit to extend.

- D&B Credit Rating

This is an estimation of overall business risk on a scale of 4 to 1. A two is good. The rating includes letters, the combination of which indicate a company’s net worth.

Even if there isn’t enough information on a business to assign a regular rating, Dun and Bradstreet will assign what they call a Credit Appraisal Score. This is based on number of employees. Another option is an alternative rating based on what data is actually available.

What Goes into a Credit Rating on Your D&B Business Credit File?

The different scores and ratings are based on information from a number of places. The first is the business itself, but they also tap into public records. A business must submit a financial statement to D&B before they can have a full rating. In the absence of that, they give a limited rating based on number of employees. For example, the rating would be 1R if the business has 10 employees or more, and 2R if they have less than 2 employees.

A composite credit appraisal may also be available in the absence of a financial statement in your D&B business credit file. A business is only eligible for a rating up to a 2 in this case however. You do not get a 1 rating without a financial statement.

You can also self-report trade references to D&B, in addition to financial statement. This makes it easier to build business credit faster. You will need a D-U-N-S number, of course. It is free and easy to get on their website.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Dun and Bradstreet and the Commercial Credit Score

The commercial credit score is the term used to describe the actual business credit score. It has three separate parts. Each predicts how likely the business is to default on bills or become delinquent. Following are the three parts and the scales by which they are ranked.

● Commercial credit score

Measured on a scale of 101 to 670, it predicts the probability of a company becoming delinquent. A score of 101 is most probable, so that’s bad. A score of around 500 is good.

● Commercial credit percentile

This is measured on a scale of 0 to 100. It measures the probability of delinquency as well, but against other companies in the Dun and Bradstreet system. A score of 1 is the highest probability compared to other businesses in the system, and most say a score of 80 is good.

● Commercial credit class

This is a method of dividing businesses into classes based on the probability of delinquency. Companies in class 1 are the least likely to be delinquent. If you are in class 2, that’s good.

Who Are the Other CRAs?

You hear so much about Dun and Bradstreet, it is easy to forget that there are other agencies that offer business credit reports.

Equifax

They collect their information in ways similar Dun and Bradstreet, including: information from public records, financial data from the business, and payment history from creditors. In addition, they factor information about credit utilization, or how much credit a business is currently using versus how much they have available, into their calculation.

They then use the information collected to generate various scores, similar to those on your D&B business credit file, but not the same. These scores include the business credit risk score and the business failure score. The business credit risk score measures how likely it is that a business will become 90 days or more delinquent on bills over the next 12 months. It ranges from 101 to 992. The business failure score ranges from 1,000 to 1610, and it predicts how likely it is that the business will file for bankruptcy over the next year. The lower the score, the higher the risk.

Another score they offer is the business payment index. This is their version of the D&B PAYDEX, and it even runs on the same scale, 0 to 100. It indicates payment history over the past year. Different from the PAYDEX however, you have to reach a score of 90 or higher for it to be a “good” score.

Equifax also offers business identity reports that serve as confirmation that a company actually exists. It also verifies details such as the company’s tax ID, number of employees, and yearly sales.

Equifax does not allow business owners to request a report on their company. They decide themselves when to start a credit file on a specific company.

Experian

Your Experian report could be a lot different than the one from your D&B business credit file. Their credit ranking, Intelliscore, uses more than 800 variables to predict a company’s risk of defaulting or becoming delinquent. A 76 or higher is considered good with Intelliscore. That indicates a low risk of late payments or default. A score from 51 to 75 indicates a low to medium risk and 26 to 50 indicates medium risk. From 25 down 1 is medium high to high risk.

Intelliscore is considered a blended score of both the business and business owner’s information. It offers insights into a business’s public record findings, collections, payment trends, and overall business background. A major difference between Experian and the other two characters is that they do not ask businesses to self-report at all. Rather, they collect all the information themselves. Since it includes personal information, you do have to give permission for a lender to view this report.

Specifically, the Experian credit ranking gives insights into a company’s payment trends, public record filings, collections, and general business background. The result is a blended score calculated using both the business and business owner’s information.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

The Experian Database and Credit Report Generation

Experian’s database has information on over 27 million businesses. Reports are generated with information from the database, which houses information on bankruptcy filings, payment history, collections, banking, insurance, and leases.

There has to be a minimum amount of information in the database about a business before Experian will generate a score for it. There must be at least one tradeline in the system, so you should definitely do business with a company that will report to Experian if you want to build business credit.

Your D&B Business Credit File and Those from Experian and Equifax Can Make All the Difference During a Recession

You can’t know or choose which one your lender will use to base their decision upon. That means it is important to build strong business credit with each one. While a lot of this is out of your control, you can choose which starter vendors you work with. Since not all starter vendors report to all credit reporting agencies, you need to make sure you do business with a variety that report to each one. Then you can be on your way to building strong business credit.

The post How a Good D&B Business Credit File Can Help In Hard Economic Times appeared first on Credit Suite.

PHP, Internet Business Marketing, & Good Web Content Go Hand In Hand

PHP, Internet Business Marketing, & Good Web Content Go Hand In Hand When it comes to browse engine optimization as well as simply great old level internet website advertising smarts, everybody has actually listened to that material is king. Just how you provide that material on your website can additionally make a globe of distinction. …

Pet Cat Litter Brands Determine Good Cat Litter Box Habits

Feline Litter Brands Determine Good Cat Litter Box Habits It may be the kind of feline clutter you purchase for her if you have a pet cat that does not utilize her pet cat clutter box. Felines are picky regarding a great deal of points, and also the pet cat clutter brand name you believe …

Exactly how To Find A Good Mortgage Lender

Just how To Find A Good Mortgage Lender

A home is just one of the largest financial investments as well as acquisitions you will certainly make in your life time. With that said stated, it’s extremely essential that you pick a loan provider with a solid track record and also one that you really feel comfy with.

To aid establish your mind at simplicity a little bit, recognize that home loan providers have an unique passion in your finance. An excellent lending institution will certainly place with each other a high quality lending that functions ideal for you.

Look for reputable lending institutions that are acquainted with your market as well as make certain to ask inquiries. When talking with the lending institution, make certain that they can provide the finance within your schedule.

A couple of pointers and also points to take into consideration when searching for an excellent lending institution are:

– Get a couple of references– Ask your relative, close friends and also Real Estate representative that they suggest as well as could have handled in the past.

– When you satisfy the car loan police officer, do they show up expert, arranged and also well-informed?

– Find out which, if any kind of, subscriptions the lending institution holds, i.e., Better Business Bureau, Chamber of Commerce, Mortgage Lender’s Association, and so on

– Is the loan provider offering you choices to aid you with the deposit and also/ or shutting expenses?

– Ask the lending institution what their techniques of interaction will certainly be with you throughout the car loan procedure.

– Did the lending institution offer you with a Good Faith Estimate as well as Truth-In-Lending Disclosure? Lawfully, you need to be given with this documentation within 3 days after sending your application.

– What are the prices connected with the agreement, i.e., shutting expenses, and so on?

– Has the loan provider given you with duplicates of whatever you’ve authorized?

– Did the loan provider provide you a full checklist of every little thing you require to bring with you when you prepare to authorize the financing application?

– Does the loan provider call for that you authorize a Borrower/ Broker Contract? RUN if they do. You do not wish to associate with a broker that makes that need.

You intend to deal with loan provider that you trust fund. Ask for referrals and also speak to those people on your own if you still have inquiries when your meetings are completed. This is a large choice you’re making and also you deserve to obtain every one of the info you desire and also require.

Talk with them regarding the ideal method for you to structure your home mortgage as soon as you’re comfy with a home mortgage lending institution. When supplies for numerous financing kinds have actually been given, you must speak with various other home loan business and also contrast their prices to what you got. As well as constantly make certain to obtain your quotes in composing!

Bear in mind that the home loan that is ideal fit for you depends upon a number of points. Your present economic circumstance, exactly how and also if you anticipate your funds to transform, how much time you intend on maintaining your residence as well as exactly how comfy you are with the opportunity of your home mortgage repayment altering are all variables that require to be taken into consideration prior to authorizing any type of agreements.

Bear in mind additionally that info is encouraging and also the even more research study as well as expedition you do, the far better off you will certainly remain in the years ahead. See to it you are totally pleased with the lending institution you select since you desire somebody that will certainly exist if you have concerns, also after you close on your finance.

To aid establish your mind at simplicity a little bit, understand that home mortgage loan providers have an unique rate of interest in your car loan. An excellent loan provider will certainly place with each other a high quality finance that functions ideal for you.

When talking with the lending institution, make certain that they can provide the car loan within your schedule. – Does the loan provider need that you authorize a Borrower/ Broker Contract? When you’re comfy with a home mortgage lending institution, talk with them concerning the finest method for you to structure your home loan.

The post Exactly how To Find A Good Mortgage Lender appeared first on ROI Credit Builders.

An Updated In-Depth Fundbox Review: Are They Still a Good Deal?

Fundbox is one of several lending companies online. They offer Invoice Financing. Surprisingly, this is not the same as Invoice Factoring. Our Fundbox review can help you decide if their financing options are a good fit for your business.

Fundbox Works for Some, Not So Much for Others

Here’s the thing. They make it easier to get approval for financing. There is a credit check. However, for the application it is only a soft pull. The key is, the minimum credit score is 500. Comparatively, this is much lower than with other lenders. There is a one-time hard credit pull on the first draw, so keep that in mind.

What They Offer: Invoice Financing and Lines of Credit

They do not offer invoice factoring. In contrast, instead of purchasing your accounts receivables for a percentage of the money owed to you, they will finance up to the full amount in the form of a loan. Then, you pay it back as your customers pay their invoices. Also, they do not communicate directly with your customers.

In addition, they offer Business Lines of Credit. In fact, you can get a line of credit up to $60,000 within about 3 minutes on average. Furthermore, this amount goes up to $100,000 with financials. The 500 personal credit score minimum holds for lines of credit the same as invoice financing. Basically, they just want to connect to your business bank account. They can provide up to $100,000 in credit.

Check out how our reliable process will help your business get the best business credit cards.

Fundbox: Fees

Fees start at 4.66% of the amount drawn. If you pay early, then the remaining draw amount plus one weekly fee is debited from your account on the upcoming payment date. However, if you miss a payment, they will continue to debit your account as scheduled. In addition, there will be an ACH for an additional average fee plus a $6 NSF charge.

Fundbox: Funding Requirements

Honestly, they look for healthy businesses. This means with accounting software, they want to see a lot of receivables, invoices going out, and healthy revenue. If you’re showing your bank account, they want to see strong transactions. Generally, they are looking for around $50,000 or more in a bank account. Typically, they want to see a minimum of three years in business. They also want to see a variety of customers.

For companies with a minimum of one year in business, they want at least three months’ worth of transactions.

Remember:

- They consider business merit as opposed to personal credit. For application purposes, they will do a soft pull on your personal credit. This will not affect your credit score. They want to see a minimum personal score of 500. When you make your first draw, they will do a one time hard pull that could affect your score, so keep that in mind.

- Timing matters. Take into consideration when you will need the funds. How much time are you willing to spend filling out an application?

- Do your own research on fees. Educate yourself on how much they are and what they cover.

- Consider how much credit you really need? You don’t want to be paying for money that you do not need.

- You control your information.

Fundbox: Reputation and Reviews

The first place I go to check up on a company’s reputation is the Better Business Bureau. Things look pretty good. They have an A+ rating, and they have been accredited since 2014. There are 5 reviews, and 4 of them are negative. However, considering how long they have been around, you have to figure there are a ton of happy customers out there, too. Also, it seems that most of the reviews are centered around recent growing pains that will likely work themselves out given their success thus far.

There are also 7 complaints. The details of the complaints are not public, but it seems that each one was at least answered by Fundbox. This shows the company pays attention to what customers are saying.

The Benefits

The benefits of Fundbox funding include flexibility in connecting to your business bank account, and fast approval. Another advantage is that they stay out of your relationship with your clients. Your clients need never know that you are working with them.

The Cost

Oddly enough, one of the benefits is also a drawback. Many people are uncomfortable with giving them bank account access, even if it does streamline processes. Of course, this is the very thing that makes it possible for them to not run a credit check. As a result, business owners with bad credit can turn here. This is important for some. Another disadvantage is the high fee if you miss a payment.

What’s the Final Word?

Fundbox works best for those businesses that can pay back their debts on time. Of course, that’s the case for any lender. You’ll have to decide if the benefits of using Fundbox outweigh the costs for your business. Certainly, they are a legit business. Just do your research and know what you are getting into on the front end.

The post An Updated In-Depth Fundbox Review: Are They Still a Good Deal? appeared first on Credit Suite.