The Secret Guide to VSEO: Video and SEO

Since the Google Penguin and Panda updates, a lot of SEOs finally have realized that ranking a website in the long term is not just about building a large number of links. It’s also about creating high-quality content that will attract links naturally over time.

However, one type of SEO that still is underutilized is VSEO: video search engine optimization. Although a lot of brands are incorporating video content into their overall online marketing strategies, most SEOs don’t place a high priority on it. Usually, they opt for creating various other types of content (e.g., infographics, images, written content, etc.).

If used correctly, video can be an extremely powerful form of content and make a significant contribution to your overall SEO strategy, in more ways than one.

Avoiding a Common Trap and Defining Your Goals

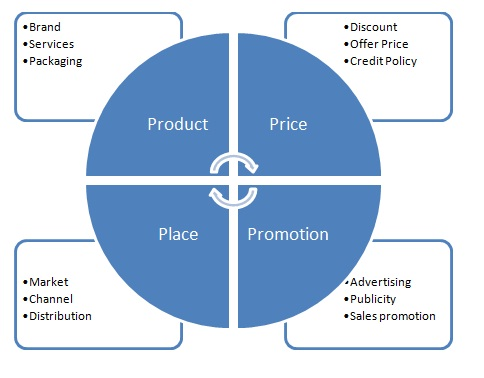

Although the idea of producing a video might seem like a “nice” idea, it’s important to remember that it must compliment your overall SEO strategy and generate a return on investment (ROI).

If you fail to define your goals in the early stages, not only will the video end up costing you (or your client) a hefty chunk of money, it will be money down the drain that could have been spent better elsewhere.

Failing to clearly define goals is a common SEO mistake and one that often is seen with content such as infographics.

Many SEOs will commission the creation of an expensive, cool-looking infographic without putting enough thought into the overall goal. They get blinded by the idea that “infographics build links” without stopping to think whether they want the infographic to increase conversions, increase high-quality traffic (i.e., visitors who are likely to convert to paying customers), or simply provide off-page SEO benefits (i.e., links).

It’s the same with video content. You need to know what you want to get out of it. Without knowing this, it will be difficult to conceptualize/commission a production that has any hope of successfully captivating the intended audience and leading to your desired goals.

What Are Your Goals?

From an SEO point of view, there really are only two main goals that you possibly could have – to build links and generate social shares or to increase conversions.

Let’s start by looking at the first benefit mentioned above…

1. Build Links/Generate Social Shares

If it’s done well, a video can generate a large number of links for a website; and often from some pretty reputable domains, too. I’m not just talking about a few links, either. I’m talking about hundreds or thousands of high-quality links in some cases.

The problem is there’s so much online video content that unless you create an exceptional video and have a great outreach/marketing plan, its success is going to be limited.

People don’t link to or share any old rubbish these days. So, to get the success you’re looking for, it’s important for you to really think about who you want to share the video and who you want to link to it.

Essentially, your video has to offer something to the viewer. It might make them laugh, educate them, amaze them, shock them, or annoy them (or even a combination of these). The point is it needs to evoke a strong enough emotional reaction that they’ll want to share it, either by clicking the Tweet/Share button or by writing a post about it on their blog/website (with a link back to your site, of course).

DollarShaveClub.com

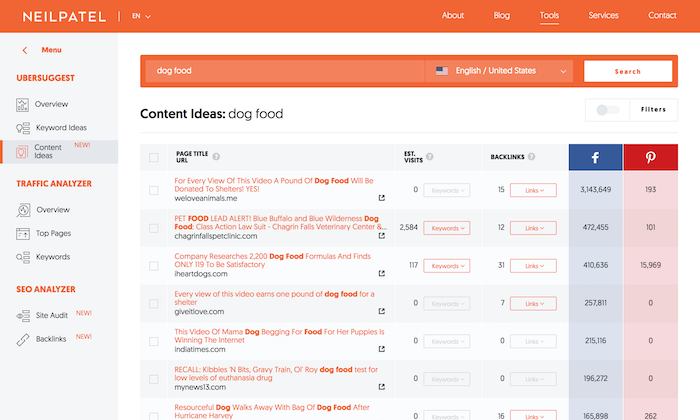

Perhaps one of the best examples of a video that generated a massive amount of backlinks is the “viral” video from DollarShaveClub.com (above).

About a year ago, hardly anyone had heard of Dollar Shave Club, but shortly after they produced and marketed the video, that all changed.

Strangely enough, the Dollar Shave Club video wasn’t produced for link building purposes. It was produced with the aim of raising brand awareness. But in the modern world of SEO/marketing, brand awareness and link building are directly related, at least when it comes to online content.

Let me explain with a timeless viral example.

According to YouTube, the Dollar Shave Club video was uploaded on March 6, 2012. Following the upload, it didn’t take long for the video to start going viral. Partly due to a great PR/outreach strategy and, in large part, thanks to its very amusing concept, it started to gain a lot of attention for the company.

Within hours, it was featured on leading news sites across the web, including Mashable (pictured above), The Next Web, Techcrunch, and literally hundreds of others. Within a month or so, it also had been featured on many other leading sites that most SEOs would work extremely hard to obtain links from, such as Forbes and BusinessWeek.

Obviously, this is great for brand exposure, but what has this got to do with link building?

Every single one of those leading news websites mentioned above linked out to Dollar Shave Club in their articles, as did the hundreds of other sites that reported on the video.

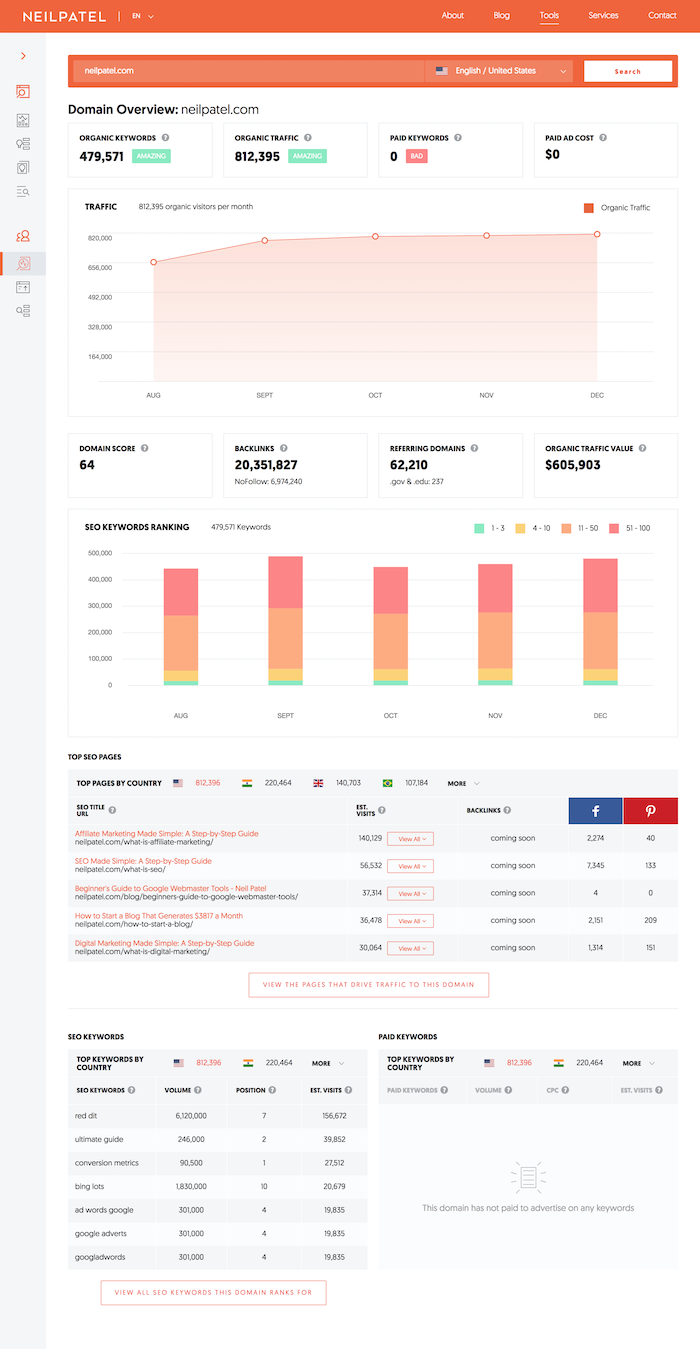

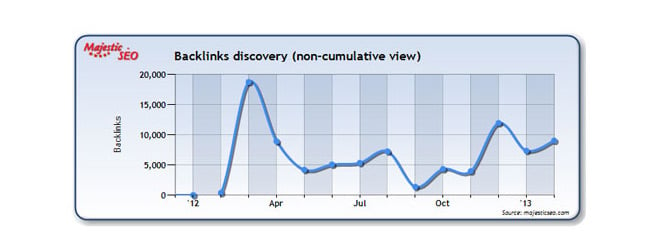

In fact, this screenshot (taken from MajesticSEO back in the day), shows just how successful the video was for Dollar Shave Club in terms of SEO.

As you can see, around March 2012 (when the video was uploaded), Dollar Shave Club attracted approximately 18,000 backlinks and has continued to attract relatively large numbers of links every month since then.

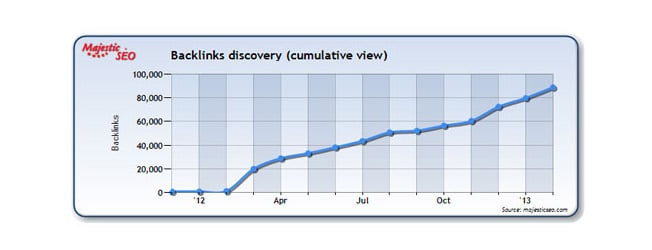

If you take a look at the cumulative view of backlinks gained (pictured below) since the video was uploaded (approximately 12 months ago), you’ll see that it has attracted almost 90,000 links to date and the site still is attracting links naturally every month as people continue to write about it (like me).

The reason for this is the video struck a chord with its intended audience, and, as a result, went “viral” and attracted links. It was funny, original, and kept its target audience in mind.

There also was an excellent outreach/PR strategy in place, which was responsible for getting the video off the ground and starting the link building process.

These are all things to note if you’re looking to use video for SEO.

Moz Whiteboard Friday

As I mentioned earlier in this guide, videos don’t necessarily have to be funny to attract links. They just have to offer viewers something they want to see. One good way to do this is to create a video that’s educational.

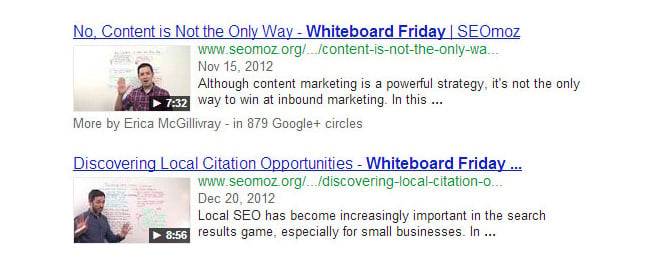

Every Friday, Moz posts a “whiteboard” style video on their blog. Due to the regularity of these videos, they’ve become known as the “Whiteboard Friday” videos. These videos not only attract a lot of attention from SEOs around the world, but also attract a significant number of links, embeds, and social shares; therefore increasing traffic for SEOmoz.

According to Open Site Explorer, a particular Whiteboard Friday video received 402 links from 37 referring domains and well over 1,000 social shares. Once again, proof that people love video content.

What Should I Learn from All of This?

In both instances above (DollarShaveClub.com and Moz), video content has been responsible for successfully attracting a substantial number of inbound links and social shares for the website in question. This proves that, when used correctly, videos really can provide a huge boost to your SEO campaign.

However, both of these videos successfully attracted links for different reasons.

For Dollar Shave Club, it was all about the video seeding/outreach strategy. Mike Dubin, the founder of Dollar Shave Club, came from a video seeding background, which obviously played a big part in the success of the video. No one knew about Dollar Shave Club in the early days, so the outreach process definitely played an important role in getting things off the ground.

With Moz, it’s likely that there was no outreach conducted in order to attract links/social shares, as Moz already has an extremely large, loyal community of followers who are likely to share their content naturally. For them, simply producing a high-quality video targeted at their fan base is enough to attract links.

It’s important to consider this when using videos for SEO because all sites are different, and, therefore, will require a different approach. Ask yourself: Do I have enough high-quality traffic already to attract links automatically, or do I need to conduct outreach? And, if so, how much?

It’s also important to remember that it doesn’t matter how good your outreach plan is if your video isn’t of exceptional quality. If that is the case, it’s not going to attract a large number of links.

It’s tempting to cut corners and produce a sub-standard video in order to keep costs down. But, in the long-run, this won’t pay off. Ask yourself: Is my target audience going to be interested in this? Would I link to this if I came across it? Does it evoke an emotion? If you answer “no” to any of these questions, go back and rethink things before you produce your video.

One last thing: To get the full SEO potential of your videos, consider hosting videos on your own website (instead of Youtube or Vimeo). The reason for this is to get people to link back to your domain, which will help your overall SEO efforts as well. The possible downside would be reduced exposure or shares.

Also, on most video hosting sites you can link back to your content from the video webpage. Don’t forget to do this! It’s a free link 🙂

2. Increase Conversions

Although some SEOs might disagree with this, I believe that the job of an SEO isn’t necessarily to increase rankings, but rather to increase online sales/revenue for the client.

Obviously, this is a two-part process: attracting more visitors to a website and then optimizing the website so that more of those visitors convert into paying customers/clients.

Video content can be fantastic for increasing conversions on just about any website. In fact, more brands than ever are using videos on landing pages and on various other pages of their websites to keep visitors engaged and, eventually, convince them to make a purchase.

There are two main ways to increase conversions with video – by embedding a video on a landing page and by making use of rich snippets.

Video on a Landing Page

When a visitor lands on your site, you’ve literally got seconds to impress them and get them engaged with what you have to offer. This is the whole point of a landing page. But these days, people are so used to seeing rich media content on the internet that, quite frankly, text content often doesn’t keep them engaged.

Accordingly, I’m sure it comes as no surprise to you that embedding a video on your website not only will increase the length of time that visitors stick around, but, also, the number of conversions to paying customers, which, ultimately, is what SEO is all about.

Product Videos

Product videos are perhaps the most common way that retailers increase the conversion rate of their website using video content. Hundreds and thousands of retailers are making use of product videos these days, and it’s easy to see why.

According to Invodo, 52% of consumers say that watching product videos makes them feel more confident about going ahead and making a purchase.

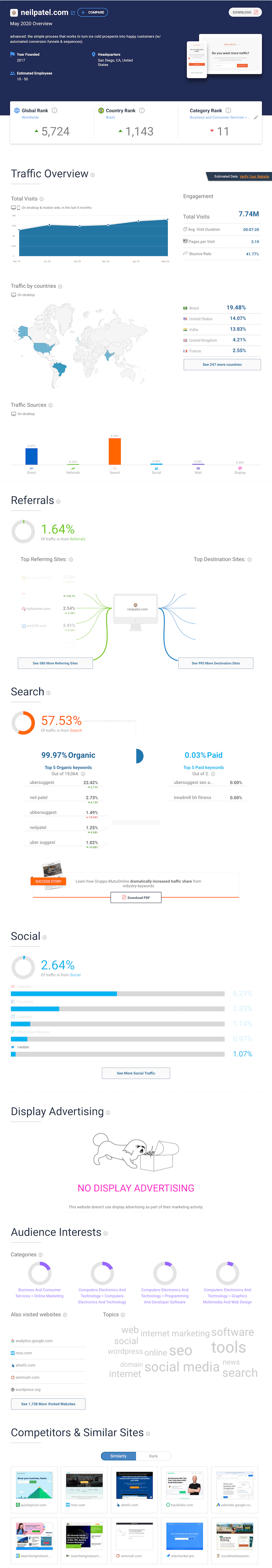

Take a look at the screenshot above from the online retailer Zappos. It shows one of their product videos being used on the page for women’s Levi jeans. According to econsultancy, Zappos found that sales increased by between 6% and 30% on products with product videos.

Explainer/Introductory Videos

Obviously, not every business with a website has a product to sell, as some businesses are service-oriented.

For these, you can increase conversions with the use of explainer/introductory videos. There are varying styles for these videos, and, truthfully, there’s no exact science as to what style works best. It’s more about producing a video that explains/introduces a client’s business effectively and in an engaging way.

Dropbox found that they increased their conversion rate by over 10% by adding this video to their homepage. And considering that their homepage receives over 750,000 visitors a month, this means that it increased signups by several thousand every day and no doubt generated a huge ROI.

This video on the other hand introduces a local mobile bar company by explaining the service, introducing the guys behind the business, and showing their services in action. It’s a similar length to the Dropbox video, but it is presented in a different style. When embedded on the “about us” page of the client’s website, it increased his overall conversion rate by around 7%.

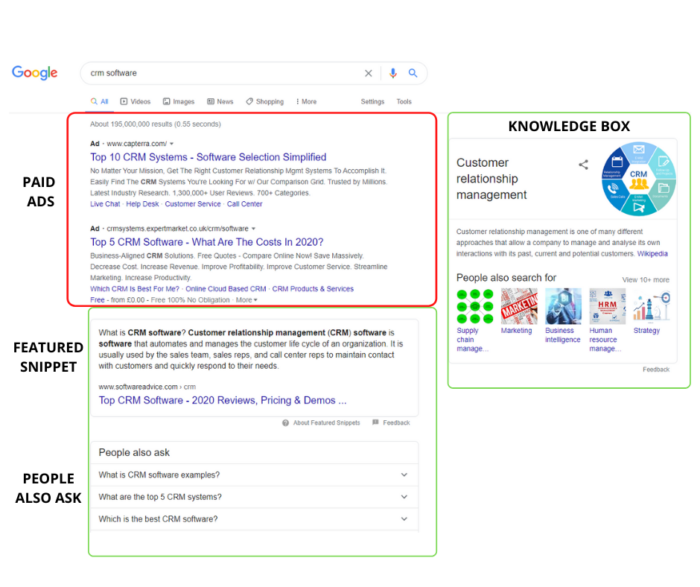

Rich Snippets

Increasing conversions with video aren’t only about what you show the visitor once they land on your website, but also what you show the visitor before they even get there.

If you’ve noticed Google’s search results recently, you have seen a significant increase in the use of something called rich snippets, and, in particular, video rich snippets.

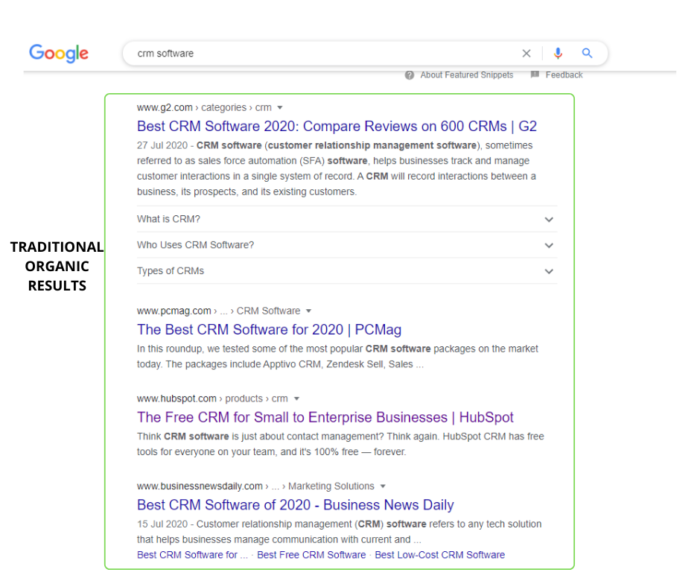

If you’re new to rich snippets, you can watch Google’s official explanation in the video above. Essentially, though, this is what a site with video rich snippets looks like in the SERPs:

As you can see, Google displays information about the video embedded on the page, letting the Googler know that, should they click through to your website, a video is awaiting them.

To put it simply, video-rich snippets help you stand out from the other nine search results on that particular page, and, therefore, searchers will be more inclined to click your result, which will increase traffic to your website.

You’ll be able to show searchers a thumbnail of your video and the length of your video. Make sure the thumbnail stands out and sums up what the video is about if you want to maximize conversions.

How Do You Use Rich Snippets for Video?

To show rich snippets for your video in the Google search results, you’re going to need to self-host your video. If you’re using WordPress, there is a workaround for hosting your videos with YouTube using the Yoast Plugin, but it’s definitely recommended that you self-host your content, if possible.

There are a number of other SEO benefits to self-hosting your videos as opposed to using a free video host such as YouTube, as documented here.

Once you’ve gotten your video hosted and embedded on your site, it’s simply a matter of informing Google about the video. To do this, you’ll have to add the required Schema.org code to your page and submit an XML sitemap within Google’s Webmaster Tools.

It’s a bit of a hassle, but once you know how to do it, it’s pretty easy to do time and time again. Plus, if you’re already ranking for any high-volume keywords, it is well worth the effort, as the increase in conversions should bring significantly more traffic to your site.

Conclusion

The popularity of online video presents a huge opportunity for SEOs willing to get creative to achieve results. Producing videos isn’t always cheap, but it usually isn’t as expensive as people believe it will be, either. If you’ve commissioned and marketed infographics before, you definitely can afford to produce a video and use VSEO that will generate a good ROI for you/your client.

Remember, quality is just as important when it comes to online video as it is when producing any other form of content.

About the Author: Josh Hardwick is the founder of ShortyMedia, a leading production company specializing in viral, corporate, and web videos. He also is a freelance SEO and loves producing great content and building links.

The post The Secret Guide to VSEO: Video and SEO appeared first on Neil Patel.