11 Critical Google Ranking Factors That Will Drive More Traffic

The number one search result on Google receives more than 39 percent of all clicks. This means if someone searches for your targeted keyword phrase, four out of ten people will click the first result and ignore everything else.

Imagine what an impact it would have on your business if you could rank first for a few of your desired phrases.

The goal of this guide is to help you understand the most important Google ranking factors so you can implement them on your website and get more traffic.

What Are Google Ranking Factors?

Google ranking factors are the elements of your website that the Google search algorithm takes into consideration when deciding what webpages to show in the search results for a given search query.

When someone searches for a phrase relevant to your business or service, you want them to find you and not your competition, right?

To truly understand how to get your website ranked in Google search results, you need to understand Google ranking SEO. There are hundreds of ranking factors, some of which can have a significant impact, while others matter less.

In this guide, we’ll cover the factors that matter most, so you know which SEO strategies to spend the most time and money on.

Why It’s Important to Know the Google Ranking SEO Factors

While the ROI on SEO can be a bit fuzzy, a study by Intergrowth gives it a little more clarity.

The first five organic results amount to 67.60 percent of all clicks. After that, the percentage of clicks drops to 3.73.

Let’s say you rank number one for a keyword with 1,000 searches per month at a 30 percent click-through rate. That would drive 300 new visitors to your site each month. If you convert only one percent of those visitors, it would still mean three new customers every month for a year.

Simply ranking number one on Google for a single keyword can bring 36 new customers per year to your business.

Implementing some of the steps in this guide to rank for a handful of keywords can have a significant impact.

Top 11 Google Ranking SEO Factors

Let’s take a look at some of the most important Google ranking factors so you can learn how to increase your SEO ranking on Google.

1. Mobile-First Optimization

In the fourth quarter of 2021, mobile traffic accounted for 54.4 percent of global traffic. The majority of people surfing the web on their smartphone expect your site to work perfectly on their device, and if it doesn’t, they’ll likely bounce from your site.

This is why mobile friendliness is one of the most important Google ranking factors. If your site doesn’t function properly on mobile, Google is knocking you down a peg.

If you don’t believe me, you can read about it directly from Google. As of summer 2019, they began mobile-first indexing, which means your functionality on mobile is what determines your ranking. Desktop performance is second in importance.

To rank in the Google search results, you need to make sure your site functions the same on phones, tablets, and computers. Make sure the theme or template you select is mobile responsive. Next, ensure all your images are displayed clearly, check whether any words fall off the screen, and limit giant walls of text, which might look fine on desktop but on mobile can cover the entire screen.

Make sure the site loads properly by reducing the number of changing video URLs and limiting the amount of “lazy-load” content on your site.

2. Core Web Vitals

Google introduced Core Web Vitals as yet another important ranking factor in May 2020. These refer to the overall health of your website in terms of the experience it provides for users.

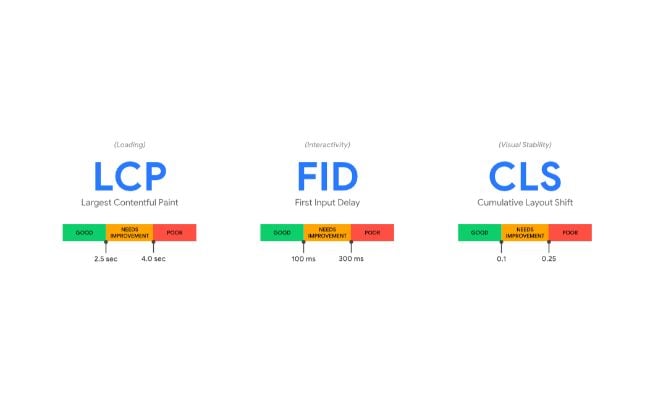

The vitals are broken down into three categories:

- LCP (Largest Contentful Paint)

- FID (First Input Delay)

- CLS (Cumulative Layout Shift)

A 2021 study revealed only four percent of websites scored well in all three Core Web Vitals categories.

Let’s break each of these down so you can understand how they impact your rankings.

Largest Contentful Paint: Google expects your site to completely load its first page within 2.5 seconds. This reduces the number of people who will click away, and it impacts Google ranking SEO.

You can improve your overall page loading speed by reducing the number of complex elements on your site, shortening pages, limiting redirects, and fixing any broken external or video links.

First Input Delay: Google expects your site to react quickly to users when they interact with something. You have 100 milliseconds or less for a button or window on your website to respond to a user when they click it.

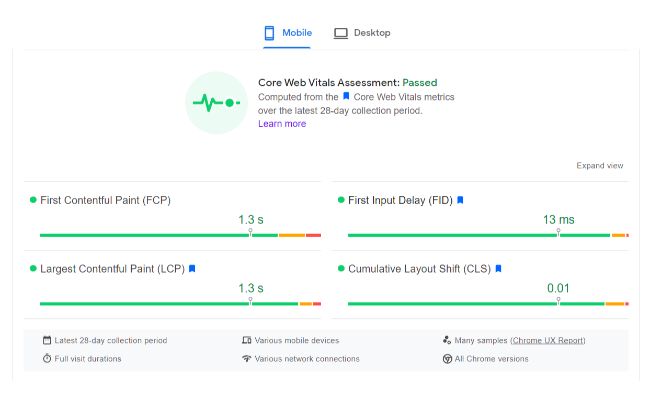

The best way to improve FID is to use Page Speed Insights. To give you an example, I ran a test on neilpatel.com.

Cumulative Layout Shift: Google expects your site to load predictably and not change once it’s loaded. Have you ever clicked a link on a site as it’s loading, and then it jumps halfway down the page taking you to a different link? This factor plays into overall page experience, which is important for Google ranking SEO.

This occurs when items on the page load at different speeds resulting in layout changes. The best way to prevent this is by ensuring all images are the same size, new content isn’t inserted above old content, and animations load at the same speed.

3. Value-Packed Content

According to SEMRush, 55 percent of brands experienced better results due to the improvements they made to their content.

There is no room on the internet for poor-quality content. I consider this one of the single most important Google ranking factors simply because it doesn’t require anything tricky or fancy. Write great, thorough, and value-rich content, and Google will work in your favor.

What do I mean by value-rich?

I mean write content people want to read, content that helps, and content that provides more than the competition. A great place to start is researching questions your customers have and creating content that provides the answers. To find common questions, use keyword research tools like Ubersuggest, question forums like Quora, and monitor chatter among your target audience on social media.

If you can create high-quality content that also incorporates the more technical elements we discuss in this guide, you have a great chance of improving your SEO and eventually, your bottom line.

4. Domain Age and Authority

Unfortunately, domain age is one of those Google ranking SEO factors you can’t necessarily control unless you’re purchasing seasoned domains.

Domain age refers to the amount of time your domain has been registered, and authority is essentially your reputation with Google.

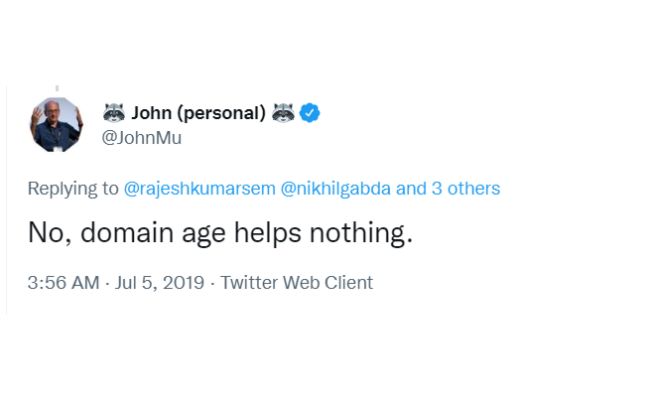

Even though the “King of Search” John Mueller himself said domain age does nothing, I still have to believe it plays a role in your overall site authority.

If you want to improve your authority you need to focus on something called E-A-T, which stands for expertise, authoritativeness, and trustworthiness.

A few ways to improve your E-A-T score are involving subject matter experts and giving them bylines in your blog posts, including interviews and reviews by industry experts, leveraging social proof across your website, and increasing your website’s security.

Keep in mind that E-A-T isn’t a direct ranking factor, but it does impact SEO indirectly. In fact, after Google’s 2018 medic update, monthly traffic to YMYL sites with a lack of E-A-T dropped from 2 million to around 4,000 by 2020.

5. Links

More than 90 percent of web pages receive no traffic, often because they don’t have any backlinks.

And yes, links are still important for Google ranking SEO. Inbound links, outbound links, and internal links are all important ranking factors because they increase the overall authority of your site and help your site prove itself as a valuable resource.

Inbound or “backlinks” are links that come from someone else’s site to your content. These increase authority by showing Google your content is so great that someone wants to link to it.

Outbound links show authority by providing additional relevant resources to visitors to your site. For example, you should be including outbound links to help readers learn more about something or back up any facts and stats you include in your content.

Internal links are links within your own website that tie ideas together. Having a web of internal links is crucial to Google ranking SEO because it shows Google you are a complete A to Z resource on a subject.

6. On-Page Experience

Bounce rate is one Google ranking factor that can significantly impact where Google ranks you in search results. One study found the average bounce rate is around 49 percent. Most believe a 50 to 60 percent bounce rate is acceptable. If your bounce rate drops much below that, it signals to Google that your page probably doesn’t give users what they’re looking for, meaning your page is less likely to appear in search results.

Click-through rate and dwell time are other important on-page experience Google ranking factors. They tell Google whether someone likes what they see when they click to your site from the search results for their search query.

You can improve your on-page experience metrics by ensuring your content aligns with your target keywords, metadata, and title tag. This ensures that when someone clicks through to your site, they get what they’re looking for.

7. Technical SEO

Technical SEO is still an important Google ranking factor. Technical SEO includes things such as:

- keywords in page titles and title tags

- keyword-optimized header tags

- properly optimized meta description at 110 to 150 characters

- keyword-rich alt text and tags

- proper schema markup

A study on technical SEO found the following:

- every fourth website has link errors

- 13 percent of websites have errors in their sitemaps

- 63 percent of websites “abandon” meta descriptions

- more than 20 percent of websites have a low site speed

Thankfully, technical SEO could be one of the easiest things to adjust on your website. Make sure you’re using relevant keywords in all headers and metadata. The key to doing this is having a quality keyword research tool that provides you with complex competitor data and keyword gaps. You can also run an SEO audit, and this guide explains how.

As for header tags, you want to ensure you’re using keywords in the headers of your articles whenever possible. When Google crawls your site, headers are a big indicator of what your article is about, and they’re important for overall Google ranking SEO.

Your meta description and title tag are what display in the SERPs when someone searches for a relevant keyword. You want to use keywords in both the meta and title tag—but make sure it’s natural and not forced.

8. Social Signals

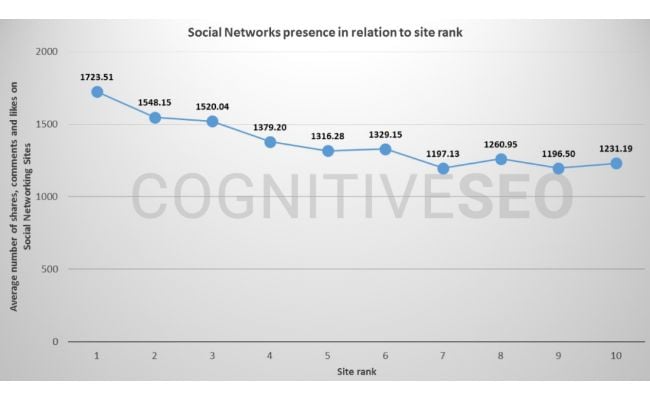

While this study may be a bit dated, it still provides context to the importance of social media in SEO.

The graph and study performed by cognitiveSEO show how the number of social shares impact the overall ranking of a web page. As the shares go down, the ranking goes down. Of course, this factor alone won’t make a tremendous impact on your ranking, but in the heat of competition, this can set you apart.

Keep in mind that a social presence is also a significant trust factor. If visitors can find you on social media and see that you’re active and present, they may feel more inclined to purchase from you.

9. Content Relevancy and Authority

This Google ranking factor can be separated into three main categories:

- search intent

- content hubs

- topical relevance

These are three incredibly important factors going forward in Google ranking SEO. Google is paying much closer attention to the actual content that people are producing and putting a lot of weight on whether a website actually provides solutions to people or if they’re writing entirely for the search engine.

Surfer did an incredible case study and found that out of 37,000 keywords, about 12 percent of them changed intent, with many shopping-related keywords turning informational. This means that people who were once searching for something to buy are now searching for information to help them make a purchasing choice.

Think of content hubs as a destination where someone can come and find everything they need to know about a subject. If your site provides an exhaustive look into something, Google sees you as an authority. By creating these hubs on your website, you’re showing Google you can provide everything from A to Z.

10. Real Business Information

This Google ranking factor is one I would consider somewhat new but falls into the category of trust signals. As more and more people turn to the internet for nearly everything, you need to translate the in-store experience to your website.

What does this mean? It means people are expecting to be able to pick up the phone and call you, they want to see where you’re based, and they expect you to be there to answer their questions in real-time.

Getting a Google Voice number, creating an “About Us” page with real pictures, and even adding an address to your website can help increase authority and show Google you’re a real business.

11. Content Length

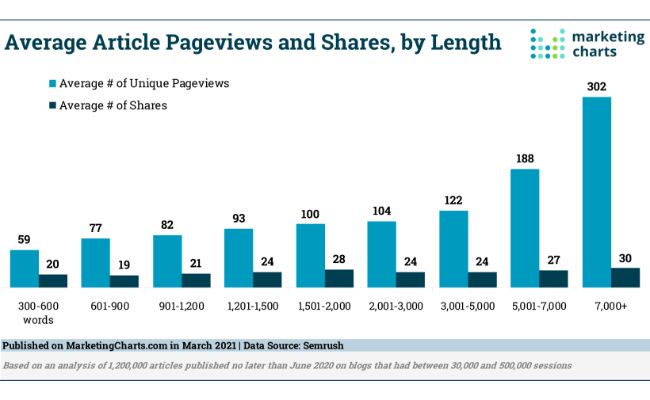

It’s been debated and tested time and time again, but it’s always proven that longer content performs better.

Longer content yields more social shares and more unique pageviews. Longer pieces of content also tend to hold their position longer.

Now, that doesn’t mean go and throw up a 15,000-word salad and expect it to rank. You still need to provide a ton of value, resources, and incredible information with those words. However, if you can put together a more comprehensive article that is longer than the competition, you have a better chance of ranking.

Possible Future Google Ranking Factors

Where do we see Google ranking SEO going in the future? Based on experience and research, I see five main factors as most important in the coming years (Google also tells us these factors are important):

- high-quality and highly relevant content

- honest and relevant keyword research and placement

- flawless user experience and site functionality

- mobile and voice optimization

- strong backlink profile

What do these five things tell us about what Google is looking for? Google wants you to provide users with a good experience when they land on your site.

This study performed by Content Science makes the importance of content relevancy clear as day. To sum it up, they state that while it’s great to have a lot of traffic on your site, and it looks good to Google, to actually generate goal completions, content relevance is key.

User experience and site functionality go hand-in-hand with content relevancy. No matter how great the content is on your site, you need to have a site that performs well and checks a lot of the technical boxes Google expects.

If you take a look at its mission statement page, it’s spelled out.

Our company mission is to organize the world’s information and make it universally accessible and useful. That’s why Search makes it easy to discover a broad range of information from a wide variety of sources.

Google Ranking Factors Frequently Asked Questions

What is the most important Google ranking factor?

I will always think that the key to Google ranking SEO is high-quality and valuable content.

Does Google release a list of its ranking factors?

While it’s not necessarily a list, it’s a solid explanation of what factors are most important. You can see the focus is primarily on user experience.

How do I improve my Google search ranking?

Improve your ranking by implementing all of the Google ranking factors in this guide.

How many Google ranking factors are there?

There are likely hundreds if not thousands of factors ranging from small to large. Google has a rigorous process to determine what factors are most important.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is the most important Google ranking factor? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

I will always think that the key to Google ranking SEO is high-quality and valuable content.

”

}

}

, {

“@type”: “Question”,

“name”: “Does Google release a list of its ranking factors? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

While it’s not necessarily a list, it’s a solid explanation of what factors are most important. You can see the focus is primarily on user experience.

”

}

}

, {

“@type”: “Question”,

“name”: “How do I improve my Google search ranking? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Improve your ranking by implementing all of the Google ranking factors in this guide.

”

}

}

, {

“@type”: “Question”,

“name”: “How many Google ranking factors are there? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

There are likely hundreds if not thousands of factors ranging from small to large. Google has a rigorous process to determine what factors are most important.

”

}

}

]

}

Conclusion: Google Ranking Factors

While there aren’t any foolproof ways to rank your content, adding these Google ranking factors can certainly increase your chances of ranking for your chosen keywords. Of course, hiring a qualified agency is another great way to rank higher.

If you’re going at it alone, you don’t have to do everything at once. Start with the most important factors and work your way down. It may take a while, but Google is a merciful and honest leader who rewards those who put in the work.

What factors do you think are most important for Google ranking SEO in the coming 5 to 10 years?