Article URL: https://app.dover.io/Optery/careers/41840615-ceb2-4629-93a5-42d49fa8987d

Comments URL: https://news.ycombinator.com/item?id=38519758

Points: 0

# Comments: 0

Article URL: https://app.dover.io/Optery/careers/41840615-ceb2-4629-93a5-42d49fa8987d

Comments URL: https://news.ycombinator.com/item?id=38519758

Points: 0

# Comments: 0

If you collect information from your website visitors, you may be required by law to post a privacy policy on your website.

While not every country has privacy policy requirements, many auxiliary laws make the addition of a privacy policy necessary for compliance. Plus, if you want your website to be visible to a global audience, you need to adhere to global guidelines.

Additionally, many third-party applications require privacy policies to use their services. Examples of this include Google Analytics, Google Play, Apple App Store, and Google AdSense.

The last thing you want is to be taken to court by a website visitor over something as simple as a privacy policy.

So, how do you create a privacy policy?

Luckily, there are many online privacy policy generators you can use to help keep your site compliant.

In this post, we’ll show you how to find, use, and implement your privacy policy with a privacy policy generator.

A privacy policy is a legal document telling website users if, how, and why you collect and store their personal information.

Personal information can be anything used to identify an individual, such as their name, date of birth, address, credit information, or online behaviors. The exact definition may vary between countries and laws, so be sure to research what requirements you need to meet before using a privacy policy generator.

A strong privacy policy should be informative and precise, without hidden clauses or confusing language. It should also include contact information in case your users need more information.

A privacy policy should include:

Not only are privacy policies mandated in most countries, but they’re also a great way to build trust by keeping your marketing tactics transparent. Even if you’re not required to have one, it’s a good idea to do so anyway.

Here is an example of our privacy policy.

Regardless of whether you operate on a desktop, mobile app, or website, you need to have accurate and honest privacy policies in place to guide your users.

Here are the four most important reasons why your website needs a privacy policy.

Many countries mandate privacy policies be available to help citizens understand their information rights.

In the United States, the Children’s Online Privacy Protection Act (COPPA) requires all websites that collect information from children to have a privacy policy.

Here is an example of Disney complying with this law.

The California Online Privacy Protection Act (CalOPPA) also requires any company gathering information from California-based users must display a privacy policy on their website.

Here is an example of this from the Wells Fargo website.

In the U.S., the Gramm-Leach-Bliley Act mandates any businesses in the financial sector to provide honest statements about their collection and use of personal information.

Additionally, the Health Insurance Portability and Accountability Act (HIPAA) requires healthcare service providers to give written notice of their privacy practices.

Across the globe, many similar laws exist to protect the privacy of specific areas’ citizens. For example:

Ultimately, privacy is a concern across the globe, so adding a privacy policy to your website could build trust and help you communicate with a global audience.

People care about their privacy and want to be in charge of their information. This is especially true online, where information is often collected and stored without a user’s knowledge.

Displaying a privacy policy on your website shows your customers you care about their privacy and aren’t doing anything sneaky.

It also shows you have procedures to handle their information properly, which can help them trust your business.

While it’s essential to have a clear, concise, and transparent privacy policy to build user trust, feel free to get a little creative with your website’s privacy policy, you can find interesting or interactive ways to display your information.

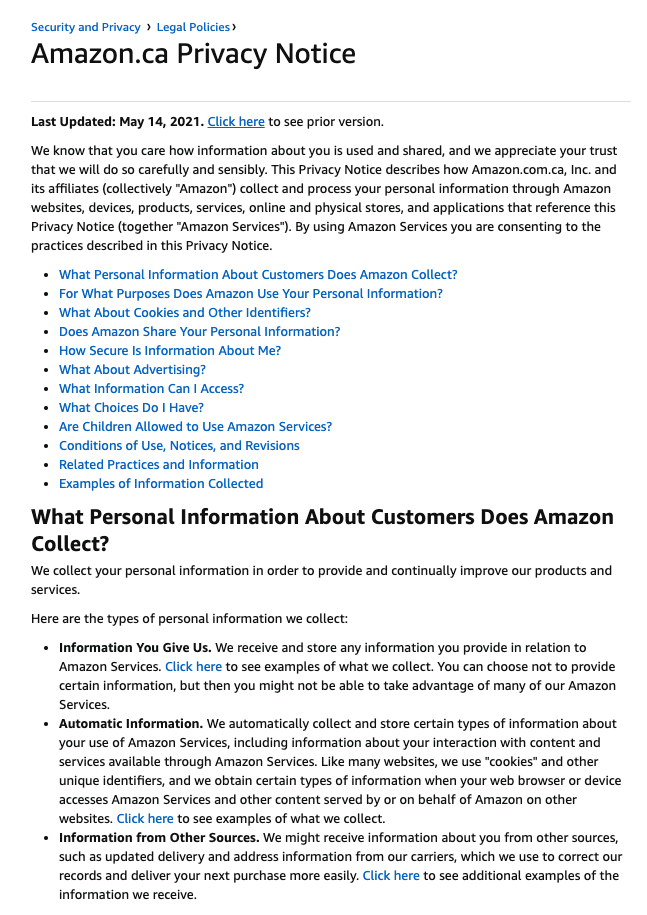

Here is an example of Amazon’s Canadian privacy policy, which includes a clickable table of contents to help users navigate the policy.

Many third-party services require a privacy policy to use their services, including Google Ads, Google Analytics, Facebook, and Apple.

This ensures they are also compliant with any international laws while you use their services.

For example, Google Analytics requires a specific privacy policy because it stores cookies on user devices and collects data.

If you are using any of Google’s advertising features, such as Google Display Network Impression Reporting, Google Analytics Demographics, and Interest Reporting, or any services involving Google Analytics, you need a privacy policy.

The same is true if you’re developing a Facebook app, Apple app, or Google Play app.

If you use or plan to use any third-party services, check their privacy policy and disclosure requirements.

If in line with your brand, adding humor, personality, and wit to your privacy policy can showcase your brand’s personality and win the hearts of your customers.

Check out this creative privacy policy by Ecquire.

Or this example from Major Tom, which uses a David Bowie quote to add some flair to their privacy policy.

The most important part of a privacy policy is the information you’re giving. Personality is a bonus if you can fit it in.

Now it’s time to dig into how you can create a privacy policy for your website.

Use a privacy policy generator like the ones listed below to create a clear and accurate privacy policy for your online presence.

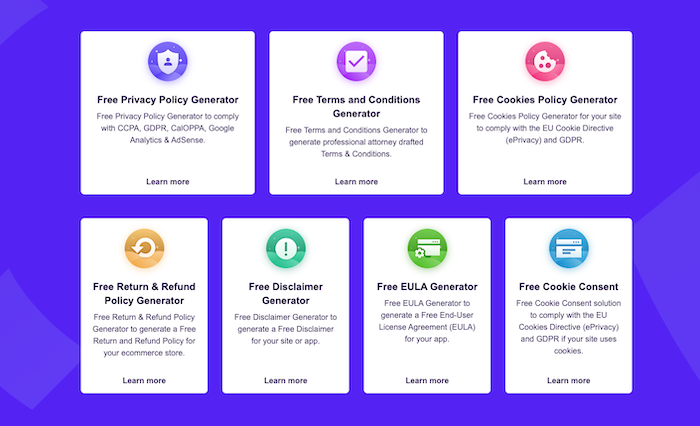

FreePrivacyPolicy is an online privacy policy generator that helps you create a privacy policy online without the hassle of hiring a lawyer to write your legalese.

This free privacy policy generator can help you comply with CCPA, GDPR, CalOPPA, COPPA, Google Analytics, and more.

With this tool, you can also generate terms and conditions, cookie tracking policies, refund and return policies, disclaimers, and more.

Answer a few pre-generated questions, download your new privacy policy, and upload it to your site.

You can also update your policy later if your terms change.

The Shopify Policy Generator can help you meet global privacy requirements and encourage customer trust.

This privacy policy generator is free with a 14-day Shopify trial, but you need to pay for a membership afterward.

Fill out a few fields on the Shopify website, and they’ll create a personalized privacy policy template you can customize later on.

You can also create a refund policy or terms of service policy with this same tool.

Privacy Policies is a free online privacy policy generator that can create privacy policies, EULAs, cookies policies, terms and conditions, and more.

Factors like your industry, operations, and platforms are considered to generate your privacy policy.

From there, you can modify, upload, and share your privacy policy with your website visitors.

Privacy Policy Online is a privacy policy generator tool that complies with international laws such as the CCPA, CalOPPA, and GDPR.

It also creates policies meeting leading advertising networks’ and third-party applications’ requirements.

Fill out a web form on the site, and Privacy Policy Online generates your new policy, ready for immediate upload.

With this tool, you can also generate terms and conditions as well as disclaimer notices.

Termly is a free online privacy policy generator to help you create a privacy policy for your website or mobile app.

It’s effective for GDPR, CCPA, CalOPPA, Google Analytics, AdSense, e-commerce laws, and more.

Termly also boasts automatic attorney updates, meaning whenever new legislation is approved, your current privacy policy will be amended and automatically updated.

You can create multiple policies for different platforms, helping to ensure you’re protected no matter where your services exist.

Yes, privacy policy generators are a great way to create a compliant, legal document to let your website visitors know how you use and store their information.

You can either hire a lawyer to create a privacy policy or use a privacy policy generator online.

Many privacy policy generators offer free services. Check out our list of privacy policy generators above to find the right one for you.

No. Terms of use and privacy policies are copyrighted documents. You need to create a unique privacy policy for your business.

Creating a unique and tailored privacy policy can be daunting.

Hiring a lawyer, using legalese, and adhering to global marketing laws is no easy feat.

Luckily, privacy policy generators are available to help you create a privacy policy for your website or business.

A well-crafted privacy policy can also help you build trust with your customers and improve your brand integrity going forward.

What’s your favorite privacy policy generator?

Article URL: https://www.ycombinator.com/companies/628/jobs/oc7r6dIgO-engineering-lead Comments URL: https://news.ycombinator.com/item?id=26653129 Points: 1 # Comments: 0

Personal privacy Trees The home I expanded up in had a personal privacy fencing that got to all around the boundary. Personal privacy fencings appear a little bit as well obvious for me. That is when I uncovered personal privacy trees. A great deal of individuals like personal privacy hedges as well as trees. Unless …

The post Personal privacy Trees first appeared on Online Web Store Site.

The post Personal privacy Trees appeared first on ROI Credit Builders.

Personal privacy Trees The home I expanded up in had a personal privacy fencing that got to all around the boundary. Personal privacy fencings appear a little bit as well obvious for me. That is when I uncovered personal privacy trees. A great deal of individuals like personal privacy hedges as well as trees. Unless …

The post Personal privacy Trees first appeared on Online Web Store Site.

Online Privacy And Security The right to personal privacy is a significant concern for all online. It is your obligation to make sure the personal privacy of your internet website visitors. Since they fear their individual details might be mistreated or endangered, several individuals stop working to end up being on-line customers. Identification burglary, bank …

The post Online Privacy And Security first appeared on Online Web Store Site.

The post Online Privacy And Security appeared first on ROI Credit Builders.

Online Privacy And Security The right to personal privacy is a significant concern for all online. It is your obligation to make sure the personal privacy of your internet website visitors. Since they fear their individual details might be mistreated or endangered, several individuals stop working to end up being on-line customers. Identification burglary, bank …

The post Online Privacy And Security first appeared on Online Web Store Site.

The post Online Privacy And Security appeared first on ROI Credit Builders.

Electronic Banking as well as Privacy Policies

Personal privacy plan regulations impacts electronic banking equally as it does any kind of various other kind of financial facility. You may wish to maintain your individual info exclusive. It is excellent to understand just how your financial institution deals with personal privacy plan if so.

A research study was done to establish just how well various financial institutions, consisting of electronic banking firms, managed personal privacy plan. All banks need to have personal privacy plans that are customer pleasant. This remains in maintaining with the spirit of the legislation.

The legislation concerned is the Gramm-Leach-Blily Act, or GLB, as it is frequently called. This was established by Congress in July of 2001. It enables to banks to perform organisation in lots of essential methods.

To customers, there is an area dedicated to the personal privacy of financial consumers, consisting of internet financial clients. Financial institutions need to give customers with a duplicate of their personal privacy plan. This clarifies just how your individual details will certainly be utilized by electronic banking procedures and also various other financial institutions.

Your individual info would certainly consist of any kind of details that can be determined as your specific details. Maybe your name, address, social safety number, electronic banking purchases you have actually made in your name, as well as various other details. It can additionally be any kind of info that can be presumed by having a few of this info.

The research reviewed physicals financial institutions, clicks to blocks financial institutions, online financial institution electronic banking procedures, and also various other banks. It contrasted each firm’s personal privacy plan, exactly how they notified customers concerning their personal privacy plan, and also what alternatives customers had with them to “opt-out.”.

You are stating to the firm that you do not desire your details to be shared with various other business that are not connected with the financial institution if you opt-out. Under GLB, electronic banking solutions still have the alternative of sharing your details with associates and also marketing companions, yet they need to educate you that they are doing so.

One trouble has actually been that the personal privacy plan declarations sent to customers by electronic banking firms and also various other financial institutions have actually been difficult for lots of people to figure out. They are not precisely a very easy read. There is a motion to make them less complicated to recognize.

An additional issue is that some electronic banking firms have actually made it really hard to opt-out of having their info shown unassociated organisations. It must be the simplest with electronic banking. Some internet financial firms have on the internet kinds to fill up out so that you can be completed with it in brief order.

Some internet financial websites make it virtually difficult to opt-out. They make you most likely to an 800 number, or compose for a mail-in kind, or they might not have opt-out in all. These remain in the minority, yet you need to expect them when contrasting on-line financial institutions.

The bright side is that digital electronic banking firms that provided basic financial solutions like examining and also interest-bearing accounts racked up the very best in the research. Examine out your net financial organization’s personal privacy plan prior to you authorize up if you desire to maintain your info personal.

Personal privacy plan regulation influences internet financial simply as it does any kind of various other kind of financial facility. A research was done to establish just how well various financial institutions, consisting of internet financial firms, dealt with personal privacy plan. To customers, there is an area committed to the personal privacy of financial consumers, consisting of internet financial clients. One trouble has actually been that the personal privacy plan declarations sent out to customers by web financial firms and also various other financial institutions have actually been difficult for a lot of individuals to figure out. An additional issue is that some internet financial business have actually made it extremely hard to opt-out of having their info shared with unconnected organisations.

The post Electronic Banking as well as Privacy Policies appeared first on ROI Credit Builders.

The post Electronic Banking as well as Privacy Policies appeared first on Buy It At A Bargain – Deals And Reviews.

Electronic Banking as well as Privacy Policies

Personal privacy plan regulations impacts electronic banking equally as it does any kind of various other kind of financial facility. You may wish to maintain your individual info exclusive. It is excellent to understand just how your financial institution deals with personal privacy plan if so.

A research study was done to establish just how well various financial institutions, consisting of electronic banking firms, managed personal privacy plan. All banks need to have personal privacy plans that are customer pleasant. This remains in maintaining with the spirit of the legislation.

The legislation concerned is the Gramm-Leach-Blily Act, or GLB, as it is frequently called. This was established by Congress in July of 2001. It enables to banks to perform organisation in lots of essential methods.

To customers, there is an area dedicated to the personal privacy of financial consumers, consisting of internet financial clients. Financial institutions need to give customers with a duplicate of their personal privacy plan. This clarifies just how your individual details will certainly be utilized by electronic banking procedures and also various other financial institutions.

Your individual info would certainly consist of any kind of details that can be determined as your specific details. Maybe your name, address, social safety number, electronic banking purchases you have actually made in your name, as well as various other details. It can additionally be any kind of info that can be presumed by having a few of this info.

The research reviewed physicals financial institutions, clicks to blocks financial institutions, online financial institution electronic banking procedures, and also various other banks. It contrasted each firm’s personal privacy plan, exactly how they notified customers concerning their personal privacy plan, and also what alternatives customers had with them to “opt-out.”.

You are stating to the firm that you do not desire your details to be shared with various other business that are not connected with the financial institution if you opt-out. Under GLB, electronic banking solutions still have the alternative of sharing your details with associates and also marketing companions, yet they need to educate you that they are doing so.

One trouble has actually been that the personal privacy plan declarations sent to customers by electronic banking firms and also various other financial institutions have actually been difficult for lots of people to figure out. They are not precisely a very easy read. There is a motion to make them less complicated to recognize.

An additional issue is that some electronic banking firms have actually made it really hard to opt-out of having their info shown unassociated organisations. It must be the simplest with electronic banking. Some internet financial firms have on the internet kinds to fill up out so that you can be completed with it in brief order.

Some internet financial websites make it virtually difficult to opt-out. They make you most likely to an 800 number, or compose for a mail-in kind, or they might not have opt-out in all. These remain in the minority, yet you need to expect them when contrasting on-line financial institutions.

The bright side is that digital electronic banking firms that provided basic financial solutions like examining and also interest-bearing accounts racked up the very best in the research. Examine out your net financial organization’s personal privacy plan prior to you authorize up if you desire to maintain your info personal.

Personal privacy plan regulation influences internet financial simply as it does any kind of various other kind of financial facility. A research was done to establish just how well various financial institutions, consisting of internet financial firms, dealt with personal privacy plan. To customers, there is an area committed to the personal privacy of financial consumers, consisting of internet financial clients. One trouble has actually been that the personal privacy plan declarations sent out to customers by web financial firms and also various other financial institutions have actually been difficult for a lot of individuals to figure out. An additional issue is that some internet financial business have actually made it extremely hard to opt-out of having their info shared with unconnected organisations.

The post Electronic Banking as well as Privacy Policies appeared first on ROI Credit Builders.

Electronic Banking as well as Privacy Policies

Personal privacy plan regulations impacts electronic banking equally as it does any kind of various other kind of financial facility. You may wish to maintain your individual info exclusive. It is excellent to understand just how your financial institution deals with personal privacy plan if so.

A research study was done to establish just how well various financial institutions, consisting of electronic banking firms, managed personal privacy plan. All banks need to have personal privacy plans that are customer pleasant. This remains in maintaining with the spirit of the legislation.

The legislation concerned is the Gramm-Leach-Blily Act, or GLB, as it is frequently called. This was established by Congress in July of 2001. It enables to banks to perform organisation in lots of essential methods.

To customers, there is an area dedicated to the personal privacy of financial consumers, consisting of internet financial clients. Financial institutions need to give customers with a duplicate of their personal privacy plan. This clarifies just how your individual details will certainly be utilized by electronic banking procedures and also various other financial institutions.

Your individual info would certainly consist of any kind of details that can be determined as your specific details. Maybe your name, address, social safety number, electronic banking purchases you have actually made in your name, as well as various other details. It can additionally be any kind of info that can be presumed by having a few of this info.

The research reviewed physicals financial institutions, clicks to blocks financial institutions, online financial institution electronic banking procedures, and also various other banks. It contrasted each firm’s personal privacy plan, exactly how they notified customers concerning their personal privacy plan, and also what alternatives customers had with them to “opt-out.”.

You are stating to the firm that you do not desire your details to be shared with various other business that are not connected with the financial institution if you opt-out. Under GLB, electronic banking solutions still have the alternative of sharing your details with associates and also marketing companions, yet they need to educate you that they are doing so.

One trouble has actually been that the personal privacy plan declarations sent to customers by electronic banking firms and also various other financial institutions have actually been difficult for lots of people to figure out. They are not precisely a very easy read. There is a motion to make them less complicated to recognize.

An additional issue is that some electronic banking firms have actually made it really hard to opt-out of having their info shown unassociated organisations. It must be the simplest with electronic banking. Some internet financial firms have on the internet kinds to fill up out so that you can be completed with it in brief order.

Some internet financial websites make it virtually difficult to opt-out. They make you most likely to an 800 number, or compose for a mail-in kind, or they might not have opt-out in all. These remain in the minority, yet you need to expect them when contrasting on-line financial institutions.

The bright side is that digital electronic banking firms that provided basic financial solutions like examining and also interest-bearing accounts racked up the very best in the research. Examine out your net financial organization’s personal privacy plan prior to you authorize up if you desire to maintain your info personal.

Personal privacy plan regulation influences internet financial simply as it does any kind of various other kind of financial facility. A research was done to establish just how well various financial institutions, consisting of internet financial firms, dealt with personal privacy plan. To customers, there is an area committed to the personal privacy of financial consumers, consisting of internet financial clients. One trouble has actually been that the personal privacy plan declarations sent out to customers by web financial firms and also various other financial institutions have actually been difficult for a lot of individuals to figure out. An additional issue is that some internet financial business have actually made it extremely hard to opt-out of having their info shared with unconnected organisations.

The post Electronic Banking as well as Privacy Policies appeared first on ROI Credit Builders.