Have you ever wondered what exactly is on your corporate credit report? For instance, what is it telling lenders about your business? How are lenders using the information in their decision-making process? Are they simply taking the information at face value? Do they have their own formulas and algorithms that they apply? Your corporate credit … Continue reading Real Corporate Credit Report Review

Tag: Real

Real Corporate Credit Report Review

Have you ever wondered what exactly is on your corporate credit report? For instance, what is it telling lenders about your business? How are lenders using the information in their decision-making process? Are they simply taking the information at face value? Do they have their own formulas and algorithms that they apply? Your corporate credit report may not be what you think it is. This real corporate credit review will answer these questions and more.

What Does Your Corporate Credit Report Say About You, and How Do Lenders Use It?

Before we dive in, there are a few things you need to know. First, there are many companies from which a lender can pull your corporate credit report. Next, each company offers lenders more than one report. There is no way to know, without asking the lender directly, which report they will pull from which company. It could be all, one, or any combination.

Keep your business protected with our professional business credit monitoring.

Lastly, many lenders do actually apply their own formula to the information in the report to calculate a score that they feel is most useful to them. As a result, they may not even use the actual score on your corporate credit report.

All of these things are out of your control. What you can control, to a point, is the information on the report. For example, does it contain positive information? Is the information on it accurate? These are things you can work with. If the information lenders are seeing is both positive and accurate, you should be in good shape. However, you cannot do anything about the information on the reports unless you understand what it is they are reporting, and where they get their information. So here we go.

Corporate Credit Report: Dun & Bradstreet

Dun & Bradstreet offers six different reports. The one utilized most often by lenders is the PAYDEX. This is most likely due to the fact that it is the one most like the consumer FICO score. It measures how quickly a company pays its debt on a scale of 1 to 100. Lenders like to see a score of 70 or higher. To put it in perspective, a score of 100 reveals the firm makes payments ahead of time. A rating of 1 shows they pay 120 days late, or more.

Together with PAYDEX, they offer following.

Delinquency Predictor Score

This rating determines the chance the company will not pay, will be late paying, or will come under bankruptcy. For scoring, the range is 1 to 5, with 2 being a good score.

Financial Stress Score

As you might guess, this is a measurement of the pressure on a firm’s balance sheet. It shows the possibility of a closure within a year. The range is 1 to 5, and a 2 is good.

Supplier Evaluation Risk Rating

This is a ranking that predicts odds of a firm surviving one year. It ranges from 1 to 9, with a 5 being a good score.

Credit Limit Recommendation

As the name implies, this is a recommendation for the amount of debt a company can handle. Financial institutions usually use it to establish how much credit to extend.

D&B Credit Rating

This is an estimation of overall business risk on a scale of 4 to 1, where a 2 is considered good. The smaller the number the better. The rating is given in conjunction with letters, the combination of which show a company’s net worth.

Consequently, if there isn’t enough data on a business to assign a regular rating, an alternative score is assigned. This is called a credit approval score. It is based on the number of employees. They will use any data they have available to calculate this alternative rating. That means, a company can control this to a point by ensuring D&B has all of the information they need.

Commercial Credit Score

Along with the PAYDEX, Dun & Bradstreet releases a commercial credit report in three components. Each part shows how likely the business is to default on expenses or become seriously late on payments.

Commercial Credit Score

On a range of 101 to 670, the commercial credit score anticipates the likelihood of a firm making late payments. A rating of 101 indicates it is very likely that the company will be late with payments. Likewise, a score of around 500 is good.

Commercial Credit Percentile

For this measurement, the scale runs from 0 to 100. It shows the chance of delinquency too. However, it determines this probability versus other companies in the Dun & Bradstreet system. A rating of 1 is the highest possible probability versus various other companies. The majority of loan providers consider a rating of 80 or higher to be an advantage.

Commercial Credit Class

In contrast to the other reports, this is an approach of dividing businesses into classes based on the chance of delinquency. Firms in class 1 are the least likely to be overdue. Likewise, if you are in class 2, that’s great.

Keep your business protected with our professional business credit monitoring.

What Information is Used to Calculated the Dun & Bradstreet Corporate Credit Report?

Unfortunately, the exact formula that Dun & Bradstreet uses to calculate their rankings is proprietary. However, we do understand what information they use, as well as where they get it. In fact, the main source of information is the business itself.

You see, a company has to send a financial statement to D&B before getting a complete score. Without that, a business receives a restricted score based on how many workers they have. For example, the ranking would be 1R if the business has 10 employees or even more. It’s 2R if they have fewer than 2 staff members.

Without financial statements, a composite debt evaluation might still be offered. However, a business is only eligible for a ranking up to a 2 in this situation. They are ineligible for a 1 rating without a financial statement.

Additionally, businesses can submit trade recommendations to Dun & Bradstreet. However, it costs money to do so. Of course, there is no guarantee it will lead to a score boost. Also, if you are building business credit properly, it will happen for free anyway.

In addition, Dun & Bradstreet accesses public documents. In doing so, they try to find liens, insolvencies, or anything else that can show creditworthiness, or its absence.

Corporate Credit Report: Experian Business Credit Scores

Experian gathers data from a lot of the same sources as Dun & Bradstreet. As a result, their reports are similar. There are a few key differences in sources, calculation, and also presentation however.

Intelliscore Plus

Experian uses the Intelliscore Plus credit score, which shows a statistics-based credit risk. The result is, it is a highly predictive score that can help users make well-informed credit decisions.

The Intelliscore scores range from 1 to 100, with a higher score indicating a lower risk class.

Score Range Risk Class

| Low Risk | 76-100 |

| Low-Medium Risk | 51-75 |

| Medium Risk | 26-50 |

| High-Medium Risk | 11-25 |

| High Risk | 1-10 |

Exactly How Does Experian Compute the Intelliscore Rating?

One of the things Intelliscore is most known for is the identification of key factors that can indicate how likely a business is to pay its debt. In fact, over 800 variables go into the Intelliscore Plus calculation. Many of them are from the list of general information all credit agencies look at. However, some are unique to Experian. So here’s a breakdown.

Payment History

As you might imagine, this is your current payment status. That means, it shows how many times accounts have become delinquent. It also shows how many accounts are currently delinquent, as well as the overall trade balance.

Frequency

This one shows how many times your accounts have gone to collections. In addition, it notes the number of liens and judgments you have. Also, it shows any bankruptcies related to your business or personal accounts.

Frequency also incorporates information about your payment patterns. Were you regularly slow or late with payments? Did you decrease the number of late payments over time? That affects your score.

Monetary

This specific factor focuses on how you make use of credit. For example, how much of your available credit are you using right now? Do you have a high ratio of late balances when compared with your credit limits?

Of course, if you are a new business owner, a lot of this information will not exist yet. Intelliscore Plus handles this by using a blended model to identify your score. This means your personal credit score becomes part of determining your business’s credit score.

Experian’s Blended Score

The blended score is a one-page report that provides a summary of the business and its owner. A combined business-owner credit scoring model works better than a business or consumer only model. In fact, blended scores have been found to outperform consumer or business scores alone by 10 – 20%.

Experian Financial Stability Risk Score (FSR)

FSR predicts the potential of a business going bankrupt or not paying its debts. Consequently, this score identifies the highest risk businesses by using payment and public records. They look at a number of factors, some of which include:

- high use of credit lines

- severely late payments

- tax liens

- judgments

- collection accounts

- risk industries

- length of time in business

Corporate Credit Report: The Equifax Service Credit Rating

Similarly, Equifax shows three different points on its corporate credit report. These include:

Equifax Payment Index

Similar to PAYDEX, Equifax’s payment index is a measurement on a scale of 100. It shows how many of your small business’s payments were made on time. Like the others, it uses data from both creditors and vendors. However, it’s not meant to anticipate future behavior. That is what the other two scores are for.

Equifax Credit Risk Score

This score shows the likelihood of your company becoming severely delinquent on payments. Scores range from 101 to 992 and include an evaluation of:

- Available credit limit on revolving credit accounts, including credit cards

- Company size

- Proof of any non-financial transactions (like merchant invoices) which are late or were charged off for two or more billing cycles

- Length of time since the opening of the earliest financial account

Equifax Business Failure Score

Equifax’s business failure score takes a look at the risk of your business shutting down. It runs from 1,000 to 1,600 and bases its scoring on these factors:

- Total balance to total current credit limit in the past three months

- The amount of time since the opening of the oldest financial account

- Your small business’s worst payment status on all trades in the last 24 months

- Proof of any non-financial transactions (like merchant invoices) which are late or are on a charge off for two or more billing cycles

For the credit risk and the business failure scores, a rating of 0 means bankruptcy.

Equifax Scores

A positive Equifax score for your business is as follows:

- Payment Index 0 to 10

- Credit Risk score 892 to 992

- Business Failure score 1400 to 1600

Are These the Only Agencies Where You Can Get a Corporate Credit Report?

In short, no. In fact, there are multiple other agencies that will issue a corporate credit report. These, however, are known as the big three. They are the most commonly used. Still, there has been an increase in the use of another option recently. It’s the FICO SBSS.

Keep your business protected with our professional business credit monitoring.

Corporate Credit Report: What is the FICO SBSS?

So, the FICO SBSS is the business variation of your personal FICO credit report. Unlike your personal FICO, the SBSS reports on a scale of 0 to 300. The higher the score the better. However, the majority of loan providers demand a rating of least 160.

Exactly how is the FICO SBSS Scored?

Surprisingly, it is significantly different from other business credit scoring designs. The SBSS utilizes your corporate credit score and individual credit rating. It also makes use of monetary details like business assets and income. As you can see, the goal is to give an overall financial picture rolled into one rating.

Business owners cannot access their FICO SBSS by themselves. There is a proprietary formula for score computations. FICO does not make that info public. The result is, you go into lending institutions blind as to what your FICO SBSS credit rating might be.

Furthermore, lenders can choose how certain factors are weighted in the computation of your score. This means your FICO SBSS could actually be different from one lender to the next. For example, one lender could put more weight on your business payment history, while another could lean more on your personal credit score.

Corporate Credit Reports: What Can You Do?

Now that you know who issues them, how they are calculated, and what information lenders may see, you can begin to figure out how you can ensure your corporate credit report contains as must positive information as possible. The number one thing you can do is make your payments on time. Regardless of what report they look at from which agency, the thing all lenders care about most is that you pay your bills.

In addition, you can monitor your credit reports to ensure all information is complete and accurate. If you see a mistake, contest it. Do so in writing, and be sure to send copies of any backup documentation. If you see old information, get it updated. You don’t want old addresses or closed accounts causing problems. Monitor your corporate credit for a fraction of what it costs with the reporting agencies directly here.

In the end, the most important thing you can do for your corporate credit report is to make your payments consistently on-time. The rest is important, but this is the number one thing lenders look for when it comes to making credit decisions.

The post Real Corporate Credit Report Review appeared first on Credit Suite.

Paper Trading And The Transition To Real Money Trading

Paper trading is extensively talked about concerning its values, and also whether it is of worth to an investor as they attempt to make the shift to actual cash investor. One perspective is that considering that paper trading is unreal, the earnings are useless, and also are no sign of genuine cash productivity. A contrary perspective would certainly specify that paper trading is an essential action in the investor’s understanding development, and also despite whether it is actual, if the investor can not ‘appropriately’ paper profession, after that they will certainly not have the ability to genuine cash profession.

I started selling very early 1995, with the objectives of coming to be an alternatives investor; my very first trading education and learning was via an oex choices mentor solution. Choices training, the solution consisted of ‘tape’ analysis, profession administration AND sp500 index futures trading– likewise consisted of in the solution was the common mindset that paper trading was for ‘sissies’.

I was a brand-new investor, attempting to find out and also comprehend entirely brand-new principles and also suggestions – what was called a trading approach AND I was ‘exercising’ with genuine cash– since paper trading was for ‘sissies’. Shedding cash and also a trading psychology ‘accident’, both from the losses as well as ideas like I was as well ‘foolish’ to ever before find out exactly how to trade, ended up being a mix which took me out of futures trading, and also after that however brought over right into my alternatives trading which I had actually formerly been doing well with.

Paper Trading Viewpoints

Also if this is appropriate, is it actually a problem unless the investor plans to be a scalper, trading for really tiny revenues, as well as therefore each tick is essential? This would certainly be my perspective, and also in this ability paper trading fill costs are not a concern.

No, there isn’t any type of monetary danger in paper trading, however I really have not satisfied virtually as numerous rewarding paper investors as one could anticipate. Also if the concern was just one of economic threat– would not you desire to start with the self-confidence of understanding that you were paper trading rewarding? It would certainly be difficult to think of a shedding paper trading being able to productively trade actual cash.

The revenues aren’t genuine– just how can you not take a ‘base’ technique configuration when paper trading– isn’t that the factor? Would certainly you be in arrangement, that if paper trading earnings could be watched in this style, that it has the capability to come to be therefore psychological and also really actual to the investor? I would certainly recommend that this is associated to paper trading actually not being ‘so very easy’, and also as pointed out over, self-worth threat can be really psychological.

Instances like this, feelings can be included to the paper trading procedure. What’s the factor, as well as when you think about the underlying ramifications of ‘requiring’ to do this– the concern absolutely isn’t regarding whether paper trading is of worth or not, however absolutely finest to locate out prior to trading actual cash. You will rapidly locate out simply exactly how psychological paper trading can be– really an extremely useful workout for the paper investor to do.

Paper Trading And Making It Further Beneficial

I have 2 primary issues with paper trading, however this is with the investor’s technique, and also not with paper trading necessarily: (1) the investor does ‘points’ paper trading that they would-could refrain from doing with actual cash (2) the investor sights paper trading earnings, as opposed to paper trading effectiveness, as the standard of whether they prepare to start trading genuine cash.

I have actually seen as well numerous paper investors, continually as well as intentionally, over profession ‘non-plan’ professions, with trading dimension that is higher than they can manage the margin for in a genuine account– allow alone approve the threat of loss, while likewise holding professions for danger quantities that they would certainly not approve with genuine cash. Watching paper trading as a ‘action’ in the discovering development as well as change to genuine cash trading, it is vital that the paper investor just trades precisely what, and also exactly how they would certainly trade with genuine cash.

There is an issue with concentrating on trading earnings -vs- trading efficiency. This is what I am referring to when I believe of trading efficiency. When an investor asks concerning including trading dimension, taking the mindset that if they can make $100 trading 3 agreements, after that they can make $1,000 by trading 30 agreements, the very first point I ask them is what is their effectiveness proportion– why rise agreement dimension as well as the equivalent trading threat, if you ‘should’ be able to make even more cash from smaller sized dimension?

What Is Your Viewpoint Regarding Paper Trading?

I never ever assumed that I would certainly ever before make a cent trading, not to mention have the ability to trade for a living or come to be entailed with attempting to show others to trade– was this merely a feature of beginning again as well as paper trading? Provided that is as well simplified, nonetheless, I do recognize that it would certainly have definitely transformed the starts that I had, while significantly reducing my knowing contour, as well as lowering a great deal of discomfort.

Plainly, I get on the ‘side’ that thinks that paper trading is not just valuable, however that paper trading is likewise needed– nevertheless the worth got will certainly be dependant upon the investor’s method and also mindset. It goes without saying, paper trading as defined is something that I have actually constantly highly suggested.

I was a brand-new investor, attempting to discover as well as comprehend entirely brand-new ideas as well as suggestions – what was called a trading approach AND I was ‘exercising’ with genuine cash– due to the fact that paper trading was for ‘sissies’. Shedding cash and also a trading psychology ‘wreckage’, both from the losses and also ideas like I was as well ‘foolish’ to ever before discover just how to trade, came to be a mix which took me out of futures trading, as well as after that regrettably brought over right into my choices trading which I had actually formerly been doing well with. Watching paper trading as a ‘action’ in the understanding development and also change to actual cash trading, it is essential that the paper investor just trades specifically what, and also just how they would certainly trade with genuine cash. There is a trouble with concentrating on trading earnings -vs- trading efficiency. When an investor asks regarding including trading dimension, taking the perspective that if they can make $100 trading 3 agreements, after that they can make $1,000 by trading 30 agreements, the very first point I ask them is what is their efficiency proportion– why boost agreement dimension and also the matching trading threat, if you ‘should’ be able to make even more cash from smaller sized dimension?

The post Paper Trading And The Transition To Real Money Trading appeared first on ROI Credit Builders.

Realty Agent Guide-Best Real Estate Agent Makes Best Deal

Realty Agent Guide-Best Real Estate Agent Makes Best Deal

An actual estate representative discovers vendors for customers as well as customers for the vendors of actual estate. Genuine estate representative can be an individual as well as a company that assists you in selling/buying actual estate.

Genuine estate broker informs you the existing worth of genuine estate. Genuine estate broker offers with commercial, domestic as well as industrial actual estate. Representative can supply assistance for any kind of kind of genuine estate.

Occasionally genuine estate representatives function without having any type of kind of genuine estate broker agent. You must be mindful of such points at the assigning a genuine estate representative.

Call 2 or even more representatives for meeting and after that ask some concerns regarding the companies where they benefited time, managing which sort of clients, for how long they’re in sell/purchase company as well as additionally inquire about energetic variety of customers. After obtaining called for info regarding them choose 1 or 2 finalists from them. Later on make a solitary phone call to picked property representatives and also choose just one that is the most effective.

Typically genuine estate representatives do not function as legal representatives for the celebrations however they offer the ideal solutions for the vendors as well as purchasers. For purchasers, genuine estate representative locates the much better actual estate as per purchasers’ demands.

Obtain your realty representative immediately!

An actual estate representative discovers vendors for purchasers and also purchasers for the vendors of genuine estate. Genuine estate representative can be an individual as well as a company that assists you in selling/buying actual estate.

Often actual estate representatives function without having any type of kind of actual estate brokerage firm. For purchasers, actual estate representative discovers the much better actual estate as per purchasers’ demands.

The post Realty Agent Guide-Best Real Estate Agent Makes Best Deal appeared first on Buy It At A Bargain – Deals And Reviews.

The Real Secret to My Social Media Success

The other day I was recording a podcast episode with my

co-host Eric Siu and he wanted to discuss something in particular.

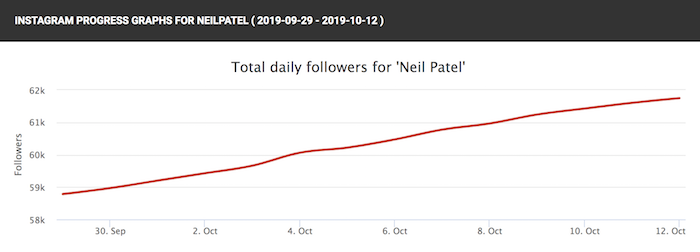

He wanted to talk about how I got to 62,000 Instagram followers in a very short period of time and without spending any money on ads or marketing.

Eric is a great marketer as well, and when it comes to

social media, he spends much more time than me on it and he even has people at

his ad agency dedicated to helping him grow his personal brand online.

And of writing this post, he has 4,056 followers.

It’s not just with Instagram either, I beat him on all

platforms.

Heck, he even does something that I don’t do, which is smart… he continually pays for advice. For example, he had his team jump on an hour call with Gary Vaynerchuk’s social media team so they could learn from them and grow his brand faster.

So, what’s the secret to my success?

Well, before I get into it, let me first start off by saying I love Eric to death and the point of this post isn’t to pick on him or talk crap… more so, I have a point to make and you’ll see it in a bit below.

Is it the fundamentals?

Everyone talks about strategies to grow your social following… from going live and posting frequently or talking about the type of content you should post and what you shouldn’t do.

I could even tell you that you need to respond to every comment and build up a relationship with your followers, which will help you grow your following and brand.

And although all of this is true, I dare you to try the fundamentals or the strategies that every marketing guru talks about doing. If you do, I bet this will happen…

It will be a lot of work and, if you are lucky, in the next 30 days you may get 10% more followers.

Sure, some of you will get much more growth, but you’ll find

that you can’t always replicate it and it won’t be consistent.

So, what is it then?

Is it luck?

Luck is part of some people’s success, but not most. The problem with luck is it doesn’t teach you much and it isn’t easy to replicate.

The reality is, some people will just get lucky and have tons of traction.

In other words, luck isn’t the secret. But if you do want to get “luckier”, then you can always become an early adopter which helps a bit.

How early is early?

When you jump onto a social network when it’s new, it’s

easier to grow and become popular.

For example, I got to over 30,000 Twitter followers

extremely fast when Twitter first came out.

At that time, I wasn’t as well known… it happened because of

a few reasons:

- Social algorithms are favorable early on – algorithms are typically favorable and most people will see your content. There aren’t many restrictions, hence it’s easier to grow. After a social network becomes popular, algorithms tighten up.

- Algorithms are easier to game early on – when you are early, you can use a lot of hacks to grow faster. For example, on Twitter, I would just follow tons of people a day and unfollow anyone who didn’t follow me back.

- First movers’ advantage – social networks want more users, that’s what they need to succeed. In the early stages of any platform, they want to help you gain more of a following so you will keep using their platform.

But here is the thing: even though being an early adopter helps, it’s not the secret to my success.

Just look at Instagram, I am really late to the game. But I started growing fast just this year as that is when we really started.

If you can get in early, you should do so, assuming you have

the time to invest. For example, this is the time to get in on Tiktok.

When you get in early, there is always the chance that the social network may end up flopping. But if it does take off, you’ll be ahead of your competition.

So what did I do?

Here was the secret to my growth… and it still works today. Eric Siu is even doing it with me right now.

It’s piggybacking on brands that are already popular.

When I first started, no one knew who I was. And I’m not saying everyone knows who I am today… by no means do I have a large brand like Tony Robbins.

What I did early on in my career was piggyback off of other popular brands.

For example, I hit up Pete Cashmore from Mashable, Michael Arrington from TechCrunch, Adrianna Huffington from Huffington Post, and so many other popular sites like ReadWriteWeb, Business Insider, Gawker Media, and GigaOm to name just a few.

I know some of them don’t exist anymore, but back then they were extremely popular. Anyone who was in tech, and even some who weren’t, knew about each of those sites.

So, when I got started as a marketer, I hit up all of those sites and offered all of them free marketing in exchange for promoting my brand and adding “Marketing done by Neil Patel” or “Marketing done by Pronet”, which was my ad agency back then.

Just look at the image above. TechCrunch used to link to my site on every page of their site… forget rich anchor text, it really is all about branding.

The hardest part is, I had to email and message these

influencers dozens of times just to convince them to let me help them for free.

And a lot of them ignored me or didn’t accept my offer.

But of a few said yes.

Pete from Mashable was one of the first to say yes. Once his traffic and rankings skyrocketed, his competition hit me up. Especially TechCrunch.

What was funny, though, is that I was constantly emailing TechCrunch and didn’t hear back. 6 months from my first email, they eventually accepted my offer.

I made a deal with Michael Arrington at the time in which once I boosted his traffic, he would add a logo that I did marketing for him, which you saw above.

In addition to that, he would tell all of his venture capital friends what I did for him and share the results (so hopefully they would share it with their portfolio companies, which would help me make money) and write a blog post about me.

He didn’t end up writing the blog post, which is fine, but he

did the other two.

When he sent out emails to VCs showing a Google Analytics graph of his traffic growing at a rapid pace, I quickly got inundated with inquiries about my marketing services.

In addition to that, I was building up my brand… and my

social media following. I was gaining “social clout” because I was doing good

work for influencers.

One could argue that boosting traffic for someone like TechCrunch by 30% is worth millions and I should have charged for my services. Although I spent countless time doing free work, I wouldn’t trade it for any single dollar as it is what made me and helped build up my reputation.

And I didn’t stop there. Even today, I try to associate myself with other popular brands. Just like how I was lucky enough to work with Robert Herjavec, who has a popular TV show in the US along with Mark Cuban…

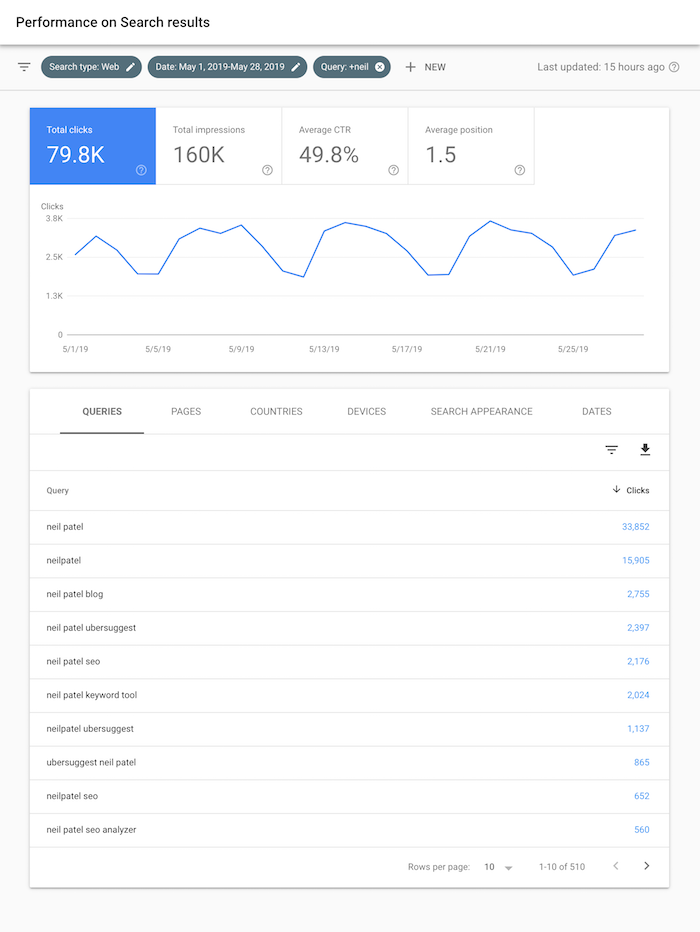

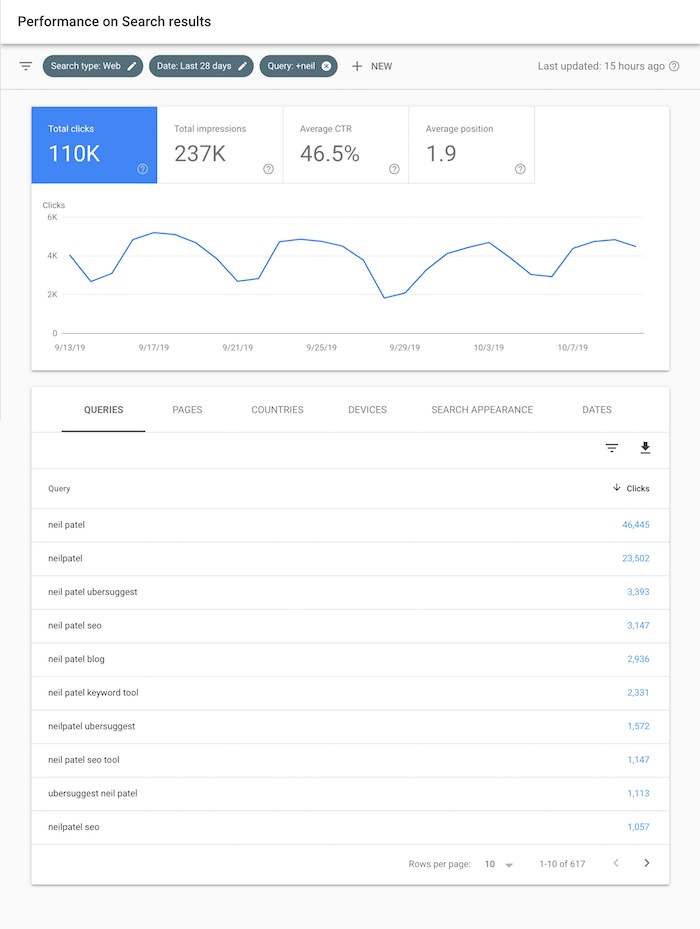

Here’s how many visitors I was getting for my name “Neil Patel” on a monthly basis before I started working with Robert.

And this is how many visitors I get for my name on a monthly

basis a few months after I worked with Robert.

That’s a 37.84% increase in a matter of months!

By piggybacking off of popular brands, it doesn’t just help my website traffic but also helps to grow my social media following as well.

Just like as you can see below with my Instagram growth…

Now it isn’t just me who can do this, anyone can.

How can you piggyback off of other brands?

Just like how I piggybacked off of brands like TechCrunch, Eric is doing something similar to me at the moment.

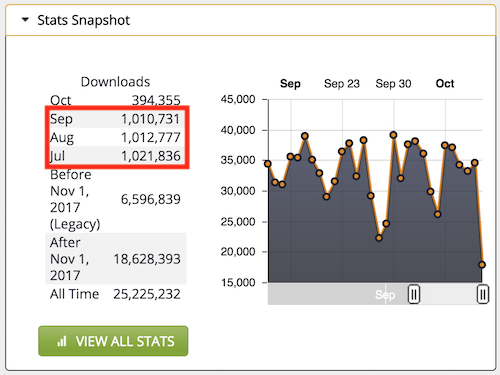

We have a podcast that generates over 1 million downloads a month.

Eric’s had a podcast for years, but the one he has with me has more than 10x the listeners. This has helped him grow his brand a lot over the last year.

Let’s just look at the data. According to Eric, due to the podcast, he has signed up 6 clients, which has generated 540,000 dollars in annual revenue.

Now when he goes to tech conferences, 3 to 4 people tend to come up to him and mention how they love Marketing School and his work. In addition to that, it has been easier for Eric to set up meetings (people respond back to him more now), and he is also getting advisory shares in companies due to his growing brand. And the best part is, he is getting more paid speaking gigs for up to $10,000 a pop because of the podcast.

The data shows it was a good move by Eric for partnering up with me. He pushed me to do a podcast years ago and I told him no because I was too lazy. He didn’t give up though. Eventually, he got me to say yes and flew to my house in Las Vegas to record our first episode.

He did all of the work and it has been a great mutual relationship as doing this podcast has also helped grow my brand at the same time.

Now you are probably thinking, why isn’t his follower count growing fast enough?

Well, he needs to do what he is doing with me with a few more influencers to really put fuel to the fire. Just like how I didn’t only piggyback off of TechCrunch… at one point the Gawker Media network was linking to me on every page of their sites, which was seen by over 100 million unique people per month.

That really gets your brand out there!

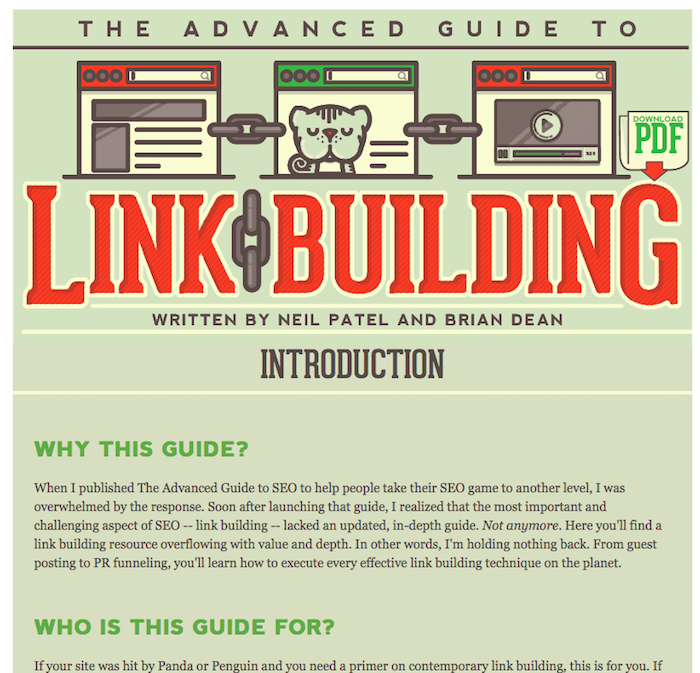

Another example is Brian Dean from Backlinko as he did something similar with me back in the day. Years ago I approached him to write a detailed guide on link building with him and he also created videos that were on my old marketing blog Quick Sprout, which helped him grow his brand.

I can’t take credit for “making” Eric or Brian successful. They would have done well without me… and in the grand scheme of things, I really didn’t do much for either of them.

It’s like saying TechCrunch made the Neil Patel brand. Of course, it helped, and helped a lot… but one partnership won’t make or break you.

And if I didn’t continually blog, create videos, speak at events, or do any of the other stuff that I did, the TechCrunch partnership wouldn’t have been as effective.

Eric and Brian would have grown their brand in other ways because their work stands for itself, hence they would have been successful on their own. I just helped provide a little boost, just like how TechCrunch provided me with a boost.

And once more people get to know you, you’ll naturally do

better on the social web.

For example, when Will Smith created his Instagram account, he didn’t have to buy ads or anything. Everyone just knows him already and that’s why his Instagram account blew up really quickly.

And you can do what Will Smith did on a smaller scale. Similar to what I did.

But don’t expect it overnight. Will Smith has been on television for over 20 years. It’s multiple shows, movies, and connections with other famous people that have really helped grow Will’s brand.

Of course, we won’t get on TV as Will has, but you can piggyback on other popular brands multiple times to create a similar (smaller) effect.

All you have to do is help these influencers out for free.

If you are a web designer, offer design services. If you are

a marketer, offer marketing services. If you are selling a product or service,

keep giving it away for free and maybe someone will talk about your company.

If you don’t have anything you can offer that has value, just look at whatever influencer you want to associate with, see where they may need help, learn that skill, and offer it for free.

It’s the easiest way to become popular on the social web.

Conclusion

That’s my secret to being popular on the social web.

It’s also how I built a decent size company… purely by

leveraging other popular brands in the early days.

You can do the same, but you have to be patient. Don’t expect it to happen overnight.

For example, Eric’s brand has been growing but we have been

doing a podcast together for over 2 years now.

Plus, he continually pushes on his own and doesn’t just rely

on leveraging other influencers.

Remember, nothing worthwhile happens overnight.

You have to be persistent with your emails, your direct messages, your text messages, and whatever else you can do to get a hold of these influencers. Most will ignore you but it is a numbers game and, eventually, you’ll be able to associate your brand with someone popular, which will grow your brand.

And last but not least: Don’t expect an influencer to make you successful. Sure, multiple influencers are better than one, but that’s not what I meant.

If Brian Dean from Backlinko wasn’t good at link building, creating content, SEO, and educating, he wouldn’t do well… no matter who he associated himself with. The same goes for Eric.

Your skills, your abilities, your product… whatever you are

trying to brand needs to stand on its own.

So, what do you think about my secret? Are you going to

copy it?

The post The Real Secret to My Social Media Success appeared first on Neil Patel.

The Real Cure for Inequality

The post The Real Cure for Inequality appeared first on #1 SEO FOR SMALL BUSINESSES.

The post The Real Cure for Inequality appeared first on Buy It At A Bargain – Deals And Reviews.

Attention All Residential Real Estate Agents Learn All About Business Credit Cards for Startups

Just Getting Your Residential Real Estate Business Off the Ground? Then You Need Get Business Credit Cards for Startups

We looked at a bunch of business credit cards for startups, and did the research for you. A residential real estate agency will need any number of goods and services to get off the ground. So here are our preferences.

Per the SBA, company credit card limits are a whopping 10 – 100 times that of personal credit cards!

This shows you can get a lot more money with business credit. And it also means you can have personal credit cards at retail stores. So you would now have an added card at the same retail stores for your company.

And you will not need collateral, cash flow, or financial data in order to get business credit.

Credit Card Benefits

Benefits can differ. So, make sure to select the perk you like from this choice of alternative business credit cards for startups.

Business Credit Cards for Startups with Average Credit

Capital One® Spark® Classic for Business

For average credit, we like the Capital One Spark Classic for Business. It has no yearly fee. There are cash-back rewards. The card earns an unlimited 1% cash back on all purchases. There is an annual fee of $0.

With this card, you will get benefits including an auto rental collision damage waiver, and purchase security. And you also get extended warranty coverage. And you get travel and emergency assistance services.

But REMEMBER: the ongoing APR is 24.74% variable APR. And the penalty APR is even higher, 31.15%. Also, there is no sign-up bonus.

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Business Credit Cards for Startups for Low APR/Balance Transfers

Discover it® Cash Back

Check out the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based upon the Prime Rate.

Details

You can get 5% cash back at different places every quarter. So, these are places like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. In addition, automatically get unlimited 1% cash back on all other purchases.

You will earn an unlimited dollar-for-dollar match of all the cash back you have gotten at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Business Credit Cards for Startups with No Annual Fee

Uber Visa Card

Check out the Uber Visa Card. Uber is the very first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays.

The card offers 4% back per dollar spent at restaurants, takeout and bars, including UberEATS. Also, get 3% back on hotel, airfare and vacation home rentals. And earn 2% back on online purchases.

So, this includes retailers and subscription services like Uber and Netflix. And get 1% back on all other purchases. Each percent/point has a value of 1 cent. Redeem points for cash back, gift cards or Uber credits directly within the app.

By spending at least $500 in the initial 90 days, users can earn a $100 sign-up bonus. Cardholders spending a minimum of $5,000 per year are eligible to receive a $50 credit toward online subscription services.

Details

If you pay your cellphone bill with this card, you are insured up to $600 for cellphone damage or theft.

Cardholders are eligible for exclusive access to specific events and offers. Uber anticipates most of these offers will be available in major cities like New York, San Francisco, Los Angeles, Chicago and DC. There is no foreign transaction fee.

But there is no introductory rate. The APR is a variable 16.99%, 22.74% or 25.74%, based on your creditworthiness. Cardholders with less than stellar credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits within the Uber app, accumulate at least 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, in a given day.

Get it here: https://www.uber.com/c/uber-credit-card/

Costco Anywhere Visa® Business Card by Citi

Not taking Uber? Then you’ll want to fill your gas tank someway. Why not do so with the Costco Anywhere Visa® Business Card by Citi?

This credit card earns cash back with every purchase. Get 4% cash back on the first $7,000 spent on eligible gas purchases annually (1% after that). Get 3% cash back at restaurants and on eligible travel purchases. Also, get 2% cash back at Costco and Costco.com. And earn 1% cash back on all other purchases.

Note: the $0 annual fee is only for Costco members. And an active Costco membership is required. Cardholders will get access to damage and theft purchase protection, extended warranty coverage and travel accident insurance.

Also, there is no sign-up bonus offered with this card.

Get it here: https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-business-credit-card

Ink Business Cash℠ Credit Card

Have a look at the Ink Business Cash ℠ Credit Card. Businesses can get cash back with each purchase. Spend $3,000 in the first three months from account opening. And you’ll earn a $500 bonus cash back.

There is a $0 yearly fee with a 0% introductory APR for 12 months on purchases and balance transfers. Thereafter, the APR is a 15.24 – 21.24% variable.

The credit card includes travel and purchase coverage benefits. So, this includes an auto rental collision damage waiver and extended warranty protection.

Details

Earn extra cash back on business categories. So, these include office supply stores, telecommunications, gas stations and restaurants.

Note: this card has a balance transfer fee. Pay 5% of the amount transferred or $5, whichever is greater. Also, there is a foreign transaction fee of 3%.

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-cash

United MileagePlus Explorer Business Card

Get a good look at the United MileagePlus Explorer Business Card.

Earn 2 miles/dollar with United and at restaurants, gas stations and office supply stores. All other purchases earn 1 mile/dollar. Earn a 50,000-mile sign-up bonus after spending $3,000 in the first three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation.

Details

Also, get two United Club passes annually. And get hotel and resort perks including upgrades. Additionally, get early check-in and late checkout. And get an auto rental collision damage waiver.

And also, get baggage delay insurance, lost luggage reimbursement, trip cancellation and interruption insurance. Finally, get trip delay reimbursement, purchase protection, price protection and concierge service.

After the first year, the card has an annual fee of $95. APR of 17.99% – 24.99%, based on creditworthiness.

Get it here: https://creditcards.chase.com/small-business-credit-cards/united-mileageplus-explorer-business

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Starwood Preferred Guest® Business Credit Card from American Express

Another possibility is the Starwood Preferred Guest Business Credit Card from American Express.

This card is for those who stay at Starwood Preferred Guest and Marriott hotels often. Get six points per dollar of eligible purchases at participating SPG and Marriott Rewards hotels.

And get four points per dollar at American restaurants, American filling stations, and on American purchases for shipping.

Also, get four points to the dollar on wireless telephone services purchased directly from US service providers. For all other eligible purchases, earn two points per dollar.

Details

Get 75,000 bonus points when you spend $3,000 in the first three months of account opening. Benefits include free in-room premium internet access, Sheraton Club lounge access, and purchase protection.

Plus you get car rental loss and damage insurance. And you get baggage insurance. There is also a global assistance hotline. And there is a roadside assistance hotline. And get travel accident insurance and extended warranty coverage.

The most significant issue is the annual fee. There is a $0 introductory annual fee for the first year, then it’s $95 after that. Plus there is no 0% introductory APR. Instead, there is a 17.74 – 26.74% variable APR

Get it here: https://www.americanexpress.com/us/credit-cards/business/business-credit-cards/spg-amex-starwood-credit-card

Business Credit Cards for Startups for Cash Back

SimplyCash Plus Business Credit Card from American Express

Take a look at the SimplyCash Plus Business Credit Card from American Express. There is a $0 annual fee. And there is a 0% APR on purchases So this is for the first 15 months an account is open.

But when the introductory period runs out, the APR for purchases is 14.24 to 21.24%. So, this is variable and based on creditworthiness.

Details

This credit card has several benefits. These include purchase protection, car rental loss and damage insurance. And they also include a baggage insurance plan, extended warranty coverage and a global assist hotline.

Also, earn 5% cash back at US office supply stores and on wireless phone services. So, these must be bought from American providers. But this pertains to the initial $50,000 of yearly spending. Then, you earn 1% cash back.

You also get 3% cash back on spending category of your choice. So, this is from eight distinct categories. They include airfare, gas, advertising and computer purchases. But it applies to the first $50,000 of yearly spending. Then, you earn 1% cash back.

Cash-back bonuses are automatically credited to the customer’s billing statement.

Note: you cannot use this credit card for balance transfers. There is a foreign transaction fee of 2.7%. The credit card charges up to $38 in late fees. And the returned check fee is also $38. The penalty APR is 29.99%.

And, it kicks in if you have two or more late payments within 12 months. It can also apply if you fail to make the minimum payment on time or have a returned payment.

Get it here: https://www.americanexpress.com/us/small-business/credit-cards/simply-cash-plus-business-credit-card/44279

Capital One® Quicksilver® Card

Take a look at the Capital One® Quicksilver® Card. It offers flat-rate rewards of 1.5% on all purchases. There are no limits to the amount of cash back rewards that cardholders can earn. Also, the card has a $0 yearly fee.

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. Then afterwards they have a 14.74 – 24.74% (variable) APR after that.

A cash bonus of $150 is on offer for those who make at the very least $500 in purchases in 3 months of account opening.

Details

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

This card also offers travel accident insurance. And you get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And the higher APR after the first 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Business Credit Cards for Startups with 0% APR – Pay Zero!

Bank of America® Business Advantage Travel Rewards World Mastercard® Credit Card

The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card has no yearly fee and comes with a 0% introductory APR on purchases for the initial nine months. Afterwards, the card has a 13.24 – 23.24% variable APR

Earn 3 points/dollar spent when you book travel with the Bank of America Travel Center and 1.5 points/dollar on all other purchases. You can get unlimited points and points will never expire.

Details

There is a 25,000-point sign-up bonus when you spend $1,000 within the first 60 days of opening the account. Cardholders get travel accident insurance, and lost luggage reimbursement.

They additionally get trip cancellation coverage, trip delay reimbursement and other advantages.

There is no introductory rate for balance transfers. Also, bonus categories are limited.

Get it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

JetBlue Plus Card

Take a look at the JetBlue Plus Card for yet another offer of a 0% introductory APR

Earn six points/dollar on JetBlue purchases, two points/dollar at restaurants and grocery stores. And get one point/dollar on all other purchases.

Details

Spend $1,000 in the initial 90 days and pay the yearly fee, and earn 40,000 bonus points. New cardholders receive a 12 month, 0% initial APR on balance transfers made in 45 days of account opening.

After that, the variable APR on purchases and balance transfers is 17.99%, 21.99% or 26.99%, based upon creditworthiness. Benefits include a free first checked bag and 50% savings on in-flight purchases.

There is a $99 annual fee for this card.

Get it here: https://cards.barclaycardus.com/cards/jetblue-card/

Business Credit Cards for Startups: Secured Credit Cards

Wells Fargo Business Secured Credit Card

Have a look at the Wells Fargo Business Secured Credit Card. It charges a $25 yearly fee per credit card (up to 10 employee cards). It also requires a minimum security deposit of $500 (up to $25,000). And it is designed to help cardholders build or rebuild their credit.

Pick this card if you want to earn 1.5% per dollar in purchases without any limits or earn one point for every dollar in purchases. You also get 1,000 bonus points. So this is for every month your company makes $1,000 in purchases on the card.

Details

Also, you get free FICO scores every month. There are no foreign transaction fees. It is possible to upgrade to unsecured credit. Your account is regularly reviewed. And you may become eligible for an upgrade to an unsecured card with responsible use over time. Approval is not guaranteed and depends on factors including how you manage this and your other accounts.

APR is the current prime rate plus 11.90%. There is no introductory APR period and no sign-up bonus. This is not a credit card for balance transfers.

Get it here: https://www.wellsfargo.com/biz/business-credit/credit-cards/secured-card/

Business Credit Cards for Startups for Jackpot Rewards

Chase Sapphire Preferred® Card

Take a look at the Chase Sapphire Preferred® Card for travel points.

You can earn two points per dollar spent on travel and dining at restaurants. And you can earn one point per dollar on all other purchases. Points can be redeemed for cash back, gift cards, or travel.

The card’s benefits include trip cancellation insurance, travel and emergency assistance services. They also include an auto rental collision damage waiver, purchase protection and extended warranty protection.

When you spend $4,000 in the initial 3 months from account opening, you will earn 50,000 bonus points. These points are worth $625 if you redeem them for travel through Chase Ultimate Rewards.

Details

You can earn an unlimited two points per dollar for travel and dining at restaurants. And then earn one point per dollar for all other purchases. Points will transfer equally to 13 leading frequent travel programs with partners. So these include British Airways, Southwest Airlines, United, and Marriott.

There is no 0% introductory APR on purchases or balance transfers. The card’s standard APR is 17.74 – 24.74% variable. Also, the card has an annual fee of $0 introductory for the first year. And then it skyrockets to $95.

Get it here: https://creditcards.chase.com/rewards-credit-cards/chase-sapphire-preferred

Ink Business Preferred ℠ Credit Card

Get a look at the Ink Business Preferred Credit Card from Chase. Cardholders earn 3 points for every dollar spent on travel, shipping, internet, cable, phone and qualifying advertising with the card. So, this is up to $150,000 each year. And all other purchases earn an unlimited one point per dollar spent.

This is a Visa card.

Cardholders get benefits like purchase protection, trip cancellation or interruption insurance. They also get cellphone protection. And they get extended warranty coverage. And they get an auto rental collision damage waiver.

Details

Earn 80,000 bonus points when you spend $5,000 in the initial 3 months from account opening. There is an annual fee of $95. You can add employee credit cards at no additional cost.

This credit card only offers 3 points per dollar to a limit of $150,000 a year. So, this is for travel, shipping, internet, cable, phone and qualifying advertising. All other purchases get an unlimited flat rate of one point per dollar. And there is no introductory APR

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-business-preferred

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Hilton Honors American Express Ascend Card

Take a look at the Hilton Honors American Express Ascend Card, which earns hotel rewards points. Get up to 12 points per dollar of eligible purchases at participating Hilton hotels or resorts.

Automatically get Hilton Honors Gold status. And this includes room upgrades when available, a 5th night free when you book a rewards stay of 5 nights or more.

And get free internet access and late checkout. It also includes a 25% bonus on base points earned with Hilton Honors.

This card has a variable purchase APR of 17.74 – 26.74%. There is an annual fee of $95.

Details

Cardholders can get a 125,000-point welcome offer after making $2,000 in eligible purchases in 3 months from account opening. Get a free weekend night award after making $15,000 in eligible purchases on your card in a calendar year.

Benefits include purchase protection. And there is extended warranty coverage. They also include car rental loss and damage insurance and travel accident insurance.

Spend $40,000 on eligible purchases with the card within a calendar year. Then you can earn Hilton Honors Diamond status through the end of the next calendar year. This status includes all of the benefits of Gold status.

It also includes a 50% bonus on base points earned with Hilton Honors. And get exclusive floor lounge access at select properties. But that is terribly high spending required for elite status. Only you can decide if that’s worth it.

Get it here: https://www.americanexpress.com/us/credit-cards/card/hilton-honors-ascend/

The Perfect Business Credit Cards for Startups for You

Your absolute best business credit cards for startups will hinge on your credit history and scores. For a residential real estate agency, some of the more important perks you need are probably deals on gas and other vehicle maintenance. And everyone can use low rates.

But only you can pick which features you want and need. So make sure to do your homework. What is outstanding for you could be catastrophic for others.

And, as always, make sure to build credit in the recommended order for the best, fastest benefits.

The post Attention All Residential Real Estate Agents Learn All About Business Credit Cards for Startups appeared first on Credit Suite.

Are Unicorns Real? The Myth of Start Up Business Loans for Women

The True Story of Start Up Business Loans for Women and More Resources for Female Business Owners Studies show that forty percent of new entrepreneurs in the United States are women. In addition, the number of businesses owned by women is growing at twice the rate of those owned by men, according to Kauffman. We … Continue reading Are Unicorns Real? The Myth of Start Up Business Loans for Women

Are Unicorns Real? The Myth of Start Up Business Loans for Women

The True Story of Start Up Business Loans for Women and More Resources for Female Business Owners

Studies show that forty percent of new entrepreneurs in the United States are women. In addition, the number of businesses owned by women is growing at twice the rate of those owned by men, according to Kauffman. We dive deep into start up business loans for women.

You might think this means that there are more start up business loans for women. That isn’t the case however. In fact, according to research done by Fundera, 3 out of 4 female business owners do not even apply for business loans. Those that do are asking for less money. About $35,000 less to be exact.

Even more discouraging is this. While about half of all business owners who apply for loans are approved, only 30% of women business owners get approval. This is from a study that Dun & Bradstreet did with Pepperdine University researchers.

- It is more likely that businesses owned by women will report a high credit risk. Studies show 41% of women-owned businesses report a medium to high credit risk. Only 33% of male-owned businesses report the same.

- Women-owned businesses rely heavily on SBA products and credit cards. This means they are utilizing less equity and fewer types of debt than male owned firms.

- Business owned by women are more often mismatched with funding sources. This causes them to experience funding gaps persistently, even if they have lower credit risk.

Learn business loan secrets with our free, sure-fire guide.

Start Up Business Loans for Women: Where Should Women Business Owners Look for Loans?

The truth is, unicorns do not exist. Neither to business loans specifically for women. Despite the unsavory statistics, women can get regular business loans, and there are ways to increase your chances.

A lot of the variables are outside of the borrower’s control. However, we can help you find the best places to look and the most likely sources of funding to help ensure your business does not become a statistic.

According to a survey by the Federal Reserve Bank, businesses owned by females are more likely to gain approval for loans at small banks. In fact, 67% are approved at small banks. This compares to only 50% at large banks. Those that have loans with smaller banks also note a higher satisfaction level.

What’s that mean practically? It’s probably best for women business owners to stick to smaller banks. There are more ways to increase your chances of success in finding funding however.

Use All Available Resources

These are things that every small business owner should do to increase their chances of loan approval, but female business owners should be especially prudent. There are a host of resources out there geared toward helping women business owners get the funding they need to start and run a successful business.

Small Business Administration

While the SBA exists for all small business owners, their Office of Women’s Business Ownership exists to help women business owners specifically. According to SBA.gov, “The Office of Women’s Business Ownership’s mission is to enable and empower women entrepreneurs through advocacy, outreach, education and support.”

They work with firms to ensure the best resources are available to women entrepreneurs at all stages. Whether starting a business, applying for a business loan, improving an already established business, or looking for government contracts, their mission is to support female business owners. If that’s you, this is definitely a good starting place.

National Women’s Business Council

The NWBC is a federal advisory council. It serves as a source of advice to the government on women’s business issues. Its mission is to encourage initiatives, programs, and policies to support women in business at all stages. This includes start up all the way through growth, expansion, and significance.

Other Resources for Female Business Owners

In addition to those agencies listed above, these organizations offer research and support to women owned business in many ways.

According to their website, the AWBC operates a network of women’s business centers that, “help women succeed in business by providing training, mentoring, business development, and financing opportunities to over 145,000 women entrepreneurs each year.”

The NAWBO offers national events, training opportunities, and other resources for female business owners across the country.

NAFE offers training opportunities, events, and other resources to help women in business succeed.

“SCORE is the nation’s largest network of volunteer, expert business mentors, with more than 10,000 volunteers in 300 chapters.” Get matched with a mentor or take a workshop to help you learn what you need to know to achieve business success.

What Does this Have to Do with Start Up Business Loans for Women?

Here’s the thing. Since we have established that unicorns and specific start up business loans for women are both myths, we know female business owners will always have to compete with male business owners for loans. The more support and education you have behind you, the better.

Use these resources for support and education, but also to help you find other sources of funding besides start up business loans for women. There are grant resources available through various local industries and businesses as well as certain corporations and professional organizations. These agencies can help you find those funding sources. They can also help you prepare for the application process.

Learn business loan secrets with our free, sure-fire guide.

How to Get Start Up Business Loans for Women

Now, as for traditional business loans, the best thing to do is be prepared. Most lenders need to see the following:

- Business Financial Statements or tax returns for the past 3 years

- Personal Tax returns for the past 3 years

- A professional business plan

- They will run a credit check, and the minimum credit score varies by lender.

- Other information at the discretion of the lender

- Always inquire about the application process on the front end so you can have any additional materials prepared.

The more of this you have prepped and ready to go, the faster and smoother the process should run. This information is what is required of a typical, traditional lender. There are non-traditional lenders that may require more, or less, information. You would be hard pressed to find a traditional loan that does not require a personal credit check, but there are other options.

Business Credit

If you are looking for start up business loans for women, you must need business funding. There are options for funding that rely on your business credit rather than your personal credit. What is business credit? It is exactly like your personal credit, except it is based only on the credit history of your business. This means that it is not affected by your personal credit history. Also, your personal history is not affected by anything that is on your business credit.

This is good for many reasons. First, you can access funding for your business despite a poor credit history. That is an obvious benefit. What some do not realize is, even if you pay on time, using your personal credit for business transactions can be detrimental.

That is because business transactions are, by nature, large. Personal credit limits are typically much lower than business credit limits. Because of this, business transactions can max out personal credit quickly. Consistently carrying balances near your limit negatively affects your debt to credit ratio. That, in turn, lowers your credit score even if you are making consistent on-time payments.

How to Get Business Credit

Every business needs business credit, even if you intend to apply for traditional loans. Sometimes lenders will look at business credit along with personal credit if it is available. However, it also opens up doors to other options if the traditional route isn’t going to work for some reason. If you have good business credit, your business is fundable.

The first step in establishing business credit is to ensure your business is recognizable as an entity separate from you personally. It has to stand on its own. This means that you must incorporate rather than operate as a sole proprietorship or partnership. You can organize as an s-corp. LLC, or full-fledged corporation. They each have their own benefits and costs, but for the purposes of establishing business credit they function equally.

The Rest of the Business Credit Story

Aside from incorporating, you will need to take a few other steps to lay the foundation for business credit.

- Obtain a separate business address and phone number. Make sure the phone number is through a toll-free exchange. List both in the directories under the business name.

- Get an EIN. This is an identifying number for your business so you do not have to associate it with your Social Security Number. Get one for free at gov.

- Apply for a DUNS number from Dun & Bradstreet. It’s free on their website, but beware. They will try to sell you a bunch of stuff you don’t need. Put on your blinders and power through. All you need is the number and it is free.

- Open a dedicated business checking account. Take care to run all business transactions through this account.

- Set up a professional website and dedicated business email address. The email address should have the same URL as the website and should not be from a free email service. Gmail and Yahoo will not work here.

What’s Next?

Once you have the foundation for business credit, you can start building. This is done in layers, or tiers. For example, the first tier is the vendor credit tier. This is the starting point because they will extend net 30 terms on invoices without a credit check. Then they will report your payments to the business credit agencies. This is how you begin to build business credit without involving your personal credit. By applying with your EIN rather than your social security number, you keep your personal name out of the equation altogether.

Who is in the vendor credit tier? There are dozens of vendors that will work with you in this tier. Some of the easiest to get started with include Quill, Uline, and Grainger. They each offer products that pretty much any business can use on a regular basis, so it’s simple to open an account and begin doing business with them.

After you have 5 or so accounts reporting from the vendor credit tier, you can apply for business credit cards from the retail credit tier. These are store cards from retailers such as Best Buy, Amazon, and Office Depot.

Learn business loan secrets with our free, sure-fire guide.

Get 10 or more of these reporting and you can apply to cards in the fleet credit tier. Cards from companies like Fuelman and Shell are in this tier. They can be used for automobile maintenance and gasoline purchases.

After that comes the cash credit tier. Once you have enough accounts reporting on time payments from these three tiers, you can apply for general business cards from companies like MasterCard, Visa, and American Express. At this point, your business credit is pretty well established, and it is not attached to your personal credit in any way.

Other Options for Established Businesses

If you have accounts receivable, you can consider invoice factoring. This is a way of selling your open invoices for less than cash value, but you get the cash immediately. If you have credit card sales, there is the option of a merchant cash advance. With this option, you receive a cash advance for your average daily credit card sales. Payments are typically deducted from future credit card sales on a daily, weekly, or monthly basis.

While neither of these options are ideal, they are valid and can be exactly the push you need to get your business through a tough spot.

A Final Word About Start Up Business Loans for Women

So that’s it then. Unicorns do not exist, and neither do specific start up business loans for women. There are grants that are geared specifically toward women entrepreneurs, but for the most part funding is non-gender specific. The challenges faced by female business owners can only be mitigated by solid preparation and education.

Having a solid business credit score is essential also. This will open up a world of funding options that would not be available otherwise. Business credit cards and products from non-traditional lenders are a valid option if you find yourself facing issues with start up business loans for women. That’s the important thing to remember. Just because unicorns do not exist doesn’t mean dreams do not come true. There are plenty of other options, and a white horse is almost a good as a unicorn. Business credit can be your white horse.

The post Are Unicorns Real? The Myth of Start Up Business Loans for Women appeared first on Credit Suite.

How Equity Crowdfunding for Real Estate Investors Can Help You Sleep at Night

Banish Nightmares with Equity Crowdfunding for Real Estate Investors

Real Estate investing can be scary. There are so many unknowns. All investments are risky, but being stuck with property that does not generate profit is a nightmare all on its own. There are many things to consider in a real estate endeavor. Some of them you may have thought about. For instance, do you want to invest in residential or commercial property? Others may not have crossed your mind. Equity crowdfunding for real estate investors is probably not running through your brain regularly. You can sleep peacefully and avoid the nightmares just by accessing a little information. Knowing what you are getting into and what your options are can work wonders for your peace of mind.

Stretch Your Mind

One thing that can help you get a good night’s sleep is doing stretches before bed. Stretching relaxes the muscles. It also helps avoid the twitching that can come with restless leg syndrome. Another benefit of stretching is that is prepares your mind and body to wind down.

When you begin to think about real estate investing, before equity crowdfunding for real estate investors can even be an option, you will need to stretch your mind to consider all the possibilities.

Make sure to check out how equity crowdfunding for real estate will help your company.

Residential Real Estate

There are two types of residential real estate investments. You can invest in property to re-sell for a profit, or you can invest in rental property.

Property for resale typically refers to house flipping, which is tricky. You have to find a home in a location that will sell. There has to be a balance between the work that needs doing and the resale price. A lot of things have to fall into place. Despite all of this, many people make a successful living flipping houses.

Rental investments include either single family homes, apartment buildings, or duplexes. Improvements may be necessary depending on the situation. It is important to be sure any improvements actually add value however. There is a break-even point where you will not be able to get the cost of improvements back through rental income.

Commercial Real Estate

There are a couple of sides to this. There are commercial real estate investors that purchase property for commercial use. These are the people building shopping centers, strip malls, and buildings for businesses. Most often they are companies rather than individuals.

The companies still need funding for their real estate endeavors. Thanks to the JOBS Act of 2012, they have a new way of getting that funding. It not only helps them, but it also lets individuals enjoy the benefits of commercial real estate investing. That does not sound like much, but previous to this it was very difficult for individuals to break into commercial real estate investing due to the high cost. What is this awesome new dream come true you ask? That would be equity crowdfunding for real estate investors.

Location, Location, Location

You are going to sleep better in a place that is meant for sleeping. Moreover, you are going to sleep better in your own place meant for sleeping. The best sleep comes in your own bedroom and you own bed. However, if your options are a hotel room and your car, the hotel is going to be the next best option, because its purpose is sleep. Location matters when sleeping, and it matters in real estate investment.

You have to consider the location of the property when making your investment decision. Flipping a house that is in an area no one is buying in is not a good idea. Even the most amazing house in the world won’t sell if it is in a high crime area, flood plain, or other unfortunate place. Even if it does sell, the price will likely have to be so low you incur a loss.

The same is true of rental property and commercial property. An apartment building in a college town or metropolis is a no brainer. An apartment building in a town of less than 2,000 may bear more thought. It could work, but there are many things to consider.

With commercial property, you have to think about whether the economy of the area will support the new business level.

Be sure to check out how equity crowdfunding for real estate will help your company.

Consistency

Any sleep expert will tell you than a consistent bedtime routine is important, regardless of age. The same is true when it comes to real estate investment. You need to find your niche and stick to it. If you are going to flip houses, flip houses. If you are going to be a landlord, do that. Commercial property investment your thing? Stick with it.

It is almost always impossible to do everything. It is impossible to do everything well. Pick one area of real estate investment and stick to it.

Ingredients Matter

There are some ingredients in the things we eat and drink that can cause problems with sleep. Choosing food that is good for you is necessary for keeping nightmares away. The same is true for real estate investing. You get out of it what you put into it, and where you get your funding can make a difference.

What are your funding options? You can self-fund, which isn’t an option for most. In the past, the only other option was financing. There are plenty of real estate lending products available from various sources.

Thanks to the JOBS ACT of 2012 however, there is now a new ingredient on the list. That is equity crowdfunding for real estate investors.

How Does Equity Crowdfunding for Real Estate Investors Work?

What is equity crowdfunding? How does equity crowdfunding work? To understand how this funding option works, you need to understand how crowdfunding itself works. With the JOBS Act of 2012, small businesses gained relief from a lot of requirements in place by the SEC. These requirements held many businesses back.

The Act allows for open investing options that do not require investors to register with the SEC. This applies as long as they meet certain guidelines. Thus, crowdfunding platforms are born. For entrepreneurs looking to “kick start” their business idea, you now see sites such as Kickstarter and Indiegogo. These sites allow individuals to post a business idea and accept investments as low as $5 and as high as, well, the sky’s the limit. In return, investors receive some sort of reward. It may be a some of the profits, a free product, or any number of things. It is often a reflection of the level of investment. Today there are tons of crowdfunding platforms all over the internet.

Real Estate Equity Crowdfunding

Though similar to crowdfunding for small businesses, it isn’t exactly the same. Most of those that list on real estate crowdfunding sites are commercial real estate businesses. They are seeking funding for their endeavors. Regular Joe’s can invest in a commercial real estate portfolio. This is similar to investing in a stock market portfolio. Then they can enjoy the returns without actually buying an entire piece of commercial property.