We Smuggled Out Hidden Information on How to Build a Business Credit Score in a Recession

Our research dynamos can teach YOU how to build a business credit score in a recession! The economy doesn’t have to be perfect to build business credit quickly and effectively.

Building better business credit means that your small business attains opportunities you never assumed it would.

You can get new equipment, bid on real property, and deal with the company payroll. And you can do so even when times are a bit lean. This is specifically helpful in holiday businesses, where you can go for calendar months with simply negligible sales.

Because of this, you ought to tackle building your company credit. Enhance and maintain your scores and you will have these possibilities. Do not, and either you do not get these opportunities, or they will cost you a lot more. And no company owner wants that.

So you need to know what affects your business credit before you can make it better.

How to Build a Business Credit Score in a Recession: Credit History Length Is Vital

This is essentially the length of time your business has been using business credit. Obviously newer businesses will have short credit histories. While there is not too much you can particularly do about that, do not despair.

Credit reporting agencies will also consider your personal credit score and your own history of payments. If your consumer credit is good, and particularly if you have a fairly extensive credit history, then your individual credit can come to the rescue of your company.

So that is, you did not just get your first credit card recently.

Normally the converse is also right. Hence if your individual credit history is poor, then it will have a bearing on your business credit scores. And it will do so until your small business and personal credit can be split up.

How to Build a Business Credit Score in a Recession: Don’t Allow Your Credit Utilization Rate to Harm Your Small business

Your credit utilization rate is just the amount of cash you have on credit. So it is then divided by your total available credit. Lenders in general do not wish to see this exceed 30%. Hence for every $100 in credit, do not borrow more than $30 of that.

If this percent is climbing, you’ll have to spend down and pay off your debts prior to borrowing more.

How to Build a Business Credit Score in a Recession: Your Payment History Truly Matters

Late repayments will affect your company credit score for a good seven years. If you pay your company debts off, as fast as possible, then you can make a very real difference when it relates to your credit scores.

Ensure that you pay promptly. And you will enjoy the rewards of promptness.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

How to Build a Business Credit Score in a Recession: Your Personal Credit Can Bear upon Your Business Credit

A substandard business year could end up on your personal credit score. And in case your business has not been around for too long, it will directly influence your company credit.

But don’t worry, you can separate them easily. Do so by taking measures to unlink them.

For instance, get credit cards exclusively for your firm. Or open business checking accounts and other bank accounts (or perhaps get a business loan). And then the credit reporting bureaus will begin to address your personal and small business credit independently.

Also, make sure to incorporate. Or at least file a DBA (doing business as) status. You can also pay for your company’s debts with your firm credit card or checking account. And make certain it is the company’s full name on the bill and not your own.

How to Build a Business Credit Score in a Recession: The Credit Reporting Bureaus Can Just Plain Get It Wrong

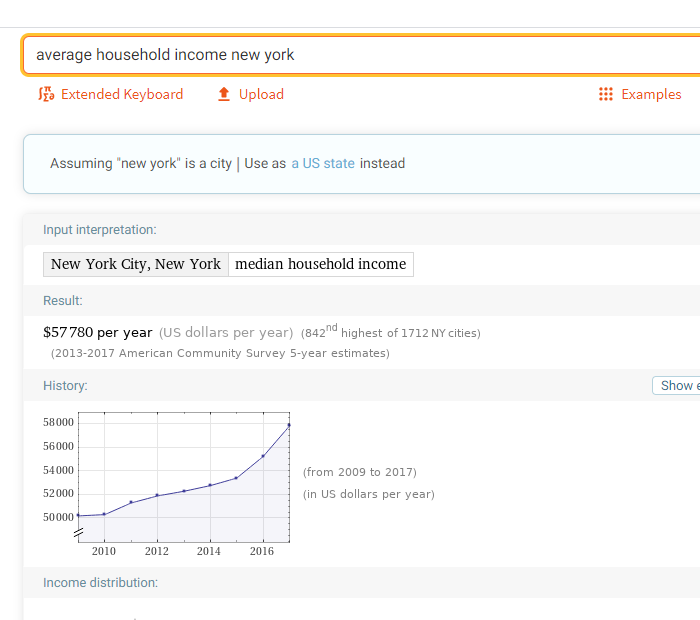

Just like each organization out there, credit reporting agencies like Equifax and Experian are only as good as their information. If your firm’s name is like another’s, there can possibly be some errors.

So check those reports, and your company report at Dun & Bradstreet, PAYDEX. Remain on top of these reports and contest charges with documentation and clear communications. Do not just let them stay incorrect! You can fix this!

And while you’re at, it you should also be overseeing the credit reporting agency which solely handles personal and not business credit, TransUnion. If you do not know how to pull a credit report, do not fret. It’s easy.

An Alternative – Business Credit!

Business credit is credit in a small business’s name. It doesn’t attach to an owner’s consumer credit, not even if the owner is a sole proprietor and the only employee of the company. Consequently, a business owner’s business and consumer credit scores can be very different.

The Benefits

Since small business credit is independent from individual, it helps to secure a business owner’s personal assets, in the event of a lawsuit or business bankruptcy. Also, with two separate credit scores, a small business owner can get two different cards from the same merchant. This effectively doubles buying power.

Another advantage is that even new ventures can do this. Visiting a bank for a business loan can be a recipe for disappointment. But building business credit, when done the right way, is a plan for success.

Personal credit scores depend upon payments but also additional factors like credit usage percentages. But for business credit, the scores truly only hinge on whether a company pays its bills on time.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

The Process

Growing business credit is a process, and it does not happen automatically. A business needs to actively work to establish business credit. Nevertheless, it can be done easily and quickly, and it is much more rapid than establishing personal credit scores.

Merchants are a big part of this process.

Doing the steps out of order will result in repetitive denials. No one can start at the top with company credit. For instance, you can’t start with store or cash credit from your bank. If you do you’ll get a rejection 100% of the time.

Business Fundability

A business has to be genuine to lenders and merchants. For that reason, a business will need a professional-looking web site and email address, with site hosting bought from a merchant such as GoDaddy.

And company telephone and fax numbers ought to have a listing on ListYourself.net.

Likewise the company telephone number should be toll-free (800 exchange or comparable).

A business will also need a bank account dedicated solely to it, and it has to have all of the licenses essential for running. These licenses all have to be in the correct, correct name of the small business, with the same business address and phone numbers.

So bear in mind that this means not just state licenses, but possibly also city licenses.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Dealing with the Internal Revenue Service

Visit the Internal Revenue Service web site and acquire an EIN for the company. They’re totally free. Select a business entity like corporation, LLC, etc.

A company can get started as a sole proprietor. But they will more than likely wish to change to a kind of corporation or partnership to decrease risk and maximize tax benefits.

A business entity will matter when it comes to taxes and liability in case of a lawsuit. A sole proprietorship means the entrepreneur is it when it comes to liability and taxes. No one else is responsible.

If you operate a small business as a sole proprietor, then at the very least be sure to file for a DBA (‘doing business as’) status.

If you do not, then your personal name is the same as the business name. As a result, you can wind up being directly responsible for all company debts.

Additionally, according to the IRS, by having this structure there is a 1 in 7 possibility of an IRS audit. There is a 1 in 50 chance for corporations! Steer clear of confusion and significantly decrease the chances of an IRS audit at the same time.

Starting Off the Business Credit Reporting Process

Begin at the D&B website and get a cost-free DUNS number. A DUNS number is how D&B gets a company in their system, to produce a PAYDEX score. If there is no DUNS number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this here. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

By doing this, Experian and Equifax will have something to report on.

Trade Lines

First you must establish trade lines that report. This is also called vendor accounts. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can start getting revolving store and cash credit.

These types of accounts have the tendency to be for the things bought all the time, like coffee, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first off, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are commonly Net 30, instead of revolving.

Hence if you get approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, like within 30 days on a Net 30 account.

Details

Net 30 accounts have to be paid in full within 30 days. 60 accounts have to be paid in full within 60 days. In contrast to with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To kick off your business credit profile the right way, you should get approval for vendor accounts that report to the business credit reporting bureaus. As soon as that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with hardly any effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

But you may have to apply more than one time to these vendors, and you may need to purchase some things you don’t need, to confirm you are responsible and will pay promptly. Consider giving nonessential things to charitable organizations.

Revolving Store Credit

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs, progress to revolving store credit. These are service providers such as Office Depot and Staples.

Use the small business’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then move onto fleet credit. These are businesses like BP and Conoco. Use this credit to purchase fuel, and to repair and take care of vehicles. Make sure to apply using the small business’s EIN.

Cash Credit

Have you been sensibly handling the credit you’ve gotten up to this point? Then move onto more universal cash credit. Keep your SSN off these applications; use your EIN instead.

These are usually MasterCard credit cards. If you have more trade accounts reporting, then these are feasible.

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and deal with any mistakes ASAP. Get in the practice of checking credit reports. Dig into the specifics, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less. Update the information if there are errors or the info is incomplete.

Disputing Errors

So, what’s all this monitoring for? It’s to dispute any errors in your records. Errors in your credit report(s) can be corrected. But the CRAs normally want you to dispute in a particular way.

Disputing credit report inaccuracies usually means you send a paper letter with copies of any proofs of payment with it. These are documents like receipts and cancelled checks. Never mail the originals. Always mail copies and retain the original copies.

Disputing credit report mistakes also means you specifically spell out any charges you challenge. Make your dispute letter as clear as possible. Be specific about the problems with your report. Use certified mail so that you will have proof that you mailed in your dispute.

A Word about Building Business Credit

Always use credit sensibly! Don’t borrow more than what you can pay off. Keep an eye on balances and deadlines for repayments. Paying in a timely manner and in full will do more to raise business credit scores than pretty much anything else.

Establishing business credit pays. Great business credit scores help a business get loans. Your lending institution knows the business can pay its debts. They know the business is bona fide.

The small business’s EIN attaches to high scores, and lending institutions won’t feel the need to demand a personal guarantee.

How to Build a Business Credit Score in a Recession: The Takeaways

Once you find out what influences your small business credit score, you are that much nearer to being able to build a business credit in a recession.

Learn more here and get started on how to build a business credit score in a recession.

The post It’s Science-backed With Our Foolproof Research: How to Build a Business Credit Score in a Recession appeared first on Credit Suite.