Steve Burton is returning to “General Hospital” after dealing with some off-screen drama that was nearly as dramatic as the soap opera that made him famous. Burton, who was let go from “General Hospital” in 2021 due to the network’s coronavirus vaccine mandate, is returning to the series after getting a divorce from his ex-wife … Continue reading Steve Burton returns to 'General Hospital' after real-life soap opera unfolds off-screen

Tag: Returns

Ferrari returns with victory in Le Mans centennial

Ferrari ended a 50-year absence from the 24 Hours of Le Mans by toppling mighty Toyota in the centenary running of the most iconic sports car race in the world.

The post Ferrari returns with victory in Le Mans centennial appeared first on Buy It At A Bargain – Deals And Reviews.

John Fetterman returns to Senate campaign trail after health scare, contest with Mehmet Oz enters final months

Pennsylvania Senate candidate and the state’s Lt. Gov. John Fetterman is heading back to the campaign trail after health troubles sidelined him for more than 90 days.

Fetterman, 52, will host an event Friday evening in Erie County, Pennsylvania where the Democrat is expected to open up about a stroke he suffered in May that threatened his political aspirations as well as his life.

Campaign spokesman Joe Calvello said Fetterman’s return to the campaign trail will start with a few lower-profile events before ramping up his schedule.

“He’ll talk about how blessed he is to be back,” Calvello said. “It’ll be somewhat emotional — a little raw about what he went through, how grateful he is to be campaigning again.”

NEW POLL: DEM JOHN FETTERMAN LEADS MEHMET OZ IN PENNSYLVANIA SENATE RACE DESPITE POOR BIDEN APPROVAL

Fetterman’s recovery is also in question as he previously declined to take prescribed medication. “He’s following the doctor’s orders,” Calvello clarified, saying the Democratic candidate is also adhering to a low-sodium diet and is walking three to five miles per day.

“He’ll miss a word here or there when he’s speaking sometimes, or maybe in a crowded room he’ll miss hearing a word,” the spokesperson said. “Besides that, he’s rock solid.”

The return to the campaign trail comes as the Democrat is in one of the most contested senatorial races in the country, against Republican opponent Dr. Mehmet Oz, who has repeatedly drawn attention to Fetterman’s absence from the campaign.

“Have You Seen This Person?” Oz asked in a poster shared online last month. “It has been 90 DAYS since Fetterman’s last public campaign event. Pennsylvanians deserve answers.”

ELECTION SPOTLIGHT: DR. MEHMET OZ AND JOHN FETTERMAN SQUARE OFF OVER BIDEN PERFORMACE, ECONOMY

The Senate’s current 50-50 tie makes each senatorial race important for both parties but the Pennsylvania contest is especially consequential as it will fill the vacancy left by retiring Republican Sen. Pat Toomey.

The contest is already the most expensive senate race in the country and has featured major endorsements including one from former President Donald Trump, who backs Oz.

Fetterman’s absence from the campaign has not severely impacted the lead he holds over Oz in most polls as Fox News and Beacon Research have Fetterman up 11 points.

Other polling data shows a smaller gap between the candidates as Blueprint Polling and Suffolk University have Fetterman up 9 points, Fabrizio Ward has Fetterman up 6, and Cygnal has Fetterman up 4.

The Associated Press contributed to this report.

Former Army Ranger returns to Iraq — but this time with her Harvard master's degrees

Shelane Etchison, a former Army officer, discusses her transition from special operations to life as a graduate student in two Harvard master’s programs.

Ganassi Racing returns to Belle Isle with IMSA win

Sebastien Bourdais and Renger van der Zande returned Chip Ganassi Racing to the victory fountain at the Detroit Grand Prix with a second consecutive win Saturday in the IMSA sports car race.

The post Ganassi Racing returns to Belle Isle with IMSA win appeared first on Buy It At A Bargain – Deals And Reviews.

What the SBA Wants to See on Your Business Tax Returns

The Small Business Administrations, Your Business Tax Returns, and You

For businesses seeking financing from the SBA, understanding all your requirements is necessary. Here’s what the SBA wants. And here’s how the SBA educates entrepreneurs on how to file their business tax returns. Because what the SBA teaches business owners is what they want to see.

Your Business Tax Returns

Filling out your business tax returns right is Job One. The SBA suggests entrepreneurs work with accounting and/or tax professionals. Well-prepared, thorough forms do more than help you get an SBA loan. They also help keep your business from an audit.

Necessary Business Tax Returns Documents for an SBA Loan

You must complete and sign IRS Form 4506-T. Each principal owning 20% or more of the business must sign. Every general partner or managing member must sign. Any owner with more than a 50% ownership in an affiliate business must sign. Affiliates include business parent, subsidiaries, and/or businesses with common ownership or management. Provide complete copies, including all schedules, of the most recent Federal income tax returns for the business. Or provide an explanation if not available.

Potential Extra Tax Documents Needed for an SBA Loan

These include complete copies, with schedules, of the most recent Federal tax returns for each principal owning 20% or more of the business. You also must supply them from each general partner or managing member. And supply them from each affiliate if any owner has more than a 50% ownership in the affiliate business. Affiliates include, but are not limited to, business parents and subsidiaries. Plus other businesses with common ownership or management. If the most recent return is not filed, a year-end profit and loss statement and balance sheet for that tax year is acceptable.

For 2020/2021 PPP Loans

You did not have to file 2019 Taxes before applying for the loan. But businesses had to submit IRS form 4506-T. This gives the SBA access to historical business tax returns. Owners with more than a 50% stake in an affiliate business must sign the form. Principals owning 20% or more of the applicant business much also sign. Each partner or managing partner must sign.

Tax Forms that Partnerships Need to Fill Out for SBA Loans

Files Form 1065, US Partnership Return of Income – information only. Each partner gets a Schedule K-1 (Form 1065): Partner’s Share of Income Credit, Deductions, etc. (See page 1-13, Pub 1066). Partner completes Schedule E of Form 1040. Subject to Self-Employment Tax. Use Publication 541.

Partnerships must have a written partnership agreement. It’s best if an attorney drafts it, as accountants cannot give legal advice. The IRS advises partners to spend the money now for a proper set-up. This will save long and expensive battles in the future.

Tax Forms that Corporations Need to Fill Out for SBA Loans

S Corporation (S-Corp) – Files Form 1120S. You can elect to be taxed like a partnership. Use Form 2553 to make this election. You will need to file Form 2553 by the 15th day of the 3rd month for the year, to be treated as an S Corp. An S-Corp does not pay tax on income from daily operations.

S Corporations

All income, losses, deductions, and credits an S-Corp generates pass through to shareholder(s). Shareholder gets Schedule K-1 (Form 1120S): Shareholder’s Share of Income, Credits, Deductions, etc.

The shareholder completes Schedule E of Form 1040. An S Corporation is NOT Subject to self-employment tax (SE Tax). But wages are subject to FICA. Also check Form 1120S Instructions and Form 2553.

C Corporations

A C corporation files Form 1120 US Corporation Income Tax Return. The law treats corporations as legal entities, treated apart from their owners. This affords individual liability protection. Shareholders get dividends with a 1099-DIV form. Employees get Form W-2.

Employees of a C corporation are NOT subject to self-employment tax (SE Tax). But they will still have to pay income tax on their earnings. Corporate shareholders should check Publication 542. Note: there is possible double taxation with a C corporation

Tax Forms that Limited Liability Companies (LLCs) Need to Fill Out for SBA Loans

File a Certificate of Formation with SOS to form an LLC. This is not a federal tax entity (see Publication 3402). An LLC with more than one member is often considered a partnership. A single member LLC tends to be a “Disregarded Entity” and it files as Sole Proprietor.

An LLC can elect a C-Corporation treatment (using Form 8832), or an S-Corporation (using Form 2553). LLCs are popular. Owners have limited personal liability for the debts and actions of the LLC. This is without many of the formalities of a corporation.

Tax Forms that Sole Proprietorships Need to Fill Out for SBA Loans

This is the most common entity type. 23 million taxpayers filed as Schedule C in 2014. It is the simplest and cheapest form of business entity. You form it with one owner. You will need to file a Master License Application from the Dept. of Revenue (DOR) for your state.

In sole proprietorships, income flows to the individual via Schedule C.

One major drawback is the owner cannot be on the payroll. You will need to budget with care. The owner makes estimated tax payments. Per the IRS, anyone considering a sole proprietorship should talk to accounting and/or tax professionals. See if this setup is right.

Record Keeping Requirements for All Businesses

Records must support income and deductions that show amount, time, place, purpose. You must keep receipts, sales slips, invoices, bank deposit slips, and canceled checks. You must also keep other documents to substantiate income and deductions. Use a separate bank account for business.

Accounting Methods the IRS Accepts

The IRS accepts cash accounting and the accrual accounting methods.

With the cash accounting method, you report income when you get it. And you deduct expenses when they are actually paid. But it’s good for no more than $1 million in sales. This works for most businesses.

With the accrual accounting method, you report income when you earn it. This is regardless of when paid. And you deduct expenses when incurred regardless of when paid.

For both methods, see Publication 538.

The SBA and IRS Rules

The SBA of course insists that you fill out all forms right, report all income and losses. Take nothing but the deductions to which you’re entitled. The SBA provides detailed information on what it expects to see on your business tax returns. It’s identical to what the IRS expects to see on your business tax returns.

Taxes and Your Business Income

This includes all income your business gets unless excluded by law. This means income from sale of product or for your services. This includes bartering (Form 1099-B). You must include other types of income. The IRS advises business owners to keep good records.

Taxes and Your Business Expenses

To be deductible, expenses must pass certain tests. First, the expense must be ordinary. It must be necessary to your business. You must incur and/or pay it.

Amortizing Startup Costs

You can choose to amortize some startup costs for setting up your business over a period of 180 months (15 years). A start-up cost is amortizable if it meets both these tests. It is a cost you could deduct if you paid or incurred it to operate an existing trade or business (in the same field). And it must be a cost you pay or incur before the day your active trade or business begins. There is a $50,000 limit.

Car and Truck Expenses

If you use no more than four vehicles at the same time for business purposes, you may use the standard mileage rate. Use the standard mileage rate the first year. Otherwise, you can’t use the standard mileage rate on a vehicle after the first year of business use. In later years you can alternate between standard mileage and actual expenses. But if you used actual expenses in the first year you can NOT alternate. Publication 463: Travel, Entertainment, Gift and Car Expenses covers this.

But commuting expenses are not allowed. Deductible local transportation expenses may include getting from one place of work to another. They can also include visiting clients or customers; and going to a business meeting.

Depreciation

Depreciation is an annual deduction. The IRS allows it to recover the cost of your investment property beyond the current tax year. It is a decrease in the value of property over time. You must use the property in the business. It must have a determinable life longer than 1 year. Must be something that wears out, decays, gets used up, becomes obsolete or loses value from natural causes.

You cannot depreciate:

- Land

- Intangibles (like business good will)

- Inventory

- Leased property

- Property outside the US

- Property used for business less than 50% of the time

Travel Expenses

Ordinary and necessary expenses for travel away from the business, not your home. Travel expenses include:

- Fares (air, taxis, etc.)

- Baggage and shipping

- 50% of meals

- Lodging

Entertainment Expenses

These must be ordinary and necessary. They must meet either the Directly Related or Associated Tests. No more than 50% deductible whether you use Per Diem or Actual. Must allocate business part. Keep receipts that show time, place, and purpose of entertainment (includes meals). See Publication 463: Travel, Entertainment, Gift and Car Expenses.

Business Use of Your Home on Your Business Tax Returns

Many businesses start out of homes these days. The SBA says the IRS puts limitations on deductions. Good recordkeeping, as always, is necessary. But some deductions are possible.

See Form 8829, Expenses of Business Use of Home, and Publication 587, Business Use of Home. Your business use of your home must pass certain tests for acceptance.

Exclusive use means you must use a specific area of home for trade or business and nothing else. But there is an exception for storage and day care facilities. Regular use means using an area on a regular basis. Trade or Business use means using an area in connection with a trade or business.

Business Use of Home Test

To declare part of your home as being for a business use, you must meet these criteria. You must use a part of your home exclusively on a regular basis as your principal place of business. Or it can be a place of business your patients, clients, or customers use to meet or deal in the normal course of your business. Or it can be a separate structure you use in connection with your business.

Self-Employment Tax

The self-employment tax is Social Security and Medicare taxes. Working for someone else they pay half, and you pay half. But working for yourself you pay it all. Sole proprietors and partners may be subject to the SE Tax. If your net profit from self-employment is $400 or more, you must file Form 1040, Schedule SE, Self-Employment Tax.

Avoiding Tax Penalties—and Doing the Right Thing with Your Business Tax Returns

File an accurate, on time, and correct return. There is a 20% accuracy related penalty if you understate tax liability due to:

- Negligence

- Substantial valuation misstatements

- Substantial understatement of tax

There is a 75% civil fraud penalty. For felony criminal fraud it’s a combined penalty of 5%/month, and a 4.5% late filing and 0.5% late payment.

An accurate, on time, and correct return might not get you an SBA loan, by itself. But an inaccurate, late, and/or incorrect return will tank your application for an SBA loan. Not to mention having to pay penalties. So work with a tax or accounting professional. Get your business tax returns right the first time, every time.

Takeaways

In short, the SBA wants to see what the IRS wants to see. There are a variety of forms and schedules to cover a multitude of circumstances. Understand depreciation. Learn how to declare your home as your place of business. Both will help you prepare more accurate and complete business tax returns. And work with a tax or accounting professional to assure your business tax returns are as good as they can be. This helps you get SBA loans and avoid penalties.

The post What the SBA Wants to See on Your Business Tax Returns appeared first on Credit Suite.

Gonzaga returns to No. 1 for third stint in '21-22

Gonzaga has reclaimed the No. 1 ranking in the Associated Press men’s college basketball poll, while Providence climbed into the top 10 and Wyoming earned its first ranking in more than seven years.

The post Gonzaga returns to No. 1 for third stint in '21-22 appeared first on Buy It At A Bargain – Deals And Reviews.

Sandra Lee returns to a post-Andrew Cuomo New York for swanky gala

Celebrity chef Sandra Lee returned to New York for a ritzy gala a day before it was announced that her ex Andrew Cuomo’s arraignment has been delayed until Jan. 7.

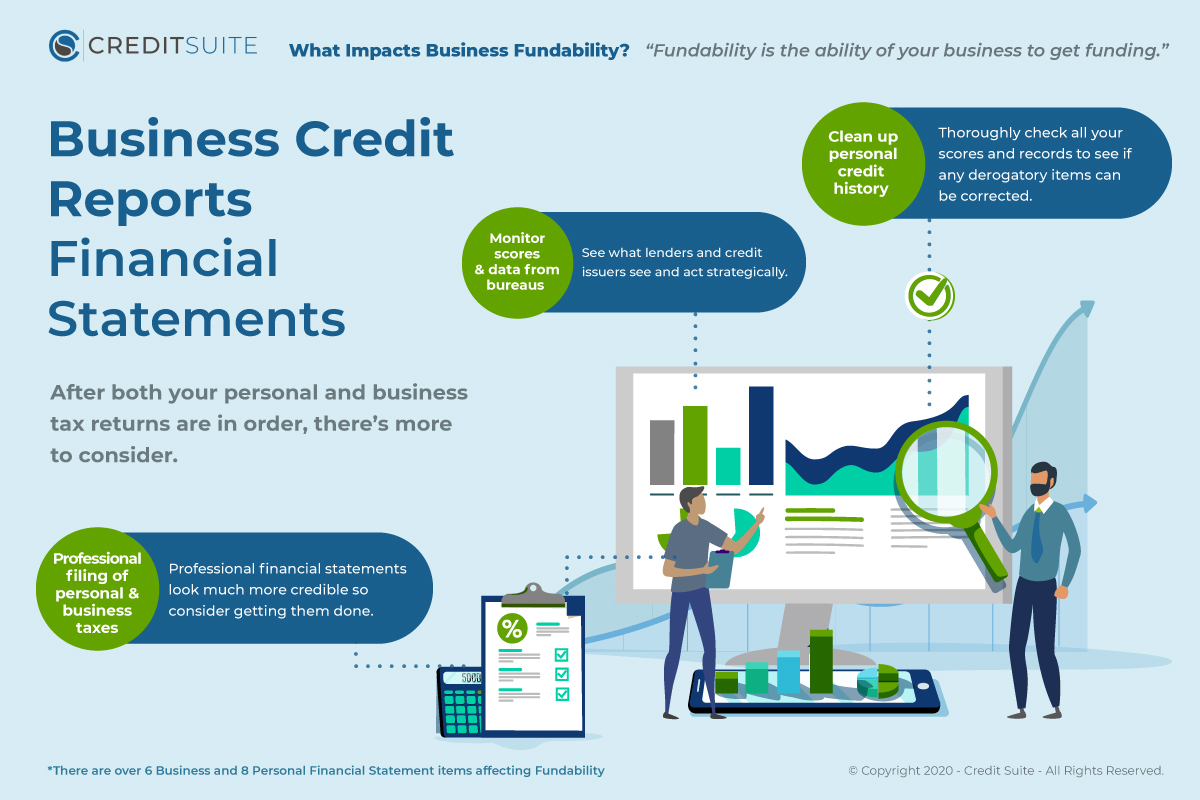

Business Tax Returns And Fundability

Fundability is like a puzzle. There are many different pieces that make up the complete picture. Financial statements are part of that, both business and personal. Business tax returns are just one piece of the puzzle.

The Basics of business Tax Returns and How They Affect Fundability

According to the IRS, except for partnerships, all businesses have to file an income tax return. There are different forms. The one you need to use depends on the business structure you choose. In addition to partnerships, there are sole proprietorships, corporations, S-corps, and LLCs.

Business Tax Returns for Beginners

If you are a new business owner, there are some things about paying business income taxes you need to know. They are not exactly the same as paying personal income tax. One of the major differences is that you may have to pay estimated tax.

Estimated Tax

Federal business income tax is pay-as-you-go. You have to pay the tax as you earn or receive income.

Sole proprietors and S-corps that expect to owe tax of $1,000 or more when they file their business tax return, will generally need to make estimated payments. For corporations, those that expect to owe $500 or will need to pay estimated taxes.

Documentation

You are going to have to track expenses, asset purchases, income and more. The absolute best way to do this is to implement an excellent bookkeeping system from day one. HIring a bookkeeper or bookkeeping agency is best. If you cannot do this, at least choose one of the many great accounting software options available.

With these options, you can print reports at the end of each tax period. Then just hand them over to your tax preparer.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Tax Preparation

Do not try to prepare tax returns for your business on your own. Just hire a tax professional. The cost will be well worth the time and money you save. You reduce the chances of a mistake, and you have back up if your business has to undergo an audit.

Note that your tax preparer should not be the same person as your bookkeeper or accountant. Whoever keeps the books should not do the tax returns. Larger corporations are not even allowed to have the same firm handle bookkeeping and taxes. With smaller businesses the same firm is ok, but it is not wise for the same person to do both. This helps deter and detect fraud.

This means, even if you have an in-house bookkeeper or accountant, they can prepare everything the tax preparer needs. However, they should not complete the tax forms themselves.

Other Choices You Have to Make Before Filing Your First Business Tax Return

When it comes to filing tax returns for your business, you have some choices to make. Discuss these with your tax professional thoroughly before making any decisions.

Cash vs. Accrual

You will need to choose your method of accounting. You can choose either cash or accrual basis. With the cash basis, you count income as revenue when it is collected. In the same way, you count expenses when you pay them. With accrual basis accounting, you record income when you earn it. You count expenses when they are incurred.

For example, using cash basis accounting, you don’t necessarily count revenue as soon as an item sells. You count it when you get the cash. That means, unless the buyer pays cash on the spot, you do not record revenue until the customer pays the invoice. You do not carry receivables on your books.

Using accrual basis accounting, you will record revenue when the item sells. A receivable for the invoice will go on the books..

If your business is new, you may have more unpaid expenses and more uncollected income at the end of the year. Then, it looks best for you to take those outstanding expenses as a deduction. That’s accrual basis accounting.

Yet, later on when your business is profitable, your outstanding receivables will likely be higher than outstanding expenses or payables. If you are using the accrual method, you will be recording more net income and thus paying more in taxes under the accrual method. Consider this when making your decision.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Once you decide which method to use, you will have to stick with it through the life of your business. Although, there are exceptions that allow for changes to be permitted. Also, certain businesses, like those with larger revenues or that carry inventory, do not have a choice. They must use the accrual method.

Depreciation

There are a few different options about depreciation. Discuss this thoroughly with your tax preparer to ensure you are doing what is best for your business. The first choice will be about first year depreciation. Typically depreciation on assets is written off over the course of 5 to 7 year. However, the IRS allows a first year deduction of up to $100,000 for equipment and most furniture instead. This is an election most business owners take.

However, if you do not make a profit you cannot take the $100,000 deduction. You can carry it forward to a year that you do make a profit.

Early on, you might want to think about using the slower depreciation method. Then, you can use the deductions later. At that time, there will likely be more income. You may be in a higher tax bracket than the startup phase. The depreciation deductions may come in handy.

The most important thing in making any tax decision is to discuss it with your tax professional.

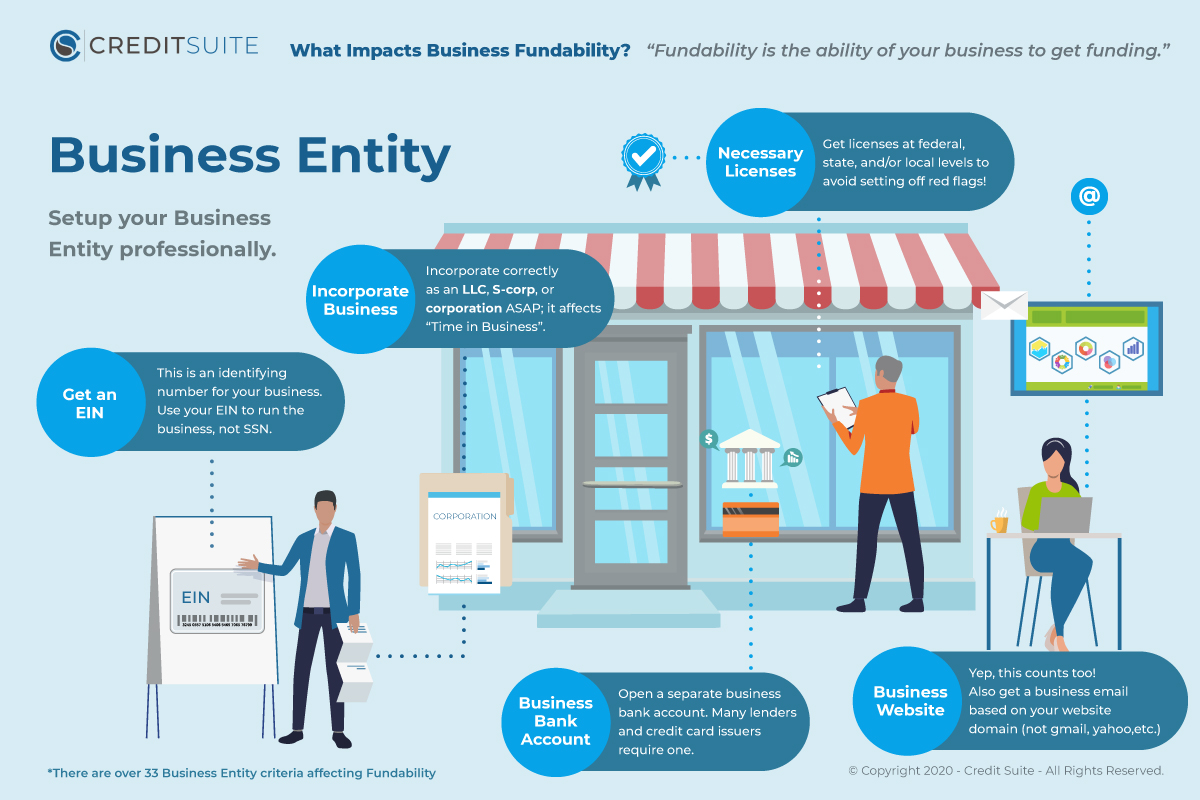

Business Tax Returns and Fundability Crossover

Fundability is, in the most simple terms, the ability of your business to get funding. For a business to be fundable, it needs to be fully recognizable as an entity separate from its owner. There is a lot of crossover between fundability and business taxes.

Fundability, Business Tax Returns, and Entity Type

Take the business entity choice for example. You can choose whichever you want for you taxes, but you do have to choose one. Generally, that choice will depend on your budget and needs for liability protection. Your tax advisor will be able to help you decide. However, the decision you make affects fundability as well.

For fundability purposes, you do not need to operate as a sole proprietorship. Your business needs to operate as a completely separate entity from you as the owner. To do that, you need to choose to operate as either an S-corp, LLC, or corporation.

Fundability, Business Tax Returns, and the EIN vs. SSN Saga

If you are operating as a sole proprietor, it is possible to use your SSN to file your business tax return. For fundability, you should not file a business tax return using your social security number. This is also a vital part of setting your business up to be fundable. You need an EIN. You can get one for free at IRS.gov.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Business Bank Account

To fully separate your business from yourself as the owner, you need to have a separate, dedicated business bank account. This is also helpful for tax purposes. It makes tracking business expenses much easier.

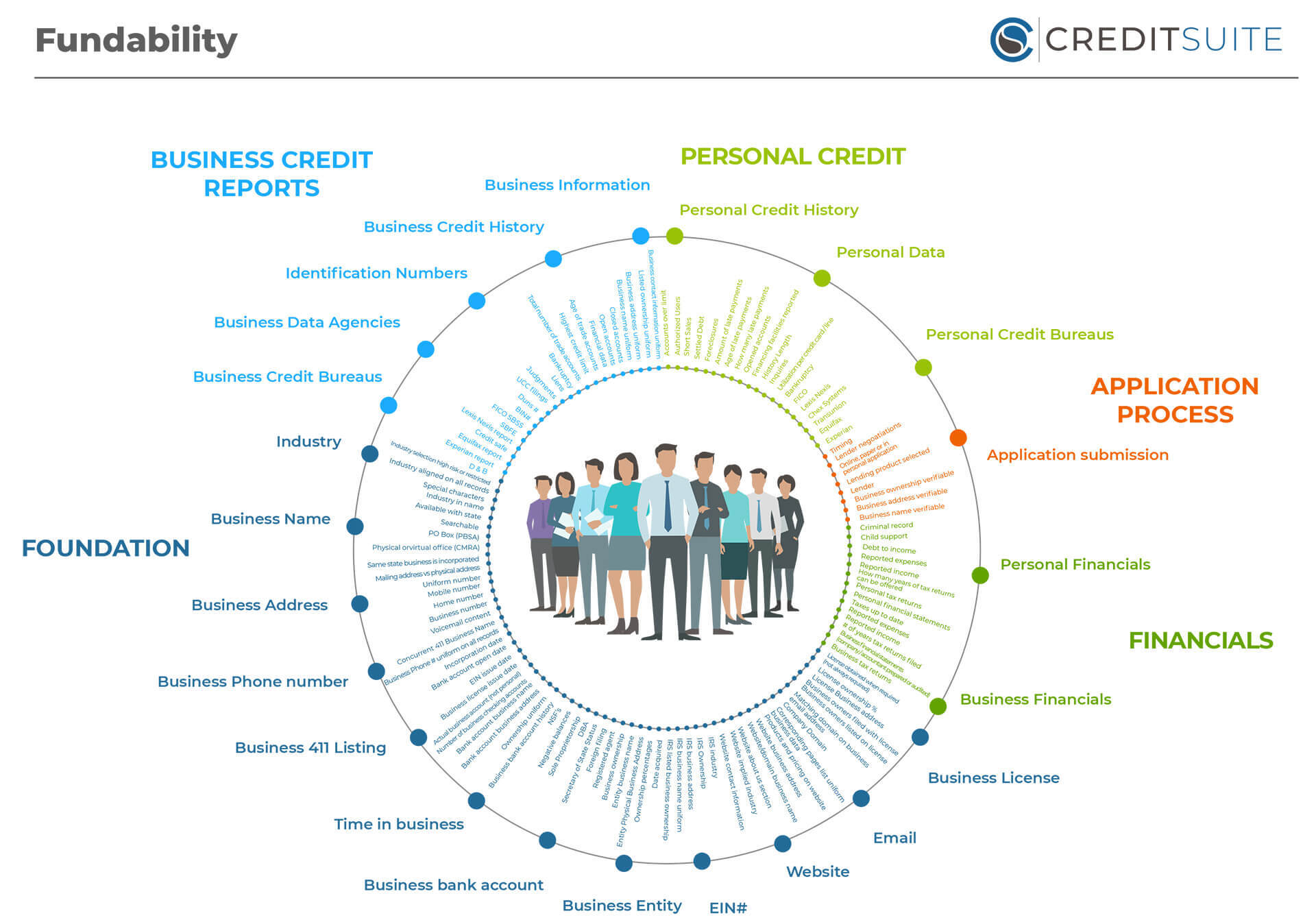

What Lenders are Looking for in Business Tax Returns

Why and how do business tax returns affect fundability? There are many factors that affect the overall fundability of a business. Credit Suite identifies 23 core principles of fundability. We break these down further into 125 fundability factors. Business financials is one of the core principles of fundability. Business tax returns are one of the factors included in this principle.

Lenders want to see that you pay your taxes, and that you are reporting things accurately to the IRS. They may not always request business tax returns. Still, if they do and you do not have things in order, it will definitely cause a problem.

Even if they do not request tax returns, they may do various background checks on your company. If they turn up that you aren’t handling your taxes responsibly, it won’t bode well for your ability to get funding.

Business Tax Returns Are Only One Piece of Fundability

Some factors affect fundability more than others. For example, consider if your business taxes are in order, but your business credit score stinks. You may struggle to get the funding you need to run your business. The same is true for how your business is set up. Say you have your taxes completely handled, but you are operating as a sole proprietorship. You are not separating your business from yourself. You use your SSN and personal contact information to file your taxes. This will cause issues with your business credit profile. That in turn causes fundability issues.

You need a tax expert to help you with your business tax return. You need a business credit expert to help you with overall fundability. Our experts can ensure you’re hitting all the core principles of fundability, and help you figure out what to do to ensure all the factors of fundability are met as closely as possible. This will give you your best shot at funding your business now, and in the future. Get a free consultation now to find out how Credit Suite can help you.

The post Business Tax Returns And Fundability appeared first on Credit Suite.