Article URL: https://remotejobs.org/companies/rankscience-remote-jobs

Comments URL: https://news.ycombinator.com/item?id=37988423

Points: 0

# Comments: 0

Article URL: https://remotejobs.org/companies/rankscience-remote-jobs

Comments URL: https://news.ycombinator.com/item?id=37988423

Points: 0

# Comments: 0

New businesses and startups face plenty of unique challenges when it comes to financing options. For example, lack of business credit history, no or low business credit score, and not being set up properly can all lead to reliance on personal financial resources.

There are financing options that can work despite these challenges however. We have a list of both general and specific resources to ensure you can get the funds you need to start and grow your business.

There are a number of possibilities here. Which one will work best for your business depends on your individual circumstances and situation.

Of all the financing options most consider when it comes to new businesses and startups, traditional loans are the most common. They can take many forms.

Choices include:

Traditional term business loans require a good personal credit score. This is regardless of whether you have business credit history, or even a business credit score at all.

If you have either collateral, a good personal credit score, or both, term loans may be the first and best option for you when it comes to new business funding. That is, unless you want to avoid using your personal credit or collateral. If that is the case, there is another choice which in some instances may be better.

Retirement plan financing is not a loan from your retirement plan. As a result, you will not have to pay an early withdrawal fee. You will not have to pay a tax penalty. There will not even be any interest.

The type of financing we are referring to here is a Rollover for Working Capital program. The IRS calls this type of program a Rollover for Business Startups (ROBS).

According to the IRS, a ROBS qualified plan is a separate entity, with its own set of requirements. The plan, through its stock investments, owns the business, not an individual.

If a traditional loan option is not going to work, and you do not have a qualifying retirement plan, it may be time to consider alternative lenders. They often have less stringent requirements than banks and credit unions.

Here are some options to consider.

BlueVine offers both invoice factoring and lines of credit.

For invoice factoring:

For the BlueVine line of credit:

Due to regulations, they cannot provide lines of credit to the following states: Nevada, North Dakota, South Dakota, or Vermont.

OnDeck requires a personal credit score of 600 or more to qualify for funding. Also, you must be in business at least one year and have an annual revenue of at least $100,000. They report to the standard business credit bureaus, and they also cannot lend to businesses in Nevada, North Dakota, or South Dakota.

Fundbox requires a minimum time in business of 6 months. In addition, your accounting or invoice software must be compatible and must be in use for at least 3 months. Your credit score must be 600 or above, and you need at least $100,000 in annual revenue.

While most alternative lenders, including these, have less stringent credit requirements, many do require a minimum time in business and minimum revenue. If you do not meet these requirements, there are other financing options available.

A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Not only that, but you can get some of the highest loan amounts and credit lines for businesses, and sometimes with 0% interest!

This is a credit card stacking program, and many of these cards report to business CRAs. That means you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

You or a guarantor need a FICO of at least 680 to qualify. No financials are required, and you can often get a loan of up to $150,000. Be aware, some cards may report on your personal credit.

Crowdfunding sites allow you to tell thousands of micro investors about your business. Anyone who wants to donate, or invest, can do so. They may give $50, they may give $150, or they may give over $500. In contrast, it might just be $5.

Most entrepreneurs offer rewards to investors for their generosity. Usually, this comes in the form of the product the business will be selling. Different levels of giving result in different rewards. For example, a $50 gift may get you product A, and a $150 gift will get you an upgraded version of product A.

Keep in mind that a crowdfunding campaign can easily become another full-time job, and that there are no guarantees of success. We suggest only considering crowdfunding if you realistically believe your chances of succeeding are over 50%.

There are a lot of crowdfunding platforms out there. Here are a few to consider.

This is the largest crowdfunding platform, and they require a prototype. Projects cannot be for charity, although nonprofits can use Kickstarter. Equity cannot be offered as an incentive.

Taboo projects and perks include anything to do with:

There is a 5% fee on all funds which creators collect.

The minimum goal amount for an Indiegogo campaign is $500. There is a 5% platform fee and 3% + 30¢ third-party credit card fee. Fees are deducted from the amount raised, not the goal you set. So, if you raise more than your goal, you will pay more in fees.

A flexible funding option allows campaigns to keep any money they receive even if they do not reach their goal. This is notably different from some other platforms.

RocketHub is specifically for entrepreneurs who want venture capital. The platform is exclusively for business owners working on projects in these categories:

If you reach your fundraising goal, there will be a 4% fee, and there is a separate 4% credit card handling fee. If you do not reach your goal, the fee increases to 8% plus the credit card handling fee.

While it is much harder for new businesses and startups to get funding, there are options out there. Remember, the best way to ensure you have access to the financing options you need in the future is to build a fundable business. That starts now. Contact us today for a free consultation on how to do it.

The post Overcome The Unique Challenges of Financing New Businesses & Startups with These 5 Financing Options appeared first on Credit Suite.

Article URL: https://www.ycombinator.com/jobs

Comments URL: https://news.ycombinator.com/item?id=27830451

Points: 1

# Comments: 0

Article URL: https://www.workatastartup.com/events/startup-tech-expo-summer-2021

Comments URL: https://news.ycombinator.com/item?id=27445070

Points: 1

# Comments: 0

Article URL: https://ycombinator.com/jobs

Comments URL: https://news.ycombinator.com/item?id=26709403

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/jobs/l/software-engineer

Comments URL: https://news.ycombinator.com/item?id=26341329

Points: 1

# Comments: 0

The problem with selling your startup is the long exit time. Sometimes it can take as long as seven years before you can sell your business and hop on the next idea.

And the investors? They feel the same way.

Who wants to wait almost a decade to buy a startup when the face of tech is evolving at such a rapid pace? Plus, the price tag on those more established businesses often run into the billions.

That’s an expensive mistake if you make the wrong investment.

The solution? Micro startup acquisitions.

From Facebook to Microsoft, there is a massive trend to seek out tiny teams of five or less, buy them, and use the technology and talent to gain a competitive edge.

In this guide, we’ll discuss the benefits of buying and selling a micro startup, the trends changing M&R strategy, and the top tools you can use to sell (or buy) your startup.

But before we dive into that, we need to look into what micro startup acquisitions are and why you need to sit up and take notice.

Micro startup acquisitions are a move away from buying businesses with established products or even proven revenue streams.

Instead, larger tech companies like Twitter and Pinterest are making investments in small startups. These businesses usually consist of 2 to 3 people, and companies are taking bets on their products that aren’t even fully realized yet.

Why?

Companies are becoming more proactive and want to acquire complementary products earlier on in their road maps as a way to outwit the competition and obtain the best talent in the industry.

What does this mean for startups?

Your exit strategy timeline is A LOT shorter. Gone are the days of waiting 5, 7, or 10 years to sell, making it more affordable than ever to bootstrap your startup.

Hike Labs was founded in 2014, and by 2015, Pinterest had swooped in and acquired the San Francisco-based mobile publishing startup.

Over the last couple of years, there have been clear trends in why big companies are choosing to invest in these small teams and use them as part of their growth strategy.

More deals are about gaining access to new capabilities or markets. While it’s a trend across sectors, it’s picking up steam in tech where companies are looking to deliver more complete solutions to consumers.

These acquisitions, which focus more on scope than scale, accounted for 90% of tech deals in 2019, which is a 40% increase from 2015. It’s a clear indicator that businesses want to expand their offerings and capabilities.

No one wants to be late to market.

Yes, the tech giants could develop the software these micro startups are making, but by the time it’s ready for market, a competitor might have rolled a similar product out and taken all the glory.

Or you could make the mistake of investing too much in the wrong idea, and there goes money, time, and resources down the toilet. It’s usually much cheaper to acquire a startup that has done the legwork than get an idea internally developed.

By acquiring micro startups, companies can mitigate both risks and reap the rewards.

For example, HR and finance SaaS vendor Workday bought Scout RFP (a San Francisco startup with a team of 8) for $540 million.

The startup built a cloud-based office procurement system that helps customers streamline supplier management. The acquisition is a step in the right direction for Workday to compete as a holistic enterprise resource planning solution.

It’s no secret that attracting top tier talent can take your business to the next level.

These micro startup acquisitions aren’t only about products. Sometimes it’s the talent that attracts the bigger guys. Micro teams can amplify a company’s productivity while getting rid of the learning curve which comes with new hires.

The innovation and ability to push a startup idea into production mean the team has skills and knowledge that is invaluable to an established company.

For example, when Instagram bought Luma (its first acquisition), the tiny three-person team was part of the deal. The Luma team’s knowledge in video stabilization technology was critical in launching Instagram’s complementary app, Hyperlapse.

A massive advantage of purchasing micro startups is the price.

It’s way cheaper to go small than fund a big, established company with hundreds of employees.

And the risk of it going under? A much softer blow.

If the investment goes the same way as Jay-Z’s Tidal music streaming app, it’s a much smaller amount to write off. Plus, you get to keep the team.

For example:

Microsoft spent $200 million to acquire Accompli and only $100 million for Sunrise. When you compare that to the $7.5 billion they spent on the acquisition of Github, or their purchase of Skype for $8.5 billion, that’s quite a bargain.

The same goes for Google acquiring Android for a measly $50 million in 2005 with key employees joining the company. As of 2020, the net worth of Android is estimated to be over $2.5 billion.

Another major trend in micro startup acquisitions is artificial intelligence. Companies in almost every sector are looking to take advantage of machine learning and integrate it into their products.

When you combine this with the shortage of AI talent, there is a race to scoop up startups and their teams who are in the early stages of funding and research.

In 2019, Facebook quickly snapped up a visual search startup called GrokStyle, who developed an app that can automatically detect decor and home furniture from a photo. When asked about the acquisition, Facebook responded in a statement that “their team and technology will contribute to our AI capabilities”.

Want to cash in on the micro acquisition boom? Whether you’re looking to sell or invest in a small business, there are various tools to help you swipe right and find your perfect match.

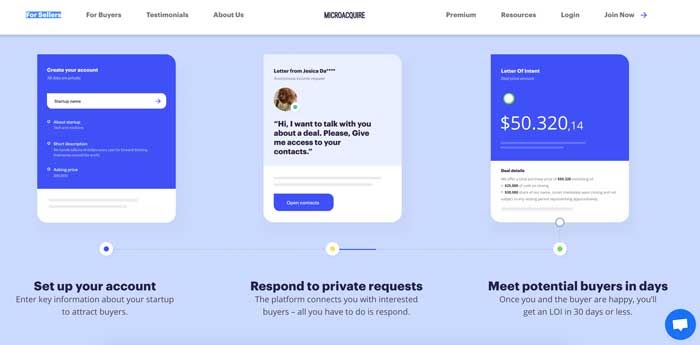

Micro Acquire is a marketplace that connects startups to buyers. The platform is free, private, and has no middlemen.

When you sign up, you’ll get instant access to over 10,000 trusted buyers with total anonymity.

The marketplace is designed to cut down on the time you need to sell your business and find startups to invest in. Once you’ve found a buyer or a seller, you’ll get a letter of intent (LOI) in 30 days or less.

Micro Aquire is for startups with an annual recurring revenue (ARR) of less than $500,000. It’s one of the best platforms for serial entrepreneurs to invest in small companies and grow them into booming successes.

Flippa is a marketplace for buying and selling websites, apps, domains, and online businesses.

While it helps to streamline the negotiation and transaction process, it does have a history of scam listings.

If you decide to buy on Flippa, do your due diligence and put the listings under a microscope to make sure it’s legit to find those diamonds in the rough.

Flippa is an ideal marketplace for small to medium-sized businesses. You can find a range of sellers at any price.

You can buy or sell online businesses and products like:

Flippa’s listing fees depend on what you’re selling:

There is also a 10% success fee on each sale, and you can upgrade your listing with various packages starting at $295.

Tiny Capital is a different breed in the micro acquisition space. Unlike some of the other tools mentioned above, it’s a traditional venture capital firm, with a twist.

Instead of buying companies and becoming a micromanaging nightmare, Tiny has a hands-off approach.

Besides the required monthly and quarterly reports, founders rarely have contact with the firm, with some businesses only speaking to Tiny Capital founder, Andrew Wilkinson, once every six months.

Tiny Capital seeks to invest in profitable internet businesses within the information technology sectors.

Think your business would be a good fit?

You need to meet the following requirements:

It’s the perfect micro acquisition option for founders who want a quick sales turn around (most deals are complete within 30 days) and an investor who is going to be seen and not heard.

There are no upfront costs with Tiny. All you need to do is contact the team, and you’ll get a response within 48 hours. If Tiny likes your business, you’ll get an offer within 7 days.

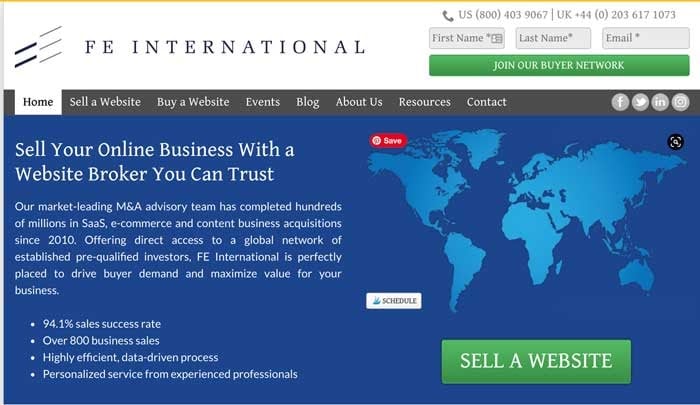

FE International is an acquisition advisory team for businesses earning five figures or more. With a 94.1% sales success rate, it’s one of the top tools for micro startup acquisitions.

As a full-service M&A (mergers and acquisitions service), the platform has integrated solutions for all the major elements of a successful acquisition. From valuation to exit planning to post-sale considerations, it’s all handled under one roof.

FE International specializes in selling websites in the SaaS, content, and e-commerce industries. It’s an excellent choice for startups within the 5 to 8 figure range who want top-tier support throughout the sales process.

There are no listing fees for sellers or joining fees for investors. Brokers are paid a 15% commission fee on all sales, and there is a buyer transaction fee of 2.5% with a maximum threshold of $1,000.

Since opening its doors in 2013, Empire Flippers has sold over $93,000,000 worth of websites and online businesses with an impressive 88% selling success rate.

Empire Flippers is interested in websites within the following categories:

There is an intensive seller vetting process to ensure only quality listings make it onto the marketplace, and there is a dedicated team for each step of the process.

To qualify for a listing on Empire Flippers, you must meet the following requirements:

Empire Flippers has a $297 listing fee for first-time sellers. But if your listing is declined, it is 100% refundable.

If you’re a repeat seller, you’ll only pay $97 to list your site.

Potential buyers must pay a refundable 5% deposit fee to gain access to a listings URL, P&L, and Google Analytics.

There are commission fees ranging from 8% to 15% depending on the final sale price.

The race is on for micro startup acquisitions.

Companies who understand the benefits of expanding their scope by adding complementary products and talent to their portfolio will reap the rewards.

Companies who forgo adding micro acquisitions as part of their mergers and acquisitions strategy are going to get left in the dust by competitors and struggle to find top-tier talent.

In short, there is no better time to be a desirable tiny startup.

Have you ever sold or acquired a micro startup? What has been your experience?

The post Micro Startup Acquisition: The Definitive Guide to Buying and Selling Small Startups appeared first on Neil Patel.

event link: https://www.workatastartup.com/events/gaming-tech-talks-2020

YC’s Work at a Startup and founders and teams of 8 YC gaming startups are coming together to host a first ever job expo focused on gaming this November. Emmett Shear, CEO of Twitch will be joining us to share his insights on how the business and technology of gaming is rapidly changing.

Aside from Emmett (if you haven’t seen it, check out his excellent TED Talk on what streaming means for the future of entertainment: https://www.ted.com/talks/emmett_shear_what_streaming_means_…), we’ve got four pretty cool 10-minute lightning talks lined up:

– Designing from Day One: Artists as Founders, Sara Alfageeh and Thariq Shihipar, Founders at Multiverse (S20)

– Designing Characters with Deep Learning, Cory Li, Founder at Spellbrush (W18)

– Synthetic Media: Virtual Influencers and Live Animation, Jay Rosenkrantz, Founder at Figments (S19)

– MMOs in the Instagram Era, Jimmy Xu, Founder at Highrise (S18)

After the talks, we’ll open up a virtual expo hall to meet with the founders and teams.

Many of the gaming startups fly under the radar at YC, but in my (biased!) opinion, if you love games they’re some of the most exciting. And the gaming industry often tackles some of the most exciting and challenging frontier technology problems before anyone else.

Working at a startup is not for everyone – and gaming startups are some of the craziest for sure. But if you’re in a position to go for it, based on my experiences I can say there might be no greater adventure. So if this piques your interest, check out the event link and apply to attend/come learn about open roles in engineering, game design, art, marketing/media and more.

Hope to see you there!

Comments URL: https://news.ycombinator.com/item?id=25014592

Points: 1

# Comments: 0

event link: https://www.workatastartup.com/events/gaming-tech-talks-2020

YC’s Work at a Startup and founders and teams of 8 YC gaming startups are coming together to host a first ever job expo focused on gaming this November. Emmett Shear, CEO of Twitch will be joining us to share his insights on how the business and technology of gaming is rapidly changing.

Aside from Emmett (if you haven’t seen it, check out his excellent TED Talk on what streaming means for the future of entertainment: https://www.ted.com/talks/emmett_shear_what_streaming_means_…), we’ve got three pretty cool 10-minute lightning talks lined up:

– Designing Characters with Deep Learning, Cory Li, Founder at Spellbrush (W18)

– Synthetic Media: Virtual Influencers and Live Animation, Jay Rosenkrantz, Founder at Figments (S19)

– MMOs in the Instagram Era, Jimmy Xu, Founder at Highrise (S18)

After the talks, we’ll open up a virtual expo hall to meet with the founders and teams.

Many of the gaming startups fly under the radar at YC, but in my (biased!) opinion, if you love games they’re some of the most exciting. And the gaming industry often tackles some of the most exciting and challenging frontier technology problems before anyone else.

Working at a startup is not for everyone – and gaming startups are some of the craziest for sure. But if you’re in a position to go for it, based on my experiences I can say there might be no greater adventure. So if this piques your interest, check out the event link and apply to attend/come learn about open roles in engineering, game design, art, marketing/media and more.

Hope to see you there!

Comments URL: https://news.ycombinator.com/item?id=24880422

Points: 1

# Comments: 0

The post YC Gaming Startups Are Hiring (Job Expo with Emmett Shear, CEO of Twitch) appeared first on ROI Credit Builders.

event link: https://www.workatastartup.com/events/gaming-tech-talks-2020

YC’s Work at a Startup and founders and teams of 8 YC gaming startups are coming together to host a first ever job expo focused on gaming this November. Emmett Shear, CEO of Twitch will be joining us to share his insights on how the business and technology of gaming is rapidly changing.

Aside from Emmett (if you haven’t seen it, check out his excellent TED Talk on what streaming means for the future of entertainment: https://www.ted.com/talks/emmett_shear_what_streaming_means_…), we’ve got three pretty cool 10-minute lightning talks lined up:

– Designing Characters with Deep Learning, Cory Li, Founder at Spellbrush (W18)

– Synthetic Media: Virtual Influencers and Live Animation, Jay Rosenkrantz, Founder at Figments (S19)

– MMOs in the Instagram Era, Jimmy Xu, Founder at Highrise (S18)

After the talks, we’ll open up a virtual expo hall to meet with the founders and teams.

Many of the gaming startups fly under the radar at YC, but in my (biased!) opinion, if you love games they’re some of the most exciting. And the gaming industry often tackles some of the most exciting and challenging frontier technology problems before anyone else.

Working at a startup is not for everyone – and gaming startups are some of the craziest for sure. But if you’re in a position to go for it, based on my experiences I can say there might be no greater adventure. So if this piques your interest, check out the event link and apply to attend/come learn about open roles in engineering, game design, art, marketing/media and more.

Hope to see you there!

Comments URL: https://news.ycombinator.com/item?id=24880422

Points: 1

# Comments: 0

The post YC Gaming Startups Are Hiring (Job Expo with Emmett Shear, CEO of Twitch) appeared first on ROI Credit Builders.