To celebrate NASCAR’s 75th anniversary, Ryan McGee presents a top-5 list every week for the rest of 2023. This week: the weirdest announcements. The post 75 things for NASCAR's 75th anniversary: Weirdest announcements appeared first on Buy It At A Bargain – Deals And Reviews.

Tag: Things

75 things for NASCAR's 75th anniversary: Weirdest announcements

To celebrate NASCAR’s 75th anniversary, Ryan McGee presents a top-5 list every week for the rest of 2023. This week: the weirdest announcements.

The post 75 things for NASCAR's 75th anniversary: Weirdest announcements appeared first on Buy It At A Bargain – Deals And Reviews.

75 things for NASCAR's 75th anniversary: Best title fights

To celebrate NASCAR’s 75th anniversary, Ryan McGee presents a top-5 list every week for the rest of 2023. This week: the best title fights. The post 75 things for NASCAR's 75th anniversary: Best title fights appeared first on Buy It At A Bargain – Deals And Reviews.

75 things for NASCAR's 75th anniversary: Best title fights

To celebrate NASCAR’s 75th anniversary, Ryan McGee presents a top-5 list every week for the rest of 2023. This week: the best title fights.

The post 75 things for NASCAR's 75th anniversary: Best title fights appeared first on Buy It At A Bargain – Deals And Reviews.

75 things for NASCAR's 75th anniversary: Greatest races

To celebrate NASCAR’s 75th anniversary, Ryan McGee presents a list of top-5s every week for the rest of the 2023 season. This week: 75 things for 75 years.

The post 75 things for NASCAR's 75th anniversary: Greatest races appeared first on Buy It At A Bargain – Deals And Reviews.

SEO Web Hosting Guide: 7 Things To Look Out For

From keywords to building backlinks and analyzing your competitors, there are many things you can work on to increase your website ranking. However, there might be one area you’re overlooking. Any idea what I’m talking about yet?

It’s the influence your web hosting has on SEO.

Whether you realize it or not, the web host you choose can make all the difference between getting your website ranking higher or being pretty much invisible online.

When you think about it, it’s obvious why.

The web host you go with impacts several areas of your website, including uptime and loading speeds.

If you are researching how to host a website, here are 7 things to look out for to help meet your SEO needs.

Why Web Hosting Is So Important For SEO

Your chosen web host plays a significant role in putting your website on the map and keeping it visible, and therefore, you need to pick your web host carefully.

Before I go too much further, let’s just see what Google says about how search works. It considers five factors:

- Relevance

- Meaning

- Quality

- Usability

- Context

As we’re talking about SEO and web hosting, I’ll focus on usability. For ranking, Google looks at:

- Loading times

- Mobile friendliness

- Country and location (so Google can serve location-based content)

Basically, the more accessible your content is, the more likely it is to rank better.

Google also considers page experience signals, like whether your site uses HTTPS.

Your webhost influences all of the above, which is why you need to choose carefully.

What To Look For When It Comes To Web Hosting And SEO

When it comes to web hosting and SEO, you should expect a few things from your provider as standard, such as uptime reliability and efficient loading times. However, as detailed in the next section, there are other features to look out for:

1. Uptime Reliability

For businesses, a few minutes of downtime can cost thousands of dollars in lost productivity. For your visitors, it’s frustrating if they can’t access your website or if it keeps crashing. However, downtime is equally damaging to your reputation among search engines.

The likes of Google regularly visit websites, and if your website is down a lot, your site gains a reputation for unreliability.

While no web host can guarantee to keep your site online 100 percent of the time, most hosts now provide 99.9 percent uptime. According to Search Engine Journal, 99 percent uptime equals approximately 1.44 minutes of downtime daily, or 8.8 hours a year. Pretty good, huh?

2. Speed

Ever heard the saying ‘speed is of the essence’? Your visitors agree with this, which is why you don’t want to keep them hanging around.

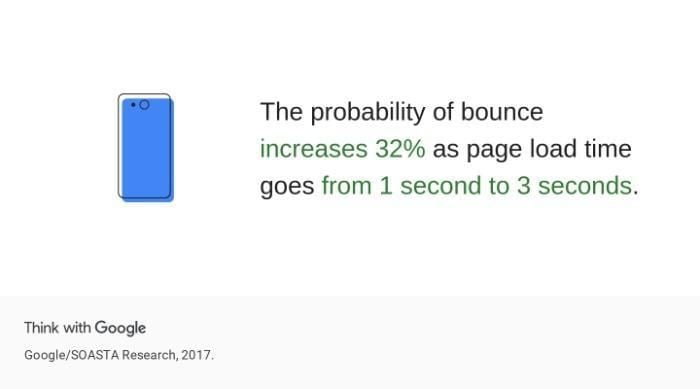

A slow website causes users to leave, increasing your bounce rate significantly, as the stat from Google’s research shows.

However, despite the importance of fast loading times, too many websites fail to make the grade.

According to research by Littledata, the average time it takes for a mobile page fully loads is 4.6 seconds. On the face of it, that sound pretty swift, but it won’t put you among the best-performing sites.

What should you be aiming for?

Littledata says if you want your site among the top twenty percent, then your loading time should be within 3.2 seconds. To appear in the top ten percent, your site should reach a full mobile page load within 2.6 seconds.

Not sure about your current speed? Here are some tools to check:

- Pagespeed Insights

- Uptrends

- Pingdom

- GTMetrix

That’s your speed covered, now let’s move on to the importance of customer service.

3. Customer Service

When choosing web hosting for SEO, there are some key areas of customer service to think about:

- The size of the company. Although it’s not always the case, a larger company is more likely to have better resources and staff available to help with customer service issues. They also have more money to invest in training their representatives.

- The company’s overall reputation. These days, you don’t need to look too far to view other people’s opinions. Find out what others say by looking at web hosting service reviews and use that as guidance for narrowing down your choices.

- Availability: is the company available 24 hours a day and seven days a week? Problems with hosting can occur at any time. You need to know that someone is available to take your call.

- Contact options: The easier it is to get in touch with a company, the better. Email and contact forms are great, but it can take time to get responses. Look for companies with a customer service contact number, social media accounts, and Live Chat for quicker responses.

4. Security

Would you buy from a site you don’t trust? I doubt it. It’s also unlikely that you’d share your sensitive information if the site didn’t have an HTTPS certificate, but It’s not just about consumer trust.

Back in 2014, Google first named HTTPS as a ranking factor. As Google’s Search Advocate, John Mu, explains on Twitter, it’s only a lightweight ranking factor, and the lack of an HTTPS won’t stop your site from getting indexed.

However, as Mu explains, HTTPS is great for users, and Google’s research shows a considerable rise in web users relying on HTTPS. Here are some of the key stats:

- Desktop users load over half of the pages they view via HTTPS and spend two-thirds of their time on secure pages

- 98 percent of Chrome users load pages via HTTP

- While HTTPS is less common among mobile users, figures among these visitors are growing too

While you can install an SSL certificate yourself, the easiest way is to find a web host that provides a free or affordable certificate.

Some of the sites offering free SSL certificates include

- Hostinger

- Hostgator

- Siteground

- A2 Hosting

That’s HTTPS covered. What about server location and its impact on your SEO and web hosting?

5. Server Location

Does server location affect loading times? Absolutely.

In a YouTube clip, former Google Search Quality expert Matt Cutts said: ‘We try to return the most relevant results to each user in each country. And server location in terms of IP address is a factor in that’.

For example, if your server is in the United States, but most of your customers are in the United Kingdom, data transfer times are likely to be considerably delayed. However, changing the server location to the UK is likely to reduce response times and improve website loading speed.

The reason for this? Well, it comes down to two things: network latency or ‘ping’ (the time it takes for information to travel from one point in a network to another) and time to the first byte (the interval between the request being sent to the server and the browser receiving the first byte).

The server location also affects your bounce rate and legal compliance (you need to store any data per local laws)

To help find the best server locations for your site, follow these three tips:

- Go to Google Analytics and sign in. Next, choose ‘audience’, then ‘geo’, and ‘location’ to determine where your audience is based.

- Check latency times. You can use a free tool like the one at devicetests.com:

3. Check your Time For First Byte with a tool such as GeekFlare:

For both tests, the lower the number, the better.

If you notice delays, it may be worth looking around for the best cheap web hosting and transferring your website to another provider.

6. Shared Hosting

Shared hosting is a popular option for small businesses, as it offers an affordable way to start a website, but it has some downsides.

The biggest issue for users can be website performance. As shared hosts typically have many users sharing the same server, performance can suffer compared to dedicated servers. This can result in slower page load times and decreased Site Speed Index scores (a page loading score metric).

Further, if you need to make any major changes or updates to your website, like adding new features or redesigning your entire site, then the customization options may be limited.

You may also find that your performance dips the more your traffic grows.

That said, shared hosting has plenty of positives, such as its ease of use and scalability,

7. CMS Quality

A content management system (CMS) is a software application or set of related programs used to create and manage digital content efficiently.

It aids your web hosting SEO by enabling content optimization and its integrated SEO plug-ins.

According to Zippia, there are over 80 CMS options to choose from, and 64.9 percent opt for WordPress.

The sheer number of available systems can make it difficult to choose, so look for the following three features to narrow down your options:

1. Ease of use: A CMS should be easy to use, even for beginners, and have a user-friendly interface and simple, straightforward controls.

2. Flexibility: Find a flexible CMS to accommodate your website’s specific needs. It should allow you to add or remove content easily, change layouts, and more.

3. Compatibility: Ensure the CMS is compatible with popular web browsers and devices. It should also work well with other software and plugins you may want to use

FAQs

It depends on which host you’re using. If SEO isn’t already built-in, you can often add plug-ins to your CMS for optimization

It depends on the host. Some are better than others but remember, you get what you pay for, and web hosting costs shouldn’t be your only consideration. Free hosting sites may lack quality, advanced features, and built-in SEO.

Yes. The closer the server location is to your visitors, the quicker the speed.

Wix has some great SEO features, including a Google Search and Google Analytics integration, as well as a single template for SEO on multiple pages.

Additionally, Wix has an SEO Wiz. This is a step-by-step checklist that you’ll find on your site’s dashboard under ‘marketing home’. The checklist helps you to connect and verify your site with Google, enables efficient site indexing, and gives you SEO tips for improved visibility.

Hostinger, Bluehost, and SiteGround all score well among reviewers for SEO web hosting, but it all depends on what features you’re looking for.

Conclusion

You will most likely have a long-term relationship with the hosting service you choose, so you want to pick the right one.

With so many web hosts to choose from, finding the perfect host is often time consuming, and you might not always get it right the first time.

To simplify things, when looking for a provider for your SEO web hosting, ensure it offers uptime reliability, speed, and security.

Also, don’t overlook server location and the impact it can have on your SEO, and test customer service first by making a few queries.

What tips do you have for SEO and web hosting?

The Disadvantages of Working from Home: 5 Things to Consider When Using Your Home Address for Your Business

Working from home has many advantages. One of the easiest ways to start a business is to start it from your own home. It’s the most natural way to start for many. Whether you are baking, woodworking, offering a service, or anything else, doing so out of your house has many advantages. What isn’t discussed as often are the disadvantages of working from home.

5 Surprising Disadvantages of Working from Home

Most business owners just assume that if they are running their business from home, their home address and their business address will be one and the same. That’s fine, but what if you decide to move out of your home? Changing business address can cause issues. This is just one of many surprising disadvantages of working from home.

Disadvantages of Working from Home #1: Your Home May Not Be Conducive to Productive Work

A home may not necessarily be well equipped to handle working. You need a workspace that will help you be productive. This will be different for everyone. But, consider that you at least need a room with a door you can close. Drawing boundaries between home life and work life can be hard.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Managing time can be harder when working from home as well. It can be easy to work all day when you are at home, or not work enough due to “home” distractions. It’s hard to get people to respect your time and boundaries. Also, isolation and depression are not uncommon.

Disadvantages of Working from Home #2: You May Not Be Allowed to Run Your Business From Your Home

In some situations, you may not be allowed to run your business from your home. If you rent, you will need to check your lease to make sure there are no issues. Whether you rent or own, you need to check zoning requirements. Also, agencies like the Health Department and the FDA have guidelines related to running certain types of businesses from your home.

Disadvantages of Working from Home #3: Home Address on Public Record

Many people worry about their home address as their business address. They feel it is unsafe, so they turn to a PO Box or an UPS Box. However, that can make it difficult to get funding. Lenders require a physical address.

This is a unique disadvantage of home-based businesses. Even home based businesses need funding for a number of things:

- Supplies

- Inventory

- Equipment (for jewelry making, woodworking, computer/ office equipment, etc.)

- Even working capital

One option is to use a virtual address. Be aware however, that some lenders will not accept those either. The truth is, if someone wants to find your home address, it’s easy enough regardless of whether you use it as your business address or not. In the end, to get funding for your business you are going to need to use a physical business address where you an receive mail.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Disadvantages of Working from Home #4: Changing Your Business Address Later Can Cause Problems

You may think you can get by with using your personal address now, and just change it later. That’s not a good idea. If you think about it, your business address goes everywhere. For example:

- All legal documents

- Licences

- Marketing materials

- Your website

- Insurance papers

- Everywhere!

The longer you wait, the more places you will have to remember to change it. It is a bigger deal than you may think if you miss one. If lenders start looking into your business and see your business address is listed differently in different places, it can cause unnecessary issues. It brings up fraud concerns.

A bank will not take the time to try to figure out all the different ways a business may be listed. Even something as simple as using Street vs St, or using an ampersand in one spot and the word “and” in another can cause issues. So you can imagine using your home address in one spot and a separate business address in another will definitely cause problems.

That doesn’t mean that if you move your business out of your home you have to keep your home address. Just be aware that you will need to make sure the address is changed everywhere.

Disadvantages of Working from Home #5: Legal Issues

There are a number of legal considerations that you have to think about when it comes to running a home based business. For example, even if zoning laws allow you to run your business from your home. You need to check out what requirements those laws lay out. Some cities have regulations regarding foot traffic. Some even regulate yard sign use for advertising. And if you have an Homeowners Association (HOA) you may need their permission as well.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Some cities limit the number of employees a home based business can have. Some even regulate the number of customers that can come to your door. You’ll need to check with your local city officials to determine what if any regulations apply to you. And figure out what licences and permits you need to operate.

Consider the tax issues as well. While you can deduct some expenses when it comes to home-based businesses, it can get complicated. You need to make sure you thoroughly understand the home business deduction on the front end and plan accordingly.

Insurance needs to be considered as well. If you have employees or customers coming in and out, you need to think about what would happen if they were injured. Will homeowners’ insurance cover it? Often you will need to purchase a separate policy or a rider. All insurance needs to be in place on the front end. Be sure it has the proper business address on it!

Avoid Many Disadvantages of Working From Home

Nothing is perfect. Running a business from your home is no different. However, you can avoid many of the disadvantages of working from home by building fundability from the beginning. Not only will it help with legal issues, but it makes a bigger difference than you may think when it comes to funding.

The best way to start building fundability, whether you own a home-based business or run a business from a different location, is to work with a business credit expert. Contact us today for a free consultation.

The post The Disadvantages of Working from Home: 5 Things to Consider When Using Your Home Address for Your Business appeared first on Credit Suite.

5 Surprising Things the Top Ranked Sites on Google Have in Common

What separates the heavyweights of the search engine rankings from everyone else? That’s a question every good SEO constantly asks themselves as they look to outrank sites that seem to dominate Google for every relevant keyword (like Wikipedia or WebMD).

Unsurprisingly, these sites have more than a few things in common. It’s not just their age or authority either—factors that other sites can’t hope to match. There are plenty of similar qualities that help top sites stand apart from their competitors that you can copy and improve today.

Let’s review five of the most important and surprising factors and explain what you can learn from them and how you can use that to improve your own site.

1. Backlinks Reign Supreme

Let’s get the least surprising commonality out of the way first. The top-ranked sites on Google all have a serious number of backlinks. As we all know, high-quality backlinks almost always mean high rankings.

Research from Backlinko finds the first result on Google has an average of 3.8 times as many backlinks as the rest of the results on the first page.

The big boys have it made when it comes to acquiring more backlinks, too. They continue to get more backlinks over time as a result of their position in Google.

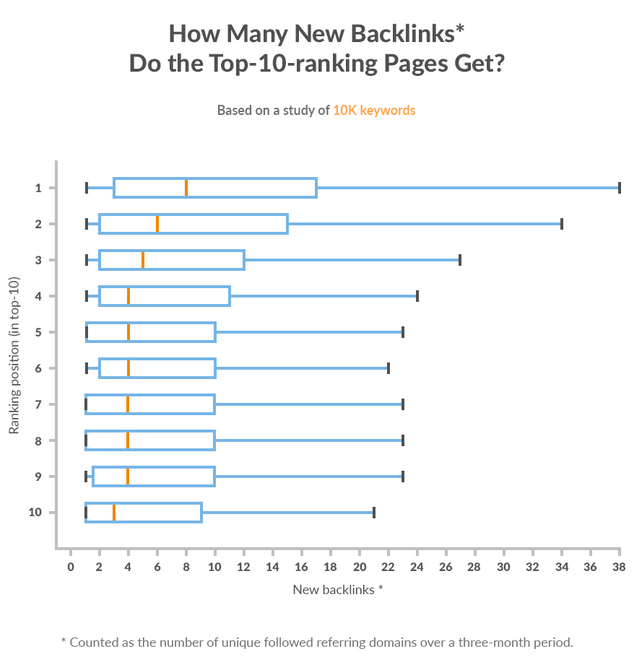

Research by Ahrefs finds that the top three results generate more new referring domains than the rest of the pages on Google. Pages ranked first and second get significantly more new referring domains. Those pages ranking first get between backlinks at a faster rate of between five percent and 14.5 percent per month.

It’s not just a large number of backlinks that are important. They need to be high quality, too. What does a quality backlink look like? It comes from an authoritative domain, is placed within its content, and has topical relevance to your website.

Let’s say you have a car blog. A link from another high-ranking car blog carries more weight and is of higher quality than a link from a major health website because it’s much more relevant to your niche.

You shouldn’t discount internal links, either. The biggest websites (and news outlets in particular) almost always put a lot of effort into making sure every new piece of content links back to several previous posts.

Great internal linking makes it significantly easier for Google to crawl your website and index your information. The easier your site is to crawl, the more likely Google will find and rank your content. They may not have the same power as backlinks, but internal links can still result in higher rankings.

All this is to say that you need to build backlinks in a scalable way if you want your site to compete with the biggest brands in your industry.

2. Provide High-Quality Content

Most top-ranking websites are well known for the quality of their content. Okay, some major sites don’t publish high-quality content all of the time, but every high-ranking site does produce exceptional content, at least some of the time.

Don’t forget, high-quality content doesn’t necessarily mean it’s longer or more detailed than everyone else’s. It might contain unique research that other companies can’t hope to copy. Or it could break a story. Or it could be designed better. Or it could go viral. There are lots of ways to create amazing content.

Doing so matters when it comes to SEO because high-quality content helps boost several ranking factors. It’s a magnet for backlinks, it reduces your bounce rate, and it should result in a higher clickthrough rate (CTR).

The top-ranked sites don’t just rely on the objective quality of their content, though. They also take steps to optimize it to perform better in Google. That means including keywords in header tags, throughout the content, in the page title, and in the URL.

Creating high-quality content isn’t easy, especially when there’s no objective way to determine how good your content is. That’s the job of your users. That being said, there are still steps you can take to make it more likely your users think highly of your content.

The first is to make sure it’s written by an expert. This is a pretty simple task for some top-ranking sites like media outlets. Journalists, by default, are experts on certain topics. However, there’s nothing stopping you from writing about your expertise or hiring expert writers, either.

You could even use a strategy adopted by some health websites, where content is written by a professional writer and then fact-checked by a medical professional. Doing so has the double benefit of having content written by an excellent writer while also being medically accurate.

3. Focus on User Experience

Top-ranking sites on Google put a premium on the user experience and do everything they can to keep customers coming back. This means having a great design, high-quality content as discussed above, an intuitive layout, and a great browsing experience in general. Yes, some of the highest-ranking sites may serve up ads on their pages, but they don’t ruin your browsing experience with them or use intrusive popup ads, either.

A great user experience is one of the reasons these sites are top of Google, after all. Google announced that user experience metrics would be used to rank sites, beginning in 2021. How your site loads, what it looks like, and how users interact with it contribute to your rankings, along with other factors like HTTPS, safe browsing, mobile friendliness, and the presence of interstitials.

Google puts such a big emphasis on your site’s user experience because it aligns with its goal of giving customers the best possible browsing experience. The search giant finds over half (52 percent) of users will be less likely to engage with a brand after a bad mobile experience. So why would it rank you if you have a high bounce rate?

Improving your site’s user experience and aligning it with the experiences provided by the top-ranking sites won’t just improve your rankings; it also makes commercial sense. Ad network Ezoic generated a 186 percent increase in earnings per 1000 visitors by improving the UX of a publisher.

4. Make Sure Your Page Speed Is Competitive

You’ve never had to wait for the New York Times to load, have you? That’s because top-ranking sites know the importance of delivering content as fast as possible. Page load speed has been a ranking factor for desktop searches since 2010, and Google announced it was also a ranking factor for mobile searches back in 2018.

Say it with me: A slower site means lower rankings.

You need to optimize for page speed if you want to mix it with the highest-ranking sites. It’s not so much about getting the edge over your competitors and making your site 0.1 seconds faster, however. It’s about having a site that’s fast enough to not impact the user experience negatively.

Research by Google finds over half (53 percent) of visitors abandon a mobile site if it doesn’t load in three seconds.

If you have a slow site, you won’t just get penalized for a poor load time. You’ll also get penalized for having a high bounce rate as users get fed up with waiting and choose a different site instead.

The easiest way to check your page speed is by using Google’s PageSpeed Insights tool. It will let you know how fast your site is, give it a score out of 100, and suggest improvements.

If you want to have a seriously fast-loading page, read my advice on getting a perfect score with Google PageSpeed Insights.

5. Consider User Intent

Have you noticed how some top-ranking sites have several pieces of content that all seem to approach the same topic from a slightly different angle? That’s because they understand the power of user intent and the value Google places on it.

Google wants to serve up the best and most appropriate content for each query. A big part of that is understanding what the user is trying to achieve from their search. Are they trying to learn something? Research a topic? Make a purchase? Google delivers different results for each intent.

For instance, Google shows e-commerce pages where it thinks the user is trying to make a purchase, but it serves up blog articles for information-related queries.

Knowing what type of content Google thinks users want to see is key to becoming a top-ranked site, because you’re much more likely to get ranked if you create content that matches the user intent for each target keyword. This is why so many top-ranking sites have similar content targeting the same topics: to catch every user intent.

It’s not simply a matter of informational vs. commercial, either. There are dozens of types of informative content that users may want to access. In some cases, it’s a listicle. For other queries, a video may be more appropriate.

Taking time to understand the user intent for each keyword or topic you’re targeting can yield serious results. Marketing SaaS CoSchedule saw a 594 percent increase in search traffic when they aligned content with user intent.

Top Ranked Sites: FAQs

They all have a lot of high-quality backlinks, great content, an excellent user experience, a fast-loading website, and content that matches the user’s intent.

This is partly because of the quality of content but also due to the fact that they sit at the top of Google. This makes them an easy target for people trying to link to an authoritative source.

Better content can improve your rankings in several ways. High-quality content attracts more backlinks, but Google also rewards in-depth content and results in users spending a long time on the page.

Google wants to provide the best experience to its users. Part of that means sending them to sites that are easy to browse. It’s why user experience factors are now ranking factors.

Use the Google PageSpeed Insights tool.

Google the keyword you want to rank for and look at the pages that appear in the results. If all of the content has the same format, that’s the type of content you should create.

Conclusion: What You Can Learn From the Top Ranked Sites

You can’t turn your website into a top-ranking site overnight. However, you can learn a lot from them and implement tactics they use to improve your site’s Google ranking. There are more than a few things they do in common, as you’ve learned.

Make sure you have a scalable system for generating backlinks, create high-quality content, focus on the user experience, ensure your site loads fast, and consider user intent when you create content.

Do these five things, and you could be well on your way to having a top-ranked site in the future.

What are you going to work on first?

6 Things You Need to Know About Alternative Business Lending

Alternative business lending rose from the ashes of the 2008 crash. This was a time when lenders were giving almost no one money. It was virtually impossible to get a loan of any sort for any reason. Business loans were extremely hard to come by, and when you could get one, rates were terrible.

Alternative Business Lending: Your Questions Answered

Find out why so many companies use our proven methods to get business loans.

As a result, alternative lenders began to pop up. Funding Circle is credited with being the first, but others soon followed. That means this is a fairly new game. It can be hard to figure out if it is one you should play. This should help.

-

What is alternative business lending?

This type of lending is offered through private companies, not traditional financial institutions like banks and credit unions. They can be an option for those who do not qualify or who do not have the time to wait for a bank loan. These lenders explore other ways of verifying creditworthiness and other forms of collateral.

This type of lending is offered through private companies, not traditional financial institutions like banks and credit unions. They can be an option for those who do not qualify or who do not have the time to wait for a bank loan. These lenders explore other ways of verifying creditworthiness and other forms of collateral.

Collateral may include credit card transactions, open invoices, equipment, real estate and more.

-

How much is alternative business lending?

This is a question asked by many when they first start considering alternative lending options. The truth is, it depends. That’s the case with any loan. There are fees, and interest is a factor. Typically interest is higher with alternative lending. But if you can’t get anything else, you can’t really compare.

-

What are the pros of alternative business lending?

So, why choose alternative lending? Well, if you can’t get a traditional business loan you may need to consider this option. However, there are other reasons as well. For example, alternative lenders typically fund much faster. So, if you need fast cash, this could be the way to go.

Also, the application process is usually faster and easier. Often you can apply online in a matter of minutes. Repayment terms are usually more flexible as well.

-

What are the cons of alternative lending?

As already mentioned, interest rates with alternative loans are usually higher. There is also a breeding ground for scammers in this industry. It’s important to know how to recognize predatory lending practices to avoid being taken advantage of.

-

Is alternative business lending right for you?

If something is blocking you from being approved for a loan through a bank or credit union, then the answer to this question is probably yes. It is highly likely that this is a type of lending that can work well for your business. This is especially true if you have invoices, accept credit card payments, or need to finance equipment. Common types of alternative loans include:

- Merchant cash advances

- Invoice financing

- Equipment financing

- And real estate financing

There are other options as well, and they vary between lenders. These are some of the most

common however.

-

A credit expert can help you find the best alternative business funding for your business.

Now you need to figure out which lender and which products from that lender will work best for your specific business needs and goals. The best choice is to work with a business credit expert. This is someone that can help your maneuver through the process in the most effective and efficient way. That will help immediately. Beyond that, into the long-term, an expert in business credit can help you figure out why you are being denied funding, and help you fix the problem.

Where should you start when looking for alternative lenders? Here are some options to consider.

Find out why so many companies use our proven methods to get business loans.

Fundbox

Fundbox offers a line of credit rather than a loan. Still, it is a great funding option because there is no minimum credit score requirement.

They offer an automated process that is super-fast. Repayments are automatic, meaning they draft them electronically, and they occur on a weekly basis. One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn currently, as the repayment period is comparatively short. This means you need to be sure you have enough funds in whatever account you connect them to so that it can cover your payment to Fundbox each week.

BlueVine

You will find with most any online lender, they often offer options more similar to invoice factoring and lines of credit. This is because those options present fewer risks than straight term loans. BlueVine is no different.

Upstart

Upstart is an online lender that uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO on their own to truly determine the risk of lending to a specific borrower. Instead, they choose to use a combination of artificial intelligence (AI) and machine learning to gather alternative data for use in making credit decisions.

This may include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. You can use their online quote tool to play with different amounts and terms to see the various interest rate possibilities.

Upstart’s innovative platform makes them one to research for sure.

Fora Financial

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

OnDeck

Obtaining financing from OnDeck is quick and easy. First, you apply the OnDeck website and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The loan amounts range up to $500,000.

Lending Club

Popular online lender Lending Club offers term loans. You can get a quote in less than 5 minutes. Funds are available in as little as 48 hours if approved. There are no prepayment penalties.

Kiva

Kiva is an online lender that is a little different. For example, the interest rate is 0%. That means even though you have to pay it back, it is absolutely free money. They don’t even check your credit. However, there is one catch. You have to get at least 5 family members or friends to throw some money in the pot as well. In addition, you have to pitch in a $25 loan to another business on the platform.

Find out why so many companies use our proven methods to get business loans.

Accion

If your personal credit is okay, Accion may be a good fit for small business startup loans. It is a microlender, a nonprofit, that offers installment loans to both startups and already existing businesses.

Credibly

Credibly is also a good option for business loans if you are already generating some revenue. They offer short term loans for both business expansion and working capital. You must be in business for at least 6 months to qualify, and Credibly will approve loans to those with credit scores as low as 500.

Alternative Business Lending Is a Great Tool, but Not a Forever Answer

I mean, it could be a forever answer, but there is a better way. If you work to build up your fundability, you can get a lot of perks offered by alternative business lending with the interest rates offered by traditional loans. You could have the best of both worlds. It takes time to get there however, and alternative loans are the best option for many in the meantime.

The post 6 Things You Need to Know About Alternative Business Lending appeared first on Credit Suite.

How the Small Business Finance Exchange Can Affect Your Business in a Recession: 4 Things You Need to Know

As the novel coronavirus continues to affect our economy, the SBFE remains committed to its mission. Let’s take a look at the Small Business Finance Exchange in a recession – because the chances of our economy going into a recession look rather high right now.

The Small Business Finance Exchange Affects the Way Lenders Do Business

The Small Business Finance Exchange, in a recession, can change the face of business credit. You need to know how. Solid business credit is necessary to business growth always, whether there is a recession going on or not. It is also important to the protection of your personal finances. Without a strong business credit profile, you will have to rely on your personal credit when it comes to business financing.

This is bad is so many ways. It may not seem so if you have great personal credit. The problem comes when you do not have separate business credit. Then anything that affects your business affects your personal score. If something doesn’t work out with the business, your personal credit score suffers.

It can work the opposite way also. A bad personal credit score can affect your ability to get business financing.

The remedy is to ensure your business has its own credit score, and to be certain that score is complete and accurate.

The Small Business Finance Exchange, also known as the SBFE, helps with that. Certain lenders and agencies have access to their data. How do they get your information? Does it affect your business credit? How can it affect your ability to get financing for your business?

What is the Small Business Finance Exchange?

To fully understand the role of the Small Business Finance Exchange in a recession, you need to understand what it is. The SBFE is a not-for-profit entity that gathers data on small businesses from its members. The data is then used to compile comprehensive credit information. Lenders use this information to make credit decisions.

The Small Business Finance Exchange does not lend money. It also does not create or distribute credit reports.

How Does the Small Business Finance Exchange in a Recession Work?

Generally speaking, it works the same way in recession as it does in solid economic times. The impact however, can change. The model they use is self-dubbed a “give-to-get” model. Members provide information about their borrowers. In return they can receive information from the exchange. This information can help them make future lending decisions.

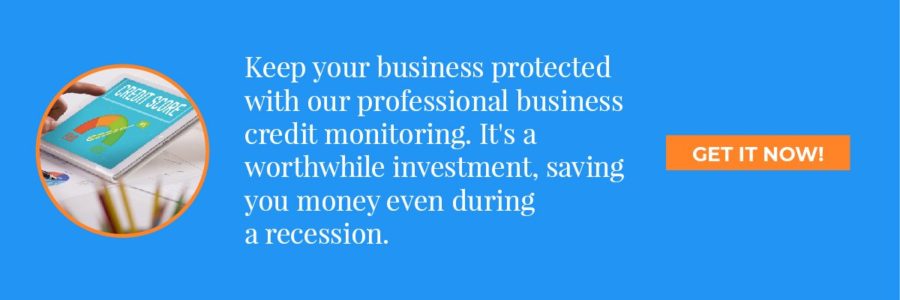

Keep your business protected with our professional business credit monitoring. It’s a worthwhile investment, saving you money even during a recession.

The process starts with members. The members report credit data from those companies that they do business with. This data will include payment history, among other things. This is one reason it is important to make payments on time. When businesses use the Small Business Finance Exchange in a recession, your payment history prior to the recession can affect your business even more.

Next, the SBFE normalizes the raw data into usable information. It then distributes this data to certified vendors. These include credit agencies that have a partnership with the SBFE. The distribution to certified vendors is step three.

Certified Vendors use the information to create comprehensive credit products for distribution to SBFE members only.

What Do Members Get?

Members can request data on any small business to whom they may extend credit, making the Small Business Finance Exchange in a recession hugely impactful. Since they gave information, they have information available to them. That means if you work with member lenders, they have access to even more information that can affect their decision than what is on a standard credit report.

Practically, it looks like this. A lender reports credit information about its current borrowers to the Small Business Finance Exchange. When a new potential borrower comes along, they request a credit report. This report does not come from the SBFE. The request is to one of the credit reporting agencies such as Dun & Bradstreet or Equifax. Because of their membership with the SBFE, they receive an extended report that includes the data received from the SBFE as well as that from D&B.

How Does Using the Small Business Finance Exchange in a Recession Affects Your Business?

There is so much more to a business than how and when they make payments. Making consistent, on-time payments is essential. However, not doing so for a period of time does not always tell the whole story. The Small Business Finance Exchange uses its data to paint a more complete picture so that creditors can be better informed.

The result is that even if your payment history is not pristine, the use of information from the Small Business Finance Exchange in a recession can be a good thing for your business. Their mission is to be an advocate for the safe and secure growth of small business. They know that lenders need the most complete and accurate information available to make a viable credit decision.

The Small Business Finance Exchange in a Recession Can Help Your Business in 4 Ways

1. It Can Help You Build Business Credit.

Strive to do business with SBFE members. When you do, you know your information is being reported, which means you are building business credit. How do you know if your lender or vendor is a member?

Keep your business protected with our professional business credit monitoring. It’s a worthwhile investment, saving you money even during a recession.

Ask them. If they are not, considered mentioning that they become a member. However, there are enough members in the network that it should not be hard to find one.

2. They Can Help You Grow Your Business.

By working with members, you ensure your complete information is being reported. When creditors receive your information, you know they get a complete credit picture and not just one piece of it. If you are making your payments and working to build strong business credit, this can only help you.

3. You May Have Increased Funding Options.

The data available about your business from the Small Business Finance Exchange in a recession could open up additional funding opportunities that may not be available to you otherwise.

4. They Can Help You Make Wise Credit Decisions.

If you are a small business that lends money to other businesses and has the ability to report that information, you can join the SBFE yourself. You will gain access to information about borrowers available exclusively to members. This information can help you make better decisions about your own business lending.

Who Can Become a Member?

Anyone who has the ability to report their small business lending information to the SBFE can become a member. The only way to gain access to the information that the exchange has in their Data Warehouse is to join.

Members include all types of lending institutions including banks, credit unions, and alternative lenders.

Certified Vendors

Certified vendors are agencies that have a partnership with the Small Business Finance Exchange. They distribute the data they receive from the SBFE. They do this by creating credit analysis products using the information that the Small Business Finance Exchange provides. Then they report the data to members who request a credit report on a business that is included.

Certified Vendors include Equifax, Dun & Bradstreet, and most recently, LexisNexis Risk Solutions. Of course, Equifax and Dun & Bradstreet are credit reporting agencies. LexisNexis sells lending risk insurance products.

While other credit agencies are available to lenders, when they are a member of the Small Business Finance Exchange, in a recession especially, they can get a double shot. If they utilize one of these certified vendors, they get the benefit of the vendor’s own information plus data received from the Small Business Finance Exchange. In a recession, this can be an essential link to risk mitigation and solid decision making.

What Goes Around Comes Around

As much as doing business with members of the exchange can help you, it can hurt you if you do not do things properly.

If you are doing business with SBFE members you eliminate the potential to not have any business credit. By default, members are reporting your information and therefore, you have business credit.

However, if you do not handle your business properly, the report members are getting about your business may not be favorable.

Members contract to report both positive and negative information.

How Do You Know If Data Related to Your Business is In the Warehouse?

If you are doing business with member entities, your data is there. How do you know if the companies you do business with are members? Ask them.

What Kind of Data do They Have on My Business?

They have identifying information related to your business. This would include your business name, DUNS number, EIN, address, and NAICS code.

They also have both positive and negative payment information. Bills paid to vendors, suppliers and business partners on time or early are all included. It also includes bills paid late, or not at all, to suppliers, business partners, and vendors.

The limits on your credit accounts, payment information on lease payments, and credit card payment history are also included.

What Action Do I need to Take?

The Small Business Finance Exchange, in a recession, can benefit small businesses. They want to see these businesses thrive and grow, and one way they do that is by offering comprehensive credit information to those who lend them money to do so.

As a small business, you are responsible for your business credit. You control what information ends up on your credit report. What can you do?

- Pay your bills consistently on time

- Do business with SBFE members.

- If the businesses you currently work with are not members, encourage them to join.

- Join the SBFE if you are eligible. (Remember you cannot self-report your own information, but by joining, you can make better credit decisions for your business.)

- Monitor your credit information

Keep your business protected with our professional business credit monitoring. It’s a worthwhile investment, saving you money even during a recession.

A Word on Credit Monitoring

There are a couple of ways to monitor credit. Remember though, that the Small Business Finance Exchange does not create or distribute any type of credit report.

You can request a report from one of the credit agencies such as Dun & and Bradstreet or Equifax. Even though they are members of the SBFE however, you cannot see that information specific to the exchange unless you are a member as well. You cannot be a member unless you extend credit to small businesses.

Working with members of the Small Business Finance Exchange in a recession is still beneficial, but it doesn’t really help with credit monitoring.

You can also join a credit monitoring service. This will give you continuous access to the information on your report, including your credit score and what is affecting it.

Use the information. Look for ways to build your business credit and report any mistakes. Send the agency a detailed explanation of what is incorrect, what the correct information is, and copies of all supporting documents available.

How to Take Advantage of the Small Business Finance Exchange in a Recession

It is a good idea to work with SBFE members regardless of the economic client. In a recession however, it can be even more beneficial for all the reasons already stated. The most prominent reason is that, by doing business with SBFE member, you ensure lenders see the most complete picture of your credit possible.

If the recession has been hard on you and you have missed a payment or two, those negative marks could have a reduced impact. This is based on information lenders receive from the SBFE. It may not make the bad things go away, but it can definitely add in other information that can help.

The Small Business Finance Exchanges in a Recession – Exists to Help Small Businesses

By offering a more complete credit picture to lenders, the SBFE ensures that more businesses have the financing available that they need to grow. As businesses grow, more businesses can be born. This is how we come out of a recession. Successful business begets successful business. And before you know it the economy is thriving again. It’s a win/win for everyone and the Small Business Finance Exchange, in a recession and out, is a superhero to all. Make your payments, do business with SBFE members, and your business can survive and even thrive during the recession.

The post How the Small Business Finance Exchange Can Affect Your Business in a Recession: 4 Things You Need to Know appeared first on Credit Suite.