Actress Lena Dunham denied using the N-word on the set of her HBO show “Girls” after Donald Glover joked about it during an awards show. The actor-musician referenced his time on Dunham’s show while presenting an award to writer-producer Paul Simms at the Writers Guild Awards on Sunday. Glover, who previously played a boyfriend of … Continue reading Lena Dunham denies using N-word after Donald Glover joke: 'Never used, nor would use'

Tag: Used

Andretti team fined, used bottle to make weight

IndyCar fined Andretti Autosport $25,000 because the team used a water bottle to make weight in the car Alexander Rossi drove to end his 49-race losing streak.

The post Andretti team fined, used bottle to make weight appeared first on Buy It At A Bargain – Deals And Reviews.

What is Expensify Used For?

You may be hearing about Expensify in money management circles. But, what is Expensify used for? It helps companies create more efficient business processes. It makes the process of turning in expense reports faster and easier. As a result, tracking and managing expenses is also easier. At its core, this is a business expense management system. Its goal is to make money management easier for employers and employees.

What is Expensify Used For? Saving Time and Money

Creating expense reports can take a lot of time. Mistakes can be expensive. Time is money. Consider the time it takes an employee to submit expense reports. That is time they could be doing something else for the business. Expensify works seamlessly with some of the most common options for accounting software. This further simplifies expense tracking.

What is Expensify used for? Saving time and money is just one thing.

What is Expensify Used For? The Expensify Card

Expensify offers a 4% cash back charge card. They draft payments from your bank account. So, it’s more like a debit card. Since they do this on a daily basis, there is no interest. Employees cannot spend more than the amount in your account. You can set a spending limit per employee card. Card users also have access to discounts from several partners. Some of these include AWS, Quickbooks, and Slack.

What is Expensify used for? Some use it to manage employee spending. They may also take advantage of partner discounts.

What is Expensify Used For? Expensify for Expense Management

When spending for the company, users take a photo of the receipt. The mobile app captures all the details of scanned receipts. Then, it creates an expense report for that transaction in real time.

Managing expense tracking and corporate card reconciliation is hard. It can be time consuming. Expensify makes the process fast and easy for employees and employers alike.

You do not have to use the Expensify credit card. You can add any card to your Expensify account.

One of the most useful benefits is the ability to create approval workflows within the app. Customize your expense policy to flag purchases that need a manager’s review. Then, you can more easily track and review the expense receipts your employees submit. Owners can also catch non reimbursable expenses more quickly. This will simplify accounting.

What is Expensify used for? Expense management is its main purpose.

Expense Management Plan Options and Cost

Expensify offers a number of plans for managing business expenses. The free plan includes the ability to send money to friends. It also offers the ability to submit expenses, send invoices, and track mileage.

Users can send receipts to managers or accountants. You can also collect payments and get free cards for your whole team.

Bundled Paid Plans

If you pay for the $5 a month plan, you get everything in the Expensify app free plan. Other benefits include custom coding, accounting integrations, and expense approval. The $9 a month plan has all the benefits the $5 a month plan does. Plus, you get multi-level approval, expense policies, and custom expense reporting.

You do not have to have the Expensify card to use the app. But, you only get the bundle savings if you do.

You can get the same plans if you do not use the card. But, you will pay more. In fact, it can cost about twice as much.

Expensify vs. Divvy

There are several differences between expense management with Divvy and using Expensify.

First, Divvy is free. There is not even an option to pay. Second, Divvy reports payments to the Small Business Finance Exchange. As a result, it can indirectly help you build your business credit score. The SBFE shares information with partners. Those include some business credit reporting agencies.

Lastly, Divvy appears to have higher ratings across the board. The difference is minimal. Still, the Expensify app generally has around 4.4 starts. Divvy typically gets closer to 4.7.

Expensify vs. Brex

Brex is a cash account and expense management system similar to Expensify. The biggest difference is Brex also reports payments. So, they also help to build your business credit score.

Brex has an Expensify integration which is interesting. You can connect your Brex card to your Expensify account. Then, you can use Expensify to manage expenses running through your Brex cash account.

Advantages of Using Expensify

The Expensify mobile app helps business owners save time. It can make managing expenses easier. Creating expense reports should go faster as well. Free corporate credit cards are another attraction for any small business.

Saving receipts and automatically organizing them into expense categories is a plus. The data entry necessary to manually create these reports is no joke. Common accounting systems integrations, including Quickbooks, makes it even more accessible.

Disadvantages

Expensify never says whether they report payment history at all. The only mention of credit is in the FAQs. There, they say they do not check business credit. Also, buried deep in their community pages, there is quick reference. It notes that applying for an Expensify card will never affect either your personal or business credit reports at all.

Is Expensify Right for Your Business?

What is Expensify used for? It’s useful in plenty of ways. It works with many common accounting programs. This simplifies the process of tracking receipts. It also makes data entry easier. That is a major benefit to any business.

But the fact is, there are other options. Options that offer the same or similar services. Many even offer the same integrations. In addition, some cost less or are free, with better reviews and ratings.

Divvy and Brex can help build a stronger business credit score, since they report payments.

None of these options include new funding. They are tools to help you manage funds you already have. Of course, positive payment history on your business credit profile always helps.

But, don’t choose a money management tool based on business credit building. If you need accounts reporting, let Credit Suite help with that. Focus instead on which option will work best for your business.

The post What is Expensify Used For? appeared first on Credit Suite.

Drones will be used to wage campaign against ISIS-K following withdrawal of US troops, expert says

As Afghanistan readies for a future without the presence of U.S. troops, American military officials will most likely combat ISIS-K through the use of drone strikes, said drone expert Brett Velicovich.

How is MLOps Used in Business and Marketing?

Chances are, your brand has data scientists and operations professionals on the team, and while they do their best to collaborate, they each have their own areas of expertise.

This could lead to miscommunications and misunderstandings. The data scientists can interpret the data, but they likely don’t have the background to manage business operations. Likewise, the business team can make their side of things work, but they don’t fully know how to interpret and implement data.

Here is where machine learning operations (MLOps) come in.

In this article, we’ll discuss how MLOps can help with collaboration between your data and business teams, as well as additional immediate and future benefits of implementing it.

What is MLOps?

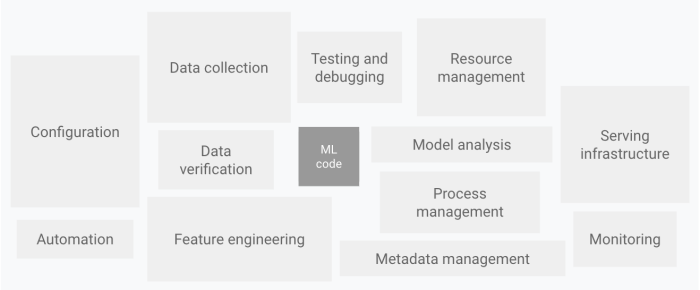

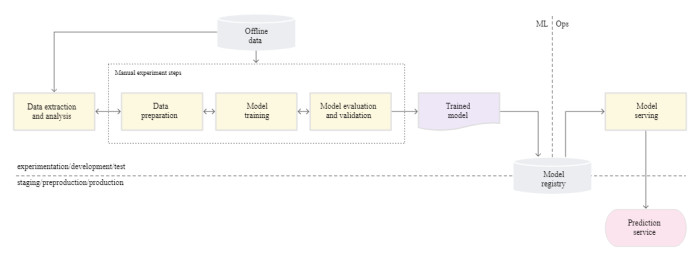

MLOps, in simple terms, is a set of best practices for improving communication and collaboration between your employees on the data science and operations sides of your brand.

In less simple terms, it’s a combination of machine learning, data engineering, and development operations. The goal is to provide a more streamlined process for developing and creating machine learning systems, allowing business administrators, data scientists, marketers, and IT engineers to cooperate on the same level.

It is an extension of what we know as DevOps. DevOps is the process of organizing cooperation between everyone involved in the design and building of big data. This process has been around for a while, but MLOps is still in its youth.

MLOps creates a lifecycle and a set of practices that apply to the development of machine learning systems. This includes research, development, operations, and implementation.

The process of brainstorming, developing, and implementing machine learning is extensive. Having a set of duplicatable processes to guide each project helps in many ways.

5 Benefits of MLOps

Now that we have a general understanding of MLOps, let’s look at how it can impact our businesses. All new technology has either a positive or negative effect on the digital marketing industry, so it’s crucial we understand what we’re getting.

1. MLOps Can Increase Efficiency and Automation

Making the most of our time is something most of us strive to do.

Ironically, we spend a lot of time figuring out how to do this.

We may look into all different kinds of apps and books. We could spend days reading articles or even attending seminars on efficiency and time management.

But, perhaps automating would be simpler for many people.

Automation, by definition, should increase efficiency. Once minute tasks are out of people’s hands, they can focus on big picture issues.

An essential but draining task many folks on data science teams spend time doing is data entry. That’s time they could spend focusing on the science rather than passively improving their typing skills (and, we all know, a typo in data entry can bring disaster!).

MLOps gives options for automating tasks like data entry. It takes some work upfront, but once things are going, the data scientists can get back to what they do best.

2. MLOps Eliminates Waste

MLOps helps businesses improve communication and avoid bottlenecks and costly errors.

How much time have you wasted answering the same questions, reiterating a previous point, or working extra hours to clean up an error because someone simply didn’t know what to do—or what someone else was supposed to be doing?

If you had a set of operations for each employee or contractor to follow, there would be no need to answer the same question continually. You could send them an operations checklist, and they work through it until completion.

The best thing about this is it’s highly duplicatable. I’ll use the example of a content marketing company creating content for its clients.

Let’s say you run a site reviewing camping products. Every page should follow the same basic format so your readers can easily compare products or skim to the parts they care about most.

Suppose you give your reviewers and editors a template to follow, step-by-step instructions, and information about what the others are doing. In that case, confusion can be lessened, and you can focus on which hiking boots are best in winter weather.

MLOps does this, not for content, but for communication. It allows leaders to share “templates” of what should be done on a given day and, after any frontloading, questions should lessen and related waste eliminated.

3. MLOps Focuses on Collaboration

As mentioned, a lack of communication can kill a business quickly. Collaboration between departments is so crucial. Otherwise, work gets lost, notes aren’t passed on, things get missed—and tempers may flare.

MLOps creates procedures for passing one task on to another department. The word “lifecycle” is often used to describe this process.

As a project moves through the lifecycle, workers should be able to see what has happened, what should be happening now, and what will happen next.

This is where we put on our marketer hat and look towards tools like ClickUp and Trello. These are useful for managing large numbers of tasks at the same time.

People involved in the project can access things like checklists and previous conversations at all points in the pipeline, eliminating the wait for responses on work chats or dealing with the dreaded group email.

Communications come in order, everyone who needs to be in on the conversation can be, and they’re unlikely to get lost in dozens of messages.

This process also allows for documentation. Not only does this create a paper trail of who did what so the right people can be given feedback, but it also eliminates miscommunication because it’s all outlined already.

4. MLOps Supports Machine Learning Models

Reducing the amount of variation from one project to another is an important key to scaling any business. MLOps help do this by creating reproducible models you can use as a benchmark at the beginning of each new project.

These data set registries help track resources, project data, logs, and metrics. These factors combined eliminate bottlenecks, reduce wasted time, and help move projects through the pipeline faster.

Essentially what you’re doing is creating a template that can be used over and over. These machine learning “templates” or “models” help reduce production time and produce a better product by having a benchmark to follow each time a new machine learning model comes out.

Having a duplicatable model is vital in marketing because it allows you to input any variable and experience the same result. SEO is an exceptional example of this.

Once you have a proven strategy to create content, upload it, optimize it, drive links to it, and re-optimize, you’ll never have to worry about variables because the steps are the same.

It wouldn’t matter if you were ranking an article about ergonomic keyboards or funeral home carpeting because the bones are the same.

It starts with providing those in need with the resources they want on their own time. We live in a 24-7 connected world where people work all different kinds of hours.

Gone are the days of working 9-5 and leaving all your work behind. Every employee or contractor you have should be able to receive an answer to any question when they need it.

If they have to sit around and wait for you to come back into the office in the morning, it’s creating a bottleneck, slowing down your process, and ultimately costing you money.

5. MLOps Makes Deployment and Implementation Easier

MLOps’ ability to improve communication, create processes, and automate things can make deployment and implementation easier because of the inherently reduced chances of errors.

With MLOps at their fingertips, developers can pack models much faster while still maintaining quality control with profiling and model validation.

It provides a way for data scientists and administrators to perform at a higher level with confidence in knowing each step was followed and validated for consistency.

What is the Future of MLOps in Business and Marketing?

MLOps is a new but colossal industry expected to hit $4 billion by 2025. The most significant impact it may have relates to how we manage data.

Data is meaningless if you don’t have an understandable way to translate it.

Machine learning operations allow you to take that data and turn it into something tangible. For example, if you made some changes to a specific business model and you notice worsening results after six months, you may want to circle back to the original model.

Plus, MLOps provides consistency. Producing a consistent product is a tall order because each scenario is different, and you’ll likely run into unique issues each time. Businesses all over the world struggle to put out a consistent product/service time and time again.

MLOps helps data scientists and operations managers work together to produce consistent results across a considerable time frame. As the project moves from one end of the pipeline to another, all the people involved need to have a way to ensure quality is maintained. MLOps can even automate the process of quality assurance with routine scans.

Conclusion

MLOps helps create lines of communication between everyone involved in the process of developing machine learning technology. As marketers, we can learn something from this and implement the same principles in our businesses.

Every business can benefit from clear guidelines and processes to follow. If you’re experiencing bottlenecks, slow production times, and a large number of errors, you might want to pull back the curtain and take a look at your procedures as a whole.

If that sounds like a lot of work, we can help!

How do you think MLOps will impact business and marketing?

The post How is MLOps Used in Business and Marketing? appeared first on Neil Patel.

Discover the Three Ratios That Are Used to Determine Commercial Lending

Discover the Three Ratios That Are Used to Determine Commercial Lending

If you do not recognize exactly how to assess as well as provide the building correctly to a business genuine estate loan provider, obtaining cash for your industrial job can be fairly an obstacle. Prior to offering your residential or commercial property to a possible lending institution it is essential to identify one of the most potential proportions that the lending institution is mosting likely to make use of in choosing to offer you the cash.

Since of the dimension of the finances, there is a boosted danger with industrial actual estate fundings. Thousands of thousands to countless bucks are lent on industrial homes and also jobs. An industrial lending institution intends to ensure that she or he will certainly obtain their cash back from the created earnings of the residential or commercial property.

If they will certainly lend the cash on a task, many loan providers will certainly utilize the adhering to 3 proportions to establish.

The very first proportion is the financial debt insurance coverage proportion or DCR. The DCR relates to the building itself as well as just how much revenue it is creating contrasted to the financial debt solution, or just how much cash is paid in the direction of the home mortgage on a regular monthly basis. It is shared by the web operating earnings split by the complete financial debt solution.

The financial debt solution is established by the home mortgage terms, such as passion price, size of the financing, as well as exactly how usually a repayment is made. Lots of loan providers need a DCR over 1.2 in order to consider it a fairly secure financial investment. A lending institution does not desire to lending cash on a task that is not able to cover its financial debt solution.

The 2nd proportion is the loan-to-value proportion. If you can obtain a loan-to-value proportion of 75%, then that is normally an excellent number.

Take into consideration that a bonus offer if you can obtain even more than 75% of the worth lent to you. Loan provider’s standards as well as policies might vary significantly relying on just how much they agree to run the risk of on the job.

The 3rd proportion is the financial debt proportion. The financial debt proportion is revealed by splitting month-to-month real estate costs by gross regular monthly revenue.

Numerous business lending institutions will certainly not approve a financial obligation proportion higher than 25%. A financial debt proportion better than 25% stands an excellent possibility of having budget plan troubles.

The reduced financial debt proportion you have, the most likely you will certainly have the ability to obtain financing for your smaller sized business job.

Prior to coming close to any kind of lending institution, it is truly essential to examine these proportions by yourself. They concern your certain offer for which you wish to obtain funding. By doing the proportion evaluation by yourself, you can much better establish if funding will certainly be hard or very easy to acquire, relying on the nature of the job as well as its degree of threat.

It might be an excellent suggestion to speak to a number of possible lending institutions and also ask their fundamental requirements as well as standards that they adhere to in reviewing residential properties. You might locate that some lending institutions are much more traditional than others.

By recognizing your residential or commercial property, you can much better fit a lending institution to your certain requirements. Keep in mind that personal lending institutions can be very handy with those dangerous offers that public loan providers will certainly not also think about. Make certain that you are well outfitted with the appropriate info and also sustaining paperwork regardless of what lending institution you come close to.

The initial proportion is the financial obligation protection proportion or DCR. The 2nd proportion is the loan-to-value proportion. The 3rd proportion is the financial obligation proportion. Several industrial lending institutions will certainly not approve a financial debt proportion better than 25%. Prior to coming close to any kind of lending institution, it is truly essential to assess these proportions on your very own.

The post Discover the Three Ratios That Are Used to Determine Commercial Lending appeared first on ROI Credit Builders.

Discover the Three Ratios That Are Used to Determine Commercial Lending

Discover the Three Ratios That Are Used to Determine Commercial Lending

If you do not recognize exactly how to assess as well as provide the building correctly to a business genuine estate loan provider, obtaining cash for your industrial job can be fairly an obstacle. Prior to offering your residential or commercial property to a possible lending institution it is essential to identify one of the most potential proportions that the lending institution is mosting likely to make use of in choosing to offer you the cash.

Since of the dimension of the finances, there is a boosted danger with industrial actual estate fundings. Thousands of thousands to countless bucks are lent on industrial homes and also jobs. An industrial lending institution intends to ensure that she or he will certainly obtain their cash back from the created earnings of the residential or commercial property.

If they will certainly lend the cash on a task, many loan providers will certainly utilize the adhering to 3 proportions to establish.

The very first proportion is the financial debt insurance coverage proportion or DCR. The DCR relates to the building itself as well as just how much revenue it is creating contrasted to the financial debt solution, or just how much cash is paid in the direction of the home mortgage on a regular monthly basis. It is shared by the web operating earnings split by the complete financial debt solution.

The financial debt solution is established by the home mortgage terms, such as passion price, size of the financing, as well as exactly how usually a repayment is made. Lots of loan providers need a DCR over 1.2 in order to consider it a fairly secure financial investment. A lending institution does not desire to lending cash on a task that is not able to cover its financial debt solution.

The 2nd proportion is the loan-to-value proportion. If you can obtain a loan-to-value proportion of 75%, then that is normally an excellent number.

Take into consideration that a bonus offer if you can obtain even more than 75% of the worth lent to you. Loan provider’s standards as well as policies might vary significantly relying on just how much they agree to run the risk of on the job.

The 3rd proportion is the financial debt proportion. The financial debt proportion is revealed by splitting month-to-month real estate costs by gross regular monthly revenue.

Numerous business lending institutions will certainly not approve a financial obligation proportion higher than 25%. A financial debt proportion better than 25% stands an excellent possibility of having budget plan troubles.

The reduced financial debt proportion you have, the most likely you will certainly have the ability to obtain financing for your smaller sized business job.

Prior to coming close to any kind of lending institution, it is truly essential to examine these proportions by yourself. They concern your certain offer for which you wish to obtain funding. By doing the proportion evaluation by yourself, you can much better establish if funding will certainly be hard or very easy to acquire, relying on the nature of the job as well as its degree of threat.

It might be an excellent suggestion to speak to a number of possible lending institutions and also ask their fundamental requirements as well as standards that they adhere to in reviewing residential properties. You might locate that some lending institutions are much more traditional than others.

By recognizing your residential or commercial property, you can much better fit a lending institution to your certain requirements. Keep in mind that personal lending institutions can be very handy with those dangerous offers that public loan providers will certainly not also think about. Make certain that you are well outfitted with the appropriate info and also sustaining paperwork regardless of what lending institution you come close to.

The initial proportion is the financial obligation protection proportion or DCR. The 2nd proportion is the loan-to-value proportion. The 3rd proportion is the financial obligation proportion. Several industrial lending institutions will certainly not approve a financial debt proportion better than 25%. Prior to coming close to any kind of lending institution, it is truly essential to assess these proportions on your very own.

The post Discover the Three Ratios That Are Used to Determine Commercial Lending appeared first on ROI Credit Builders.