5 Awesome Ways to Build Business Credit Score

Build Business Credit Score to Get the Funding You Need

Business owners hear it all the time. You need business credit to run a business. You shouldn’t run your business using personal credit. Business credit is the best way to ensure you can get the funding you need to build and grow your business. The problem is, you don’t hear a lot about what business credit is, how to get it, or how to build business credit score.

Did you know you can’t automatically build business credit score? That’s right. It isn’t like your personal credit score where accounts are automatically reported. You have to be intentional when you want to build business credit score. In fact, if you have not been intentional, you may not even have business credit yet, despite the fact that you own a business.

How Do You Get Business Credit?

Before you can even begin to build business credit, you have to establish your business as an entity separate from yourself. Here is how that happens:

You have to incorporate

This is the most decisive first step in separating your business credit from your personal credit. When you cease operating as a sole proprietorship and incorporate your business, it will be easier for credit agencies to recognize your business separately. You have a few options.

- C Corp

This is the most definitive separation, but it is also the most complicated and expensive. Before choosing this option, be certain there are reasons other than establishing business credit that it needs to be done. If it isn’t necessary for some other reason, there are other, less complicated, and less costly options.

- S Corp

This option basically offers the same separation as the C Corp, but taxes are paid at the personal level, rather than requiring the business to be taxed as well, resulting in double taxation. It is also cheaper than incorporating as a C Corp. If you aren’t required to file as a C corp, this is a good alternative.

- LLC

Forming a Limited Liability Corporation results in less liability, thus the name, and offers enough separation to serve the purpose of establishing business credit. If you are not required to be a C Corp or S Corp, this is the easiest and most cost-effective way to create the separation of business and personal credit needed.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

Get an EIN

You need to apply for an EIN and stop using your Social Security Number as the identifying number for your business. Your SSN is tied to you, personally, and it is virtually guaranteed that anything connected credit-wise will end up on your personal credit reports.

The process for applying for and EIN is easy. The IRS has an online form, and as soon as all the information is verified you receive your number. It typically happens almost immediately.

Get a DUNS Number

Dun and Bradstreet (D&B) is the most widely used business credit reporting agency. They issue each business on file a 9-digit DUNS number. Application is easy and free, and once you have that number, you will be even closer to establishing credit for your business separate from your own.

Separate Contact Information

Your business needs its own phone number. This way, when you apply for credit, you can enter contact information that is separate from your own. When information is reported to agencies, sometimes the phone number is an identifying factor. If you and your business share a number, that just decreases the level of separation.

Be sure you get your business phone number listed in the directory under the business name.

Business Bank Account

There has to be a dedicated business bank account. Run all business transactions through this account. Resist the temptation to pay personal expenses from it by paying yourself a salary instead.

What if You Already have Business Credit?

The next question is, how do you build business credit score if you have business credit already, but it is bad? How do you improve your business credit score? It is impossible to improve on anything if you do not know what you are starting with, what you have to work with, and what you have control over. Let’s break down where exactly your business credit score comes from and what it means. This is important to get a good starting point.

Dun & Bradstreet

Dun & Bradstreet offers several different types of business credit reports. In fact, there are six different reporting options in all. They all offer different information related to credit worthiness. It takes all of them to get the whole picture.

The report most used is the PAYDEX. This is probably because it is the easiest to understand. It is the options most like the consumer FICO score. It measures how quickly a customer makes payments and ranges from 1 to 100. Scores of 70 or higher are acceptable. For reference, a score of 100 shows payments are made in advance, and a score of 1 indicates that they are 120 days late, or more.

Experian Commercial

Experian uses what it calls Intelliscore as its credit ranking. There are more than 800 different factors that they use to predict a company’s credit risk. With Intelliscore, a score of 76 or higher indicates a low risk of default or late payment. If a score falls between 51 to 75, it indicates a low to medium risk. Scores from 26 to 50 are medium risk, and from 25 down to 1 is medium high to high risk.

Experian Commercial offers a number of other scores as well, similar to Dun & Bradstreet.

Equifax Business

Equifax gets its business credit data in ways similar to D&B and Experian. They get Net 30 type industry trade credit information from a wide variety of suppliers that provide products and services to businesses on an invoice basis.

In addition, they use financial data with this industry trade data, and they add in utility and telephone payment data. They also use public records information.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

Equifax Business credit scores include:

- The Small Business Credit Risk Score for Suppliers

It is scored on a scale of 1 to 100, with 90+ indicating that a business has paid its obligations as agreed. An 80 to 89 means they are 1 to 30 days past due, 60 to 79 indicates they are 31-60 days overdue, 40 to 59 is 61 to 90 days past the payment date. It just goes down from there.

- Business Failure Risk Score

This score indicates the chance of a company paying its bills late on the following scale:

- 497 – 816: 25% or less chance of payment being overdue

- 452 – 496: 26 – 50% chance of payment going overdue

- 415 – 451: 51 – 74% chance of delinquent payments

FICO SBSS

The FICO SBSS is the business version of your personal FICO credit score. It is becoming increasingly more common for lenders to use this score, rather than the Experian or even the D&B PAYDEX business credit score.

Unlike your personal FICO, the SBSS reports on a scale of 0 to 300. Of course, the higher the better, but most lenders require a score of at least 160.

This is a lot different from other business credit scoring models because it combines your business credit score, personal credit score, and other financial information such as business assets and revenue. It is a total global financial picture rolled into one score.

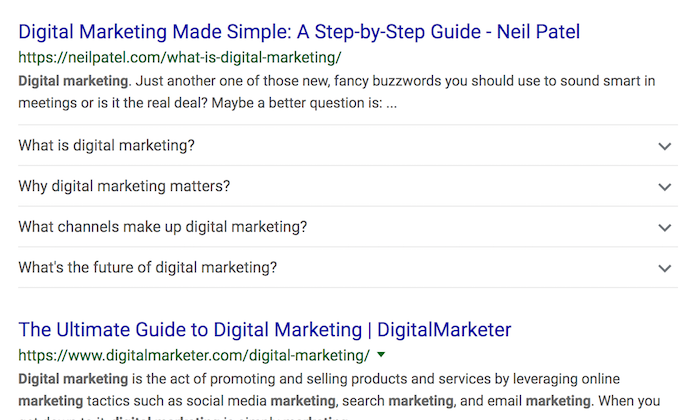

How Do You Know What Your Score Is?

Unfortunately, there are not a lot of ways to find out what your business credit score is without paying. Find out how to get business credit reports for free here. Most options do not work on a continual basis however. You will eventually have to pay.

The prices are not cheap. Here are the prices for the top 3 business credit reporting agencies:

- Dun & Bradstreet reports range in price from $61 to $229 per report.

- Experian reports are $49.95 per report.

- Equifax is $99.95 per report.

As for your FICO SBSS, that is a whole other story. You cannot really get a copy of it because it will be different from lender to lender. They system calculates a score based on what the lender tells it to look for. This means the lender can weight certain aspects of the calculation. For example, if one lender says that they want the personal credit history to be heavily weighted and another prefers to focus on another type of debt, those two lenders will have two different scores. Meanwhile, another lender may leave out student loans all together. The next may not want any personal credit information at all. With the huge number of possibilities, you could feasibly have a different FICO SBSS score every time.

With Credit Suite, you can monitor your scores with Dun & Bradstreet and Experian for a fraction of the cost. Get more information here.

5 Way to Build Business Credit Score

Once you understand where it comes from, what it is, and what it means, you can get to work and build business credit score. Here are some of our favorite tips.

1. Get more accounts reporting

The fastest way to build business credit score is to get as many accounts as possible reporting on-time payments. The fastest way to do this is to work with starter vendors.

These are vendors that will offer net terms on invoices without a credit check. After you pay, they will report those payments to the credit agencies. As more and more of these vendors report your payments, your business credit score will start to grow.

Another way to get more accounts reporting on-time payments is to ask vendors you already work with to report. You pay things like rent, utilities, and your telephone bill each month. Sometimes if you ask them, they will report those payments. They are not required to though.

2. Dispute Mistakes on Your Credit Report

This is one thing that a lot of business owners do not realize they can do to build business credit score. Once you are able to see your business credit report, be sure to dispute any mistakes you find. Do this in writing. When you send the letter, you have to be very detailed about what the mistake is. Be clear about the correct information, and send copies of supporting documents. These are documents like receipts and cancelled checks. Additionally, use certified mail to send dispute information. .

Dispute your or your business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute mistakes on your or your business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service contact number is here: www.dandb.com/glossary/paydex.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

3. Do Business with SBFE Members

The Small Business Finance Exchange collects information from its members for their database. They then provide this information to partner credit agencies. These credit agencies can then distribute that information to other SBFE members seeking credit data on potential borrowers. Consequently, by doing business with members of the Small Business Exchange, you ensure that the credit agencies have as much information as possible related to your business.

4. Work on Credit Utilization

It’s important to remember that using too much of your available credit can cause problems. Your credit utilization, as indicated by your debt-to-credit ratio, needs to stay as low as possible. So you cannot use up every bit of credit you have. Carrying balances close to your limits will raise this ratio. As a result, your credit score will go down. Granted, you need to carry balances and make payments to get those payments reported. However, avoid getting too close to your limits.

5. Don’t Forget About Your Personal Credit Score

Despite the fact that business credit is separate from your personal credit, there are some business credit reporting agencies, like Experian Business and FICO SBSS, that use your personal credit history in the calculation. As a result, it is possible for a poor personal credit score to have a negative effect on your business credit score. So don’t neglect it.

Follow These Tips and You Can Build Business Credit Score

Here’s the thing. It will not do you any good to get more accounts reporting, correct mistakes, or work with SBFE members if you are not making payments on time. Regardless of how much credit you have available and how little you are using, not paying will tank your score fast. Hence, it will totally negate any progress you make to build business credit score. You just have to pay, on-time, and consistently.

Whether you are starting from scratch or trying to build up a bad score, trying to build business credit score can be completely overwhelming. Honestly, you have to start somewhere though, right? These tips can help you find a good starting point, and from there you just keep swimming.

The post 5 Awesome Ways to Build Business Credit Score appeared first on Credit Suite.