Six Ways to Creatively Fund a Startup Without Using Equity During a Recession Cycle

Creative Recession Cycle Funding For New Businesses

As an entrepreneur, raising money for your new startup business can seem hard to execute. You’ve probably seen dozens of competition funds out there, so you have chances to secure funding. Ultimately, you want funding for your startup to come from investors. But getting investors can be impossible for a new startup. Recession cycle funding for startups can happen.

Using your equity might seem like the best idea to fund your business as you wait for investors to come. Most new startup business owners, fall prey to taking out the equity to fund the business before the revenue starts rolling in. You don’t have to take out equity to fund your startup. It’s not necessary. The success of your business solely comes from decisions you make as the business owner.

Here are some ways to creatively make money for your new startup without taking out of your equity.

Recession Era Funding

The number of United States financial institutions as well as thrifts has been decreasing progressively for a quarter of a century. This is from consolidation in the marketplace along with deregulation in the 1990s, decreasing barriers to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets focused in ever‐larger financial institutions is problematic for small business proprietors. Big banks are a lot less likely to make small loans. Economic recessions mean banks become extra mindful with lending. The good news is, business credit does not depend on financial institutions.

Recession Cycle Funding: Crowdfunding

Use Kickstarter. There’s a method to the madness in using Kickstart to fund your startup. First, do your research before pitching your idea to Kickstarter. Find out if there’s another project they have approved like your startup. So if they deny your idea, refer to similar projects they have approved. And when you ask for money from Kickstarter, be realistic and ask for money to help you survive for a few months. Don’t forget to spread the word to your friends and family asking them to help fund your start up.

Recession Cycle Funding: Bootstrap

Put your Money in First. When you first start out, tap into your own saving accounts, home equity, retirement accounts, etc. This might seem a bit risky, but you should invest in your own startup venture before you expect other investors to put money into it. Most investors will want to see the owners of the business have invested some of their own cash in the business to show confidence.

But there can be some issues with bootstrapping your business.

Still, here are some ways to bootstrap to build more financial resources.

Share and Save on Services and Equipment

Share office services and equipment. You’ll probably need to get a co-work space where you can share the office space and equipment with other business owners. This will help you cut the cost of renting an office space and paying the high monthly rent.

Use the computers and servers you have. Don’t go out and buy new equipment when you start your startup. Use the computers, software, and desks, etc., you already have. Don’t spend extra money renting new equipment.

Recession Cycle Funding: Grants

Pursue non-dilutive capital. Look for government grants to get more money for your startup. Cities and states have grant programs offering low-interest rates on loans. Having access to these resources give startups the ability to qualify for large sums of money.

Recession Cycle Funding: Startup Business Credit Cards

Business credit cards can be a great way to get a startup off the ground.

We looked at a number of business credit cards, and did the research for you. So here are our picks.

Per the SBA, business credit card limits are a whopping 10 – 100 times that of personal cards!

You can get a lot more money with business credit. And you can still have personal credit cards at stores. So you would now have an added card at the same stores for your company.

You don’t need collateral, cash flow, or financials to get business credit. This is still true during a recession cycle.

Benefits can vary. So, make certain to choose the benefit you would prefer from this assortment of alternatives.

Dependable Credit Cards for Fair to Poor Credit, Not Calling for a Personal Guarantee

Brex Card for Startups

Look into the Brex Card for Startups. It has no annual fee.

You will not need to provide your Social Security number to apply. And you will not need to supply a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Likewise, there are some industries they will not work with, as well as others where they want added documentation. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a business’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Also, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have poor credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Secure Business Credit Cards for Fair Credit

Capital One® Spark® Classic for Business

Take a look at the Capital One® Spark® Classic for Business. It has no yearly fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can earn unlimited 1% cash back on every purchase for your company, without any minimum to redeem.

While this card is within reach if you have fair credit scores, beware of the APR. But if you can pay on schedule, and in full, then it’s a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

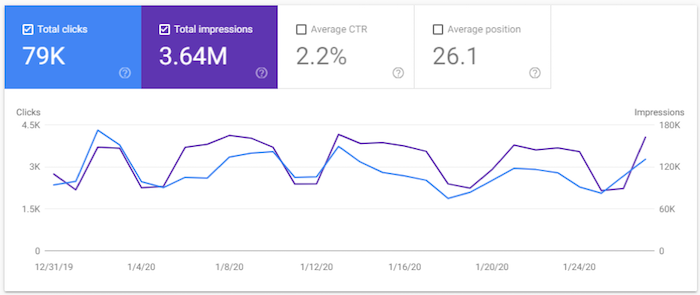

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Exceptional Business Credit Cards with No Yearly Fee

No Yearly Fee/Flat Rate Cash Back

Ink Business Unlimited℠ Credit Card

Check out the Ink Business Unlimited℠ Credit Card. Past no yearly fee, get an introductory 0% APR for the first one year. After that, the APR is a variable 14.74 – 20.74%.

You can get unlimited 1.5% Cash Back rewards on every purchase made for your company. And get $500 bonus cash back after spending $3,000 in the first 3 months from account opening. You can redeem your rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®. You will need excellent credit to get approval for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/unlimited

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Company Credit Cards with a 0% Introductory APR – Pay Zero!

Blue Business® Plus Credit Card from American Express

Take a look at the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the first 12 months. After that, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on everyday company purchases like office supplies or client dinners for the first $50,000 spent annually. Get 1 point per dollar afterwards.

You will need great to outstanding credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

American Express® Blue Business Cash Card

Also have a look at the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. But its rewards are in cash instead of points.

Get 2% cash back on all eligible purchases on up to $50,000 per calendar year. After that get 1%.

It has no yearly fee. There is a 0% introductory APR for the first one year. Afterwards, the APR is a variable 14.74 – 20.74%.

You will need good to excellent credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Terrific Cards for Cash Back

Flat-Rate Rewards

Capital One ® Spark® Cash for Business

Check out the Capital One® Spark® Cash for Business. It has an introductory $0 yearly fee for the first year. After that, this card costs $95 each year. There is no introductory APR deal. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the initial three months from account opening. Get unlimited 2% cash back. Redeem at any time without minimums.

You will need great to excellent credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Flat-Rate Rewards and No Yearly Cost

Discover it® Business Card

Check out the Discover it® Business Card. It has no annual fee. There is an introductory APR of 0% on purchases for 12 months. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimal spend requirement.

You can download transactions| quickly to Quicken, QuickBooks, and Excel. Note: you will need great to superb credit to receive this card.

https://www.discover.com/credit-cards/business/

Bonus Categories

Ink Business Cash℠ Credit Card

Take a look at the Ink Business Cash℠ Credit Card. It has no annual fee. There is a 0% introductory APR for the first year. After that, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the initial 3 months from account opening.

You can get 5% cash back on the initial $25,000 spent in combined purchases at office supply stores and on net, cable, and phone services each account anniversary year.

Get 2% cash back on the first $25,000 spent in combined purchases at gasoline stations and restaurants each account anniversary year. Get 1% cash back on all other purchases. There is no limit to the amount you can earn.

You will need superb credit to get approval for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Boosted Cash Back Categories

Bank of America® Business Advantage Cash Rewards MasterCard® credit card

Take a look at the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the first 9 billing cycles of the account. Afterwards, the APR is 13.74% – 23.74% variable. There is no yearly fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gasoline stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Earn 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. After that get 1% after, with no limits.

You will need outstanding credit scores to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Flexible Financing Credit Cards – Take A Look at Your Alternatives!

The Plum Card® from American Express

Check out the Plum Card® from American Express. It has an introductory yearly fee of $0 for the first year. Afterwards, pay $250 per year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need good to exceptional credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Unbeatable Cards for Jackpot Rewards That Never Expire

Capital One® Spark® Cash Select for Business

Have a look at the Capital One® Spark® Cash Select for Business. It has no annual fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can get. Also earn a one-time $200 cash bonus when you spend $3,000 on purchases in the first 3 months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR afterwards.

You will need good to outstanding credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

The Recession Cycle Funding for You

Your absolute best business credit cards hinge on your credit history and scores.

Only you can pick which features you want and need. So be sure to do your homework. What is outstanding for you could be catastrophic for somebody else.

And, as always, make sure to establish credit in the recommended order for the best, fastest benefits.

Recession Cycle Funding: Takeaways

Raising money during a recession cycle might feel a little overwhelming. It takes time to build up funds to start a new business. But you don’t have to feel you have to use your equity to fund your new business. There are so many other ways you can find money to help your business grow. Don’t get focused on making quick money. Think about the long-term growth of your company, and how your decisions today will affect its finances in the future. Develop a plan to find money from different resources before using company equity. And yes, you can even do this during a recession cycle.

The post Six Ways to Creatively Fund a Startup Without Using Equity During a Recession Cycle appeared first on Credit Suite.