Clubhouse is an interesting app that acts as a combination of podcasting, Facebook Messenger, and Snapchat mixed into one. This audio-based platform is growing dramatically. In fact, the app has more than 228,000 reviews and a 4.9-star rating on the App Store. If you’re looking for a unique way to reach a highly targeted audience … Continue reading 15 Useful Clubhouse Tools to Help Your Marketing

Author: Alvin Tipton

How to Use First-Party Data for Ad Personalization

Have you ever felt like someone was watching you online? Those shoes you just searched for on Amazon suddenly show up in ads on Facebook. Maybe you start seeing ads on YouTube for a resort you were researching for an upcoming vacation.

The truth is, you are being watched. In fact, marketers have used cookies to track the actions of internet users for years—but that may soon change. Google announced they are ending the use of third-party cookies. As a result, most businesses will have to rely on first-party data for things like ad targeting.

What does that mean for your marketing strategy? It might not be as bad as you think.

Here’s what you need to know about first-party data and how to use it to create targeted paid ads. (Spoiler alert: It might actually be better for your PPC strategy in the long run!)

What Is First-Party Data?

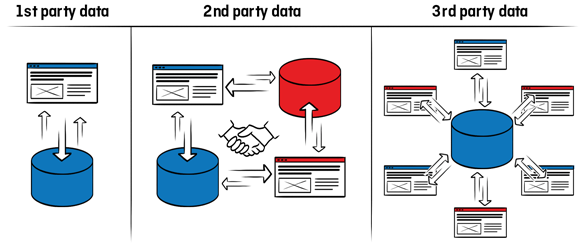

Before we dig into what this change means for your paid ads, let’s talk about the different types of data companies use in marketing.

First-party data is information companies collect from their own sources about their customers. For example, the data from your website tracking tool, your email subscribers, or surveying your audience.

Second-party data is when two or more organizations come together to mutually share their data. Third-party data is collected by one source, often aggregated, and then sold to a third party who has no connection with the original source.

To summarize:

- first-party data: data you collect about your customers or site visitors

- second-party data: data you and someone else pool together

- third-party data: data collected by one party and sold or shared with an unrelated third-party

What Is the Difference Between First-Party Data and Third-Party Data?

Third-party data, the type Google is phasing out, refers to data collected from (as you might have guessed) a third-party, meaning a site or entity without a direct relationship with the original source.

Third-party data is collected, aggregated, and sold to other parties. The problem is the brands buying the data have little idea where it came from.

There are other issues, too. For example, you can buy third-party data, but so can your competitors. That makes it hard to be competitive.

This chart helps illustrate the difference between the different types of data.

Why Is Third-Party Data Being Phased Out?

The main reason third-party data is being phased out is due to major security and privacy issues.

David Temkin, Director of Product Management, Ads Privacy, and Trust at Google, shared,

People shouldn’t have to accept being tracked across the web in order to get the benefits of relevant advertising. And advertisers don’t need to track individual consumers across the web to get the performance benefits of digital advertising.

Advances in aggregation, anonymization, on-device processing and other privacy-preserving technologies offer a clear path to replacing individual identifiers.

Google isn’t the only one phasing out cookies. Firefox stopped using cookies in 2013, and Microsoft made “Do Not Track” their default setting the same year.

In addition to privacy issues, cookies aren’t as accurate as some might think. For example, they can’t always track users across devices.

If you shop on your phone for a pair of shoes but buy them on your laptop, you might still see ads for those shoes on your mobile device—which is terrible for ad spend, as brands waste money targeting users that have already converted.

How Will Using First-Party Data Impact Ad Personalization?

As Google phases out third-party cookies, many brands will begin using first-party data to better personalize ads. What does this mean for your paid marketing strategy?

Don’t worry; you won’t have to rebuild your marketing strategy from scratch. However, there are a few changes you’ll want to pay attention to:

- Brands will need to focus on collecting first-party data: If you haven’t been gathering data about your audience, now is the time. Consider hosting contests, using website tracking tools, or sending out surveys to collect more information about your audience.

- Competitive analysis will get harder: One of the downfalls of third-party data is that you and your competitors are using the exact same targeting data. With the move to away from third-party cookies, it might become harder to understand why your competitors are taking certain actions.

- Ads may get more personalized: First-party data is data from your actual site visitors and customers, making it easier to create a personalized experience.

Day-to-day, the switch away from third-party data is unlikely to impact the marketing world in a massive way. Most brands will begin to rely on first-party data more; however, Google is also creating what they call a “privacy sandbox” to allow brands to target users without invading their privacy.

Brands that want to succeed shouldn’t rely entirely on Google’s new data plan because there are a ton of advantages to using this type of data?

Advantages of Only Using First-Party Data for Ad Personalization

Why should you consider moving to first-party data rather than relying solely on Google’s privacy sandbox?

For starters, most brands are increasing their reliance on first-party data, which likely means they are seeing positive results. According to Google, 87 percent of APAC brands consider it critical to their marketing efforts.

Let’s look at a few other benefits to consider.

First-Party Data Is More Accurate

First-party data is information you collect about your customers. This makes it more accurate because you know who it is about and where it came from.

Third-party data is sold and sometimes resold, which means brands have no access to the source data and, sometimes, very little idea about where the data is actually from.

Boost Marketing Performance

Some people are really concerned about the end of third-party data, but I’m not. Why? Because first-party data isn’t just more accurate; it’s also much more efficient at driving consumers to take action.

According to a study by Boston Consulting Group, marketers that use first-party data see a lift in marketing efficiency, generating nearly double the revenue from a single ad or placement.

Your Competitors Don’t Have the Same Data

Standing out online sometimes feels impossible. With millions of companies, billions of internet users, and more content being churned out every day, brands that want to stand out face a ton of noise.

With third-party data, you and your competitors can buy the exact same data, which makes it pretty hard to be competitive. However, your competitors don’t have access to the data you collect, making it easier to test new initiatives or uncover opportunities about your own traffic and customers.

You Can Double Down on Personalization

According to Forrester, 89 percent of digital companies invest in marketing personalization. It’s easy to see why when 80 percent of customers report they are more likely to purchase from brands that offer a personalized experience.

Using third-party data for personalization was never a perfect match. You might not know when a customer converts from another device or if the data you’re using is skewed. With first-party data, you can dive into personalization, secure in the knowledge that your data is accurate.

It Is More Standardized

Imagine asking five people to create a puzzle piece. You give them all the same parameters for height, length, and shape. Even with the same directions, each of those pieces isn’t quite going to fit together.

The same thing happens with third-party data. Each platform might gather it just a little bit differently, which can make it almost impossible to pull all that data together. With first-party data, however, you gather the data. This means you can ensure it is standardized and works well with all your tools and systems.

First-Party Data Is Cheaper

Third-party data is purchased from another vendor, which means you are shelling out cash for data that is less efficient, less accurate, and harder to use. First-party data, on the other hand, is information from your own audience.

Which means you don’t have to buy it. You will have to pay a bit to collect and store the data, but it’s likely much cheaper than purchasing the data from another source.

How to Use First-Party Data for Ad Personalization

We’ve covered what first-party data is, why Google is ditching third-party data, and a few of the advantages of using it. How do you actually put first-party data to use? Here’s what you need to know to use this data for ad personalization.

Determine How to Leverage First-Party Data

Before you start collecting data, take the time to figure out how you will use the data to further your marketing goals. How you plan to use the data will impact what type of data you want to collect and how you gather it.

You might use it to:

- build brand awareness

- reduce churn

- send timely ads

- drive more qualified leads

For example, if the data will be used to send more personalized email marketing campaigns, you could gather the data through an email survey.

Make a Plan to Gather First-Party Data

Unlike third-party data, you can’t just buy first-party data; you’ll have to gather it yourself. Luckily, there’s no shortage of ways to gather it.

For example, you can collect first-party data from:

- website visitor tracking tools like Crazy Egg

- your mobile apps

- offline surveys

- social media channels

- user registration for your website

- contests

Before making a plan to gather data, think about how you plan the data to personalize your marketing. For example, retargeting ads, personalized product recommendations, or account-based marketing.

Ask Permission to Gather the Data

One of the major issues with third-party data is some web users don’t even realize they’re being tracked. As first-party data becomes more popular (and as privacy laws limit the data we collect about our audiences), it’s important to be transparent about the data you gather.

Ensure your audience clearly understands what data you collect, what you do with it, and how it’s stored. Being transparent about the data you collect and how you use it isn’t just the right thing to do, it’s required by law in some places, like the EU’s GDPR.

Test, Tweak, and Retest

With third-party data, you get what you get. There is no way to change the type of data you collect or adjust how you gather it.

With first-party data, you can test to figure out the best way to collect data by adjusting how you gather it or test and tweak how you use the data by A/B testing ads to see what your audience responds to.

Conclusion

Third-party cookies are coming to an end. What does that mean for marketers? It means it’s time to start leveraging first-party data for personalization. The good news is, it is more accurate and cheaper, and it can even improve marketing efficiency.

The first step to using first-party data is to find a way to collect it through polls, customer surveys, or website tracking tools. Then make a plan for how to use it. If you need help getting it set up, we can help.

Are you planning to use first-party data for ad personalization? What are your marketing goals?

How to Build a Sales Forecast Model

In an ideal world, sales teams and business leaders would have crystal balls to help them predict accurate sales forecasts. With these predictions, it would be easier to create budgets, set goals, know when you’ll need to hire more people, and so much more. Unfortunately, crystal balls belong in the movies, and predicting anything in …

The post How to Build a Sales Forecast Model first appeared on Online Web Store Site.

Orange Health (YC S20) Is Hiring Mobile App Engineers (RN, iOS/Droid) in India

Article URL: https://www.orangehealth.in/jobs/experienced-mobile-app-engineer-(ios%2Fandroid%2Freact-native)-

Comments URL: https://news.ycombinator.com/item?id=24683624

Points: 1

# Comments: 0

How Hard is it to Establish Business Credit in a Recession?

Do you know? How hard is it to Establish Business Credit in a Recession?

It’s a brilliant question. How hard is it to establish business credit in a recession? Is business credit building impossible? Or is it just some nightmare? And what happens in an economic downturn?

I assure you it is not only possible, it is downright sure-fire. And business credit is all but recession-proof!

Business credit is credit in a business’s name. It doesn’t link to an owner’s personal credit, not even if the owner is a sole proprietor and the solitary employee of the corporation. Because of this, an entrepreneur’s business and consumer credit scores can be very different.

The Advantages

Because business credit is distinct from individual, it helps to safeguard a business owner’s personal assets, in the event of court action or business insolvency. Also, with two separate credit scores, an entrepreneur can get two separate cards from the same merchant.

This effectively doubles buying power.

Another benefit is that even startups can do this. Visiting a bank for a business loan can be a formula for frustration. But building small business credit, when done right, is a plan for success.

Individual credit scores are dependent on payments but also additional considerations like credit usage percentages. But for small business credit, the scores actually merely depend on whether a corporation pays its invoices timely.

How Hard is it to Establish Business Credit in a Recession: The Process

Establishing business credit is a process, and it does not occur automatically. A corporation will need to proactively work to build business credit. Nonetheless, it can be done readily and quickly, and it is much swifter than developing individual credit scores.

Merchants are a big component of this process.

Doing the steps out of sequence will cause repetitive rejections. No one can start at the top with company credit. For instance, you can’t start with store or cash credit from your bank. If you do you’ll get a rejection 100% of the time.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

How Hard is it to Establish Business Credit in a Recession: Company Fundability

A business has to be authentic to lenders and vendors. As a result, a company will need a professional-looking website and email address, with website hosting from a company like GoDaddy. Additionally business phone and fax numbers need to have a listing on ListYourself.net.

At the same time the company telephone number should be toll-free (800 exchange or the like).

A company will also need a bank account dedicated strictly to it, and it must have every one of the licenses essential for running. These licenses all must be in the accurate, accurate name of the company, with the same business address and phone numbers.

Keep in mind that this means not just state licenses, but potentially also city licenses.

How Hard is it to Establish Business Credit in a Recession: Dealing with the Internal Revenue Service

Visit the IRS web site and obtain an EIN for the small business. They’re free of charge. Select a business entity like corporation, LLC, etc.

A small business can start off as a sole proprietor. But will most likely wish to switch to a form of corporation or partnership to decrease risk and maximize tax benefits.

A business entity will matter when it concerns tax obligations and liability in the event of litigation. A sole proprietorship means the owner is it when it comes to liability and tax obligations. No one else is responsible.

If you run a company as a sole proprietor, then at least be sure to file for a DBA (‘doing business as’) status.

If you do not, then your personal name is the same as the small business name. Therefore, you can find yourself being directly responsible for all company debts.

And also, per the IRS, with this structure there is a 1 in 7 probability of an IRS audit. There is a 1 in 50 chance for corporations! Prevent confusion and drastically lower the odds of an Internal Revenue Service audit as well.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

How Hard is it to Establish Business Credit in a Recession: Starting off the Business Credit Reporting Process

Begin at the D&B website and obtain a cost-free DUNS number. A DUNS number is how D&B gets a corporation into their system, to produce a PAYDEX score. If there is no DUNS number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this at https://www.creditsuite.com/reports/. If there is a record with them, check it for accuracy and completeness.

If there are no records with them, go to the next step in the process. By doing this, Experian and Equifax will have something to report on.

Trade Lines

First you must build trade lines that report. This is also known as vendor accounts. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can start obtaining revolving store and cash credit.

These kinds of accounts have the tendency to be for the things bought all the time, like shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first of all, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are oftentimes Net 30, instead of revolving.

Hence if you get approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, like within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts need to be paid in full within 60 days. Compared to with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To begin your business credit profile the right way, you should get approval for vendor accounts that report to the business credit reporting agencies. As soon as that’s done, you can then make use of the credit.

Then repay what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with very little effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

And Continue…

So get 3 of these to move onto the next step, which is revolving store credit.

1. Uline Shipping Supplies

Uline Shipping Supplies is a true starter vendor. Find them online at https://www.uline.com/. They offer shipping, packing, and industrial supplies, and they report to D&B and Experian.

You need to have a DUNS number. They will ask for 2 references and a bank reference. The initial few orders may need to be paid in advance to initially get approval for Net 30 terms. Also, you may need to buy some things you do not need.

2. Crown Office Supplies

Crown Office Supplies is another true starter vendor. Find them online at https://crownofficesupplies.com.

They sell a variety of office supplies and take helping clients seriously. They say, “just starting your business, or maybe have an existing business, but you have a question regarding office supplies… we are here to help!” And they report to Dun and Bradstreet, Experian, and Equifax.

There is a $99.00 yearly fee, though they do report that fee to the business credit reporting agencies. For other purchases to report, the purchase must be at least $30.00. Terms are Net 30.

3. Grainger Industrial Supply

Grainger Industrial Supply is also a true starter vendor. Find them online at https://www.grainger.com/. They sell safety equipment, plumbing supplies, and more, and they report to D&B. You will need a business license, EIN, and a DUNS number.

For less than $1000 credit limit they will approve virtually anybody with a business license.

Accounts That Don’t Report

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to at the very least one of the CRAs, a trade account which does not report can yet be of some worth. You can always ask non-reporting accounts for trade references.

Also credit accounts of any sort will help you to better even out business expenditures, consequently making financial planning simpler. These are companies like PayPal Credit, T-Mobile, and Best Buy.

Revolving Store Credit

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs move to revolving store credit.

Use the corporation’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then progress to fleet credit. These are companies like BP and Conoco. Use this credit to buy, repair, and take care of vehicles. Make certain to apply using the business’s EIN.

Cash Credit

Have you been sensibly managing the credit you’ve gotten up to this point? Then move onto more universal cash credit. These are service providers such as Visa and MasterCard. Keep your SSN off these applications; use your EIN instead.

These are typically MasterCard credit cards. If you have more trade accounts reporting, then these are doable.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

How Hard is it to Establish Business Credit in a Recession: Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and fix any inaccuracies ASAP. Get in the practice of checking credit reports. Dig into the specifics, not just the scores.

We can help you monitor business credit at Experian and D&B for $90 less. Update the relevant information if there are errors or the details is incomplete.

Disputing Mistakes

So, what’s all this monitoring for? It’s to challenge any mistakes in your records. Errors in your credit report(s) can be taken care of. But the CRAs typically want you to dispute in a particular way.

Disputing credit report inaccuracies usually means you send a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never mail the originals. Always send copies and retain the originals.

Disputing credit report inaccuracies also means you specifically detail any charges you challenge. Make your dispute letter as clear as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you mailed in your dispute.

How Hard is it to Establish Business Credit in a Recession: A Word about Business Credit Building

So always use credit sensibly! Don’t borrow beyond what you can pay off. Monitor balances and deadlines for payments. Paying on time and fully will do more to boost business credit scores than virtually anything else.

Establishing corporate credit pays. Good business credit scores help a company get loans. Your credit issuer knows the corporation can pay its financial obligations.

They know the corporation is authentic. And the business’s EIN connects to high scores, and credit issuers won’t feel the need to require a personal guarantee.

How Hard is it to Establish Business Credit in a Recession: Takeaway

Business credit is an asset which can help your small business for years to come.

Obtaining merchant accounts for business credit means that you are on your way to getting good business credit.

These three should conveniently get you going. How hard is it to establish business credit in a recession? Pretty easy! So go out there and clobber it! Learn more here and get started toward establishing business credit.

The post How Hard is it to Establish Business Credit in a Recession? appeared first on Credit Suite.

The post How Hard is it to Establish Business Credit in a Recession? appeared first on Business Marketplace Product Reviews.

The post How Hard is it to Establish Business Credit in a Recession? appeared first on Buy It At A Bargain – Deals And Reviews.

New comment by vmarcetic in "Ask HN: Who wants to be hired? (June 2020)"

Location: European Union, Central Europe

Remote: Yes (cca 10 years remote)

Willing to relocate: No, but I can visit.

Technologies: Ruby, Rails, SQL, NoSQL, Docker, AWS, DigitalOcean, Heroku, CI, …

Integrations: Stripe, Paypal, Paywhirl, Shopify, Recurly, Zendesk,…

Email: vmarcetic@gmail.com

——————————————————————————

My online CV: http://vedran.codes

Hey! I am an experienced Backend Web Developer, mostly working with Ruby and Rails. I have also experience with setting up and maintaining a smaller server architecture.

My work experience extends to optimising existing codebases, best practice implementations, payment and CRM integrations, and code reviews 😀

Throughout my career I have worked remotely with large and small teams and companies.

I have also worked with non-technical founders, helping them develop MVP applications to start-up their business.

I am immediately available for full/part time contracts

Awesome! Trade References Can Help in the Slump Economy

Learn the Secrets of Trade References in the Slump Economy Today

You may have heard or read the term ‘trade reference’, but do you really know what it’s all about? Are you asking yourself, what are trade references on a standard business credit application? What are the most important things you should know about trade references? How can they help you in a slump economy?

Building corporate credit is more than just the objective information. It’s also about the subjective. So sit tight, because here are the details.

Recession Era Funding

The number of American banks and also thrifts has been decreasing progressively for a quarter of a century. This is from consolidation in the marketplace as well as deregulation in the 1990s, lowering barriers to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets focused in ever‐larger banks is problematic for small business owners. Big banks are much less likely to make small loans. Economic downturns imply banks come to be extra cautious with financing. Luckily, business credit does not depend on banks. And it is utterly independent of any pandemic.

Things You Should Know About Trade References: 5. Just What is a Trade Reference in a Slump Economy, Anyway?

Here is a standard trade reference definition. A trade reference on a credit application is used to help lenders and business to business suppliers make decisions about whether or not to extend credit to a credit applicant.

So, what are trade references on a credit application? They are one of the only parts of a credit file that isn’t just numbers or court filings!

These credit references for businesses are usually presented in conjunction with a formal credit report. Such a formal credit report would come from a known business credit-rating agency. These are the best-known CRAs, such as Experian or Dun & Bradstreet.

Companies and banks which loan money and extend credit want to be sure that their customers can pay their debts on time and in full. Excellent trade references are an important asset which successful companies should place a high value on.

A trade reference means there is more to go on that numbers. With trade references on credit application, there is a lot more detail.

Things You Should Know About Trade References: 4. Criteria for a Business Trade Reference in a Slump Economy

Lenders and credit suppliers will often ask just how long an account has been open. They will ask about its credit or purchasing limit. And they also want to know how many times (if any) the amount due has been paid late. Such inquiries can come either by phone or in writing.

Creditors naturally place a higher value on customers with longstanding payment histories. Plus they often will save their best deals for credit applicants with the best trade references and credit profiles.

Things You Should Know About Trade References: 3. A Trade Credit Reference Can Provide an Accurate and Correct Picture, Even in a Slump Economy

Some banks may not report negative payment histories to the big national credit bureaus (Experian, Equifax, and Dun & Bradstreet) until the borrower is 30 or 60 days late.

And some suppliers, in particular smaller businesses, will not report their client histories at all. These factors make checking trade references vital when companies are making the decision to extend credit.

In addition, month to month payment histories will always represent a far more accurate picture of a small business’s true financial viability. This is because even companies with good cash flow could be taking unreasonable risks at the expense of their suppliers.

Things You Should Know About Trade References: 2. Bank and Trade References Showcase Timely Payment and Repayment, Especially in a Slump Economy

Most businesses realize that maintaining a prime credit rating is very important. Therefore, if they start struggling, they may become good at prioritizing their debt and supplier payments.

This is like the old expression, ‘robbing Peter to pay Paul’. By using their cash flow to pay any bank loans and larger suppliers, they might also be putting off smaller creditors. In this way, these businesses on the edge can paint a misleading credit portrait.

Therefore, it is important to start checking both large and small references. As a result, you can save yourself the time and headaches of taking on new clients whose accounts have a high chance of going into collections.

This is true of both companies looking to extend credit, and banks looking to make loans. And for startups, this is really vital. It helps a lot to get trade references for new business.

Things You Should Know About Trade References: 1. What About the Number and Sort of Trade References in a Slump Economy?

A standard business credit application will ask for three trade references. These are often creditors and suppliers within the industry. Trade reference examples tend not to be utilities like telephone and gas service.

This is because many struggling businesses may try to put off their suppliers for a month or two, but not the utility companies. At least, they won’t do this if they want their offices to have heat and lights.

Primary and direct references, which include suppliers of items such as computer equipment and raw materials, will be the most valuable.

Secondary trade references may include subcontractors who may be willing to not be paid until the main client pays. As a result, these examples of credit references can be less reliable indicators of a small business’s overall financial health. Still, you should take any negative feedback on a trade reference sheet seriously.

Hit the jackpot and weather any recession with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Things You Should Know About Trade References: Bonus #1 for a Slump Economy: How to Make a Credit Reference Request if You Are the Creditor Asking About a Company You Do Business With

A trade reference sample is best. This great business credit reference form came from Business Debt Line. Make sure to fill in the blanks or information in square brackets [].

Same Trade Reference Request Letter for Creditor

From:

__________ [Sender’s name]

__________ [Sender’s address]

__________

__________

Date: __________ [Sender wrote the letter on this date]

To:

__________ [Receiver’s name]

__________ [Receiver’s address]

__________

__________

Dear Sir/Madam:

Re: [enter the name of the company you are asking about here]

I have received an application for a credit account from the above named company. Your name has been given as a referee. Therefore, I would be grateful if you could answer the following questions.

How long has the customer traded with you? ________________________________

What are your terms of payment? _______________ days

Does the customer generally pay within the time required? YES/NO

Would you consider the customer to be a good credit risk? YES/NO

Please add any other comments you feel are relevant below.

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

Once you have completed this form please return it in the envelope provided.

Thank you for your assistance.

Yours faithfully,

Signature

Name

For and On Behalf of Your Business

Hit the jackpot and weather any recession with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Things You Should Know About Trade References: Bonus #2 for a Slump Economy: How to Ask for One if You Need a Trade Reference for Your Company

Let’s use another business credit application sample. Make sure to fill in the blanks or information in square brackets [], and select anything with a slash (/) and delete the other choice. This is a great trade reference form template.

Same Trade Reference Request Letter for Company

From:

__________ [Sender’s name]

__________ [Sender’s address]

__________

__________

Date: __________ [Sender wrote the letter on this date]

To:

__________ [Receiver’s name]

__________ [Receiver’s address]

__________

__________

Dear Sir/Madam:

Re: Trade Reference for [your company]

It has been [your company]’s pleasure to conduct business with you for [number] years/months. The company is applying for more credit, and I hope to be able to cite your name as a referee. Would that be possible? Please let me know either way.

If the answer is yes, then I have prepared a few brief questions. Please send back in the enclosed envelope and we will type it up. We will send it back with another self-addressed, stamped envelope, so you can send us a signed copy. Of course we will enclose a copy for you to keep for your records.

Therefore, I would be grateful if you could answer the following questions.

How long has [your company] traded with you? ________________________________

What are your terms of payment? _______________ days

Does [your company] generally pay within the time required? YES/NO

Would you consider [your company] to be a good credit risk? YES/NO

Please add any other comments you feel are relevant below.

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

Once you have completed this form please return it in the envelope provided.

Thank you for your assistance.

Yours faithfully,

Signature

Name

For and On Behalf of Your Business

Hit the jackpot and weather any recession with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Things You Should Know About Trade References: Bonus #3 for a Slump Economy: How to Write a Trade Reference Letter About a Company You Do Business With

Let’s start with a trade reference example. Make sure to fill in the blanks or information in square brackets [], and select anything with a slash (/) and delete the other choice in this trade reference form.

Sample Trade Reference Letter

From:

__________ [Sender’s name]

__________ [Sender’s address]

__________

__________

Date: __________ [Sender wrote the letter on this date]

To:

__________ [Receiver’s name]

__________ [Receiver’s address]

__________

__________

Subject: Trade Reference for [company name]

Dear Sir/Madam:

Thank you for requesting a trade reference. We have done business with the [company name] for [amount of time]. Our terms of payment with them are [number] days.

[Company name] generally pays/does not pay within the time required. Payment patterns with [company name] are/are not subject to seasonal fluctuations. I would/would not consider the customer to be a good credit risk.

If you have any questions, please feel free to contact me.

Yours faithfully,

Signature

Name

Business Name

Things You Should Know About Trade References: Bonus #4: What to Do with a Trade Reference Request About Your Company

Send a copy of your trade reference to Dun & Bradstreet here. It will become part of your credit report, available to anyone who pulls your report. Because D&B gives trade references meaning – slump economy or not.

Things You Should Know About Trade References in the Slump Economy: Takeaways

So, what is trade references? Trade references for a small business can provide a much clearer picture of the overall health and day to day operations of a company. These allow a credit or loan provider to dig much deeper into the financial guts of a company.

What is trade reference meaning? What is a trade reference on a credit application? This is the best way to get to the real truth about the business’s financial viability. And that goes double in a slump economy.

The post Awesome! Trade References Can Help in the Slump Economy appeared first on Credit Suite.

TKO upheld in Ladd's gender discrimination claim

The California State Athletic Commission voted 3-2 to uphold the TKO result by referee Herb Dean in a fight between Germaine de Randamie and Aspen Ladd from the UFC Sacramento main event on July 13.

The post TKO upheld in Ladd's gender discrimination claim appeared first on Buy It At A Bargain – Deals And Reviews.

Obtain A Cheap Credit Card By Understanding The Fees

Obtain A Cheap Credit Card By Understanding The Fees

Charge card business bill costs of some type or an additional. The trick is to locate a card with the most affordable charges for the solutions you make use of. If you utilize cash money advancements, after that explore those charges with credit scores card business prior to you authorize up with them.

Upfront Fees

Not every bank card program has ahead of time charges, so it pays to search for the ideal card. Yearly costs are usual on cards with repaired or reduced prices. In the appropriate condition, this cost with the best price can conserve you loan.

You will certainly additionally locate cash loan charges, either a level price or percent. Not all cards bill this, yet normally they have greater APRs. If you prepare on utilizing this attribute, it is crucial to check out the terms.

Balance-transfer charges likewise can be billed, normally when you make use of a ‘check’ sent out by the bank card business. Some programs provide no costs or reduced prices for transfers, specifically with an initial deal.

Bonus Fees

Bonus charges can typically be stay clear of however ought to still be looked into. Much less usual are set up, return thing, or telephone purchasing costs.

Reduced Fees Equal High Rates – Sometimes

While nobody intends to pay costs, occasionally they can conserve you loan. With big equilibriums or equilibrium transfers, you can usually locate reduced prices by paying a little charge. You might additionally locate that with motivation programs, a month-to-month cost will certainly still permit you ahead out in advance.

For those that pay off their equilibriums every month, pick a card with no or reduced charges. You can likewise pick to have a number of various kinds of bank card programs to fulfill your various funding demands.

Study Fees

Under government regulation, credit history card firms are called for to checklist charges and also APRs prior to you use. It will certainly consist of yearly, minimal money, money advancement deal, transfer, late settlement, and also over-the-credit-limit costs.

Credit score card business bill costs of some type or one more. If you make use of cash money developments, after that check out those costs with debt card business prior to you authorize up with them.

Not every credit rating card program has in advance costs, so it pays to go shopping about for the appropriate card. Yearly charges are usual on cards with taken care of or reduced prices. Under government regulation, credit score card business are needed to listing charges and also APRs prior to you use.

The post Obtain A Cheap Credit Card By Understanding The Fees appeared first on ROI Credit Builders.

The post Obtain A Cheap Credit Card By Understanding The Fees appeared first on Automation For Your Email Marketing Sales Funnel.

The post Obtain A Cheap Credit Card By Understanding The Fees appeared first on Buy It At A Bargain – Deals And Reviews.

How I Ranked For 636,363 Keywords Using This Simple Hack

When I started doing SEO on NeilPatel.com I used this advanced formula

to rank for 477,000 keywords.

Over time, my traffic started to flatline and I wasn’t ranking for many more keywords, even though I was continually creating more content.

But then I figured out a simple hack that took me from

477,000 keywords to 636,363 keywords as you can see in the image above.

So, what was this hack?

Well, it’s so effective that I just updated Ubersuggest so that includes the

hack.

So how did I do it?

When someone does a Google search, what are they typically

doing? They are trying to find a solution to their problem, right?

So how can you easily identify these problems people are

searching for?

Typically, you want to look for 3 types of keyword phrases:

- Questions – people type in questions because they are looking for answers. And if your product or service helps answer those questions, you’ll see a boost in conversions.

- Comparisons – when someone is searching for comparison keywords such as “MailChimp VS Converkit” there is high buyer intent, even if your company isn’t mentioned in the search phase. (I’ll go into how to leverage this in a bit.)

- Prepositions – when keywords contain a preposition, they tend to be more descriptive. If you aren’t sure what a preposition is, simple prepositions are words like at, for, in, off, on, over, and under. These common prepositions can be used to describe a location, time, or place.

But how do you find these keywords?

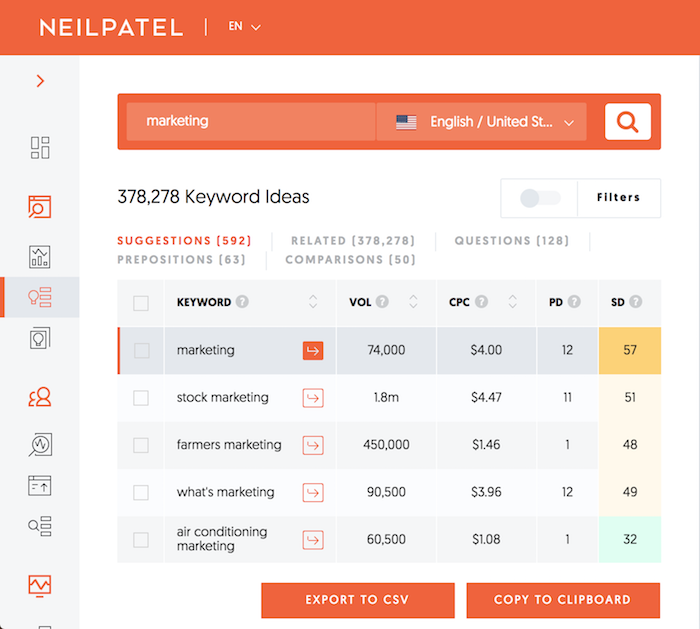

Well, I just updated Ubersuggest to now show you questions, comparisons, and prepositions.

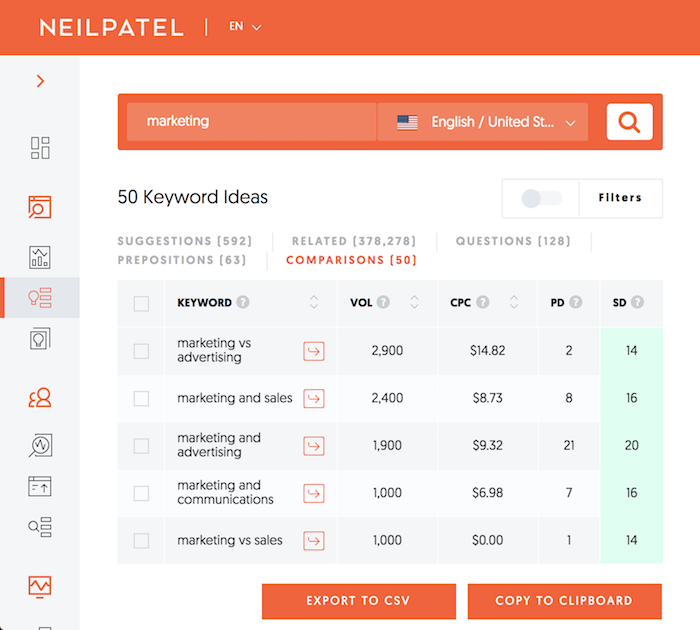

Just head over to Ubersuggest and type in a keyword that you want to go after. For this example, I typed in the word “marketing”.

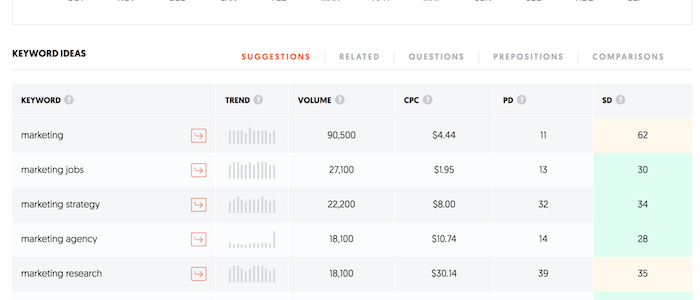

Then as you scroll down, in the keywords ideas table you’ll see tabs for questions, prepositions, and comparisons.

I want you to click on the “view all keyword ideas”.

You’ll now be taken to the keyword ideas report that looks

like this:

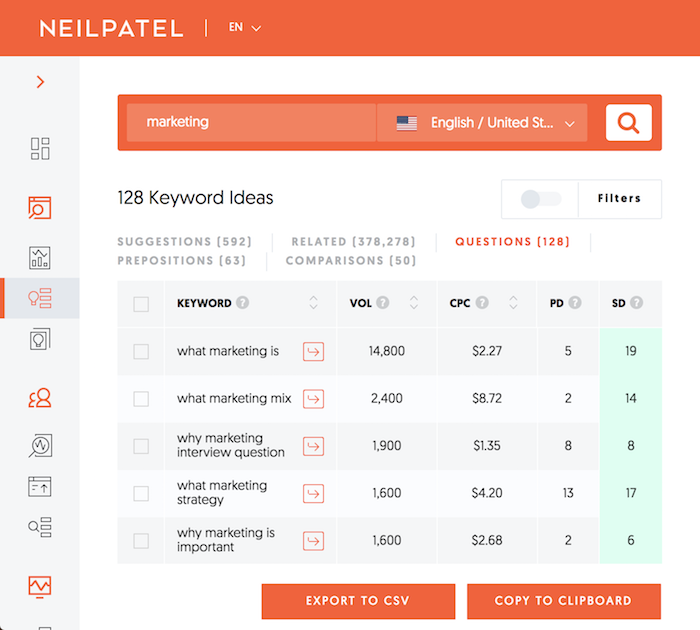

Now, click on the tab labeled “questions”. It will adjust the keyword recommendations to show you all of the popular questions related to the main keyword you just researched.

You’ll then see some suggestions that you could consider

going after. Such as:

- Why is marketing important?

- What marketing does?

- How marketing works?

But as you scroll down, you’ll find more specific questions such

as:

- Why a marketing plan is important?

- How marketing and sales work together?

- How many marketing emails should you send?

Now that you are able to see these questions people are typing, in theory, you can easily rank for them as most of them have an SEO difficulty score of 20 or so out of a 100 (the higher the number the more competitive it is).

More importantly, though, you can create content around all of those phrases and sell people to your product or service.

For example, if you created an article on “why a marketing plan is important,” you can go into how you also can create a marketing plan. From there you can transition into describing your services on creating a marketing plan and how people can contact you if they want your help or expertise in creating one.

You can do something similar with the “how marketing and sales work together” article in which you can break down how to make each department work together. From there, you can either be an affiliate for software solutions that help merge the two departments like HubSpot or sell your own software if you offer one. You can even pitch your consulting services that help tie sales and marketing together.

And as for the “how many marketing emails should you send,” you can create content around that and have an affiliate link to popular email tools that have high deliverability and offer automation. Or you can promote your own email product.

Now imagine all of the extra keywords you can rank for by going after question-related keywords. What’s amazing about this is most of these keywords are competitive and they have extremely high search intent.

Can it get any better?

Speaking of search intent, I want you to click on the comparisons

tab.

You’ll see a list of ideas just like you did with the questions tab. But what I love doing here is typing in a competitor’s brand name here.

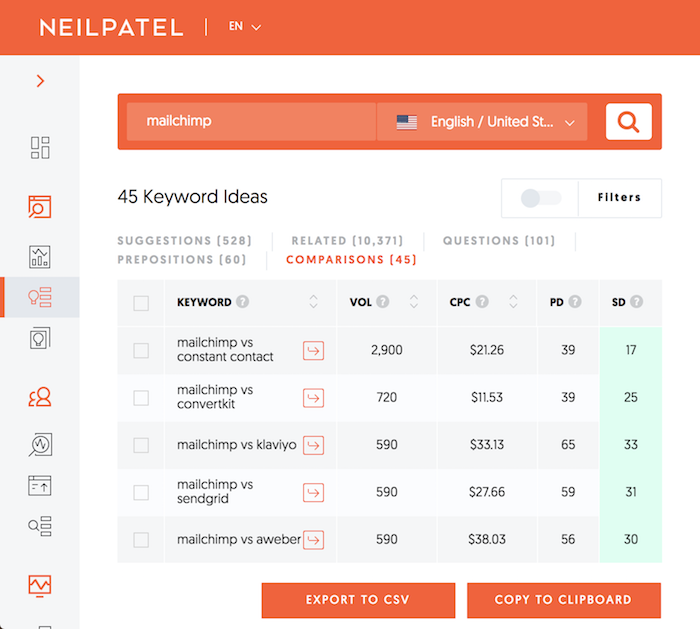

Let’s say I am offering an email marketing tool. I could type in “Mailchimp” and see what comparison ideas Ubersuggest comes up with.

Now for this example, I want you to imagine that you have an email company called Drip and Drip isn’t really mentioned in any of these keyword comparison ideas.

What’ll you want to do is create articles on all of the popular comparison terms like “Mailchimp vs Constant Contact” or “Mailchimp vs Convertkit” and within those articles break down the differences and also compare them with your own tool Drip.

Be honest when writing the comparisons. Show off which is the best solution using facts and data and break down how you are different and in what ways your own solution is better than the two solutions the reader is comparing.

This will bring awareness to your solution and you’ll find

that people will start purchasing it even though they were comparing two of

your competitors.

If you want a good example of how to create a neutral

comparison type of blog post, check out this article

comparing web hosts.

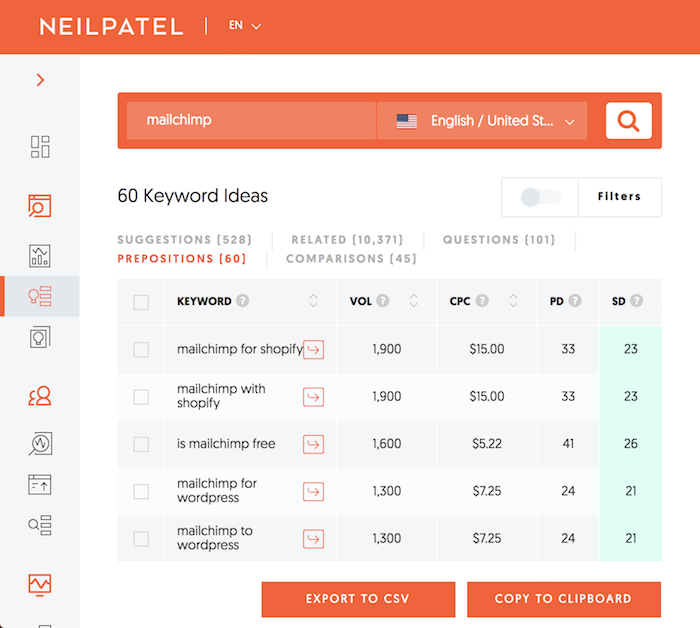

And if you want to take it one step further, you can click on the “prepositions” tab to find even more ideas.

Sticking with the Mailchimp example, you can see that people are curious about Shopify and WordPress integrations.

You can write articles related to integrations and also push your own product and break down how it differs from the others.

If you want to take it one level deeper, it will give you ideas on how to modify your business. For example, if I created an email marketing tool, I would create a Shopify, WordPress, Woocomerce, and Squarespace integration based on the ideas I got from the prepositions tab.

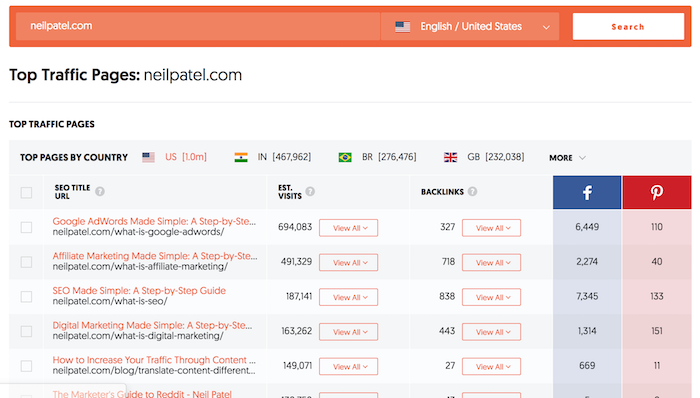

So how did I rank for 636,363 keywords?

I didn’t use all of the examples above on NeilPatel.com because I am not really trying to sell a product and I don’t have the time to write thousands of new blog posts.

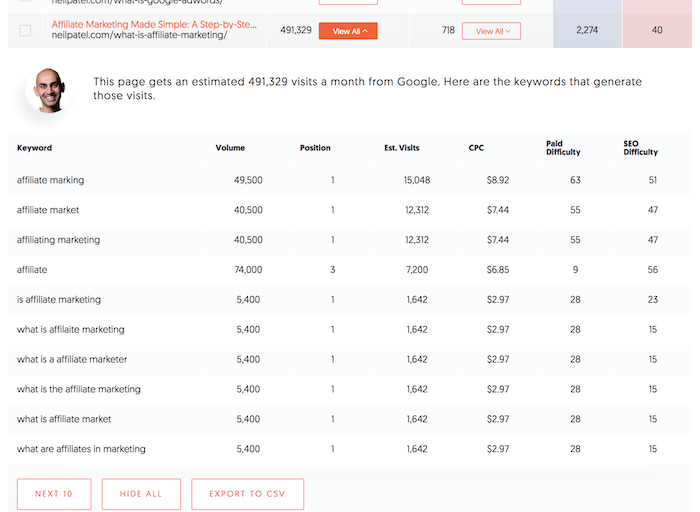

But I did type in my domain name into Ubersuggest and then headed over to the top pages report.

From there I looked at the pages that are already ranking well on Google and clicked on the “view all” button to see the exact keywords each page ranks for.

As you can see from that page I rank for questions like “what

is affiliate marketing” as well as popular prepositions and comparisons.

How did I do this?

Well, that top pages report shows you keywords each of your pages already ranks for. So all you have to do is research each of those terms through Ubersuggest and find popular questions, prepositions, and comparisons.

Conclusion

The natural instinct for any SEO or marketer is to rank for

popular terms that have a lot of search traffic.

But there is an issue with that strategy. It takes a lot of time, it’s extremely competitive, and many of those search phrases don’t cause a ton of conversions as they are super generic.

So, what should you do instead?

Focus on solving people’s problems. The way you do this is by creating content around the questions, prepositions, and comparisons people are searching for in Google.

What do you think about the new Ubersuggest feature?

The post How I Ranked For 636,363 Keywords Using This Simple Hack appeared first on Neil Patel.

The post How I Ranked For 636,363 Keywords Using This Simple Hack appeared first on #1 SEO FOR SMALL BUSINESSES.

The post How I Ranked For 636,363 Keywords Using This Simple Hack appeared first on Buy It At A Bargain – Deals And Reviews.