10 Successful Google Advertising Ideas

Coming up with Google advertising ideas is challenging. However, it’s well worth it to have a solid strategy.

With around 3.5 billion searches per day, Google gives you an incredible opportunity to get in front of the right audience. Of course, you first need to know what you’re doing.

If you’ve been looking for ways to get the most out of your Google ad campaigns, this article is just for you.

Before we get to strategy, let’s first understand what Google ads are. Google Ads (previously known as Google AdWords) is an advertising platform for PPC ads. With the right strategy, you can drive qualified traffic, connect with your target customers, and drive sales.

One of the platform’s best aspects is that it allows you to stick within your ad budget by setting your ads to stay within a certain daily, weekly, or monthly cap. You can also pause or completely stop the ads at any time.

Sometimes in marketing, keeping a close eye on the budget can be a challenge. This flexibility allows you complete control over your budget.

If you’re not yet convinced about how effective the platform is, perhaps these numbers can give you more clarity:

- 58 percent of Millennials say they purchased a product because of an online or social media ad.

- 63 percent of users have clicked on a Google ad.

- 43 percent of users bought a product after going online and seeing the ad.

It’s clear that Google ads can do wonders for your business and your bottom line.

The only questions now are: With so many marketers using the platform, how do you stand out in this virtual crowd? How do you create the right Google ads that get you in front of the right audience at the right time?

Let’s find out!

Tips for Generating Google Advertising Ideas

There are a lot of components involved in generating and executing successful Google advertising campaigns. Here are a couple of tips to set you on the right path:

Keyword Research

Keyword research is an essential element of your campaign. If you don’t get this part right, it will be challenging to achieve the results you’re looking for.

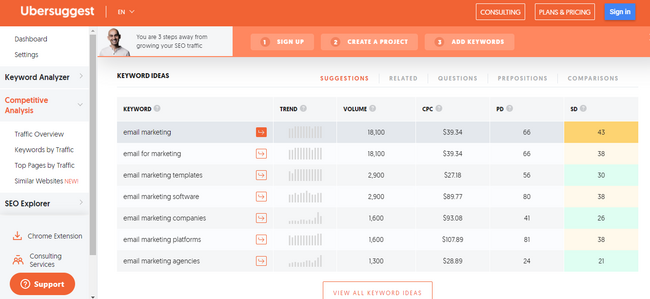

Below, we’ll talk more about keyword research for Google ads, but for now, it’s important to start generating some keyword ideas. To get started, you can use a tool like Ubersuggest.

It’s a free keyword research tool that allows you to generate keyword ideas and look at some of your competitors and the keywords they’re using.

Trend Forecasting

Predictions are an essential part of marketing. Before you start any campaign, it’s necessary to have some idea of what your success (or not) might look like.

Of course, the best way to predict this is with data.

Google Ads offers a keyword planner, which you can use to get forecasts for your chosen keywords. This planner can provide you with essential information, such as the number of clicks your ad might get every day, the average cost for those clicks, the number of impressions, the click-through-rate (CTR), and more.

With this information, you can start building a solid Google advertising campaign.

Keyword research and trend forecasting are just a couple of essential steps to get started. Now, let’s get into the nitty-gritty, the strategies, and everything that can help make your campaign a success.

Top 10 Google Advertising Ideas

It’s time to get down to the good stuff: What are the Google advertising ideas that can help you reach your goals?

1. Write a Good Headline

John Caples once wrote: “If the headline is poor, the copy will not be read. And copy that is not read does not sell goods.”

There’s no denying the impact that a strong headline has on your audience. Of course, this is what convinces people to click on the ad!

Here are some basic pointers for writing strong headlines:

- Understand your audience. Who are you speaking to?

- Include your main keyword.

- Address a problem your audience is facing.

- Highlight the biggest benefit in the headline.

- Don’t overcomplicate things. Keep things simple.

- Don’t be afraid to add some humor.

Creating a headline can be one of the challenging parts of the campaign. Sometimes, you just don’t know where or how to start. Consider following a strategy, like Melanie Duncan’s 4U formula, to create useful, urgent, unique, and ultra-specific headlines to help you get started.

2. Think About User Intent Before Diving into Google Advertising Ideas

When we research keywords, we tend to focus on the numbers. How much search volume does this keyword get per month? What’s the cost per click (CPC)? What about the paid difficulty?

While all these numbers are essential to consider, the most important element of a keyword strategy should be the user intent.

Why? Because user intent (sometimes referred to as “search intent”) gives you the “why” behind the keyword.

Why did your audience search for that particular keyword? Were they trying to purchase something, or were they just trying to get more information about it?

Understanding your audience’s intentions can help you discover which keywords are the best to target for higher ROI.

There are four different kinds of user intents:

- Informational: This is when a user wants more information about a topic. For instance, “How many calories in a donut?”

- Navigational: This is when a user wants to go to a particular web page. For instance, if you want to go to the Neil Patel blog, you type that into your Google search bar.

- Commercial: This is when a user wants to research a particular product or service. This user will likely make a purchase in the near future, but right now, they are at the research phase. For instance, “New iPhone specs” or “iPhone vs. Samsung.”

- Transactional: This is when a user wants to take action, like buy a product. For instance, “iPhone charger” or “cheapest flights from LA to Chicago.”

Understanding user intent will help you target the right keywords. If someone is searching for how many calories are in a donut, they want content related to that. If your product is a calorie calculator, that’s great! They’re likely to go to the calorie calculator because it helps them fulfill what they’re looking for at that time.

Paying attention to user intent can help you rank higher and attract more clicks because you’ll be giving your audience what they want.

3. Advertise Limited Offer Sales

Any offer with a ticking clock naturally encourages your audience to act faster and purchase the product or service. That’s why limited offer sales work so well.

In a nutshell, a limited offer sale is any deal, discount, or reward you offer to consumers who make a purchase during a certain period.

An excellent example of this is Black Friday Sales. Every year, Black Friday sales seem to hit a new record, with consumers spending more and more.

That’s because consumers know they’ll have to wait a long time before they can get the product at the discounted price again, so they’re encouraged to make the purchase quickly.

For your Google ad campaign, if you offer seasonal sales for any of your products, you can create ads around these sales and have them go live when your sale launches.

4. Track and Use Google Advertising Data for Iterating

One of the most important elements of any successful advertising campaign is your KPIs.

Depending on your ad goals, there are a lot of important metrics you can track, including:

- number of clicks

- CTR

- CPC

- conversion rate

Tracking your KPIs helps you know if you’re on track to meeting your goals or not.

For instance, if you see that you’re getting great clicks on your ads, but your CTR is on the lower side, it can mean your headline and keywords are getting you in front of your audience’s eyes. However, something about the ad isn’t connecting.

It could be the copy. It could be the cost of the product or service. Maybe the headline doesn’t connect with the offer in the actual ad.

Whatever the case, now’s the time to look into it and adjust what you need to.

5. Choose the Right Campaign Type for Your Google Ad

You can use one of five different types of Google ad campaigns for your Google advertising ideas.

Search Ad Campaigns

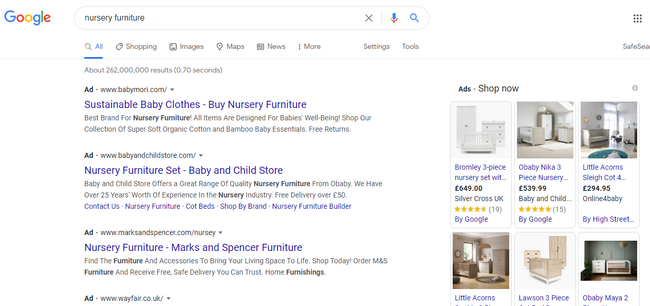

These ads appear at the top of the Search Engine Results Pages (SERPs).

For instance, if someone searches for “nursery furniture,” this is what the results look like:

Creating search ads is great because of what we highlighted earlier: The platform receives over 3.5 billion searches per day! This is the perfect place because many people (including your audience) are already searching for products you offer.

Video Ad Campaigns

Video ads show up before, after, and sometimes in between YouTube videos. Research has shown how effective video has become over the past few years. Creating a video ad campaign, which is different from a text ad, might help you stand out and grab your market’s attention.

Display Ad Campaigns

Display ads are a way of attracting the market of a particular social media platform, website, or other digital channels to your product or service.

The best way to go about this is to find the website or brand that best connects with your audience. Display ads are great because these are a win-win situation for both you and the owner of the site or digital platform.

The website owner gets an agreed-upon commission (usually based on clicks or impressions), and you have the opportunity to advertise in front of an audience that connects to your brand.

App Ad Campaigns

If you have an ad, perhaps Google app campaigns can be the right choice. Here, you can advertise your mobile app through Google Play, Google Search Network, Google Display Network, YouTube, and many more channels.

For app campaigns, you can run ads that encourage your target market to install your app on their devices, or if there’s a new upgrade or version to the app, you can encourage them to take a particular action.

Shopping Ad Campaigns

Lastly, there’s Google shopping ad campaigns. These ads include your product’s images and prices, and you can run them from Google Merchant Center.

You’ll input information about the product, and Google creates your ad from this information.

Shopping ads make sense if you’re trying to market a particular product but not necessarily your brand as a whole.

These are all examples of the different types of Google Ad campaigns. As you can see, it’s essential to understand your product and your market. From this, you’ll be able to know which campaign best suits your needs.

6. Perfect Your Landing Page

You’ve done all the hard work of creating a great headline, finding the right keywords, and bidding for them.

While these steps may get you clicks, it’s what happens after your market has clicked that’s so important. As you know, they still need to buy into the product or service you’re selling.

Your landing page is essential because this is what your user sees as soon as they click on your ad. Ask yourself whether the landing page addresses your market’s pain points clearly. Besides just addressing, does it also solve your audience’s challenges?

There are many elements to creating a perfect landing page, including using testimonials, the right images, and shorter forms, to name a few.

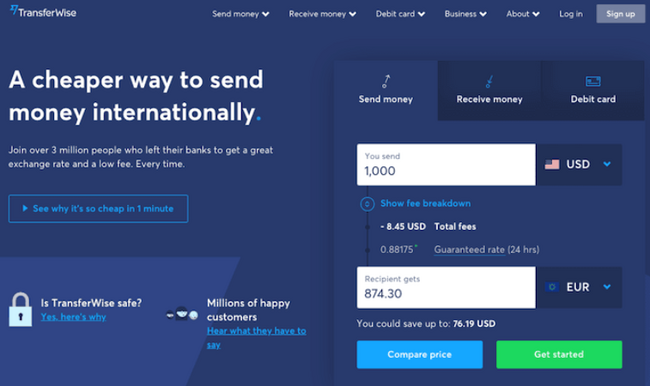

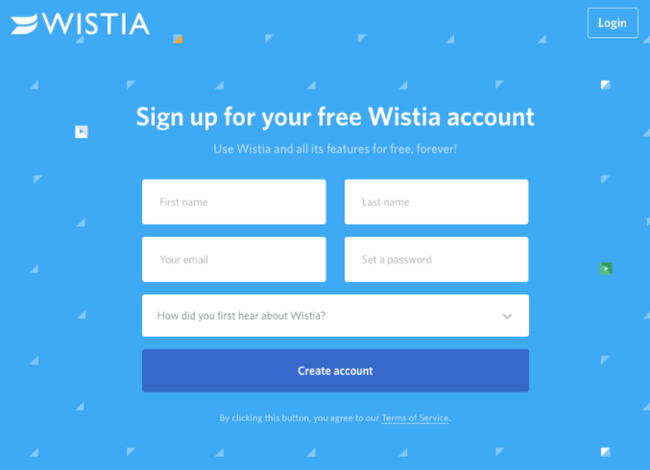

For some inspiration, here are some examples of great landing pages:

From the above examples, you’ll notice that the landing pages are all simple and clear, and the copy and graphics immediately grab your attention. These are crucial elements of a successful landing page.

7. Make Your Google Ads Specific

Earlier, we mentioned the importance of understanding user intent when doing your keyword research because this helps you target the right keywords.

Now we want to highlight the importance of specificity. Your keywords shouldn’t be too broad as this might cause Google to place your ad in front of the wrong market.

Naturally, this would lead to fewer conversions.

For instance, “nursery furniture” may seem like a good keyword at first, but you can do better by getting more specific.

Aim for clarity and specificity in your keywords. Instead of just “nursery furniture,” how about:

- “nursery furniture for boys”

- “nursery furniture for girls”

- “nursery furniture in Florida”

It might take a while to get the right keywords, but that’s fine. Remember to keep reviewing which keywords are getting the most clicks and which aren’t. This can help you understand what you should focus on and what to add, remove, or tweak to get the high conversions you’re looking for.

8. Target Your Google Ads

When trying to get the right Google advertising ideas, remember there are three keyword match types: exact, phrase, and broad matches.

Exact Match

Compared to the other keyword match types, exact match is extremely specific. Initially, if you used this match type, users could only see your ad if they typed in the same keyword phrase. Since then, Google made a few changes so that even if your user doesn’t enter the exact keyword phrase, your ads might still match. For this, the match might be with plurals, synonyms, or different variations of your chosen keyword.

Using the exact match type is great because users who type in your specific keyword are more likely to convert.

Phrase Match

Your ad appears for a phrase match if a user enters your key phrase in the exact order, but there can be other words before and after the phrase. This leaves you with the possibility of increasing traffic.

However, if the key phrase is too broad, this could mean getting lots of clicks that don’t convert because the phrase wasn’t specific enough.

Broad Match

The broad match reaches more people because your ad appears when a user types in any word of your key phrase, in no particular order. Like with phrase matches, you might get lots of traffic and clicks to your ads, but because it’s not specific enough, there may be fewer conversions.

As you can see, there are pros and cons to all three phrases. To get the most out of your Google advertising campaign, use a combination of all three so that you get a lot of traffic and conversions.

9. Optimize Your Google Ads for Mobile

While creating your ads and coming up with creative Google advertising ideas, it’s important to keep in mind that many users are using their mobile devices for searches.

Research shows that 61 percent of US Google visits happen via mobile devices. Most people are using their phones for searches, and it makes sense to keep these users in mind.

Optimizing your ads for mobile includes:

- choosing responsive landing page designs

- compressing images

- making sure the loading speed is fast

These small details can make a huge impact on how your ads display in front of your audience and your overall conversion rate.

10. Make Your Google Ads Available in Other Languages

It depends on the nature of your business, but if you have an international audience or you’re in a multi-lingual area, consider making your ads available in different languages to cater to your audience that may not speak or understand English very well.

This may seem like a little detail, but don’t forget that language is powerful and helps us communicate and connect. If you have a non-English speaking audience you’re trying to reach, help bridge the gap by making the Google ads available in their languages.

Conclusion

It takes a lot to generate great Google advertising ideas. While the process may be a lengthy one, it’s certainly worth it to see increased clicks and conversions.

The above tips can help get you on the right path, but don’t forget to A/B test your ads to see what your audience responds to.

Do you have any other Google advertising ideas you swear by?

The post 10 Successful Google Advertising Ideas appeared first on Neil Patel.