Article URL: https://www.emergetools.com/careers/jobs/growth-engineer

Comments URL: https://news.ycombinator.com/item?id=39495125

Points: 0

# Comments: 0

Article URL: https://www.emergetools.com/careers/jobs/growth-engineer

Comments URL: https://news.ycombinator.com/item?id=39495125

Points: 0

# Comments: 0

Location: Istanbul, Turkey Remote: Yes Willing to relocate: Yes Technologies: – Java, Spring Boot, Spring Data, Spring Framework, Spring Security, JPA, Hibernate – Angular, TypeScript, HTML, Bootstrap, CSS, JavaScript, JQuery – SOAP and RESTful web services, XML, JSON – SQL, PostgreSQL, Oracle Database, MongoDB – Apache Tomcat, Oracle WebLogic – Maven, Gradle – Git, Bitbucket, … Continue reading New comment by ahuseyin in "Ask HN: Who wants to be hired? (September 2023)"

Formula One will feature a new sprint format at the Azerbaijan Grand Prix after unanimous agreement among the teams to make a change.

The post F1 teams agree on tweak to sprint format appeared first on Buy It At A Bargain – Deals And Reviews.

Location: California, US

Remote: Yes

Willing to relocate: Not at this time

Technologies: Figma, Sketch, Adobe Creative Suite

Résumé/CV: https://allie.goodson.dev/resume-2023-03-10.pdf

Email: allie@goodson.dev

I am a designer based in San Francisco, focused on user centered design. I communicate easily and clearly with technical teams to ensure products are usable and accessible. I am looking for opportunities with companies that will provide the chance to get my hands on a variety of products at all stages of development. If you would like to know more about me, please visit my portfolio website: https://allie.goodson.dev/

I don’t get it. I have a ton of friends who own companies. As soon as they start making some money, they start talking to me about all kinds of investments.

“Real estate’s supposed to be good.”

“I wanna be an angel investor, any tips?”

My usual response?

“Google Ads, dude!”

They run these big companies, selling great products, and what do they do? Run off and try to put their money in anything, EXCEPT their own business.

Why not just sell more of their products? Double down on what’s already working, instead of starting to play in a field you know nothing about?

In my experience, Google Ads is usually the easiest way to do it. If my friend wants to increase his investment money, say $50,000, he can spend 1000 hours trying to become good at angel investing, learn everything about it, and hopefully land an investment in the next Facebook. A friend of mine could do the same for real estate, trying to snag a cheap apartment or condo, and flip it (easier, but still hard).

Instead, you can spend 100 hours learning Google Ads (or just hire someone who knows it) and invest $50,000 in Google Ads campaigns to make $500,000 in sales. Which one do you think is the most likely to pan out?

In my opinion, option three is a no-brainer.

In light of that, today, I want to open a black box most people are unfamiliar with: Google Ads.

Google Ads is a way to get your money’s worth, often boasting an ROI in the hundreds of percentage points. However, the steps I cover here ensure you’re depositing more money into your own bank account rather than just funding Google’s empire.

Now, let’s get down to it. Tie on your Google Ads apron, grab a pen to write down the key steps of a successful campaign, and follow along as I walk you through how to create a profitable Google Ads campaign from scratch.

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

If your customers are not searching for your product or service online, then obviously, Google Ads won’t work for you.

With that in mind, before you get too excited about creating your first Google Ads campaign, you need to verify there is a search volume for what you’re offering.

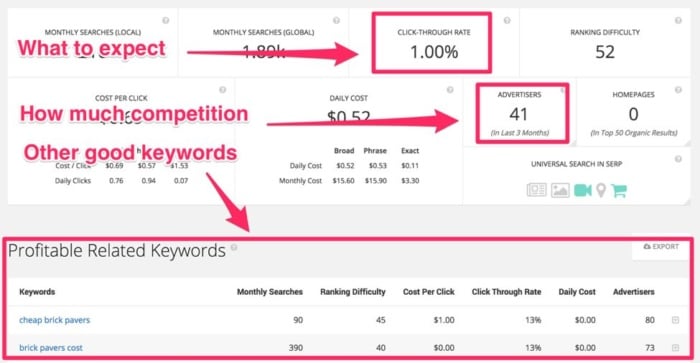

I recommend using Ubersuggest, which is my free keyword research tool. The keyword tool acts much like a thesaurus. You enter in phrases you think your prospects are searching for, and it tells you other similar, relevant phrases.

Additionally, Ubersuggest tells you how:

When put together, all this information helps you determine which keywords to use in your first Google Ads campaign.

I also recommend you use the keyword “Suggestions” provided under the main chart. This gives you an idea of related keywords and how much search volume those keywords have.

In addition, you can use Google’s Keyword Planner tool to help you find the best keywords to target. It provides you with bid estimates and total searches, so you can make a plan.

Next, there are three questions to ask to determine whether to advertise on a particular keyword:

Before finalizing your keyword list, you must ensure it makes sense to target that term. This prevents you from going after unprofitable keywords. I find it’s better to run these numbers before you start sinking time and money into a campaign destined to fail.

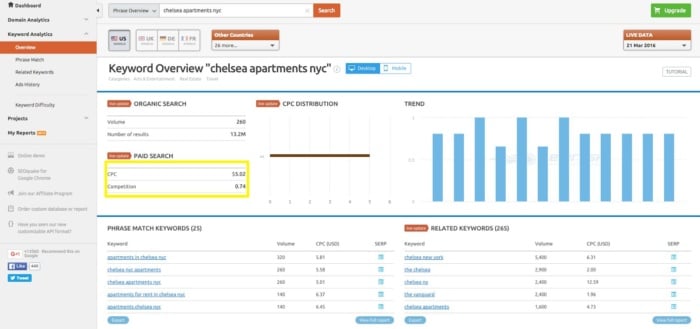

To answer the question “Can I afford to advertise on this keyword?” you need to calculate your maximum cost per click (Max CPC). To do this, you compare your business’s Max CPC to the estimated keyword CPC in the Keyword Tool to see if you can afford to advertise.

For example, if your Max CPC is $5 and the estimated CPC is $4, then you know there’s a good chance you can profitably advertise on that particular keyword.

You determine your Max CPC by your website’s conversion rate, profit per customer, and target advertising profit margin. If you don’t know these numbers, you need to guesstimate or set up tracking to calculate them more accurately.

Use the formula below to calculate your Max CPC and then compare it to the estimated CPC you found above:

Max CPC = (profit per customer) x (1 – profit margin) x (website conversion rate)

For example, let’s say your average profit per customer is $500, and out of 1,000 website visitors, you convert 10 into customers. That means you have a 1 percent website conversion rate.

If you are comfortable with a 30 percent profit margin, then here’s how you would calculate your Max CPC:

Max CPC = $500 x (1 – 0.30) x 1% = $3.50

Again, your Max CPC must be in the neighborhood of the estimated CPC in Google’s Keyword Planner tool, or else you’re in trouble.

Suppose your Max CPC is $3.50 and the estimated CPC for a keyword is $10. In that case, you need to first increase either your profit per customer or your conversion rate before you can profitably advertise on that particular keyword.

At this point, you now have a list of “buying intent” keywords that you’re confident you can afford. The next step is to reduce your risk by leveraging competitor intelligence.

In most industries, you find competitors who know far more than you do about optimizing and testing their Google Ads campaigns. That means they understand which keywords, ads, and landing pages work in your niche. Peeking into your competitor’s business helps you to determine if it’s easy to outrank a competitor.

Here’s how to get started.

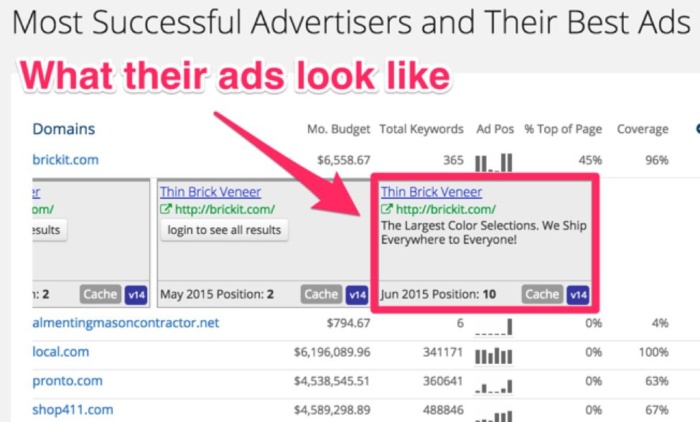

Go to Spyfu.com and enter your keyword. In this case, it’s “cheap bricks.”

It shows you the average CTR and the number of companies that have advertised for this keyword in the past three months.

In this case, there are just 41, which is nothing, considering there are over 1 million companies advertising on Google Ads.

It also shows you other keywords that are performing well on Google Ads.

If you click on “Advertiser history,” you even see the actual ads that your competitors use.

Pro tip: One determinant of relevancy, for Google’s quality score, is whether the keyword shows up in your actual ad.

In this case, Brickit doesn’t even mention bricks in its ad. That means they shouldn’t be too hard to beat.

However, here’s an even better tip.

You can look up an individual competitor. Maybe start with the 800-pound gorilla who’s dominating the SERPs.

Then you can go in and look up all the keywords they’re currently bidding on (along with their estimated volume and costs, of course).

See, combining these approaches helps you uncover your competition’s entire PPC playbook, and then you can reverse engineer it to outperform them.

Sneaky, right?!

Don’t compete. Dominate.

Your USP, or unique selling proposition, differentiates your business from your competitors and gives your prospects a compelling reason to choose you.

In other words, your USP answers the question, “Why should I, your prospect, choose to do business with you, versus every other option.”

When it comes to Google Ads, there are three important reasons to create a powerful USP. It:

OK, a USP is a key ingredient. Makes sense, but how do you create one?

Well, first, you focus on your core strengths. What are you better at than your competitors?

Second, talk to your customers, and more importantly, listen to them. The best companies built their USP on customer insight, so ask your customers why they do business with you.

Also, ask questions to determine what your customers dislike about your industry and what your customers wish you could provide in addition to your core products or services.

Third, analyze your competitors, and look for an opening. The most important word in unique selling proposition is unique.

To create a solid USP, you need to study your competitors’ ads, websites, and marketing materials, and find your opportunity to stand out. To find the commonalities in your competitors’ ads and websites, I recommend you use a spreadsheet. As you’re doing this, look for an opening to say something unique and superior.

For example, remember the old Domino’s slogan?

“You get fresh, hot pizza, delivered to you in under 30 minutes – or it’s free!”

(Image source: ConversionXL)

What more could you want when ordering pizza? Fast delivery and it’s still hot when you get it.

Domino’s Pizza doesn’t claim to be all things to everybody, though. In fact, it doesn’t even mention quality ingredients, price, or taste. It focuses its entire business on the one thing its customers care about most – fast, on-time delivery.

Picture some college students late Saturday night, and you’re looking at Domino’s Pizza’s ideal customer profile!

Now, spend some time thinking about how you’re different from everyone else. What can you bring to the table that your competitors don’t?

Capitalize on that.

What can you offer in your Google Ads campaign that is so compelling your prospect would be a fool to not take action? How can you stand out from the other ads your prospect sees in the search results?

The answer is your irresistible offer, which consists of the following four components:

Your product or service must be more valuable than the price. That’s marketing 101. This doesn’t mean your offer has to be cheap. You just need to clearly define all the value your product or service provides to your customer and ensure it outweighs your price tag.

When you make an offer that appears to be too good to be true, then your prospect may be a little skeptical. That’s why you must provide a believable reason for your offer.

For example, if you’re running a special sale, explain why you’re offering such a steep discount. The reason could be anything: clearing out inventory, end-of-the-year sale, celebrating an anniversary, opening a new store, your birthday, and so on.

Everyone is scared of getting ripped off online. One of the best tactics to minimize the risk to your customer is with a money-back guarantee. A money-back guarantee puts the risk on your business to deliver excellent service, or else you have to give the money back to the customer.

Whenever possible, I always recommend you include some kind of guarantee in your offer. It improves your response rates, and it’s a great way to differentiate yourself from your competitors.

One of my elementary school art teachers once gave me fantastic advice when he was teaching a class. He told me to always “Use the KISS method… Keep it simple, stupid.” I didn’t realize it at the time, but those truly are words to live by, especially when you’re creating an irresistible offer.

If you want your prospect to call you, then make it crystal clear and simple to pick up the phone. Don’t expect your prospect to connect the dots or search around your website to figure out the next step. Use a strong call to action and keep it simple.

At this point, you’re probably wondering when you actually create your Google Ads campaign. After all, we’re already halfway through the steps, and you don’t have any ads to show for it!

Trust me, the first five steps are absolutely critical, and you’ll thank me later once your ads are live and you’re generating profit.

However, since you’re so keen, let’s dive in and talk about creating your ads.

With a Google Ads campaign, you pay only when people click on your ads. Therefore, your ads have two crucial jobs:

That means more traffic, more sales, and less wasted money on unqualified leads, which all leads to higher profits for you.

There’s one more important job for your ads. Compelling ads with a high click-through rate (CTR) boosts your Quality Score, which in turn lowers the cost per click of your keywords.

Don’t forget that your ads directly affect how much you pay per click for each keyword. Great Google Ads lower your costs, while lousy ones raise your costs.

Do you see why step #6 is so important? This is also why you must complete the previous steps, because we use them all to make the ads more compelling.

There are four key components to your Google Ads text ads:

The headline is the most critical component because it’s the first thing your prospect will read. Try to include your keyword in your ads’ headline because Google will bold the text, which makes it stand out from other ads.

This also is the easiest way to ensure your ad is 100 percent relevant for the prospect that is searching.

Another great strategy is to ask a question in the headline. For example, if the keyword is “new york city dentist,” a compelling headline is “Need a New York Dentist?”

Not only is part of the keyword in the headline, but the question will get the prospect nodding their head yes. As all great salespeople know, just one yes is sometimes all it takes to start a chain reaction leading to the sale.

Now, let’s look at character length.

Google Ads allows 30 characters for your headline, so make every letter count and use abbreviations whenever possible.

In your two description lines, reiterate the benefits of your service, state your USP, provide social proof, and/or describe your offer. And, of course, include your call to action. Google’s description fields allow 90 words each.

The display URL is an easily overlooked area of your ads. Don’t just copy and paste your domain name. Instead, use your display URL to include your offer, your call to action, your USP, or anything else that makes your ads stand out.

Here are three examples for a dentist to give you an idea of what you can do:

Before we move on, I want to show you an example of a good ad and a bad ad, so you can see the difference.

Same Day Sub-Zero Repair

24 Hour Service…Within 1 Hour

$25 Off Coupon. Call Us Now.

As you can see, the advertiser is clearly targeting a specific niche – people with Sub-Zero appliances. They offer compelling benefits, including same-day 24-hour service within one hour. They have an offer of a $25-off coupon. And they have a clear call to action to call now.

Note that I would try to improve this ad by including the keyword in the title to make it more relevant to the search phrase.

[Name of Company]

family-owned since 1939 for all

your appliance needs call now

The headline of this ad was the name of the company, which is not relevant to the keyword “appliance repair.” Unless you’re a big-name brand, no one will recognize or even care about your name. It’s not compelling and there’s no congruence from the keyword to the ad.

Also, “family-owned since 1939” is not a specific benefit. There’s implied benefit if the prospect puts two and two together and believes longevity equals good service. However, that’s a lot to ask and clearly does not follow the KISS principle. Stick to explicit benefits rather than implied benefits in your ads.

Finally, the phrase “for all your appliance needs,” is too vague. This is an example of trying to be all things to all people, rather than solving a very specific problem for a very specific target customer.

At this point, your prospect is actively searching for your product or service. They found your ad to be compelling versus all of the other options, clicked to learn more, and landed on your website.

Now what?

Well, if you’re like a lot of first-time advertisers, then your prospect is now on your homepage scratching their head trying to figure out what just happened. The ad made a promise the homepage couldn’t keep.

That’s because your homepage is not an advertising landing page!

Homepages explain everything your business does, all of your products and services, and all the different customers you serve. In other words, your homepage is not 100 percent relevant to the keyword searched and the ad clicked. Do not make this mistake.

Instead, create a dedicated landing page that matches the keyword and the ad. The goal is to make the entire sales process congruent so your prospect is continually reassured they are going down the right path.

The most important component on your landing page is your headline, which is the first thing your prospect will read. Your headline must grab attention, reiterate the offer made in the ad, and compel your prospect to keep reading the rest of the page.

Ensure the copy of high-converting landing pages is relevant both to the keyword searched and the ad clicked on. In addition, include:

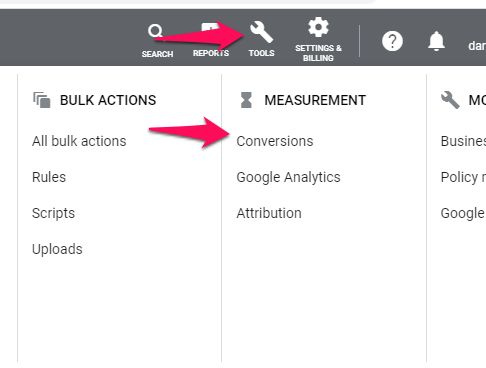

We’re almost ready to set up your campaign in Google Ads, but there is one final ingredient: conversion tracking.

If you skip this step, you never know which keywords and ads generate sales and which are losing money. In other words, you can’t optimize your Google Ads campaign once it’s up and running.

Conversion tracking measures the sales generated by your Google Ads campaign. More specifically, you want to know which keywords and which ads are generating sales.

If some or all of your sales occur online with an e-commerce shopping cart, then conversion tracking is pretty straightforward. Just use the built-in Google Ads conversion tracking.

The Google Ads conversion tracking code can be found in your Google Ads account under the tool icon, then “Measurements > Conversions.”

To create a new conversion, simply click on the [+ Conversion] button and follow the steps to define your conversion. Then add the small snippet of code to your order form’s thank-you page or receipt page.

This code is similar to Google Analytics code, if you have that installed on your website, but it should be on only the final page after a customer completes their order.

Then, when a customer lands on your receipt page or thank you page, Google tracks the conversions in your Google Ads account automatically. That’s really all there is to it, and there’s no reason not to install this before you turn on your ads.

Google can also track app installs, web conversions, phone calls, and offline conversions.

What if you generate leads online, but you ultimately close the sale “offline” – over the phone or in-person – rather than online? Clearly, you can’t add a conversion code to your cash register, so what can you do?

The three tactics I recommend for tracking offline sales are:

Once conversion tracking is in place, then the time has finally come to log into Google Ads and set up your first campaign.

The Google Ads interface makes campaign setup a breeze, but don’t blindly accept the default settings as one of them can get you into trouble.

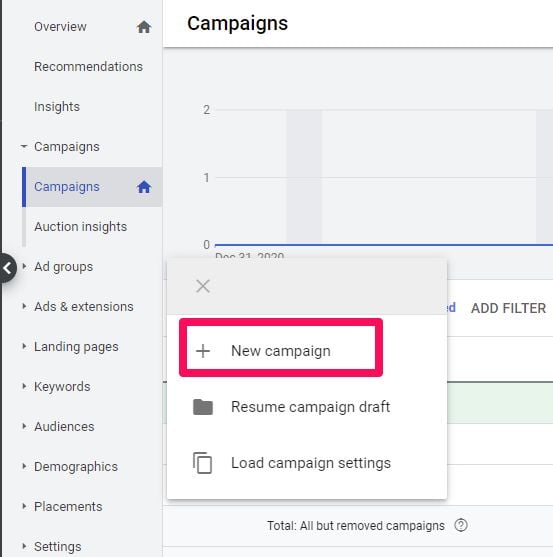

As I mentioned, Google Ads does a great job of making it fairly easy to set up your Google Ads campaign. Simply click on the blue plus symbol, then the New Campaign button, as shown below, and follow the steps to add in your ads and keywords.

The process is pretty simple; however, many of the default settings are not in your best interest. That’s why step #9 is to use the correct Ads settings for success.

Here are the most important settings to watch out for:

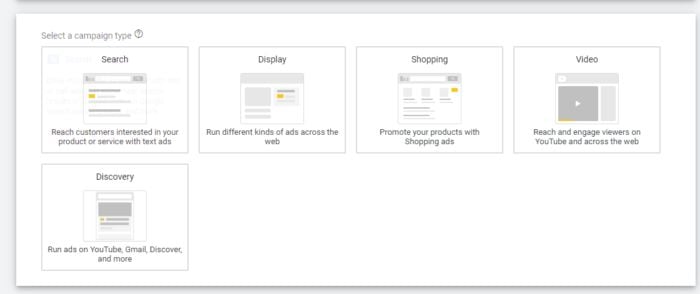

Select Search Network Only for your campaign type, so you’re targeting only the Google Search Network and not the Display Network.

The display network is a completely different animal than search advertising and it requires a different set of keywords, ads, and landing pages. So always set up separate campaigns to target each network.

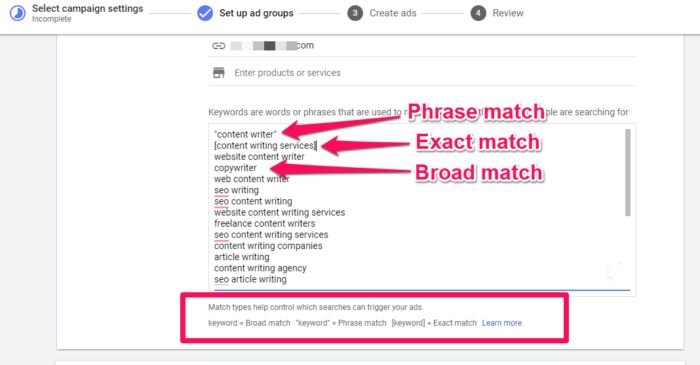

Many first-time advertisers have no idea there are different match types. As a result, they waste money on irrelevant search phrases that are not part of the keywords listed in the account.

There are three main keyword match types:

Broad match, as you now know, is the default match type. If you leave your keywords as a Broad match, then Google will show your ads to any search phrase Google thinks is relevant to your keyword.

This means your ads will get more impressions, but you’ll likely show ads to irrelevant search phrases that will just waste your budget. So I do not recommend Broad match.

Phrase match keywords will trigger ads when the exact phrase is part of the keyword typed into Google. For example, if your Phrase match keyword is “office space,” then your ad will display for “New York office space” and “office space in New York.” However, your ad would not display for “office in space” because the phrase “office space” is broken up by the word “in.”

Phrase match gives you much more control over your ads than Broad match. To change your keyword to Phrase match, simply add quotes around the keyword (see image below).

Exact match simply tells Google to display your ad only when the exact keyword is typed into Google. You get the most control with Exact match, but you limit your exposure. To set your match type to Exact match, add square brackets around your keywords (see image below).

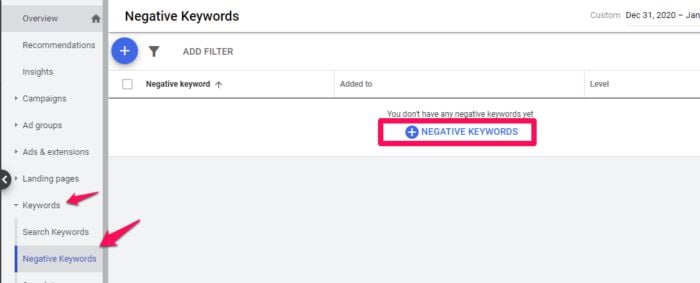

I recommend starting with Phrase match because you get the best of both worlds with regard to targeting and reach. However, when you use Phrase match, you need to make sure you include negative keywords.

Negative keywords give you the ability to block phrases from triggering your ads. For example, if you’re an office space rental company advertising on the Phrase match keyword, “office space,” then you will want to block the keyword “movie.”

That way, Google won’t display your ads for an office space rental for folks searching for the Office Space movie.

To add negative keywords, go to the Keywords tab in your account, scroll down, and click on the Negative keyword link (see image below).

Next, click the Add button to add in the keywords you want to block.

Once you’ve completed the setup process, then you’re ready to enable the ads and start optimizing your campaign!

As soon as you set your bidding, enable your campaign, and Google approves your ads, you can take a nice deep breath. Congratulations, your ads are live!

Unfortunately, you can’t relax yet. Most campaigns are not profitable from the start and they always require continual optimization to stay profitable.

There are three main areas to improve your Google Ads campaign performance:

You’ve set up your Google Ads. What do you do now? Don’t sit back and wait. I’m serious.

Turn on your second ad and once everything is running, do something else.

Don’t sit at the computer waiting for things to happen.

Remember the third promise that you made before we began? Google Ads takes patience.

Check back in a day. Then, create more ads and start building your first ad groups. Read the data. Start tweaking.

Finally, remember that nothing matters without conversions.

It’s great if you can tell which Google Ads get a better CTR, but, if they don’t get conversions, that also doesn’t help you make money.

It might take you a month or more to get results.

Just follow your ads and analyze the data, as it comes in over the next 10 days.

Then, review, turn off ads that don’t work, add more keywords, and double down on what’s performing well.

Once you start going deeper, be sure to check out the great videos we have on Google Ads, over at Quicksprout University. You can also try to join the Google Partner program.

Have you launched a successful Google Ads campaign? What tips do you have to share?

Location: Atlanta Ga, USA (planning on moving to another state though)

Remote: Required.

Willing to relocate: Not for work.

Technologies: Modern C++ (up to C++17), CMake, some python, familiar with HTML/CSS/JavaScript but rusty. Recently dabbled with OpenGL/Compute shaders, some Qt

Résumé/CV: https://www.dropbox.com/s/n22o28lk8wc0lgq/Iris%20Chase%20Resume%20April%202022.pdf?dl=0

Email: iris (at)) ....... enesda puncutation com (good luck scraping that ;)

I spent several years developing a project called IVD (github.com/irischase/IVD) which is a GUI programming language and implementation. I really leveled up a ton in all aspects as an engineer from the project. But it’s unfinished and in hiatus because after spending 3+ years on it I realized how much time doing anything interesting takes (especially alone) and that I need to pick my battles more wisely. I’ve also exhausted my ramen money if you catch my drift.

In my spare time now I’m mostly trying to develop my skills as a 3D artist, sculpting, modelling, subdivision topology, rigging and experimenting with non-photorealistic rendering (NPR).

It’s hard for me to sum up what I would or would not be interested in. What sounds boring to some might sound interesting to me and vice versa. So, feel free to reach out if you feel I could be a fit for what you’ve got and we’ll go from there!

The BPI’s Bill Nelson explains how the facilities would benefit Wall Street and Main Street

The post Show them the money: why the Fed should adopt CLFs appeared first on Buy It At A Bargain – Deals And Reviews.

Employees may need those face-to-face meetings more than their employers do.

The post What We've Missed by Working From Home appeared first on #1 SEO FOR SMALL BUSINESSES.

The post What We've Missed by Working From Home appeared first on Buy It At A Bargain – Deals And Reviews.

The Chiefs beat the Broncos and now turn their attention to the playoffs.

The post Chiefs secure AFC's No. 2 seed but still hopeful of getting the top spot appeared first on Buy It At A Bargain – Deals And Reviews.

But be aware of what secured business credit cards really are – and what’s a much better alternative to kickstarting a business credit profile.

Secured business credit cards are for businesses with no credit or a less than perfect credit history. An initial security deposit is necessary. This deposit establishes your card’s credit limit. Often a minimum deposit of $500 is necessary. Once you start making purchases you get invoices like a regular credit card. But this begs the question: what does it mean when a business credit card is unsecured?

An unsecured business credit card works like an unsecured consumer credit card. Credit limits are calculated from many factors, this depends on the card issuer. Factors in deciding credit limit can include personal credit and/or your company’s business credit scores. They can also include time in business, annual revenues, etc. These credit cards can give your business the opportunity to earn incentives and rewards.

There are a number of types of business credit cards. Some aren’t too different from secured cards. Or they may have some of the same results, where you can get credit when you normally couldn’t, and you may even have the opportunity to build business credit with such cards.

A prepaid business card works as a convenient alternative to carrying cash. In this way, it works a lot like a secured credit card. You add funds to your account. And then whatever amount you add is available for purchases. Sounds like a debit card, right?

But, a business debit card is a card that works a lot like a business checkbook. The limit is the amount of funds you currently have in your business checking account. Every time you use it to make a purchase, the amount you charge comes from your account as a deduction

Prepaid cards and debit cards are both widely accepted at merchants worldwide, but one is preloaded and the other is not. Debit cards are linked to a checking account, while prepaid cards aren’t and instead require you to load money onto the card

Not exactly. The salient difference between secured credit cards and prepaid debit cards has to do with whose money you’re spending when you use the card. With secured credit cards, you spend money borrowed from the credit card company. You pay that money back after the purchase. With prepaid debit cards, you’re spending your (or your business’s) own money. You load money onto the card before the purchase.

Because it involves borrowing and repaying money, a secured credit card can help someone (or a business) build their credit. It can also harm their credit if they don’t use the card responsibly. Prepaid debit cards have no effect on a credit score.

Another, similar-sounding card is a business charge card. A business charge card has all the convenience of a credit card. But it’s without the high price of interest. When using this card you must pay your balance in full each billing cycle.

Since you can’t carry a balance, a charge card doesn’t have a periodic or annual percentage rate. Hence there is no rate for a charge card issuer to disclose. Let’s look at some secured cards for business.

With this card, you can, “take control of your credit history and help rebuild your credit”. Request your own credit limit between $2,000 and $100,000, in multiples of $50, when you apply. Your credit limit is subject to credit approval and a security deposit.

Your security deposit is 110% of the amount of your credit limit. And you will earn interest on your security deposit. But there is a $39 annual fee. Pay a variable 20.24% APR on purchases and balance transfers based on the Prime Rate.

Get it here: https://www.fnbo.com/small-business/credit-cards/

With this card, you can, “start building credit for your business”. Get up to a $25,000 secured credit limit. You will pay a 13.99% variable APR on purchases and balance transfers. And pay a 5% balance transfer fee on each transfer, with a minimum of $10.

There is a 25.25% APR for cash advances. And there is a $30 annual fee. Also, Union Bank will demand immediate payment in full, if you use this business credit card for personal, family, or household purposes.

Get it here: https://www.unionbank.com/business/visa-credit-cards-all

Score the best business credit cards for your business. Check out our professional research.

A Wells Fargo business checking or savings account must be open before applying. Upon approval, your funds will be transferred from the deposit account to fund the credit line

Get a $500 to $25,000 credit line, based on the amount of funds deposited by you as security in a collateral account. Pay no annual fee, and no foreign transaction fee.

You can get up to 10 employee cards. Pay prime + 11.90% APR on purchases. And pay prime + 20.74% APR on cash advances. Cash advance or balance transfer fees may apply.

Choose between Cash Back or Rewards Points. There is no annual rewards program fee. And there are no required spending categories or caps. Earn 1.5% cash back for every $1 spent on net purchases. You can receive cash back automatically as a credit to your account or to your eligible checking or savings account each quarter.

If you choose rewards points, you will earn 1 point for every $1 spent on net purchases. Get 1,000 bonus points when your company spends $1,000 or more in any monthly billing period. Redeem points for gift cards, merchandise, airline tickets and more. Get a 10% points credit when you redeem points online. And you can earn extra bonus points or discounts from Earn More Mall® retailers.

Wells Fargo reports your payment and usage behavior to the Small Business Financial Exchange. Payment and usage activity of the Wells Fargo Business Secured card is not reported to the consumer credit bureaus, therefore it will not help build or rebuild personal credit history.

Wells Fargo will periodically review your account and recent credit history for an opportunity to upgrade to an unsecured business credit card. You may become eligible with responsible use over time. Being able to upgrade to an unsecured business credit card also depends on your FICO score, payment history and ratio of credit card usage to credit limit.

Get it here: https://www.wellsfargo.com/biz/business-credit/credit-cards/secured-card/

Score the best business credit cards for your business. Check out our professional research.

Wells Fargo is the best when it comes to annual fees (it’s hard to beat $0). For the highest possible credit limit, the FNBO Business Edition® Secured Visa® Card comes out on top,

with a $100,000 maximum.

For the best balance transfer rate, it looks like Union Bank® Business Secured Visa® Credit Card is the best. But keep in mind, they do charge a 5% balance transfer fee on each transfer,

with a minimum of $10.

New businesses can get credit from starter vendors, and often there’s no need to pay money to secure a card. Consider CEO Creative and Grainger Industrial Supply. Neither of them require a deposit to secure a card.

Let’s focus on another starter vendor: Supply Works. They are a part of Home Depot, and offer integrated facility maintenance supplies. But they will not accept virtual addresses. They will report to Experian. Terms are Net 30. You can apply online or over the phone.

You will need:

But at least there is no minimal time in business requirement.

Score the best business credit cards for your business. Check out our professional research.

For entrepreneurs just starting out, getting secured business credit cards may seem to be one of the only ways they feel they can get credit. But you can build business credit with starter vendors. Even if you start with lower limits, you often don’t have to secure those cards with a deposit. As a result, starter vendor credit is nearly always a superior alternative to getting secured business credit cards.

The post The Top 3 Secured Business Credit Cards appeared first on Credit Suite.

The post The Top 3 Secured Business Credit Cards appeared first on Automation For Your Email Marketing Sales Funnel.

The post The Top 3 Secured Business Credit Cards appeared first on Buy It At A Bargain – Deals And Reviews.