There’s no shortage of amazing images online, but that doesn’t mean you’re always going to find the original. So many images you find on blogs and other websites originated from somewhere else. While it may not seem like a big deal, it seriously pays to know how to find the original. Here’s how to find … Continue reading How to Find Image Sources For Proper Attribution or Research

Author: Heather Robinson

Kraftful (YC S19) hiring founding engineers to build the standard IoT platform

Article URL: https://www.ycombinator.com/companies/kraftful/

Comments URL: https://news.ycombinator.com/item?id=27080810

Points: 1

# Comments: 0

The post Kraftful (YC S19) hiring founding engineers to build the standard IoT platform appeared first on ROI Credit Builders.

New comment by kaspar1992 in "Ask HN: Who is hiring? (December 2020)"

Humanitec is looking for a developer advocate/technical writer/speaker and awesome storyteller. The position is (and will remain) fully remote:

https://humanitec.com/open-positions/senior-developer-advoca…

This is an incredibly exciting job offering for anyone in software engineering who has a passion for writing and speaking. For anyone who wants to evangelize an entirely new category (Internal Developer Platforms) in a lean, fast and crisply executing company. An Internal Developer Platform is like Heroku but on top of the tech and tools you use already.

You’ll work with a bunch of exceptional and experienced colleagues on enabling other developers to focus on code rather than the underlying infrastructure. Truly rewarding job you can learn a ton in with weekly coaching sessions with industry leading advisors such as Chris Schagen (ex CMO Contentful).

I highly encourage you to apply even if you don’t have previous experience with developer advocacy but just want to get into this field. If you have experience with software engineering and especially kubernetes and devops that’s totally fine!

Please everyone, share, comment and spread the word everywhere it’s much appreciated!

New comment by neilpanchal in "Ask HN: Who is hiring? (November 2020)"

Rigetti Quantum Computing | Multiple Software Positions | Fulltime Remote

Senior Software Engineer (Full-stack), Internal Quantum Software

https://jobs.lever.co/rigetti/6aa1c738-a8e7-48dd-8884-afd4d8…

Software Engineering Manager – Internal Quantum Software

https://jobs.lever.co/rigetti/6aa1c738-a8e7-48dd-8884-afd4d8…

Our stack: Python, Julia, Postgres, Angular, React

Please apply online and we will review your application. Please mention in the application that you’re coming from HN. Questions? send me a note (not application) to npanchal \@ rigetti.com.

New comment by sangerSCB in "Ask HN: Who is hiring? (October 2020)"

Santa Cruz Bicycles | UI Designer| Salt Lake City, UT | Remote for now, Onsite later | Full Time | www.santacruzbicycles.com Santa Cruz Bicycles, Juliana Bicycles, and Cervelo Cycles’ SLC-based digital team is hiring a UI Designer to create new online experiences for customers across our brands. As the next member of our team you …

The post New comment by sangerSCB in “Ask HN: Who is hiring? (October 2020)” first appeared on Online Web Store Site.

The post New comment by sangerSCB in “Ask HN: Who is hiring? (October 2020)” appeared first on ROI Credit Builders.

One Of The Most Incredible Residual Income Ever

One Of The Most Incredible Residual Income Ever Recurring earnings is the divine grail of earnings streams. You quit working, however you maintain making money. Pleasant! The fact is, many individuals transform away from the a lot more usual lorries for recurring earnings. Multi Level Marketing (Multi-Level Marketing) is a really typical car today that …

The post One Of The Most Incredible Residual Income Ever first appeared on Online Web Store Site.

The post One Of The Most Incredible Residual Income Ever appeared first on Business Marketplace Product Reviews.

The post One Of The Most Incredible Residual Income Ever appeared first on Buy It At A Bargain – Deals And Reviews.

The Best VoIP Phone Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

The best VoIP phone services create exceptional customer experiences. And exceptional customer experiences work wonders for your bottom line.

Imagine this: a potential customer calls the sales number listed on your website. Six states away, a personal cell phone rings. Your sales person picks it up, answers a few questions, and closes the sale.

Within a matter of seconds, that potential customer turns into a paying customer rather than being transferred from employee to employee, wasting their time and testing their patience.

With the right VoIP service, you can streamline and automate the customer journey, resulting in more money for less work. Furthermore, these services are easy to set up, easy to use, and most of the leg work happens behind the scenes.

But choosing the right service feels like a daunting task. With countless options out there, how do you decide which one’s right for you?

If you’re not sure how to answer that question, you’re in the right place. In this article, I cover how to choose the right service for your needs, the different types of VoIP services, and my top recommendations.

Let’s dive in!

The top 6 options for VoIP phone service:

- Ooma – best for small businesses

- Nextiva – best for remote teams

- RingCentral – best for fast-growth

- Grasshopper – best for mobile teams

- Verizon – best for large businesses

- 8×8 – most affordable VoIP service

How to choose the best VoIP phone services for you

With countless VoIP service providers to choose from, finding the perfect solution for your business isn’t always easy. To make things easier, I want to share the criteria I considered when making this list and some must-haves regardless of the company you choose.

You can use these to help narrow things down as you go through the process.

Deployment options

Some VoIP phone services work with the hardware you already have, while others require proper installation. In some cases, you may need to buy an adapter or something else to enable the system.

But others are as simple as a mobile app you download on your phone.

So, carefully consider the amount of time and the level of support you have when making a decision. The simpler the system, the easier it is, and the less support you need to get things up and running.

The size of your business

Most VoIP phone service providers charge per user per month.

And while some offer discounts if you have a large team, those prices can quickly add up and get expensive.

So it’s essential to understand how many users you have and how to get the best deal with the features you need at a reasonable price point.

Phone call capabilities

It’s important to consider the phone call capabilities you need because each provider offers different capabilities at different price points.

Do you need automatic call rejection, call forwarding, or caller ID? What about voicemail, voicemail transcription, and hold music?

You may also want to consider other capabilities like:

- Call forwarding and routing

- Automatic attendants

- Phone number types

- Extensions

- Blocking and auto rejections

- Voicemail to text

- Call recording

- Call history

- Instant responding

- Custom greetings

Make a list of everything you need so you can choose the right provider and the right plan.

Other forms of communication

Most VoIP providers also offer other forms of communication like SMS messaging, document sharing, online faxing, and video conferencing.

However, they may not all be available on basic plans.

With that said, you may not need all of them, either. So, carefully consider the additional forms of communication you need your team to have.

Reliability

Your internet, VoIP provider’s uptime, and power source affect the quality of your phone calls.

With reliable, high-speed internet, you probably won’t have any issues. But what happens if the power goes out?

If you use your mobile device, you’re probably fine.

But desk phones aren’t. However, some come with battery backups that may last up to a few hours. So, make sure this is an option if you rent or buy hardware from your VoIP service provider.

Furthermore, some VoIP providers offer network monitoring that lets them switch to wireless backups if wired data links fail. And you should also expect nothing less than 99.99% uptime, as well.

The different types of VoIP phone service

Device-based

For this type of service, you need to buy an adapter from the service provider and connect it to an existing phone (or a phone they provide).

Software-based

These services are desktop programs. Skype and Google Talk are two good examples. You have to install the program and connect to the internet to use them.

However, most providers offer cloud-hosted and software-based systems.

Cloud-hosted

Cloud-hosted VoIP, or “virtual private-branch-exchange” (PBX), services are available as well. The only hardware you need is a networking router or switch and the provider handles the rest

This includes mobile VoIP services, too. These mobile apps run on Android and Apple devices through cellular internet or a local Wi-Fi network.

All of the options on this list are a combination of cloud-hosted and software-based, with most offering both types of systems.

#1 – Ooma Review — The best VoIP phone service for small businesses

If you’re a small business looking for a reliable, no-contract VoIP phone service, Ooma is a great choice. They provide everything you need (i.e. hardware, software, and know-how) so you can start using their services in as little as 15 minutes.

Everything is ready to go straight out of the box. And you can keep your existing phone number or swap it out for a new one — for free.

Ooma offers 35 powerful features, including:

- A mobile app

- Virtual receptionist

- SMS messaging

- Call blocking

- Voicemail and caller ID

- Unlimited calls in North America

- One complimentary toll-free number

- One direct-dial number per user

Furthermore, Ooma has an excellent customer service team ready to help you get up and running, navigate snags, and create a seamless experience for your customers.

However, the service is missing more advanced features. But it’s incredibly affordable and accessible for small businesses with a tight budget.

Plus, you don’t have to worry about complicated contracts. Ooma’s pricing is simple and straightforward with two business plans, including:

- Ooma Office — $19.95 per user per month

- Ooma Office Pro — $24.95 per user per month

Ooma Office is suitable for most users. But you can upgrade to the Pro plan if you need a desktop application, call recording, or higher usage limits.

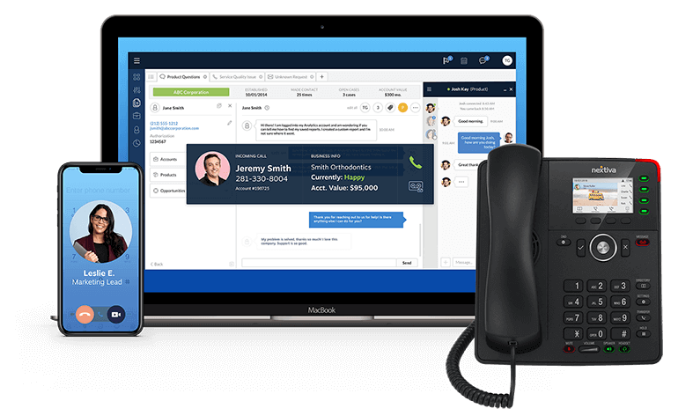

#2 – Nextiva Review — The best VoIP phone service for remote teams

Remote teams face unique challenges. And they need a VoIP provider equipped with the tools and features required to conquer those challenges.

Nextiva is “made for business owners, not IT wizards” and built with remote teams of all sizes in mind. They offer solutions for small businesses, midsize businesses, and large enterprise companies alike.

Plus, their in-house customer service team is ready to help every step of the way.

Nextiva includes a wide variety of VoIP features, including:

- Android and iOS applications

- Unlimited text messaging

- Customizable hold music

- Multi-level auto attendant

- Unlimited calls in the US and Canada

- Free local OR toll-free number

- Video and audio meetings

- Internet faxing

Furthermore, you can make and receive business phone calls straight from your desktop, laptop, or mobile device. This service completely replaces an in-office phone system, empowering your remote team to stay connected.

Alternatively, you can use it in conjunction with your current phone system. So, it’s also a great fit for call centers and non-remote teams, as well.

Nextiva offers simple and affordable pricing. Their plans include:

- Essential — $19.95 per user per month

- Professional — $20.95 per user per month

- Enterprise — $27.95 per line per month

Nextiva boasts an “ultra-high uptime of 99.999%,” with around-the-clock network monitoring and zero outages in 2019. With relatively reliable service, various essential features, and reasonable prices, their service is among the best.

#3 – RingCentral Review — The best VoIP phone service for fast-growth businesses

RingCentral is an excellent option for fast-growth businesses. They’re the world’s #1 business communications platform with plans and features for business communications as well as customer support.

Plus, RingCentral offers discounts depending on the size of your team. So, as your team grows (regardless of how fast), your phone service affordably scales to match your needs.

They promise 99.99% uptime, and they maintain countless global data centers. This means you get excellent coverage and phone quality wherever you are on the globe.

Furthermore, installation and setup are a breeze, thanks to RingCentral’s step-by-step installation and intuitive admin panel.

You can set up new users from the admin panel, monitor service quality, and view your analytics all in one centralized place. Plus, you can even access it on the go.

Their services include features like:

- Unlimited calls in the US and Canada

- Voicemail to text

- Team messaging

- Document sharing

- Unlimited text messaging

- Unlimited faxing and conferencing

- Call recording

- Developer platform

- Custom integrations

RingCentral’s most affordable plan starts at $19.99 per user per month, making them a top contender for affordability.

Their paid plans include:

- Essentials — $19.99 per user per month

- Standard — $24.99 per user per month

- Premium — $34.99 per user per month

- Ultimate — $49.99 per user per month

While their basic plans are suitable for smaller teams, their Premium and Ultimate plans allow teams to create custom-fit solutions, regardless of how fast they grow.

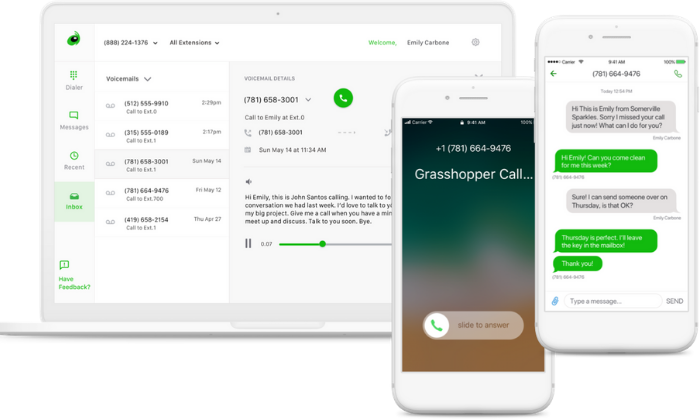

#4 – Grasshopper Review — The best VoIP phone service for mobile teams

If your team works in the field, works from home, or works from anywhere in the world, Grasshopper is a smart choice.

It’s a mobile (or desktop) app that adds a business line and an integrated phone system to your employee’s phones. So, they don’t need to carry around two phones or be present in the office to message customers and accept business calls.

Plus, you can access and manage your entire phone system with mobile and desktop apps anywhere with an internet connection.

The best part is that Grasshopper integrates seamlessly with the phones you already have.

There’s no need to buy any fancy equipment or go through the hassle of messy and time-consuming installations. It’s as easy as picking a number and a plan, downloading the app, and configuring your settings.

Plus, with Grasshopper, you get access to intuitive, yet powerful, features like:

- Business text messaging

- Call forwarding

- Voicemail transcription

- Phone extensions

- Online faxing

- Custom greetings

- Instant responses

- Ruby Receptionist

And while Grasshopper doesn’t automatically enable VoIP calling, you can quickly turn it on for free using the mobile app if you have poor cell service or prefer internet calling instead.

Their paid plans include:

- Solo — $26/mo for one number and three extensions

- Partner — $44/mo for three numbers and six extensions

- Small Business — $80/mo for five numbers and unlimited extensions

Extensions can forward to any number you want. So, you can operate with three employees using Grasshopper’s solo plan.

This is a breath of fresh air instead of per-user pricing with the other services on this list.

#5 – Verizon Review — The best VoIP phone service for large businesses

Known for the stability of its network, Verizon provides VoIP business features for medium and large-scale businesses. However, it’s overkill for most small companies and very expensive compared to other options on this list.

Furthermore, it’s most suitable for businesses that need to be available for customer calls, route calls to the right teams/people, or respond quickly to customer requests.

Verizon’s VoIP phone service includes 45 features, including:

- Customized hold announcements/music

- A virtual receptionist

- Complete call history

- Administration web portal

- Make and receive calls on your phone

- Visual voicemail features

- Call transfers

- Do not disturb mode

- Inbound caller ID

- Selective call rejection

- Instant messaging

You can purchase or rent desk phones through Verizon or purchase a converter to continue using your current equipment.

Furthermore, you get free access to mobile and desktop apps to access or manage your phone system from anywhere in the world. However, Verizon’s services aren’t available everywhere, so you may not be able to use their services.

Verizon business phone plans start at $35 per user per month plus any additional fees, taxes, or equipment charges. However, their pricing is confusing when you start reading the fine print. And you have to commit to a two-year contract, as well.

So, keep that in mind as you’re making your final decisions.

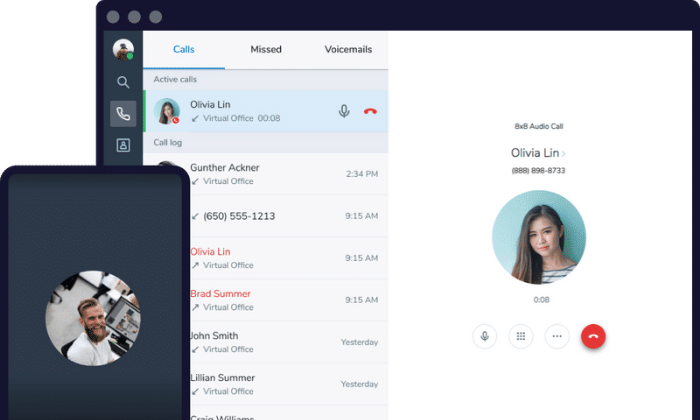

#6 – 8×8 Review — The most affordable VoIP phone service

If you’re looking for a basic, affordable VoIP phone service, 8×8 is a smart choice.

Their 8×8 Express Business Phone System plan starts at $12 per user per month (with a free trial). This low pricing makes it the most affordable option on this list.

However, with that low price point comes limited features. The Express plan includes:

- Unlimited calling in the US and Canada

- Global and direct toll-free numbers

- Basic auto attendant

- Ring groups

- Call routing

- Business SMS

And to access their more advanced features, you have to pay between $25 – $45 per user per month. Which… is more expensive than some of the other options listed here.

So I don’t recommend it unless you go with the Express Plan.

Summary

My #1 recommendation for most small businesses is Ooma. It’s affordable, reliable, and easy to set up in about 15 minutes. However, if you’re looking for a large-scale solution, Verizon is your best bet.

Furthermore, Nextiva is perfect for remote teams, and Grasshopper is a simple, yet powerful, mobile app for small teams who are frequently out of the office.

If you’re on a tight budget, 8×8 is the cheapest VoIP phone service, starting at $12 per user per month. However, it’s features are limited.

Regardless of the route you go, don’t forget to consider your requirements, budget, and the criteria we talked about as you go through the process of choosing the best VoIP phone service for your business.

Have you used a VoIP service provider in the past? What was your experience like?

The post The Best VoIP Phone Services (In-Depth Review) appeared first on Neil Patel.

Tamara Bourne Awarded as Top Rated Real Estate Agent in Peac…

Tamara Bourne Awarded as Top Rated Real Estate Agent in Peachtree City — Tamara Bourne has actually been picked as one of the Top Rated Real Estate Agents in Peachtree City to be included on Top Real Estate readily available on Xfinity On Demand. Leading Rated Real Estate functions video clips of Top Rated Real …

Here’s a Great Question from Residential Real Estate Agents: How Do I Build Recession Business Credit

COVID-19 got you down? It’s not going to last forever. In the meantime, you can build recession business credit. Get a jump on then competition and use this pause in our lives to get ahead.

Recession Business Credit for Residential Real Estate Agents and the Rest of Us!

Every entrepreneur asks this same question: how do I build recession business credit?

The United States’s economy has been through any number of changes throughout the years. Our economic fortunes can depend on breakthroughs in modern technology, diplomatic ties (or cutting those ties), the weather, and a lot more. Business credit, luckily, is an asset which you can build even during economic recessions. Nevertheless, you may need to get a little imaginative with it, and with other forms of company funding.

Business credit is credit in a company’s name. It doesn’t link to a business owner’s consumer credit, not even when the owner is a sole proprietor and the sole employee of the company.

As such, a business owner’s business and consumer credit scores can be very different.

Recession Business Credit – Get The Advantages

Due to the fact that recession business credit is separate from individual, it helps to safeguard a business owner’s personal assets, in the event of a lawsuit or business insolvency.

Also, with two distinct credit scores, a small business owner can get two separate cards from the same merchant. This effectively doubles purchasing power.

Another advantage is that even new ventures can do this. Going to a bank for a business loan can be a recipe for disappointment. But building small business credit, when done properly, is a plan for success.

Consumer credit scores rely on payments but also other components like credit utilization percentages.

But for company credit, the scores actually only hinge on if a business pays its invoices on time.

Recession Business Credit – Start The Process

Growing company credit is a process, and it does not occur automatically. A small business has to proactively work to establish business credit.

However, it can be done readily and quickly, and it is much swifter than establishing consumer credit scores.

Merchants are a big part of this process.

Doing the steps out of order will lead to repetitive rejections. Nobody can start at the top with company credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

Recession Business Credit – Get Started with Small Business Fundability

A small business needs to be fundable to lenders and vendors.

Hence, a business will need a professional-looking website and e-mail address. And it needs to have site hosting bought from a supplier like GoDaddy.

And also, company phone and fax numbers ought to have a listing on ListYourself.net.

At the same time, the company phone number should be toll-free (800 exchange or comparable).

A business will also need a bank account dedicated solely to it, and it has to have all of the licenses essential for running.

Licenses

These licenses all have to be in the particular, accurate name of the small business. And they must have the same small business address and phone numbers.

So keep in mind, that this means not just state licenses, but potentially also city licenses.

Learn more here and get started toward establishing small business credit. Get money even in a recession!

Recession Business Credit – Start Credibly Dealing with the Internal Revenue Service

Visit the Internal Revenue Service web site and get an EIN for the small business. They’re free. Pick a business entity like corporation, LLC, etc.

A small business may get started as a sole proprietor. But they absolutely need to change to a form of corporation or an LLC.

This is to diminish risk. And it will take full advantage of tax benefits.

A business entity matters when it involves tax obligations and liability in the event of a lawsuit. A sole proprietorship means the owner is it when it comes to liability and tax obligations. No one else is responsible.

The best thing to do is to incorporate. You should only look at a DBA as an interim step on the way to incorporation.

Recession Business Credit – Set off the Business Credit Reporting Process

Start at the D&B web site and obtain a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a company in their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the business. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

This way, Experian and Equifax will have activity to report on.

Starter Vendor Credit

First you must establish tradelines that report. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get credit for numerous purposes, and from all sorts of places.

These types of accounts often tend to be for things bought all the time, like marketing materials, shipping boxes, outdoor workwear, ink and toner, and office furniture.

But first of all, what is trade credit? These trade lines are credit issuers who give you starter credit when you have none now. Terms are generally Net 30, instead of revolving.

Therefore, if you get approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, such as within 30 days on a Net 30 account.

Details

Net 30 accounts have to be paid in full within 30 days. 60 accounts need to be paid fully within 60 days. Unlike revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To launch your business credit profile the right way, you ought to get approval for vendor accounts that report to the business credit reporting bureaus. As soon as that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit – It Helps

Not every vendor can help like true starter credit can. These are vendors that grant approval with marginal effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

As you get starter credit, you can also start to get credit from retailers. This is to continue to prove you are reliable and pay in a timely manner. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Uline

Uline is a true starter vendor. You can find them online at www.uline.com. They offer shipping, packing, and industrial supplies, and they report to D&B and Experian. You MUST have a D-U-N-S number and an EIN before starting with them. They will ask for your business bank information. Your company address must be uniform everywhere. You need for an order to be $50 or more before they’ll report it. Your first few orders may need to be prepaid initially so your business can get approval for Net 30 terms.

- How to apply with them:

- Add an item to your shopping cart

- Go to checkout

- Select to Open an Account

- Select to be invoiced

Quill

Quill is an additional true starter vendor. You can find them online at www.quill.com. They sell office, packaging, and cleaning supplies. And they also sell toner, office furniture, and even shipping and school supplies. They report to Dun and Bradstreet every quarter.

To apply, you MUST have a D&B PAYDEX score. If not given a Net 30 they will ask you to do prepaid orders of $100.00. Normally any prepaid order won’t report but you would need them to have given you a Net 30 account. Net 30 accounts require $50.00 purchase to report.

New business or businesses with no credit history may need to prepay purchases until Net 30 approval. Terms are Net 30.

- Here’s how to qualify:

- Your corporate entity must be in good standing with the applicable Secretary of State

- You must have an EIN and a D-U-N-S number

- Business address (it has to match everywhere)

- Business license (if applicable)

- A corporate bank account

Apply online or over the phone.

Grainger Industrial Supply

Grainger Industrial Supply is likewise a true starter vendor. You can find them online at www.grainger.com. They sell hardware, power tools, pumps and more. They also do fleet maintenance. And they report to D&B. You need to have a business license, EIN, and a D-U-N-S number.

- To qualify, you need the following:

- A business license (if applicable)

- An EIN number

- A company address matching everywhere

- A business bank account

- A D-U-N-S number from Dun & Bradstreet

Your business entity must be in good standing with the applicable Secretary of State. If your company doesn’t have established credit, they will require additional documents. So, these are items like accounts payable, income statement, balance sheets, and the like.

Apply online or over the phone.

Recession Business Credit – Get Benefits from Accounts That Don’t Report

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to a minimum of one of the CRAs, a trade account which does not report can still be of some worth.

You can always ask non-reporting accounts for trade references. And credit accounts of any sort will help you to better even out business expenditures, thereby making budgeting simpler. These are companies like PayPal Credit, T-Mobile, and Best Buy.

Store Credit

Store credit comes from a variety of retail companies.

You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use the small business’s EIN on these credit applications.

Fleet Credit

Fleet credit is from companies where you can purchase fuel, and fix and maintain vehicles. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the business’s EIN.

Learn more here and get started toward establishing small business credit. Get money even in a recession!

Cash Credit

These are businesses such as Visa and MasterCard. You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are often MasterCard credit cards.

And there are tons of ways these business credit cards can help residential real estate agents.

Learn more here and get started toward establishing small business credit. Get money even in a recession!

Recession Business Credit – Monitor My Business Credit

Know what is happening with your credit. Make certain it is being reported and take care of any mistakes ASAP. Get in the practice of taking a look at credit reports and digging into the details, and not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost at the business CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update Your Data

Update the relevant information if there are inaccuracies or the information is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. So for Equifax, go here: www.equifax.com/business/small-business.

Recession Business Credit – Fix My Business Credit

So, what’s all this monitoring for? It’s to dispute any inaccuracies in your records. Mistakes in your credit report(s) can be fixed. But the CRAs often want you to dispute in a particular way.

Disputes

Disputing credit report errors typically means you mail a paper letter with copies of any evidence of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always mail copies and retain the originals.

Fixing credit report inaccuracies also means you specifically itemize any charges you dispute. Make your dispute letter as crystal clear as possible. Be specific about the concerns with your report. Use certified mail so that you will have proof that you sent in your dispute.

Recession Business Credit – A Word to the Wise

Always use credit smartly! Don’t borrow more than what you can pay back. Keep track of balances and deadlines for payments. Paying off on schedule and fully will do more to elevate business credit scores than nearly anything else.

Establishing small business credit pays off. Great business credit scores help a business get loans. Your lender knows the small business can pay its debts. They understand the company is bona fide.

The business’s EIN attaches to high scores and credit issuers won’t feel the need to demand a personal guarantee

How Do I Build My Business Credit: Takeaways

Business credit is an asset which can help your small business for years to come. Learn more here and get started toward establishing small business credit. The COVID-19 pandemic is not going to last forever.

The post Here’s a Great Question from Residential Real Estate Agents: How Do I Build Recession Business Credit appeared first on Credit Suite.

Jerry (YC S17) Is Hiring Full Stack Engineers (Toronto, SF Bay Area, Remote)

Article URL: https://getjerry.com/careers

Comments URL: https://news.ycombinator.com/item?id=22728768

Points: 1

# Comments: 0