Many of us analyze ourselves mercilessly in the mirror. We pick apart every flaw and consider how we might change or improve each one. While that may or may not be a positive activity, in the same way, you can improve the success of your business by reflecting on what is working and what is … Continue reading Is Your Business Fundable: An Analysis of Fundability

Author: Jessica Stubbs

Just how To Make An Effective Short Video Clip To Market Your Business Online

Exactly how To Make An Effective Short Video Clip To Market Your Business Online There are millions of brief video clip clips on the internet, either generated by specialists or beginners for sharing with different video clip sharing websites such as YouTube as well as Google video clip. The novices release their video clip clips … Continue reading Just how To Make An Effective Short Video Clip To Market Your Business Online

Recently funded… $13,400.00 in Accounts Receivable financing!

Creditors and Predators: 10 Ways to Avoid Falling Prey to Predatory Lenders, and 6 Questions to Ask Before You Jump In

How to Tell the Difference Between Legit Creditors and Predators Out to Eat You Alive

Watch any animal reality show and you will see what happens between predators and prey. In a similarly menacing way, some lenders actually prey on unsuspecting borrowers. Not only do they leave finances in ruins, but often the trail of destruction trails across their entire lives. They basically eat their prey alive. How can you avoid falling victim to these devilish creatures? We are going to show you how to tell the difference between legit creditors and predators, so that you can survive in the credit wilderness.

Know Thy Enemy: What is Predatory Lending

According to Investopedia: “Predatory lending benefits the lender and ignores or hinders the borrower’s ability to repay a debt. These lending tactics often try to take advantage of a borrower’s lack of understanding concerning loans, terms, or financial literacy.”

Basically, just like predators in the wild, predatory lenders take advantage of the weak. They look for those that are unassuming, easily tricked into coming closer, and without suitable defenses. Then they pounce.

In the wild, predators often disguise themselves as something else. Consider the venus fly trap. To the fly, it looks like a flower. The fly saunters over to enjoy the beauty, and snap! It’s gone before it even knows what hit it. That is the peril of a predatory lender. It looks great, inviting even. Before you know it, however, they trap you. The best protection you can have is to know the difference between creditors and predators. Don’t be fooled. Learn the signs and build your defenses. Know thy enemy.

Common Signs that a Creditor is Actually a Predator

The only way to tell the difference between creditors and predators is to know the signs of a predator. They are not that hard to spot if you know what tricks to look for.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Payment is King

If you are trying to get a loan and the “creditor” continues to emphasize what your payment will be, while downplaying how much the actual loan is, that creditor might be a predator. While a monthly payment is obviously important for budgeting purposes, you need to know all the terms of the loan.

A lender can use many tactics to ensure your monthly payment is where you need it to be to fit your budget. They can increase the loan period, adjust terms, and add balloons to make things look much better than they really are. The result is that you get a really bad loan in exchange for a temporary lower payment.

Burst the Balloon

Speaking of balloon loans, those are also a common predatory lending practice. They use them to provide unsuspecting borrowers with a low monthly payment for most of the loan. Most borrowers do not realize that they are typically only covering the interest for each month.

In fact, usually the principle isn’t reduced at all by payments until the very end of the loan. The final payment ends up being a large “balloon” payment that should pay off the entire principal of the loan all at once. Most of the time borrowers are not prepared for this, and they end up either refinancing or defaulting.

Unpack the Packing: Unnecessary Baggage

Packing is another practice that predatory lenders seem to lean towards. It involves them adding extras onto the loan. You do not need these extras, and they add them without your knowledge. The most common culprits are insurance products that are not necessary for your situation. You pay for them without realizing it, and they offer you no benefit.

Excessive Points and Fees

It’s not uncommon for lenders to charge points and fees on a loan. It is a practice that some use to increase profits. As a general rule, one point is worth one percent of the loan balance.

Asking for more points and higher fees than is normal for the type of loan you are getting can be a sign of predatory lending. If you feel that is what is going on, dig deeper.

How do you know what is “normal” and what is excessive? As a general rule, three points, or 3% of the loan amount or less, is a decent deal. This includes appraisals and title insurance, which are necessary. Research to see what is normal for your area, but know this is a good rule of thumb.

The New York Connection: Of Creditors and Predators and Judgements and Confessions

New York plays a unique role in the predatory lending drama. Knowing this can provide a pivotal clue when trying to determine if you are about to become prey. In New York, state law is friendly to confessions of judgement. Cash -advance companies, which are a huge faction of the predatory lending family, almost always make borrowers sign one of these as a loan condition.

If a borrower signs a confession of judgment, they are basically agreeing to lose in a court battle if a dispute arises about repayment. Regardless of where these types of loans take place, almost all of them contain a New York confession of judgement. If you see one of these in your loan documents, run.

Punishment for Paying Early

If they are going to charge a prepayment penalty, you should be wary. Early payment is a good thing, even though the lender loses some interest. It isn’t a deal breaker, but it should definitely cause you to look for other red flags and proceed with caution.

Obviously Seeking the Weak

Senior citizens, those with no credit or bad credit, minorities, those considered low income are all easy targets. They are more likely that others to get tangled up with predatory lenders, according to a 2015 Center for Responsible Lending report. Stay away from lenders that advertise in a way that targets these populations.

Language such as “bad credit doesn’t matter” is a definite sign. In addition, lenders that initiate contact unprovoked and those that try to rush your decision are bad news.

It’s a Bad Deal Now, but They’ll Fix It

Lenders that are searching for prey may try to get borrowers to sign on to a bad deal by promising to make it better in a future refinance. Do not fall for this. A bad deal is a bad deal. Just walk away.

Loan “Flipping” is NOT the Same a House “Flipping”

Flipping a house in real estate terms can actually be very profitable. However, loan flipping is something else altogether, and predatory lenders are great at it. When they see you struggling, they offer a refinance. While it may lower your payments, you end up paying points and fees again. Eventually you end up owing more than ever on your house, car, or whatever it is you used as collateral.

It is a vicious cycle that can bury you quickly.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

The Payment Isn’t “All In”

This is typically and issue with predatory lending in mortgages. Inquire from the beginning as to whether there will be an escrow account set up for your required tax and insurance payments. Lenders that are not on the up and up will often make payments look super low because they do not include all the costs a borrower is responsible for.

What Are Some Questions I Can Ask to Help Discern Between Good Creditors and Predators?

Protecting yourself means recognizing these signs, they will not always be obvious. Sometimes you need to look a little closer. Asking these questions, whether to yourself or to the lender, can help you get to the root of the issue.

- Is the offer too good to be true?

As with almost anything in life, if it seems too good to be true, it probably is.

- What does the product truly cost?

If the lender doesn’t spell it out for you, do the math yourself. If you need help understanding it all, find someone you trust that can walk you through it. You need to know exactly what this loan is going to cost you. That means all fees, points, insurance, and taxes need to be clear before you can make an educated decision.

- Does the lender check my ability to repay?

It is ridiculous to think you will get a loan without the lender ensuring you can repay. It doesn’t have be a credit check. If they do not at least verify income or employment however, there is almost certainly a problem.

- Does the lender help me build credit?

Not all lenders do this, but if they do help you build your credit score, it is a point in their favor.

- Does the lender require electronic payments?

While there is nothing wrong with paying electronically, the requirement that electronic payments are the only way you can pay should throw up a red flag.

- Have others complained about the lender?

Check out reviews online. Look them up on the Better Business Bureau’s website at BBB.org. Find out if others have had a good experience with the lender, or not.

Is Anyone Doing Anything to Separate Creditors and Predators?

In recent years there has be a push by legislators to put an end to predatory lending practices. There have been safety nets in place for far longer however. What is being done? Does anyone care? Actually, yes, they do.

The Truth in Lending Act

It really started way before now with the Truth in Lending Act of 1968. This Act requires that lenders clearly communicate the sum of all payments, APR, and amount to be paid in interest and fees. In addition, the total credit that is being extended must be made clear. All of this has to be disclosed before a loan contract is signed.

Another component of the Truth in Lending Act is that a borrower has the right of rescission. This means that with certain loans, borrowers have three days to cancel after signing.

The Consumer Financial Protection Bureau

After the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Consumer Financial Protection Bureau was born. The goal of the CFPB is to help oversee federal laws that protect consumers financially. They have resources that can help borrowers learn to decipher loan terms and risks, and also help them report and resolve any complaints they may have against lenders.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Signs of a Good Lender

Telling the difference between good creditors and predators means more than just knowing how to spot the bad guys. There are things to look for that can clue you in as to whether a lender is actually good, or if they are just not a predator. There is a gray area, and even reputable lenders can fall into poor practices.

Knowing that, keep in mind that legitimate lenders will always check your ability to pay. They may rely on a credit check or some other means. In addition, they will not pressure you. The best will actually offer tools to help educate you financially so that you can better understand the details of the loan.

Also, a good lender will have few complaints. Consumers will almost always complain liberally if they feel like they were ripped off. In addition to BBB.org, check out the CFPB Complaint Database and the Federal Trade Commission’s scam alerts. While even good lenders get complaints occasionally, a long history of dissatisfied customers is a huge warning sign.

Other Ways to Protect Yourself

Like I said, the best way to know the difference between creditors and predators, and avoid becoming a predator’s prey, is to educate yourself. Here are some additional sources for doing just that:

- The Money & Credit page on the Federal Trade Commission’s website has tons of educational articles on a broad variety of topics including debt, credit and loans.

- The Ask CFPB pageincludes answers to hundreds of questions related to personal finance, many of which you can apply to business finance as well.

- The attorney general’s officein your specific state will be able to help if you need to submit complaints. They can also help you understand consumer protections in your own area.

Learn the Difference Between Legit Creditors and Predators to Avoid Problems with Personal and Business Finance

Predatory lending is prevalent in the realm of personal finance, but that does not mean that business finances are unaffected. Many business loans are dependent on personal credit scores, which a bad loan from a predatory lender can devastate. This is one reason building business credit is so important.

The fact is, however, a bad loan is like a predatory parasite. It seeks out the weak, and once it attacks, it attaches itself to your finances and plagues every aspect of them, even slipping to the business realm if left unattended. It can cause devastation that could last for years. Don’t let it happen to you. Learn the signs, and make sure you can tell the difference between creditors and predators.

The post Creditors and Predators: 10 Ways to Avoid Falling Prey to Predatory Lenders, and 6 Questions to Ask Before You Jump In appeared first on Credit Suite.

What Type of Links Does Google Really Prefer?

We all know that links help rankings. And the more links you build the higher you’ll rank.

But does it really work that way?

Well, the short answer is links do help with rankings and I have the data to prove it.

But, you already know that.

The real question is what kind of links do you need to boost your rankings?

Is it rich anchor text links? Is it sitewide links? Or what happens when the same site links to you multiple times? Or when a site links to you and then decides to remove the link?

Well, I decided to test all of this out and then some.

Over the last 10 months, I decided to run an experiment with your help. The experiment took a bit longer than we wanted, but we all know link building isn’t easy, so the experiment took 6 months longer than was planned.

Roughly 10 months ago, I emailed a portion of my list and asked if they wanted to participate in a link building experiment.

The response was overwhelming… 3,919 people responded, but of course, it would be a bit too hard to build links to 3,919 sites.

And when I say build, I’m talking about manual outreach, leveraging relationships… in essence, doing hard work that wouldn’t break Google’s guidelines.

Now out of the 3,919 people who responded, we created a set of requirements to help us narrow down the number of sites to something more manageable:

- Low domain score – we wanted to run an experiment on sites with low domain scores. If a site had a domain score of greater than 20, we removed it. When a site has too much authority, they naturally rank for terms and it is harder to see the impact that a few links can have. (If you want to know your domain score you can put in your website URL here.)

- Low backlink count – similar to the one above, we wanted to see what happens with sites with little to no backlinks. So, if a site had more than 20 backlinks, it was also removed from the experiment.

- No subdomains – we wanted sites that weren’t a Tumblr.com or a WordPress.com site or subdomain. To be in this experiment, you had to have your own domain.

- English only sites – Google in English is more competitive than Google in Spanish, or Portuguese or many other languages. For that reason, we only selected sites that had their main market as the United States and the site had to be in English. This way, if something worked in the United States, we knew it would work in other countries as they tend to be less competitive.

We decided to cap the experiment to 200 sites. But eventually, many of the sites dropped off due to their busy schedule or they didn’t want to put in the work required. And as people dropped off, we replaced them with other sites who wanted to participate.

How the experiment worked

Similar to the on-page SEO experiment that we ran, we had people write content between 1,800 and 2,000 words.

Other than that we didn’t set any requirements. We just wanted there to be a minimum length as that way people naturally include keywords within their content. We did, however, include a maximum length as we didn’t want people to write 10,000-word blog posts as that would skew the data.

Websites had 2 weeks to publish their content. And after 30 days of it being live, we looked up the URLs within Ubersuggest to see how many keywords the article ranked for in the top 100, top 50 and top 10 spots.

Keep in mind that Ubersuggest has 1,459,103,429 keywords in its database from all around the world and in different languages. Most of the keywords have low search volume, such as 10 a month.

We then spent 3 months building links and then waited 2 months after the links were built to see what happened to the rankings.

The URLs were then entered back into the Ubersuggest database to see how many keywords they ranked for.

In addition to that, we performed this experiment in batches, we just didn’t have the manpower and time to do this for 200 sites all at once, hence it took roughly 10 months for this to complete.

We broke the sites down into 10 different groups. That’s 20 sites per group. Each group only leveraged 1 link tactic as we wanted to see how it impacted rankings.

Here’s each group:

- Control – with this group we did nothing but write content. We needed a baseline to compare everything to.

- Anchor text – the links built to the articles in this group contained rich anchor text but were from irrelevant pages. In other words, the link text contained a keyword, but the linking site wasn’t too relevant to the article. We built 3 anchor text links to each article.

- Sitewide links – they say search engines don’t care for sitewide links, especially ones in a footer… I wanted to test this out for myself. We built one sitewide link to each article.

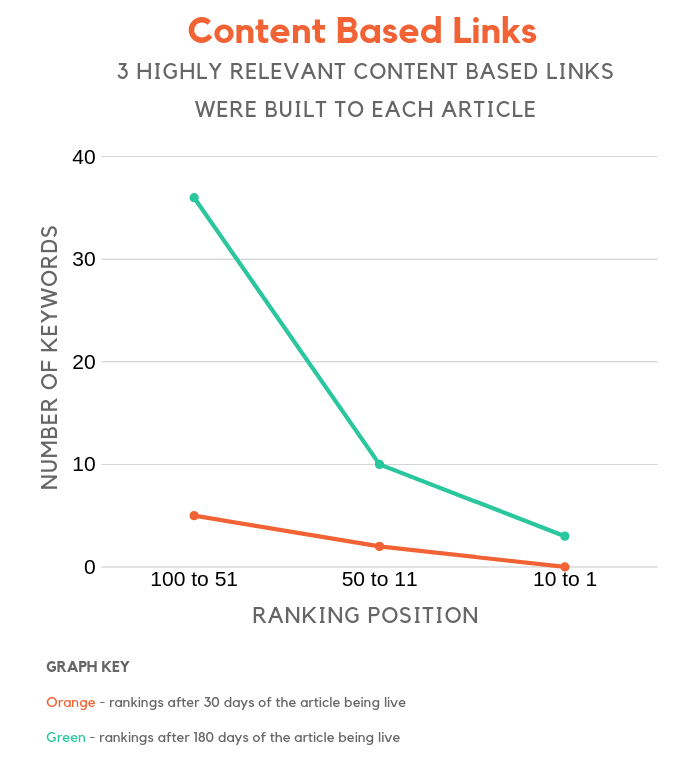

- Content-based links – most links tend to happen within the content and that’s what we built here. We built 3 content-based links to each article.

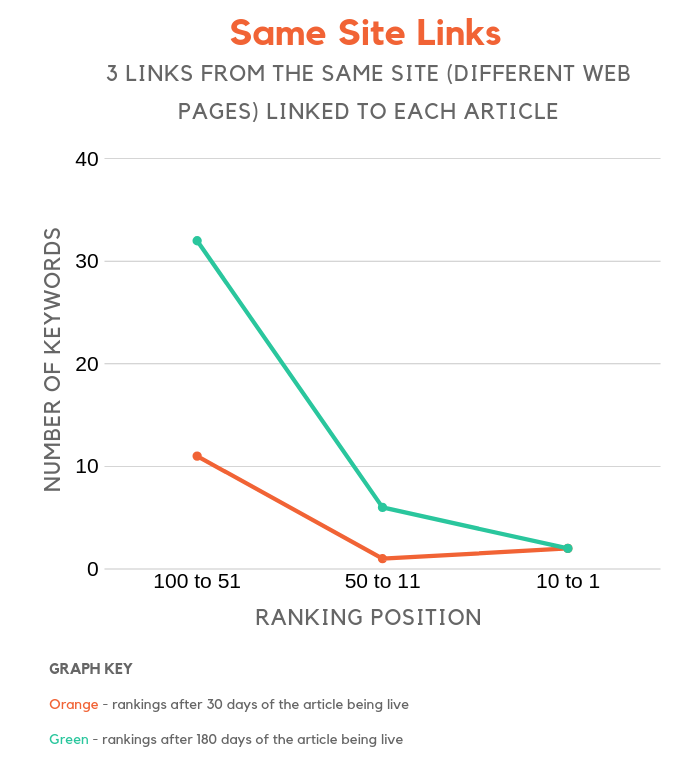

- Multiple links from the same site – these weren’t sitewide links but imagine one site linking to you multiple times within their content. Does it really help compared to having just 1 link from a site? We built 3 links from the same site to each article.

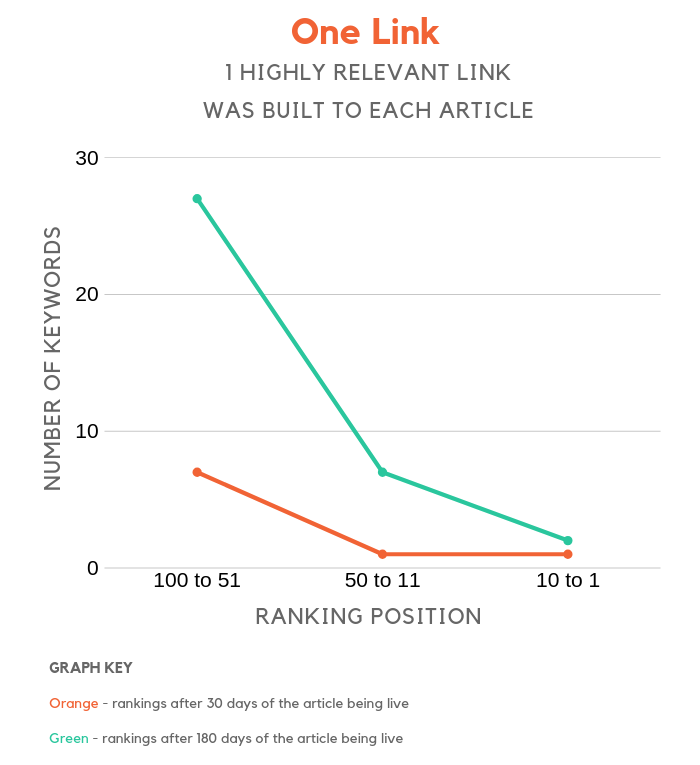

- One link – in this scenario we built one link from a relevant site.

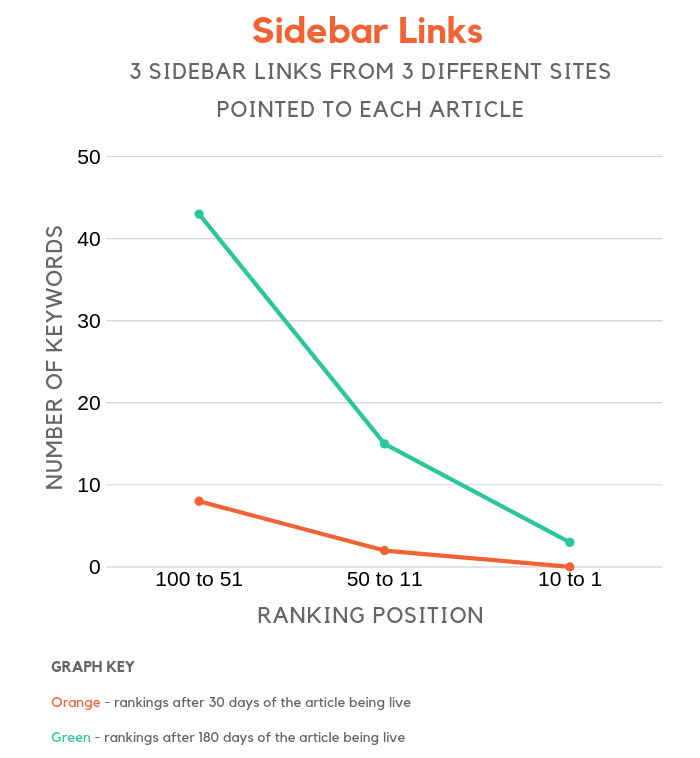

- Sidebar links – we built 3 links from the sidebar of 3 different sites.

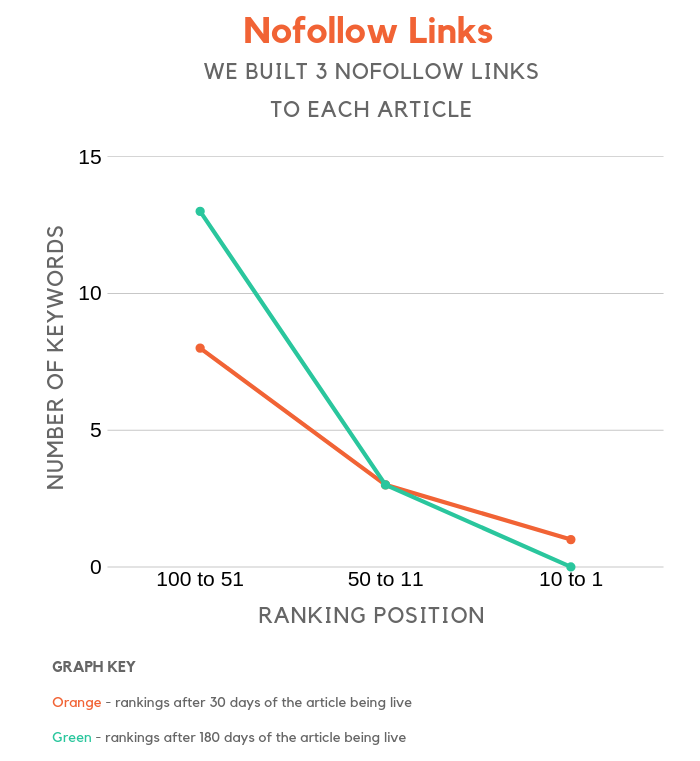

- Nofollow links – does Google really ignore nofollow links? You are about to find out because we built 3 nofollow links to each article.

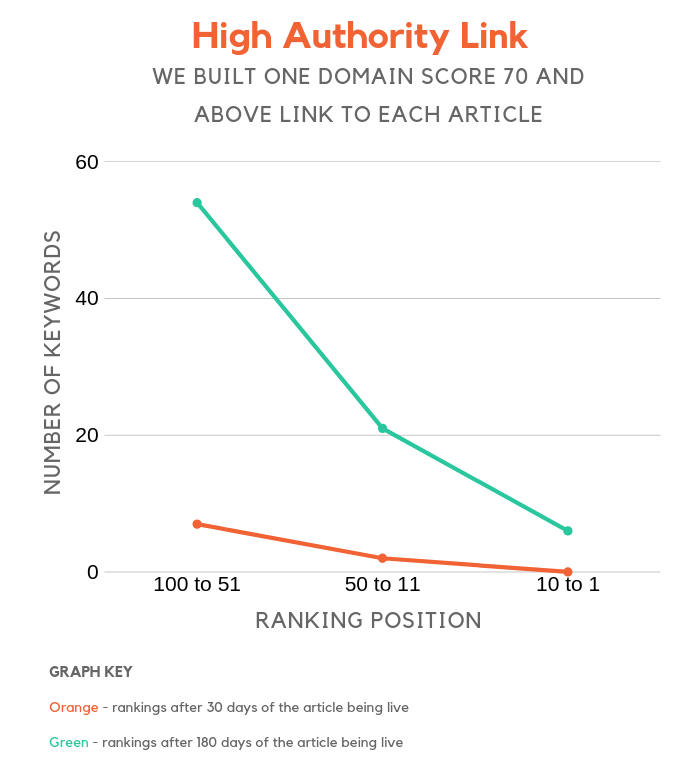

- High authority link – we built 1 link with a domain score of 70 or higher.

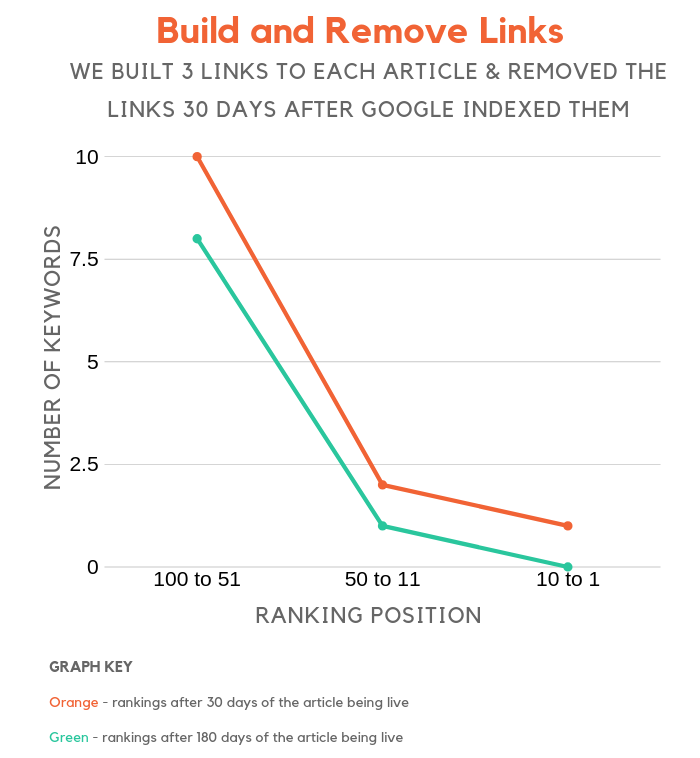

- Built and removed links – we built 3 links to articles in this group and then removed them 30 days after the links were picked up by Google.

Now before I share what we learned, keep in mind that we didn’t build the links to the domain’s homepage. We built the links to the article that was published. That way we could track to see if the links helped.

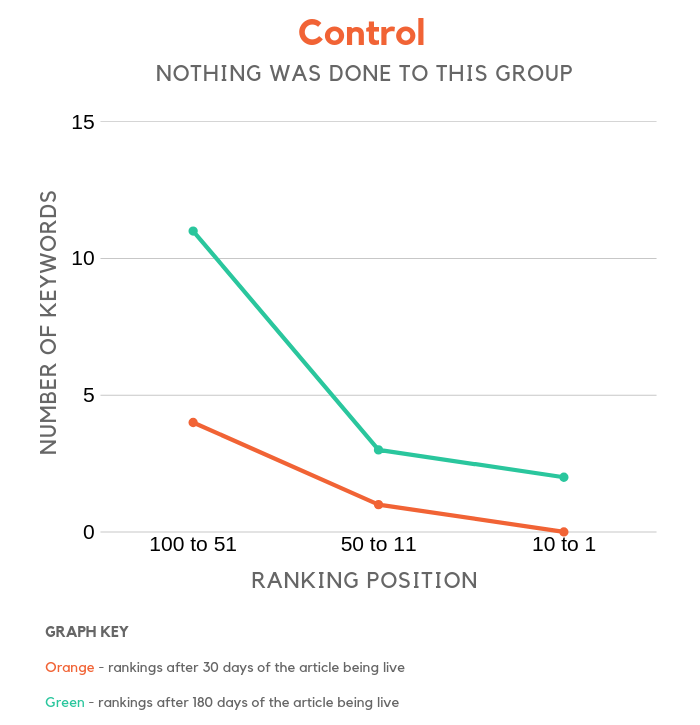

Control group

Do you really need links to rank your content? Especially if your site has a low domain score?

Based on the chart, the older your content gets, the higher you will rank. And based on the data even if you don’t do much, over a period of 6 months you can roughly rank for 5 times more keywords even without link building.

As they say, SEO is a long game and the data shows it… especially if you don’t build any links.

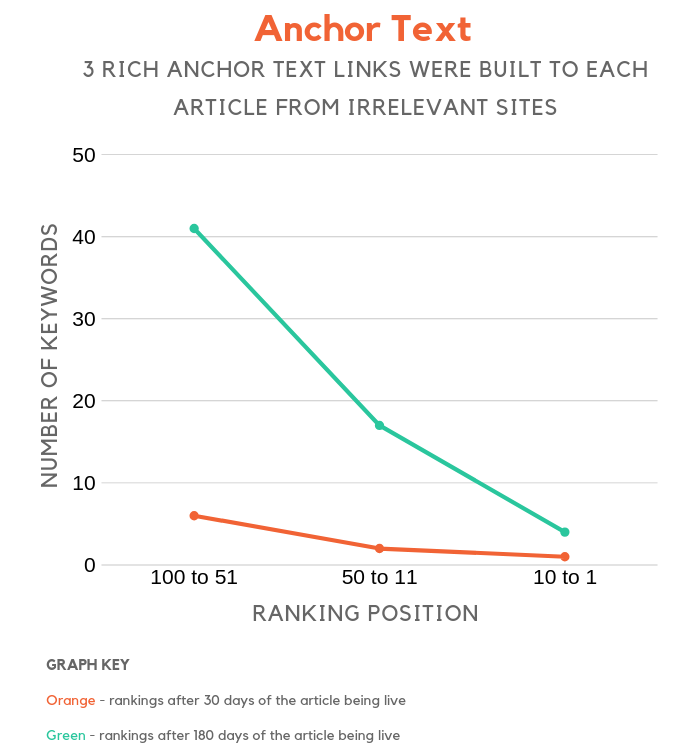

Anchor text

They say anchor text links really help boost rankings. That makes sense because the link text has a keyword.

But what if the anchor rich link comes from an irrelevant site. Does that help boost rankings?

It looks like anchor text plays a huge part in Google’s rankings, even if the linking site isn’t too relevant to your article.

Now, I am not saying you should build spammy links and shove keywords in the link text, more so it’s worth keeping in mind anchor text matters.

So if you already haven’t, go put in your domain here to see who links to you. And look for all of the non-rich anchor text links and email each of those site owners.

Ask them if they will adjust the link and switch it to something that contains a keyword.

This strategy is much more effective when you ask people to switch backlinks that contain your brand name as the anchor text to something that is more keyword rich.

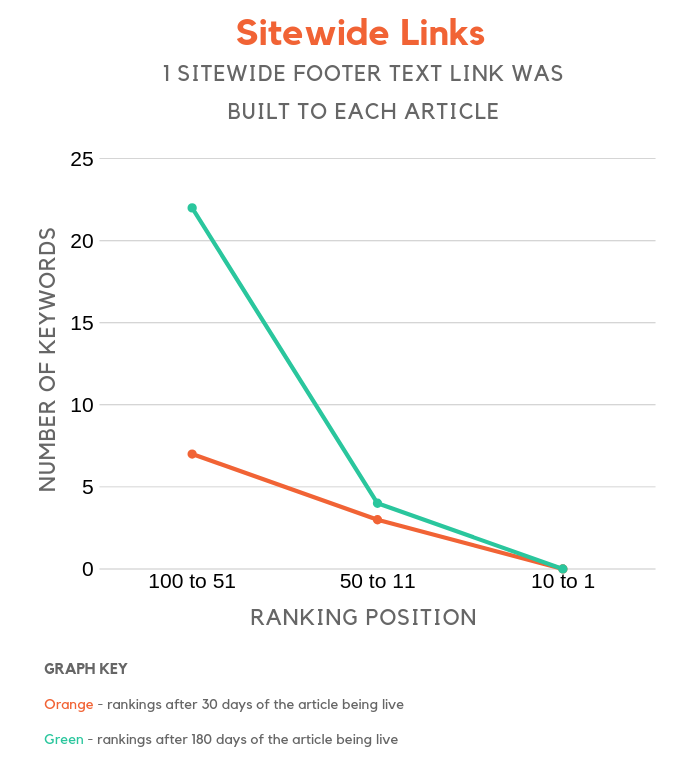

Sitewide Links

They say sitewide links are spammy… especially if they are shoved in the footer of a site.

We built one sitewide footer link to each article to test this out.

Although sites that leverage sitewide links showed more of an increase than the control group, the results weren’t amazing, especially for page 1 rankings.

Content-based links

Do relevance and the placement of the links impact rankings? We built 3 in-content links that were relevant to each article.

Now the links were not rich in anchor text.

Compared to the baseline, rankings moved up to a similar rate as the sites who built rich anchor text links from irrelevant sites.

Multiple site links

I always hear SEOs telling me that if you build multiple links from the same site, it doesn’t do anything. They say that Google only counts one link.

For that reason, I thought we would put this to the test.

We built 3 links to each article, but we did something a bit different compared to the other groups. Each link came from the same site, although we did leverage 3 different web pages.

For example, if 3 different editors from Forbes link to your article from different web pages on Forbes, in theory, you have picked up 3 links from the same site.

Even if the same site links to you multiple times, it can help boost your rankings.

One link

Is more really better? How does one relevant link compare to 3 irrelevant links?

It’s not as effective as building multiple links. Sure, it is better than building no links but the articles that built 3 relevant backlinks instead of 1 had roughly 75% more keyword placements in the top 100 positions of Google.

So if you have a choice when it comes to link building, more is better.

Sidebar links

Similar to how we tested footer links, I was curious to see how much placement of a link impacts rankings.

We looked at in-content links, footer links, and now sidebar links.

Shockingly, they have a significant impact in rankings. Now in order of effectiveness, in-content links help the most, then sidebar links, and then sitewide footer when it comes to placement.

I wish I tested creating 3 sitewide footer links to each article instead of 1 as that would have given me a more accurate conclusion for what placements Google prefers.

Maybe I will be able to run that next time. 🙁

Nofollow links

Do nofollow links help with rankings?

Is Google pulling our leg when they say they ignore them?

From what it looks like, they tend to not count nofollow links. Based on the chart above, you can see that rankings did improve over time, but so did almost every other chart, including the control group.

But here’s what’s funny: the control group had a bigger percentage gain in keyword rankings even though no links were built.

Now, I am not saying that nofollow links hurt your rankings, instead, I am saying they have no impact.

High authority link

Which one do you think is better:

Having one link from a high domain site (70 or higher)?

OR

Having 3 links from sites with an average or low domain score?

Even though the link from the authority site wasn’t rich in anchor text and we only built 1 per site in this group… it still had a bigger impact than the sites in the other group.

That means high authority links have more weight than irrelevant links that contain rich anchor text or even 3 links from sites with a low domain score.

If you are going to spend time link building, this is where your biggest ROI will be.

Build and removed links

This was the most interesting group, at least that is what the data showed.

I always felt that if you built links and got decent rankings you wouldn’t have to worry too much when you lost links.

After all, Google looks at user signals, right?

This one was shocking. At least for sites that have a low domain score, if you gain a few links and then lose them fairly quickly, your rankings can tank to lower than what they originally were.

I didn’t expect this one and if I had to guess, maybe Google has something programmed in their algorithm that if a site loses a large portion of their links fast that people don’t find value in the site and that it shouldn’t rank.

Or that the site purchased links and then stopped purchasing the links…

Whatever it may be, you should consider tracking how many links you lose on a regular basis and focus on making sure the net number is increasing each month.

Conclusion

I wish I had put more people behind this experiment as that would have enabled me to increase the number of sites that I included in this experiment.

My overall sample size for each group is a bit too small, which could skew the data. But I do believe it is directionally accurate, in which building links from high domain score sites have the biggest impact.

Then shoot for rich anchor text links that are from relevant sites and are placed within the content.

I wouldn’t have all of your link text rich in anchor text and if you are using white hat link building practices it naturally won’t be and you won’t have to worry much about this.

But if you combine all of that together you should see a bigger impact in your rankings, especially if you are a new site.

So, what do you think about the data? Has it helped you figure out what types of links Google prefers?

The post What Type of Links Does Google Really Prefer? appeared first on Neil Patel.