Utah police officer, suspect both wounded in shootout: reports

A Utah police officer and a suspect both suffered gunshot wounds Friday night, according to reports.

A Utah police officer and a suspect both suffered gunshot wounds Friday night, according to reports.

Article URL: https://chumsco.notion.site/chumsco/Come-Work-Chums-d4788a53d8ee4820891e2ae7fa156120

Comments URL: https://news.ycombinator.com/item?id=28895833

Points: 1

# Comments: 0

Amy Schumer revealed she had her uterus and appendix removed because of the toll endometriosis has taken on her body.

SEEKING WORK Location: PK Remote: Yes Willing to Relocate: No Technologies: Python(Scraping,Automation, ETL, Blockchain Integration), PHP Laravel, Code/Db Optimization, Go and Solidity Smart Contracts. Blog:- http://blog.adnansiddiqi.me/ Resume: http://adnansiddiqi.me/Resume2020.pdf I have interest in working domains like Finance, Healthcare and Bioinformatics. I wrote a bit about each in my blog as well. Or just anything which is … Continue reading New comment by pknerd in "Ask HN: Freelancer? Seeking freelancer? (June 2021)"

Suddenly you notice that none of your social media activity seems to be showing up at all. It’s like you don’t even exist on the site… Weird!

Is it a bug? Every website suffers from them sometimes, and the interactive features can often be the first to go haywire. Server maintenance could also be the culprit.

But another possibility is that you might have been “shadowbanned” (previously called ghostbanned).

Accounts that are shadowbanned are put into a kind of invisible mode. In other words, they become a “shadow” that no one can see.

In this post, we’ll talk more about what exactly shadowbanning is, and how you can tell if it happened to you.

Shadowbanning is when your posts or activity don’t show up on a site, but you haven’t received an official ban or notification.

It’s a way to let spammers continue to spam without anyone else in the community (or outside of it) seeing what they do.

That way, other social media users don’t suffer from spam because they can’t see it. The spammer won’t immediately start to look for ways to get around the ban, because they don’t even realize they’ve been banned.

Now, all of this might sound a little odd or shady. Since many websites and apps deny that they shadowban, there’s no way to know for sure that it’s happened.

If you suspect a shadowban, a change in the website’s search or newsfeed algorithm might actually be to blame. And since the algorithms are the property of social media companies, it’s not in their best interest to reveal everything about them publicly.

Regardless of whether you’ve been penalized deliberately or accidentally, the effect is still the same… no one can see your posts.

There’s no way of getting a full list of sites that shadowban people, since the practice isn’t entirely out in the open.

However, shadowbanning has been reported before under certain circumstances, on sites and apps like Facebook, Instagram, and TikTok, among others.

Respondents to a survey called Posting Into the Void reported four general types of shadowbans:

Here’s how to tell if you’ve been shadowbanned on some popular social media sites:

Does Twitter actually shadowban people? Well, yes and no.

In a blog post, Twitter claimed that they don’t “deliberately make people’s content undiscoverable to everyone except the person who posted it”, and they “certainly don’t shadowban based on political viewpoints or ideology.”

However, they did say they “rank tweets and search results” to “address bad-faith actors”. Basically, if Twitter thinks you’re a spammer or a troll, its algorithm will penalize your content.

Twitter lists these as some of the factors they use to tell if you’re a “bad-faith actor” or not:

To avoid getting shadowbanned on Twitter, you should confirm your email address and upload a profile picture.

Don’t spam people and don’t be overly promotional. If you’re trying to sell a product or service and are posting too much, other users might block your content, causing a shadowban on your account.

You should also try to avoid trolling, getting into online arguments, or being too confrontational in your posts and comments. This can lead people to mute or block you.

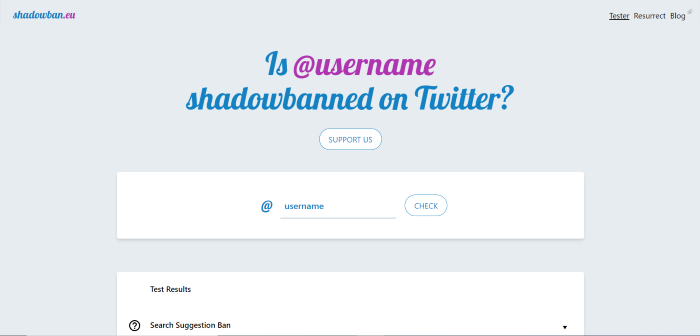

There’s no way to tell for sure if you’ve been shadowbanned on Twitter. However, you could try using the site Shadowban.eu, which claims to be able to detect a shadowban.

How frustrating is it to work hard at building up an Instagram following, only to see that your posts suddenly aren’t showing up?

Like with Twitter, Instagram’s CEO has publicly claimed that “shadowbanning is not a thing”, but as with Twitter, that’s not entirely true.

While you personally might not be being shadowbanned, the algorithm could still be hiding your posts.

Instagram’s algorithm is designed to remove certain content. Namely, the algorithm penalizes content that Instagram considers “inappropriate”, even if the content doesn’t go against the app’s Community Guidelines.

Specifically, they mention sexually-suggestive content. According to their Community Guidelines, spammy content and content associated with illegal activity or violence is also a no-go.

Instagram prefers “photos or videos that are appropriate for a diverse audience”… so less family-friendly content may be at risk of a shadowban.

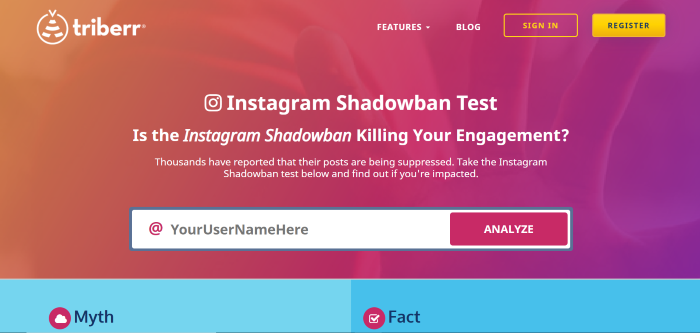

There’s no surefire way to tell if you’ve been shadowbanned on Instagram, but there are sites that say they can test it. Triberr is one option.

Shadowbanning on Reddit is a bit different from shadowbanning on other social media sites. Up until 2015, Reddit openly shadowbanned users who broke the site’s rules by hiding their posts.

Reddit then announced that the shadowbanning system had been replaced with an account suspension system. Basically, some Reddit staff thought that the shadowban tool had been useful for dealing with bots, but that banning real human users without telling them what they did wrong was unfair.

However, the site appears to still occasionally be using shadowbans, with the r/ShadowBan subreddit still active.

According to their official content policy, Reddit may enforce their rules by “removal of privileges from, or adding restrictions to, accounts”, and also by “removal of content”, among other methods.

Of course, to avoid getting shadowbanned on Reddit, you’ll need to follow their rules. But one tricky thing about that is that the rules on Reddit actually depend on the subreddit you are submitting to.

You’ll want to read and comment a lot first before submitting your own links. Watch how people react to various types of submissions within a specific subreddit, and then act accordingly.

You can also check out this unofficial guide on how to avoid being shadowbanned. Some key points:

To find out if you’re shadowbanned on Reddit, make a post in the r/ShadowBan subreddit. A bot will respond to you, letting you know if you’re shadowbanned.

Even if you’re not, the bot will tell you which posts of yours have been removed recently (if any).

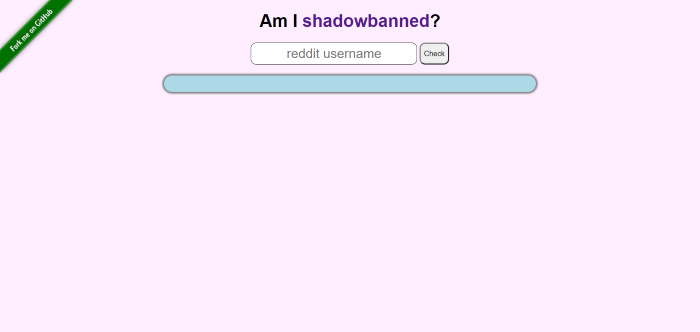

You could also use a third-party tool, like Am I Shadowbanned?

TikTok is a popular social network for sharing short videos. Unfortunately, you can get shadowbanned there too (kind of).

While there’s no official mention of the term “shadowban” in TikTok’s Community Guidelines, like other social media networks, TikTok uses algorithms to privilege certain content. If you get on the wrong side of the algorithm, fewer people might see the content you post.

To have more people see your content and avoid penalties, try to follow best practices for TikTok’s recommendation algorithm, and always follow the Community Guidelines.

Stay away from illegal material, violence, hate speech, spam, and other similar topics.

To check if you’ve been shadowbanned on TikTok, look at your pageviews and “For You” page statistics. You can also use a hashtag and see if your post shows up under that hashtag.

Facebook calls its content moderation policy “remove, reduce, and inform.”

Basically, content that violates Facebook’s Community Standards will be removed from the site, while other undesirable content (like misleading information) may be less visible on Facebook or have a warning label placed on it.

If Facebook is consistently “reducing” your content, that could be considered a type of shadowban.

The main thing you can do to trigger a shadowban on Facebook is to share links to fake or misleading information. Content on the site is checked by independent fact-checking organizations.

Facebook also penalizes links from websites that its algorithm considers clickbait. Low-authority websites without a lot of inbound and outbound links that generate a lot of clicks on Facebook may be considered clickbait.

Facebook groups where a lot of misleading links and clickbait are frequently shared may be shadowbanned.

If you’re worried your personal page, business page, or group might have been shadowbanned on Facebook, check for a change in engagement levels on your recent posts.

While people don’t often think about getting shadowbanned on LinkedIn, it’s possible for your content’s reach to be throttled there.

Like other social media sites, LinkedIn has Community Policies that all members need to follow to avoid problems.

Since LinkedIn is a professional site, its content policies are even stricter than other platforms. Not only should your content be safe, legal, and appropriate, it has to be professional as well.

Although LinkedIn is obviously a place for career growth and self-promotion, spamming people is still a no-go.

You’ll need to respect others’ privacy and intellectual property. You should also avoid harassment or unwanted romantic advances towards other members.

If you violate LinkedIn’s policies, they may “limit the visibility of certain content, or remove it entirely.”

That said, the LinkedIn algorithm is pretty complicated. Even if your content is perfectly professional and high-quality, it might still not be getting the reach you want.

Engagement and relevance are the top two factors to keep in mind when creating content for LinkedIn.

While it’s not exactly a social network, it’s definitely still a site where people go to learn and share content. Can you be shadowbanned from YouTube?

Well, YouTube shadowbanning has been in the news because of popular creator PewDiePie. According to his fans, the Swedish videogame YouTuber’s channel was penalized in YouTube search.

YouTube’s official response was that it doesn’t shadowban channels, but that some videos might be flagged and need to be reviewed before they show up in search.

In an interview with Polygon, they said they were “currently working on fixing the issue.”

Different social networks have their own opinions on what type of violations merit a shadowban. However, we can definitely see some general trends that are worth noting.

Adhere to these guidelines if you want to be safe from a shadowban:

You may not have any idea you are being shadowbanned. At least not at first… though over time, you may begin to suspect it.

What you should do to protect yourself is to be careful that what you post isn’t against the terms and conditions of the site or app. Also, try to avoid spamming content, starting fights with and trolling other users, or posting things that might be considered inappropriate.

A shadowban can be frustrating, especially if you don’t feel like you deserve one. Maybe you don’t agree with the social media algorithm about what is or isn’t inappropriate, or maybe you think you were having a constructive debate while the algorithm thinks you were being a troll.

However, hopefully the tips in this guide can help you avoid being shadowbanned in the future, so your content can get better engagement.

What other ways can help people know if they’ve been shadowbanned? Let us know in the comments.

The post How to Tell if You’re Shadowbanned on Social Media appeared first on Neil Patel.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission. Without customers, your business wouldn’t exist. I guess it could… but you wouldn’t last long without a stream of revenue helping you keep the lights on. Because of that, it’s critical to understand how …

The post The Best CRM Software (In-Depth Review) first appeared on Online Web Store Site.

The post The Best CRM Software (In-Depth Review) appeared first on ROI Credit Builders.

If you are reading this, I suspect you are a minority looking to start a business. You either need to know where to start when it comes to finding a business loan, or you have already tried and are having trouble. Maybe you are wondering to yourself “Are there minority loans to start a business?” This is a logical thought, because it would seem it would be easier for minorities to get loans geared specifically toward them.

The truth is, there are some types of loans that are easier than others for minorities to get, but they may not be what you expect. In contrast, some of them probably look exactly like you think they will. Here’s how to find the best minority loans to start a business.

In this MBDA study that was recently reprinted, “Disparities in Capital Access between Minority and Non-Minority-Owned Businesses: The Troubling Reality of Capital Limitations Faced by MBEs,” Robert Fairlie, Ph.D. and Alicia Robb, Ph.D. looked at both national and regional studies over several decades. They found that limited financial, human, and social capital, as well as racial discrimination, were the major reasons for the disparities between non-minority and minority businesses. The study is 10 years old, but many of the realities remain the same.

Find out why so many companies use our proven methods to get business loans.

There are minority specific loan programs out there. Most of them, however, work better for existing businesses rather than for starting a business. Your better option is to simply find loans that, minority specific or not, will work despite the challenges that are unique to minorities when it comes to starting a business.

Also, work to build your business in a way that will make it appear fundable to lenders, regardless of who the owner is.

According to Forbes, these are major challenges faced by minority business owners in getting business funding.

Lower Net Worth

In general, the level of wealth for Latino and African Americans is 11-16 times less than for Caucasians. White business owners typically have more working capital when they start their business.

Lack of Collateral

For the most part, banks are not as likely to approve loans to applicants with less collateral to use against a loan. Lower net worth means less home ownership and fewer high-value assets to sell if a loan defaults. This combination of less security and net worth means banks will likely issue smaller loans that need to be paid back quickly, slowing long term growth.

Poor Location

Businesses owned by minorities in locations that have not traditionally supported new business are not as likely to get funding.

Little to No Credit History

Credit is a huge factor for banks when considering loan applications. Since minority business owners tend to have lower credit scores, for all the reasons already listed, it is harder to get the best rates and terms.

Absolutely. You just have to know where to look. The first stop is the Small Business Administration. As a general rule, they do not lend money themselves. However, they do offer a federal guarantee on loans made by traditional lenders. This makes it easier for borrowers that may not otherwise qualify to get a loan.

In addition, the SBA offers valuable resources that can help business owners and entrepreneurs prepare for the loan application process as well as running a business.

When it comes to minority loans to start a business, one of the best SBA options is the SBA Community Advantage Loan program.

These are designed to meet the needs of small businesses in neglected markets. Of course, that includes minorities. The goal is to get local lenders to increase loans up to $250,000. It does this by backing up to 85% of the loan amount. It helps small business owners who might not be able to get traditional financing.

Consequently, credit decision makers overlook factors such as poor credit or low revenue if the business has the potential to stimulate the economy or create jobs in underserved areas.

Loan amounts range from $50,000 to $250,000 with a maximum interest rate of 11%. Terms range up to 25 years.

Find out why so many companies use our proven methods to get business loans.

Accion is a non-profit that offers loans in all states. Funds are available to the following:

Loan amounts start from $300 and go up to $250,000. Business owners can use them to help build businesses from the beginning. In addition, Accion will provide you with ways to strengthen your chances of approval should you not qualify.

The qualifications for Accion loans vary by location. You can enter your zip code to see the eligibility requirements for where you live. I entered several different zip codes to get a feel for what I was looking at. Sometimes the minimum credit score was 575. Other times there was no minimum credit score requirement. In addition, there were other requirements that varied by location including not being 30 days late on credit cards, loan payments, or bills. Not being late on rent or mortgage payments over the past year also popped up as a qualifier in some locations.

Kiva is a good place to start to find business startup loans. There is no credit check. It is absolutely free. You have to repay the money, but the interest rate is 0%. The only thing required from you is a thorough business credit profile. Also, you must loan $25 to another business on the site. Last is the requirement that you raise funds from a certain number of friends and family. Usually, it is at least five people from your own network that need to be willing to pitch in.

Since you are reading about minority loans to start a business, it’s likely your business is in the very early or planning stage. This is the perfect time to set your business up to be fundable, build business credit, and increase your chances for funding approval from all financing sources.

Fundability is the ability of your business to get funding. The first step in building fundability and business credit is to have a fundable foundation. These are the building blocks you need.

The first step in setting up a foundation of fundability is to ensure your business has its own phone number, fax number, and address. That’s not to say you have to get a separate phone line, or even a separate location. You can still run your business from your home or on your computer. You do not even have to have a fax machine.

Actually, you can get a business phone number and fax number pretty easily that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This part may seem outdated, but it does help your business appear legitimate to lenders.

You can use a virtual office for a business address. How do you get a virtual office? What is that? It’s not what you may think. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally. Some business owners used their SSN for their business. This is what a lot of sole proprietorships and partnerships do. However, it really doesn’t look professional to lenders, and it can cause your personal and business

credit to get all mixed up. When you are looking to increase fundability, you need to apply for and use an EIN. You can get one for free from the IRS.

Find out why so many companies use our proven methods to get business loans.

Incorporating your business as an LLC, S-corp, or corporation is necessary to fundability. It shows your business is legitimate. It also offers some protection from liability.

Which option you choose does not matter as much for fundability as it does for your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional. What is going to happen is that you are going to lose the time in business that you have. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated as well.

This is why you have to incorporate as soon as possible. Not only is it necessary for fundability and for building business credit, but so is time in business. The longer you have been in business the more fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

For a business to be fundable it has to have all of the necessary licenses it needs to run. If it doesn’t, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

I am sure you are wondering how a business website can affect your ability to get funding. Here’s the thing. These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

Having these things helps establish your business as a separate entity from yourself as the owner. This is not only important for fundability, but also in building business credit, which is essential to fundability also.

You may need to use one of the minority loans to start a business listed above to get your feet off the ground. Don’t stop there though. You have to work on building a fundable foundation and building business credit at the same time. This is essential to opening doors to more and better financing opportunities as your business grows.

The post How to Get Minority Loans to Start a Business appeared first on Credit Suite.

Frontend engineer and web consultant with 8 years of experience in highly successful and fast-growing startups across San Francisco and Berlin (https://smikulic.com/#work).

My strengths are in UI/UX product development and frontend infrastructure. Looking for part-time engagement to help build your product.

—

Location: Croatia, Europe

Remote: Yes

Willing to relocate: No

Technologies: JavaScript (React, Redux, TypeScript, Node.js, Webpack), GraphQL, Ruby/Rails

Website: https://smikulic.com

LinkedIn: https://www.linkedin.com/in/sinisamikulic

Email: sinisa@codewell.studio

—

Sample project I co-founded — https://movieo.me/

Can You Invest With Just $100?

Several personal capitalists do not have a huge quantity of resources at their disposal to purchase supplies. Some take the path of Penny Stocks to create high returns yet some individuals locate these as well high-risk. Dime Stocks ARE dangerous– if you do not recognize exactly how to bring out research study.

There are several various other means to spend. I am chatting concerning Offshore Investments, likewise understood as High Yield Investment Programs (HYIP).

These are “Autosurfs” as well as Private HYIPs. Both are easily accessible to the basic public and also offer high returns– generally with a minimal down payment as reduced as $5.

The return you will certainly get depends on the quantity you spend. Typically, Autosurfs are concerned as a greater danger than HYIPs.

Personal HYIPs are a much safer alternative for little financiers. Numerous of them have actually surpassed 3 years, therefore offering you even more than 10 times your intial financial investment.

Locating personal HYIPs is not as difficult as it utilized to be. Reviewing individuals’s remarks as well as viewpoints on them will certainly aid you create your very own viewpoint as well as inform you if you need to spend or not.

For tiny capitalists, exclusive HYIPs resemble a desire become a reality. We can currently develop easy revenue with just $100.

Numerous personal financiers do not have a big quantity of resources at their disposal to spend in supplies. There are lots of various other means to spend. I am chatting concerning Offshore Investments, likewise recognized as High Yield Investment Programs (HYIP).

The return you will certainly get depends on the quantity you spend. Checking out individuals’s remarks as well as viewpoints on them will certainly aid you create your very own point of view as well as inform you if you must spend or not.

The post Can You Invest With Just $100? appeared first on ROI Credit Builders.