How to Run a Content Audit (2022 Update)

Have you lost track of all the content you’ve created? It’s easy to do.

If you’re anything like me, you’re so focused on coming up with ideas and creating new articles that you might lose track of what you’ve already created.

But the truth is the content you’ve already created is just as valuable as anything you’re yet to create, possibly more so. Optimizing it just a little bit could result in thousands of dollars more in revenue.

That’s why you need a content audit of existing pages. In this article, I’ll cover:

- What a content audit is

- Why you need an audit

- Content audit tools at your disposal

- How to run a content audit step by step

Ready to create an inventory of your assets? Then let’s begin.

What is a Content Audit?

A content audit is the process of creating an inventory of your website’s content assets and analyzing them against a set of criteria.

It’s a way of keeping track of the content you have created, seeing which assets need improving, and identifying which topics to tackle next.

A content audit can be as brief or as detailed as you want. You can audit your entire site, just your blog, or even just a category of your blog. They can all offer value and insight. I recommend doing a comprehensive audit, though. The time you spend on your audit now will pay off later.

Why Does My Website Need a Content Audit?

You should carve out the time to do a content audit to see where the gaps are and to start creating better content.

Why should you do a content audit? There are a number of reasons a content audit can help your website perform better.

A content audit offers a heap of benefits. These include:

- Analyzing the performance of your content to help you make data-backed decisions about which pages to improve.

- Highlighting pages on your site that aren’t optimized for SEO. Some pages may be missing metadata or have a poor heading structure, for instance.

- Identifying SEO opportunities and content gaps that you can fill with new content.

- Improving the quality of content on your site to upgrade the reader experience.

- Identifying content you can repurpose.

- Creating a complete inventory of content that makes managing your content strategy easier in the future.

- Improving your content’s accessibility and inclusivity.

Whether or not you see value in running a content audit, there are certain points in the life of your website when running a content audit becomes essential. Consider running a content audit if:

- Your website is a few years old and you’ve never run an audit.

- There’s no clear strategy or you’ve inherited a content marketing strategy from another team.

- You’re redesigning your website.

- You think you’ve created content on every possible topic in your niche.

Determine Your Content Audit’s Purpose

How you approach a content audit will depend on your goals. While you can create a content audit that achieves all of the benefits I listed above, it will be much more effective if you pick one or two goals to focus on.

For instance, if you want to use a content audit to improve your SEO, then you’ll want to focus on identifying content gaps and pages with missing metadata. That means paying particular attention to the technical SEO of each page.

Given you are reading a digital marketing blog, I’m going to write the rest of this guide as if you were running an SEO-driven content audit. You can still use this guide if you’re looking to improve your reader’s experience or make your content more inclusive and accessible, but just know some of the more technical aspects may not be relevant.

Content Audit Tools

Software tools are an essential part of the content audit process. Rather than go through your website manually, noting each issue in turn, you can use the following tools to automate much of the process.

Ubersuggest

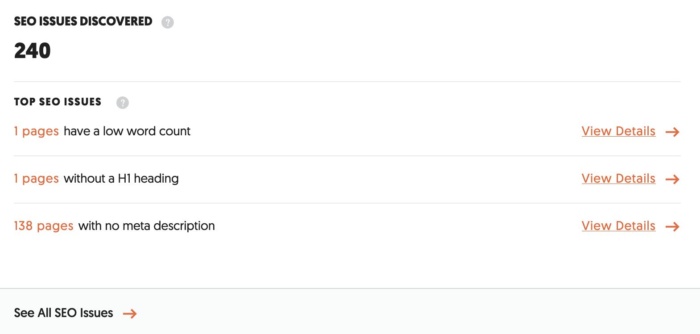

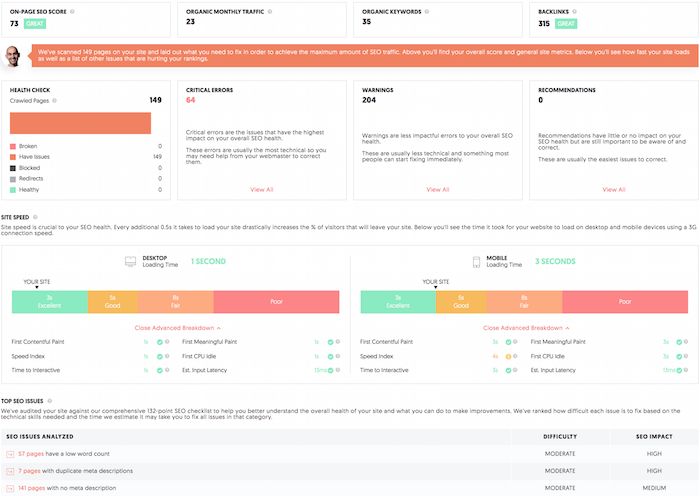

If you’re running a content audit to improve your SEO, Ubersuggest is essential. Running a site audit is easy. Just enter your URL, click “Search,” and click “Site Audit” on the left. Think of this as a quick, free overall look at how your website is doing.

You’ll also get a snapshot of which SEO issues are most prevalent on your site and how critical they are.

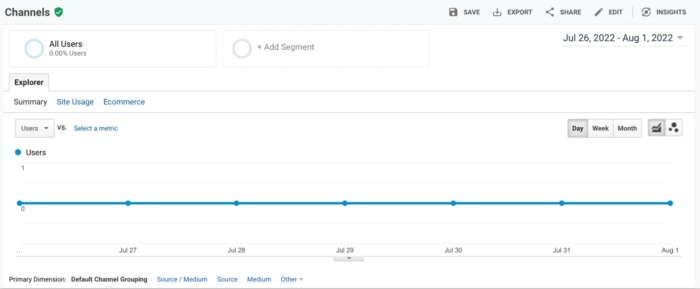

Google Analytics

Do you want to compare the performance of your pages? Then use Google Analytics to find traffic data for each page.

Note: Be aware that Google is sunsetting Universal Analytics on July 1, 2023, in favor of Google Analytics 4. If you haven’t already, you should make the switch to GA4 before completing your content audit. The faster you switch, the more historical data you’ll have and the easier it will be to reuse your content audit in the future.

Broken Link Checkers

As you analyze your content, you’ll want to find and fix broken links. Integrity, Ahrefs, and Dead Link Checker can help you there.

Content Inventory

You could manually pull each content link associated with your website, but that could take far too long and you could risk overlooking some things. Instead, you may want to try a content inventory tool like Screaming Frog or DynoMapper.

Website Content Audit Steps

It may seem like there’s a lot of work involved with creating a content audit. But it’s easy when you break it down into manageable steps.

#1: Create a List of Your Content Assets

The first step of a website content audit is to make an inventory of your assets. Seeing all of them in one location makes it much easier to analyze content performance, highlight areas to improve, and update each asset methodically.

Screaming Frog’s SEO Spider Tool is the best way to extract content assets from your site. It’s free to use if your site has less than 500 pages. But you can also use any of the other content extractors I mentioned above.

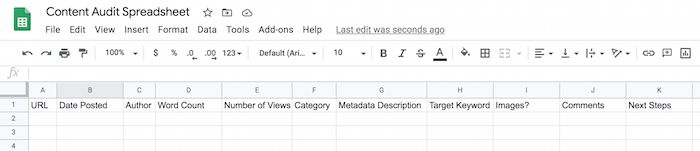

Whichever tool you use, export your data into a spreadsheet, making sure relevant data points (word count, meta description, target keyword, no. of images, etc.) are included. You may also want to add traffic data from Google Analytics to each page so you can analyze content performance alongside technical SEO metrics.

Content Audit Templates

As I explained above, you will want to build a content audit spreadsheet so you can keep all the data in one place. You can build one from scratch, download one of the following templates, or use these as a launching point and customize your spreadsheet.

Keep in mind the goals we discussed earlier. There are lots of stats or data points you could pull alongside each content. However, some data is going to be more relevant to you than others.

If you are using this audit to improve your content marketing engagement, you will want to check information about clickthroughs, social media engagement, comments, and so on.

If your goal is associated with SEO, you may want to include warnings and recommendations you gather from Ubersuggest.

#2: Create a List of Content Issues to Identify

Now you have all your content assets in one place; it’s time to analyze them. Go through each piece of content one at a time to see how it’s performing, whether it’s missing metadata or there are any obvious ways it can be improved.

Here are a few things to look for, in particular:

- Duplicate Content: Search engines prioritize fresh content. If you have a lot of duplicate content living on different pages or posts, you’ll want to remove or rewrite those pages.

- Outdated Content: People don’t want to read outdated content, and search engines overlook it too. Update it wherever possible.

- Content Gaps: What’s missing in your content? Are there topics you haven’t addressed yet? Target markets you haven’t spoken to? Being able to look at everything at once can help you find the gaps and fill them in.

- Target Keyword: Does the content asset target a particular keyword and include it in the copy?

- Metadata: Have you written metadata descriptions for all pages? This spreadsheet is going to help you see which ones need to be written and which ones are repetitive and should be updated.

- Image Data: Does every image have a descriptive title and alt tag? This will ensure your images are SEO-optimized and accessibility-friendly.

- Word Count: Do your pages and posts have enough words to optimize for SEO? Or are they too short? Check that word count to see if pages need to be updated or edited down.

Keep track of everything by creating a note next to each asset about why it needs improving. You can also color-code your spreadsheet based on the type of optimization required, but this can quickly become complicated if a single asset has multiple issues.

#3: Address Content Issues

You can’t do everything at once, so now it’s time to prioritize your content issues. One strategy is to work through each asset numerically, starting with those at the top of the spreadsheet. Another is to group each optimization issue together and tackle them in bulk. For instance, you could update the meta data on every page, then move on to fixing image issues and so on.

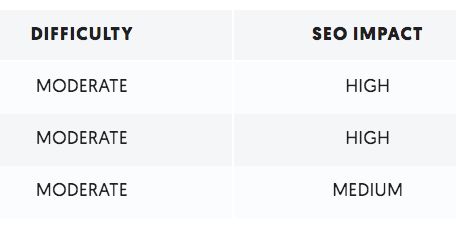

Alternatively, use Ubersuggest to prioritize content issues for you. When you run an SEO audit on Ubersuggest, you’ll receive recommendations based on an issue’s difficulty and SEO impact.

Focusing on tasks with a high SEO impact and low difficulty will give you a series of quick wins. But you could also prioritize all of the easy tasks to get the ball rolling if you’re not that confident.

Content audits work best when they are tackled by several people, so don’t be afraid to ask for help and split up the work. Maybe you can take care of on-page issues while a colleague addresses the content gaps your audit has highlighted.

FAQs

A content audit is the process of creating an inventory of your website’s pages and analyzing their performance.

Content audits help you identify topic gaps, problems, and areas for improvement on your website. Good content helps you rank better in Google and can earn you more traffic, conversions, and revenue.

You can use tools like Ubersuggest, SEMrush, and Ahrefs to run a content audit.

You should start your content by compiling a list of all of your content assets. You can do this by pulling a report through tools like Screaming Frog and then analyzing the results in a spreadsheet.

Conclusion

A content audit may feel overwhelming at first glance. But don’t let that stop you.

Starting a website content audit is one of the best steps you can take to improve your content marketing strategy. Compiling all of your assets in one place makes it much easier to see what needs improving and which assets are missing. It also makes it easier to prioritize and fix issues.

Once you’ve run a content audit once, managing your assets in the future becomes a breeze. You’ll have no problem taking your content marketing efforts to the next level.

What issues has your content audit identified?