Make the Benefits of Working From Home Outweigh the Disadvantages

There are some obvious benefits of working from home. There are also some not so obvious disadvantages. The key is make the most of the benefits of working from home and figure out how to work around the disadvantages.

How to Ensure the Benefits of Working from Home Outweigh the Disadvantages

Many do not realize there are ways to fund your work at home business without using your personal credit. In fact, many would consider difficulty finding funding a formidable disadvantage of working from home running a business.

The truth is, you most definitely can enjoy the benefits of working from home and not have to fund the whole endeavor using your personal credit. You can build business credit even while running a home-based business.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Advantages of Working from Home

What are the advantages of running your business out of your home? It’s a hard question to answer. The problem is, what is a benefit to some is a disadvantage for others. Some love the isolation, others miss working with people. Production increases for some people for various reasons. Others struggle to stay focused when working from home.

The close proximity of food is fabulous for some. You can save money and time by simply eating what is in your fridge. Others find it hard to stop eating when working from home. This makes it hard to maintain a healthy weight. Along the same lines, some find it easier to exercise working from home, while others need the commute to or from the office to encourage them to stop by the gym.

That said, one clear advantage of running your business from your house is that you save money. Overhead costs are much lower. You save on building costs. Time and money spent commuting is almost nonexistent. Clothing costs are significantly less as well. Even so, business funding is always a necessity.

Disadvantages of Working from Home

Aside from those already mentioned above that are actually an advantage for some, there are some other clear disadvantages of working from home. First and foremost, it can be difficult to get home based business loans, or even home based business grants. That doesn’t mean funding a home-based business is impossible. You just have to know what to do to make even a home based business more fundable.

How to Increase the Fundability of a Home-Based Business

The number one best way to increase the fundability of your home-based business is to talk to a business credit expert. A consultation like this can be priceless. It’s true, you can take the work from home tips about funding that we are about to offer and execute many of them yourself. However, it will take you twice as long. Furthermore, you may very well miss something.

A business credit expert can help you assess the current fundability of your business. Then, they can walk you through the steps to help you fill in any fundability gaps. Finally, they have relationships with lenders to help ensure you get the best funding possible for your business now.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

They not only help you start the processes necessary to ensure you are eligible for funding in the future, but also help you find the best funding for your home based business right now.

Is Your Home Based Business Set Up to Be Fundable?

This is likely the number one issue with the fundability of a business run out of your home. Most home business owners set their business up as a sole proprietorship. They use their personal contact information. Typically they do not incorporate, and some do not even open a business bank account.

This seems like the easiest, fastest way to do things. It’s no wonder it is the standard. Still, it is probably the number one reason for the work at home disadvantage of having trouble getting funding. Setting up as a sole proprietor can be detrimental to fundability. For a lender to see your business as a separate, fundability entity apart from you as the owner, you need to do things differently.

-

Separate contact information, including a business phone number and a business address that are different from your personal phone number and address.

-

An EIN, to use in place of your SSN on business documents and funding applications. You can get one for free from the IRS.

- Incorporate and an LLC, S-corp, or C-corporation. It is necessary to fundability. Also, it lends credence to your business as one that is legitimate. Not to mention it offers some protection from liability.

- Open a separate business bank account. Among other things, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

Best Home Based Business Loans

Fundability, in the simplest terms, is the ability of your business to get funding. If your business is not seen as fundable, then lenders will not help you fund it. Home based business loans will be out of the question.

Not all loans are created equal when it comes to getting money for your home based business however. Some work better than others. Here are some of our top picks for work from home business loans.

Credit Line Hybrid

With the Credit Line Hybrid, you can usually get a loan of 5x the amount of your highest revolving credit limit account, up to $150,000. Honestly, this is more than what you could get on your own when applying for credit cards. Furthermore, you can get cash out on this program.

Also, there is no impact on your personal credit with this type of financing. You need a 680+ credit score, but if you don’t meet that you can take on a credit partner who does. A lot of business owners use the good credit of friends or family to help them get the funding they need.

The best part is, not only does this not affect your personal credit score, it can help build your business credit score if your business is set up properly as mentioned above.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

401K Financing

Your existing 401(k) or IRA can help fund your business as well. The funds work as collateral for business financing. As a result, your personal credit score isn’t really an issue. This program uses IRS proven strategies. You will pay no tax penalties, and you still earn interest on your 401(k). Even better, rates are low, and this option usually has a quick closing and funding process.

SBA 7 (a) Loan

This is the SBA’s most popular program. The SBA offers federally funded term loans up to $5 million. The funds can be used for expansion, purchasing equipment, working capital and more. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the funds.

Credit Suite business credit experts can help you with these types of funding and more!

Funding Doesn’t Have to Be a Disadvantage of Working from Home

Arguably, business funding is one of the greatest work from home challenges. It can be such a challenge in fact, that it can seem to overshadow many, if not all, of the work from home benefits. With the right expert to walk you through the process, you can be sure that at least this one challenge can be overcome, and the benefits of working from home can tip the scale. You’ll have to keep yourself out of the refrigerator though.

The post Make the Benefits of Working From Home Outweigh the Disadvantages appeared first on Credit Suite.

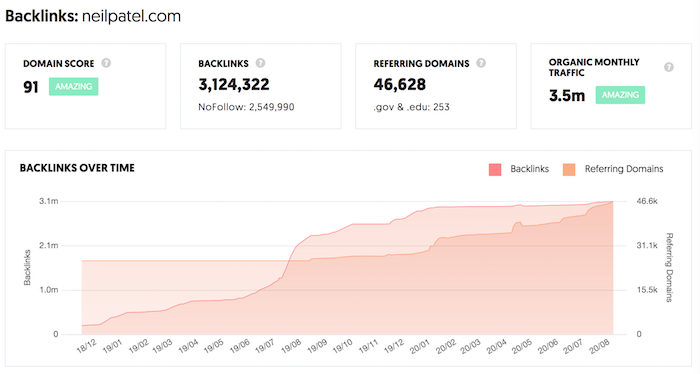

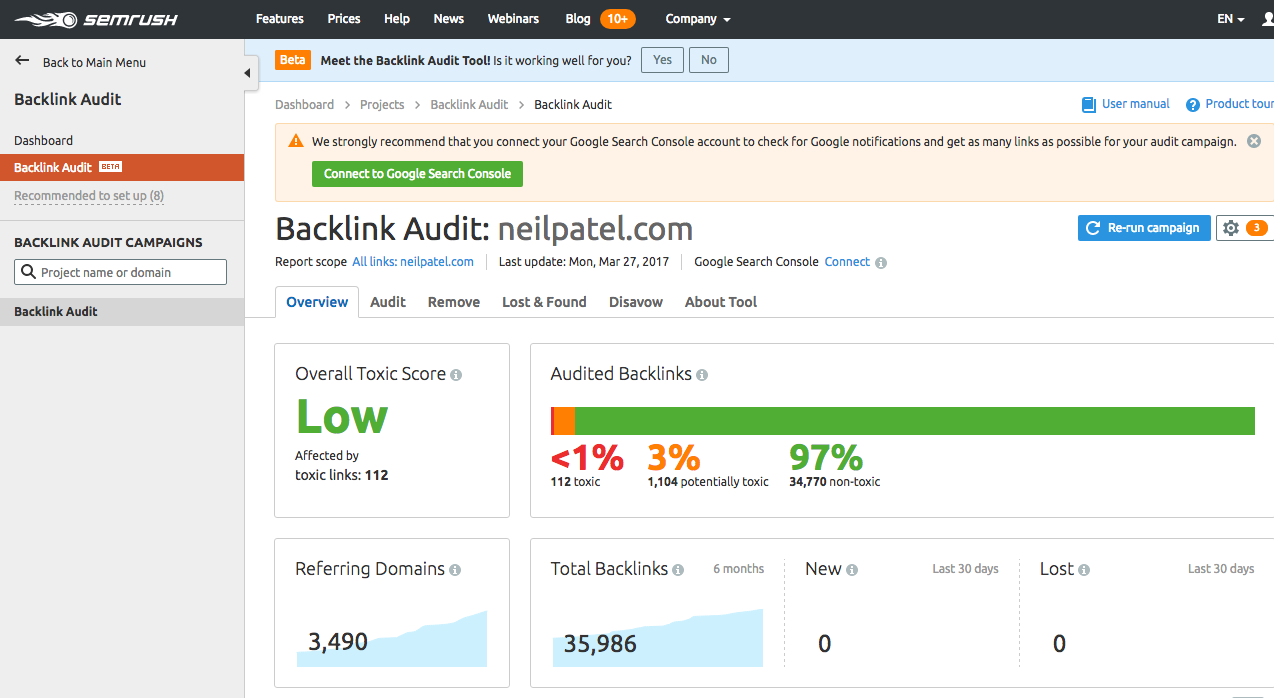

However, I’ve found that about 90% of the time, conducting a backlink audit will help you find bad links.

However, I’ve found that about 90% of the time, conducting a backlink audit will help you find bad links.