2021 Inflation and the Cost of Doing Business

2021 Inflation, You, and 2022

If you pay attention to business news—and even some national news—you’ve likely heard that 2021 inflation is coming. Or maybe that we’ll be spared until 2022.

But that’s wrong. 2021 inflation is already here.

Wait, what?

Is Inflation Coming Soon?

Economic predictions are, of course, never guaranteed. But per the New York Times, “there’s enough evidence to believe that a further upturn in inflation is coming.” But inflation isn’t all bad. Once the stock market calms down, an inflationary period is often the best time to buy stocks.

Per Inflation Calculator, the trouble started in March of this year. In January and February, inflation was at 1.4 and 1.7%, respectively. Then in March, it crept up to 2.6%. In April, it was already 4.2%.

Then in May, it hit 5.0%. And now, through August, it hasn’t gone below 5.0%.

That’s more than a little troubling.

But What Exactly is 2021 Inflation?

Or, inflation in any year?

Per Investopedia, inflation is “the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time. The rise in the general level of prices, often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods.”

In plain language, inflation is best understood through an example. In 1970, the standard cost of a new car was a little over $3,500. Yet in 1980, the average cost was $7,000. And in 2010, it was a little over $29,000. While the Covid-19 pandemic reduced prices, it didn’t reduce them even to 2010 levels. In 50 years, the average price of a new car went up close to ten times!

What Does the Federal Reserve Do?

If and when inflation strikes, the Federal Reserve will most likely raise short-term interest rates. The reason is to make it more attractive for banks to lend money. During an inflationary period, lenders will demand higher interest rates as compensation for the decrease in purchasing power of the money they are paid in the future. The Federal government will also sell off US securities. This takes money out of banks. And since the banks have less to lend, it forces the banks to raise interest rates.

Why Are We Experiencing 2021 Inflation Right Now?

What we’ve got right now is a near-perfect storm of circumstances, and it’s incubating the 2021 inflation we’re seeing.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet.

Reason #1: Supply Chain Disruptions

Remember the Great Toilet Paper Shortage of 2020? Remember that container ship that was stuck in the Suez Canal? The former was due to hoarding. And the latter caused some disruptions, but those were supposed to be done.

Not so fast. If you’ve had to have any work done on your home in the past year, you’ve experienced how slow and difficult it is to get lumber. This basic, vital commodity can still be obtained—but it takes longer. And delays cost money. Because those costs are passed on to the consumer, prices rise. Hence, 2021 inflation.

Reason #2: COVID-19

Well, of course. The pandemic doesn’t cause inflation by itself. But our country (as of the day writing this blog post) is missing over 600,000 people from the workforce.

When labor is scarce, it helps to raise salaries. This is because workers have gotten into a better bargaining position.

When there aren’t a lot of jobs and too few and too many workers to fill them, then the employer is in the catbird seat. They can set wages, and often those wages can be low. But the opposite is true right now. With businesses awash in jobs, but not enough people to fill them, potential employees are starting to dictate terms.

And their terms include higher salaries.

Health Care Workers, a Special Case

In addition to people trying to dictate better terms, we also have an issue with healthcare workers. Every day in the news, you see stories of health care workers who are just plain fed up. It could be that they’ve seen far too many COVID patients die, or they are angry at people who aren’t vaccinated, or they refuse to be vaccinated themselves. In any of these circumstances, this means that they just plain don’t want to work. They are ready to throw in the towel and leave.

And what is especially interesting about this is that nursing in particular was only until recently considered to be a recession-proof profession. Hospitals, nursing homes and more could barely fill job openings.

But now they really can’t fill job openings.

Retail and Hospitality Workers: Another Special Case

For people who normally make either minimum wage, or make some of their money in tips, the pandemic and its resultant pauses in our lives has led a lot of them to reconsider their career choices. People are also considering that if they need to enforce a mask requirement, then they may have few to no tools with which to do that. These people are tired of being abused, particularly for a very low salary.

So they want more money. And they’re tired of working three jobs to be able to feed their families and make rent. They’re just plain tired.

Reason #3: People Restarting Their Lives

In addition to hospitality and health care workers, there are a number of other people who don’t necessarily fit into those buckets. But during shutdowns in particular, they reassessed their lives. And some of them realized that they didn’t want to do what they had been doing. There’s nothing wrong with this. People change their careers all the time. But what we’re seeing right now is a wholesale change in hundreds of thousands if not millions of people.

Because, at times, those people are used to higher salaries, they are trying to demand them even if they need to start over at the bottom.

Social media and the regular mainstream media don’t help. If they tell people that they can get more money to do any kind of work, then job seekers will start demanding higher salaries, and continue to do so. No one will want to demand a lower salary, of course.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet.

Reason #4: Side Hustles

As a corollary to people changing their lives, there are also people who may have thought that they wanted to perhaps change things. But they weren’t ready to jump in headfirst. As a result, they’ve created side hustles of various kinds. With eBay, Etsy, Upwork, and various other sites where you can sell or offer your services online, people are spreading their wings and trying to do something different.

A businessperson might decide that because they make incredible muffins, that they should go into the bakery business. But chances are the bakery business is not very easy to succeed in. So instead of quitting their day job, they bake muffins on the side, and ship them. They can do so without an office, and can quit pretty much whenever they need to.

Higher Starting Wages and Decreased Supply Equals 2021 Inflation

Prices are going up. Whether it’s because of shortages, or potential workers demanding higher salaries, either way, prices are rising. Hence, 2021 inflation.

How Does 2021 Inflation Change How You Run Your Business?

The first obvious reason is that the cost of supplies is increasing. There are parts of this country where gasoline costs over $5 per gallon. And shortages of other supplies, such as lumber (mentioned above), means that everything takes longer to do. If you would normally complete, say, ten jobs in a week, but you can only complete eight now, then you will have to pass your added costs onto the consumer. And since you still need to pay rent, feed your family, and perhaps make payroll, you’ll raise prices.

If you raise prices, then other people will as well. And around and around we go.

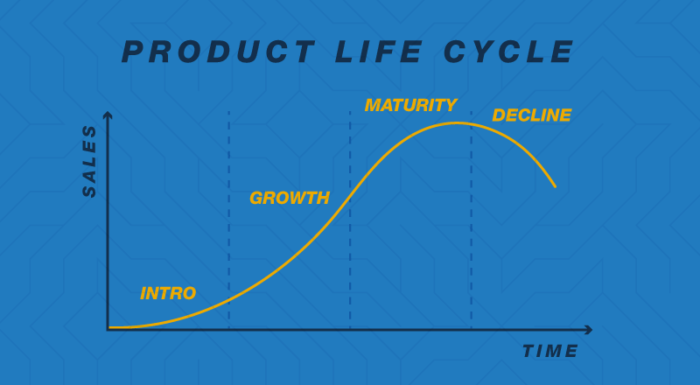

The Inflationary Cycle

Inflation will cut into your profit margin unless you raise your prices.

Inflation will cut into your profit margin unless you raise your prices.

If your business customers raise their prices, that perpetuates a cycle of price increases. Government clients may start to rack up municipal debt. Individual customers might buy less, and they may even take their business elsewhere. But since inflation hits everyone, chances are they won’t find a safe haven with lower prices at your competitors’.

How Can Your Business Ride Out Inflation?

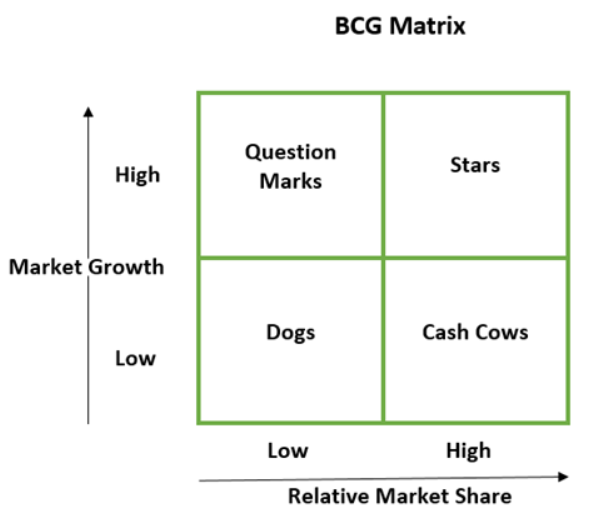

You will need business capital. This is the money or wealth needed to produce goods and services. All businesses have to buy assets and maintain their operations. Business capital comes in two main forms: debt and equity. Getting capital for business financing should be your concern.

Business financing is the act of leveraging debt, retained earnings, and/or equity. Its purpose is to get funds for business activities, making purchases, or investing. With lower retained earnings and perhaps less equity, it’s a good time to leverage debt. One way you can do so is to request a credit line increase, particularly if you’ve been a good credit customer and have paid your business’s bills on time.

Building and improving your business credit is a great way to help your business ride out inflation. Buying on credit means you can wait a bit (although not forever) to pay for goods and services. If prices go down, particularly during a grace period where you don’t have to pay, you’ll do better. But better terms will only come to your business if your business credit is good.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet.

How Can Your Business Prepare for Inflation?

It’s already here, but it may get worse. And, no matter what, it’ll come back when it’s finally gone. So here are some ways to get your business ready.

Your money won’t go as far. So before inflation hits harder, it should be a good idea to invest in new equipment if you need it. This may mean leveraging accounts receivable or using merchant cash advances to get capital now so you can act before inflation skyrockets.

It may also mean equipment financing and/or equipment sale and leaseback. So you can spread payments out over time.

And build business credit. Because if prices are going to rise, you want to buy from starter and other reporting vendors before that happens.

Getting Through 2021 Inflation Now, and Coming Out Better on the Other Side: Takeaways

As prices continue to rise, and demands for goods, services, and workers goes unfulfilled, inflation has the potential to worsen before it gets better. Act now. Secure larger ticket items your business needs before they become more expensive. If you need to hire, see if you can offer non-salary incentives to help break the cycle, such as offering more vacation time to new employees. And work to build your business credit before you need it, to better weather 2021 inflation and beyond. Good business credit is an asset that won’t lose its value, no matter what the economy does.

The post 2021 Inflation and the Cost of Doing Business appeared first on Credit Suite.