10 Online Survey Creator Options to Use For Feedback

Every business wants to feel like its customers and employees are happy. After all, it’s human nature to want to be loved, right?

However, “making people happy” isn’t just a nice-to-have. Doing so has real-world business benefits.

For instance, did you know customers will pay up to a 16-percent price premium and display greater loyalty if a company delivers an excellent experience? Or 63 percent of companies say retaining talent is harder than hiring?

What’s the common denominator between those statistics? They both demonstrate the value of feedback surveys.

By surveying your workforce or customer base, you can identify the things that are making them unhappy and take action to set them right. This means no more losing customers or talent to your biggest rivals.

Why Should You Use an Online Survey Creator?

I’ve already touched on a couple reasons why you should be using online survey creators to assess customer and employee sentiment, but there are lots more.

5 Reasons to Send Customer Surveys

- Customers appreciate being given a platform for their opinions. According to Microsoft, 77 percent of customers say they look more favorably on brands that ask for and accept feedback.

- Online surveys help brands deliver better customer service. That’s important, because 73 percent of Americans say experiencing good customer service increases their chances of spending more money than planned, according to research from the International Council of Shopping Centers.

- Solving customers’ problems improves your retention. By surveying your customers, identifying the issues they’re facing, and overcoming them, you stand a better chance of keeping them.

- Improving retention is cheaper than chasing new customers. In fact, acquisition is estimated to cost anywhere between five and 25 times more than retaining existing customers. That’s another compelling reason to start surveying your customer base.

- Customer experience is the biggest focus for business leaders right now. That’s right, almost 46 percent of business leaders say CX is their top priority, ahead of product (34 percent) and pricing (21 percent). How can you improve your customer experience if you don’t understand how good (or bad) it is at the moment?

3 Reasons to Send Employee Surveys

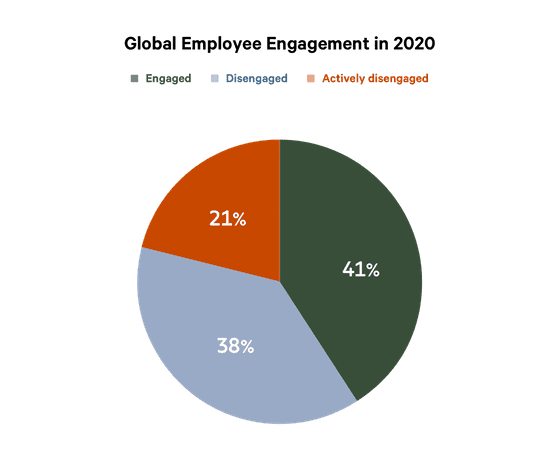

- Most of your employees aren’t engaged. Worldwide, 59 percent of employees say they’re either disengaged or actively disengaged at work. Using an online survey creator can help you understand why that’s happening (and hopefully turn it around).

- Companies with engaged employees perform better. According to Gallup, highly engaged business units see a 41 percent reduction in absenteeism and a 17 percent increase in productivity. What’s more, a separate Gallup survey shows engaged organizations generate up to 18 percent more revenue per employee.

- Employee engagement surveys help you improve processes like onboarding. After all, how can you deliver an effective onboarding program without gathering feedback from people who have recently experienced it? It’s certainly in your interest to get onboarding right, because 69 percent of employees say they’re more likely to stay with a company for three years if their onboarding experience was excellent.

Top 10 Online Survey Creators

Here are online survey creator tool options, including how they work and their main features.

#1: Qualtrics

How It Works

Increase your chances of asking the right question in the right way and at the right time by choosing up to eight question types and including 15 questions per survey. All surveys can be sent out via multiple channels, including email.

Main Features

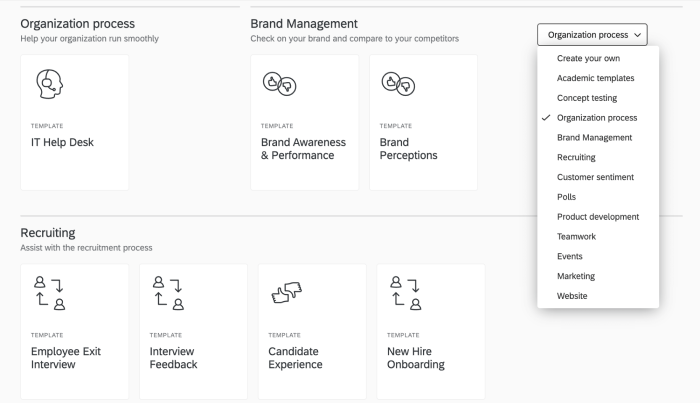

Qualtrics’s ExpertReview feature helps you hone in on the right question types and survey formats by giving you real-time recommendations and letting you choose from a wide selection of expert-built survey templates.

Pros

- Qualtrics Surveys accounts are free to set up, with no need to enter a credit card number.

- Access over 20 template types, from demographic polls to employee suggestions.

- Built-in reporting lets you keep up with responses as they come in.

Cons

- Free accounts are limited to 100 responses and one active survey.

- The level of detail and range of options can be overwhelming for newcomers.

- With no “undo” functionality, editing surveys rely on finding the correct backup version.

#2: SoGoSurvey

How It Works

SoGoSurvey offers different options depending on the goal of your survey. For instance, customer experience surveys use APIs to automate feedback collection by hooking into your CRM, while responses are analyzed using natural language processing.

Main Features

Choose the plan that fits your needs. If you just need to send basic surveys, you don’t need to pay for functionality like auto-translation and advanced skip logic.

Pros

- Tailored options for customer and employee experience surveys.

- Add your own branding to the survey, thank you page, and more.

- Access regular best practice webinars and free training to help you get the most from the product.

Cons

- Comparatively expensive if you only need it for one or two months a year, with monthly prices starting at $199.

- Some features, like word clouds, are only available at the Enterprise product tier.

- In a similar vein, the free tier is very limited.

#3: SurveyMonkey

How It Works

SurveyMonkey is arguably the best-known online survey creator, and certainly one of the simplest to use. Set up an account for free and you can start building your first survey straight away.

Main Features

SurveyMonkey offers 15-question types, including multiple-choice, text box, and Net Promoter Score. Alternatively, choose from a catalog of more than 1,600 questions written by survey experts.

Pros

- Free account option is extremely generous in its functionality.

- Simple online interface is easy for anyone to pick up.

- Buy responses from specific audiences based on attributes like location, gender, age, income, and employment status.

Cons

- The simple layout isn’t necessarily the most professional-looking on the market.

- Free plans are limited to viewing the first 40 responses received.

- Harder to customize and personalize than some other options.

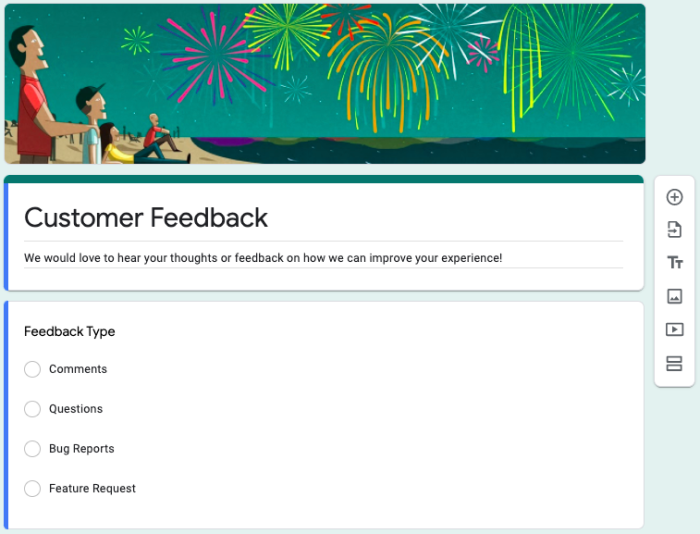

#4: Google Forms

How It Works

Know how to use Google Drive? Then you know how to use Google Forms. Just log into Drive, click to create a new form, then choose from a prebuilt template or start from scratch.

Main Features

In keeping with Google’s mobile-first ethos, Google Forms is responsive, making it easy to create surveys that look good and function smoothly on mobile devices.

Pros

- Completely free for personal use.

- If you already use Google Drive, you’ll be instantly familiar with how to use Google Forms.

- Add collaborators to build Forms with you, just like in other Google Drive tools.

Cons

- The simple interface can appear unprofessional, so it’s better for internal use.

- Limited ability to change the layout or add graphics and other media.

- Fewer question types available than some other platforms.

#5: Smartsheet

How It Works

Smartsheet is much more than a surveying tool. Rather, it’s a collaboration and work management platform that can be used to assign tasks, manage calendars, track progress, share documents, and much more. Surveys are just one part of the feature set.

Main Features

Forms can be created to gather survey responses, then shared via email or hyperlink, or embedded in dashboards or webpages.

Pros

- Follows the basic setup of Microsoft Excel, making it simple to use.

- Offers extensive automation and collaboration options.

Cons

- Surveys are only a small part of Smartsheet’s functionality, so you might be paying for a lot of features you don’t need.

- Users report some issues when importing and exporting from Excel.

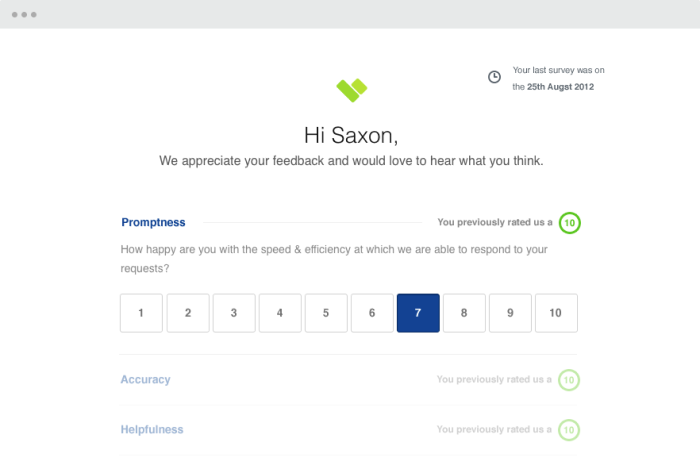

#6: Client Heartbeat

How It Works

As the name suggests, Client Heartbeat is 100 percent geared toward measuring client satisfaction and improving retention. It’s a simple feedback tool that assesses happiness levels to identify unhappy customers.

Main Features

Choose from a list of prebuilt questions already being used by brands in your industry, allowing you to compare your scores against those of your biggest competitors.

Pros

- Live customer service dashboard can be accessed free of charge.

- Interface is simple to use without any training.

- Industry benchmarking adds context to your results.

Cons

- Features are more limited than some of the other platforms on this list.

- Specifically designed for customer satisfaction rather than employee engagement.

- Limited functionality makes the pricing a little expensive.

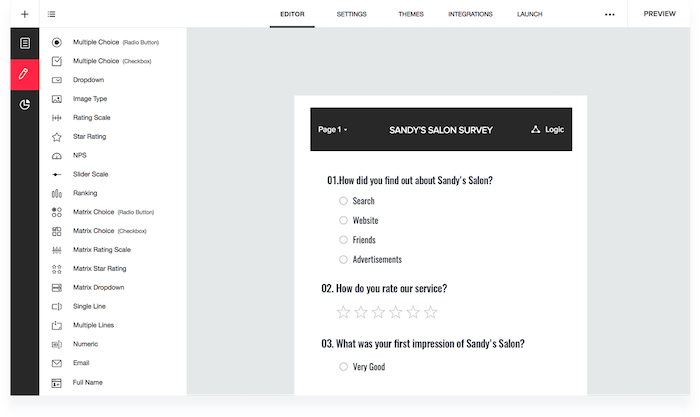

#7: Zoho Survey

How It Works

Zoho Survey is a highly customizable online survey creator, with extensive options for tailoring surveys to fit your brand and house style, plus the ability to choose from more than 25 question types.

Main Features

Zoho offers multiple ways to send surveys, from the basics (like web links and email campaigns), to more advanced options like QR codes and private group access.

Pros

- Free account level allows unlimited surveys with up to 10 questions and 100 responses per survey.

- Surveys can be embedded in emails, making them easy to access.

- Drag-and-drop interface makes it relatively simple to design complex surveys.

Cons

- Interface is perhaps harder to grasp than more user-friendly tools like Google Forms.

- Limited customization options, unless you upgrade to one of the paid product tiers.

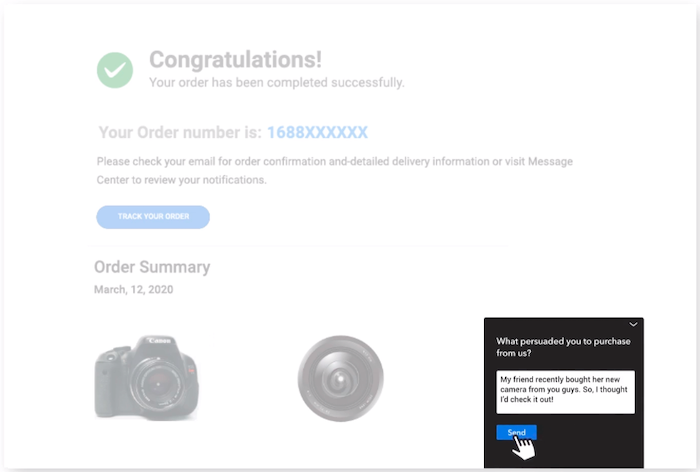

#8: Qualaroo

How It Works

Qualaroo uses “Nudges” (a type of pop-up) to online survey creator customers when they’re on your website, rather than contact them down the line via email or some other channel.

Main Features

Unique calls to action can be created based on the language used by surveyed customers thanks to sentiment analysis powered by IBM Watson. For instance, angry responses might automatically generate a task for the customer success team to get in touch.

Pros

- Qualaroo claims its native surveys are 10 times more valuable than email surveys.

- Questions are asked when customers are on your site, making their feedback more timely.

- No impact on page speed, so it doesn’t hamper user experience.

Cons

- Pricing is based on tracked page views per month, which is more complex than other options.

- No templates for employee engagement surveys at time of writing.

- Best for micro-surveys of one or two questions.

#9: SurveyPlanet

How It Works

SurveyPlanet is a simple, affordable online survey creator with an extremely robust free tier offering all the functionality you need to build unlimited basic surveys.

Main Features

Unless you need advanced features like question branching (whereby users are asked different questions based on their previous responses), you’ll be just fine with the free version of SurveyPlanet.

Pros

- Offers a huge amount of free functionality, including unlimited survey responses.

- Simple pricing; if you want more features, there’s just one paid tier at $20 per month (or $180 per year).

- Access dozens of prewritten surveys and a bunch of basic templates for free.

Cons

- Branching (or skip logic) is only available for paid users.

- Likewise, customization options are limited at the free account level.

- Paid tier is less advanced than more expensive alternatives like SurveyMonkey.

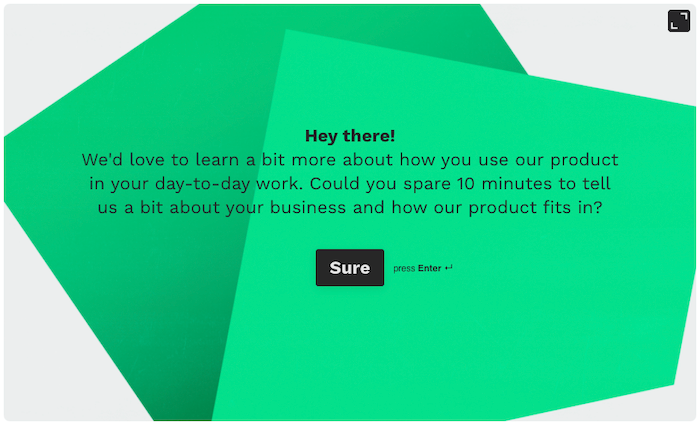

#10: Typeform

How It Works

Typeforms are customizable online survey creator forms that can be embedded on your website, launched in an email, or shared via hyperlink. Responses can be synced to Google Sheets, and notifications can be sent to other tools like Slack, so it’s easy to see when a response has been received.

Main Features

Unlike a lot of the other tools in this list, Typeform is all about building stylish surveys. You can even add visual elements like images, videos, and GIFs to your forms.

Pros

- Webpage forms are stylish, engaging, and fun to complete.

- Access extensive templates on employee engagement, branding, customer satisfaction, and more.

- Choose from 18 different question types.

Cons

- The editor takes some getting used to.

- Even the mid-tier package only offers 500 responses per month as standard, making it comparatively expensive to gather a lot of data.

- Typeform branding can only be removed at the middle product tier.

Conclusion

Clearly, there are a lot of choices in the online survey creator market. Employee and customer satisfaction surveys are valuable, so if you’re not doing them now, pick a tool with a robust free tier and get going.

Once you’ve found an approach that works, feel free to switch things up by testing more advanced features, formats, and layouts.

What’s your favorite online survey creator? Think I’ve missed something? Let me know in the comments.