It can be tricky to get a loan for new business endeavors. You do not yet have the benefit of a long time in business, profitability, or positive business credit history. As a result, you have to rely on a killer business plan, a fundable foundation, and your personal credit.

What You Need to Know About How to Get a Loan for New Business Endeavors

When you need a loan for new business, there are several things to consider. Most business owners understand the personal credit piece. If you have a high enough credit score lenders will lend you money with pretty much no questions asked. However, what if your credit score is just okay? Can you still get a loan? What if your credit score is great but you have a poorly written business plan? Do you even know how to set up your new business to be fundable? Here’s what you need to know.

Find out why so many companies use our proven methods to get business loans.

How to Get a Loan for New Business Endeavors: You’ll Probably Need Collateral

If your credit score is high enough, you can sometimes get a loan for new business without security, also known as collateral. However, regardless of how great your score is, you can almost always get more money with a better rate and terms if you have collateral.

Security could be your business, but often it is necessary to use personal assets such as land or a home. While this can be scary, it is the best way to show a lender you have faith that your business will be profitable. If you aren’t willing to take a risk, why should they?

However, the better your credit is, the more professional and complete your business plan, and the more fundable your foundation, the less collateral you may be able to get away with.

How to Get a Loan for New Business Endeavors: Write a Killer Business Plan

Your business plan is the first impression a lender gets of your business. This is especially true if you are trying to get a loan for new business startup. Consequently, your business plan must be complete and professionally put together.

Honestly, it is best to hire a professional business plan writer if possible. A professional business plan writer can help you gather all the necessary information. Then, he or she can compile it into the traditional, acceptable format.

If you cannot hire a business plan writer, there are a number of options. For example, The Small Business Administration offers a template, and your local small business development center can help as well.

For a business plan to be taken seriously by a lender, it needs to include the following:

Opening

An Executive Summary

This is a complete summary of the business idea.

Description

The description goes into more detail than the summary, describing the business. What type of business is it? What will it offer? This is where you get others excited about what you are doing.

Strategies

Layout your plan for getting things up and running. Do you have a marketing plan? Is there a location you have in mind? How many employees you will start with? What is your ramp up plan?

Research

Writing a complete business plan requires a ton of research. Not only must you do market research to ensure your product is needed and want, but also that your location and market coincide. In addition, you need to know that the market can support your business.

Research on any competitors is also necessary.

Market Analysis

This actually includes two parts, the analysis of audience and the competitive analysis.

What need will your business fill, and for who? Will your business fulfill a childcare need for working parents? Are you a restaurant filling a need for those working downtown to have easy access to fast, healthy lunch options? How will your business fill those needs? Include all of this in the analysis of audience section.

Is there a business currently working to fill this need? Is there room for more? How do you plan to be the best?

Strategy

This is the way you plan to run your business moving forwards. Put another way, it is how you plan to put into action what you learned in the research phase.

Plan for Design and Development

How is all of this going to play out? From start to finish, what steps are you going to take? This section includes more detailed than the strategies section.

Plan for Operation and Management

How will ownership be structured, and who will handle the day to day running of the business? This could be as simple as stating that you are the sole owner and operator. In contrast, it could mean laying out a complete partnership plan or board or directors’ format. It just depends on how your play for your business to work.

Financials

While all parts of the business plan are important, this is where lenders really sit up and pay attention. even of the whole rest of the plan is fabulous, it will not matter if the financial section isn’t in order.

Financial Information

This section includes current financials, projections, and a plan for the loan funds you are asking for. Lenders need to see that you know how to handle the funds you get, and that you have a plan for paying them back.

How to Get a Loan for New Business Endeavors: A Fundable Foundation

When you apply to get a loan for new business endeavors, having a fundable foundation can make all the difference. What’s a fundable foundation? It’s basically how your business is set up. It has to appear to be a fundable entity separate from you, the owner. Like any foundation, it is best to start at the beginning.

Contact Information

The first step in setting up a fundable foundation is getting your business its own phone number, fax number, and address. That’s not to say you have to get a separate phone line, or even a separate location. You can still run your business out of your home or on your computer if you want to. You don’t even need a fax machine.

In fact, you can get a business phone number and fax number that will work over the internet instead of phone lines. Also, the phone number will forward to any phone you want, so you can simply use your personal cell phone or landline to take calls.

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This may seem outdated, but it does help solidify legitimacy with lenders.

You can use a virtual office for a business address. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to hold a face-to-face meeting. If you are not going to have a physical location other than your home, this is going to be your best option. A post office box is not ideal when you want to get a loan for new business endeavors.

Find out why so many companies use our proven methods to get business loans.

EIN

The next thing you need to do is get an EIN. An EIN is an identifying number for your business that works in a way similar to how your SSN works for you personally. Some business owners use their SSN for their business. However, it really doesn’t look professional to lenders. Also, it can cause your personal and business credit to get all mixed up when you get to that point. When it comes to building a fundable foundation, you need to apply for and use an EIN. You can get one for free from the IRS.

Incorporate

This is the most important step in fundability thus far. Incorporating your business as an LLC, S-corp, or corporation is necessary for fundability. Not only does it lend credence to your business as one that is legitimate, but it also offers some protection from liability.

For the purpose of fundability, it does not matter which one you choose. Choose the option that works best for your budget and liability protection needs. The best thing to do is talk to your attorney or a tax professional. If you do not do this now and instead choose to begin operating as a sole proprietorship or partnership, you will lose fundability in the future. This is because when you incorporate, you become a new entity. This means that at that point, you will lose any time in business and positive payment history you may have accumulated. You need both of those for fundability, so best to just go ahead and incorporate now.

Business Bank Account

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit cards payments. Studies show consumers tend to spend more when they can pay by credit card.

Licenses

For a lender to see you as fundable, you need to have all the licenses necessary to run. If you aren’t there yet, at least let them know you know what you need and how to get it.

Website

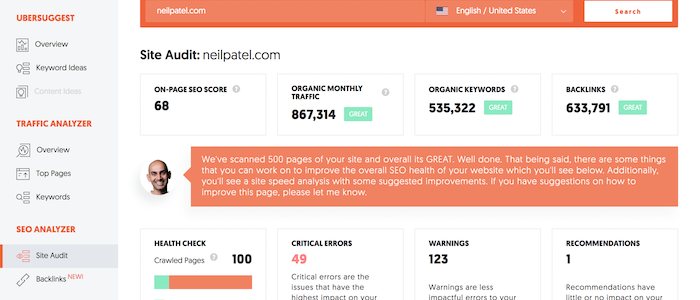

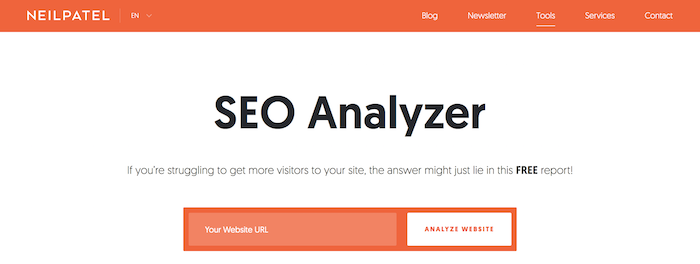

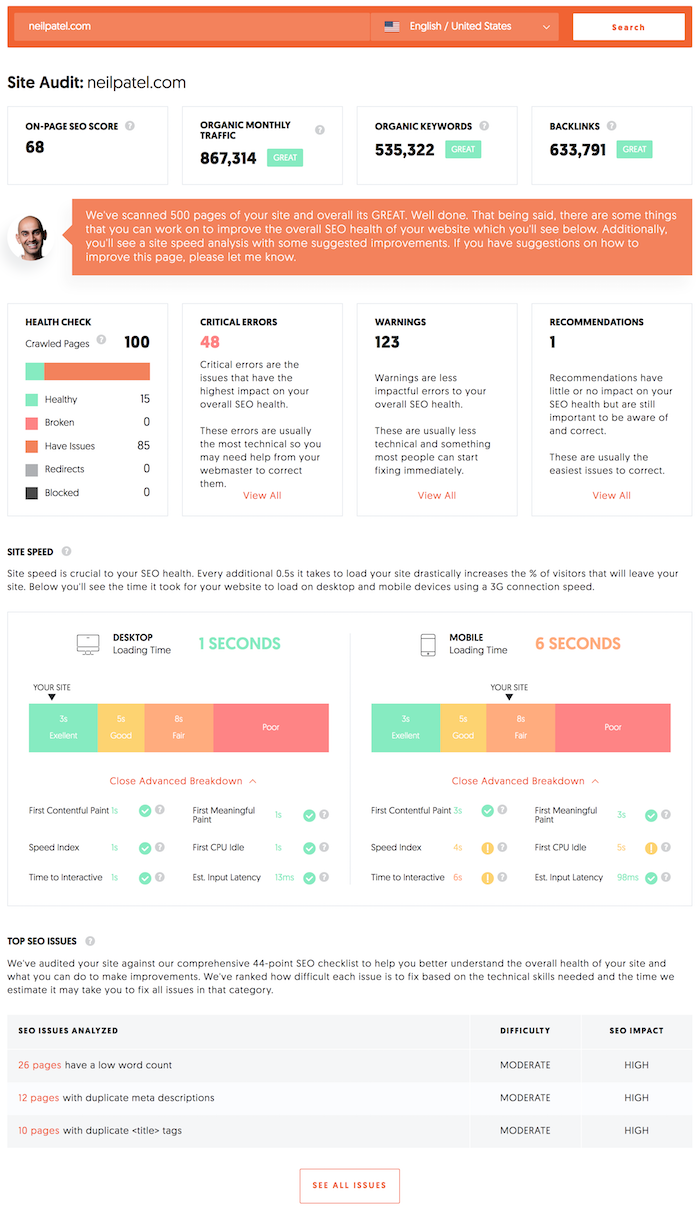

I am sure you are wondering how a business website can affect you ability to get funding. Here’s the thing. These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

How to Get a Loan for New Business Endeavors: The Application Process

You’re probably thinking that after all this work, the application process should be a breeze. It could be, but there will still be some work to be done. For one, you will need to take some time to consider your options when it comes to choosing a lender and a type of loan. Do you want to go with a traditional lender or a private lender? Is a commercial bank or a community bank better for your needs? Can you apply for a secured loan, or do you need to look for an unsecured option? Would a line of credit be better?

Applying for the right loan with the right lender from the beginning can make a huge difference in your chances for approval.

You Can Get a Loan for New Business Endeavors

Being prepared when you apply for a business loan can mean the difference between approval and denial. A poorly put together business plan or a kink in the fundable foundation chain can throw a wrench in the entire system.

Find out why so many companies use our proven methods to get business loans.

Spending the time and money necessary to get these things in order, as well as doing a little research to make sure you are applying for the right loan with the right lender for your needs, can make all the difference. It will be worth it. Not only will you be able to get a loan for new business, but you will also be able to get the funding you need to grow and thrive long into the future.

In the end, it really is all about preparation and knowledge. Knowing what lenders want to see and giving them what they want can open doors for your business that you never imagined.

The post How to Get a Loan for New Business Endeavors appeared first on Credit Suite.