Article URL: https://sirum.breezy.hr/

Comments URL: https://news.ycombinator.com/item?id=23992931

Points: 1

# Comments: 0

Article URL: https://sirum.breezy.hr/

Comments URL: https://news.ycombinator.com/item?id=23992931

Points: 1

# Comments: 0

Hi, I’m a Data Engineer with close to 5 years of hands on experience in many companies, across several countries and ranging from small startups to large international organizations. I hold 2 AWS Certifications (developer/bigdata) and am working on the third one (SA Pro), cloud infrastructure/technologies is one of the things that interests me the …

Various Types of Lenders

According to Carrier Reeder, financial obligation consultant: The most vital kind of funding is mortgage and also as in various other instances the option of loan providers are tremendous. She evaluations the different kinds of fundings offered as well as the alternatives provided by them. The numerous kinds of loan providers are a. Mortgage Banker, b. Mortgage broker c. Credit Unions, d. Savings and also Loans as well as e. Government Loans.

According to Reeder, in situation of Mortgage Banker one individual is accountable for the consumer from starting to finish, that overviews with the different procedure of finance centers, the different deals, picking the fundings which ideal matches one, the time duration etc he additionally adheres to on the payment elements, rate of interest included as well as till the end when the financing is all paid up. Federal government does not themselves use financings yet back some of the lendings currently in offering.

According to Kevin Stith, a financial debt advisor, monetary establishments, financial institutions as well as personal lending institutions provide home mortgages or fundings. The exclusive loan provider below takes a danger by providing financing to a person that has a poor credit report ranking, for this reason to minimize his danger he asks for a greater charges and also home as safety and security.

The distinction in between obtaining a car loan online and also via a broker is that the interest rates are repaired in situation of an on the internet car loan center and also in instance of a broker the interest rate can be worked out as well as numerous centers which match the debtor can be supplied by the broker. It is stated that in situation of a home loan broker, if a transaction is dealt with as well as the lending institution appears to get benefit after that he might supply might centers to the debtor. According to Stith the market is complete of debtors as well as for this reason going shopping around for one that provides far better bargain is certainly useful to the consumer.

According to Carrier Reeder, financial debt consultant: The most vital kind of funding is house car loan and also as in various other situations the option of lending institutions are tremendous. According to Reeder, in situation of Mortgage Banker one individual is liable for the customer from starting to finish, that overviews via the different procedure of financing centers, the numerous deals, selecting the financings which ideal matches one, the time duration etc he likewise adheres to on the payment variables, passion included and also till the end when the car loan is all paid up. The distinction in between using for a funding online and also via a broker is that the prices of rate of interest are repaired in situation of an on the internet finance center as well as in situation of a broker the price of rate of interest can be discussed as well as different centers which fit the debtor can be provided by the broker.

The post Various Types of Lenders appeared first on ROI Credit Builders.

Looking for Funding Circle reviews? We took a look at this alternative lender to see if the information we had on them is still true. Welcome to Funding Circle reviews.

Funding Circle is one of several lending companies in the online space. They have loaned over $11.7 billion, with over 4.9 million loans under management. They work as a peer to peer lender.

In the US, Funding Circle leads the Marketplace Lending Association, along with LendingClub, Prosper, and Sofi.

Funding Circle is online here: www.fundingcircle.com/us/. Their physical addresses are in San Francisco, Denver, London, and Berlin. You can call them here: (855) 385-5356. Their contact page is here: www.fundingcircle.com/us/about/contact/. They have been in business since 2010.

Funding Circle has a business borrowers’ Bill of Rights, here: www.fundingcircle.com/us/business-borrower-bill-of-rights/

It says:

You have a right to see the cost and terms of any financing you are offered in writing and in a form that is clear, complete, and easy to compare with other options, so that you can make the best decision for your business.

You have a right to loan products that will not trap you in expensive cycles of re-borrowing. Lenders’ profitability should come from your success, not from your failure to repay the loan according to its original terms.

You have a right to work with lenders who will set you up for success, not failure. High loss rates should not be accepted by lenders simply as a cost of business to be passed on to you in the form of high rates or fees.

You have a right to fair and equal treatment when seeking a loan.

If you are unable to repay a loan, you have a right to be treated fairly and respectfully throughout the collections process. Collections on defaulted loans should not be used by lenders as a primary source of repayment.

At Funding Circle, you can borrow anywhere from $20,000 to $5 million from the SBA. Loan terms run for up to 10 years. Pay an interest rate of prime +2.75%. as of the writing of this blog post, that is 6%.

There are no prepayment penalties.

Funding Circle will charge a one-time origination fee on each loan they fund. This amount ranges from 3.49% to 6.99% of the approved loan amount.

Small businesses which meet the below criteria are eligible to apply for an SBA 7(a) loan:

Because these are SBA loans, Funding Circle must conform to the SBA’s requirements when it comes to industries. Therefore, they cannot lend to these industries:

As a part of working with the Small Business Administration, Funding Circle offers their COVID-19 relief, in the form of the Paycheck Protection Program.

What frustrates you the most about funding your business during a recession? Check out how our guide can help.

Apply online, and a personal account manager will reach out to you within one hour. They will ask about your business and request and collect documentation. They will decide on your loan in as little as 24 hours.

If you accept a loan offer, you can get funding in as little as one business day. You can return for more funding in as little as six months.

If your monthly payment is more than 10 days late, they may charge a late fee of up to 5% of each missed payment amount. The late fee will be payable immediately and is in addition to the missed payment.

They will place your loan into default if you miss three or more consecutive payments, four out of six monthly payments or do not comply with your loan agreement.

Funding Circle Reviews: Advantages

So the advantages include no prepayment penalty. There are also relatively fast decisions and funding. In addition, the Borrowers’ Bill of Rights is encouraging. The maximum rates you could pay are within reason.

Funding Circle Reviews: Disadvantages

So what are Funding Circle’s disadvantages? It should be obvious: fees, fees, and more fees. They are for origination, missing payments, and also for insufficient funds.

An Alternative to Funding Circle

Of course one great alternative to Funding Circle is to build business credit. But how do you do that? Fortunately, we have the method right here. And we’re more than happy to let you in on the secret.

Corporate credit is credit in a small business’s name. It doesn’t connect to a business owner’s personal credit, not even if the owner is a sole proprietor and the only employee of the business. Accordingly, an entrepreneur’s business and personal credit scores can be quite different.

The Advantages

Because small business credit is separate from individual, it helps to protect a small business owner’s personal assets, in the event of legal action or business insolvency. Also, with two separate credit scores, an entrepreneur can get two different cards from the same vendor. This effectively doubles buying power.

Another benefit is that even startups can do this. Visiting a bank for a business loan can be a formula for disappointment. But building business credit, when done the right way, is a plan for success.

Individual credit scores rely on payments but also other components like credit usage percentages. But for company credit, the scores actually only hinge on whether a company pays its bills in a timely manner.

The Process

Growing small business credit is a process, and it does not happen automatically. A corporation must proactively work to establish corporate credit. Having said that, it can be accomplished readily and quickly, and it is much more efficient than establishing individual credit scores. Merchants are a big part of this process.

Performing the steps out of order will cause repetitive denials. No one can start at the top with company credit. For instance, you can’t start with store or cash credit from your bank. If you do, you’ll get a denial 100% of the time.

Company Fundability

A business needs to be fundable to loan providers and vendors. For this reason, a business will need a professional-looking website and e-mail address, with website hosting bought from a supplier like GoDaddy. And company phone and fax numbers need to have a listing on ListYourself.net.

In addition the business telephone number should be toll-free (800 exchange or the like).

A corporation will also need a bank account devoted strictly to it, and it must have all of the licenses necessary for running. These licenses all must be in the specific, correct name of the company, with the same company address and telephone numbers. Bear in mind that this means not just state licenses, but possibly also city licenses.

What frustrates you the most about funding your business during a recession? Check out how our guide can help.

Working with the Internal Revenue Service

Visit the IRS website and acquire an EIN for the small business. They’re totally free. Choose a business entity such as corporation, LLC, etc. A business can start off as a sole proprietor but will probably want to change to a kind of corporation or partnership to decrease risk and maximize tax benefits.

A business entity will matter when it concerns tax obligations and liability in the event of litigation. A sole proprietorship means the entrepreneur is it when it comes to liability and tax obligations. Nobody else is responsible.

If you operate a business as a sole proprietor at least file for a DBA (‘doing business as’) status. If you do not, then your personal name is the same as the corporate name. Hence, you can find yourself being personally responsible for all small business debts.

In addition, per the Internal Revenue Service, with this structure there is a 1 in 7 possibility of an IRS audit. There is a 1 in 50 possibility for corporations! Avoid confusion and significantly decrease the odds of an IRS audit at the same time.

Note: any DBA filing should be a steppingstone to incorporating, which is best for building business credit.

Starting Off the Business Credit Reporting Process

Begin at the D&B web site and obtain a free D-U-N-S number. A D-U-N-S number is how D&B gets a business in their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the corporation. You can do this at https://www.creditsuite.com/reports/. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process. By doing this, Experian and Equifax will have activity to report on.

Trade Lines

First you must establish trade lines that report. This is also called vendor accounts. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin getting revolving store and cash credit.

These varieties of accounts have the tendency to be for the things bought all the time, like shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first of all, what is trade credit? These trade lines are creditors who will give you initial credit when you have none now. Terms are often Net 30, versus revolving.

Hence if you get approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Details

Net 30 accounts must be paid in full within 30 days. 60 accounts must be paid in full within 60 days. Compared to with revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To launch your business credit profile properly, you need to get approval for vendor accounts that report to the business credit reporting agencies. Once that’s done, you can then make use of the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with minimal effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 3 of these to move onto the next step, which is revolving store credit.

Accounts That Don’t Report

Non-Reporting trade accounts can also be helpful. While you do want trade accounts to report to at least one of the CRAs, a trade account which does not report can yet be of some worth. You can always ask non-reporting accounts for trade references. And credit accounts of any sort ought to help you to better even out business expenses, thus making financial planning simpler. These are providers like PayPal Credit, T-Mobile, and Best Buy.

Revolving Store Credit

Once there are 3 more vendor trade accounts reporting to at least one of the CRAs, move onto revolving store credit. These are businesses which include Office Depot and Staples.

Use the business’s EIN on these credit applications.

Fleet Credit

Are there more accounts reporting? Then move to fleet credit. These are companies such as BP and Conoco. Use this credit to buy fuel, and to repair and maintain vehicles. Make certain to apply using the small business’s EIN.

Cash Credit

Have you been sensibly managing the credit you’ve up to this point? Then move onto more universal cash credit. These tend to be MasterCard credit cards. Keep your SSN off these applications; use your EIN instead.

If you have more trade accounts reporting, then these are in reach.

What frustrates you the most about funding your business during a recession? Check out how our guide can help.

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and deal with any mistakes ASAP. Get in the habit of checking credit reports and digging into the specifics, and not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less. Update the relevant information if there are errors or the data is incomplete.

Disputing Errors

So, what’s all this monitoring for? It’s to challenge any mistakes in your records. Mistakes in your credit report(s) can be corrected. But the CRAs usually want you to dispute in a particular way.

Disputing credit report errors typically means you send a paper letter with copies of any evidence of payment with it. These are documents like receipts and cancelled checks. Never mail the original copies. Always send copies and retain the original copies.

Disputing credit report errors also means you precisely spell out any charges you contest. Make your dispute letter as clear as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you sent in your dispute.

A Word about Building Business Credit

Always use credit smartly! Never borrow beyond what you can pay off. Track balances and deadlines for repayments. Paying off punctually and in full will do more to elevate business credit scores than almost anything else.

Growing business credit pays off. Excellent business credit scores help a business get loans. Your creditor knows the business can pay its financial obligations. They recognize the small business is for real. The small business’s EIN attaches to high scores, and creditors won’t feel the need to require a personal guarantee.

Business credit is an asset which can help your small business for years to come.

Funding Circle Reviews: Takeaways

Fees are high at Funding Circle, but at least they’re being transparent about them. Plus, there is no prepayment penalty – but there are late fees. Hence Funding Circle is best for companies which do not need to borrow much and can pay it all back not only on time, but early. Borrowers which need more time to pay a loan back would probably do better elsewhere.

Finally, read the fine print and do the math. Therefore, go over details carefully. And decide if this option will be good for you and your company. In addition, consider alternative financing options beyond lending. This includes building business credit, to best get the money you need. Funding Circle reviews should be just the beginning.

The post Get Better Financing with Funding Circle Reviews appeared first on Credit Suite.

When I first started out in marketing, I thought traffic was everything.

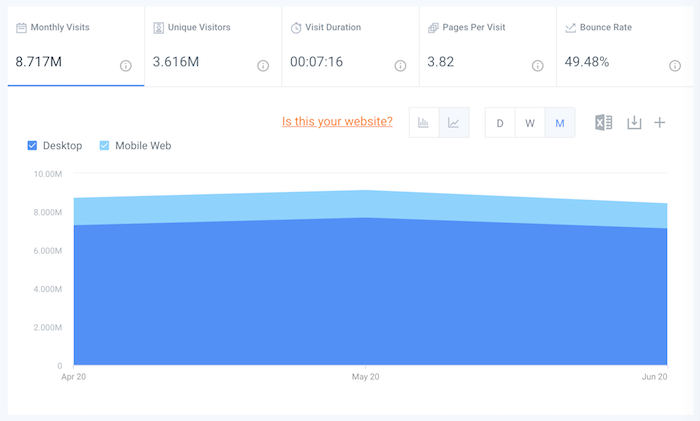

I wanted to be as big as companies like HubSpot. Just look at the image above and you’ll see how many visitors they are getting.

They generate 29.61 million visitors a month from 11.74 million people. And those visitors produce roughly 10 billion dollars of market cap.

Now, let’s look at NeilPatel.com. Can you guess how many visitors I’m getting each month?

I’m generating roughly 8.717 million visitors a month from 3.616 million people.

When you look at it from a unique visitor perspective, HubSpot is getting 3.24 times more unique visitors than me.

So, in theory, I should be worth roughly 3 times less than them, right? Well, technically I’m not even worth 1/10th of them. Not even close.

Why is that? It’s because I didn’t go after the right target audience, while HubSpot did.

And today, I want you to avoid making this massive mistake that I made. Because marketing is tough, so why would you start off by going after the wrong people?

It will just cause you to waste years and tons of money like it did with me.

Defining your target audience is the first and most essential step towards success for any company or business, especially if you are just getting started.

So before we dive into things, let me first break down what you are about to learn in this article:

Let’s get started!

A target audience is a share of consumers that companies or businesses direct their marketing actions to drive awareness of their products or services.

I know that is a tongue twister, so let me simplify it a bit more…

The intention here is to target a market with whom you will communicate with. A group of people with the same level of education, goals, interests, problems, etc. that will need the product or service you are selling.

Basically, you want to target people who will buy your stuff.

If you target people who don’t want to buy your stuff, you might get more traffic to your site… but it won’t do much for you. And you’ll be pulling out your hair trying to figure out why none of your visitors are buying from you.

Now before we dive into the details on finding your target audience, let’s first go over “personas” because many people confuse them with a target audience and if you do, you’ll just end up wasting time.

You already know the definition, so I won’t bore you with that again.

The most commonly used data to define the target audience of a company are:

Examples of a target audience: Women, 20-30 years old, living in Los Angeles, with a bachelor’s degree, monthly income of $4,000 – $6,000, and passionate about fashion and decor.

If you start a company without knowing your exact target audience, you could end up like me instead of HubSpot… we wouldn’t want that now. 😉

And here is another example. Let’s say you have a business that sells educational toys. So your target audience might be children, mothers, education specialists, or teachers.

Or you have a motorcycle business. Your audience will definitely not be people younger than 18, right?

There is no point in trying to reach everyone in order to increase your chances of sales and profit. It will actually cost you more and decrease your profit margins in the long run.

Now let’s go over “personas”…

In marketing, personas are profiles of buyers that would be your ideal customers.

Personas are fictional characters with characteristics of your real customers. They’re developed based on target audience research and may help you direct your marketing actions better.

A persona is a person that may be interested in what you have to offer since they’re very connected to your brand and you must make an effort to make them a client and retain them.

A persona involves much deeper and more detailed research than the target audience since it includes:

Persona example: Mariana, 22, blogger. Lives in Miami, Florida. Has a journalism degree. Has a blog and posts makeup tutorials and tips about fashion and decor. She always follows fashion events in the area and participates in meetings with other people in the fashion niche. As a digital influencer, she cares a lot about what people see on her social network profiles. Likes to practice indoor activities and go to the gym in her free time.

If I had to define the main difference between persona and target audience, I’d say that the target audience considers the whole, in a more general way, while the persona has a more specific form.

And if you want help creating personas for business, check out this article about creating the perfect persona. But for now, let’s focus on finding your right target audience.

The big mistake I made was that I didn’t figure out my target audience when I first started. I just created content and started marketing to anyone who wanted traffic.

But that is a bit too vague because not everyone who wants more traffic is a good fit for my ad agency.

They could just want to be famous on Instagram or YouTube, which is a lot of people, but that doesn’t help me generate more income.

Funny enough, there are more people who are interested in getting Instagram followers than people who want to learn about SEO.

But once you know your target audience, it’s easier to find and perform keyword research. For example, I know that I shouldn’t waste too much time writing articles about Instagram or Twitch even though the search volume is high.

It will just cause me to get irrelevant traffic and waste my time/money.

And that’s the key… especially when it comes to things like SEO or paid ads. The moment you know your target audience, you can perform keyword research correctly and find opportunities that don’t just drive traffic, but more importantly, drive revenue.

Now let’s figure out your target audience.

Figuring out your target audience isn’t rocket science. It just comes down to a few simple questions.

6 actually, to be exact.

Go through each of the questions below and you’ll know the exact audience you are targeting.

When thinking about who might be your target audience, you must consider who are the people who identify with your brand.

One way to find out is to monitor who follows, likes, shares, and comments on your posts on social sites like Facebook, LinkedIn, YouTube, and Instagram.

If someone is willing to engage with you, then chances are they are your target.

But in many cases, your ideal audience may not always be on the social web. They might be inactive on social media but buy from your company frequently or sign up for your services.

Even those who bought from you only once must be considered a part of your target audience, as someone who bought once might buy again.

There is no point in making a great effort to sell if you don’t make a similar effort to keep the customers you have already gained.

Customers like to feel special, and that is why the post-sales process is so important. Your relationship with the customer must remain even after the purchase is completed.

What is cool, interesting, and good for you might not be for the customer.

You can’t think only of yourself when it’s time to define the difficulties, problems, and desires of your target audience. You must put yourself in their shoes.

Don’t make offers based on what you think. Make them according to research grounded in data, previous experiences, and analysis of your potential customers’ behavior.

Understand the greatest difficulties your audience faces to try to help solve them.

Everyone needs information.

Every day you are surrounded by tons of information on the channels that you follow, but when you need it the most, where do you go to find that information?

Identify the communication channels most appropriate to your target audience and try to talk to them using a specific language from their universe.

For example, I know my target audience will either read marketing blogs or spend a lot of time on social sites like YouTube and LinkedIn consuming information.

Everyone wants solutions for their problems and to make their lives easier. This is a collective desire and it’s no different for your target audience.

Think a little about your product and the problem of your target audience. What benefits does your product or service offer? What can it do to solve those problems? What is the main value offer?

With so much competition, you must try to find your competitive advantage in your niche and always try to improve your product, offering something extra that others do not.

Being optimistic helps a lot, but thinking about the negatives can also help, especially when we talk about target audiences.

Better than considering what your audience wants, you can consider what it definitely doesn’t want, what it considers negative, and what it avoids.

With this powerful information in hand, you may have more chances to captivate your potential customers.

Avoiding what they consider negative is the first step to gain their approval. After that, you only need to apply other strategies to do efficient marketing.

Trust is everything to your target audience. No one purchases a product or service from a company they don’t know or trust.

This is why reviews on Amazon are read and so important for sellers. They know it builds trust… it’s also helped Amazon become a trillion-dollar company.

Even though this is the last question to define target audiences, it is one of the most important ones.

This is why the reputation of your company is so important. Taking care of the relationship with your customers is essential as they will spread information about your brand on the internet and to their friends and family.

If you get good reviews, have positive comments, and garner a great reputation, this will be the base for potential customers to feel motivated to buy from you.

Now that you know your audience, let’s get to the fun stuff. Let’s create content for them.

Everyone creates content, right? Just look at Google if you don’t believe me.

You just have to put a keyword on Google and you will see thousands if not millions of results for each keyword.

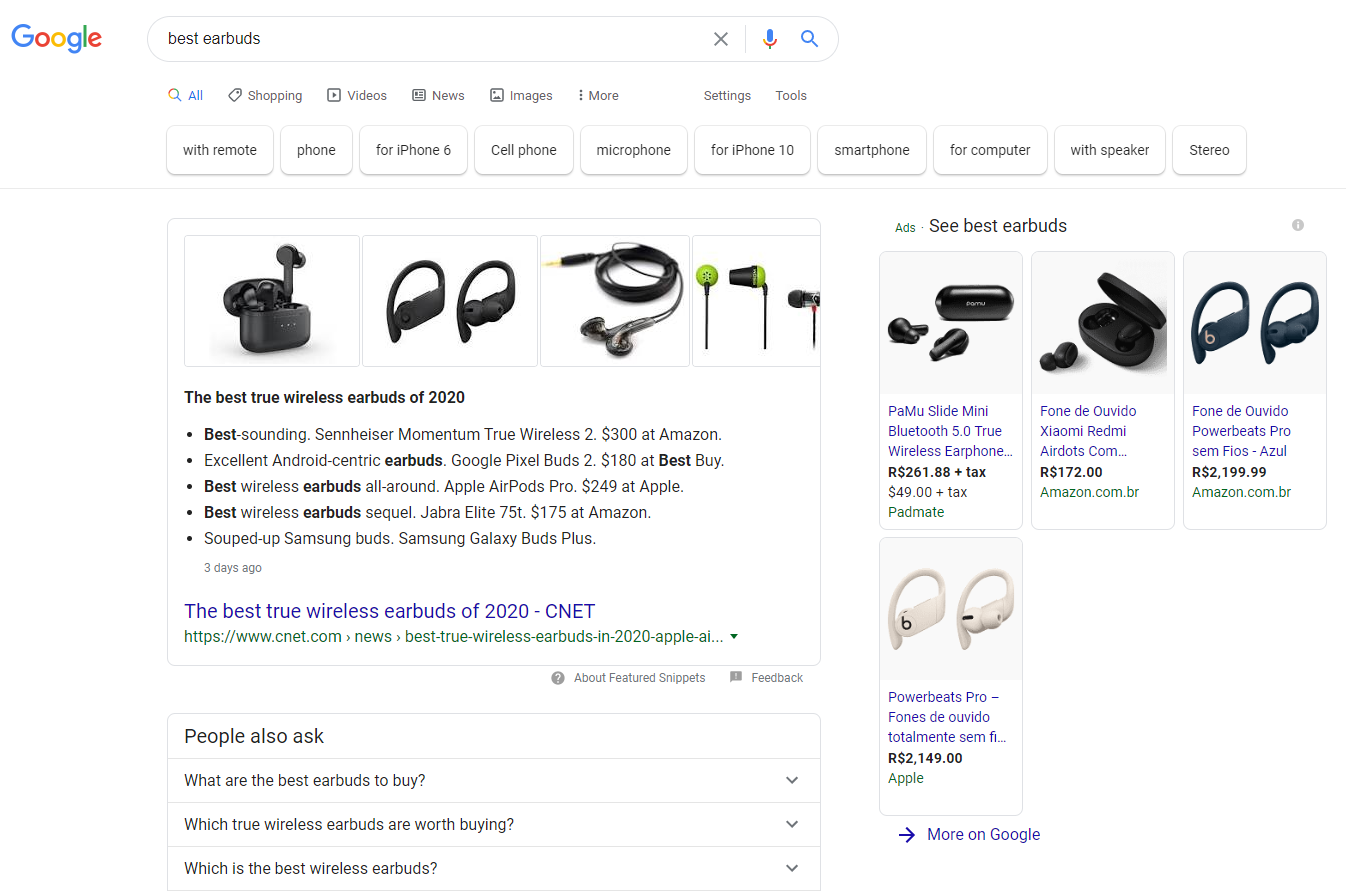

When you research “best earbuds” on Google, this is what you see:

First, there are options of products from Google Shopping, with ads and prices for different earphones for various audiences, needs, and tastes.

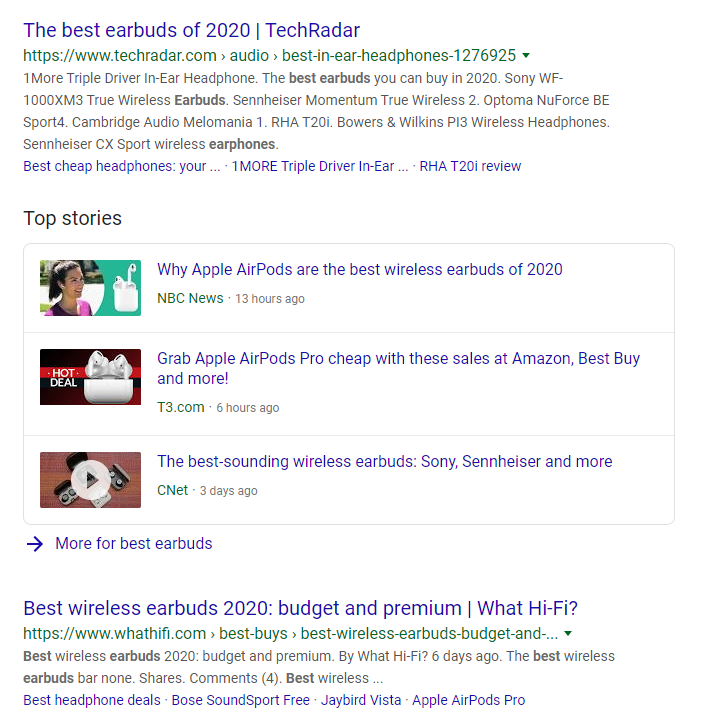

Next, there is a list of sites and blogs with information about different types of earphones and comparisons:

There is no shortage of content about this subject or any other that you can search for. Anyone can create and publish text with no barriers.

The question is how you can make this content more personalized and attractive for your consumer.

Everyone produces content. Millions of publications are posted every day.

The secret though is to create content that targets your ideal customer and no one else. Generic content may produce more traffic, but it will also produce fewer sales.

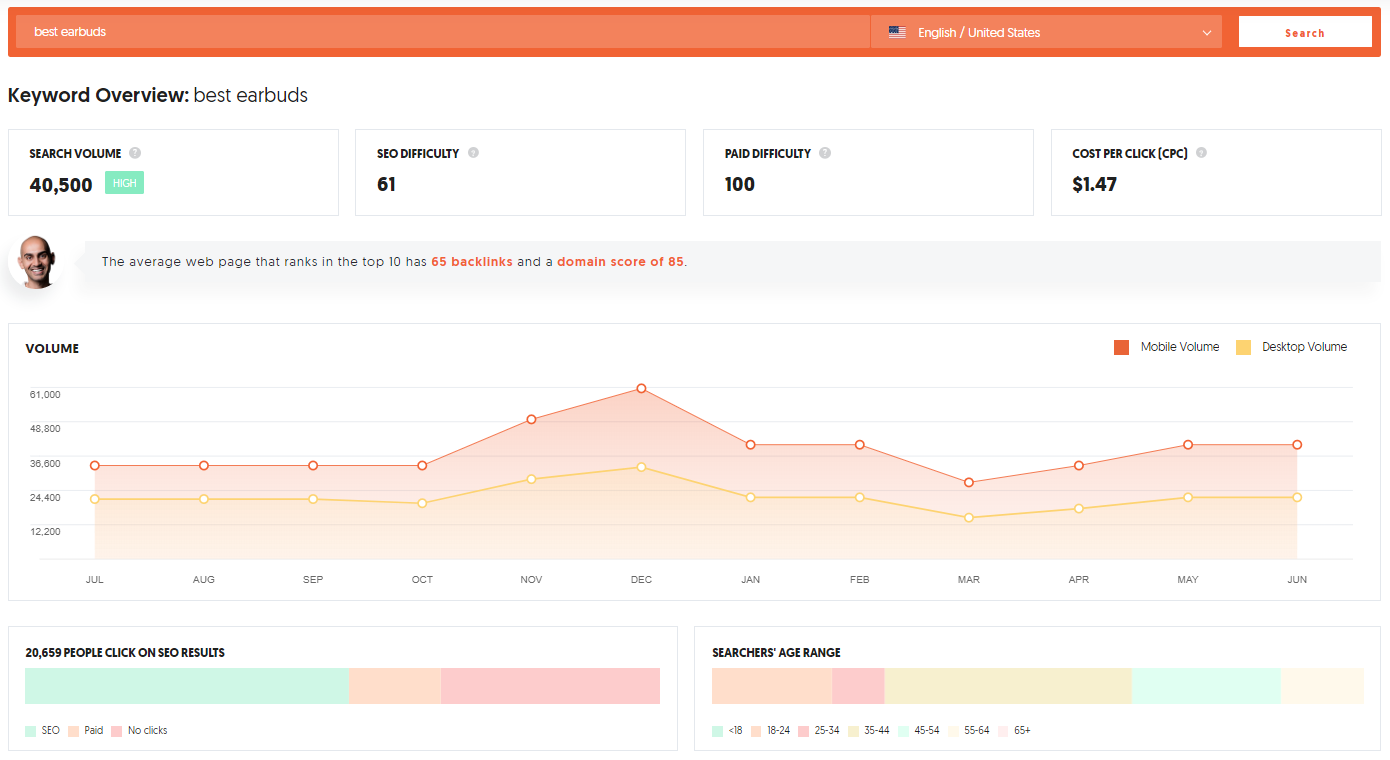

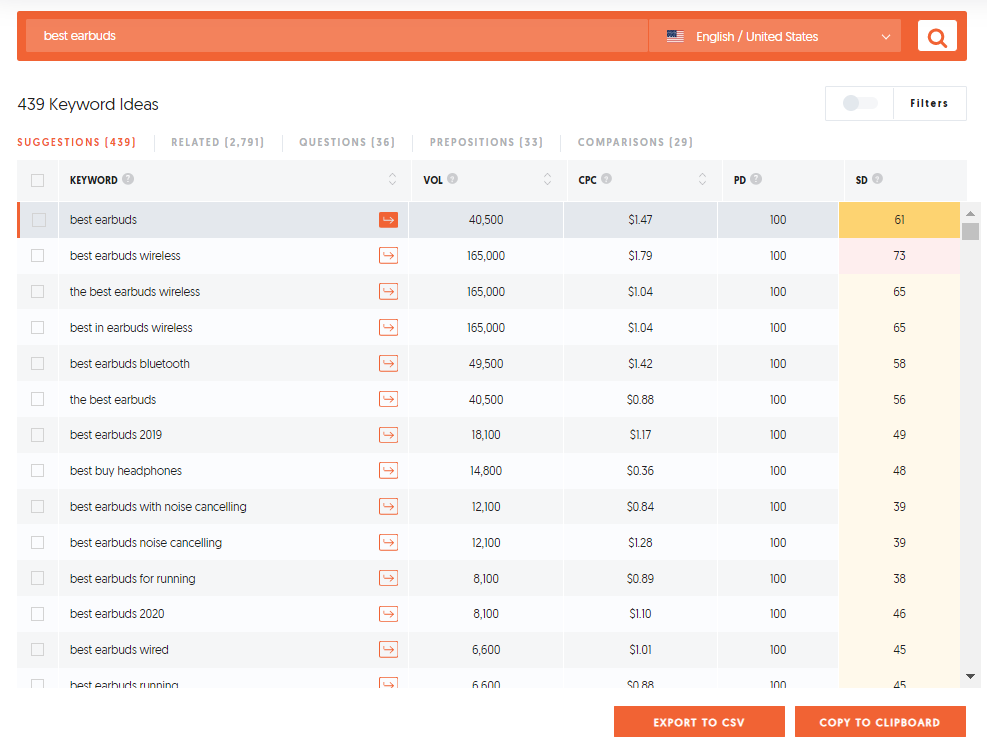

To find what your target audience is searching for, you can use Ubersuggest. Just type in a keyword related to your audience.

From there, on the left-hand navigation, click on “keyword ideas.” You’ll then be taken to a report that looks like the one below.

You now have topics to choose from. Not all of them will be a good fit but some will.

I recommend that you go after the long-tail terms, such as “best earbuds for running” (assuming your target audience is active). The more generic terms like “best earbuds” will drive traffic and a few sales, but it won’t convert as well as more specific terms.

The same goes if you are doing keyword research for the service industry or even the B2B space.

Once you have a list of keywords you want to target, you might be confused as to what type of content you should be creating.

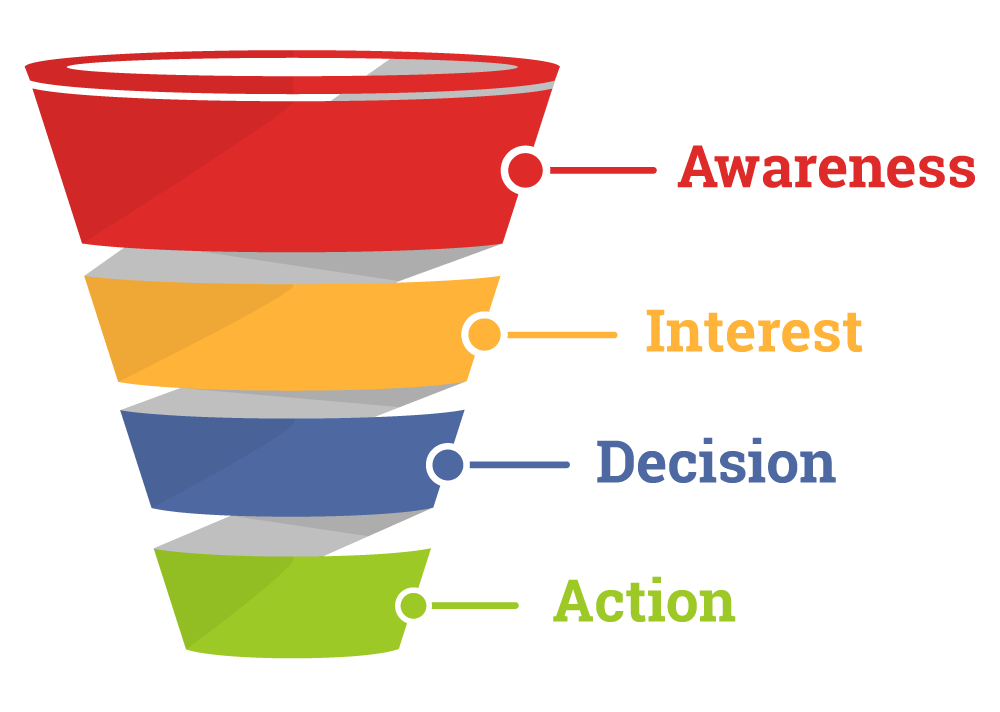

You’ll want to create content based on your funnel. In essence, you want to cover each step of the funnel.

The top of the funnel involves content created for visitors and leads, that is, people that might access your site, blog, or social networks by chance.

When thinking about the top of the funnel, the idea is to create materials with more general subjects, with clear and easily accessible language.

It could be educational content, including clarifications or curiosities about your product or service or something somehow related to your industry.

The middle of the funnel is when the conversions happen. In other words, in this stage, the person who has a problem and the intention to solve it considers the purchase of your product or service.

It’s the middle of the road, but it is not the sale itself, because it’s still only about ideas. It’s in the middle of the funnel that you get closer to your target audience and generate more identification.

Next: bottom of the funnel content. This content focuses more on your product or service.

Here you can introduce details about functions, benefits, and other direct information about your product or service.

It is far more likely to convert here as this particular audience has practically decided to buy already and you are only going to give them a final push.

I’m hoping this article saves you from making the big mistake I made.

But knowing your target audience isn’t enough, though. It doesn’t guarantee success. You still need to create and market your content. That’s why I covered keyword research in this article as well.

Once you create content, you may also want to check out these guides as they will help you attract the right people to your site:

So have you figured out your target audience yet?

The post How to Find Your Target Audience appeared first on Neil Patel.

Location: Curitiba, Brazil

Remote: Yes

Willing to relocate: No

Technologies: C, C++, Python, Flask, Django, Docker, SQL, NoSQL, React, Redis, GraphQL, Serverless, RESTful, Kubernetes, Linux and bash.

Résumé/CV: https://storage.skhaz.io/resume.pdf

Email: rodrigodelduca@gmail.comArticle URL: https://lowkey.gg Comments URL: https://news.ycombinator.com/item?id=23973632 Points: 1 # Comments: 0

Article URL: https://docs.google.com/document/d/1UgK8Lb8vQLPijElrQEl2t0bZqwu28xBdQRKAbjLj21Y/preview Comments URL: https://news.ycombinator.com/item?id=23970217 Points: 1 # Comments: 0

All businesses, irrespective of their sector, can significantly benefit from digital marketing. It allows you to cost-efficiently reach clients, places your brand in the right circles, and positions your business in the same standing as your peers. Moreover, digital marketing platforms – such as your website or Facebook page – can also double up as …

Outer Inc | Product Manager / Sales / Customer Service / Operations / Marketing / Content | Remote & Santa Monica (US only) | Full time | Outer is a venture-backed startup based in Santa Monica, California on a mission to get people outside and inspire healthier, happier, and more fulfilling lives by creating innovative …