Article URL: https://jobs.lever.co/berbix/291c9e7e-e65b-4fe4-ac5d-3b684b5c9d98

Comments URL: https://news.ycombinator.com/item?id=24453778

Points: 1

# Comments: 0

Article URL: https://jobs.lever.co/berbix/291c9e7e-e65b-4fe4-ac5d-3b684b5c9d98

Comments URL: https://news.ycombinator.com/item?id=24453778

Points: 1

# Comments: 0

SEEKING WORK | Remote Location: Turkey; able to move to other countries CV: https://gildedhonour.co Email: alex @ serendipia.email Technologies: various; mostly: Erlang/Elixir, Haskell, Ocaml, Rust, Ruby, Python, C, D, JS, web in general (full-stack, mostly backend) ====== Expert of nothing. A problem creator and also solver. I possess around a decade of experience in IT. …

The post New comment by cascada in “Ask HN: Freelancer? Seeking freelancer? (September 2020)” first appeared on Online Web Store Site.

Location: Turkey Remote: yes Willing to relocate: yes Technologies: various; mostly: Erlang/Elixir, Haskell, Ocaml, Rust, Ruby, Python, C, D, JS, web in general (full-stack, mostly backend) CV: https://gildedhonour.co Email: alex @ serendipia.email ====== Expert of nothing. A problem creator and also solver. I possess around a decade of experience in IT. ====== https://gildedhonour.co/projects

The post New comment by cascada in “Ask HN: Who wants to be hired? (September 2020)” first appeared on Online Web Store Site.

Article URL: https://mux.com/jobs

Comments URL: https://news.ycombinator.com/item?id=24447274

Points: 1

# Comments: 0

The post Mux (YC W16) is hiring to build video for developers appeared first on ROI Credit Builders.

Overtime Episode #402 (Originally aired 08/05/16) – Bill and his roundtable guests Julian Assange, Jeff Ross, Rob Reiner, Rick Santorum and Tara Setmayer answer fan questions from the latest show.

The post Overtime – Episode #402 (Originally aired 08/05/16) appeared first on Buy It At A Bargain – Deals And Reviews.

Article URL: https://www.orangehealth.in/jobs/full-stack-engineer Comments URL: https://news.ycombinator.com/item?id=24438162 Points: 1 # Comments: 0 The post Orange Health (YC S20) Is Hiring Full Stack Engineers in India first appeared on Online Web Store Site. The post Orange Health (YC S20) Is Hiring Full Stack Engineers in India appeared first on ROI Credit Builders.

The post Orange Health (YC S20) Is Hiring Full Stack Engineers in India first appeared on Online Web Store Site.

The post Orange Health (YC S20) Is Hiring Full Stack Engineers in India appeared first on Buy It At A Bargain – Deals And Reviews.

If you own a business, you know word of mouth is vital to your success.

A glowing review from a handful of customers, or even just one influential somebody, can put your business on the map. And a bad review? Well, that can ruin your reputation. Or at least put a good dent in it.

Before you worry about good or bad, you first need a place to get those reviews.

Here are a few questions to ponder:

Let’s take a closer look at Yelp Ads, Yelp’s various other services, and how they may help.

A crowd-sourced business review platform for consumers, Yelp is also an excellent place for businesses to be found online.

Yelp prides itself on being the leading social network for consumer ratings and reviews.

In its earlier days, the platform was solely consumer-focused. It was a place for customers to leave their reviews without any expectation of a business’s response.

Yelp has expanded its platform in recent years with Yelp for Business, which gives business owners like you greater control over your listings and consumer interactions. These features go beyond the free page listing that any business can claim.

Yelp for Business offers two options: self-service and a contract plan.

Self-service is an à la carte offering that allows you to choose from Yelp’s premium business tools. These include:

If you choose the contract plan, you’ll work with a Yelp sales representative to create an advertising program that fits your business’s needs. You pay a monthly fee for all the services included in your plan.

There’s no doubt that Yelp’s higher-than-average cost per click (CPC) and cost per mille (CPM) have garnered some negative press.

So why might you consider Yelp as part of your overall marketing strategy?

Yelp users are at a later stage in the buying cycle than those on Google or Bing. Consumers on Yelp are no longer looking for information about a service or product; they’re narrowing their focus to local businesses to make a purchase.

According to a Nielsen study, a whopping 82 percent of Yelp users intend to buy a service or product. So even if only a few hundred consumers per month see your ad, the likelihood of your ad being displayed to a potential customer is high.

Let’s look more closely at one of Yelp for Business’s key offerings: Yelp Ads.

An advertising service exclusively targeting Yelp users, this feature displays advertisements to consumers on the platform’s search results pages and business pages, via desktop and mobile.

You can create standard or custom ads linked to your business listing.

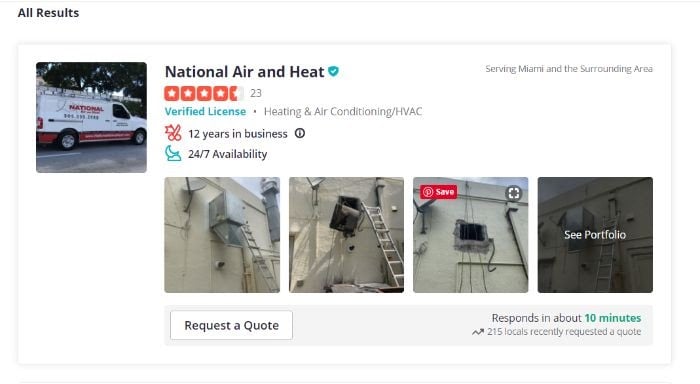

The standard ad looks like any search result on Yelp. The difference is it will appear at the top of search page results and on competitors’ profiles:

With custom ads, you can add text snippets, choose a photo, and select the customer review you’d like to feature:

You can also add value propositions to the bottom of your advertisements, such as sale and deal details or average response time. These are called Business Highlights, and they may be included in your Yelp for Business package or purchased separately.

Don’t forget your call to action (CTA). With this add-on feature, you can customize the CTA buttons on your listing page and at the bottom of your search result listings. This allows you to link directly to a relevant page or form on your website.

Like Google or Bing, your ads will display based on search terms, location, and other parameters determined by Yelp’s ranking algorithm.

Your ads can appear on relevant search result pages or competitor business pages across all Yelp platforms. These include the desktop site, the mobile site, and the mobile application (available on iOS and Android).

Do you think Yelp Ads might be right for your business? Here’s how to get started.

If your business is well established, the odds are good that a listing already exists. To claim an existing listing, follow Yelp’s step-by-step instructions.

If your business doesn’t have a listing, it’s easy to register.

Your profile, also known as a Business Page, is your way to provide accurate information about your business to local consumers. Available fields include business hours, address, phone number, and a list of services and products.

The more accurate your profile is, the greater your chances of converting consumers who find your listing.

As a verified business owner, you can respond to ratings and reviews publicly or privately. While you may be tempted to ignore a negative review, this can have a detrimental effect on how consumers view your business.

If you want to keep your business’s online reputation positive, promptly respond to reviews—both positive and negative.

With 71 percent of consumers saying they’re more likely to do business with a company that has responded to reviews, you can’t afford to miss out on this opportunity.

When you choose the self-service option, you can immediately begin using Yelp Ads and other premium features. If you’d prefer a customized plan, you’ll need to work with a sales representative.

In its early years, Yelp gained popularity in the restaurant industry. But as of June 2020, restaurants make up just 18 percent of businesses on the platform. Shopping isn’t too far behind, with 16 percent of companies categorized as such.

As a local e-commerce business, you, too, can benefit from Yelp’s various features.

If you’re not reaching the right audience, what’s the point?

With Yelp Ads, you can run targeted ads based on consumer location.

As a local business, why might you want to target non-local as well as local consumers? I’m glad you asked!

Let’s say you own a hybrid business, online and in-store. Your physical storefront is in Connecticut, but your dropship warehouse is in Texas.

Instead of mentioning delivery times, a local Connecticut ad might focus on customers’ ability to purchase online and pick up in-store:

Order online. Pick up in-store today.

But a local Texas ad aimed at customers within a few hundred miles of your warehouse location may read:

Delivery within two business days. Guaranteed.

The same can apply to local businesses like florists and bookstores. Even if you don’t ship to locations outside your local area, you can still appeal to non-local consumers with services you do offer.

Let’s say you’re a florist who offers local delivery services in Albany, NY. Your ads to non-local consumers may look something like this:

Call now for free, next-day delivery within Albany, NY.

But how can you advertise to the right audience?

Target larger metropolitan areas around your locale, or use existing customer data to determine the most likely locations for your non-local consumers.

With full control over your business page, include as much relevant information as possible.

What does this look like?

Did your business hours change? Or maybe you’re running a sale over the next week. This insight is the kind of information potential customers want to know.

Don’t have a physical storefront? You still have plenty of opportunities to flesh out your profile. For example, you can update your business’s:

Your customers will appreciate the transparency.

Whether your business is brick-and-mortar or online, adaptability is crucial to success. How are you adapting to the results from your latest Yelp Ads campaign?

You may already use analytics software such as Google Analytics on your website. As a Yelp Ads user, you also have insight into campaign metrics, including:

Keep track of campaign metrics, and use that data to adjust your ads and overall strategy. The key is to take a solutions-based approach to your advertising campaign. Here are a few examples.

You’ve started a new targeted campaign for a nearby metropolitan area. The CTA clicks are the highest you’ve ever seen on a campaign, but the conversion rate is abysmal.

The good news? Your campaign is sending people to your website. The bad news? The likely culprit is the landing page itself. You have three options:

Remember that Yelp Ads is just one step on your journey toward conversions.

Targeted ads can help drive relevant traffic to your website, but if your website is lacking, you’re more likely to lose the conversion.

Now let’s say user views are high, but customer leads are low. What’s the deal?

First, rule out the usual suspects such as out-of-date profile information and poor ratings or reviews.

Next, consider that your potential customers may be drawn away by sponsored ads on your business profile.

One way to combat this is to purchase a package that enables you to remove sponsored ads from your business page. You may also want to place additional value propositions and CTAs higher on your page, so users are more likely to interact with your website before they even see the sponsored ads below.

For many consumers, Yelp is more than just a ratings and reviews platform. It’s the search engine of choice when it comes to finding a local business for their needs.

You may be thinking, “It’s too late in the game to rank anywhere near the first page in Yelp local results. What’s the point?”

But that’s the beauty of Yelp Ads!

You can ensure your listing is at the top of the search page results every time. And you can experiment with the content in custom ads to see how leads respond. And if you need help setting up paid ad campaigns, set up an initial consulting call.

Even if you don’t intend to use Yelp’s premium services, you can get control of your business page and interact with consumers just by claiming your free business listing.

That leaves me with just one question:

Have you taken advantage of your free Yelp business listing yet?

The post An Introduction to Yelp Ads for Local and e-Commerce Businesses appeared first on Neil Patel.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

However, many payroll services offer tax features that simplify the process. From calculating payroll taxes to automatically withholding employee income taxes, there are countless things to consider.

So, it’s important to choose a payroll service that offers essential tax features to make your accountant’s life easier.

Or yours if you do your taxes yourself.

If you offer benefits to your employees, you need a payroll service that helps you effectively manage things like time off, vacation requests, workers’ compensation, insurance, and more.

Furthermore, services with an employee self-service dashboard make this much more manageable. Employees can log in, update their accounts, request time off, and see an overview of their benefits package.

The cheaper options on this list tend to ditch HR features. So, carefully consider what you need against your budget before making any decisions.

If you have salaried employees or a set payroll schedule, most payroll services are adequate. However, if you pay freelancers or contractors on an irregular basis or run payroll more than twice a month, you need to be careful.

Some services offer unlimited payroll processing, while others limit the number of times you can issue payments every month.

So, carefully consider how often you need to send payments when making your final decision.

To further simplify your business processes, it’s crucial to consider the business tools you’re already using to run your business.

It’s important to choose a payroll service provider that integrates seamlessly with those tools. Think about your accounting software, your employee scheduling software, and other essential tools related to payroll.

There are several different services to consider, depending on your business’s size and your specific payroll needs.

So, before we dive into my top recommendations, I want to talk about the different types and how to decide between them.

If you can afford it, hiring someone (either in-house or as a contractor) to run payroll for you is an excellent option. This ensures you find someone who knows how to do it and that they have the time to do it well.

However, you still need payroll software. They may have their own preferences and expertise, which may help you decide which service is right for your business.

With that said, many small businesses don’t necessarily need to hire someone.

The best payroll services make running payroll easy, so anyone on your team can take care of it in a few clicks.

The software as a service (SaaS) model means you pay to use the software. Most service providers charge monthly or annually for this, and as long as you keep paying, you get to keep using it.

Most SaaS tools are cloud-based, meaning you can access it from a web browser anywhere.

However, some also offer desktop applications and mobile apps you install on a specific device.

This is the most common type of payroll service and the most convenient to use because you and your employees can access their accounts from any device, anywhere in the world with an internet connection.

All of the recommendations on this list are SaaS payroll services.

Most payroll services offer enterprise-grade and industry-specific solutions for large businesses. They come with specialized, custom pricing to match the unique needs of enterprise-grade companies.

A software like this could be a SaaS tool or an on-premise deployment, depending on what you need and the company you choose.

Most businesses don’t need this. But if you manage payroll for a large company or find your current solution limited, it may be a good idea to consider an enterprise solution.

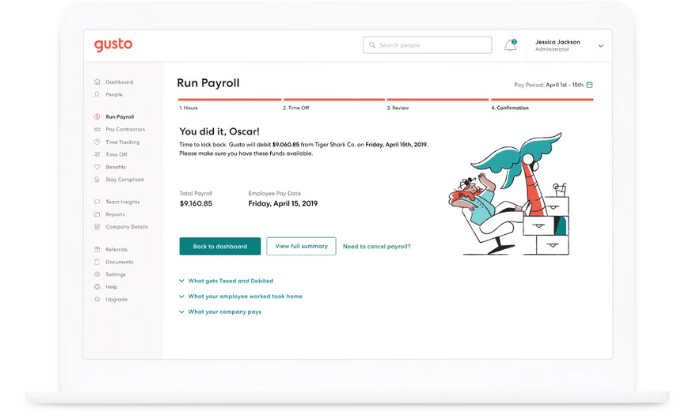

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages, and hundreds of employees may find it limiting.

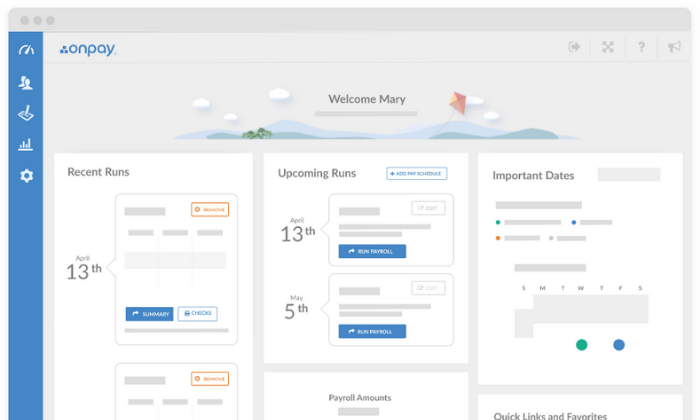

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

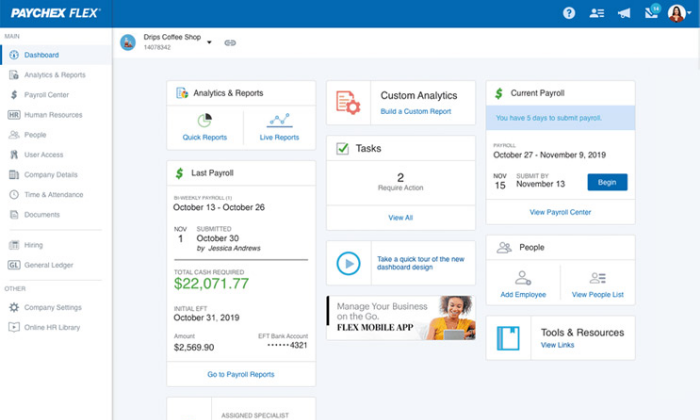

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

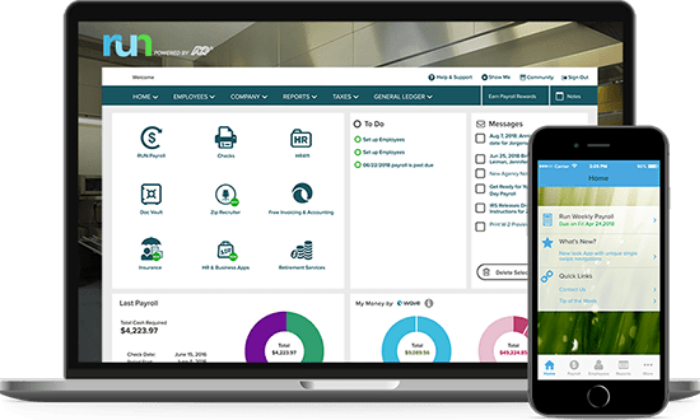

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

For most users, Gusto, OnPay, and Wave are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.

Funding for businesses is needed now more than ever. Funding that does not have to be repaid is always in high demand, as is funding that does not require a stellar credit score. In the eyes of most, and rightly so, that is exactly what crowdfunding is. That is not the crowdfunding definition however. There is so much more to the whole crowdfunding scene.

According to Dictionary.com, the crowdfunding definition is:

“the activity or process of raising money from a large number of people, typically through a website, as for a project or small business.”

It sounds like a great plan, right? It is, until you know that the average success rate of crowdfunding campaigns is 50%. That said, 78% of crowdfunding campaigns reach their goal. Of course, that sounds better. Still, reaching your goal doesn’t guarantee success.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

The thing is, crowdfunding is definitely a viable option, but it is too risky to depend upon as your sole source of funding. For some, it works out to where you can get a whole business off the ground without any other funding source. For most, crowdfunding simply reduces the amount of debt you must take on. Yet, for many, there are not even enough funds raised from such campaigns to get started.

Whether crowdfunding for startups or for an already existing business, it is not a legitimate only option. There needs to be a backup plan for either supplemental funds or full funding. If your credit score is good, there is no worry here as financing options abound. However, a not so great credit score can make a backup plan more difficult.

While not an exhaustive list, these are some of the most popular crowdfunding platforms.

Whichever platform you choose, whether one of these or one not on this list, remember there are a number of crowdfunding resources available to help you on this journey. You just have to look for them.

Now, the best way to find out about crowdfunding is to take a look at some actual campaigns. Here are some of the most notable, the good, the bad, and the ugly.

Now, the best way to find out about crowdfunding is to take a look at some actual campaigns. Here are some of the most notable, the good, the bad, and the ugly.

Pebble actually has several of the top 10 campaigns ever on Kickstarter. Their 2nd campaign is the highest funded campaign to date, reaching over $20,000,000. That’s not too shabby for a goal of only $500,000. They blew it out of the water!

Are they still successful? Well, yeah, but not in the way you may think. They actually sold to FitBit.

This one is not one that most would expect to explode onto the scene the way it did. The FlowHive Indiegogo campaign definitely generated some major buzz. The idea was to find a way to get the honey from bees without harming the bees.

Traditionally, hives are simply broken open to obtain the honey. This process can kill the bees. FlowHive developed a fake hive of sorts, made from reusable plastic. Bees make honey in it, and the honey flows through a spout out into the world. The bees are safe and fresh honey is ours for the taking.

Apparently, beekeeping is growing in interest. This campaign raised $14,000,000. Though they won’t disclose exact numbers, the queen bees claim they are still buzzing and in the black.

The coolest cooler was a super cool Kickstarter campaign that came in at over $13.000,000 raised. The cooler boasted bluetooth and a blender among other things. Investors received a cooler for their donation toward the cause.

This one had some trouble when it wasn’t able to deliver investment rewards as quickly as promised and there was actually a lawsuit. In the end, everything worked out and everyone got their rewards.

This jacket has 10 different elements, including a drink holder and a neck pillow. They raised over $11,000,000 across 2 campaigns. It was a bumpy start, partially because the jacket was available on retail sites before investors even got theirs, but it is still selling today.

As you can see, while mostly successful, even these top campaigns had some pretty serious bumps along the way. You need to be prepared for the same, even if you reach your fundraising goals.

Here are some options for financing. The one that will work best for your business will depend on your credit score, your business fundability, and how much you are able to raise through crowdfunding and other debt-free options.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

These are lumped together because they each require working with a traditional lender and a decent credit score. However, it is important to remember that SBA loans typically require a lower credit score, although still good, as they are government backed business loans. A few examples of SBA loans that work great for starting a business include:

This one offers federally funded term loans of up to $5 million. Funds can be used for expansion, purchasing equipment, and working capital, in addition to startup. Banks, credit unions, and other specialized institutions, in partnership with the SBA, process these loans and disburse the funds.

The funds work well to purchase machinery, facilities, or land. They are generally used for expansion. Private sector lenders or nonprofits process and disburse funds. They are also good for commercial real estate purchases especially.

There is also a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Microloans work for starting a business, purchasing equipment, buying inventory, or for working capital. Community based non-profits administer microloan programs as intermediaries. Financing comes directly from the Small Business Administration.

A credit line hybrid is a form of unsecured business funding. With it, you can fund your business without putting up collateral. You only pay back what you use.

It is not as hard to qualify as you may think. Your personal credit needs to be good, as in at least 680. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have no more than 4 inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

However, if you do not meet all of the requirements, the credit line hybrid is still accessible. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding. This makes a credit line hybrid an excellent option for bad credit business funding.

There are many benefits to using a credit line hybrid. For example, it is unsecured, meaning you do not have to have any collateral to put up. Next, it is no-doc funding. This means you don’t have to provide any bank statements or financials.

Not only that, but typical approval is up to 5x that of the highest credit limit on the personal credit report. Also, it is possible to get interest rates as low as 0% for the first few months. That allows you to put that savings back into your business.

The process is usually fast, especially with a qualified expert to walk you through it. One other benefit is this. With the approval for multiple credit cards, competition is created. This makes it easier, and likely even if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

These are also an option if your credit score is lacking. Remember, lenders change details such as requirements and rates frequently. Be sure to check with the specific lender for the most up to date information.

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Your personal credit score has to be 600 or above.

Upstart is an online lender unlike any other. It uses a completely innovative platform for loans. The company itself questions the ability of financial information and FICO, on their own, to truly determine the risk of lending to a specific borrower. Instead, they use a combination of artificial intelligence (AI) and machine learning to gather alternative data. Then, they use this data to help them make credit decisions.

This alternative data can include such things as mobile phone bills, rent, deposits, withdrawals, and even other information less directly tied to finances. The software they use learns and improves on its own. To be eligible for a loan with Upstart, you must meet the following qualifications:

These are the requirements they list on their website. One independent review said that the requirement for the debt to income ratio is a maximum of 45%. It also says that the minimum annual income has to be at least $12,000.

Check out our trustworthy list of seven vendors to help you build business credit. Conquer any recession!

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

Just like any other online lender, they do have certain requirements to qualify for a loan. For example, a personal credit score of 600 or more. Also, you must be in business for at least 3 years. Annual revenue must be at or exceed $100,000. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Knowing the crowdfunding definition is just the first step. As with most else in the world, a definition isn’t enough. Once you know the crowdfunding definition, the hard part starts. You have to figure out if it is right for you and your business. It may work great, or it may not. Plan for the best and hope for the worst is a great motto to live by here. Do your research on how to run a great campaign, and spend the time necessary to thoroughly research platforms and determine which one will work best for your needs.

Then formulate your backup plan. Do you need loans, a credit line hybrid, or some combination? The time to figure that out is on the front end, before you need it. By the time you see the need is a reality, it could be too late.

The post Beyond a Simple Crowdfunding Definition: What You need to Know Now appeared first on Credit Suite.

Iteratively | Engineers & Designer | Full Time | Remote

Iteratively helps teams who rely on data to capture clean, consistent analytics they can trust.

You will be working in an early-stage but fast-growing VC backed startup with experienced founders.

Tech stack: TypeScript, React, Node.js, GraphQL, Postgres, Redis, AWS.

Senior Software Engineer: https://iterative.ly/careers/senior-software-engineer/

Senior Backend Engineer: https://iterative.ly/careers/senior-backend-engineer/

Senior Frontend Engineer: https://iterative.ly/careers/senior-frontend-engineer/

Product Design Lead: https://iterative.ly/careers/product-design-lead/

I’m one of the co-founders of Iteratively, feel free to reach out to me at patrick@iterative.ly with any questions.