Article URL: https://blog.repl.it/seriesa

Comments URL: https://news.ycombinator.com/item?id=26217145

Points: 1

# Comments: 0

The post Replit (YC W18) is hiring to make computing more accessible appeared first on ROI Credit Builders.

Article URL: https://blog.repl.it/seriesa

Comments URL: https://news.ycombinator.com/item?id=26217145

Points: 1

# Comments: 0

The post Replit (YC W18) is hiring to make computing more accessible appeared first on ROI Credit Builders.

So you have worked hard to build your own personal brand. Is there any way to turn that effort into a source of income? Yes! Here my three favorite ways to monetize your brand: 1. …

The post Three Ways to Monetize Your Personal Brand appeared first on Paper.li blog.

People who grew up in the 1980s and 1990s can’t possibly not know who Bob Ross is. His trademark afro hair and his “happy little trees” were all the rage, turning the “Joy of Painting” …

The post 4 Content Marketing Lessons Bob Ross’ “Happy Little Trees” Can Teach You appeared first on Paper.li blog.

Article URL: https://jupiter.co/careers

Comments URL: https://news.ycombinator.com/item?id=26223519

Points: 1

# Comments: 0

Cyphercor Inc. | Senior Software Engineer | Remote, Kanata, Ontario | Full Time

Cyphercor is a premiere security company specializing in two factor authentication. We build solutions that solve security challenges and deliver peace of mind to our global clients. We are a team of dedicated, thoughtful and forward-thinking people that want to make security accessible rather than get in your way. LoginTC is trusted worldwide by organizations large and small representing virtually every sector of the economy.

We believe all organizations should have access to seamless, user friendly, secure and well supported multi-factor authentication. Anywhere there is a username and password, we add strong authentication and protect organization assets.

Learn more about our flagship product, LoginTC, at logintc.com.

See full roles and apply at https://jobs.github.com/positions/7a03df91-118d-45a3-8cde-6b…

Article URL: https://blog.repl.it/seriesa Comments URL: https://news.ycombinator.com/item?id=26217145 Points: 1 # Comments: 0 The post Replit (YC W18) is hiring to make computing more accessible appeared first on ROI Credit Builders.

Article URL: https://blog.repl.it/seriesa

Comments URL: https://news.ycombinator.com/item?id=26217145

Points: 1

# Comments: 0

The post Replit (YC W18) is hiring to make computing more accessible appeared first on ROI Credit Builders.

Article URL: https://blog.repl.it/seriesa

Comments URL: https://news.ycombinator.com/item?id=26217145

Points: 1

# Comments: 0

The post Replit (YC W18) is hiring to make computing more accessible appeared first on ROI Credit Builders.

Every website needs a hosting plan.

But there’s such a wide range of web hosting costs out there. It’s overwhelming for beginners and experienced website owners alike. How much should you pay for web hosting? Are you overpaying for web hosting? How much does web hosting really cost?

Some plans start below $1 per month. Others start at over $2,000 per month!

To make matters even more complicated, there are 330,000+ web hosting providers on the market today. Trying to find the best web hosting plan for your site without overpaying can feel like an impossible task.

Fortunately, I’m going to let you in on a little secret—you don’t need to overpay for web hosting.

This guide will teach you the truth about web hosting costs. I’ve identified the top costs associated with web hosting and how to evaluate those costs as you’re shopping around. You’ll learn more about how much you should pay for certain web hosting benefits and whether or not you even need specific features in your hosting plan.

Bluehost is my favorite tool for keeping web hosting costs low.

As an industry leader in the web hosting space, more than two million sites worldwide rely on Bluehost for hosting. They have packages for everyone. Whether you’re starting a small personal blog or looking for a new provider to host your business site with millions of monthly visits, Bluehost can accommodate your needs.

To be clear, Bluehost is not necessarily the cheapest web hosting provider on the market. Some providers offer free web hosting or web hosting for less than a dollar. But you should avoid free web hosting at all costs—there is always a catch.

But Bluehost really delivers in terms of value. They offer low entry-level pricing for new websites, and their web hosting services help keep other costs low over time.

Continue below to learn more about general web hosting costs. I’ll even explain how Bluehost can help save you some money in some of these categories.

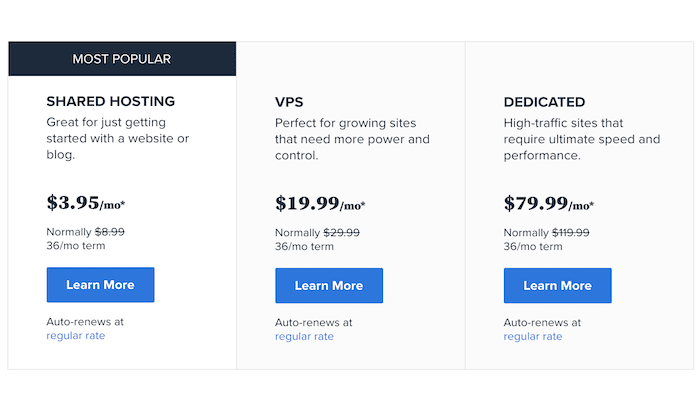

The type of web hosting plan you select will have the most significant impact on the price. This isn’t a hard and fast rule, but generally speaking, here’s the order listed from cheapest to most expensive:

Depending on the hosting provider, cloud hosting and VPS hosting might be switched. But the list above is a good rule of thumb.

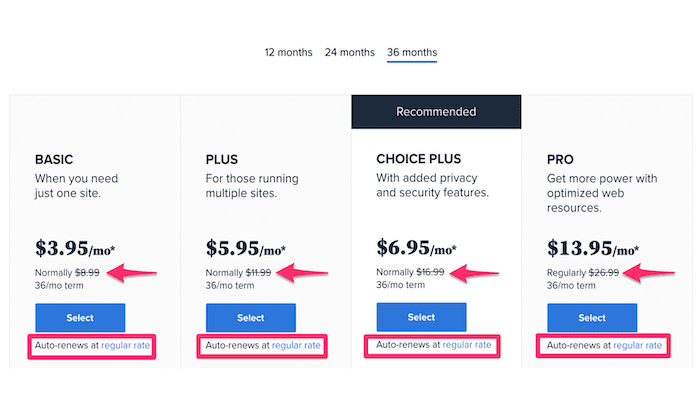

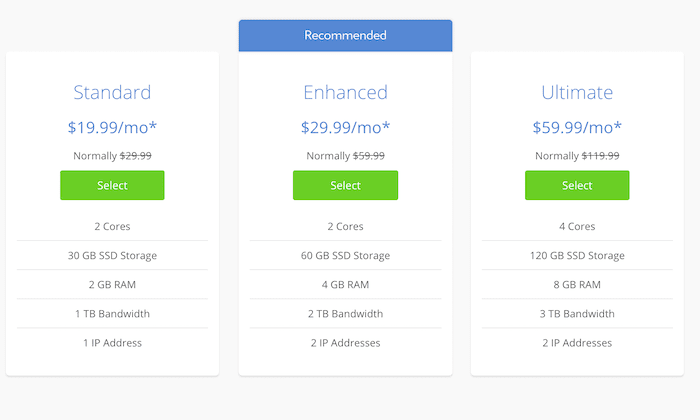

Check out this pricing page from Bluehost as an example:

As you can see, there’s a significant price gap between each type of web hosting. The starting price of a dedicated server is roughly 20 times higher than the shared starting rate.

Unless you’re expecting huge traffic surges out of the gate, the vast majority of new websites should stick to a shared plan. That’s the best way to save some money, and you can always upgrade down the road as your site grows.

Most shared plans can accommodate anywhere from 10,000 to 25,000 monthly visits. Once you start getting into the 50,000 monthly visit range, you should consider upgrading to a VPS or cloud package. I wouldn’t consider a dedicated server until you eclipse 100,000 monthly visits, and even at that point, it’s not 100% necessary.

Generally speaking, you’ll need to commit to a longer-term contract to get the lowest possible rate. This is one of the best ways to save money on web hosting costs, especially as a new customer.

Depending on the provider, plans are typically offered in 12, 24, 36, and up to 48-month contract terms. Month-to-month web hosting isn’t very common. So expect to commit to a year, at a minimum.

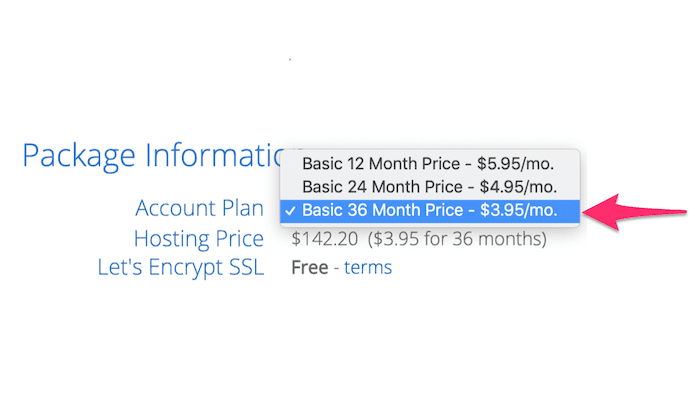

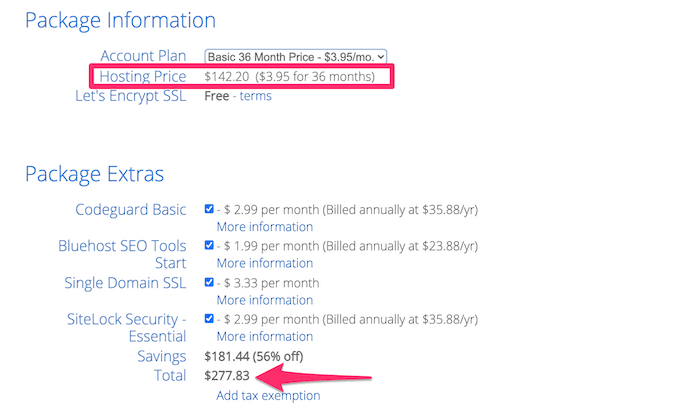

Here’s an example of the different prices offered by Bluehost based on contract length:

As you can see, there’s a $2 per month difference in price between the 36-month contract and the 12-month contract. This isn’t life-changing money or anything like that. But it will save you $72 over the course of three years.

Just understand that you’ll need to pay upfront for your contract in full when you sign up. In this case, $3.95 per month for 36 months actually means $142.20 today.

Locking in a long-term contract also helps you avoid renewal rates. It’s standard practice in the web hosting industry for providers to offer low promotional rates and then jack up the prices when your contract renews.

Don’t get me wrong. It’s not like they aren’t upfront about it. But most people don’t think about the costs they’re going to incur three or four years down the road. Some providers double, triple, or even quadruple your rate upon renewal.

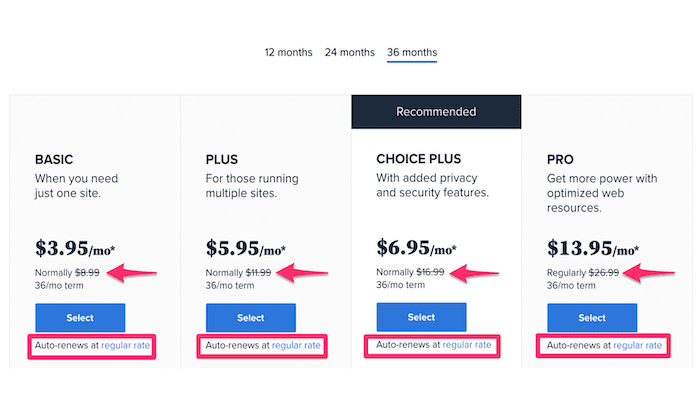

Let’s take a closer look at the shared hosting packages from Bluehost. You can clearly see the renewal rates below each introductory price.

In this case, the renewal rate is more than double the introductory price. Believe it or not, this is actually fairly reasonable compared to some of the other web hosting providers on the market today.

There’s not a whole lot that you can do to avoid this increase. Your best bet is to just lock in a long-term introductory contact. That’s the best way to save the most money.

Once your website has been up and running for a few years, the extra costs upon renewal shouldn’t feel like too much of a burden.

Every web hosting plan allocates a certain number of resources to your website. While this might vary slightly from one provider to another, here’s a basic overview of what to expect:

Generally speaking, the more resources you have, the higher your hosting costs will be.

Here’s a screenshot from Bluehost’s VPS pricing table to illustrate my point:

As you can see, the SSD storage, RAM, and bandwidth increase at each tier. The number of CPU cores remains the same from the Standard to Enhanced plan but doubles at the Ultimate package level.

Some providers offer “unlimited” or “unmetered” bandwidth. Just be forewarned that you’re not actually getting unlimited bandwidth. Unlimited bandwidth doesn’t really exist. Even the best servers have limits. Unlimited bandwidth just means that you can use as much bandwidth within a particular range offered by the provider.

So, how much bandwidth do you need? This isn’t an exact science, but generally, 5 GB of bandwidth can accommodate up to 15,000 or 20,000 visitors per month browsing pages with an average size of 50 KB.

Consider a cloud hosting plan if your traffic varies significantly from month to month. These packages typically allow you to scale resources on-demand to accommodate traffic spikes.

Most web hosting providers offer free setups. This is especially true with entry-level packages, like shared hosting plans. However, if the provider actually needs to take in-depth steps to get you started, you might incur some setup fees.

Setup fees are more common at the dedicated server level, where providers need to physically add hardware components based on your plan requests.

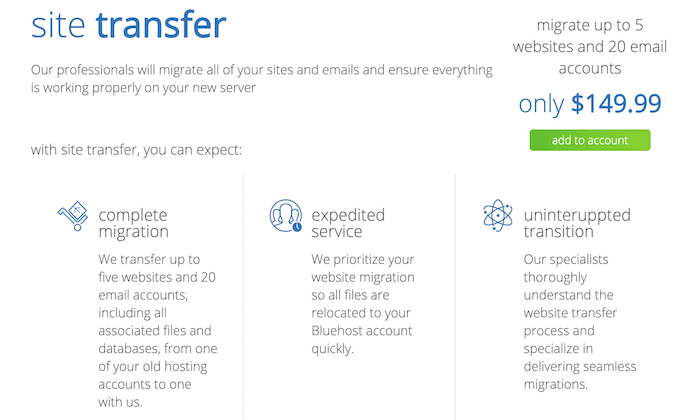

If you’re transferring your website from one hosting provider to another, you might incur a site migration fee as well.

Bluehost charges $149.99 for site transfers. Other providers offer this service for free, but it shouldn’t make or break your decision to use one web host over another.

You can justify the cost by having a professional handle this for you. I don’t recommend trying to migrate a website on your own. Too much can go wrong, so pay the fee and don’t think twice about it.

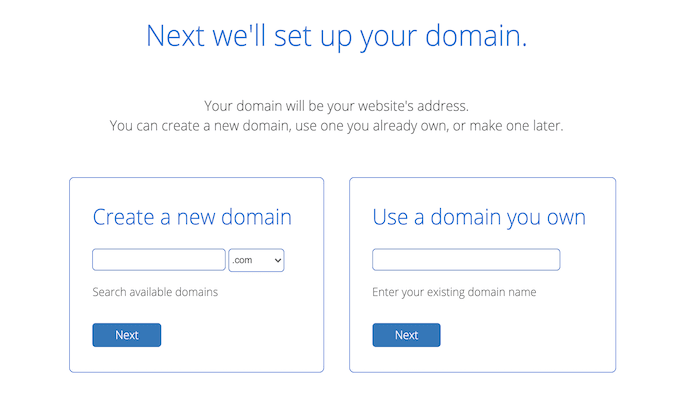

Normally, I wouldn’t mix domain registration and web hosting. It’s usually in your best interest to get your domain name from a domain registrar and your hosting package from a web hosting provider.

That said, new websites can bundle the two, especially through Bluehost. All new Bluehost customers get a free domain for one year with a web hosting subscription.

It’s cheaper long-term to get your domain directly from a registrar. Bluehost’s domain renewal rates will be a bit higher. But overall, the added cost is pretty marginal.

Most new website owners will just find it easier to bundle everything under one roof, as opposed to using different platforms for a domain name and hosting plan.

I don’t care what type of website you have; security needs to be a top priority for everyone.

There are a handful of different security measures that should be added to your site. I’m referring to things like network protocols, spam filtering, malware scans, firewalls, and more. But you can get additional security directly from your web hosting provider.

At a minimum, every web host should be offering you a free SSL certificate. That’s become an industry standard, and I wouldn’t recommend any host that charges an extra SSL fee.

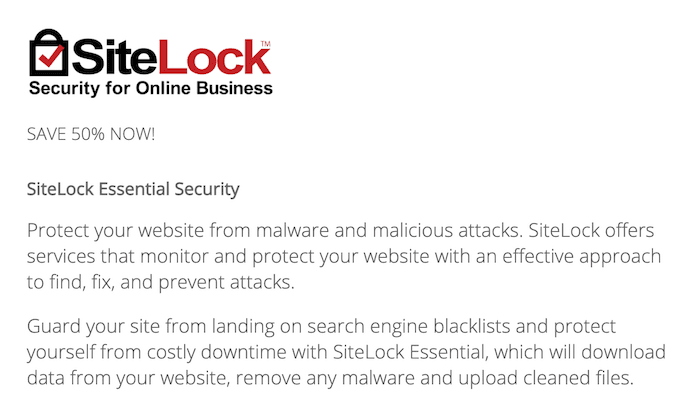

The exact security options vary from provider to provider, but here’s an example from Bluehost.

For $2.99 per month, SiteLock Security Essential gives you automated malware detection, unlimited page scans, blacklist monitoring, file-level scanning, automatic malware removal, plugin scanning, weekly reports, and more.

Alternatively, you could always skip this and beef up security on your own. If you’re using WordPress, there are plenty of great WordPress security plugins to consider.

Managed web hosting has become increasingly popular over the years. The term has different meanings depending on the plan and provider you’re using, but in short, a managed web host will take care of all the server operations behind the scenes. This typically includes setup, maintenance, server monitoring, support, updates, and more.

Alternatively, high-traffic websites could consider a managed WordPress plan.

The entry-level managed plan from Bluehost starts at $19.95 per month and can accommodate up to 50,000 visitors per month. These plans scale all the way up to sites with 500,000 monthly visitors.

If you’re using a dedicated server, you definitely need to think about the maintenance costs. Dedicated servers are typically offered with managed or unmanaged options.

The unmanaged plans will be cheaper if you’re just comparing rates side-by-side. But you’ll be responsible for the cost of maintaining and updating the server on your own. Unless you’re really technical or have a dedicated IT team, it’s generally better to just get a managed plan from your hosting provider. Long-term, it’s cheaper than managing a server on your own.

Every web hosting provider makes an effort to sign you up for as many different services as possible. Navigating through upsells is just part of shopping around for web hosting.

With that said, you can skip the vast majority of add-ons and upsells offered by web hosts, especially the ones that aren’t directly tied to web hosting.

Here’s an example to show you what I mean:

The web hosting costs highlighted above come to $142.20. But if you add-on all of the package extras to your plan, your total becomes $277.83. That’s a big jump from an advertised price of $3.95 per month.

Believe it or not, Bluehost actually doesn’t even offer that many extras compared to other hosting providers. Some will offer double or even triple this amount.

The key here is knowing what to select and what not to select.

A single domain SSL isn’t necessary, as you’re already getting a free Let’s Encrypt SSL with your plan. You don’t need the marketing or SEO tools. SiteLock Security Essential is something we discussed earlier.

If you’re not going to get security features elsewhere, adding it on now is a good choice.

Codeguard Basic is another 50/50 option. It includes daily backups, one-click restores, and other helpful tools. But you could always get this later on from other plugins or services.

Downtime is an indirect cost of web hosting. It’s not something that you’ll see on your bill.

But every time your site goes down due to a server crash or network error, it costs you money. The type of website you have and your monetization strategy will dictate exactly how much money you’re losing.

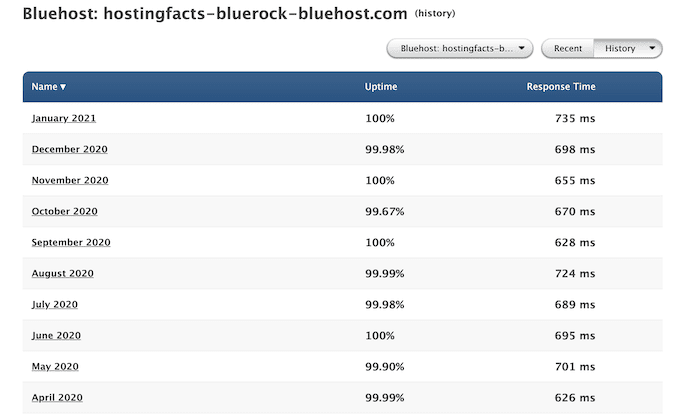

You can use uptime monitoring from Pingdom to see how different web hosts stack up with each other. Here’s an example showing Bluehost’s uptime stats over the last ten months.

Don’t just look at an uptime guarantee from a hosting provider and assume you’re in good shape. Those guarantees typically come with all types of contingencies. In the event that they fail to meet the uptime agreement, you’ll just get credit off of a future bill.

But that $0.50 or $1.25 credit two years from now isn’t worth the cost of losing customers today.

Always look at reviews to see what real people have to say about the uptime reliability of different web hosting providers. Frequent downtime can be costly long-term.

What’s the truth about web hosting costs? You don’t need to pay a fortune.

Your total cost to host a website will depend on several different factors. I’ve identified the top ten costs associated with web hosting above. As you can see from this list, it’s actually fairly easy to keep hosting costs low if you understand what to look for.

Bluehost is my favorite way to save money on web hosting. So if you sign up with them, you’re on the right track. You’ll even get a free SSL certificate and free domain name.

The post The Truth About Website Hosting Costs appeared first on Neil Patel.

Got budget gaps in your business? If there’s anything that 2020 has taught us, it’s that what we think is a sure thing, just might not be. That includes the cash flow of a business.

Budget and funding gaps are large for newer businesses. If you don’t have a lot of clients, you might offer them better terms to attract their business. Sweetening the pot can help overcome a client’s initial skepticism. So just like a starter vendor, you might be offering Net 30 terms.

Offering Net 30 or Net 60 or even Net 90 terms is a great strategy to develop business relationships. But you end up with a lot of time between providing your good or service and getting payment for them. But in the meantime, your business’s bills have to be paid, and you have to make payroll no matter what.

An MCA technically isn’t a loan. Rather, it is a cash advance based upon the credit card sales of a business. A small business can apply for an MCA and have an advance deposited into its account fairly quickly. So you can offer Net 30 terms, but not have to wait a month for payment.

A merchant financing program is ideal for business owners who accept credit cards and are looking for fast and easy business financing. An MCA program is designed to help you get funding, based strictly on your cash flow as verifiable per your business banks statements. As a result, lenders in general will not ask for any burdensome document requests.

Not asking for a lot of documents, is not like what most conventional lenders demand. These can include financials, business plans, and resumes. Best of all, you can get approval regardless of personal credit quality. You don’t even need collateral. Your business’s credit card receipts and business bank statements do all the talking.

Merchant cash advance providers weigh risk and credit criteria differently from how a banker does. An MCA provider looks at your company’s daily credit card receipts. This is to determine if your business can pay back the funds in a timely manner. In essence your small business “sells” a portion of future credit card sales, this is in exchange for immediate payment.

Rates on a merchant cash advance can be much higher than other financing options. Depending on the company, rates can end up being prohibitively high. As a result, it’s crucial understand the terms you’re being offered. That way, you can make an informed decision about whether an MCA is worth it.

To determine approval, the lender will review 3 months of your bank and merchant account statements. All the lenders are looking for is consistent deposits. They want to see deposits showing your revenue is $50,000 or higher per year. They will also verify that you have been in business 6 months or more.

Lenders are also looking to see that you don’t have a lot of Non-Sufficient-Funds (NSFs) showing on your bank statements. They want to see you don’t have a lot of chargebacks on your merchant statements. And they want to see that you have more than 10 deposits in a month going into your bank account. In essence, they want to see that you manage your bank and merchant accounts responsibly. And they want to see that have a decent number of consistent credit card transaction deposits each month.

The small business owner and MCA provider agree on the advance amount, payback amount, holdback, and term of the advance. Once an agreement is made, the advance is transferred to the business’ bank account. This is in exchange for a future percentage of credit card receipts.

Each day, an agreed upon percentage of daily credit card receipts are withheld, to pay back the MCA. This is called a holdback. The holdback will continue until the advance is paid in full.

A business that uses a merchant cash advance will typically pay back 20% – 40% or more of the amount borrowed. This percentage is called the factor rate. There’s a difference between the holdback amount that a small business pays every day, which is a percentage of sales receipts, versus the repayment amount for the entire advance.

There could, for example, be a holdback of 15% and a repayment of 30%. It’s important for business owners to understand this distinction.

A holdback percentage is based on the amount of funds a business gets, how long it will take to pay back the money, and how big monthly credit card sales are.

Access to a business owner’s merchant account eliminates the collateral requirement needed for a traditional small business loan. Since repayment is based upon a percentage of the daily balance in the merchant account, the more credit card transactions a business does, the faster they can repay the advance.

One great plus when it comes to MCAs, is they are based on percentages. So if transactions are lower on any given day, the draw from the merchant account will also be less. This means that during times of slow business, the business’ payback is relative to incoming cash flow.

Our merchant financing program is perfect for business owners with credit issues. Lenders are not looking for, nor do they require good credit to qualify. You can even get approval with severely challenged personal credit and low credit scores. You can get approval regardless of personal credit quality, even if you have recent derogatory items and collections on your credit report.

This is one of the best and easiest business financing programs in existence, that you can qualify for even if you have personal credit problems. You can get approval for as much as $500,000 in financing, with no collateral requirements and bad credit.

You can get pre-approval for our merchant financing program within 24 – 48 hours. You can get your formal approval and funds within 72 hours of submitting your application. Our clients love this program partially due to how easy it is to apply and get approval and how FAST you get your funds!

Loan amounts and qualifications depend on credit card statements. Go from application to funding in 3 days or less. Get approval for additional future funding.

Easy merchant statement review for approval. No application fees. Get approval with bad credit. There are no collateral requirements.

The only financials you need are 3 months of bank statements. Get approval with revenues of $50,000 or less. Starter programs are also available. Get 3 – 36 month terms. Get approval for up to one month’s revenue with our proven solution.

Over 80% of our clients come back for even more financing, after their initial approvals with our Revenue and Merchant Financing programs. Typically within 3 – 6 months of approval, you will get an opportunity to get even more money than you got before. And all you will need to get approval for more funding is, a quick review of your last 3 months of bank statements

You can get your money in your bank account within 24 hours or less! We also provide you access to merchant credit lines. So you can have consistent access to cash. Our merchant financing program helps you rapidly grow and scale your business. You will have ongoing access to receive more and more funding easily and very quickly when you need it!

Many businesses have budget gaps due to giving better terms to their clients, or for any other reason. Merchant cash advances are one excellent way to bridge the money gap. Understand the numbers and know what you’re getting yourself into. Always ask questions if you don’t understand something. And check out Credit Suite’s merchant financing program for fast money. Let’s take the next step together.

The post How Do Merchant Cash Advances Work? appeared first on Credit Suite.