Month: June 2021

Inflation and Your Small Business

Inflation Can Affect Your Small Business – But is it Coming at all?

How does inflation affect small businesses like yours? And is it really on the horizon, anyway? Experts aren’t sure.

Prices are starting to go up. Wages are sometimes keeping up. Everyone has experienced it. You’ve undoubtedly noticed that fuel prices go up and down, or a movie costs more than it used to. And if you’ve had to have construction done, you may have noticed the price of lumber rocketing up.

It’s not your imagination. According to US News and World Report, “Prices for materials and components used in construction spiked 4% in May from April and were up over 17% from a year earlier, according to the Labor Department. Manufacturers paid 2% more last month for materials than they did in April and 21% more than in May 2020. Also in the mix: intense competition for workers that has some companies paying more to attract new hires and retain current staffers.”

What is Inflation?

According to Forbes, “Inflation occurs when prices rise, decreasing the purchasing power of your dollars.”

Seems simple enough. But it goes beyond a few higher prices on one or two goods or services. Rather, it’s an across the board increase in prices, across a sector or an industry.

In small doses, it’s actually good for the economy. It pushes consumers to buy, rather than save. Because holding onto funds means their value will diminish over time. Buying, of course, keeps small businesses viable.

Is Inflation Really Going Up?

You’d better believe it. Check out this chart from YCharts. “The US Inflation Rate is the percentage in which a chosen basket of goods and services purchased in the US increases in price over a year.”

Per the chart, June of 2020 had a rate of 0.65%. But about a year later, this same metric is up to 4.99%. Particularly concerning is the fact that the rate has leapt up in the last few months – from 2.62% in March 2021, to the near-5% recorded last month.

That YCharts page goes back to April of 2017. The rate has stayed at 2.95% or less until April of 2021, when it was already over 4%. That was a historically large increase.

How Does it Affect Small Businesses?

Beyond price increases for goods and services, it can also affect how you price your own goods and services. Whether your business serves consumers, other businesses, or the government, it doesn’t matter. Inflation will cut into your profit margin. That is, unless you raise your prices. And then your business customers raise theirs, thereby perpetuating the cycle. Or your government clients print more money or borrow and rack up municipal debt. Or your individual customers buy less. They may even take their business elsewhere.

Demolish your funding problems with 27 killer ways to get cash for your business.

What if There Was Another Way to Get a Cash Infusion Without Having to Jack Up Your Prices?

What you need is business capital. This is the money or wealth needed to produce goods and services. In the most basic terms, it is money. All businesses must have to buy assets and maintain their operations. Business capital comes in two main forms: debt and equity.

Getting capital for business financing should be your concern. That’s regardless of what the economy may be doing.

Business financing is the act of leveraging debt, retained earnings, and/or equity. Its purpose is to get funds for business activities, making purchases, or investing. This is the act of funding business activities.

With lower retained earnings and perhaps less equity, it’s time to leverage debt.

How to Request a Credit Line Increase to Keep up with Inflation

Start off by understanding that some credit cards and lines won’t be eligible for an increase. For example, secured business credit cards are limited by how much you put in to secure them. Can you get a higher credit line with a secured credit card by putting in more money to secure it? It depends on the issuer.

Another class of cards and lines that tend to not be eligible for increases? New credit cards and lines. Providers like Capital One won’t increase a credit lines for new accounts opened within the past several months.

Providers may also want to allow for some time between credit line increase requests. But the amount of time in between isn’t a standard in the credit industry.

Requesting a Credit Line Increase

Let’s operate under the assumption that the standard reasons for denial do not apply. How do you actually ask for a credit line increase?

First off, you need to approach this task from a position of strength. This means paying off your balances as much as possible. It also means waiting for at least one billing cycle to elapse so the newer, lower balance will show up.

Reporting all your income will also be helpful. Because your card or credit line issuer only wants to know if you can pay them back.

The provider may very well ask why you’re looking for a credit line increase. And your provider may ask for some documentation, such as annual revenue and expenses. Having this information at your fingertips will go a long way toward getting to a ‘yes’.

Demolish your funding problems with 27 killer ways to get cash for your business.

Asking for a Credit Line Increase – How to

In general, you can make your request either by phone or online. At Bank of America, for example, you sign into online banking. Go to Account Summary, then Card Details, and then Request a credit line increase. Or you can call their Customer Service Info Line, at (800) 732-9194.

Don’t ask for an enormous amount. If your credit limit is currently $10,000, you’re most likely not going to get an increase to $50,000 all in one shot. But an increase to $15,000? If your balances are good, then it’s very possible.

Credit Line Increases: the Pros and Cons

The most obvious pro is getting access to more debt for business financing. But recognize one major con – the likelihood of a hard inquiry. Hard inquiries can bring your credit score down. But if you truly need the increase and have a good credit score to begin with, then requesting an increase is a good idea. The positives, in this instance, would outweigh the negatives.

Demolish your funding problems with 27 killer ways to get cash for your business.

More Business Financing Choices to Combat Inflation

Most of our business financing options can help address the inflationary elephant in the room. Consider our Credit Line Hybrid. You can get several business credit cards, applied for at the same. They provide 0% rates and cash out capability. If you or a credit partner have good personal credit scores, then these are within reach.

Address Inflation Head-on By Borrowing NOW

If interest rates are climbing, borrowing today could say money over borrowing tomorrow. This goes for more than credit cards and lines, but also business loans.

Or Invest NOW

Keeping rapidly depreciating cash on hand won’t do you any favors. Of course you will always need some cash on hand. But if you can pump some of it into an exchange-traded fund or a mutual fund, you can be putting your surplus to work.

But two caveats apply. One, past performance is never a guarantee of future results. And two, always talk to a financial professional before making any investments.

Takeaways

The economy is a little like the weather. It will change, whether we want it to, or not. But you can take some steps to help your small business, both now and in the future. Your small business can get the upper hand over inflation, and come out stronger than ever.

The post Inflation and Your Small Business appeared first on Credit Suite.

How and Where to Get a Women Owned Business Grant

A grant is a great way to fund a business. It’s free money. You don’t have to pay it back. However, grants are highly competitive, so you need every advantage you can get. In addition, you need a backup plan in case you do not get it, or if it’s not enough money. Here are some tips to help increase your chances of getting a women owned business grant.

Learn business loan secrets and get money for your business.

Top Tips to Increase Your Chance of Landing A Women Owned Business Grant

All grant programs are highly competitive. Still, they are still worth the effort to apply. Truly, there really isn’t anything to lose except time and application fees, which are typically minor. A women owned business grant will rarely be enough to fully fund a business. Yet, it may supplement other funding types. Not only that, but often winners receive other support such as mentoring and networking opportunities.

5 Hacks to Increase Your Chances of Winning a Women Owned Business Grant

Of course, there are no guarantees. But, there are some things you can do to increase your chances of winning a grant.

1. Don’t Waste Your Time on the Wrong Grant

Most grant application processes take a significant amount of time and preparation. Don’t waste your time applying for every women own business grant out there. Be intentional to find those that you have the best chance at winning. For example, if you own a restaurant, don’t apply for a grant meant for tech businesses. Rather, pay attention to the requirements and only fill out applications for those that you qualify to win.

2. Do Your Research

2. Do Your Research

Take the time to study up on the history of the program, past winners, and anything else you can think of to learn about the grant. There are a few ways this can help you. First, you may be able to see what past winners have in common and aim to show the decision makers you have similar qualities. It can give you direction when it comes to working on your application materials.

But also, if there is an interview, it can give you background knowledge. This can only help you.

3. Have a Complete Business Plan

Most people think of business plans more in terms of applying for a loan. However, it is vital to grant applications as well. You want to convince the award committee that your business is worth it. Honestly, having a complete, professional business plan goes a long way toward that goal.

4. Customize Your Business Plan for the Grant

4. Customize Your Business Plan for the Grant

There is no need to use the exact same plan, verbatim, for each grant application. You’ve done the research. You’ve seen who won each grant in the past. Now, it’s time to show what you know, and why you should be next. Make certain to include information that the grant specifically asks for. If you share any qualities of previous winners, slip that in. Show them what other funding sources you have. Tell them how you intend to spend the grant funds if you win. Put your best foot forward, this is your time to shine.

5. Don’t Let Time Run Out

Start now researching grants you may be interested in. Pay attention to when applications open and close, and don’t let something simple knock you out of the running. With competition being so fierce, application acceptance after a deadline is virtually unheard of. Also, some grants have more than one deadline with different aspects of the application being due at different times. Pay attention.

Where to Find a Women Owned Business Grant

Now, you need a women owned business grant, or a few, to apply for. Start with these, but the buck doesn’t stop here. There are plenty of local and state options, as well as grants that are not limited by location or type of business owner. There are minority business grants that you may qualify for as well.

SBA Women’s Business Centers

In addition to helping with loans, the SBA Women’s Business Centers also help women entrepreneurs get access to other types of funding. Some lend money or award grants directly, while others help connect women entrepreneurs with financial institutions. Take a look at their website to find out more on how to apply for women owned business grants through this network.

Eileen Fisher Women Owned Business Grant

The clothing brand Eileen Fisher hands out $100,000 per year to 10 women-owned businesses. To qualify, a woman must have at least 51% ownership, and the business must be in operation for at least three years. Also, it must bring in less than $1 million per year in revenue and have a focus on environmental or social change.

Amber Grant

The Amber Grant awards $500 to $1,000 per month to a woman-owned business. One of the recipients also receives an additional $10,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee.

The Amber Grant awards $500 to $1,000 per month to a woman-owned business. One of the recipients also receives an additional $10,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee.

Cartier Women’s Initiative Award

The Cartier Women’s Initiative Award is $100,000 for first place and $30,000 for second place. They award the grant to 18 female business owners from around the world each year. Women business owners who are just getting started may qualify.

All of the finalists get to attend the INSEAD Social Entrepreneurship 6-Day Executive Program (ISEP). They will also have the opportunity to participate in workshops on entrepreneurship and business coaching seminars, as well as be exposed to networking opportunities.

Tory Burch Fellowship Program

The Tory Burch Fellowship Program offers an amazing opportunity for up to 50 winners. An applicant must be a woman-identifying entrepreneur with at least a 51% stake in a qualifying business, or the largest equal stake if it is owned 100% by women.

Applicants must also speak proficient english and be a legal U.S. resident. Nonprofits, ventures in the idea stage, and franchises or subsidiaries are not eligible.

Applications open in the fall, and winners receive a $5,000 grant in addition to a one-year fellowship that includes virtual education, workshops, and guidance.

Learn business loan secrets and get money for your business.

Women Founders Network Fast Pitch Contest

The Women Founders Network offers this unique opportunity each year to female founders. What makes it different is the leadership, coaching, and in-kind sponsorships that are included in addition to the cash prices. The contest also draws the attention of investors, which offers the opportunity to raise even more capital.

A Women Owned Business Grant is Not The Only Answer

While these programs work to meet the unique challenges faced by women business owners, sometimes it just isn’t enough. You need a backup plan. Here are some other funding options that can supplement grant funds, or even replace them if your business isn’t chosen as a recipient.

some other funding options that can supplement grant funds, or even replace them if your business isn’t chosen as a recipient.

Grameen

Grameen is one of the few lenders that offers microloans specifically for women. The loan amounts range from $2,000 to $15,000, and they also offer financial training and support.

The Credit Line Hybrid

The Credit Line Hybrid is a form of unsecured business financing. It is available to pretty much anyone for any type of business expense. You can use it for real estate, equipment, working capital, and even startup expenses. There is no down payment, and you do not have to provide income documentation. It is completely no-doc financing. A credit score of 680 or higher is necessary, and there are some other requirements. However, if you do not meet them you can take on a credit partner that does.

You can get up to $150,000, and often interest rates are as low as 0% for the first 6 to 18 months.

Learn business loan secrets and get money for your business.

SBA Enterprise Loans

You need to have collateral worth up to at least 50% of the loan amount, but you only need a FICO of 620. There also can be no bankruptcies in the past 4 years. Only for profit companies qualify, and they must have positive trends in sales growth. Generally amounts are available of up to $12 million with terms up to 25 years.

The BEST Way to Ensure You Can Always Get the Business Funding You Need

Remember, you are always going to need funding. Furthermore, grants are not going to be the answer every time. Loans, credit lines, and other financing options are likely going to be necessary throughout the life of your business.

The best way to ensure you have access to these when you need them is to make certain your business’s overall fundability is in order. The thing is, that isn’t as easy as it may seem. There are over 100 factors that affect fundability.

Unfortunately, it’s a complicated puzzle to piece together. Thankfully, you can save time and money by working with a business credit expert. They can help you evaluate your current fundability, help you improve it if necessary, and guide you toward the best funding options for your business right now. Get started with a free consultation with one of our business credit experts today.

The post How and Where to Get a Women Owned Business Grant appeared first on Credit Suite.

Best SSL Certificate Provider

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

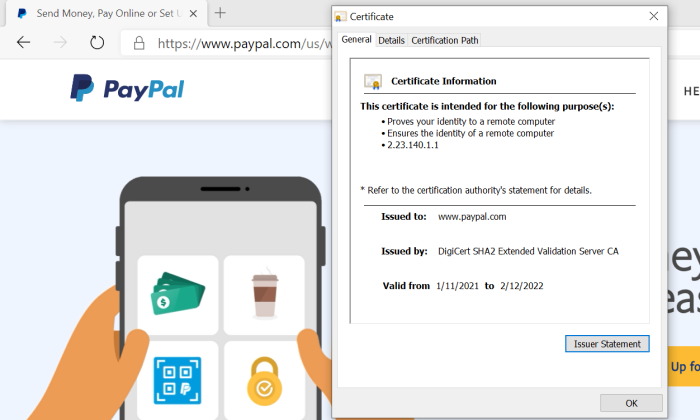

You want people to trust your site, and that requires a valid secure sockets layer (SSL) certificate.

SSL certificates are issued by a certificate authority (CA) and they build trust in two important ways:

- The CA authenticates the identity of the organization that wants the certificate. This way, people know that they are in fact sending their information to PayPal, for example, and not someone who has set up a fake PayPal site.

- The SSL certificate encrypts the data travelling between your website and visitors. This way, potential attackers can’t steal the information people share on your site, such as their username, password, or credit card number.

Today, all of the popular browsers like Google Chrome will warn users anytime they attempt to visit a site without an SSL certificate. It’ll say something like “This site is not secure,” or “Any information you share may be vulnerable to attackers.”

Would-be visitors are going to head to a different site where they feel comfortable entering their credit number. I know I would.

There are a lot of different CAs to choose from and they sell a range of SSL certificates designed to help companies establish their online identity and protect their customer’s privacy.

For some people, going with a free SSL certificate is going to be fine. All that’s required is a quick demonstration that you control a particular domain. These are known as DV (domain validated) SSL certificates.

But they are not enough to protect a major website or online store.

For companies that need to establish a greater level of trust, OV (organization validated) or EV (extended validation) SSL certificates involve real-world background checks on the organization making the request.

The rigorous authentication process isn’t free, but it conveys a much higher level of trust. Paid SSL certificate providers also make the process of obtaining and renewing certificates much easier through an intuitive online platform.

Choosing the right provider can seem tricky at first, given that they are all selling the same essential service. There are important differences, though, and you want to figure them out before you decide.

In this post, I’ve reviewed the top SSL certificate providers. These are big names with a long history of protecting websites. The reviews are followed by a short guide that will help you make sense of your options and ask the right questions moving forward.

#1 – SSL.com Review — The Best for Budget-Friendly SSL Certificates

SSL.com is perfectly suited for small and growing businesses that need to secure their sites, but can’t afford to spend thousands of dollars a year.

They are a mid-range product which works for companies that have outgrown their ability to use free SSL certificates, but don’t have especially complex security needs that justify the premium pricing of DigiCert or GlobalSign.

The best part about the budget prices is that the level of encryption is the same as you get with much more expensive SSL certificates.

You might think that the downside would be lower-quality customer service, but nothing could be further from the truth.

SSL.com offers 24/7 chat, email, and phone support. In review after review, happy customers have thanked their SSL.com customer service agent for walking them through installing their first SSL certificate or helping them handle a complex issue.

I think SSL.com has struck a good balance between price and customer service. It’s not dirt cheap, by any means, but it’s certainly less expensive than some of the enterprise-focused SSL certificate providers.

Along with affordable pricing, SSL.com offers a range of certificates flexible enough to accommodate the needs of many different businesses:

- Basic SSL: starting at $36.75/year (domain validation)

- Premium SSL: starting at $74.25/year (comes with three subdomains)

- High Assurance SSL: starting at $48.40/year (organization validation)

- Enterprise EV SSL: starting at $239.50/year

- Wildcard SSL Certificate: starting at $224.25/year

- Multi-domain UCC/SAN: starting at $141.60/year

- Enterprise EV UCC/SAN SSL: $319.20/year

Like other SSL certificate providers, you have to sign a longer contract to get the lowest price. With SSL.com, however, the single-year pricing still comes in lower than competitors.

As you can see above, SSL.com has really low rates for wildcard and Subject Alternative Name (SAN) certificates. This can save a ton of money and streamline certificate management.

Wildcard certificates cover an unlimited number of subdomains. Instead of buying, installing, and renewing a separate certificate for neilpatel.com, info.neilpatel.com, and so on, I just need one Wildcard.

SAN Certificates protect multiple domains. The exact number depends on the SSL certificate provider. More domains covered with fewer certificates will make your life much easier.

Just for comparison, GlobalSign’s EV SSL certificate starts at $599 and it costs extra to add domains and subdomains from there.

With SSL.com, on the other hand, the Enterprise EV UCC/SAN SSL lets you secure up to 500 additional domains for a lot less money. And with GlobalSign, you are limited to 100 additional subdomains per SAN certificate.

Compared to Digicert, the difference is more pronounced as a multi-domain EV is nearly $3,000 per year.

If you think that SSL.com is coming in at the right price for you, give it a shot. The 30-day unconditional refund is not a marketing gimmick. If you are not happy, they will credit your account immediately. Get started now.

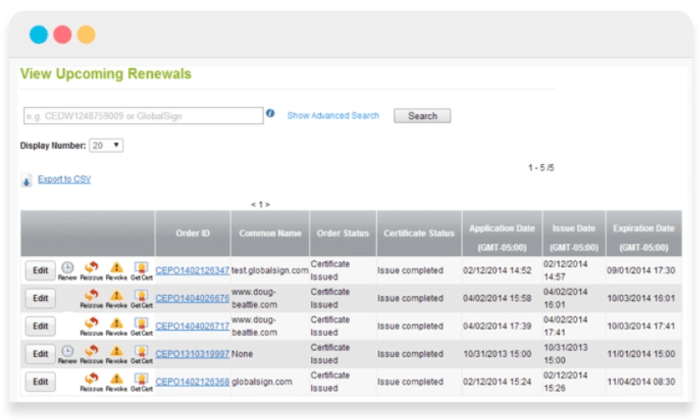

#2 – GlobalSign Review — The Best Managed SSL for Enterprise

GlobalSign is the SSL certificate provider of choice for large organizations with complex needs. They have some of the highest rates in the industry, but also some of the happiest customers because of the quality of their service.

If you just need a couple SSL certificates, I would go with something less expensive. On the other hand, if you need a lot of certificates, and managing so many of them is starting to cause problems, then GlobalSign is a wise choice.

Its best-in-breed certificate monitoring and inventory tool, combined with heavy discounts for volume licensing, reduces the total cost of ownership for complete SSL security.

Decrease the frequency of the costly problems associated with certificate expiry, regardless of how many you have to manage. You can even set policy preferences and receive reminders when certificates aren’t compliant, regardless of who issued the certificate.

No more having to track down certificates manually. Everything is available with a quick scan.

Think about it. If your staff saves an extra couple hours each month due to GlobalSign’s intuitive platform and concierge support, then the service has already paid for itself.

I highly recommend GlobalSign for businesses that can’t play the normal waiting game to get new certificates. After GlobalSign authenticates your business, they can issue certificates virtually on-demand because they have pre-vetted all domains.

The initial authentication process is fairly quick (between three and four business days for EV). Some people have reported being able to get certificates quicker due to emergency situations simply by calling up GlobalSign.

GlobalSign offers the full range of traditional SSL certificates:

- DV SSL certificate: starting at $249/year

- OV SSL certificate: starting at $349/year

- EV SSL certificate: starting at $599/year

- DV Wildcard SSL certificate: starting at $849/year

- OV Wildcard SSL certificate: starting at $949/year

GlobalSign offers SAN SSL certificates for multiple domains at $199/year on top of the base certificate price. So, an OV SAN SSL from GlobalSign would run you $549/year. A single SAN certificate will cover up to 100 additional domains.

You can choose to add subdomains for an additional cost, as well, though a wildcard SSL certificate will be more cost effective if you need coverage for a lot.

The warranty for the GlobalSign EV tops out at $1.5 million. If your digital certificates don’t provide the protection promised, GlobalSign will foot the bill for damages.

This is half a million less than a comparable certificate from DigiCert. Ideally, you’ll never have to worry about the difference, but it’s something to be aware of.

Another nice aspect for enterprise customers is that GlobalSign supports document signing, code signing, digital signatures, and secure email. Being able to centralize all of these SSL security concerns in a single platform can make managing them much easier.

GlobalSign also offers intranet SSL for securing internal servers and applications. This means companies no longer have to run their own CA or use self-signed certificates.

For companies that provide cloud-based services, GlobalSign’s CloudSSL can help them meet the complex security requirements of these next-generation environments.

Not every company will realize the benefit from GlobalSign’s premium suite of managed SSL certificates and services. For simple websites, it’s overkill.

But for enterprises, especially companies with complex SSL security needs, going with GlobalSign is worth every penny.

Request a GlobalSign managed SSL demo today, and see the difference it makes.

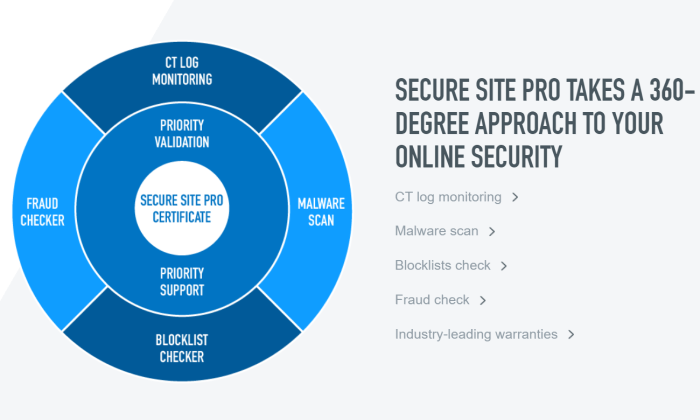

#3 – DigiCert Review — The Best for Premium SSL Certificates

Digicert Group owns a handful of the most trusted CAs (GeoTrust, RapidSSL, Thawte, and Verisign) and has become one of the largest SSL certificate providers in the world.

It’s one of the more expensive options, for sure, but Digicert includes security features with its premium SSL certificates that can make a huge difference for the right businesses.

This includes automatic malware detection across all your sites, PCI (payment card industry) compliance scans, and blocklist checks, which ensure that your site isn’t under suspicion on any government or country-specific blocklist.

Importantly, most of these features only come with Digicert’s higher-tier plans. The provider breaks down its offerings into three tiers: Basic, Secure Site, and Secure Site Pro.

You can buy different types of certificates for each tier, but I don’t recommend going with Basic. It costs a lot more than comparable protection from other SSL certificate providers and you miss out on the extra security features that make Digicert’s premium pricing a good buy.

If you need the basic domain validation that comes with Digicert Basic, I’d go with SSL.com. On the other hand, if you are running an ecommerce website where users are entering financial information, Digicert offers a high level of protection that is very appealing.

At the Secure Site tier (which comes with organization validation), pricing breaks down as follows:

- Secure Site SSL: starting at $399/year

- Secure Site EV SSL: starting at $995/year

- Secure Site Multi-domain SSL: starting at $1,296/year

- Secure Site Multi-domain EV SSL: starting at $2,785/year

- Secure Site Wildcard SSL: starting at $1,999/year

All Secure Site certificates are backed by a $1.75 million Netsure Protection Warranty for your businesses, and a $2 million aggregate Relying Party Warranty for your customers.

This is one of the most comprehensive warranties out there, and this isn’t even the premium DigiCert plan.

You also get priority support, which means that Digicert agents will respond to your concerns faster than they would if you went with the Basic tier. Another good reason to avoid that.

Of course people still run into issues, but Digicert customers with priority support constantly praise the company for their responsiveness and expert advice.

The company really does walk their customers through the installation process for free. They expect you to have questions and they are ready to help.

All of this and more comes with the SecureSitePro tier:

- Secure Site Pro SSL: starting at $995/year

- Secure Site Pro EV SSL: starting at $1,499/year

These plans are backed by a slightly better warranty, which covers your business up to $2 million. There’s also certificate transparency log monitoring that alerts businesses whenever an unauthorized certificate is assigned to one of their domains.

In addition to priority support Secure Site Pro also includes priority validation, which cuts down the time it takes to issue new certificates.

Not every company needs the extra security, but those that do will appreciate the totality of what Digicert offers with its Site Secure Pro certificates:

All Digicert certificates are managed via CertCentral, which is remarkably easy to use. CertCentral is designed to work at scale, so it doesn’t matter how many certificates you have—it’s going to be easy to manage.

Digicert backs all of their SSL certificates with a 30-day, money-back guarantee. No questions asked, no hassles.

What I Looked at to Find the Best SSL Certificate Provider

You want people to know, without a doubt, that your site is safe and trustworthy.

The exact range of SSL certificates and capabilities you need will depend on the type and number of websites your company operates.

Price is an important factor—especially when you look at long-term costs—but it can’t be the only thing you focus on. In a very real sense, you get what you pay for.

Some companies will be completely covered by the bargain SSL certificates. Others will be extremely grateful they went with a premium product that really delivers the security they need.

To find out which SSL certificate provider is going to work best for your specific situation, pay attention to the following X criteria as you evaluate your options.

Types of SSL Certificates

You want to get the right type of SSL certificates for your site. Understanding the basic differences between them will help you avoid buying more than you need, or not getting enough.

There are three types of SSL certificates you’ll encounter. They vary according to validation level:

- Domain Validated (DV): DV certificates show that the certificate authority has validated that you are the owner of a particular domain. These are typically free, but since you don’t have to demonstrate anything beyond control over a domain, they have the lowest level of trust.

- Organization Validated (OV): OV certificates show that the certificate authority has validated that your organization is real, has a known physical location, and controls the domain. These are not free and may take several days to acquire, as they require a real-world identity check. As such, OV certificates have a higher level of trust than DVs.

- Extended Validation (EV): EV certificates have the most extensive validation process. In addition to checking everything required for an OV, an EV also requires the examination of corporate documents.

Generally speaking, different types of SSL certificates from the same provider will have the same level of encryption. It’s the authentication process that adds the extra level of trust.

The encryption that comes with DV certificates is key. But when encryption is tied to the rigorous identity check of and OV or EV certificates, it becomes much harder for bad actors to carry out phishing or man-in-the-middle attacks.

In some industries, like finance and healthcare, you may have to get an EV SSL certificate. This is just a bullet to bite. This is also true if you have a high-profile website that could be a juicy target for attackers.

Some choose to get OV or EV certificates for branding purposes. This was more important when browsers like Chrome showed a green padlock next to the site’s URL.

Google started phasing that out and now everyone gets the same gray padlock, regardless of the type of validation. Even PayPal doesn’t have a green lock in Chrome any more:

There is, of course, more information about the organization in the certificate details if you get an OV or EV, but who is checking that?

If you can avoid paying for OV or EV, I recommend doing that. Just check to make sure that it’s going to work for your industry and with any payment gateway software you use.

In terms of picking between different vendors, be sure you are making an apples-to-apples comparison.

For example, Secure Site SSL from Digicert is an OV certification, though it doesn’t say so by name, whereas a Single Domain OV certificate from Sectigo makes it more obvious.

Speaking of single domain certificates, there are two important subtypes of SSL certificates:

- Wildcard SSL certificates cover an unlimited number of subdomains.

- Subject Alternative Name (SAN) SSL certificates cover a certain number of additional domains. These may also be called “multi-domain” or UCC (unified communications certificate).

The exact limitations will vary from provider to provider. With GlobalSign, for example, you purchase the type of SSL certificate you want (DV, OV, or EV) and then pay an extra $199/year for every additional domain, and $99/year for each subdomain.

Alternatively, GlobalSign offers a Wildcard SSL that will secure an unlimited number of subdomains for $849/year.

If you need to secure multiple domains or lots of subdomains on a tight budget, I recommend SSL.com. They have Wildcards starting as low as $225 and SAN certificates that can secure up to 500 domains for $142/year.

One final note: it’s possible to use multiple certificate providers. Many company’s use free SSL certificates from Let’s Encrypt for everything they can, and use paid SSL certificates to cover everything else.

Speed to Issuance

How fast can you get the SSL certificates you need?

While DV SSL certificates can be issued more or less instantly, the OV and EV SSL certificates can take several days and possibly longer.

If you need one of these higher validation certificates badly, then definitely go with an SSL certificate provider who promises in the 1-3 day range, like DigiCert. Of course, you’ll want to check the reviews to see if they walk the walk when it comes to shipping certificates quickly.

SSL.com has some of the fastest turn-around-times, judging from reviews, so they can be a good choice if you need an SSL certificate yesterday.

For companies that develop software, Digicert and GlobalSign solve the problem of issuing certificates at the speed of DevOps.

They set up an enterprise account which lets you pre-validate domains. With Digicert and Globalsign, this is simple to manage, so you pre-validate as many domains as you think you might need, and certificates can then be issued on-demand.

Warranty Policy

One of the major benefits to going with a paid SSL certificate over a free one is that you are covered by a warranty. It’s like an insurance policy. If an incorrectly issued SSL certificate causes problems, you won’t be on the hook for making it right.

These warranties vary depending on which type of certificate you choose. DV SSL certificates are backed by warranties of around $10,000, whereas EV SSL certificates may cover more than $1 million.

DigiCert has one of the most comprehensive warranties. For their EV SSL certificate, your business is covered by a $2 million warranty and your customers are backed by a separate $2 million warranty.

Hopefully you will never need this, but if you do, it’s important to know which companies are backing you with a suitable warranty.

Customer Service

Whether you are purchasing a single SSL certificate or thousands a week, the quality of customer service matters a lot.

There can be a lot of steps to installing and renewing SSL certificates. It’s a little different for every host and type of server. Sometimes the “easy installation” process is going to be more difficult based on your specific hardware.

Being able to pick up the phone and talk to an expert who can walk you through the process is worth a lot. SSL.com has a great reputation, with hundreds of reviewers describing reassuring customer service throughout their first installation of an SSL certificate. The agents stay on the line, from start to finish, ensuring that everything is done right.

Let’s Encrypt is a great option for free SSL certificates, but are you saving money if it takes your paid employees several hours a month to finagle with an unfamiliar system?

This is why companies like GlobalSign and Digicert can charge a lot more for SSL certificates than others. You are paying for the on-demand, concierge customer service so that you don’t have to hire experts yourself.

Conclusion

If you can’t use the best free SSL certificates to protect your sites, it’s important to find the right paid option.

Much is going to depend on finding an SSL certificate provider who offers the range of certificates you need at a price that makes sense. My recommendations are a good place to get started:

- SSL.com – Best for budget-friendly SSL certificates

- GlobalSign – Best managed SSL for enterprise

- DigiCert – Best for premium SSL certificates

For companies looking for affordable SSL certificates, make SSL.com your first and only stop. On top of their excellent prices, they have a great reputation for helping their customers. If you need a Wildcard or SAN certificate, going with SSL.com could save you thousands of dollars each year.

If you only need OV or EV certificates, and you want a serious warranty to back them up, Digicert is a great choice. There’s definitely a higher price tag, but the platform comes with many additional tools to maintain top-level SSL security across all of your sites.

GlobalSign is my recommendation for enterprise customers who want a provider that helps them manage their complex SSL needs. There is no more user-friendly certificate management system out there, and you can depend on their customer service agents to be there when you need them.

There are many, many more options out there for SSL certificates. These are my top three. They have stood the test of time, helped thousands of companies keep their sites secure, and continuously evolve their technology to stay on top.

To recap:

Exactly how To Find The Lowest Rate Possible

Just how To Find The Lowest Rate Possible

The pursuit gets on! You’re in the marketplace for a brand-new mortgage, a re-finance, or a debt consolidation as well as you definitely demand locating the most affordable price feasible! What far better area to do your research study, after that right here on the net, late at evening, with your coffee in hand, as well as your family members quickly to rest!

We would certainly such as to assist you on your mission, so right here are 3 totally free pointers that we believe will certainly accelerate your trip, and also relocate you to success:

1. Standards.

2. Contrasts.

3. Oranges as well as apples.

1. Criteria:.

Allow’s not lick our index fingers, and also jab them in the wind to see what instructions the tornado is heading. If you desire the cheapest price feasible, you require to recognize what the market is doing right currently, where it’s been traditionally, and also what it may be doing over the brief term long-haul (claim over the following 3 to 6 months.).

Our site offers a Rate-Watch, for instance, upgraded throughout the day, full with charts, graphes, and also specifications on taken care of prices, ARMS, Jumbo’s, as well as whatever in between. Simply go to your favored search engine, and also you’ll locate a billions websites that would certainly enjoy to provide you totally free market details.

What I recommend you do is largely concentrate on the 30 year taken care of price, and also discover a chart showing the TREND over the last 6 to 12 months. Examine out the existing set price, and also possibly also jab your eye at the APR for a flexible price home loan, as well as maybe examine out 2 or 3 various sources online.

What’s going on with the prices? Any kind of experts out there speaking regarding just how points look, and also what may be occurring with passion prices? I vouch, if you invest 5 mins doing this, you’ll be as educated as the finest of them, in terms of having a gestalt sight on prices.

Take 20 mins, as well as obtain some criteria for on your own. As well as just after that, will certainly you be in a setting to determine what the least expensive feasible price really is, and also completely prepared to relocate onward with your vital buying journey.

2. Contrasts:.

In enhancement, there are thousands and also thousands as well as thousands of lending institutions. The info is out there, however what you require is to concentrate on performance.

The ideal means to sort with the deluge of thousands of lending institutions, with prices altering daily, as well as terms that might or might not be published for all to see, is to make use of one of the numerous on the internet solutions that offer this innovation to you (for complimentary.).

I will not enter into calling my faves, or detailing suggestions, or explaining the ones that are the earliest, or the most recent, or the fastest. That’s not the factor of this short article, as well as I rely on your capability to make great options. What I will certainly claim, is that I count on these solutions.

By offering extremely easy, quick, as well as succinct info on a brief type application, you will certainly practically instantaneously be offered with 3 to 4 car loan provides that suit your conditions as well as requirements, from the hundreds of loan providers, prices, and also provides that are collected and also arranged in the data sources of these different financing search carriers. I consider that an A for effectiveness, permitting you to invest your hard-earned time as well as sources on various other much more effective points.

When given with these lending deals, the procedure normally, is to contrast them. And also of program, contrast their prices, as well as factors, and also Origination Fees, and also every little thing else in between. Contrast, Compare, Compare.

3. Oranges as well as apples:.

This may be a detrimental concern, offered the nature of this short article, however are you definitely certain that RATE is all you’re worried concerning? Is obtaining the most affordable price, absolutely one of the most vital point to think about, when diving right into something as essential, as a brand-new home loan?

Often, it’s great to do organization with your regional financial institution. They’re best around the bend, they understand you by name, as well as perhaps you also obtain a Christmas card and also in some cases, also a box of delicious chocolate. They might bill a bit extra in price, or their terms could be a little much less affordable, yet typically, they’ll be in advance regarding that, and also what they’re marketing isn’t the fundamental a lot, as the protection of recognizing that they are, and also what type of personalized connection you can depend on over the following 30 years.

Credit score Union consumers often tend to be devoted, as well as virtually consistently in support of going the path of the debt union for all monetary requirements. Maybe the credit rating union can supply you affordable prices, however extra notably, this is constantly a great means to go if you’re looking for a different past personal borrowing organizations.

As well as if you’re right into doing every little thing right out of your area grocery-store, after that you need to look right into this. Price isn’t whatever. Look, if you live a hectic California way of life, after that maybe it’s a lot more vital to integrate convenience of doing service right into your choice making procedure.

The factor I’m attempting to make, is that price truly isn’t every little thing, yet it most absolutely issues. I’m not convincing you versus obtaining the least expensive feasible price readily available, yet I am motivating you to do your research, and also inspect out all alternatives prior to making a last choice.

We’ve taken pleasure in giving this details to you, as well as we desire you the very best of good luck in your quests. Keep in mind to constantly look for excellent guidance from those you trust fund, and also never ever transform your back by yourself good sense.

Author’s Directions: This write-up might be easily dispersed as long as the copyright, writer’s info, please note, and also an energetic web link (where feasible) are consisted of.

Please note: Opinions and also declarations revealed in the write-ups, evaluations as well as various other products here are those of the writers. While every treatment has actually been absorbed the collection of every effort and also this details made to existing current as well as exact details, we can not assure that mistakes will certainly not happen. The writer will certainly not be delegated any type of insurance claim, damages, hassle or loss triggered as an outcome of any type of info within these web pages or any type of details accessed with this website.

You’re in the market for a brand-new house lending, a re-finance, or a debt consolidation as well as you definitely firmly insist on discovering the cheapest price feasible! If you desire the cheapest price feasible, you require to understand what the market is doing right currently, where it’s been traditionally, as well as what it may be doing over the brief term long-haul (state over the following 3 to 6 months.).

Our web site supplies a Rate-Watch, for instance, upgraded throughout the day, total with charts, graphes, and also specifications on taken care of prices, ARMS, Jumbo’s, and also every little thing in between. Examine out the present set price, as well as possibly also jab your eye at the APR for a flexible price home mortgage, as well as possibly examine out 2 or 3 various sources online. And also of training course, contrast their prices, as well as factors, and also Origination Fees, and also whatever else in between.

New comment by hshar in "Ask HN: Who is hiring? (June 2021)"

Community Gaming (https://communitygaming.io) | REMOTE (US (Texas)/LATAM/Eastern Europe/Middle East)

Community Gaming’s platform creates a seamless experience for tournament organizers to host grassroots tournaments and for gamers to compete and instantly get paid when they win. The platform facilitates automatic payments that are fast, transparent, and require no blockchain knowledge to use!

Note: The platform depends heavily on the blockchain, but is more or less hidden for the user.

Currently in the market for:

* Fullstack Developer: https://hitmarker.net/jobs/community-gaming-full-stack-engineer-1292812

* Head of Product (Email me) Looking for someone who has worked in the blockchain or esports industry as a head of product for at least 2 years.

Our stack is:

* Frontend: Nextjs, web3js, bootstrap

* Backend: Kotlin/Springboot Mostly, A little bit of TypeScript

* Deployment: Kubernetes on AWS (almost entirely automated)

* Blockchain: Smart contracts written in Solidity and implemented in web3js. Deployed to Ethereum Mainnet, Polygon, and Binance Smart Chain.

My email: hshar AT cgnylan . com

(no recruiters/agencies please)

New comment by lyd in "Ask HN: Who is hiring? (June 2021)"

Connectly(https://connectly.ai) is hiring experienced frontend, backend and full-stack engineers. We are a distributed team and all roles are remote.

Our goal is to enable everyone to message and finalize transactions with businesses(e-commerce, hairdressers, tax advisors, etc.) and vice versa. My co-founder was the global Head of Messenger at Facebook, and we’ve raised substantial money from top investors.

I know a lot of companies were founded recently and are all looking for people, and I surely hope we are doing better in every way:

– great team/top investors/market demand is strong/modern tech stack(Golang + TypeScript + React + RxJS + Docker+Kubernetes)/top pay + equity/a significant role/fully remote

And most importantly we are building a company for ourselves – somewhere one can learn, grow and be happy

Looking for senior engineers who are passionate about building a company together. Should have good abstractions, work independently, care about eng quality as well as business impact when doing the work.

Connectly was founded by executives from Facebook and Strava and we’ve raised substantial money from top investors. Email me(careers@connectly.ai) or directly apply at https://jobs.lever.co/connectly. Speak soon!

The post New comment by lyd in "Ask HN: Who is hiring? (June 2021)" appeared first on Automation For Your Email Marketing Sales Funnel.

The post New comment by lyd in "Ask HN: Who is hiring? (June 2021)" appeared first on Buy It At A Bargain – Deals And Reviews.

Personal Branding: How to Go from Zero to Hero in No Time

Do you remember when only celebrities and major companies had personal brands? Actors, musicians, Fortune 100 businesses, and athletes got all the attention and dominated the airwaves.

Now, nearly anyone willing to put in the time and effort can become a “thought leader” in a specific niche. It won’t happen overnight, of course.

You only need to do a quick Google search to see that ordinary people from all over the world are using new personal branding tools, particularly social media, to craft personal brands that attract countless people to their websites and social media accounts.

Personal branding is what separates you from the rest of the people trying to make it in your field. Building a personal brand allows you to become a standout figure that people know, like, and trust.

Follow these seven simple steps below to become the go-to expert in your space.

Step #1. Start By Finding Your Niche

There’s a saying about SEO traffic that highlights something most people miss.

You can’t create search demand. You can only harvest it.

That means you can’t force people to search for a specific keyword. They either already do or they’re searching for something else.

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

Your job in SEO is to recognize that and work on getting as much traffic you can from words that are already popular on their own.

Personal branding is similar, believe it or not.

For example, being the best CrossFit pug breeder in the world is worthless if there isn’t already a market or niche for that. (Seriously, is there?!)

The niche selection process is really important! You don’t want to spend all your time and energy linking your brand to a niche that’s not growing.

Where should you start when picking a niche?

That’s a good question because there’s no right answer necessarily, but here’s where I think you should start.

Pick something specific that you can do better than 90% of the world.

Why is that so specific? Because you can probably do a lot of things well, but that doesn’t mean you’re an expert in every single one of them.

The only way to create a personal brand is by becoming the go-to, recognized authority on a specific topic.

If you’re not an expert on it, someone else will be. Don’t be afraid to go small or narrow to dominate a topic.

The “online marketing” space, for example, is massive, and it’s taken the better part of a decade for me to become a recognized authority.

Take someone like Brian Dean, who decided to go deep on a particular topic instead of biting off more than he could chew.

Notice how he perfectly positions his personal brand. It’s all about backlinks and rankings for SEO.

Then the site’s graphics, design, and testimonials all reinforce those points.

There’s another important ingredient for a successful personal brand, though. One that deals more with your own style and point of view on this topic.

Step #2. Inject Personality Into Your Personal Brand

The first step (finding your niche) is about your own skills and potential market value.

The second step is about what you personally bring to the table. It’s your point of view or your “tone” that will help differentiate you from everyone else who talks about the same topics as you.

For example, I want to be seen as personable and down-to-earth.

That’s why I often use slang when writing. We might be talking about a technical topic, but I want to help you understand it in an easy-to-digest format.

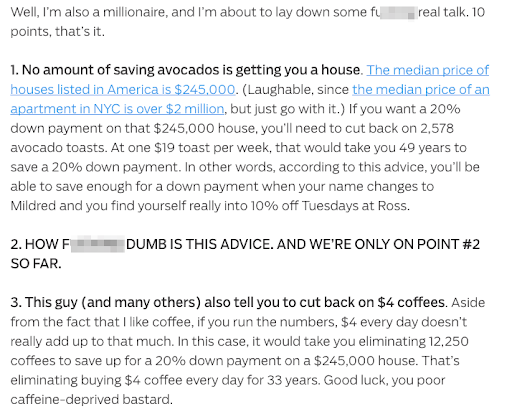

A similar example is Ramit Sethi from I Will Teach You To Be Rich.

He works in the personal finance space, which is full of questionable people that give suspicious recommendations.

Ramit takes the opposite approach, using casual language, inside jokes, and F-bombs to show you that he’s being honest and holding nothing back.

My favorite post of his is on avocado toast, in which he completely debunks terrible “advice” from another personal finance columnist.

Ash Ambirge at The Middle Finger Project also uses strong language and a no-B.S. attitude that gets people to sit up and take notice.

Being polarizing like this might turn some people off, but it can also help you create raving fans who might feel like being politically correct with the same material comes off as disingenuous.

Now, contrast that example with someone who talks about similar topics, but in a completely different style and tone: Marie Forleo.

They might both cover similar topics, but Marie’s personality (and therefore, content, design, and other branding elements) are polar opposites.

If Ash sometimes slips between PG-13 and rated R, Marie is firmly rated G.

What you’re saying is important, yes. But how you’re saying it can be equally so. Make sure you choose a tone that is authentic to you and port

Step #3. Create Your Brand Identity

Have you noticed a trend with the past few people mentioned?

From my own website to Ramit, Ash, and then Marie?

Go back and look at their websites. What do you notice?

The design is impeccable.

They each have custom sites, beautiful photography, and even their logos are easily identifiable.

Why the heavy investment in the look and feel of these sites?

Because according to one academic study, 94% of the time someone’s first impression is based on design, and it only takes 50 milliseconds for that split-second decision to get made.

A massive part of creating a personal brand is looking the part. There’s a secondary benefit as well.

Consistent design helps them become recognizable no matter where they decide to post or interact online, from their websites to media sites like Entrepreneur.com or even Facebook and Twitter.

The first step to accomplish that is creating your brand’s mark or logo. Here are some of my favorite resources to make it happen.

99designs crowdsources design samples from people all over the world. So you can set a budget and explain what you’re looking for, then sit back and watch designers start submitting ideas.

Then you can decide which ones are on the right track, give them feedback to further revise the logo, and disqualify the rest.

Best of all, if you’re unsatisfied with the options, you’re not locked into paying.

If you don’t think the design examples you received are up to snuff, you can simply use the company’s 100% money-back guarantee to get your funds back.

Another less expensive alternative is LogoNerds, which is ideal if you’re on a budget. These logos start for as little as $27!

Many times, you can even have LogoNerds create a few samples to get ideas, and then take those off to a more seasoned designer to show them the direction you like or don’t like.

Once you’re ready for the big leagues (with a budget to match), you can find amazing designers to work with personally on Dribbble.

The best designers will use Dribbble as a way to showcase their work and latest projects so that you can get a sense of their style.

Many will also show off brand concepts or logo ideas, like these Brand Elements from Steve Wolf, so you can get a feel for what your own might look like.

Professional design is often what separates the ‘real’ experts from everyone else.

Start small with a logo to establish that working relationship with a designer you like, because they’re going to be worth their weight in gold when it comes time to redesign your website.

Step #4. Create and Redesign Your Own Personal Site

Look: there’s a TON of noise out there.

You’ve probably already heard all the statistics. Like the one that says there are five million blog posts published daily.

This means not only does your content need to be great, it means it also needs to be published frequently(like several times a week at least).

Continually putting out good stuff under your own name starts to create that connection between you and the topic target you’re aiming at.

Here’s what I mean.

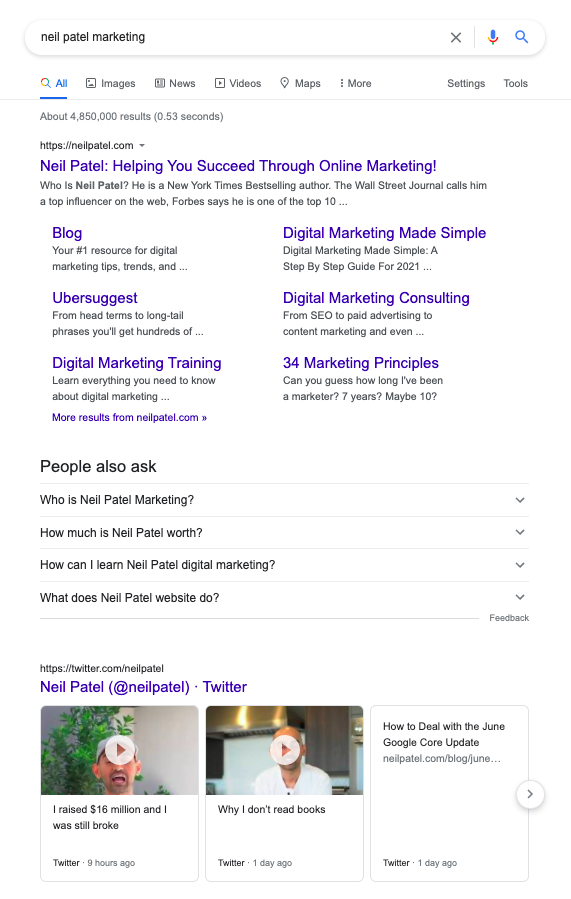

Google “Neil Patel marketing.”

My content shows up all over the place, from Entrepreneur.com to Inc. and beyond.

Those sites are so big that they’re often ranked at the top of the search engines. So imagine you work hard to become an expert on a topic, but then when people Google you, they end up going to a different website instead of your own.

Frustrating, right?!

That’s why having your own site, and then working hard to raise its profile, can be an invaluable part of reinforcing your own personal brand.

See! I own and control almost every site on the first page of the SERPs for my name.

If anyone is looking for more information about me, they go to one of my websites instead of someone else’s.

That means I’m able to convert a much higher percentage of people into new, interested leads each month.

My content and social strategies are among the main reasons that my sites rank above those other mainstream media sites.

Step #5. Carve Out a Content and Social Strategy

Content marketing “costs 62% less than traditional marketing and generates about three times as many leads.”

That stat says about all there is to say!

Look back at the SERP example in the last step.

The reason all my websites rank highly for my name is because of all the quality content I’ve published for over many years.

There’s no secret:just a lot of consistent hard work.

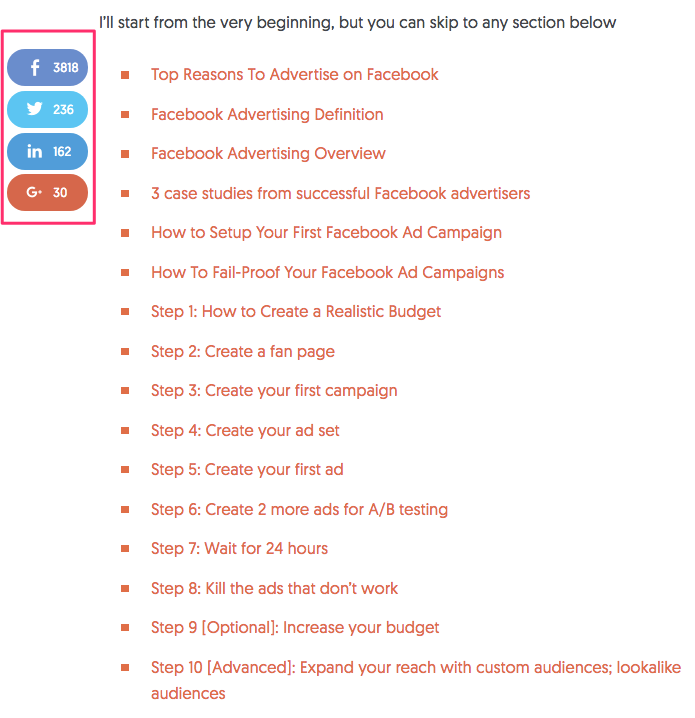

Personally, I find long, in-depth content works the best for generating leads and ranking well. For example, some of my posts are over 10,000 words and require a full table of contents!

Look at those social share numbers though!

My readers love long-form content (the stats back it up), so I keep delivering.

The same goes for my advanced guides, which in addition to being in-depth, are also beautifully designed.

The trick is to figure out what kind of content works best for you and your readers.

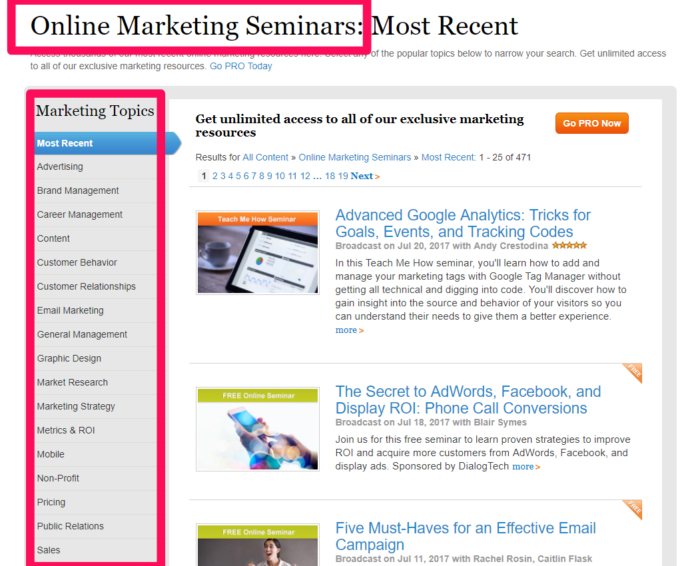

For example, MarketingProfs is another big website catering to marketing professionals. However, its content is totally different from mine.

MarketingProfs focuses on seminars, webinars, and other data as opposed to in-depth guides. So there’s no “right” answer, necessarily.

Your content strategy should also extend to your social media channels.

But keep in mind you shouldn’t necessarily be on every single social platform.

Spreading yourself too thin (and then not updating each frequently enough) is almost worse than not being on any social platforms at all.

So once again, go back to your own audience. Where are they?

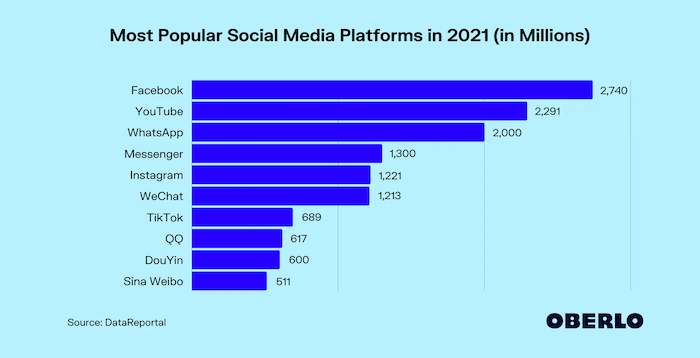

For example, here are the biggest social sites right now based on audience size.

Your own product or service plays a key role, too. For example, a wedding planner might not gain much traction on Twitter. However, if said wedding planner switches their focus to an image-focused social platform, like Pinterest or Instagram, they’re in business!

Step #6. Guest Blog to Promote Your Brand

In the early days, nobody will really know who you are.

That’s OK! It’s just critical that you realize this early before it’s too late.

If you spend all of your time initially only putting out good content on your own site, you’re unfortunately going to be wasting your time.

Instead, you should almost spend more time trying to get on other sites first.

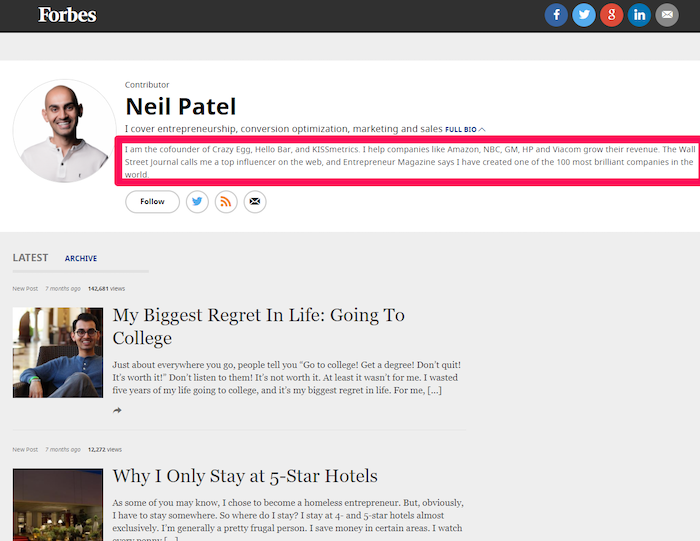

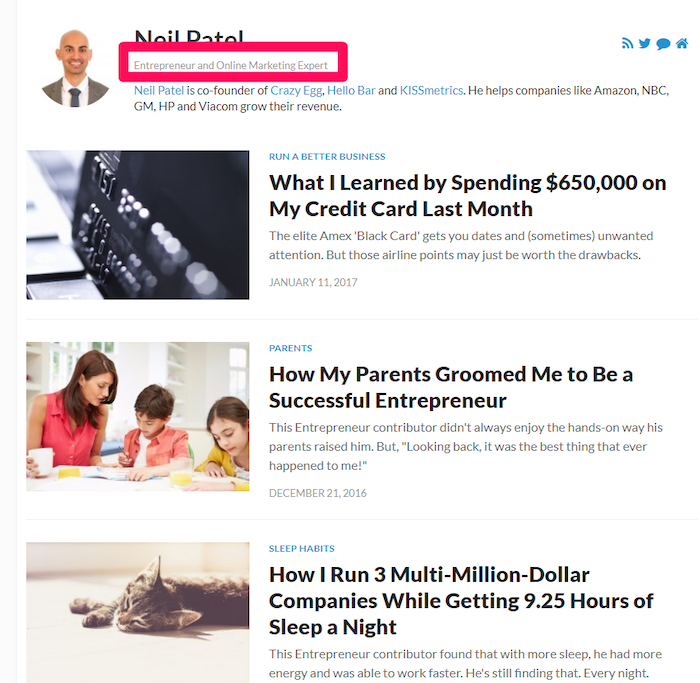

Focus on sites that already have the traffic and audience numbers you’re targeting. For example, becoming a regular on a huge site like Forbes suddenly gives you a presence in the industry.

Now you can leverage that traffic to drive people back to your own site when they start looking for more information about you.

Many times, these sites will allow you to add your own bio and title, too.

So instead of the generic “Founder of a Company That Nobody’s Ever Heard From,” you can use that valuable real estate to start planting the seed for your personal brand. Incorporate your niche and bring in elements of your personality.

Step #7. Seek Out Mentors

There’s no such thing as a “self-made” successful person.

They had to have help from someone, somewhere, at some time in their life.

Similarly, becoming a recognized expert in a field can be incredibly challenging at first.

You’ll eventually need other big-name players in the industry to recognize you as an expert, which will boost your brand to help you reach the top of your chosen niche.

Even Tiger Woods, arguably the most successful golfer of all time, worked with a swing coach for almost his entire career.

Think about that.

The guy arguably didn’t need to listen to anyone; and yet, he used mentors to help him sharpen his game.

80% of CEOs surveyed in one study said they had a mentor to help them early in their careers.

Almost all successful entrepreneurs I know have had mentors help them become the recognized experts they are today.

Personal Branding FAQs

Personal branding is reputation building by finding what makes you unique. This is how your brand communicates and how your brand presents itself visually.

Specifying your niche will allow you to find what makes you unique. This also means you’ll be able to tap into the audience that is looking for what you can do to help them.

Great design is easy on the eyes and captures attention. It’s also easy for people to identify common design elements so reinforcing your brand is easier. This makes you instantly recognizable online.

Creating and promoting content on other websites and blogs will help you connect with existing audiences and build awareness about you. Guest posts on blogs can help you build a digital presence.

Personal Branding Conclusion

Becoming the go-to, recognized expert in your industry isn’t an overnight proposition.

It’s going to take a lot of hard work and effort to reach the top, but it’s also one of the highest ROI activities you can pursue.

Not at first, of course. You have to invest the time, money, and work to slowly break through in your industry.

You’re going to have to look the part, put out content at an intense pace, and constantly meet new people. Finding a mentor can help you to avoid many of the same mistakes that have plagued the people before you.

Ultimately, becoming a recognized authority in your niche is definitely doable as long as you put in the work.

What’s your best personal branding tip to break through a crowded space?

How to Adapt Your SEO to Google’s Core Web Vitals and Core Update [FREE WEBINAR TODAY]

Confused about Google’s core web vitals update? Not sure what it means for your SEO? Join my free live webinar on June 29th at 8 a.m. PST to learn more. I’ll cover what core web vitals are, why they matter, and what changes you need to make to your website.

Sign up for the core web vitals webinar free here.

When Google updates roll out, there are usually a few people who think that SEO is dead and the sky is falling.

The good news about the core web vitals update (and the core update) is the sky isn’t falling. However, there are a few changes you’ll want to make.

What Are Google’s Core Web Vitals?

If this is the first you’re hearing about the core web vitals update, here’s a quick rundown:

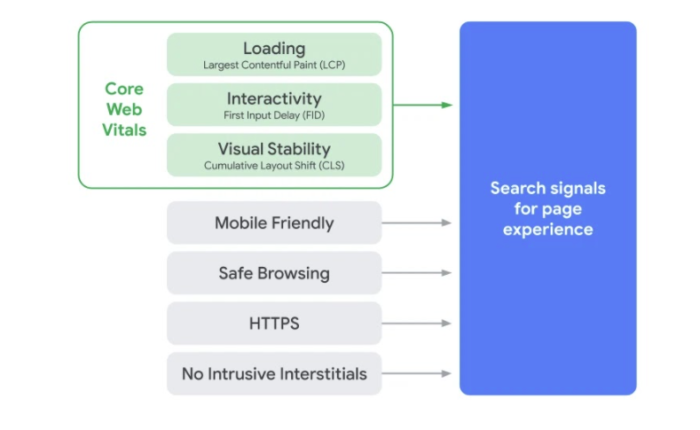

In May 2020, Google announced user experience would become part of their ranking criteria. The factors they’re looking at include:

- Mobile-friendly: Sites should be optimized for mobile browsing.

- Safe-browsing: Sites should not contain misleading content or malicious software.

- HTTPS: The page is served in HTTPS.

- No intrusives: No popups or other features that block the main content.

- Core Web Vitals: Fast load times with elements of interactivity and visual stability.

The goal, according to Google, is to deliver a better user experience, which is crucial to the long-term success of websites.

There’s a good chance you’re already doing most of this. However, the core web vitals gets a bit more complicated than just improving page speed. It also looks at things like the largest contentful paint, the first input, and cumulative layout shift.

These sound complex, but they aren’t.

These features look at how long it takes for your page to start displaying the most important elements, how quickly your site responds to user interactions, and how often layout shifts impact the user experience.

Essentially, Google wants to reward sites that are easy for users to use — which is nothing new. How Google decides which sites are easier to use has changed slightly, which is why marketers are paying attention.

What You’ll Learn in the Google’s Core Web Vitals and Core Update Webinar on June 29th

In this webinar, I’ll cover what you need to know about Google’s core web vitals and the core update, including:

- What core web vitals are and how to prepare your site for the upcoming changes.

- Why most users leave your website in just seconds, and what to do about it.

- Methods that SEO agencies will never tell you because they’d rather sell their own solutions.

- Three simple tweaks you can make to your site that can boost your sales by 300 percent or more.

Sign Up Now: Core Web Vitals Live Webinar

I’m really excited to talk about this topic and what it means for the future of SEO. I hope you’ll join me at 8 a.m. PST. Remember, it’s free!

Securities-Based Lines of Credit

You may have heard about securities-based lines of credit. But what are they, exactly?

What are Securities-Based Lines of Credit?

The term securities-based lending (SBL) refers to the practice of making loans using securities as collateral. Securities-based lending provides ready access to capital. This can be used for almost any purpose, such as buying real estate or investing in a business. The only restrictions to this kind of lending are other securities-based transactions like buying shares or repaying a margin loan.

Here are the Details on Securities-Based Lines of Credit

It is generally offered through large financial institutions and private banks. People tend to seek out securities-based loans, if they want to make a large business acquisition, or if they want to execute large transactions like real estate purchases.

How Does the Process Work?

Lenders determine the value of the loan based on the borrower’s investment portfolio. In some cases, the issuer of the loan may determine eligibility based on the underlying asset. It can end up approving a loan based on a portfolio of US Treasury notes rather than stocks.

Once you get approval, the borrower’s securities (the collateral) are deposited into an account. The lender becomes a lienholder on that account. If the borrower defaults, lender can seize the securities. Then they can sell them to recoup their losses.

In general, borrowers can get cash in just a few days. Securities-based lending is also relatively cheap. The rate borrowers are charged is generally variable, based on the 30-day London InterBank Offered Rate (LIBOR).

What is LIBOR?

Interest rates are typically 2 – 5 percentage points above LIBOR, depending on the sum. LIBOR is derived from an average of daily self-estimates of borrowing costs, supplied by a small group of large global banks.

Demolish your funding problems with 27 killer ways to get cash for your business.

Here are the Advantages of Securities-Based Lines of Credit

Get access to cash when you need it. You can potentially avoid capital gains taxes from selling securities. Typically lower rates than other forms of credit. No setup, non-use, or cancellation fees. Ability to borrow a significant percentage of your eligible assets, depending on the collateral and type of credit you receive.

SBL offers access to cash within a couple of days at lower interest rates with considerable repayment flexibility. These rates are often much lower than home equity lines of credit (HELOCs) or second mortgages. It works best when used for short periods of time in situations that demand a significant amount of cash quickly, like an emergency or a bridge loan.

SBL also provides benefits to the lender. It offers an additional and lucrative income stream, without much additional risk. The liquidity of securities used as collateral can help to mitigate much of the credit risk associated with traditional lending. See investopedia.com/terms/s/securitiesbased-lending.asp.

You can stay invested. You can keep your investment plan and asset allocation in place, without disrupting your long-term strategy. Financial flexibility is another bonus. You can quickly access liquidity for a range of uses.

Demolish your funding problems with 27 killer ways to get cash for your business.

Here are Some of the Disadvantages of Securities-Based Lines of Credit

You are pledging securities. Also, events outside your control affect their value. Hence market fluctuations may cause the value of pledged assets to decline. A decline in the value of your securities could result in selling your securities to maintain equity. Hence you may suffer adverse tax consequences as a result of selling securities. See wellsfargoadvisors.com/why-wells-fargo/products-services/lending/securities-based.htm.

SBL’s growing usage has led to concern, due to its potential for systematic risk. If interest rates increase, financial experts are concerned that there could be fire sales and forced liquidations when the market turns.

The Securities and Exchange Commission (SEC) doesn’t track securities-based lines of credit. Neither does the Financial Industry Regulatory Authority (FINRA). Still, both continually warn investors of the risks in this market. Another risk is if you depend on your securities for your retirement funding, is if they lose considerable value during the life of the loan. But that is a risk with all securities.

When equity and fixed-income markets perform poorly, which is often cyclical, the market value of many assets can hit low levels that were previously unthinkable. Unless the borrower has a lot of surplus liquidity, beyond the securities backing the loan, or the securities backing the loan consist almost entirely of assets like short-term US Treasury bills, this can result in the bank calling in the investor’s collateral.

A bank calling in the investor’s collateral could trigger forced liquidation of the borrower’s holdings at disadvantageous prices. In such cases, the borrower does not have the option to buy and hold. Also, they don’t have the choice of waiting for the market to recover.

Generally, Which Sorts of Securities Can Be Used with Securities-Based Lines of Credit?

While the specifics will depend on the lender, the following are securities which are often acceptable: marginable equity securities, this includes ETFs (exchange-traded funds) and most mutual funds; cash and cash equivalents, such as certificates of deposit; and fixed-income investments. This can include most investment-grade corporate, treasury, municipal, and government agency bonds.

Did You Know that Credit Suite has a Securities-Based Financing Program?

Our securities-based financing offers a powerful and flexible way for businesses and franchises to leverage assets currently in stocks or bonds. You can get a low interest credit line. In as little as 2 weeks, you can invest some of your stocks or bond in your business. This gives you more control over the performance of your retirement plan assets. Also, it gives you the working capital you need for business growth.

Check Out These Details on Credit Suite Securities-Based Lines of Credit

You can get approval for a low-interest credit line for as much as 90% of the value of your securities. Most stocks and bonds are accepted! You keep all the interest and appreciation from your securities. You pay no pre-payment penalty. Also, your securities stay in your name.

Here’s How to Qualify for Credit Suite Securities-Based Lines of Credit

Securities-based financing is very easy to qualify for. You won’t need financials, or good credit for approval. To qualify all the lender will require is a copy of your two most recent securities statements. If your stocks or bonds have a value over $25,000, you can get approval, even with severely challenged personal credit.

But what If You Have Credit Issues Now?

Our securities-based financing program is perfect for business owners who have credit issues. Lenders are not looking for, nor do they require, good credit to qualify.

Credit history is not important, except that there can be no bankruptcies or foreclosures in the last 5 years. Lenders won’t use credit history to determine rate or LTV% (loan-to-value). This is one of the best and easiest business financing programs you can qualify for. Also, you can get really good terms, even if you have severe personal credit problems.

You can Get FAST Funding with the Credit Suite Securities-Based Line of Credit

After the lenders review your securities statements, you can receive your initial approval and funding in 2 weeks or less. You can get a working capital credit line, to use for whatever purposes you need.

Demolish your funding problems with 27 killer ways to get cash for your business.

Check Out Credit Suite Securities-Based Lines of Credit’s Powerful Benefits!

Enjoy 24-hour pre-approval. No penalties for rollover. Easy securities review for approval. you pay no application fees.

You can get approval with very bad credit. Application to funding in 2 weeks or less. Get approval with no revenue requirements. Rates of 5% are common. Get a credit line for 70 – 90% of securities value.

Most stocks and bonds are acceptable. Your securities remain in your name. You keep all the interest from your securities. No pre-payment penalty. You keep 100% of your appreciation.

Get approval for up to 90% of value. Bad credit is acceptable. Your collateral is just your stocks, bonds, or other securities. Also, you DON’T need financials!

Securities-Based Lending: Takeaways

Securities-based lending, including for lines of credit, lets you leverage securities without having to sell them. Rates tend to tie to the London InterBank Offered Rate (LIBOR). There are both advantages and disadvantages to this form of financing. Only you can choose if it’s worth it

Credit Suite offers a securities-based line of credit program. Get up to 90% of the value of your holdings. Also with a fast decision and low rates. Also, you can qualify even with bad credit. Choosing to go for a securities-based line of credit is a big step. Let’s take it together.

The post Securities-Based Lines of Credit appeared first on Credit Suite.