Inflation pushes retiree back into workforce after 20 years: 'I need compensation'

Retiree Tina Caston shared various ways she is cutting costs while weighing a possible return to the workforce on Sunday’s ‘Fox & Friends Weekend.’

Retiree Tina Caston shared various ways she is cutting costs while weighing a possible return to the workforce on Sunday’s ‘Fox & Friends Weekend.’

Gov. DeSantis beat Trump in the 2024 straw poll at the Western Conservative Summit for the second year in a row

Business credit is credit in the name of a business. Unlike consumer credit, you need to actively work to intentionally start establishing business credit. A small business owner can get business credit with EIN only, but it doesn’t happen on its own. You have to establish and build it intentionally. How do you do that?

It helps to understand what an EIN is before you begin establishing business credit. EIN stands for Employer Identification Number. The IRS issues it to businesses. The process to apply for an EIN is fast and easy. Even better, it is free.

The key to getting business credit with EIN only is to use the business’s Employer Identification Number instead of the small business owner’s Social Security Number to apply for a business credit card or vendor credit.

If your business is set up correctly, the business credit card will not be tied to your consumer credit.

Card issuers and other credit providers may ask for your Social Security Number for identity purposes. This is in an effort to prevent fraud. If your small business is set up properly, it will not be necessary for determining creditworthiness when you apply for vendor credit or a business credit card.

Foundation

FoundationYou cannot get business credit with EIN only if your business is not set up to be separate from you as the owner. To do this, you need to build a Fundable Foundation. It involves a number of details that most small business owners do not realize matter when it comes to whether or not their company can get funding.

Foundation. It involves a number of details that most small business owners do not realize matter when it comes to whether or not their company can get funding.

When you apply to get a business credit card, you may never consider that whether you choose to operate as a sole proprietor or a limited liability company, personal finance issues, business licenses, and even the name of your small business can cause you to be denied. But it can.

For all business owners, choosing a name for your business is one of the first things you do. It’s one of the fun parts. Yet, small businesses can help or harm themselves with how they name their businesses.

It’s best to pick a name and stick to it before you choose your EIN. Making changes after the fact creates more opportunity for mistakes. If you create strong business credit with EIN only, and then change your business name, creditors may have issues if you forget to change the name everywhere. Your EIN may show up connected to one name, but the business name is listed differently somewhere else.

How can the name you choose harm your business? Because adding the name of a risky industry can harm your future chances of getting financing. When you apply for a business loan, you don’t want your search for funding to end before it even gets started.

There is nothing deceptive about naming a business Amy’s rather than Amy’s Gun Range. If a lender has any reason to think the industry is risky, they may throw out the application before they even look at creditworthiness.

Ensure your business has its own phone number and address. You can get a business phone number that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone.

If you want, you can use your personal cell phone or landline. Just not your personal phone number. Set it up so that whenever someone calls your business number it will ring your personal phone.

A business address has to be a physical address where you can get mail. You can use a virtual office for a business address. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services.

In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

Now it’s time to apply for an EIN for your business. Go to the IRS website and apply using the name of your business and contact information. Just your EIN with the name of your business and contact information is not enough for a fully Fundable Foundation or to build business credit with EIN only however.

Foundation or to build business credit with EIN only however.

You have to choose the right business entity. Incorporating your business as an LLC, S-corp, or corporation is necessary. It lends credence to your business as one that is legitimate. It also offers some protection from liability.

Even if you are the sole proprietor, operating as a sole proprietorship does not offer the separation of business from owner that you need to build business credit.

Card issuers see sole proprietors and the business they own as one and the same when it comes to making credit decisions.

That means, for sole proprietors, consumer credit is the main determination factor. If sole proprietors have bad credit themselves and apply for business credit with their Social Security Number, they will likely be denied financing. The same is not true when it comes to corporations.

Which option you choose does not matter as much for Fundability , or even card issuers, as it does for your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional.

, or even card issuers, as it does for your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional.

They can help you decide between a limited liability company or another type of corporate business entity for liability and tax filing purposes.

Incorporate as soon as possible. Not only is it necessary for Fundability and for building business credit, but so is time in business.

and for building business credit, but so is time in business.

The longer you have been in business the more Fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax filing purposes. The internal revenue service requires you to report them separately anyway. This just makes it easier.

Even more important, is the fact that this is actually a requirement of many credit issuers. They often want to see a certain number of deposits or minimum average balance in a business bank account before they will approve you.

There’s more to it however. There are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance.

In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business.

What does a business website have to do with whether or not you can get a business credit card, or any business credit with EIN only? Does a website really matter to your business credit profile? Do lenders that offer loans backed by the Small Business Administration really care about this? The answer is somewhat complicated.

These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. This is the first impression you make on many. If it appears to be unprofessional, both customers and lenders will see your business in a bad light.

Your business credit profile may not mention your business website. Companies that issue credit cards are not likely to notice if you have a website or not. However, traditional lenders such as banks may research your business online.

If they do not find a professional website, it won’t help you. It might not ruin your chances completely if everything else is in order. However, if they already have doubt, this could push them over the line to denial.

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Also, your business needs a dedicated business email address. Make sure it has the same URL as your website. Don’t use a free service such as Yahoo or Gmail.

It would be tragic to put all the work in to build business credit with EIN only, and then be denied because your website appears unprofessional, or because you do not have one at all.

When you are working to establish business credit with EIN only, the ultimate idea is to separate business credit from personal credit. Still, that doesn’t mean consumer credit doesn’t matter when it comes to business funding. Even if you don’t use your Social Security Number on a business credit card application and use only an EIN.

This is because some of the business credit reporting agencies use consumer credit in their business credit calculation. For example, Experian uses a blended model when they calculate your business credit score. FICO SBSS also uses consumer scores to calculate business credit scores.

Unlike business credit, your personal score is driven by factors that go beyond your payment history. For good credit scores on the consumer credit side, you will need to keep your credit utilization low.

You also will need a mix of consumer credit types. That means credit cards would complement a personal loan, auto loan, or mortgage.

Traditional lenders take personal credit into consideration in addition to business credit anyway. So, even if they do check your Experian business credit report or your report with FICO SBSS, your consumer credit will still make a difference.

Basically, for good consumer credit, you need to show a few ways how you handle credit responsibly.

You will need a DUNS number. This is the number Dun & Bradstreet uses to identify your business in their system. A DUNS number plus three reported payment experiences will equal a PAYDEX score.

You cannot have business credit with EIN only without establishing a credit profile with Dun & Bradstreet.The main score they issue is called the PAYDEX. Once you have a PAYDEX score, the other business credit bureaus will create a profile for you if they haven’t already.

Dun & Bradstreet is the largest and most commonly used business credit bureau, so having a credit score with them is important.

Monitor your business credit reports with all three of the major bureaus to ensure they exist and remain complete and accurate.

This includes your Dun & Bradstreet report with your PAYDEX score, as well as your Equifax and Experian business credit report.

Credit Suite offers a business credit monitoring package that includes all three for a fraction of the price it would be if you monitored reports with each credit bureau individually.

Foundation, What’s The Next Step to Build Business Credit With EIN Only

Foundation, What’s The Next Step to Build Business Credit With EIN OnlyAfter you have the foundation in place, you have to get accounts reporting on-time payments to your business credit reports. That’s how you establish business credit and start building a business credit history.

The only way to build business credit once you get a business credit profile is to get business business credit accounts, with EIN only, that will report positive payment history. That’s easier said than done. Plenty report missed payment, but far fewer actually report payments made on time.

If you are just starting out trying to build business credit with EIN only, the first accounts you get are typically net accounts with vendors. You’ll have to find vendors that will extend credit without a credit check, since you don’t want your personal credit in the mix and you do not yet have a score for your business. And of course, they have to report. Finding these vendors is easier said than done.

This is where Credit Suite comes in. We keep track of the vendors and corporate cards out there, and know which will report to the business credit agencies. We also keep track of how to apply to these vendor and corporate credit cards, how to make sure you qualify, and if card issuers are looking for personal guarantees.

When you apply for business credit cards for your business purchases, credit card companies will often check your personal credit report. However, some of them will not look at credit at all. That means you can get them without a personal credit check and before you have any business credit. Then, if they report, your business score will start to grow.

Credit Suite divides accounts that report into tiers, with Tier 1 vendors being what are often called starter vendors. These are vendors you can get before you have a business score, that will report to your business credit report. Uline and Grainger are just two examples of these.

Both of these vendors will extend business credit based on factors other than credit score. Then, they will report on-time payments. You can use the credit for the business purchases you need to make in everyday business, and as payments are reported your business credit score will grow.

As it grows, you’ll be eligible for more and more accounts. We have these divided into Tier 2 and Tier 3. Our list is useful because most vendors do not advertise whether or not they report possible payment history.

Our thumb is on the pulse of the industry, and we keep an eye on who is reporting and who isn’t. You can choose those that will allow you to make business purchases that you actually need, while you build your business credit score.

Without this knowledge, a business owner would just have to apply for accounts at random and hope they report. This could take years and you still may not ever even establish business credit.

In general, vendor accounts are issued with Net terms. Meaning, if you have a Net 30 account with Uline, you have 30 days to pay the balance in full. In contrast, business credit cards are typically revolving accounts.

However, you will likely qualify for some before you qualify for others. Some retailers will offer a credit card only for use with their specific business.

So, you may only be able to use your Office Depot credit card at Office Depot. This is different from a vendor account because it is revolving, not net terms.

Most of the time you will need to already have a few vendor accounts reporting and have a decent business credit score before you qualify for store credit cards.

However, credit card companies offer business credit cards that are not limited to where you can use them. Yet, they will want to see strong, established business credit.

This is confusing for a lot of business owners. They can apply to get a business credit card easily enough. However, if the business is not set up with a Fundable Foundation, it’s really just a personal credit card. Without the separation Fundability

Foundation, it’s really just a personal credit card. Without the separation Fundability offers, credit card companies will not recognize that you and your business are actually separate legal entities.

offers, credit card companies will not recognize that you and your business are actually separate legal entities.

An actual business credit card is going to have a lot of additional benefits for your business. First, the limits will likely be much higher than any credit card you can get on personal credit.

Since business expenses are much higher than personal expenses, this is important. Also, it will not report on your personal credit. Using consumer credit to fund a business can be tragically detrimental to your consumer credit score.

This is largely because of these higher expenses. Personal credit is affected by your debt-to-credit ratio. If you consistently carry balances at or near your credit limits on your personal accounts, your credit score will be lower even if you make payments consistently. Using consumer credit cards to fund a business is going to make this scenario likely.

Using business credit cards that report to business credit agencies for business expenses takes the pressure of business expenses off of your consumer credit report. Once you establish business credit, you will be able to work on growing the credit score for your business so you can use business credit cards for business purchases.

Even better, the credit bureaus for businesses function much differently from consumer credit bureaus in that it is really only payment credit history that affects your score. The debt-to-credit ratio is not an issue for small business owners when it comes to business credit.

Using a credit card can also help protect your business, as they may limit exposure with online purchases. In addition, most have fraud protocols that can help protect you from having to pay for fraudulent charges. In contrast, using a debit card leaves very few options for recovery.

It’s pretty obvious to see how a strong business credit score can help you get a business credit card and vendor accounts. It’s not all about business credit cards though.

Traditional lenders tend to look at consumer credit regardless. The question then becomes, can business credit be useful at all when it comes to getting SBA loans, lines of credit, and other types of funding from a bank?

The answer is yes! While they will not discount personal credit completely when making lending decisions related to small businesses, they may take business credit into account also.

As a result, using business credit with EIN only to build a strong business credit score can help a small business counteract not so great personal credit. In addition, it can help you get better terms and rates on loans and business lines of credit. It can even help when it comes to accessing loans backed by the Small Business Administration.

Even better, good business credit with EIN only can make a difference in the extent of personal guarantee you are required to give. In fact, in some cases it may eliminate the need for a personal guarantee at all.

It’s important to note that a personal guarantee is not necessarily a bad thing. There is a place for it. However, it does mean that you are personally responsible for repaying the loan if the business defaults. As a result, it is best to limit debt that requires a personal guarantee as much as possible.

This is why establishing credit for your business is so essential. There is much more to it than qualifying for corporate cards or a corporate gas card. It is necessary for effective and efficient management of business finances over all.

Having a well rounded mix of business credit with EIN only will help you build a strong business credit portfolio. This is an important tool for managing business financing. It is the combination of vendor credit, corporate gas cards, any small business credit cards, lines of credit, loans, and all other business financing. It includes financing both with and without a personal guarantee.

When you start building business credit with EIN only, aim to build a well rounded business credit portfolio. Then, you will always have the funding you need, when you need it. One corporate credit card will only go so far, but a variety of credit cards and other business funding will ensure you can manage cash flow, regular expenses, and emergencies when they pop up.

Using business credit to build a business credit portfolio and cash pool is key to cash flow management. There are 3 parts to this:

When you have a cash pool that includes business credit, you have options and flexibility. You can run your day-to-day business operations with cash.

Then, if you need more for something out of the ordinary, you can pull from your other funding options that you already have in place. Consider these examples.

For example, if you are a contractor and land a large contract, but do not have the materials on hand available to complete it, you can use vendor accounts with suppliers. Then, when the contract is complete and you are paid, you can pay your supplier.

Another example would be if you wanted to take advantage of bulk sale pricing from a wholesaler. You may not have the cash on hand to spare for ordering extra at the lower prices. However, you can use a corporate credit card to make the purchase, and repay as the items sell.

One of the easiest business credit card types to get is a corporate gas card. This type of credit card is useful in a number of ways. Even if you do not run a fleet, and even though corporate gas cards rarely limit purchases to fuel and maintenance, this type of business card can help you with these types of expenses.

In turn, you can budget for them better. Note here, that even though it is one of the easiest business credit card types to get, you don’t need too many. Just get what you can use for your business.

A prepaid business card can help if it reports. Otherwise, there is really no point. A prepaid business card that does not report is just taking an unnecessary extra step or two that will only slow you down. Focus on any business card that will report. That’s what will get you further along in the journey.

Whether you use vendor accounts, corporate credit cards, credit lines, or some other business card or loan will depend on the circumstance.

However, using a business card or vendor account will ensure you only have to take the time necessary to apply for a business loan when you really have to.

Having a business card available to take care of things as needed offers the much needed convenience and flexibility to manage your business effectively and efficiently.

Truly, business credit is a journey, not a destination. At Credit Suite, we aim to help small businesses build a strong business credit profile in the most effective, efficient way possible.

That means starting with a Fundable Foundation. We meet you where you are in that process, and walk you step-by-step through the end, starting wherever you are right now.

Foundation. We meet you where you are in that process, and walk you step-by-step through the end, starting wherever you are right now.

Then, we help you find the right accounts for your business that will report to the business credit bureaus. That includes vendor accounts and any business credit card that will report positive payment history.

The goal is not only to build business credit with vendor accounts and a business credit card or two. The goal is to ensure that when you need other funding, you are set up in the best way possible to qualify.

Then, your business can access the funding it needs, when it needs it. Whether through a business credit card, a vendor account, a loan, a line of credit, or other other option. It will not matter, because your business will be Fundable .

.

The post How to Get Business Credit With EIN Only appeared first on Credit Suite.

NOTE: On June 8, 2022, Christopher Coomer, VP of Data, Analytics, and Insights at NPD, will cover the essentials of GA4 in a short presentation. This will be followed by an extensive Q&A session with webinar host Will Francis of DMI. Register here. Those who attend will receive a free follow-up guide to help them transition to GA4.

Google recently announced it is sunsetting Universal Analytics in June of 2023. This means if you’ve been holding out on switching to Google Analytics 4, your time is almost up.

I’ve heard from a lot of marketers and business owners who are not excited about the switch. Change is always hard, but I really think this switch is going to be a good thing. For starters, it provides a ton more data and is more customizable—which means you can track what matters to you, not just what Google thinks might matter to you.

This guide walks you through everything you need to know to make the switch, including what you can do with Google Analytics 4, how to make the switch, and how to get started with the new platform.

What can you expect? New report functions, enhanced features, and predictive insights make this new generation of GA more powerful than ever.

Google Analytics 4 is the newest version of Google Analytics. This is a whole new generation of web analytics that will allow marketers to effectively analyze important customer usage metrics, not just track traffic.

Google Analytics 4 tracks the entire customer path across multiple platforms and leverages AI and machine learning to provide more detailed insights into how users interact with your website and app.

GA4 is also focused on customer privacy. This comes in the face of some of the latest privacy laws, such as GDPR and CCPA. With privacy-first tracking, cross-channel data measurement, and AI-driven predictive analytics, GA4 is an advanced tool that provides unparalleled insights.

The most obvious difference between Google Analytics 4 and Universal Analytics is that GA4 enables you to report on activity that occurs on both websites and applications. There are a number of other differences, including:

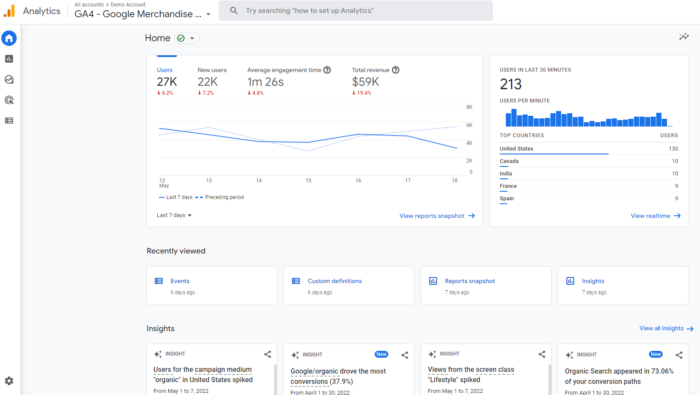

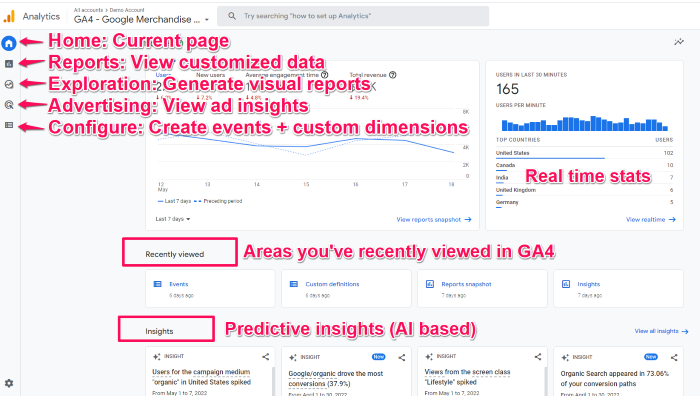

The first change you are likely to notice is the entirely new dashboard. It is more streamlined and many of the reports you are used to are gone or have been moved. The navigation bar to the right includes buttons for home, reports, explore, advertising, configure, and library.

At the bottom, under Insights, you’ll see predictive insights based on Google’s AI. I’ll dig more deeply into the features and what they mean in a later section, so keep reading!

With Universal Analytics, page views were the most important metric. With Google Analytics 4, all measurements are events. Instead of seeing generalized data, you can now gain a fuller understanding of how users interact with your app and website.

What does this mean for you? You can still view session-level reporting, but the ability to break it down by interaction means more in-depth reports and insights.

GA4 also has an array of new metrics. These include engagement metrics such as:

It also tracks a number of other dimensions, including attribution, demographics, events, and so forth.

This is a big change, but it’s actually going to make it easier to track customers throughout their journey. GA originally assumed page views were the most important metric—that is no longer true. The new parameters might have a learning curve, but you will have access to more data.

While looking at past behaviors is helpful in understanding your audience, it doesn’t help you make proactive decisions. With GA4’s powered predictive metrics, you can make data-driven decisions on a large scale.

What does this look like? For most businesses, predictive analytics can significantly impact retargeting campaigns. AI metrics include:

With the above metrics, you can create audiences based on their predicted behaviors. For example, users who are likely to purchase in the next 7 days or users that are likely to spend more than $500 in one purchase.

These audiences can then be targeted using Google Ads campaigns or even on social media.

These metrics can also improve website performance. You can create custom funnels for different audiences based on their behaviors and needs. The suggestions will continue to improve as more data is collected.

GA4 allows you to customize the dashboard, enabling you to see the reports that matter most to your business. It even works well in conjunction with Google Data Studio so you can create custom visualizations of the data collected.

You can also create custom segments based on trigger events which are essentially a subset of events that occurred on your website or application. This enables you to more accurately track customer interactions.

For example, you can create segments on all conversion events that occurred in a particular location. These capabilities make it possible to take a more granular view of your users and their behaviors.

What happens when users are active on more than one platform? With the old Google Analytics, tracking users across platforms was nearly impossible. The new Google Analytics 4 tracks both web and app data in one property (hence the beta name of Google Analytics App+Web).

Cross-platform tracking enables you to see the complete customer journey, including acquisition, engagement, monetization, and retention. You can use GA4 to track the user experience from start to finish—and from platform to platform.

This is done through unique user IDs assigned during app or website login.

With the appropriate gtag.js script, the user ID for each logged-in session will be sent from either the website or the application to Google Analytics. The ID will be reported to the GA4 property and any user metrics will be logged. When the user logs in again on an alternative platform, the reports will connect the user’s data to their unique ID and pick up where it left off.

This is incredibly useful information for any marketer, as it allows you to better understand the cross-platform experience of your users. The data can also be used to extrapolate information for a generalized demographic and build more accurate customer models

Since Google Analytics 4 can be used for your website or application (or both), there are two separate setup processes. They are outlined below.

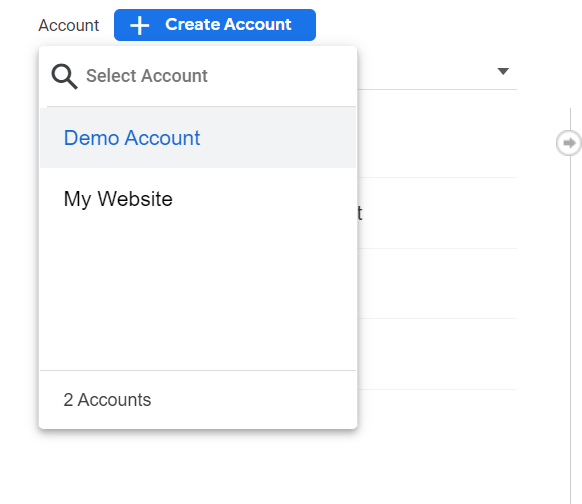

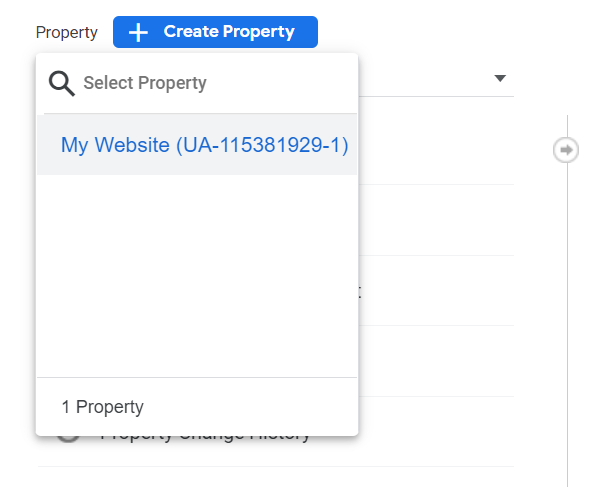

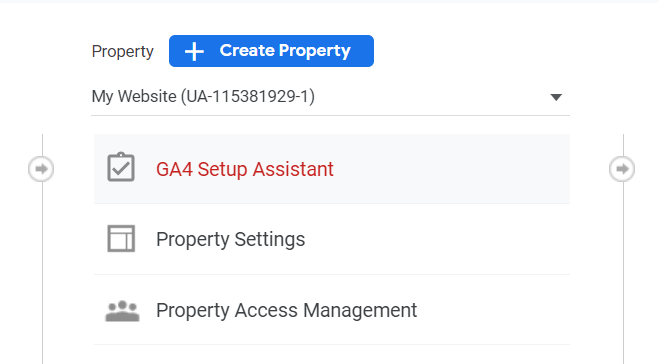

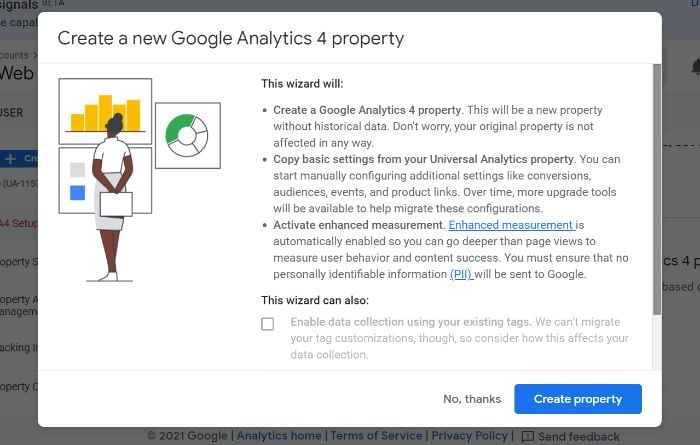

If you currently have a Universal Analytics property for your website, then set up of a Google Analytics 4 property can be completed with the GA4 Setup Assistant.

If you are unable to “Enable data collection using your existing tags,” it’s for one of three reasons:

In all three cases, you’ll need to add the tag yourself.

To upgrade your Firebase account to Google Analytics 4, follow these steps:

Once upgraded, you can find app analytics in both the Firebase console and Google Analytics.

Now that you understand the power of the new Google Analytics platform, I’ll walk you through how to use it. I will say there is a learning curve for the platform, and that can definitely be frustrating.

Start by following the steps below. This will help you understand the basics and how to navigate the new platform. If you still aren’t seeing the data you need, consider signing up for a longer-form course or reaching out to my team for more help.

The search bar in GA4 lets you access more than ever, including instant answers for specific queries (such as “how many users this month vs last year”), specific reports or insights, property configuration, or to access the help content.

Try a few queries to see what you can access, such as “how to create a report” or “top users by city.” As you learn the new dashboard, the search board will be invaluable.

Now let’s look at the new dashboard. At first glance, it might look pretty familiar. Take a look around, however, and you’ll see most of the reports you’re used to are not where they used to be.

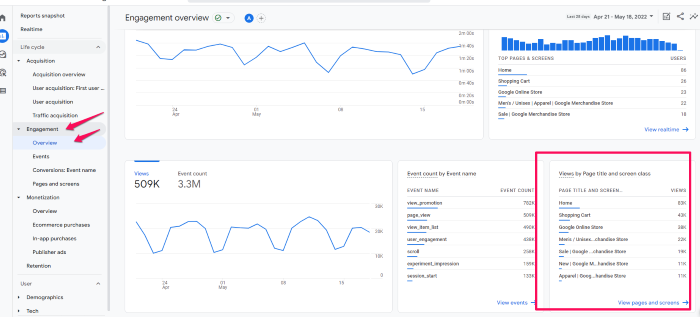

Here’s an annotated version of the dashboard. I’ve labeled the navigation bar on the left as well as the different displays. For this walk-through, I’m using GA’s demo account (Which you can access here), so it may look a bit different than your version, especially if you’ve already started customizing it.

NOTE: A few of the navigation menu items including Audience and Library aren’t in this screenshot, but should be accessible in your dashboard if you have editor access.

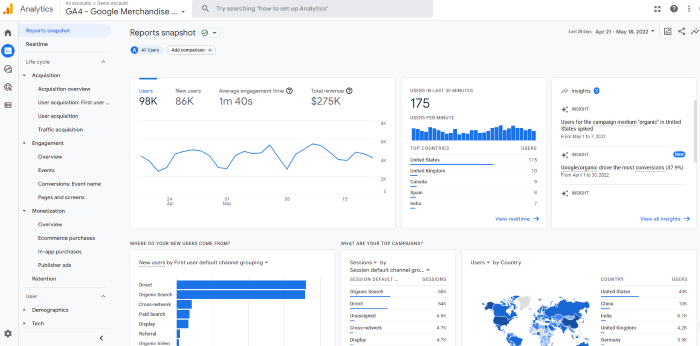

From the dashboard, click on the second icon on the left nav bar, the one that looks like a graph: . This will take you to the reports dashboard, which shows you snapshots of different reports. Most of the reports you are used to seeing are in this tab, though they may look a bit different.

There’s a ton of data here. I won’t walk through all of it because different sites will track different metrics, so yours might look different.

But let’s say you want to see how many people viewed a specific page. In this dashboard, you’d click “engagement” and then look at the “Views by page title and screen class” chart.

You can also view acquisition, monetization, and user demographics here. If you want to compare different metrics, select the + icon at the top (next to Engagement Overview.)

One of my favorite features is the ability to customize the reports snapshot so you can see the data that matters most to you at a glance. This will also help you get to know GA4 a bit better so you are more comfortable using it.

First, let’s create a new report.

To start, click Library at the bottom of the left navigation bar. Note, if you don’t see this option (It’s not in the demo account), it means you don’t have admin access.

Then, scroll down to the Reports table and click Create a new report. Then, select Create an Overview Report. You’ll be asked to provide the data source and GA will walk you through creating the report. (This part changes based on the type of report.)

If you want to change the layout of your overview, click the six dotsdrag indicator. This will let you drag and drop the cards. To remove cards, click the X icon. If you want to add new cards, select +Add Cards.

Events are crucial in the new Google Analytics—in fact, this is how you’ll track just about everything. You will need an editor role in GA to make these changes, so if you don’t see the options I mention, that may be the issue.

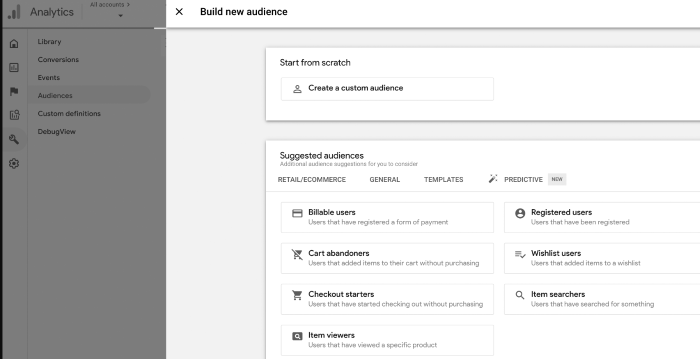

Google Analytics 4 now suggests new audiences. If you’re looking to expand your user base or break into new markets, this can be crucial information. When you create a GA4 property, you’ll tell Google about your business, including your industry category.

Google uses that information to generate new audiences that may be a good fit for your business. To view this data head to Audiences, under the Library. You’ll see suggested audiences listed under Build a New Audience.

Frequently Asked Questions About Google Analytics 4

Google Analytics 4 is a new analytics property offered by Google. It enables users to analyze data from websites, apps, or both websites and apps. It is a complete redesign of GA, so there is a bit of a learning curve.

The main difference between Google Analytics 4 and the old GA is in what the two different property types track. Google Analytics 4 can track the analytics of both websites and applications, while the old GA can track only website analytics.

Similar to Universal Analytics, Google Analytics 4 is a free property type. There are no costs associated with using one (or more) GA4 properties on your account.

Yes, you can currently run both platforms parallel to each other. UA will stop gathering data in the summer of 2023, so make sure you’ve installed GA4 even if you aren’t ready for the switch quite yet.

GA4 is extremely customizable, which can make it hard to learn. However, once you get a hang of it, you’ll find you have access to deeper insights you can use to grow your business.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is Google Analytics 4?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Google Analytics 4 is a new analytics property offered by Google. It enables users to analyze data from websites, apps, or both websites and apps. It is a complete redesign of GA, so there is a bit of a learning curve.

”

}

}

, {

“@type”: “Question”,

“name”: “What is the difference between Google Analytics 4 and the old GA?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

The main difference between Google Analytics 4 and the old GA is in what the two different property types track. Google Analytics 4 can track the analytics of both websites and applications, while the old GA can track only website analytics.

”

}

}

, {

“@type”: “Question”,

“name”: “Is Google Analytics 4 free?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Similar to Universal Analytics, Google Analytics 4 is a free property type. There are no costs associated with using one (or more) GA4 properties on your account.

”

}

}

, {

“@type”: “Question”,

“name”: “Can you run Google Analytics 4 and Universal Analytics at the same time? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Yes, you can currently run both platforms parallel to each other. UA will stop gathering data in the summer of 2023, so make sure you’ve installed GA4 even if you aren’t ready for the switch quite yet.

”

}

}

, {

“@type”: “Question”,

“name”: ” Why is Google Analytics 4 so hard to use? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

GA4 is extremely customizable, which can make it hard to learn. However, once you get a hang of it, you’ll find you have access to deeper insights you can use to grow your business.

”

}

}

]

}

Google Analytics 4 is a powerful analytics tool that provides invaluable insights into your audience. There are numerous benefits to GA4, including cross-platform tracking, more control over data, and AI-driven insights.

Fortunately, setting up a GA4 property on your website or app is easy. The steps outlined above should take you less than 10 minutes to complete, so there’s no excuse to put off the transition.

Have you made the switch to Google Analytics 4? I’d love to hear your thoughts in the comments.

Business credit is a journey, not a destination. The destination is Fundability , and business credit is just one of many tools you need along the way. If you’re interested, our business credit guide can help any user ensure their toolbox is well stocked.

, and business credit is just one of many tools you need along the way. If you’re interested, our business credit guide can help any user ensure their toolbox is well stocked.

Making this trip isn’t easy, but some routes are easier than others. We have the roadmap to starting Fundability , but you have to trust the process.

, but you have to trust the process.

?

?It might help if we first define Fundability . Fundability

. Fundability is the ability of any business to get the funding it needs. Obviously any business will be interested in funding for the purpose of improving and to grow. That is the way to success, and being Fundable

is the ability of any business to get the funding it needs. Obviously any business will be interested in funding for the purpose of improving and to grow. That is the way to success, and being Fundable means you have access to the money to do it.

means you have access to the money to do it.

The first step, before you even open the roadmap, is also one of the most important steps in the journey. Think of it like choosing the most efficient and comfortable vehicle for your trip. It doesn’t take an expert to figure out some types of transportation are better than others.

Just like that, a Fundable Foundation gives you the best start not just with Fundability

Foundation gives you the best start not just with Fundability , but with business credit as well. It will help you avoid issues that can slow down your ability to get approved for credit.

, but with business credit as well. It will help you avoid issues that can slow down your ability to get approved for credit.

This is the easy part, but it is vitally important.

To be successful on the road to Fundability , there is more than this to consider. The goal is to have lenders see your business and you as the owner as low risk. Here are some things to think about.

, there is more than this to consider. The goal is to have lenders see your business and you as the owner as low risk. Here are some things to think about.

When developing your business name, it’s best to leave any indication of a risky industry out of it. This may not help you get financing, but it will minimize the likelihood of being turned down immediately due to being linked to a risky industry before you get a chance.

It’s also important for your company name to be consistent and in alignment everywhere. Even inconsistencies in small details, like using the word “and” sometimes and an ampersand at others, can indicate higher risk. Lenders are not interested in why there is an inconsistency. They will just deny it.

All entrepreneurs need a D-U-N-S number from Dun & Bradstreet for their organization. Set your business up for success by getting it as soon as you can. It is how Dun & Bradstreet will identify your business in their network and how your PAYDEX is linked to your business.

Once you have the foundation, or the right vehicle to make the journey, it’s time to get on the road. Making sure you are prepared is the only way to reach where you are going.

The foundation is definitely something you can control. After that, it’s time to start establishing and building strong business credit. This is only part of what makes a business Fundable , but it is a big part. It’s important for most any type of company financing if you want to run a profitable business.

, but it is a big part. It’s important for most any type of company financing if you want to run a profitable business.

Now, it’s time to fill the car up with gas. That gas is business credit accounts that report payments to your business credit reports. It all starts with vendors. Not just any vendors however. Just like any journey, you have to start at the beginning.

Starter vendors are those that will give net terms on invoices. They are not as interested in credit scores, so you can get approved with less focus on that and more on other factors. Not only that, but they will also report the positive payment experience to the business credit reporting agencies.

At Credit Suite we discuss vendors in terms of tiers. Starter vendors are those in Tier 1. Since most vendors do not classify themselves as such, how do you get them? A simple search will give you a few options. However, how do you know if those vendors work with your company marketing and growth strategies? Furthermore, the information changes without warning.

The answer to all of these questions is Credit Suite. Our product includes select vendors that we know report, and what they require for approval.

We also track changes with recommended vendors. So, if they change requirements or reporting standards in ways that make them no longer align with the values we have for our clients, we can adjust.

Maybe they now rely more heavily on personal finance data and need to be moved from Tier 1 to another tier. Maybe they decided to adjust their minimum business credit requirement. Perhaps they no longer report payments? All of these things will stunt business credit growth.

Credit Suite will check in with your business at each level in the process. We will discuss the risk you present to lenders, and determine what needs to be done in order to reduce that risk.

Our processes allow us to keep our vendor database updated. Our industry experts have the skills necessary to help clients find the best vendor options for them. Whatever stage of the journey our clients are in when they come to us, we can help them find the vendors that can best help them be successful, with confidence.

Working with Credit Suite to find starter vendors and to figure out which vendors to apply for when is kind of like using help to find a gas station that’s open in the middle of the night. It lets you avoid paying more money than you have to for gasoline.

Our resources get you where you are going faster. Team recommended strategies save you both time and money, and one of the best benefits is your business can grow and transform along the way. Our team uses best practices to add value.

Starter vendors are just the first fill-up a company makes to get on the road, but it will only get you so far before your check engine light comes on. As you move further into the process, you’ll need to get credit with more vendors and apply for business credit cards to continue to operate. You can’t just sit back and read a good book, you have to keep moving.

If you handle your approved credit responsibly, you’ll soon have enough accounts reporting to more easily get business credit cards. Even better, you should be able to get higher limits, better rates, and less if any personal guarantee. This is the best way to grow and increase earnings. There are no shortcuts.

Of course there are parts of the car you cannot see. There are curves and bumps in the road you may not be able to predict. As a result, things happen that you cannot control, making the trip quite uncomfortable at times. However, you can do your best to be prepared.

Here are a few things that can affect Fundability , and thus your ability to get money for your company easily, that you have less control over.

, and thus your ability to get money for your company easily, that you have less control over.

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. This can throw a kink in your business journey if you aren’t careful.

Two clear examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data on businesses from a variety of sources, including public records. This means they could even have access to data relating to automobile accidents and liens. They share this information with their partners, some of which are business credit bureaus.

While you may not be able to access or change the data these agencies have on your business, you can be making sure you always use strategies to guarantee any new information they receive is positive.

Enough positive data can help counteract any negative data from the past and reduce those risks over time. Consequently, your personal risk tolerance with underwriters will be easier to overcome. This is how you start to see your company success grow.

Lenders are going to ask for both personal and business financials. They want to see income and profit. They need to know you have the money to pay back any financing you get. The numbers are what they are, and underwriters will verify them. Don’t try to create a false idea about money, whether personal or business. It is not worth the risk.

There are other agencies that hold data related to your personal money as well. Take ChexSystems for example . This agency keeps up with bad check activity. That makes a difference when it comes to your bank score, your ability to open a checking account, and definitely Fundability .

.

Personal credit can affect business credit. Not only do many lenders consider owner credit background alongside business credit, but some business credit reporting agencies use your personal credit score in their business credit score calculation.

You never stop building business credit. But, after a point you will want to keep your progress at a steady pace. Just don’t stop. That’s where many businesses go wrong. Business credit that isn’t growing is doing nothing. They do not understand that, the only option if you want to stay successful, is to continue to use it. Then, be sure to let it keep growing.

Interested in business credit and want to explore more about how Credit Suite can help you? We love to share how to utilize our products to launch your own business credit journey. We want to help businesses understand what we do and how we can help them.

Check out our free business finance assessment now. We will discuss and explore where your business is currently, so we can best learn how to help you. We’ll work to understand what you need, and help you determine what your next steps should be.

The post The Fundability™ Roadmap: Your Business Credit Guide appeared first on Credit Suite.

Article URL: https://www.aptible.com/careers/

Comments URL: https://news.ycombinator.com/item?id=31600446

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/terra/jobs/NGbGJeN-founder-associate

Comments URL: https://news.ycombinator.com/item?id=31605104

Points: 1

# Comments: 0

With offices reopening and restaurants filling up again, the economy is struggling to adjust anew

The post Stores Are Stocked Like We're All Still Working From Home appeared first on Get Funding For Your Business And Ventures.

The post Stores Are Stocked Like We're All Still Working From Home appeared first on Buy It At A Bargain – Deals And Reviews.

Health officials in New York City report that two people have died and at least 24 were infected with Legionnaires’ disease. The outbreak was located in the Bronx.

Alnylam Pharmaceuticals | Senior Software Engineer | REMOTE (US) | Full-time | https://alnylam.taleo.net/careersection/alny_ext/jobdetail.f…

Alnylam Pharmaceuticals is hiring a senior full stack software engineer to join our team focused on delivering data and informatics solutions for our research and development scientists. We are working to robustly bring RNAi therapeutics to patients around the world.

The position can be REMOTE, though we prefer a HYBRID or local presence to our Cambridge, MA, research facilities. Those with VISA considerations are welcome to apply.