Article URL: https://www.flexport.com/careers/department/engineering

Comments URL: https://news.ycombinator.com/item?id=20360925

Points: 1

# Comments: 0

Business News

Article URL: https://www.flexport.com/careers/department/engineering

Comments URL: https://news.ycombinator.com/item?id=20360925

Points: 1

# Comments: 0

Article URL: https://boards.greenhouse.io/logdna/jobs/4124607002

Comments URL: https://news.ycombinator.com/item?id=20363081

Points: 1

# Comments: 0

June 19, 2018 In April 2018, Facebook announced a series of changes on their newsroom and developer blog which have had an effect on Paper.li and all services using their API (Application Programming Interface), the software that allows two different services to work together. Some of these policy reforms are the result of Facebook’s audit in the aftermath… Read more »

The post Impact Of Recent Facebook Changes On Paper.Li appeared first on Paper.li blog.

When you think about SEO and what’s changed over the last 5 years, what comes to your mind?

Chances are, it’s something related to how it’s harder to get rankings on Google.

But why has it gotten harder to get more organic traffic?

Well, if you ask most SEOs, they’ll say it’s because Google has created a much more complex algorithm.

They look at factors like page speed, brand queries, and hundreds of other factors that it may have not been placing much emphasis on in the past.

But that’s only half the story.

The reason SEO has gotten harder is only partially related to Google’s algorithm changes.

Here’s what most SEOs aren’t talking about that you need to pay attention to because this will show you the future of SEO.

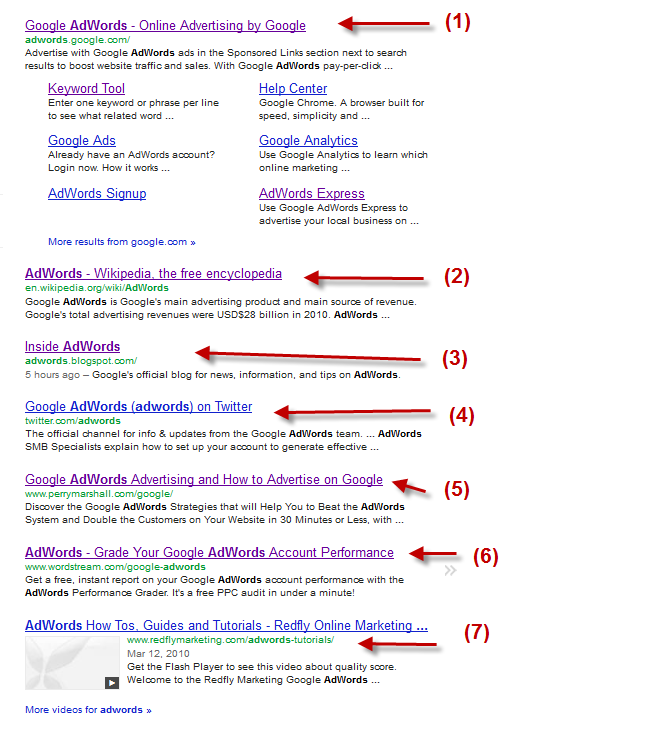

When you perform a Google search, what do you see?

Some organic listings and some paid results, right?

And that’s what Google has shown for years. Much hasn’t changed from its core concept.

But over the years, they have continually made small layout tweaks which have added up to big changes.

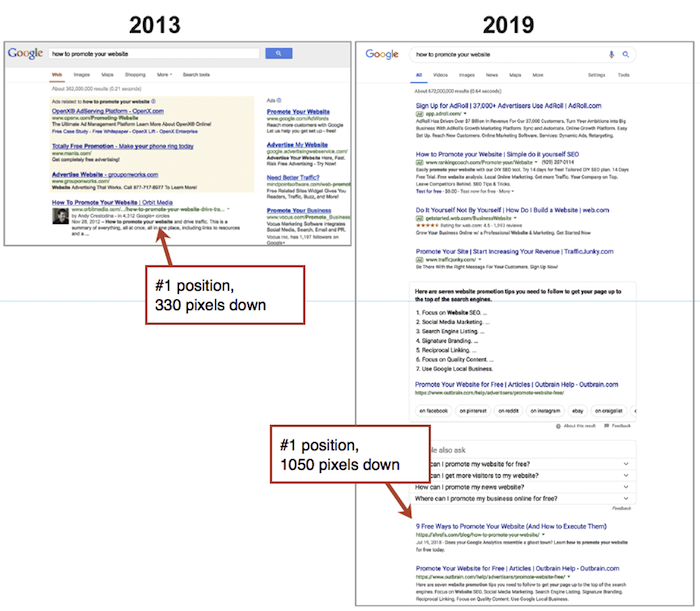

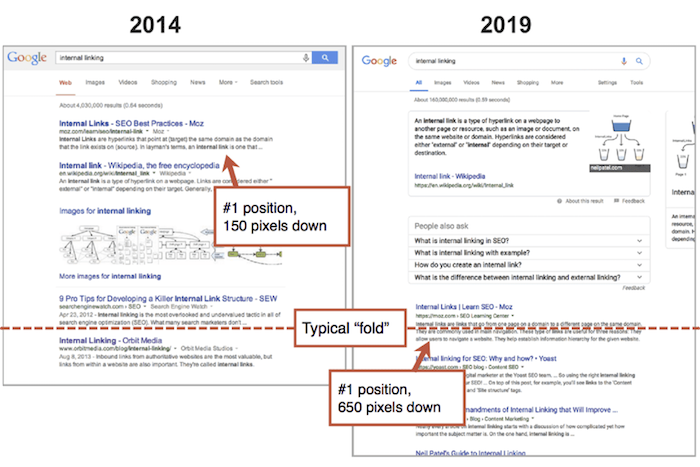

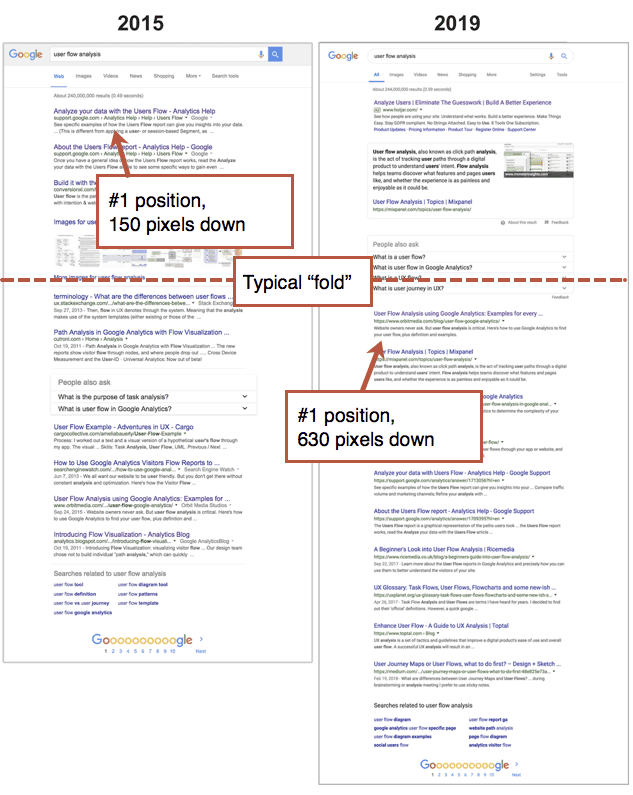

Let’s look at Google’s layout changes over the past few years… lucky for us, Orbit Media performed random Google searches in 2013, 2014, and 2015 and compared them to Google’s current layout for us.

The big differences from 2013 versus 2019 are:

Now let’s look at 2014 versus 2019:

And 2015 versus 2019:

The big trend is that the organic search results have been drastically pushed down below the fold. Roughly by 3.3X.

That’s a huge difference!

A listing these days may have a map, elements from their knowledge graph, more videos and images, and whatever else Google feels their users may want.

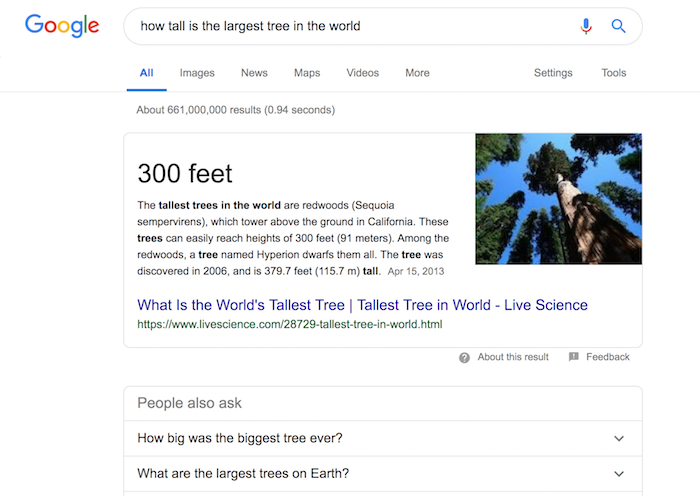

Another big trend is that there are now featured snippets. Although these featured snippets can drive traffic to your site, they also provide the searcher with the answer they are looking for without having to click through to your site.

Just perform a search for the largest tree in the world…

Sure, I could click through over to livescience.com to get the answer, but why? Google gives it to me right then and there.

With organic listings being pushed down, and Google answering a portion of people’s questions without them even needing to click through, this means organic listings will get fewer clicks over time.

Let me ask you a question…

How many organic listings are on the first page?

10, right?

Well, that’s what we are used to, but when’s the last time you actually counted?

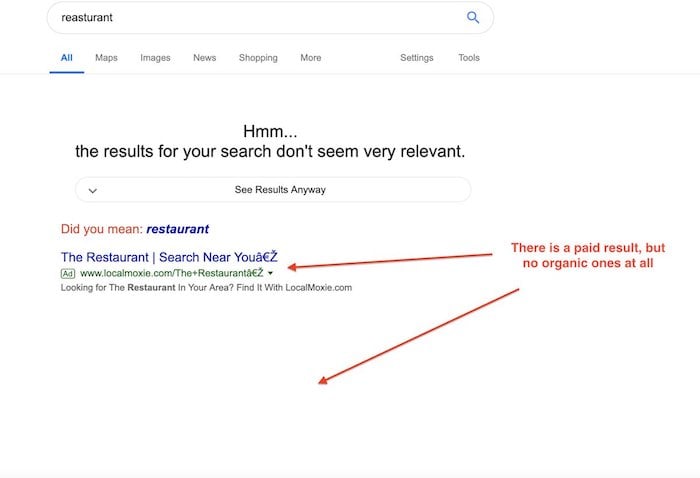

Google’s dumped 5.5% of organic first page listings. Yes, the first page does have 10 listings a lot of the time, but not as often now.

Here’s a graph that’ll show you the change:

18%!! That’s the percentage of first page listings with less than 10 organic results.

What’s crazy is it used to be 2%. That’s a huge jump.

This is a small test that they are doing with their layout, in which some results may not have any listings.

But Google did report that was a glitch. The page was not supposed to contain any organic listings, but at the same time, it was supposed to contain no paid listings either.

And over time you should continually expect Google to run more layout experiments and make more permanent changes.

Now before we get into the future of SEO, let’s get one thing straight.

Google is a publicly traded company. Sure, their goal is to create an amazing product, but they have to make money at the same time.

You can’t blame them for making changes that increase their ad revenues.

Yes, you may claim that this is creating a terrible experience for users, but is it really? If it was, people would switch to Bing or any of the other alternative search engines out there.

I still use Google every day. Yes, it may be harder to get clicks organically, but as a user, they’ve created an amazing experience.

Google doesn’t just make changes to their layout blindly. They run experiments, they survey users, they try to figure out what searchers want and provide it.

Based on the layout changes they have made over the years, you can make a few assumptions:

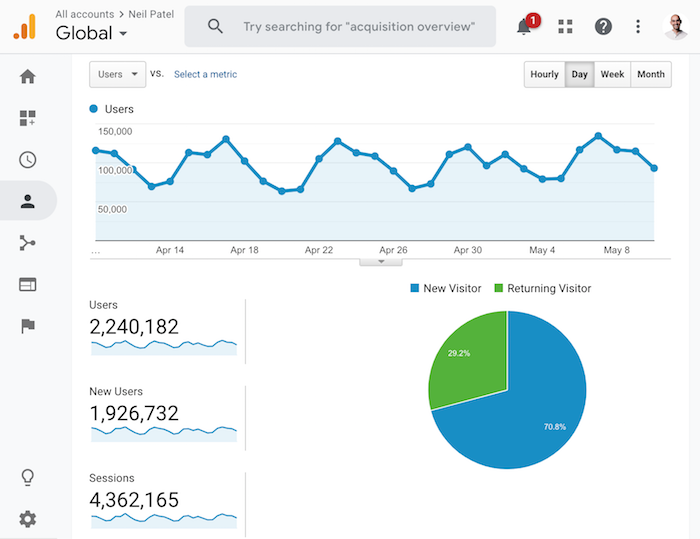

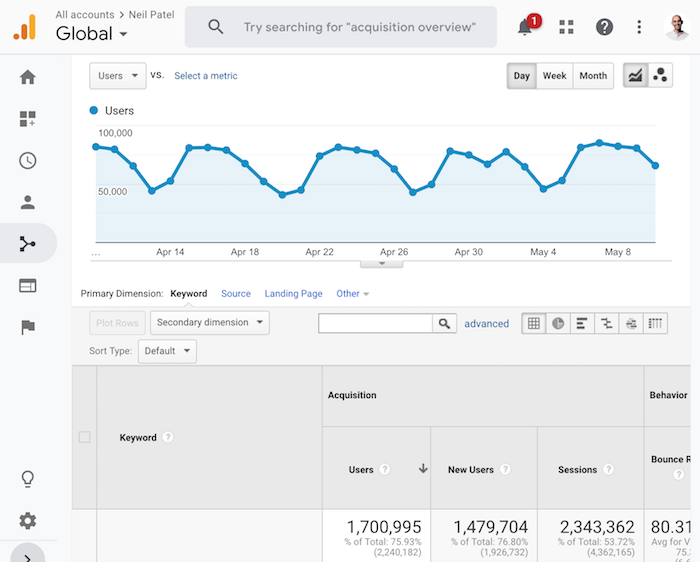

In other words, SEO isn’t dead and it is still an amazing channel. Just look at my traffic stats over the last 31 days:

Now of those 4,362,165 monthly visits, guess how many come from search engines like Google?

A whopping 2,343,362 visits.

In other words, SEO makes up 53.71% of my traffic. That’s a ton of traffic.

And even with Google’s continual changes, you would expect my traffic to be lower, but it isn’t… it’s gone up.

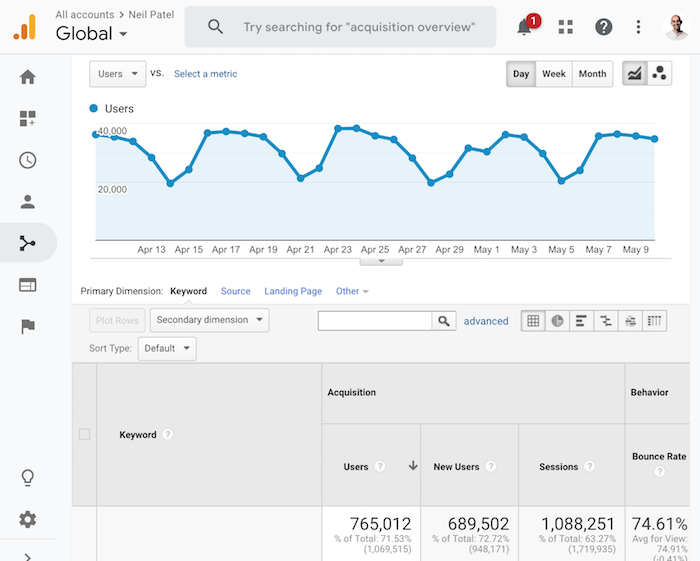

A year ago, I was generating 1,088,251 visits a month from Google. It’s now gone up to 2,343,362 even though Google’s algorithm has continually gotten harder and organic results are continually being pushed further below the fold.

I love Google and even though there is a future for SEO, you shouldn’t rely on it. No matter how good you are at SEO, it doesn’t guarantee success.

Let’s look at a company that you are familiar with… Airbnb.

Did you know that Airbnb didn’t come up with the concept of renting out your house or rooms in your house?

Can you guess who it was?

It was VRBO and they came up with that model 13 years before Airbnb did.

But here’s what’s interesting… who do you think wins when it comes to SEO?

Shockingly, it’s VRBO.

VRBO crushes Airbnb when it comes to Google rankings and they have for a very long time. Here are just a few examples of keywords VRBO ranks for that Airbnb doesn’t:

Airbnb does rank for organic keywords as well, but most of them are brand related.

They crushed their competition without relying on SEO and they were 13 years late when it came to entering the market.

So how did Airbnb win? Well, the main way was they built a better product.

But in addition to that, you focused on an omnichannel approach. From SEO to PPC to advertising on TV screens in airplanes, they tried all of the major channels out there.

Yes, you need to do SEO, but you can’t rely on it as your only source of traffic or income. Diversify, not because of Google, but because you can’t control consumer behavior.

People may not prefer to use search engines in the future, they may want something else, which means you will have to adapt.

Plus you can no longer build a big business through one channel.

Yes, Facebook did grow through referrals. Quora did grow through SEO. Dropbox grew through social media… but those circumstances don’t exist anymore. What worked for these old companies won’t work for you.

You have to leverage all channels to do well in today’s market.

Google may be making changes that you don’t like as a marketer or business owner, but that doesn’t mean SEO is dead.

You can see it from my own traffic stats. You can still grow your traffic, even with Google’s ever-changing algorithm.

Don’t worry about the future because you won’t be able to always predict it or even prevent the inevitable.

The only real solution is to take an omnichannel approach so that you aren’t relying on any one channel.

What do you think about Google’s current layout?

The post How Google’s New Layout Predicts the Future of SEO appeared first on Neil Patel.

The Banking Internet Basics

Conventional financial has actually constantly been a physical structure where you most likely to down payment or take out loan. The financial Internet industry has actually blown up in the previous 5 years. You might not understand what financial Internet really is, as well as it can be a little bit complicated due to the fact that it has numerous names from electronic banking to COMPUTER financial in addition to web banking and also financial online.

With the appeal of the power as well as the net it offers individuals to take control of their lives, numerous conventional financial institutions have actually produced financial Internet websites where clients can move cash, established costs settlements persisting or otherwise, promptly examine things that have actually gotten rid of, and also several various other features that can be accessed 24 hrs each day 7 days a week. This financial Internet alternative has actually been popular not just for clients that wish to have some control over their account without needing to go to the financial institution but also for financial institutions too whose guy hrs have actually been liberated from doing easy jobs like equilibrium questions, account transfers, and so forth due to the fact that the client does it himself with financial Internet.

Financial Internet which just exist on-line ways you will certainly have to move your cash to the brand-new account or else mail a repayment by means of check. Considering that the entire suggestion of financial Internet is to make financial as very easy as feasible, many financial Internet websites will certainly enable you to make a transfer from a block and also mortar financial institution to the financial Internet website as frequently as you such as with no cost or a little cost.

When you use financial Internet choices you have the ability to access your account, relocate loan, pay expenses, and also any type of variety of points from any kind of computer system with Internet gain access to worldwide. Since with financial Internet you constantly understand where your account stands, this is outstanding and also makes taking a trip a whole lot much less difficult as well.

The post The Banking Internet Basics appeared first on ROI Credit Builders.

Our founding fathers adopted the Declaration of Independence on July 4, 1776. Since then, thousands of men and women have fought to maintain that independence for our country. Now home, those that fought should enjoy some of that independence. One of the best ways to do that is to be your own boss. Run your own business. Veterans business loans can help you do just that.

Where are these veterans business loans? How do you find them? When you do, how do you get them? You’re in luck! That is just what we are going to tell you. Some of the following are specifically veterans business loans. Others are loans for anyone, but they tend to work especially well for veterans.

These are our top picks for veterans business loans.

If someone necessary to the business is called into active duty, this is the first place to go for veterans business loans. The Military Reservist Economic Injury Disaster Loan Program (MREIDL) offers loans up to $2 million to qualifying businesses. Funds are meant to help cover operating costs that can’t be met due to the loss of a necessary worker called to active duty in the Reserves or National Guard.

Boots to Business is the 2-step entrepreneurial program offered by the Small Business Administration on military installations around the world. It functions as a training track of the Department of Defense (DOD) Transition Assistance Program (TAP). This is a great resource for tracking down and qualifying for veterans business loans.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

The Veterans Women Igniting the Spirit of Entrepreneurship (V-WISE) is an SBA funded program. It is offered by the Institute for Veterans and Military Families which includes online training. There is also a conference that utilizes the spirit of female veterans and female military spouses. In addition, mentoring is available.

The National Center for Veterans Institute for Procurement extends the entrepreneurship training offered in TAP to veterans of all ages in their communities.

SBA Veterans Advantage guarantees loans approved to businesses operated by veterans or military spouses.

In addition to those already mentioned, the Small Business Administration offers many sources of guidance and funding for veteran owned small businesses.

The Veterans Business Outreach Center (VBOC) furnishes entrepreneurial development solutions including business training, guidance, and mentoring for qualified veterans operating or considering launching a small business.

The SBA Express program is a fantastic loan program for veterans. You can get approval for a loan for up to $350,000. Get rates of 4.5-6.5%. Lines of credit are available for 7 years. You will not need to offer any collateral for up to $25,000, and turnaround time is 36 hours.

The Leveraging Information and Networks to Access Capital (LINC), an online matchmaking service, connects business owners to nonprofit lenders. These lenders supply free financial advice and specialize in microlending and smaller loans. This is the SBA Community Advantage program, and you can learn more about it here: https://www.sba.gov/sites/default/files/files/CA-Participant-Guide-4-December-28-2015.pdf

You need 3 years’ worth of business tax returns, credit that’s not too bad, and collateral for 50% to 70% of what you need to borrow to qualify for this loan.

This program offers business real estate financing.

In addition, the SBA Office of Veterans Business Development offers a broad range of programs and services to sustain and encourage future and existing veteran business owners and military spouses.

Finally, if you still need more funding, or if none of the above options will work for you, try alternative lenders. Business owners with decent personal credit and income tax returns for 2 years that show a profit can usually get approval. You could have rates of 7% or lower. Lenders will want to see some kind of profit on your tax returns.

Regardless of whether you qualify for a traditional loan, veterans business loans, or alternative lending options, you need to be building business credit. It is the best thing for your business.

Small business credit is in the business name. It doesn’t lead back to the business owner’s personal credit. In fact, a business owner’s business and consumer credit scores can be very different. For this reason and many more, business credit is vital to the life of a business.

Because company credit is separate from personal credit, it helps to safeguard a business owner’s personal assets. They can survive even if there is a problem with the business.

Personal credit scores are dependent on payment history. Not only that, but other factors like credit utilization percentages matter as well. Due to business purchases being much higher than personal expenses by nature, and personal limits much lower than business card limits, you can max out limits quickly using personal cards for business transactions. That skyrockets your credit utilization percentage. For that reason, your personal score can suffer if you use personal cards for business even if you make your payments on time.

Growing small business credit is a process, and it does not occur automatically. A corporation has to actively work to establish corporate credit. It is not hard, however, as long as you follow and trust the process.

Due to the fact that the process builds on itself, performing the steps out of order will lead to repetitive rejections. Nobody can start at the top with business credit. For example, you can’t start by applying for store or cash credit from your bank. If you do, you’ll face rejection 100% of the time.

First of all, you must make your business appear to be a fundable entity that is separate from yourself. Here’s how:

come tax time.

Visit the IRS website and get an EIN for the business. It will be free. You also will need to formally incorporate. That means choosing to become a corporation, s-corporation, or LLC. In addition to separating your business from yourself, you will gain some protection for your personal assets. The level of protection will vary, as will the cost, based on the option you choose.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Dun & Bradstreet is the most commonly used business credit reporting agency. Head to their website and obtain a totally free DUNS number. A DUNS number is how D&B gets a small business into their system to generate a PAYDEX score. If there is no DUNS number, then there is no PAYDEX score.

The vendor credit tier is composed of vendors that will offer net invoice terms. They do not require a credit check, and they report payments to the business credit reporting agencies. You can buy things from them that you use every day, like shipping boxes, outdoor workwear, ink and toner, and office furniture.

Net accounts need to be paid in full based on their terms, usually 30,60, or 90 days. This is in contrast to revolving accounts, where you can make payments. If you pay your net accounts on time with vendors that report, your business credit profile will be opened.

It is important to remember that not every vendor does this. Certain vendors known as “starter vendors” make up the vendor credit tier and can help you build business credit. These are merchants that will grant an approval with very little effort. You also need them to be reporting to one or more of the big three credit reporting agencies (CRAs): Dun & Bradstreet, Equifax, or Experian.

Once there are 5 to 8 or more vendor trade accounts reporting to at least one of the credit reporting agencies, then move onto the retail credit tier. These are businesses such as, Office Depot and Staples, offer credit for their stores only. They will have more of the things you need to run a business.

Use your SSN and date of birth for identification purposes only and not for guaranteeing the credit.

After another 8 to 10 accounts are reporting, it is time to move to the fleet credit tier. These are service providers such as BP and Conoco. Use this credit to purchase gasoline and maintain vehicles. Again, use your SSN and date of birth for identification purposes only and not for guaranteeing the credit.

If you are responsible for managing your credit up to this point, you can move on to the cash credit tier. These are businesses like Visa and MasterCard. Remember, your SSN and birthdate should not be used to verify credit, though they may be required for identity verification.

Furthermore, after you have business credit, you need to stay on top of it. Make sure it is being reported and take care of any errors as soon as possible. Get in the practice of checking credit reports and digging into the specifics, not just the scores. Update the relevant information if there are errors, or if the details are incomplete.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you with each of them directly. See: https://www.creditsuite.com/business-credit-monitoring.

Errors in credit reports can be corrected, but the credit agencies normally have a set way they want you to do it.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Disputing credit report mistakes usually means you mail a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Send copies instead.

Fixing credit report inaccuracies also means you precisely detail any charges you challenge. Do so in writing and make your letter is as clear as possible. Be specific about the concerns with your report. Use certified mail so that you will have proof that you sent in your dispute.

Another benefit of credit monitoring is that you will know how many accounts are reporting from each credit tier. Therefore, you will know when to move on to the next tier.

Always use credit carefully. Do not borrow more than what you can pay. Keep track of balances and deadlines for repayments. Paying on time will do more to increase business credit scores than just about anything else.

There are Veterans business loans out there. In addition, there are other fantastic loan options that can work well for veterans, despite not being specifically designed for them. This funding can help you gain independence in your work life by giving you the funding you need to start and run your own business.

Above all however, you need to build credit for your business. This is simply one more step toward running your own business and gaining your independence. We appreciate that you fought hard for our country, and now we want to fight hard for you. We can help you through the business credit building process. Visit www.CreditSuite.com to find out more.

The post Enjoy the Independence You Fought For: 5 Options for Veterans Business Loans appeared first on Credit Suite.

May 8, 2018 Dear Paper.li Community. Yesterday, we released a new Privacy Policy and Terms of Service which reinforce our already high standards for data protection and privacy. The new Privacy Policy provides better clarity on exactly how your data is being processed and protected. What’s not changing, however, is our continued commitment to the secure processing and storage of… Read more »

The post New Privacy Policy and Terms of Service appeared first on Paper.li blog.

The post New Privacy Policy and Terms of Service appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

Mercedes is confident it can find a solution for the cooling issues that cost it performance at the Austrian Grand Prix and has revealed it was already working on a solution even before it turned a wheel at the Red Bull Ring last weekend.

It’s often said that your network determines your net worth. We’re fortunate to be living in an era where technology has accelerated networking in both the real world and online. Platforms such as meetup.com have allowed people with shared interests to find each other online and meet in the real world. Online, ad-hoc “communities” are… Read more »

The post Identify and connect with like-minded news sharers appeared first on Paper.li blog.